TIDMCHAR

RNS Number : 1287N

Chariot Limited

28 September 2021

28 September 2021

Chariot Limited

("Chariot", the "Company")

H1 2021 Results

Chariot (AIM: CHAR), the Africa focused transitional energy

company, today announces its unaudited interim results for the

six-month period ended 30 June 2021.

-- Appraisal drilling at Anchois, offshore Morocco, anticipated

to commence in December 2021; a key step in early monetisation path

for Anchois gas development project.

-- Key contracts and team in place with the signing of a

contract for the Stena Don rig and award of well services contract

to Halliburton.

-- Acquisition of Africa Energy Management Platform ("AEMP")

completed in Q2 2021 under the new Transitional Power business

stream looking to transform the energy market for mining operations

in Africa, providing a largely untapped market with cleaner,

sustainable and more reliable power.

-- Memorandum of Understanding ("MoU") signed with the

Government of Mauritania to progress a potential green hydrogen

development.

-- Recapitalised Company through successful placing, subscription and open offer.

Adonis Pouroulis, Acting CEO of Chariot commented:

"We have achieved significant progress in the first half of the

year as we aim to deliver on the strategy in place across our two

business streams. We are fully focused on delivering a successful,

safe and cost-effective appraisal well in Morocco that meets the

objectives set out in our earlier fundraising. The acquisition of

AEMP has brought a pipeline of high-value accretive clean energy

investment opportunities and we are making great strides in our

relationship with Total Eren to bring these projects to investment

stage.

We are on track for drilling operations to commence in December

2021 and look forward to an exciting period of newsflow from our

Moroccan operations and across the wider group with the progression

of our exciting new power business stream."

Highlights during and post-period:

Transitional Gas

The Anchois Development Project

-- Rig contract awarded to Stena Drilling to use the Stena Don,

a semi-submersible rig, suitable for drilling, completion, and

workover operations. Anchois appraisal drilling operations are

anticipated to commence in December 2021 and expected to take up to

approximately 40 days.

-- Appraisal drilling objectives:

o Unlock the development of the discovered sands by confirming

the gas resource volumes, reservoir quality and well

productivity.

o Provide a future production well for the development of the

field.

o Potentially deepen the well into additional low-risk

prospective sands with the aim of establishing a larger resource

base for longer term growth.

-- Gas Market Memorandum of Understanding ("MOU") signed in

March 2021 with partner the Office National des Hydrocarbures et

des Mines ("ONHYM") and the Ministry of Industry, Trade and Green

and Digital Economy ("Ministry") in Morocco to support the Anchois

Gas Development.

-- Collaboration agreement with Subsea Integration Alliance

signed in February 2021, a developer of

offshore gas projects, to progress the front-end design,

engineering, procurement, construction,

installation and operation of the Anchois Gas Development.

-- Rissana Offshore Licence, Morocco, capturing prospective

acreage surrounding the core Anchois development, in process of

formal award.

Transitional Power

-- Acquisition completed of AEMP in Q2 2021.

-- Acquisition meets Chariot's key environmental, social and

corporate governance ("ESG") values of positive impact on the

environment, countries, and communities where it operates.

-- Entire AEMP team fully integrated into Chariot, under the

Transitional Power business stream, including founders Benoit

Garrivier and Laurent Coche.

-- Right to invest in up to 15% project equity at cost in

projects developed in strategic partnership with Total Eren, a

global renewable IPP to develop low-risk mining power projects in

Africa.

-- Partnership has built a pipeline of 500MW of African mining

power projects; Chariot's management is also looking to leverage

its other significant business interests in multiple mining

operations across Africa to rapidly grow the pipeline.

-- First project in operation, the largest hybrid solar plant in

Africa, at the Essakane gold mine in Burkina Faso, successfully

completed and currently generating returns providing proof of

concept.

New Business

-- Green hydrogen project given exclusivity over an onshore and

offshore area in Mauritania totalling approximately 14,400 km(2) to

carry out pre-feasibility and feasibility studies with the

intention of generating electricity from solar and wind resources

to be used in electrolysis to split water to produce green hydrogen

and oxygen.

