TIDMPCTN

12 November 2019

PICTON PROPERTY INCOME LIMITED

("Picton", the "Company" or the "Group")

LEI: 213800RYE59K9CKR4497

Half Year Results

Picton announces its half year results for the period to 30 September 2019.

Continued Growth in Net Assets

* Profit after tax of GBP14.5 million

* Total return of 2.8%

* Increase in EPRA net asset value per share of 0.9%, to 94 pence per share

Strengthened Balance Sheet

* Raised GBP7.1 million of new equity at a 1.9% premium to the March net asset

value

* Repaid GBP7.6 million of borrowings

* Loan to value ratio reduced to 24.5%

* Dividend cover of 107%

Outperforming Property Portfolio

* Total property return of 3.2%, outperforming the MSCI UK Quarterly Property

Index of 0.8%

* Total property return and income return outperforming MSCI over 1, 3, 5 and

10 years

* Like-for-like valuation increase of 1.2%, driven by industrial and office

sectors

* 14 lettings completed with a rent roll of GBP1.5 million per annum

* 20 lease renewals completed with a rent roll of GBP1.2 million per annum

* 12 rent reviews completed securing an uplift in rent of GBP0.5 million per

annum

Investing for Income and Capital Growth

* GBP2.8 million invested in refurbishment projects

* Occupancy of 88%

* 79% of the void space under refurbishment

* GBP9.4 million of reversionary potential

Balance Sheet 30 Sept 2019 31 March 2019

Property valuation GBP693.4m GBP685.3m

Net assets GBP510.7m GBP499.4m

EPRA NAV per share 94p 93p

Income Statement Six months to Six months to

30 Sept 2019 30 Sept 2018

Profit after tax GBP14.5m GBP18.9m

EPRA earnings GBP10.2m GBP11.8m

Earnings per share 2.7p 3.5p

EPRA earnings per share 1.9p 2.2p

Total return 2.8% 3.9%

Total shareholder return 0.3% 6.4%

Total dividend per share 1.75p 1.75p

Dividend cover 107% 125%

Picton Chairman, Nicholas Thompson, commented:

"During the last six months we have been able to further strengthen our balance

sheet, increasing net assets and maintaining a covered dividend. Our June

fundraising has enabled us to continue to invest into our portfolio, enhancing

the quality of our assets for occupiers and shareholders alike."

Michael Morris, Chief Executive of Picton, commented:

"There has been an encouraging level of activity in the portfolio over the past

six months. With an estimated GBP9.4 million of reversionary potential to be

unlocked, we believe there is significant upside to come from refurbishment and

leasing initiatives."

This announcement contains inside information.

For further information:

Tavistock

Jeremy Carey/James Verstringhe, 020 7920 3150,

james.verstringhe@tavistock.co.uk

Picton

Michael Morris, 020 7011 9980, michael.morris@picton.co.uk

Note to Editors

Picton, established in 2005, is a UK REIT. It owns and actively manages a GBP693

million diversified UK commercial property portfolio, invested across 49 assets

and with around 350 occupiers (as at 30 September 2019). Through an occupier

focused, opportunity led approach to asset management, Picton aims to be one of

the consistently best performing diversified UK focused property companies

listed on the main market of the London Stock Exchange.

www.picton.co.uk

CHAIRMAN'S STATEMENT

Introduction

This has been a productive six months for Picton as we continue to deliver

against our strategic objectives, and I am pleased to report another increase

in our net assets. Through continued investment and proactive asset management

we seek to deliver further valuation and income growth.

Performance

We have delivered another positive set of results which show a total return of

2.8% and a total profit of GBP14.5 million. Net assets have grown to over GBP510

million, reflecting approximately 94 pence per share.

We were not surprised that overall returns were lower than for the same period

last year, in view of the ongoing political and economic uncertainty in the UK.

Moreover, to have delivered such positive results when (according to MSCI) the

market has seen negative capital growth for every month throughout 2019,

highlights the quality of the portfolio and the work the team is doing to

extract value.

EPRA earnings per share were 1.9p, lower than 12 months ago. We expect this to

improve as refurbishment projects complete and we achieve further lettings,

unlocking the significant income upside.

