0001601280

false

2022

FY

0001601280

2022-01-01

2022-12-31

0001601280

2022-06-30

0001601280

2023-08-02

0001601280

2022-12-31

0001601280

2021-12-31

0001601280

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001601280

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001601280

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001601280

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001601280

2021-01-01

2021-12-31

0001601280

mdxl:SeriesAVotingPreferredStockMember

2020-12-31

0001601280

mdxl:SeriesBVotingPreferredStockMember

2020-12-31

0001601280

us-gaap:CommonStockMember

2020-12-31

0001601280

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001601280

us-gaap:RetainedEarningsMember

2020-12-31

0001601280

2020-12-31

0001601280

mdxl:SeriesAVotingPreferredStockMember

2021-12-31

0001601280

mdxl:SeriesBVotingPreferredStockMember

2021-12-31

0001601280

us-gaap:CommonStockMember

2021-12-31

0001601280

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001601280

us-gaap:RetainedEarningsMember

2021-12-31

0001601280

mdxl:SeriesAVotingPreferredStockMember

2021-01-01

2021-12-31

0001601280

mdxl:SeriesBVotingPreferredStockMember

2021-01-01

2021-12-31

0001601280

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001601280

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001601280

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001601280

mdxl:SeriesAVotingPreferredStockMember

2022-01-01

2022-12-31

0001601280

mdxl:SeriesBVotingPreferredStockMember

2022-01-01

2022-12-31

0001601280

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001601280

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001601280

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001601280

mdxl:SeriesAVotingPreferredStockMember

2022-12-31

0001601280

mdxl:SeriesBVotingPreferredStockMember

2022-12-31

0001601280

us-gaap:CommonStockMember

2022-12-31

0001601280

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001601280

us-gaap:RetainedEarningsMember

2022-12-31

0001601280

us-gaap:CommonStockMember

mdxl:MediXallGroupIncMember

2022-01-16

2022-01-17

0001601280

mdxl:MediXallGroupIncMember

2022-01-01

2022-12-31

0001601280

srt:MinimumMember

2022-01-01

2022-12-31

0001601280

srt:MaximumMember

2022-01-01

2022-12-31

0001601280

2022-12-01

2022-12-31

0001601280

us-gaap:ConvertibleDebtMember

2022-01-01

2022-12-31

0001601280

srt:ScenarioForecastMember

mdxl:SeriesAConvertiblePreferredStockMember

2023-01-01

2023-12-31

0001601280

srt:ScenarioForecastMember

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001601280

us-gaap:EquipmentMember

2022-12-31

0001601280

us-gaap:FurnitureAndFixturesMember

srt:MinimumMember

2022-12-31

0001601280

us-gaap:FurnitureAndFixturesMember

srt:MaximumMember

2022-12-31

0001601280

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001601280

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001601280

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001601280

us-gaap:SeriesBPreferredStockMember

2021-01-01

2021-12-31

0001601280

mdxl:SeniorConvertibleDebenturesAndWarrantsMember

2022-01-01

2022-12-31

0001601280

mdxl:SeniorConvertibleDebenturesAndWarrantsMember

2021-01-01

2021-12-31

0001601280

us-gaap:SeriesBPreferredStockMember

2020-06-24

0001601280

mdxl:TBGHoldingsCorpMember

2022-01-01

2022-12-31

0001601280

2021-04-01

2021-04-30

0001601280

mdxl:R3AccountingLLCMember

2022-01-01

2022-12-31

0001601280

mdxl:R3AccountingLLCMember

2021-01-01

2021-12-31

0001601280

mdxl:TBGHoldingsCorpMember

2022-12-31

0001601280

mdxl:TBGHoldingsCorpMember

2021-12-31

0001601280

mdxl:TurnkeyMember

2022-12-31

0001601280

mdxl:TurnkeyMember

2021-12-31

0001601280

mdxl:R3AccountingLLCMember

2022-12-31

0001601280

mdxl:R3AccountingLLCMember

2021-12-31

0001601280

2022-03-01

2022-03-31

0001601280

mdxl:ThreeConvertibleLoanDebenturesMember

2022-01-01

2022-12-31

0001601280

mdxl:ThreeConvertibleLoanDebenturesMember

2022-12-31

0001601280

srt:MinimumMember

2022-12-31

0001601280

srt:MaximumMember

2022-12-31

0001601280

mdxl:EmployeesMember

2022-01-01

2022-12-31

0001601280

mdxl:AdvisorsAndIndepedentContractorsMember

2022-01-01

2022-12-31

0001601280

mdxl:EmployeesMember

2021-01-01

2021-12-31

0001601280

mdxl:AdvisorsAndIndepedentContractorsMember

2021-01-01

2021-12-31

0001601280

2022-11-01

2022-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number 333-194337

MediXall Group, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

33-0964127 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| |

|

|

2929 East Commercial Blvd., Suite Ph-D

Fort Lauderdale, Florida |

33308 |

| (Address of principal executive offices) |

(Zip Code) |

954-440-4678

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/A |

N/A |

N/A |

Securities registered pursuant to Section 12(g)

of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☒

No ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the

registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to

submit such files). No Yes ☒

No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act.). Yes ☐

No ☒

The aggregate market value of the voting and

non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently

completed second fiscal quarter (June 30, 2022) based upon the closing sale price of the registrant’s common stock on the OTCPK

that day was $40,630,822 as computed by reference to the price at which the common equity was last sold, which was $0.40 on that date

As of August 2, 2023, there were 130,487,491 shares

of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

NONE

TABLE OF CONTENTS

MediXall Group, Inc.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2022

OTHER PERTINENT INFORMATION

We maintain our web site at www.gethealthkarma.com.

Information on this web site is not a part of this Annual Report on Form 10-K and is not incorporated herein by reference.

Unless specifically set forth to the contrary, when

used in this Annual Report on Form 10-K the terms “MediXall", the "Company," "we", "us", "our"

and similar terms refer to MediXall Group, Inc., a Nevada corporation, and its subsidiaries. The Company has the following wholly-owned

subsidiaries: (1) IHL of Florida, Inc., which is dormant, (2) Medixall Financial Group, which is dormant, (3) Medixaid, Inc., and (4)

MediXall.com, Inc., which were established to carry out the development and operation of our healthcare marketplace platform, and (5)

Health Karma, Inc. which was established in 2020 to increase functionality of the MediXall platform.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking

statements. Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions,

forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,”

“could,” “should,” “would,” “may,” “seek,” “plan,” “might,”

“will,” “expect,” “predict,” “project,” “forecast,” “potential,”

“continue” negatives thereof or similar expressions. Forward-looking statements contained in this Report speak only as of

the date of this report, are based on various underlying assumptions and current expectations about the future and are not guarantees.

Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity,

performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking

statements.