-- Transitional Gas and Transitional Power teams continue to

evaluate new opportunities that play to our strengths as energy

professionals and our long-standing presence and experience across

the African continent

Corporate

-- Unaudited cash balance as at 30 June 2021 of US$18.0 million

-- Successful fundraise completed H1 2021 to fund Gas and Power work programmes

-- No debt or remaining work commitments

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, as retained in the UK

pursuant to S3 of the European Union (Withdrawal) Act 2018.

For further information please contact:

Chariot Limited

Adonis Pouroulis, Acting CEO

Julian Maurice-Williams, CFO +44 (0)20 7318 0450

finnCap (Nominated Adviser and Joint Broker)

Christopher Raggett, Simon Hicks, Edward

Whiley +44 (0)20 7220 0500

Peel Hunt (Joint Broker)

Richard Crichton, David McKeown +44 (0)20 7418 8900

Celicourt Communications (Financial PR)

Mark Antelme, Jimmy Lea +44 (0)20 8434 2754

NOTES FOR EDITORS:

About Chariot

Chariot is an African focused transitional energy group with two

business streams, Transitional Gas and Power.

Chariot Transitional Gas is executing a high value, low risk gas

development project with strong ESG credentials in a fast-growing

emerging economy with a clear route to early monetisation, delivery

of free cashflow and material exploration upside. Chariot

Transitional Power is looking to transform the energy market for

mining operations in Africa, providing a giant largely untapped

market with cleaner, sustainable, and more reliable power.

The ordinary shares of Chariot Limited are admitted to trading

on the AIM under the symbol 'CHAR'.

Chariot Limited

Chief Executive's Review

The first half of 2021 has seen material change in the Company's

make-up: we have acquired a renewable and hybrid energy project

developer and we have forged ahead with our core asset, the

transitional Anchois gas project in Morocco such that we have an

operated gas appraisal well due to commence in December 2021. The

progression of our twin business streams reaffirms our stated

strategy to create value and deliver positive change though

investments that are driving the energy revolution. We are

embracing the new era of environmental, social and governance

("ESG") principles and driving forward with our sights on projects

that will revolutionise energy across Africa. Importantly we have

also re-capitalised the Company to enable delivery of this strategy

within a meaningful timeframe for all stakeholders.

Transitional Gas - Anchois Development Project

The Lixus licence, offshore Morocco, contains the Anchois gas

discovery, with audited total remaining recoverable resource in

excess of 1 Tcf for Anchois, comprising 361 Bcf 2C contingent

resources and 690 Bcf 2U prospective resources. Having undertaken

an optimised work programme since award in 2019 to reprocess

existing seismic data and mature gas marketing and development

attributes, this gas project comes at an opportune time to assist

Moroccan energy transition. The clear next step to unlock the

development and fast-track to gas production is the drilling of an

appraisal well, which with the recent signing of the Stena Don rig

contract with Stena Drilling, is now anticipated to commence in

December 2021.

The primary technical objective of the appraisal well is to

unlock the development of the discovered sands by confirming the

gas resource volumes, reservoir quality and well productivity.

Secondly, this well will have the ability to provide a site for a

future production well for the development of the field and finally

we have the option to deepen the well into additional low-risk

prospective sands with the aim of establishing a larger resource

base for longer term growth. The drilling team is in place, led by

David Brecknock who recently re-joined the Company having

previously played a pivotal role in Chariot's previous drilling

campaign in Namibia, which was operated safely, on time and under

budget.

The subsea-to-shore development concept for the Anchois gas

field, progressed through pre-FEED studies performed with Xodus, an

engineering consultancy owned by Subsea 7, validated the

development plan and identified the possibility to use standardized

technology and optimise costs, due to favourable subsurface

conditions. The e xcellent reservoir properties and gas quality

mean that costs are greatly reduced as we can decrease subsea

complexity, use standard materials and technology, and reduce the

number of initial producer wells due to high productivity rates.

Further advancement in the planning phase of the development came

in February 2021, when we signed a collaboration agreement with

Subsea Integration Alliance, the world-leading developer of

offshore gas projects, to progress the front-end design,

engineering, procurement, construction, installation and operations

work streams. The current development plan consists of two initial

subsea wells tied into a subsea manifold with a 40km offshore

flowline connected to an onshore gas processing facility, from

which a short 40km pipeline connects to the trunk pipeline to

Europe allowing access not only to the growing Moroccan energy

market but also to the European gas market.

