Renewi plc (RWI) Renewi plc: Half Year Trading Update

04-Oct-2021 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

4 October 2021

Renewi plc

("Renewi", the "Company" or, together with its subsidiaries, the

"Group")

Half Year Trading Update

Performance and outlook materially ahead of the Board's

expectations

Renewi plc (LSE: RWI), the leading international

waste-to-product company, announces its trading update for the six

months ended 30 September 2021 and materially upgrades its

expectations for the year ending 31 March 2022.

Renewi has performed strongly in the first six months of the

year, with increased volumes, improved recyclate prices and ongoing

cost management continuing to support better than expected trading.

Revenues on a like-for-like basis in the first five months have

been more than 10% above the Covid-affected prior year and 7% ahead

of the pre-Covid year ended 31 March 2020.

The Commercial Division has performed particularly well. Core

volumes in Belgium have increased by 15% in the five months to the

end of August, recovering from a severe Covid lockdown in the prior

year. Core volumes in the Netherlands have increased by 2% in the

same period, reflecting the lesser Covid-related reduction in the

prior year. While the hospitality and retail sectors have partly

recovered, we have not experienced predicted negative effects in

the after-Covid period including a significant slowdown in late

cycle sectors such as construction or an increase in insolvencies.

However, bulky waste has reduced as forecast. Recyclate prices have

also remained at high levels throughout the first half in most

major product categories, supporting a strong increase in operating

margin. As these prices are expected to moderate in the future, the

Division will continue to generate attractive returns, benefiting

from dynamic contract pricing and the structural improvements to

the cost base over the last 18 months.

The Mineralz & Water Division has experienced a mixed first

half. At ATM we have increased our soil throughput and over 350,000

tonnes of TGG have now been placed in the market, creating space on

the site and beginning to reduce external storage costs. The

waterside business was slightly softer than expected. While we

continue to participate in increasing tenders for future business

for ATM, we are seeing some weakness in incoming contaminated soil

due to a slow industry-wide recovery post Covid with a delay in

large remediation projects and delays in securing permits for

imported waste. Although we expect a full recovery as earlier

communicated, this will take longer than anticipated.

The Specialities Division has performed well in the first half,

with a particularly strong performance by Coolrec.

Good progress continues to be made with our three strategic

growth initiatives:

-- our innovation pipeline - which will deliver significant

additional revenues and earnings over the nextthree years and

beyond. In particular, we have committed over EUR80m of capital

that will underpin the targeted EUR20mimprovement in EBIT from this

initiative by the end of FY25;

-- recovery of earnings at ATM (albeit slower than planned);

and

-- the Renewi 2.0 programme to digitise and streamline our

business.

Cash performance in the first half continued to be strong, with

tightly controlled working capital and replacement capital

expenditure. Leverage will remain below 2.0x net debt to EBITDA at

the half year.

The strong performance in the first half and positive trading

outlook have led the Board to materially increase its expectations

for the full year ending 31 March 2022. Longer term, the transition

to increased recycling will continue to support our business model.

The sustainability agenda and the potential for a "green recovery"

supported by the EU and national governments will present further

attractive opportunities for Renewi to convert waste into a wider

range of high-quality secondary materials.

The Group announces a virtual Capital Markets Event for analysts

and investors on 12 October 2021 at 1400 CET / 1300 BST. The

Capital Markets Event will focus on how we intend to grow our

business organically by commercialising new and innovative

technologies from our innovation pipeline and how Renewi will

continue to be a market leader and beneficiary in an increasingly

circular economy. We will explore in depth Board committed projects

in Organics, Plastics, Construction Materials and Advanced Sorting.

Please see the Group's website, www.renewi.com, for further

details.

The Group's results for the six months ended 30 September 2021

will be announced on 9 November 2021.

For further information:

Paternoster Communications

Renewi plc

Tom Buchanan

Adam Richford, Head of IR

+44 (0)20 3012 0241

+44 7976 321 540

Ben Honan

Michelle James, Head of Communications

+44 (0)20 3012 0241

+44 7773 813 180

www.renewi.com

About Renewi

Renewi is a pure-play recycling company with a focus on

extracting value from waste and used materials rather than disposal

through incineration or landfill. The company also plays a key role

in limiting resource scarcity through the creation of secondary

materials, and by so doing addresses both social and regulatory

trends and contributes to creating a cleaner, greener world.

Renewi's vision is to be the leading waste-to-product company in

the world's most advanced circular economies. By opting to recycle,

the company avoids emissions of more than 3 million tonnes of CO2

and as a result plays a part in contributing to a sustainable

society, transitioning to a circular economy and driving the

progress needed to halt climate change.

Renewi, which draws on innovation and the latest technology to

turn waste into useful materials - paper, metals, plastics, glass,

wood, building materials, compost and energy - employs over 6 500

people who work on 165 operating sites in 6 countries across Europe

and the UK. Renewi is recognised as a market leader in Benelux and

a regional European leader in recycling.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BNR4T868

Category Code: TST

TIDM: RWI

LEI Code: 213800CNEIDZBL17KU22

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 123445

EQS News ID: 1237651

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1237651&application_name=news

(END) Dow Jones Newswires

October 04, 2021 02:00 ET (06:00 GMT)

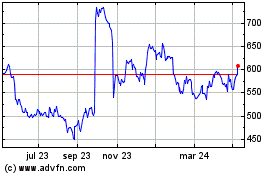

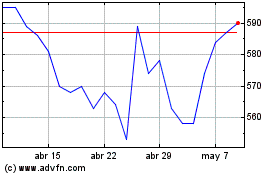

Renewi (LSE:RWI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Renewi (LSE:RWI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024