TIDMESC

RNS Number : 1349T

Escape Hunt PLC

22 November 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, THE REPUBLIC OF IRELAND, NEW ZEALAND OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN ESCAPE HUNT PLC OR ANY OTHER ENTITY

IN ANY JURISDICTION. NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS

DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION

WITH, ANY INVESTMENT DECISION IN RESPECT OF ESCAPE HUNT PLC.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION STIPULATED UNDER THE

UK MARKET ABUSE REGULATION. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For immediate release

22 November 2021

ESCAPE HUNT PLC (To be renamed XP Factory Plc)

("Escape Hunt", the "Company" or the "Group")

Result of the General Meeting

Total Voting Rights

And

Directors' Shareholdings

Result of Meeting

Escape Hunt plc (AIM: ESC), a leading operator of escape rooms

in the fast-growing experiential leisure sector, is pleased to

announce that at the General Meeting held earlier today, all of the

Resolutions proposed were duly passed. Please note that all terms

in this announcement have the same meaning as in the Circular sent

to Shareholders on 4 November 2021.

Application for Admission has been made in respect of, in

aggregate, the 57,385,007 New Ordinary Shares to be issued pursuant

to the Placing (49,250,000 New Ordinary Shares), the Subscription

(750,000 New Ordinary Shares, and the Open Offer (7,385,007 New

Ordinary Shares).

It is expected admission of these New Ordinary Shares will

become effective and dealings in these Ordinary Shares will

commence at 8.00 a.m. on 23 November 2021.

Total Voting Rights

Upon Admission, the Company's total issued share capital will be

146,005,098 Ordinary Shares and the Company does not hold any

shares in treasury. This figure may be used by shareholders as the

denominator for calculations by which they will determine if they

are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Directors' Shareholdings

Details of each Director's participation (or their associates)

in the Fundraising and their resultant beneficial shareholdings

immediately following Admission are set out below:

Number of

New Ordinary Number of

Number of Shares subscribed Ordinary Percentage

Existing for pursuant Shares held interest

Ordinary to the Subscription immediately in the Enlarged

Director Shares held or Placing after Admission Share Capital

Richard Rose 1,387,000* 1,000,000 2,387,000* 1.5%

------------- --------------------- ----------------- -----------------

Richard Harpham 709,606 158,333 867,939 0.5%

------------- --------------------- ----------------- -----------------

Graham Bird 1,442,202 341,667 1,783,869 1.1%

------------- --------------------- ----------------- -----------------

Karen Bach 142,400 116,667 259,067 0.2%

------------- --------------------- ----------------- -----------------

*of which, 53,666 Ordinary Shares are held by Richard Rose, with

the balance held in a trust for his adult children.

Proposed Change of Name

The Resolutions included a resolution to change the name of the

Company to XP Factory Plc to reflect the changing nature of the

Enlarged Group's business. Upon the change of name being registered

at Companies House, which is expected to occur within approximately

three weeks following Admission, the Company's AIM ticker symbol

will be changed to XPF and its website address will be changed to

www.xpfactory.com. A further announcement will be made in due

course.

Enquiries:

Escape Hunt plc

https://www.escapehunt.com/

Richard Harpham (Chief Executive

Officer)

Graham Bird (Chief Financial

Officer) +44 (0) 20 7846 3322

Shore Capital, NOMAD and Joint

Broker

https://www.shorecap.co.uk/

Tom Griffiths

David Coaten +44 (0) 20 7408 4050

Zeus Capital Limited, Joint

Broker

https://www.zeuscapital.co.uk/

Daniel Harris +44 (0) 20 3829 5000

KK Advisory Ltd, Placing Agent

www.kkadvisory.co.uk

Kam Bansil +44 (0) 20 7039 1901

IFC Advisory - Financial PR

https://www.investor-focus.co.uk/

Graham Herring

Florence Chandler +44 (0) 20 3934 6630

The person responsible for arranging the release of this

information is Richard Harpham, CEO of the Company.