This development plan is fundamental to us achieving our goals

of helping deliver energy security and independence to the Kingdom

of Morocco in the near-term and move away from reliance on imported

fossil fuels. Indigenous Moroccan gas, such as that from an Anchois

Field development, has the ability to fuel existing power stations.

The industrial demand for gas is robust and growing, with high

established gas prices. Furthermore, with a connection to the

Maghreb-Europe Gas Pipeline (GME pipeline), surplus gas from the

Anchois field development could potentially be exported to Europe,

highlighting the bankability and commercial optionality of the

project. Lixus boasts excellent contract terms in what is widely

known internationally to be a favourable fiscal environment. There

is a 10-year corporate tax holiday from the commencement of

production and a low 3.5% royalty on gas produced offshore at the

water depth of the Anchois discovery. The signature of the

Memorandum of Understanding with the Ministry of Industry in

Morocco, supporting the Anchois Gas Development project, also

confirms that the project will be contributing to social

development. We are fully aligned with the Ministry in helping the

Kingdom meet its key national strategy of industrial development

and economic decarbonization. By bringing this project onstream, we

will be improving infrastructure and providing clean and

competitive energy for consumption by the Moroccan industrial

sector. The Ministry's support of utilising natural gas extracted

in Morocco has been a huge step forward in Chariot's development

plan.

Last year, Chariot received two Expression of Interest ("EOI")

letters, acknowledging Lixus as an important strategic asset, with

strong ESG credentials. The EOI's came from Africa Finance

Corporation ("AFC"), a pan-African Multilateral Development

Financial Institution, for the provision of development debt

finance for the Anchois Gas Discovery, and a major Multinational

Investment Bank, for the provision of Reserves Base Lending for the

development of Anchois. In parallel, we are holding very positive

discussions with potential partners who could join the project to

provide extended support and capital to progress the project into

development post-appraisal well.

There is a huge amount of follow-on potential to grow Lixus in

the coming years and we see that potential extending onto the

Rissana licence, which surrounds the borders of Lixus. Key terms

were agreed on Rissana, in late 2020, and we anticipate the formal

award of the licence shortly.

Transitional Power

Our acquisition of AEMP in the first half of the year was an

important first step to diversifying the business and a

demonstration of the new strategy in practice. The team is

comprised of accomplished energy professionals, who are innovating

solutions for the carbon-intensive mining industry in Africa, which

is estimated to be comparable in size to 50% of the UK power

market. We have chosen to focus our business on the continent of

Africa due to its many growing populations and industries that need

access to cleaner and more competitive energy. Initially leveraging

the group's network of African mining connections for immediate

project delivery, we hope to expand beyond the mining industry and

serve these other rapidly growing markets.

Our proven concept and ESG project credentials can be seen at

the IAMGOLD mine, in the Sahel region, Burkina Faso. The Essakane

PV Plant is situated on-site at the gold mine, providing clean

solar energy through 130,000 photovoltaic panels, contributing to

the mine's power production, and replacing 15 MW with clean solar

energy. Chariot owns a 10% share of this 15MW project, which

creates a positive impact and benefits the local communities, while

respecting the environment. The Essakane project was registered to

the UNFCCC with a confirmed 18,000 Certified CO(2) Emission

Reductions credited every year, a major contribution to sustainable

development that was recognised by the "2019 Towards Sustainable

Mining" excellence award.

We are in a unique position where we have potential access to

multiple mining operations across Africa on account of management's

wide reach in the mining industry putting us in a position to

rapidly grow the pipeline.

Financial Review

The Group remains debt free and had a cash balance of US$18.0

million at 30 June 2021 (US$3.7 million at 31 December 2020). The

equity fundraising completed in June 2021 raised net proceeds of

US$17.4 million which are further supplemented by an underwriting

commitment of $5.2 million from Magna Capital LDA (of which Adonis

Pouroulis is a substantial shareholder). The underwriting

commitment ensures that the total fundraising will equate to

approximately US$23 million before expenses. Further details in

note 7.

Other administrative expenses of US$1.7 million (30 June 2020:

US$1.7 million) are in line with the prior period with a reduction

in admin expenses driven by the restructuring in the first half of

2020 being offset by increases to business development costs and

advisory fees driven by acquisition activity in the period.

