UniCredit Sells NPL Portfolio to Mediobanca and Cerberus

27 Noviembre 2017 - 11:35AM

Noticias Dow Jones

By Nathan Allen

Italy's UniCredit SpA (UCG.MI) said Monday that it had agreed to

sell a portfolio of non-performing loans to Mediobanca SpA's

(MB.MI) MBCredit Solutions unit and an affiliate of Cerberus

Capital Management LP.

The portfolio consists of secured and unsecured credits with a

gross book value of about 715 million euros ($852.7 million),

UniCredit said.

MBCredit Solutions has bought the unsecured segment of the

portfolio, with a gross book value of EUR450 million, while

Cerberus has bought the secured segment, which has a gross book

value of EUR265 million, UniCredit said.

UniCredit also said that the sale forms part of its strategy to

reduce its non-performing exposures, and that the transaction will

be reflected in its fourth-quarter results.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

November 27, 2017 12:20 ET (17:20 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

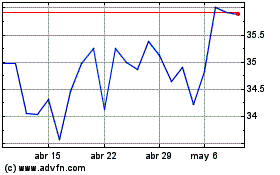

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De May 2023 a May 2024