Such forward-looking statements include statements

regarding, among other things, matters associated with:

| |

● |

our ability to continue as a going concern; |

| |

● |

our history of losses which we expect to continue; |

| |

● |

the significant amount of liabilities due related parties; |

| |

● |

our ability to raise sufficient capital to fund our company; |

| |

● |

our ability to integrate acquisitions and the operations of acquired companies; |

| |

● |

the limited experience of our management in the operations of a public company; |

| |

● |

potential weaknesses in our internal control over financial reporting; |

| |

● |

increased costs associated with reporting obligations as a public company; |

| |

● |

a limited market for our common stock and limitations resulting from our common stock being designated as a penny stock; |

| |

● |

the ability of our board of directors to issue preferred stock without the consent of our stockholders; |

| |

● |

our management controls the voting of our outstanding securities; |

| |

● |

the conversion of shares of Series A and B preferred stock will be very dilutive to our existing common stockholders; |

| |

● |

risks associated with and unique to health care; and, |

| |

● |

risks associated with stability of the internet, data security, exposure to data breach. |

This information may involve known and unknown

risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from

the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found

at various places throughout this Annual Report on Form 10-K including, but not limited to the discussions under “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and "Business." Actual events or results may

differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the

matters described in this Annual Report on Form 10-K generally.

Although forward-looking statements in this Annual

Report on Form 10-K reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and

unknown risks, business, economic and other risks and factors that may cause actual results to be materially different from those discussed

in these forward-looking statements. Many of those factors are outside of our control and could cause actual results to differ materially

from the results expressed or implied by those forward-looking statements. Accordingly, you are urged not to place undue reliance on these

forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K.

We assume no obligation to update any forward-looking

statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, other than

as may be required by applicable law or regulation.

PART I

ITEM 1. BUSINESS.

Overview

MediXall Group, Inc. (OTCPK:MDXL)

is an innovation-driven technology company designed to deliver health and well-being services which address gaps in access to care, spiraling

healthcare costs, and the pain points faced by both consumers and businesses. MediXall is structured to provide solutions that are proactive

and preventive versus the current reactive system, structured primarily on treating the sick, which is inherently costly.

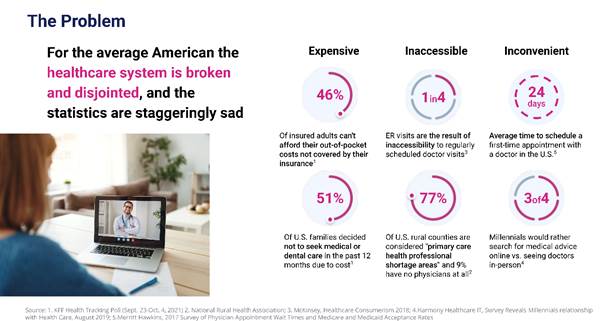

We started Health Karma in response

to the design and delivery flaws we saw in the American health care system. We believe that these flaws made healthcare too expensive,

reactionary, and inconvenient for far too many Americans to obtain quality health care and maintain their health. Since inception, we

have been focused on changing the way individuals access, interact with, and consume healthcare. Our mission is simple: we want to provide

easy access to health and wellbeing solutions to consumers and businesses, while reducing what consumers and businesses pay for it.

As the U.S. healthcare market

remains opaque and highly fragmented for consumers, even simple healthcare transactions, such as finding a doctor, scheduling routine

procedures or filling a prescription at an affordable price, can be difficultAs a result, Americans are often neglected by the health

care system, whether or not by choice, and those who would otherwise be more proactive fail to access care due to the health care system’s

inherent complexity.

Recognizing that these trends

are not sustainable, Health Karma is focused on addressing these problems by providing solutions that shift healthcare from a one-size-fits

all model to a more personalized experience built around each individual and each company - reducing and even removing layers of complexity

that healthcare system brings. We believe that a new healthcare

model, one that places the consumer at the center of the healthcare ecosystem, can help to improve their health care access while reducing

what they pay for it.

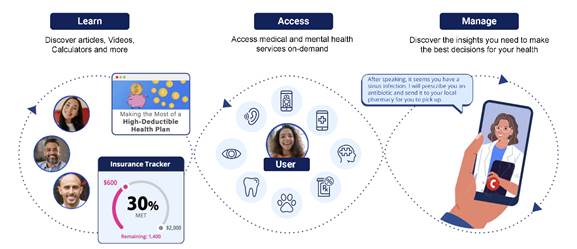

To accomplish this, we developed

Health Karma as a robust digital healthcare platform providing a single place for healthcare consumers and organizations to turn for personalized

information, programs, and resources needed to understand, access, and manage their health and well-being. Focusing on the individual,

Health Karma gives people information they need to access the right level of care from the start, when and where they need it, and provide

ongoing support, thereby saving money for companies and their employees, while also improving care.

MediXall Group is reimagining

how Americans access and afford care to give people a more consumer-centric way to manage their health & wellbeing: immediate, seamless,

affordable, and tailored to their unique needs:

| · | Easy and accessible healthcare – Making healthcare

easy to understand and use through the entire health journey – from onboarding and monitoring to everyday use. Users can actively

and confidently engage with their health anywhere, anytime they want and not just when it is convenient for the healthcare providers. |

| · | Personalized health experience – Empowering users

to take charge of their health and well-being through targeted health campaigns that come with relevant programs, resources and education. |

| · | Always-on service – Delivering immediate support

to solve healthcare-related questions and address health-related concerns throughout the health experience. |

We have engineered the Health

Karma Platform to be scalable and to grow beyond its current offerings. The flexibility of the Platform enables us to seamlessly integrate

and quickly launch new services, expand service offerings or enter new verticals in a cost- effective manner. This has enabled us to acquire

and integrate synergistic offerings, such as Responders 1st Call™, Workers 1st Call & Report™, and

Student 1st Call™ which help us better serve both our members and employer/organization clients.

MediXall Group is currently

comprised of the following five solutions:

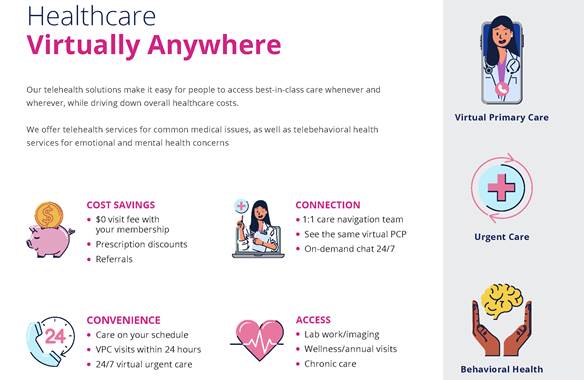

Health Karma

– With Health Karma, we have created a unique membership model that

provides consumers with convenient and affordable access to best-in-class care, whenever and wherever, while driving down overall healthcare

costs. We provide our members access to licensed healthcare providers across a wide and growing spectrum of care through $0 copay virtual

primary, urgent, behavioral, and pet care, as well as significant discounts to prescriptions, dental care, eye care, and hearing. For

employers, our Health Karma membership offers a comprehensive way for them to offer supplemental health benefits to all of their employees,

including part-time and gig workers, which include independent contractors, on-demand platform workers (ie Uber, Lyft, etc.), freelancer,

and other temporary workers, who typically are not eligible for benefits. The Health Karma membership is also targeted for the small companies

who cannot afford to provide health insurance to their employees as well as an adjunct for high-deductible health insurance plans.

Health Karma Behavioral

Health – The behavioral health market has traditionally been underserved for a number of reasons, including as a result

of inadequate access, a limited universe of qualified providers, high cost and social stigma. That is why we created Health Karma Behavioral

to focus on providing mental health care exactly when and how is needed, instead of waiting six weeks for an appointment to see a psychiatrist.