Finance income of US$Nil (30 June 2020: US$0.4 million) and

finance expenses of US$0.3 million (30 June 2020: <US$0.1

million) reflect the holding of higher cash balances in Sterling to

meet administrative and capital expenditures resulting in higher

foreign exchange losses, in addition to the unwinding of the

discount on the lease liability under IFRS 16.

Share-based payments charges of less than US$0.1 million (30

June 2020: US$0.2 million) are marginally lower than the prior

period due to the vesting of historic awards of employee deferred

shares.

Outlook

Chariot is founded on a deep-rooted reputation for technical

excellence across Africa, forged over many years of proving

ourselves as capable, safe, and efficient operators. We are tapping

into a wide-reaching network and long-standing position across the

continent, with a wealth of fantastic opportunities open to us to

grow the business.

Transitional Gas is looking to drill the planned appraisal well

on Anchois at the end of the year as operator with the same team

that executed the 2018 drilling campaign safely, on time and

significantly under budget. We will look to capitalise quickly on

the outcome of the drilling to move into the next phase of the

project.

We are also extremely excited to embark on new and innovative

projects with our partners Total Eren, improving access to clean

and sustainable energy across Africa. We are determined to fulfil

our mission of creating a positive impact on the countries and

communities in which we operate, providing value to the Chariot

stakeholders as we proceed. The new Transitional Power team is

already pioneering and continuing to create ground-breaking

projects that will revolutionise energy solutions in the mining

sector, with plans to target projects in other industries,

including the recently announced potential green hydrogen project

in Mauritania.

We have set forth on a journey to contribute to a cleaner

future; we have a responsibility to the communities we work in, our

shareholders and the environment, as we seek to provide energy

solutions across Africa.

Adonis Pouroulis

Acting Chief Executive Officer

28 September 2021

Chariot Limited

Consolidated statement of comprehensive income for the six

months ended 30 June 2021

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Share based payments (26) (236) (222)

Loss on disposal of inventory - (524) (524)

Impairment of exploration

asset 4 - (66,666) (66,666)

Other administrative expenses (1,655) (1,736) (3,678)

--------------------------------------- ------- -------------- -------------- ---------------

Total operating expenses (1,681) (69,162) (71,090)

--------------------------------------- ------- -------------- -------------- ---------------

Loss from operations (1,681) (69,162) (71,090)

Finance income - 361 543

Finance expense (329) (38) (72)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period before

taxation (2,010) (68,839) (70,619)

Tax expense - (1) (1)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period and total

comprehensive loss for the

period attributable to equity

owners of the parent (2,010) (68,840) (70,620)

--------------------------------------- ------- -------------- -------------- ---------------

Loss per ordinary share attributable 3 US$(0.01) US$(0.19) US$(0.19)

to the equity holders of the

parent - basic and diluted

--------------------------------------- ------- -------------- -------------- ---------------

Chariot Limited

Consolidated statement of changes in equity for the six months

ended 30 June 2021

Share Shares Total

based based attributable

Share Share Contributed payment to be Retained to equity

capital premium equity reserve issued deficit holders

reserve of the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

------------------ ----------- ----------- --------------- ---------- ---------- ------------ -----------------

For the six

months ended

30 June 2021

(unaudited)

As at 1 January

2021 6,549 359,609 796 1,447 - (352,239) 16,162

Loss and total

comprehensive

loss for the

period - - - - - (2,010) (2,010)

Issue of capital 3,491 15,666 - - - - 19,157

Issue costs - (1,241) - - - - (1,241)

Share based

payments - - - 26 - - 26

Share based

deferred

consideration - - - - 142 - 142

As at 30 June

2021 10,040 374,034 796 1,473 142 (354,249) 32,236

------------------ ----------- ----------- --------------- ---------- ---------- ------------ -----------------

For the six Share Total

months ended based Foreign attributable

30 June 2020 Share Share Contributed payment exchange Retained to equity

(unaudited) capital premium equity reserve reserve deficit holders

of the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

As at 1 January

2020 6,268 356,503 796 5,408 (1,241) (281,174) 86,560

Loss and total

comprehensive

loss for the

period - - - - - (68,840) (68,840)