IMPORTANT NOTICE

This announcement (the "Announcement") and the information

contained herein is for information purposes only and is not for

release, publication or distribution, directly or indirectly, in

whole or in part, in or into or from the United States, Canada, New

Zealand, Australia, Japan, the Republic of Ireland or the Republic

of South Africa, or any other jurisdiction where to do so might

constitute a violation of the relevant laws or regulations of such

jurisdiction (the "Placing Restricted Jurisdictions"). The New

Ordinary Shares have not been and will not be registered under the

United States Securities Act of 1933 (the "Securities Act") or

under the securities laws of any state or other jurisdiction of the

United States and may not be ordered, sold, or transferred,

directly or indirectly, in or into the United States absent

registration under the Securities Act or an available exemption

from or in a transaction not subject to the registration

requirements of the Securities Act and, in each case, in compliance

with the securities law of any state or any other jurisdiction of

the United States. No public ordering of the New Ordinary Shares is

being made in the United States. Persons receiving this

Announcement (including custodians, nominees and trustees) must not

forward, distribute, mail or otherwise transmit it in or into the

United States or use the United States mails, directly or

indirectly, in connection with the Fundraising. This Announcement

does not constitute or form part of an order to sell or issue or a

solicitation of an order to buy, subscribe for or otherwise acquire

any securities in any jurisdiction including, without limitation,

the Placing Restricted Jurisdictions or any other jurisdiction in

which such order or solicitation would be unlawful. This

Announcement and the information contained in it is not for

publication or distribution, directly or indirectly, to persons in

a Placing Restricted Jurisdiction unless permitted pursuant to an

exemption under the relevant local law or regulation in any such

jurisdiction.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the Prospectus Regulation) to be

published.

Shore Capital and Corporate, which is authorised and regulated

in the UK by the FCA, is acting as nominated adviser to the Company

in connection with the matters described in this document and is

not acting for any other persons in relation to the Fundraising and

Admission. Shore Capital and Corporate is acting exclusively for

the Company and for no one else in relation to the contents of this

announcement and persons receiving this announcement should note

that Shore Capital and Corporate will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of Shore Capital and Corporate or for advising any other

person on the arrangements described in this announcement. The

responsibilities of Shore Capital and Corporate as the Company's

nominated adviser under the AIM Rules and the AIM Rules for

Nominated Advisers are owed solely to the London Stock Exchange and

are not owed to the Company or to any Director, Shareholder or

other person in respect of his decision to acquire shares in the

capital of the Company in reliance on any part of this document

and/or the application form, or otherwise.

Shore Capital Stockbrokers, which is authorised and regulated in

the United Kingdom by the FCA, is acting as broker to the Company

in connection with the matters described in this announcement and

is not acting for any other persons in relation to the Fundraising

and Admission. Shore Capital Stockbrokers is acting exclusively for

the Company and for no one else in relation to the contents of this

announcement and persons receiving this announcement should note

that Shore Capital Stockbrokers will not be responsible to anyone

other than the Company for providing the protections afforded to

its clients or for advising any other person on the arrangements

described in this announcement.

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by or on

behalf of the Company (except to the extent imposed by law or

regulations), Shore Capital Stockbrokers or Shore Capital and

Corporate or by their affiliates or their respective agents,

directors, officers and employees as to, or in relation to, the

contents of this Announcement, including its accuracy, completeness

or verification or for any other statement made or purported to be

made by any of them, or on their behalf, the Company or any other

person in connection with the Company, the Fundraising or Admission

or for any other written or oral information made available to or

publicly available to any interested party or its advisers, and any

liability therefore is expressly disclaimed. Each of Shore Capital

Stockbrokers and Shore Capital and Corporate and their affiliates

and agents disclaims to the fullest extent permitted by law all and

any responsibility or liability whatsoever, whether arising in

tort, contract or otherwise, which it might otherwise have in

respect of this Announcement or any such statement.

The New Ordinary Shares to be issued pursuant to the Fundraising

will not be admitted to trading on any stock exchange other than to

trading on AIM.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUUAARARUAUAA

(END) Dow Jones Newswires

November 22, 2021 06:13 ET (11:13 GMT)

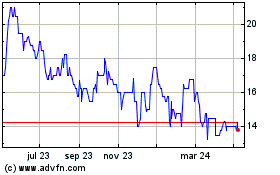

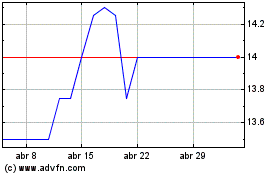

Xp Factory (LSE:XPF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Xp Factory (LSE:XPF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024