We believe this specialized offering for behavioral health can help to removes or reduces these burdens associated with traditional face-to-face

mental health services by improving convenience through 24/7 access to our platform, providing more accessible entry level price points,

and reducing associated stigmas by promoting easier access and preserving privacy. Health Karma Behavioral provides our members both the

ability to speak to a therapist in-the moment they need it or schedule a call or video chat with a therapist within 24 hours.

Workers 1st

Call & Report™ - Workers 1st Call & Report is a 24/7/365 pre-claim, preemptive solution to reduce work comp

claims, costs, fraud and unnecessary and over-utilized case management. The program combines behavioral health consultations to mitigate

the primary reasons injuries happen in the workplace which is distracted employees along with Registered Nurse triage to mitigate minor

injuries from becoming a work comp claim integrated into an easy-to-access, plug-and-play program.

Responders 1st

Call™ - Responders 1st Call is a confidential, anonymous in-the-moment 24/7/365 solution for First Responders to destress

and digest traumatic situations which could lead to a work comp claim, disability, or suicide. This program provides in-the-moment consultations

to the First Responder and their family to address work-related or personal, emotional, or behavioral health issues, or other issues interfering

with responsibilities at work or home.

Student 1st

Call™ - Student 1st Call is a solution for in the moment confidential access to master-level clinicians targeted

for college age student population to help with depression, stress, sleep, addiction, relationship problems, anxiety, grief, and more.

Our evidenced-based assessment and clinician-led consultation sets the student on a clear path for emotional support.

By bringing the Workers 1st Call,

Responders 1st Call and Student 1st Call programs into the Health Karma ecosystem, we believe we are better positioned to meet

the growing industry needs by allowing us to collectively build out our employer client base with more coverage options, enhance our distribution

footprint, and strengthen our operational capacity to meet growing customer demands. With the addition of the 1st Call products, Health

Karma is uniquely equipped to meet the growing needs of the Small to Medium Businesses, as well as individuals and families across the

nation.

We believe the addition of these

new programs will help to further enrich our membership model by creating a comprehensive and interconnected offering that delivers a

virtuous circle of value for consumers, employers and partners.

We generate revenue from the membership

payments of companies, organization memberships, and consumer subscription fees, which are typically a 12-month commitment in nature,

providing significant revenue visibility. Through our per-membership-per-month (“PMPM”) subscription model, we enter into

contracts with our employer customers that pay a fixed monthly rate based on the total number of Memberships. In most cases, Employees

and their Dependents have unlimited access to our Platform and do not pay extra fees for increased utilization, unless they wish to access

services outside the scope of those covered by the subscription.

We see exciting growth potential

as we continue to attract new members through our existing offerings, launch new offerings to address more of the healthcare needs of

consumers & employers, and improve Americans’ access to health while reducing what they pay for it. As we extend our platform,

we believe that we can create multiple monetization opportunities at different stages of the consumer healthcare journey, enabling us

to drive higher expected consumer lifetime value without significant additional consumer acquisition costs.

Focusing on the Underserved Small Employer and

Individual Market

The primary reason the landscape

of healthcare offerings has not evolved to solve this problem until recently is due to many companies solely focusing on creating solutions

and businesses models targeting large self-insured employers and payors, leaving the small-to-midsize employer and individual market completely

underserved.

Over the last 10 years, multiple

generations of healthcare technology companies struggled to get lift-off and scale, not because their products and services weren’t

transformative for this market, but because they failed to find an executable path for sustainable distribution and value capture. We

believe the lack of maturity of the underlying distribution — has been arguably the most significant bottleneck in the adoption

and growth of healthcare solutions for this market.

We believe there are three

reasons why existing providers haven’t focused on this market. First, small and midsize businesses (SMBs), and individuals are fragmented

and hard to reach. Relative to the value they bring in, the cost of reaching and serving them has traditionally been too high to warrant

the effort unless you can sell multiple products to them. Second, there is significant signup friction for benefits and healthcare products.

Lastly, benefits products can be costly for SMBs to offer to employees, which results in many just forgoing benefits altogether. The lack

of access to simple, low-cost healthcare and benefits solutions has had a significant impact on the recruitment and retention efforts

of SMBs and the well-being of their employees.

But we believe where there is

a gap, there is an opportunity. This is why we have put tremendous focus into building out a unique distribution engine that capitalizes

on the current infrastructure of health insurance distribution and merges it with proven strategies from B2C and B2B2C from other industries.

Our Unique Distribution Engine

Our Distribution is currently

made up of five pillars:

Employer Groups

Providing health benefits to employees

is costly, complicated, and time-consuming for SMBs. While larger organizations are starting to realize the cost of traditional group

health insurance is becoming unsustainable, the annual rate hikes and increasing premium prices are even more of a concern for SMBs with

smaller budgets to dedicate to their employees’ healthcare.

With fewer employees, SMBs also

have a much harder time meeting a group health insurance plan’s minimum participation requirement. Whether they have a lot of employees

still on their parents’ insurance, older employees who qualify for Medicare, or others who simply don’t want to participate

in a group health plan, SMBs need a more flexible health benefits solution. The reliance on part-time employees and 1099 employees by

SMBs also precludes those type of workers being eligible for health insurance. With Health Karma, we saw an opportunity to provide a comprehensive

solution for SMBs brings many of the benefits, resources, tools, and advantages big companies have historically had. With Health Karma,

we wanted SMB owners to be able to afford solutions that can make their employees healthier and happier.

With fewer tiers in the organization’s

hierarchy and less people involved in the decision-making process, one of the benefits to working with SMBs is they generally have a much

quicker buying process than larger employers. Health Karma is focused on 3 types of employers

| · | Employers that don’t offer insurance or that have a high number

of part time, 1099, or employees without social security numbers. These type of employees are in many cases their highest area of

turnover, which costs a ton of money, but health insurance doesn’t consider those employees to be benefits eligible. And they likely

have wanted to provide something, but health insurance is just too expensive anyway even if they were eligible. |

| · | Employers that offer health insurance coverage that have a high deductible.

Most companies have had to increase deductibles year after year after year to battle the double-digit health insurance increases. So,

a totally typical plan may have a $3,000 deductible for an individual and $6,000 deductible for family. You think that person that needs

mental health counseling or a doctor’s visit is going to be rethinking if they even go because they will have to pay it all out

of pocket and they still need to pay for gas, food and their rent and all that is going up. You don’t address things at the initial

level, and they turn into a crisis which results in lost work time and productivity and more expense for the employer. |

| · | Employers that have high Workers Comp claims. According to the National

Safety Council, in the United States in 2021, a worker is injured on the job every 7 seconds. This equates to 7 million work injuries

per year and a total cost of over $160 billion. Approximately 70% of workplace injuries are minor and do not need clinical intervention.