Share based

payments - - - 236 - - 236

Transfer of

reserves due

to issue of

share awards 157 2,101 - (2,258) - - -

As at 30 June

2020 6,425 358,604 796 3,386 (1,241) (350,014) 17,956

----------------- ----------- ----------- --------------- ---------- ------------ ------------ ----------------

For the year Share Total

ended 31 based Foreign attributable

December Share Share Contributed payment exchange Retained to equity

2020 (audited) capital premium equity reserve reserve deficit holders

of the

parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

As at 1

January

2020 6,268 356,503 796 5,408 (1,241) (281,174) 86,560

Loss and

total

comprehensive

loss for

the year - - - - - (70,620) (70,620)

Share based

payments - - - 222 - - 222

Transfer

of reserves

due to issue

of share

awards 281 3,106 - (3,387) - - -

Transfer

of reserves

due to lapsed

share options - - - (796) - 796 -

Transfer

of reserves - - - - 1,241 (1,241) -

As at 31

December

2020 6,549 359,609 796 1,447 - (352,239) 16,162

---------------- ----------- ----------- -------------- ---------- ----------- ----------- --------------

Chariot Limited

Consolidated statement of financial position as at 30 June

2021

30 June 30 June 31 December

2021 2020 2020

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Non-current assets

Exploration and appraisal

costs 4 13,756 12,311 12,822

Investment in power projects 5 450 - -

Goodwill 5 380 - -

Property, plant and equipment 52 59 43

Right of use asset: office

lease 492 819 655

------------------------------------ ------- ----------- ----------- ------------

Total non-current assets 15,130 13,189 13,520

------------------------------------ ------- ----------- ----------- ------------

Current assets

Trade and other receivables 704 711 811

Cash and cash equivalents 6 18,049 5,845 3,740

------------------------------------ ------- ----------- ----------- ------------

Total current assets 18,753 6,556 4,551

------------------------------------ ------- ----------- ----------- ------------

Total assets 33,883 19,745 18,071

------------------------------------ ------- ----------- ----------- ------------

Current liabilities

Trade and other payables 990 848 1,060

Lease liability: office lease 431 355 409

------------------------------------ ------- ----------- ----------- ------------

Total current liabilities 1,421 1,203 1,469

------------------------------------ ------- ----------- ----------- ------------

Non-current liabilities

Lease liability: office lease 226 586 440

------------------------------------ ------- ----------- ----------- ------------

Total non-current liabilities 226 586 440

------------------------------------ ------- ----------- ----------- ------------

Total liabilities 1,647 1,789 1,909

------------------------------------ ------- ----------- ----------- ------------

Net assets 32,236 17,956 16,162

------------------------------------ ------- ----------- ----------- ------------

Capital and reserves attributable

to equity holders of the parent

Share capital 7 10,040 6,425 6,549

Share premium 374,033 358,604 359,609

Contributed equity 796 796 796

Share based payment reserve 1,473 3,386 1,447

Shares to be issued reserve 5 142 - -

Foreign exchange reserve - (1,241) -

Retained deficit (354,249) (350,014) (352,239)

------------------------------------ ------- ----------- ----------- ------------

Total equity 32,236 17,956 16,162

------------------------------------ ------- ----------- ----------- ------------

Chariot Limited

Consolidated cash flow statement for the six months ended 30

June 2021

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

US$000 US$000 US$000

Unaudited Unaudited Audited

-------------------------------------------- -------------- -------------- ---------------

Operating activities

Loss for the period before taxation (2,010) (68,839) (70,619)

Adjustments for:

Loss on disposal of inventory - 524 524

Impairment of exploration asset - 66,666 66,666

Finance income - (361) (543)

Finance expense 329 38 72

Depreciation 177 198 387

Share based payments 26 236 222

Net cash outflow from operating

activities before changes in working

capital (1,478) (1,538) (3,291)

Decrease / (increase) in trade and

other receivables 38 67 (34)

Decrease in trade and other payables (290) (1,100) (728)

Cash outflow from operating activities (1,730) (2,571) (4,053)

Tax payment - (1) (1)

-------------------------------------------- -------------- -------------- ---------------

Net cash outflow from operating

activities (1,730) (2,572) (4,054)

-------------------------------------------- -------------- -------------- ---------------

Investing activities

Finance income - 29 29

Payments in respect of property,

plant and equipment (22) - (8)

Payments in respect of intangible

assets (793) (1,300) (1,971)

Net cash consideration on acquisition (21) - -

Net cash outflow used in investing

activities (836) (1,271) (1,950)

-------------------------------------------- -------------- -------------- ---------------

Financing activities

Issue of ordinary share capital 17,396 - -

net of fees

Payment of lease liabilities (192) (245) (337)

Finance expense on lease (27) (38) (72)

Net cash inflow from financing activities 17,177 (283) (409)

-------------------------------------------- -------------- -------------- ---------------

Net increase / (decrease) in cash

and cash equivalents in the period 14,611 (4,126) (6,413)

Cash and cash equivalents at start

of the period 3,740 9,635 9,635

Effect of foreign exchange rate

changes on cash and cash equivalent (302) 336 518

Cash and cash equivalents at end

of the period 18,049 5,845 3,740

-------------------------------------------- -------------- -------------- ---------------

Chariot Limited

Notes to the interim financial statements for the six months

ended 30 June 2021

1. Accounting policies

Basis of preparation

The interim financial statements have been prepared using

policies based on International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board (IASB) as adopted for use in the EU.

The interim financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial statements for the year ended 31 December 2020. The Group

has not adopted IAS 34: Interim Financial Reporting in the

preparation of the interim financial statements.

There has been no impact on the Group of any new standards,

amendments or interpretations that have become effective in the

period. The Group has not early adopted any new standards,

amendments or interpretations.

2. Financial reporting period

The interim financial information for the period 1 January 2021

to 30 June 2021 is unaudited. The financial statements also

incorporate the unaudited figures for the interim period 1 January

2020 to 30 June 2020 and the audited figures for the year ended 31

December 2020.

The financial information contained in this interim report does

not constitute statutory accounts as defined by sections 243-245 of

the Companies (Guernsey) Law 2008.

The figures for the year ended 31 December 2020 are not the

Group's full statutory accounts for that year. The auditors' report

on those accounts was unqualified, did not contain references to

matters to which the auditors drew attention by way of emphasis and

did not contain a statement under section 263 (3) of the Companies

(Guernsey) Law 2008.

3. Loss per share

The calculation of the basic earnings per share is based on the

loss attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Loss for the period US$000 (2,010) (68,840) (70,620)

------------- ------------- --------------

Weighted average number of

shares 391,409,534 371,519,129 379,349,854

------------- ------------- --------------

Loss per share, basic and diluted* US$(0.01) US$(0.19) US$(0.19)

------------- ------------- --------------

*Inclusion of the potential ordinary shares would result in a

decrease in the loss per share and, as such, is considered to be

anti-dilutive. Consequently a separate diluted loss per share has

not been presented.

4. Exploration and appraisal costs

30 June 2021 30 June 2020 31 December 2020

US$000 US$000 US$000

-------------- -------------- ------------------

Balance brought forward 12,822 78,264 78,264

-------------- -------------- ------------------

Additions 934 713 1,224

-------------- -------------- ------------------

Impairment - (66,666) (66,666)

-------------- -------------- ------------------

Net book value 13,756 12,311 12,822

-------------- -------------- ------------------

As at 30 June 2021 the net book value of US$13.8 million

comprises entirely the Moroccan cost pool (31 December 2020:

US$12.8 million) with activities in Namibia and Brazil having been

assessed as non-core and fully impaired in the period ended 30 June

2020.

5. Business combination

On 25 June 2021 the Company completed the acquisition of the

business of Africa Energy Management Platform ("AEMP") including

the related 10% holding in the Essakane project. AEMP is a

renewable and hybrid energy project developer with an ongoing

strategic partnership with Total Eren, a leading global player in

renewable energy, and qualifies as a business as defined in IFRS 3.

AEMP was acquired as an extension of the updated strategy to have a

positive impact on the environment, the countries and the

communities in which the Company operates.

Consideration and fair value of assets and liabilities

acquired

As initial consideration for the acquisition the Company paid

US$0.1 million in cash and issued 9,196,926 new ordinary shares at

a value of US$0.7 million. Deferred consideration representing

1,982,096 new ordinary shares is payable dependent on certain

project pipeline targets being met, which has been recognized in

equity. The consideration shares were valued at US$0.07 (5.16p)

being the close price on the day preceding completion of the

acquisition.