Overextension, slip, trip, falls, contact with equipment account for 86% of workplace injuries. This issue is compounded by the number

of fraudulent injuries exacerbated by aggressive litigators. If work comp fraud were a legitimate business, it would rank among Fortune

500 companies. SMB have limited resources to address the injured worker other than sending them to urgent care or ER regardless of the

severity of the injury. Plus, the required work comp state regulatory and OSHA injury reports pose a significant burden on the smaller

businesses with no risk insurance personnel. |

| | | |

Health Insurance Brokers & General Agencies

Most employers do not manage

benefits selection alone—thousands of licensed and trained insurance brokers serve as trusted advisors to small and large businesses,

helping employers and their employees navigate the complexity of benefits. According to MetLife’s 15th Annual

U.S. Employee Benefits Trend Study, over 80% of small and midsize businesses work with insurance brokers to manage their benefits. These

insurance brokers serve as a key intermediary between insurance carriers seeking to access a widely dispersed SMB population, which often

lacks dedicated personnel and technology budgets to fully self-direct critical benefit decisions. They play a crucial role in educating

SMBs about their health benefit options. Health insurance brokers and agents are experts in helping their clients select the right set

of products.

When it comes to the selling,

education and distribution of health benefits (can include health, dental, life and other types of insurance) to small employers, mid-size

employers, individuals, associations and some large employers it is that insurance broker who is providing that key role. The broker is

talking to the business owner and the human resources team to sell or renew policies and adjust and make changes according to the needs.

Often a relationship has been built over many years and that company relies on their broker for advice each year on their benefit package.

In addition, there are brokers attempting to expand their business and they are looking for unique benefits to help them get access to

a new client. Many employers won’t add an additional health benefit without discussing it first with their broker.

This is why health insurance brokers

are a key pillar to our distribution, as they provide an immense expansion of our sales efforts with our Health Karma and our Workers

1st and Responders 1st call solutions. To accelerate the expansion of our health insurance broker relationships,

we also look to partner with General Agencies. These organizations provide brokers the administrative support, product education and home

base to build up their business. By partnering with the organization, we are able to access 100s and sometimes 1000s of brokers

without having to onboard and train each one individually.

We believe we have built a robust

and extensive partnership network in the health insurance industry with distribution agreements with many leading insurance agencies in

their respective states, such as BHC Insurance, the third largest independent insurance agency in Arkansas, and Gem State Financial, a

leading Idaho-based General Agency. We have been able to increase the reach of our partnership network through an Affinity Marketing Partnership

agreement with the National Association of Health Underwriters, a professional association representing more than 100,000 health insurance

agents, benefits professionals, consultants, and brokers, from both small and large health insurance companies throughout the United States.

The Partnership enables NAHU brokers to market the Health Membership in combination with various insurance products or self-insured plans.

This expands NAHU members’ ability to work with organizations to provide additional benefits for employees with customized membership

options to enhance existing benefits packages or to open the door to benefits for non-traditional, gig and part-time workers.

Associations, Chambers, Other membership organizations

Associations, Chambers of Commerce

and other types of organizations are a large driver of our distribution engine, as it enables us to drive significant reach to very targeted

member populations. These organizations look to drive revenue in two ways, through member dues and “non due” revenue. Health

Karma can help increase both. Associations and other membership organizations will enter into agreements with us to offer Health Karma

to their own end-user customers or members as a benefit, a reward or a component of a loyalty program. In addition to helping increase

member dues, Health Karma also becomes a new source of non-due revenue through a revenue share on new membership driven through the organization.

Municipalities and Public Service Departments

According to the National League

of Cities data, there are 36,000 municipalities and local governments in the United States, of which 18,700 are municipalities of less

than 50,000 lives, 16,360 are town and townships, and 4,031 are county governments. These smaller municipalities and governments are dealing

with the same issues and pain points as with smaller companies; namely many 1099, part-timers and other employees with limited health

benefits, issues in dealing with workplace injuries and work comp claims, fraud, and reporting requirements. Our Health Karma and Workers

1st Call solutions address these issues and pain points.

When you look at Public Service

Departments and the First Responder market, according to the National Law Enforcement Officers Memorial Fund, there are over 800,000 law

enforcement officers in the US; according to the US National Fire Department registry there are 1.2 million fire fighters of which 795,00

are volunteer; according to the National Association of State EMS Officials, there are 219,000 EMS professionals, and according to the

US Bureau of Labor Statistics, there are approximately 400,000 correction officers in the US; represented by 75,000 departments or organizations.

This represents the market opportunity for Responders 1st Call to mitigate trauma, PTSD, disability and suicide ideations for

our First Responders. And this does not include the 800,000 ER nurses and doctors according to Zippia Emergency Room Statistics and the

NIH, plus the 2 million active and reserve military according to Defense Department personnel data and over 2 million retired military

according to Statista 2023 . who can benefit from the virtual technology embedded in our Responders 1st Call product which

is an effective treatment for trauma and PTSD.

Colleges and Universities

According to the National

Center for Education Statistics (NCES), there are approximately 6,000 colleges and universities in the US of which 4,000 are

degree-granting institutions. According to the National Student Clearinghouse Research Center, undergrad enrollments in 2021 were 17.5

million representing a decline of almost 10% after the pandemic. Further almost 600 institutions have closed over the last 3 years. With

the effects of the pandemic retention and recruitment is a critical issue for higher education along with the increasing concern on how

to support the mental and emotional well-being of their student population.

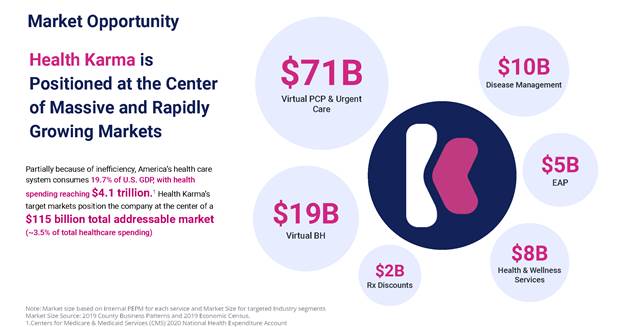

Our Market Opportunity

Since inception, we have been

focused on changing the way consumers access, interact with and consume healthcare. In the United States, healthcare spending grew to

$4.1 trillion in 2020 and is expected to reach $6.2 trillion by 2028, according to the Centers for Medicare & Medicaid Services.

However, it is not always clear what the employer group or individual consumer receives in return for this massive spending. We believe

that a new healthcare model, one that places the consumer at the center of the healthcare ecosystem, can help to improve their health

care access while reducing what they pay for it.

Evolving

Attitudes Among Consumers and Employers Towards Virtual Medicine

Supported by increasing deregulation

and broad societal shifts, demand for and provision of virtual medical and behavioral health services is surging. Telehealth enables more

efficient allocation and utilization of existing clinical resources that could otherwise go unused. With an aging population requiring

more complex care and a younger generation that is accustomed to digital technology, telehealth offers an efficient way to leverage finite

resources. In the coming years, the telehealth market is positioned for significant growth. The demand for telehealth services is clear

among younger generations. According to a survey by Harmony Healthcare IT, three out of four millennials would rather search for medical

advice online versus seeing a doctor in-person. These younger generations represent the future of the healthcare system, and telehealth

can be at the center of their care experience.

Healthcare is a Top Priority for Employers

To attract and retain staff, employers

are looking to make significant investments in health benefits; yet, as commercial insurance costs have reached record highs, employers

and employees remain frustrated. Barriers to accessing timely care during the day and after business hours cause employees to miss work

and lose productivity. As a result, many employees self-direct themselves to higher cost settings such as emergency rooms. Efficient healthcare

needs to be available 24/7/365 from anywhere that employee happens to be.