At acquisition, total identifiable assets and liabilities

assumed were US$0.5 million, the majority of which was attributable

to the 10% project equity held in the operational Essakane power

project. The balance of the consideration of US$0.4 million has

been allocated to goodwill, indicative of intellectual property,

management team and customer relationships acquired. None of the

goodwill is expected to be deductible for income tax purposes. No

impairment of goodwill was identified in the short period from

acquisition to 30 June 2021.

The amounts recognized in respect of the identified assets

acquired and liabilities assumed are set out in the table

below.

30 June 2021

US$000

--------------

Investment in power projects 450

--------------

Trade receivables 5

--------------

Cash 69

--------------

Trade payables (12)

--------------

Total identifiable assets acquired and liabilities assumed 512

--------------

Goodwill 380

--------------

Total consideration 892

--------------

Satisfied by:

--------------

Cash 90

--------------

New ordinary shares 660

--------------

Contingent consideration payable in shares to be issued 142

--------------

Total consideration transferred 892

--------------

Contingent payments

Further contingent payments representing a maximum of 3,964,192

new ordinary shares are payable to key members of the AEMP team

dependent on their retention and certain project pipeline targets

being met and will be recognised as share-based payments in the

Consolidated Statement of Comprehensive Income over the retention

period.

6. Cash and cash equivalents

As at 30 June 2021 the cash balance of US$18.0 million (31

December 2020: US$3.7 million ) contains the following cash

deposits that are secured against bank guarantees given in respect

of exploration work to be carried out:

30 June 2021 30 June 2020 31 December 2020

US$000 US$000 US$000

-------------- -------------- ------------------

Moroccan licences 350 650 500

-------------- -------------- ------------------

350 650 500

-------------- -------------- ------------------

The funds are freely transferrable but alternative collateral

would need to be put in place to replace the cash security.

7. Share capital

Allotted, called up and fully paid

At At At At 31 December 31

30 June 30 June 30 June 30 June 2020 December

2021 2021 2020 2020 2020

--------------- ---------- --------------- ---------- --------------- -----------

Number US$000 Number US$000 Number US$000

--------------- ---------- --------------- ---------- --------------- -----------

Ordinary

shares

of 1p

each 636,077,728 10,040 378,868,721 6,425 388,367,946 6,549

--------------- ---------- --------------- ---------- --------------- -----------

Details of the Ordinary shares issued during the six month

period to 30 June 2021 are given in the table below:

Date Description Price No of shares

US$

1 January

2021 Opening Balance 388,367,946

------------------------------------- ------- --------------

Issue of initial consideration

25 June 2021 shares for acquisition of AEMP 0.07 9,196,926

------------------------------------- ------- --------------

Issue of shares at GBP0.055 in

Placing, Subscription, Open Offer

28 June 2021 and fees 0.08 238,512,856

------------------------------------- ------- --------------

30 June 2021 636,077,728

------- --------------

The ordinary shares have a nominal value of 1p. The share

capital has been translated at the historic rate at the date of

issue, or, in the case of the LTIP, the date of grant.

In the June 2021 equity fundraising Magna Capital LDA (of which

Adonis Pouroulis, Acting CEO, is a substantial shareholder),

conditionally agreed to underwrite the fundraising. Accordingly

subsequent to the completion of the placing, subscription and open

offer, the remaining underwriting commitment is US$5.2 million

which will be fulfilled by subscribing in two tranches on or before

31 January 2022 and 28 February 2022 for new Ordinary Shares at

5.5p. Mr. Pouroulis has personally sub-underwritten the

underwriting commitment. The underwriting commitment is

transferable at Magna's sole discretion and shall reduce in equal

proportion to any funds received separately by the Company from a

farm-in or a further fundraise. The underwriting commitment

constitutes a related party transaction.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LRMFTMTITBIB

(END) Dow Jones Newswires

September 28, 2021 01:59 ET (05:59 GMT)

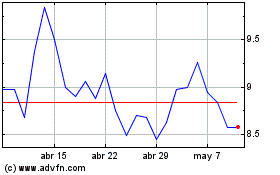

Chariot (LSE:CHAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chariot (LSE:CHAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024