Rising health care costs are causing

many employers to question whether they can afford to offer health benefits to their employees. According to the Kaiser Family Foundation’s

2021 Employer Health Benefits Survey, it costs up to $21,804 each year for employer-sponsored family health coverage for covered workers

in small firms.

As costs continue to rise, a common

way to offset them is to adjust benefits, such as increasing deductibles or copays, lowering coinsurance and increasing out-of-pocket

limits. At a certain point, when the benefits become too lean, employees’ perception of their benefits deteriorates.

Health Insurance is Tailored to Large Enterprises

not Small Businesses

In November 2021, Americans quit

jobs at a record pace with about 4.5 million workers quitting their jobs, the most since the Bureau of Labor Statistics started publishing

the data in 2000. In the "Great Resignation," small businesses face an uphill battle for labor. Some employees are leaving for

better pay and benefits, while some are leaving the workforce and relying on government programs.

Small business owners are still

managing the reality that the number of job openings exceeds the number of unemployed workers, producing a tight labor market. In the

January 2022 Jobs Report survey from the National Federation of Independent Business (NFIB), 47% of independent businesses said they had

job openings they struggled to fill, which far exceeds the 48-year historical average of 23%. Moreover, 50% of small business owners reported

raising compensation in part to stay competitive as employers and attract applicants to their open position, which is another 48-year

record high reading.

Small businesses — defined

as 500 employees or less by the US Small Business Administration (SBA) — are a key part of economic growth and job creation in the

United States. The US Small Business Administration said in 2019 that they accounted for two-thirds of net new jobs. According to the

SBA 2021 Small Business Profile, there are over 32 million small business in the US, making up 99.9% of all US businesses and providing

employment for 61.2 million Americans. More jobs are also traditionally created by small businesses and new company formation than by

large corporations, with small companies creating 1.5 million jobs annually which accounts for 64% of new jobs, according to the Small

Business Administration.

Small businesses, like their larger

counterparts, have not been shielded from the increasing cost of health care. Without advantages such as a larger pool of insured employees,

more bargaining power with health insurance companies, and the benefit of full-time human resources personnel, small-business owners are

often left with little recourse and few options when a health insurance carrier hikes costs. In addition, many small employers have been

hanging on during the pandemic and are just starting to rebound. They may not be able to afford full insurance, but they need their employees

to stay, as turnover is costly.

The Rise of the Independent Worker, Freelancer,

and 1099 (Changing Workforce)

With the slow transition away

from traditional employment and rise of independent labor over the past decade, the U.S. economy has experienced a significant shift in

how employees choose to work. The pandemic has served as a catalyst for deeper change with respect to Americans’ embrace of the

gig economy. The gig economy is characterized by short-term, flexible jobs that businesses offer to freelancers and independent contractors

instead of traditional, full-time employees. What seemed like a gradual uptick in interest for freelance and gig work up until 2019 has

now exploded into the mainstream.

While approximately 156 million

Americans, about half the U.S. population, gets health insurance through an employer, now more than one-third of the workforce works in

the gig economy full- or part-time, according to Upwork’s study of the U.S. independent workforce, “Freelance Forward:2020.”

Covid-19 only accelerated this trend towards the gig economy with Upwork’s data showing that 12% of workers started freelancing

during the pandemic. And there may be no turning back; 60% of people who had taken up freelancing reported that no amount of money would

convince them to take a traditional job again.

The pandemic also magnified the

fundamental problems in the traditional employer benefit system for Americans. People who lost their jobs and took up independent work

were forced to find their own benefits or go without coverage during the pandemic. Today, nearly 70 million Americans, representing more

than one-third of the total U.S. workforce earn income as freelancers and that figure is expected to swell to 90 million to by 2028, according

to Statistica. Despite the trend however, this group of people are underserved compared to W2 full-time employees. The challenge of accessing

benefits isn’t just limited to independent workers either. Many employees, particularly part-time employees, do not have access

to benefits through their employers. As of January 2022, the Bureau of Labor Statics reported over 25 million part-time workers are in

the US. With this changing workforce, the needs of independent and part-time workers will only become more central in the U.S.

We believe that favorable macro-economic

trends, in combination with the expansion of our capabilities, present significant opportunities for on-demand and consumer driven healthcare

to address the most pressing, universal healthcare challenges through solutions, such as the Health Karma’s. At the same time, the

emergence of technology platforms solving massive structural challenges in other industries has highlighted the need for similar solutions

in healthcare. We believe there is a significant opportunity to solve these challenges through affordable easy-to access online solutions

to health and wellcare, such as ours, that matches consumer demand, offering health plans and employers an attractive, cost-effective

healthcare alternative for their beneficiaries, and addressing pain points such as work comp claims and costs. We believe that MediXall

Group provides solutions to address these challenges.

Health Karma Platform

At MediXall Group, we empower

consumers—both individual consumers and SMBs—to make smarter healthcare decisions with confidence via our digital platform.

Technology has changed the way consumers manage their healthcare, making them more comfortable with comparing and accessing healthcare

services online. This change has accelerated with the dramatic growth in companies offering innovative healthcare products and services.

At Health Karma, we are leveraging this transformation to improve peoples’ access to health care while reducing what they pay for

it—ultimately helping to improve the well-being of consumers and the healthcare industry as a whole. As the healthcare industry

becomes more fragmented and complex, our value proposition as a trusted, independent platform for consumers increases.

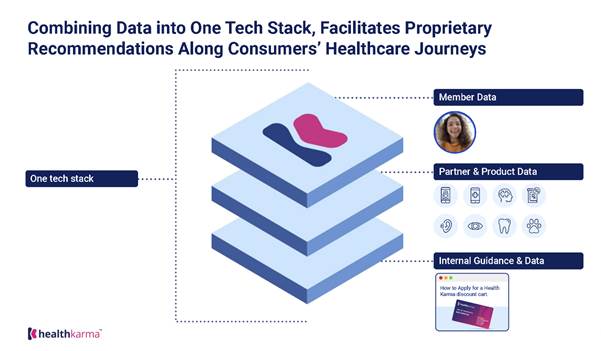

Powered by our own proprietary

full stack technology platform, we have built a suite of services that enable us to earn our members’ trust, leverage the power

of personalized data, and help our members access quality care they can afford.

The Health Karma Platform was

purpose-built to seamlessly connect our existing and future health and wellness programs into one Platform to help drive real member and

customer outcomes. We have built our Platform from the ground up to solve the unique challenges of individual consumers as well as organizations

and their members.

We believe that the Health Karma

Platform helps solve many of the common pain points for both Consumers and Employers when launching, administering, and maintaining health

and wellness-related programs. By seamlessly integrating best-in-class providers into one Platform, users get the same, consistent user

experience, without fumbling for passwords across multiple programs or struggling to remember where to access each benefit. Built as a

modular solution Health Karma can scale up depending on the unique needs of each member or employer customer by adding programs over time.

As we continue to bring the Health

Karma experience to new members, new employers, and new markets, our goal will remain the same: to build engagement, earn trust, and help

our members stay healthy and well.

Complete Solution to Manage the Consumer Healthcare

Journey

Health Karma offers a simple and

intuitive consumer experience that enables our users to take control of their health care decisions.

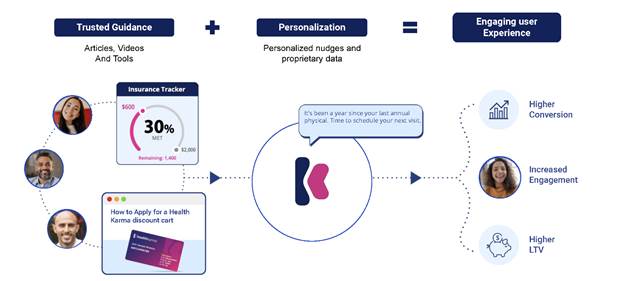

That experience begins with trust

and engagement, which we earn by providing our users with features that help them navigate the many disconnected elements of the healthcare

ecosystem. When our users adopt these tools, we not only streamline their day-to-day interactions with the healthcare system and improve

user satisfaction, but we also obtain valuable data that enables a better understanding of their unique health care needs. Trust, engagement,

and personalized data allow us to guide our users to the providers that can give them the right care, including virtual care, at the right

time and right cost. Our technology stack will also permit us to offer personalized insights and benefits. Our ability to deliver a high-value

product, in turn, creates more trust, engagement, and in time, enhances our ability to provide personalized, data-driven insights.

An important aspect of our approach

to building trust and engaging members is to engage with them through whatever channel is most comfortable for them. Whether it is a secure

in-app message to answer coverage and benefit questions, a consultation with a licensed medical provider in the middle of the night through

our telehealth offering, talking immediately with a licensed, behavioral health clinician 24/7/365 to address common emotional well-being

and behavioral health concerns, we are there for our users when they need us most. In this way, we are building a consumer-centric experience

more similar to what consumers experience from a best-in-class technology or consumer products company than from a traditional health

care organization.

Our management and team have shared

values in bringing our brand to life through materials, communications, content and interactions. From the first touch point our members

feel our commitment to delivering a service that focuses on their needs. In addition to employing A/B testing to increase engagement and

utilization, we simplify the often-complex language used in health care and insurance so that our users feel confident and comfortable

with the choices they make.

Our MediXall Group Solutions:

Health Karma

Whether a member is insured or

uninsured, their Health Karma membership makes it easy for them to access healthcare services through a convenient, virtual platform.

For an affordable monthly cost, members get access to the following programs:

$0 Co-Pay services:

Virtual Primary Care Physician

(PCP) – - Our Primary Care team will manage our members’ health in many of the same ways as a traditional primary care

physician – just over the phone or through video chat, and without any charges outside of the monthly membership fee. With Virtual

Primary Care members can:

| · | Pick a dedicated provider from the Health Karma network that will see the

member at every follow up visit. |

| · | Manage chronic conditions like asthma and diabetes with ongoing treatment

plans. |

| · | Receive prescriptions for treatment as needed. |

| · | Make an appointment to connect by phone, computer, or tablet from any location

that is convenient for the member. |

| · | Pay $0 when members have an appointment - all visits are included in the

membership fee. |

| · | Request and get an appointment in as few as 24 hours! |

| · | Receive an annual wellness visit with a metabolic panel (see all tests included

in the panel in the details) included for $0. |

Urgent Medical Care –

When care can’t wait, members can request Virtual consultations with a licensed Medical Doctor 24/7/365 for non-emergency incidents

which require care within 24 hours, like colds, flu, stomach ailments, UTIs, and more. Health Karma members can use Urgent Care when they

have minor illnesses or injuries that can't wait to be treated or that can be fully addressed in one or two visits.

Emotional Well-Being and Behavioral

Health - Getting help with emotional health can be difficult. Health Karma provides on-demand, in-the-moment support wherever members

call from by connecting them and their immediate family with a master’s level therapist. The therapist can help our members with

concerns like anxiety, stress, depression, addiction, and any other life/work balance or emotional health issue. Consultations are available

24/7 for immediate, in-the-moment help — no need for a call-back or to schedule a consultation. Consultations are confidential and

are generally up to 30 minutes in length. In addition, when appropriate, the therapist may provide our members guided solutions materials

via email. The clinician may also suggest additional steps and referrals to other resources and professional care. Health Karma’s

Virtual Behavioral Health Solution includes:

| · | 24/7 immediate in-the-moment consultations with master’s level behavioral

health clinicians |

| · | Secure, HIPAA compliant virtual consultations up to 30 minutes in duration |

| · | Intake and assessment of the member’s problems/concerns at the time |

| · | Personally directed clinically recommended, “guided solutions”

addressing members concerns. |

| · | When an employee or family member calls in multiple times a year for the

same specific issue, our clinicians may make recommendations for appropriate additional levels of care. |

Health Karma

Pets - 24/7/365 virtual consultations with licensed veterinarians to discuss pet health, wellness, behavioral, and training issues.

Includes a Pet Drug Card with prescription savings up to 75% at pharmacies nationwide.

Message Medical

Specialists with 24-hour response - Ask medical questions to our board-certified physicians, psychologists, pharmacists, dentists,

dietitians, and fitness trainers.

$0 Copay Medications

- access to 37 commonly prescribed medications ranging from antibiotics to pain management, and more, at no charge.

Psychology

– Scheduled access to a licensed Psychologist available M-F 8:00 am - 5:00 pm central standard time. Each up to 45-minute session

fee is $100.

Psychiatry

– Consult with a US- based board-certified Psychiatrist who can diagnose, treat, and prescribe medication with no referral required.

The initial scheduled consultation fee is $215 with follow up consultation fees being $100 per visit

HealthCare Advocate

– Access to dedicated subject-matter experts who provide professional support regarding healthcare costs, benefits coverage, in-network

providers, second opinions, help with medical bills, insurance plans, etc.

Discount Programs

Health Karma

Rx – With Health Karma Rx, our members have access to prescription savings with discounted pricing of approximately 60% on average,

available through 65,000 pharmacies across the U.S.

Lab Services

– Up to 50% discount at participating Quest Diagnostics lab facilities. Lab services include tests for wellness, women's health,

sexual health, and other common tests.

Dental Services

- As part of the Health Karma membership, members have access to discount saving program offered by an industry leader in dental

care Careington International Corporation. With one of the largest dental networks in the nation and its member-transparent pricing, Careington

International Corporation is one of the most recognized professional dental networks in the nation. With our dental program Health Karma

members can save 20% to 50% on most dental procedures including routine oral exams, unlimited cleanings, and major work such as dentures,

root canals, and crowns.

Vision Services

– Our discount vision program offers Health Karma members savings on eye care and eyewear the VSP Vision Savings Pass. Special prices

on eye care and eyewear through trusted, private-practice Vision Saving Pass (VSP) network of doctors with15-20% savings on eye exams

and special pricing on glasses and sunglasses.

Hearing Services

– Health Karma members have access to hearing aid discounts from 30% to 60% at over 5,500 network providers nationwide through

EPIC Hearing. Additional no charge services include routine hearing test, one-year supply of batteries, extended manufacturer’s

warranty, and follow-up visits for one year.

Vitamins and

Supplements – Health Karma members save 25% off Swanson Brand products and 5% - 15% off most other products on Swanson website;

plus free shipping on orders over $50; and 100% money-back guarantee.

Workers 1st Call & Report Solution

Work comp cost and claims are

a major issue for all businesses but especially for SMBs.

| · | The National Safety Council estimates that the total cost of work injuries

in 2020 was $164 billion; representing a cost of $1,100 per employee. |

| · | If work comp fraud were a legitimate business, it would rank among Fortune

500 companies according to Property Casualty 360. |

| · | Finally, filing all the required state and OSHA work comp reports is a huge

burden for SMBs. Liberty Mutual: delayed reporting of an injury by 1 week increases claims by 10%, & 30 days by 50% |

Seventy percent of physical workplace

injuries are minor and do not require sending the injured worker to Urgent Care or the ER. Overextension, slip, trip, falls, contact with

equipment account for 86% of injuries according to the NCCI. Further “presenteeism” meaning being at work but distracted are

one of the primary causes of workplace injuries. According to Workers Compensation.com, 75% of employees struggle with an issue which

affects their mental health.

Workers 1st Call &

Report is a pre-claim, preemptive, 24/7/365 solution for both physical and mental injuries and incidences addressing all these issues

by providing the following solutions:

| · | Virtual 24/7/365 immediate on-demand consultation with master’s level

behavioral health clinicians to address employees emotional and behavioral issues thereby keeping them focused, on-the-job and safe |

| · | Behavioral Risk Mitigation support for Frontline supervisors via coaching

with experienced behavioral health clinicians to provide immediate support to identify and assist possible “at-risk” employees. |

| · | 24/7/365 telehealth access to US-based Registered Nurses employing a proprietary

algorithm which provides the proper level of care for the injured worker. 9 years of evidenced-based results with thousands of companies

show that over 43 % of the injuries can be handled with self- or home-care vs Urgent Care or ER thereby preventing a work comp claim. |

| · | Immediately after the triage, the RN prepares and distributes all the required

reports including the Incident Report, Provider Notice, First Report of Injury, and the OSHA reports. |

Responders 1st Call Solution

Our First Responders need

support to address the stress, anxiety, depression and suicide ideation on them and their immediate family. With traumatic incidents impacting

First Responders and medical personnel and the cost of mental health claims and suicides in those populations, Responders 1st Call

was created to help First Responders and their families through emotional and behavioral health concerns. The Responders 1st

Call offering includes:

| · | Trauma

Helpline – provides 24/7/365 confidential, informal, and anonymous consultations

with experienced behavioral health clinicians experienced in critical incident stress management

and guides First Responders to compartmentalize trauma. |

| · | Behavioral

Health Consultations for all immediate Family members - address and alleviate work or

personal behavioral/emotional health issues. |

| · | Behavioral

Risk Management Consultations – provides management with in-the-moment support

to quickly identify, deal with, and deploy appropriate resources for "at-risk"

employees. |

| · | Peer

Support, Wellness, HR Consultations – provides guidance for intervention strategies,

helps determine when a situation is emergent or high-risk, strategizes how to refer/connect

a fellow responder to a clinician trusted by the agency/employer. |

| · | Virtual

EMDR – An online virtual treatment to overcome PTSD and trauma through Virtual

Eye Movement Desensitization and Reprocessing. The program is endorsed by the World Health

Organization, Veterans Administration, Dept of Defense, American Psychiatric Assoc. |

Student 1st Call Solution

The students at our colleges

and universities are dealing with emotional health. Returning to campus, regenerating friendships, lack of trust, loss of hope are a few

reasons why students need a dedicated confidential, anonymous “in-the-moment” emotional health support program. Student 1st

Call was created for universities and school districts to delivers this to their student base. Student 1st Call provides:

| · | 24/7/365 confidential and anonymous in the moment tele- or secure video

behavioral health consultations and assessments by experienced master’s level clinicians |

| · | Consultation and training for faculty and staff to help identify and provide

support for “at-risk” students |

| · | Referral if required to additional mental health care and treatment if assessed

as necessary |

| · | Medical benefit coordination with the student’s or parents’

health coverage if required |

Our Growth Opportunities

Expand clients and B2B offering.

We expect to meaningfully expand our B2B channel through both the addition of new employer and group clients, as well as a focus on

driving deeper penetration rates within our existing clients. We plan to add new B2B clients by contracting with additional regional and

national general insurance agencies, accelerating our outbound marketing efforts, leveraging our broker and consultant relationships and

continuing to penetrate the massively underserved part-time, independent, and the smaller employer worker market. Additionally, we are

focused on further developing our dedicated internal B2B sales team solely focused on expanding our B2B client base across our different

verticals as well as driving penetration within existing contracts by cross-sales with our various MediXall Group solutions –an

effort we expect to drive significant traction within the near-term. Within our existing employer base, we plan to drive penetration and

engagement with an invested focus on client success. Additionally, because of our embedded position serving the B2B customer base, we

believe we are well-positioned to innovate and lay the groundwork for additional services that drive value for their members such as navigation

across the ever-changing health and wellness landscape.

Continue expanding B2C user

base through Associations and increase engagement. Through our expanding client base of associations and performance marketing initiatives

drive penetration with these associations, we will continue to focus on growing consumer member acquisition and activation. We expect

this strategy to be further complemented by sustained investment in our platform capabilities, as well as through continuing to leverage

our growing brand awareness. We believe our growth opportunity in both health and wellness to be substantial. In addition, as a result

of the end-to-end nature of our platform, we believe we are well-positioned to create care continuity for our members across a broader

range of health and wellness verticals. We plan to drive further engagement of our existing member base by expanding our offerings beyond

our current programs to include capabilities such as enhanced behavioral and emotional well-being offerings, wearable (i.e. Apple Watch,

FitBit) integration, Wellness challenges and rewards, and medical records transfer in order to drive higher member lifetime engagement

and value. We use a strategic and disciplined approach to scaling our marketing budget, as we believe we are able to achieve efficient

spend levels on a per-customer basis by leveraging the Health Karma brand, the breadth of our MediXall Group solutions, and strong relationships

with outbound and inbound marketing channels.

Opportunistic M&A and Product

Development. We are well positioned to further expand our solution set through opportunistic acquisitions or product development responsive

to the evolving and expanding needs of our client base. Our technology platform is built to easily integrate with non-native technologies

and to offer a single cohesive platform. We plan to use a disciplined approach to strategically acquire complementary capabilities and

service lines. These may include, but are not limited to, healthcare FinTech platforms, Third-party data providers, wellness and coaching

platforms, workers comp solutions, and other virtual behavioral and care coordination platforms.

MediXall Group Technology

The underlying technology for

MediXall Group is a highly scalable, integrated, application program interface or API-driven technology platform. This enables the platform

to accommodate the seamless and quick introduction of new services, technologies and functionality that we have introduced through strategic

partnerships.

Our platform is built on a modern

cloud-based technology stack, employing Agile development cycles and a DevOps approach to infrastructure. This approach allows us to evolve

and improve our platform at a faster pace than using a traditional software development and infrastructure management process. Our technology

platform is updated frequently, without long upgrade cycles. Our modular, service-oriented architecture utilizes API standards for ease

of implementing new functionalities and integrating with external systems. By designing our product as a platform, we have created an

overarching infrastructure where consumer data, preferences, and third-party partners can all interact through Health Karma’s API.

Data is the heart of our technology so because of this we have the potential to integrate machine learning and natural language processing

to automate recommendations and workflows, uncovering insights that we can incorporate back into the design platform.

This enables our platform to act

as a sales channel for other companies. We can deliver other’s state-of-the-art technology and applications through our platform.

Similar to other two-sided marketplaces, the platform can bring innovative new products to consumers and employers, while at the same

time opening up distribution and revenue opportunities for other health companies. Furthermore, we believe that this will generate a virtuous

cycle, leveraging our growing customer base to attract the best healthcare partners (and vice versa)-increasing value for all stakeholders.

Our proprietary technology platform

powers all aspects of our company: engaging members, supporting partners, and advancing business objectives. Our technology is grounded

in human-centered design thinking and leverages insights from behavioral interaction. Our product designers and engineers collaborate

closely with our operational team members, as well as healthcare advisors and partners in the Health Karma Network to observe and then

optimize workflows. We employ user testing and experiment-driven design (such as A/B testing) to enhance our member and partner experiences.

With the opportunities and growth

trajectory in front of the company, we believe our skilled internal development team is uniquely positioned to make critical real-time

product development decisions, enabling us to be responsive and stay ahead of the competition.

Sales & Marketing

MediXall Group focuses on member

growth through the distribution channel partners previously described. We use marketing and sales strategies tailored for each distribution

and market channel to reach consumers, employees, as well as employee benefits leaders. Employer marketing and sales strategies also include

account-based marketing, business development initiatives, and client service teams focused on customer acquisition, employee enrollment,

and member engagement. We derive employer sales through a direct sales force, focused on large enterprises, and channel partners primarily

for small and medium businesses and organizations, which enables us to distribute all our MediXall Group solutions to the market efficiently.

Employer Sales & Marketing

With the roll out of MediXall

Group solutions to employers, we are developing and expanding our in-house employer sales force to be comprised of sales professionals

who will be organized by each of the unique MediXall Group solution, geography, customer size, and industry. We support our sales force

in several ways, including through account-based marketing resources and the deployment of a business development team to educate employer

decision makers on the benefits of offering Health Karma to their employees. We also leverage sales analytics to further support lead

generation. Additionally, our account management and client success team actively manages our customer accounts, provides in-depth support,

and cross-sells the client to other MediXall Group solutions which address their pain points.

Also, we work with channel partners

such as associations, chambers, payroll and professional employer organizations to reach small and medium businesses and organizations.

Additionally, we partner with select regional and national benefits brokers and consultants to educate and sell potential customers on

our offerings.

Consumer Sales & Marketing

When we market and sell directly

to individuals, we initially plan to focus on increasing brand awareness, followed by performance marketing targeted toward user acquisition,

activation and engagement.

Our marketing strategy in new

markets is primarily centered on increasing overall brand awareness, familiarity, consideration and ultimately enrollment. We have carefully

developed a robust marketing plan to achieve these objectives:

| · | SEO, Social & Traditional - We will drive brand awareness

and conversions to our platform using social media marketing via Facebook, LinkedIn, Twitter, Instagram, Snapchat, YouTube, and others.

In addition, we plan to leverage SEO & SEM (Search Engine Optimization & Search Engine Marketing) to enhance MediXall Group’s

search presence both organically and paid. |

| · | Content Marketing - We consistently release marketing content

through our blog that aims to educate our audience about the value that our services provides. We also develop thought leadership content

such as whitepapers, eBooks, and infographics and use public relations to secure earned media placements. Our content marketing efforts

aim to influence and persuade readers without having to rely solely on conventional direct selling tactics. |

| · | Influencer Marketing - We will launch an initiative to guest

blog articles and features in healthcare, personal finance, and startup tech publications like TechCrunch, Wired, VentureBeat, and other

outlets in our industry. Additionally, we participate in industry conferences, and may partner with media outlets, event venues, local

businesses, and social media influencers to increase brand awareness. |

As brand awareness increases in

more established markets, we shift our efforts to performance marketing focused on both customer acquisition and engagement. Our performance

marketing initiatives include customized task-based in-app messages and email communications to drive engagement among members, in addition

to more targeted advertisements through direct mail, Google Search, YouTube and social media for member acquisition.

Customer and Client Services and Support

We believe that because our clients

and employer customers bear an enormous responsibility to successfully run their businesses day in and day out, they welcome our support

to provide end-to-end customer support, including full profile data conversion and import, live onboarding and technical support via telephone,

email, and screen sharing; in-software self-service tools; advanced professional services; and educational events. Our dedicated support

team is focused on seeking to ensure that every MediXall Group member has the best possible experience.

Customer & Client Onboarding.

We onboard new customers and partners with live training sessions delivered via telephone and web conference. These trainings are supplemented

by self- service setup checklists, online help materials and webinars.

Customer & Client Success.

To identify opportunities for greater adoption of our products and services and to further help our customers be more successful on our

platform, we engage with them to better understand their business goals, objectives, and pain points; provide targeted education about

relevant features, products and services as well as business best practices; and develop a recommended success plan with periodic outreach

to check in on their progress.

Ongoing Customer Support.

Inclusive with being a member of the Health Karma Partner Program, we offer customer service and support via phone, chat, emails and self-help

knowledge centers. All customer service and support is provided by our in-house personnel who are invested in MediXall Group’s core

values and are closely connected to our Product, Technology and Experience team.

Competition

While we believe there are currently no direct competitors

that offer the full suite of solutions as we do, there are several companies that offer components of telehealth or address conditions

that compete with our solutions. These include companies whose primary business is providing and marketing telehealth and health and wellness

management, such as the delivery of on-demand access to healthcare and wellness services. We compete with other providers that are larger

in scale and generally provide telehealth on behalf of self-insured employers and insurance plans. Within parts of the behavioral health

market, we also compete with public and private organizations with similar product offerings for consumers. Competition focuses on, among

other factors, technology, breadth and depth of functionality, range of associated services, operational experience, customer support,

extent of customer base, and reputation.

Regulatory Environment

Participants in the health care

industry are required to comply with extensive and complex laws and regulations in the United States at the federal and state levels as

well as applicable international laws. Although many regulatory and governmental requirements do not directly apply to our business, our

customers are required to comply with a variety of laws, and we may be affected by these laws as a result of our contractual obligations.

Similarly, there are a number of legislative proposals in the Unites States, both at the federal and state level, which could impose new

obligations in areas affecting our business. We have attempted to structure our operations to comply with applicable legal requirements,

but there can be no assurance that our operations will not be challenged or impacted by enforcement initiatives.

Healthcare Reform

Our business could be affected

by changes in health care laws, including without limitation, the Patient Protection and Affordable Care Act (the “ACA”),

which was enacted in March 2010. The ACA has changed how health care services are covered, delivered and reimbursed through expanded coverage

of individuals, changes in Medicare program spending and insurance market reforms. Ongoing government and legislative initiatives may

bring about other changes.

While most of the provisions of

the ACA and other health care reform legislation will not be directly applicable to us, they may affect the business of many of our customers,

which may in turn affect our business. Although we are unable to predict with any reasonable certainty or otherwise quantify the likely

impact of the ACA, any amendment or repeal of the ACA, or other health care reform on our business model, financial condition, or results

of operations, negative changes in the business of our customers and the number of individuals they insure may negatively impact our business.

Requirements Regarding the Privacy and Security of Personal Information

U.S.- HIPAA and Other Privacy