Capital Structure

By raising equity on a non-dilutive basis in June this year, we have been able

to further strengthen our balance sheet. The proceeds have initially been used

to reduce borrowings, with our loan to value ratio currently standing at 24.5%.

However, we intend to use the proceeds for identified capital projects within

the portfolio over the short-term.

The Employee Benefit Trust acquired shares in the market in September, as a

hedge against potential future awards under our Deferred Bonus and Long-Term

Incentive Plan. This was undertaken at a discount to net asset value which had

the effect of reducing the number of shares in issue, resulting in a small

positive impact on the net asset value per share.

Property Portfolio

The UK commercial property market remains polarised. The industrial, warehouse

and logistics sector and, to a lesser extent, the office sector continue to

deliver positive results while the retail sector continues to suffer from poor

occupational demand and occupier defaults, which is reflected in rental and

capital values. As a result of our reshaping of the portfolio over the past few

years, we are benefitting from having more than 80% of our portfolio allocated

to the stronger performing sectors.

We have had a busy six months managing the property portfolio, delivering some

key asset management transactions, and have begun a significant refurbishment

programme across key assets. More detail about this is included in the Business

Review.

With occupancy at 88%, there is still plenty of scope to increase income upon

re-letting. It is worth highlighting that nearly 80% of the void is currently

undergoing significant refurbishment and consequently not ready to lease. There

is GBP9.4 million of reversionary income across the portfolio which can be

captured through stepped rents, lettings, rent reviews and lease renewals.

Dividends

Dividend cover over the period was 107% and this surplus also contributed to

the growth in net assets. We continue to believe it is appropriate to maintain

a fully covered dividend and not to over distribute and undermine the balance

sheet.

The Board believes that in the current market conditions and with continued

political uncertainty, it is appropriate and in shareholders' interests to

maintain a prudent distribution policy, which continues to be reviewed

regularly.

Governance

The process for appointing my successor is well underway and we expect to be

able to conclude this before the end of the year.

We are delighted to have been recognised by EPRA with two gold awards this year

for the quality of both our financial and sustainability reports and we have

recently won the UK Property category at the Citywire Investment Trust Awards

for the third year in succession.

Outlook

There is much political and economic uncertainty at present and a perception

that we are in an environment where interest rates are likely to remain low for

the foreseeable future, alongside a period of lower returns generally.

Against this backdrop we believe that investing in real assets remains

attractive, in particular where there is a strong income stream with further

potential for growth through active management. Investing in the right assets

where there is good occupational demand will continue to deliver positive

results for shareholders.

We have an encouraging pipeline of both leasing and active management activity,

which underpins the reversionary potential of the portfolio. Recognising our

portfolio composition and balance sheet strength, we believe Picton is well

positioned to continue its track record of outperformance.

Nicholas Thompson

Chairman

11 November 2019

MARKET OVERVIEW

Economic Backdrop

The UK economy has been sluggish as evidenced by the Office for National

Statistics estimate of 0.4% GDP growth for the six months to June 2019. This

has more than halved since December 2018.

Between June 2019 and August 2019, the unemployment rate stood at 3.9%. This is

lower than a year earlier but 0.1% higher than the previous three months. In

nominal terms, average weekly earnings increased by 3.8% for both total pay and

regular pay compared with a year earlier.

CPI inflation has stayed close to the Bank of England's 2% target for the 12

months to September 2019, standing at 1.7% per annum. This compares to 2.4% a

year earlier. Annual RPI Inflation was 2.4% per annum in September 2019

(September 2018: 3.3% per annum).

Consumer spending has been resilient off the back of solid growth in household

income, and retail sales volumes grew 0.6% in the three months to September

2019. Despite this, retail failures and CVAs continue to be the theme affecting

the retail sector, where the impact of online sales is increasing. The latest

businesses affected include Thomas Cook, Arcadia and Mothercare.

The Bank of England has held the base rate at 0.75% since August 2018. There is

a possibility of a rate cut in the short-term, dependant on the outcome of

events in Westminster. A reduction in long-term interest rate expectations have

caused the ten-year Gilt yield to fall over the last six months to reach 0.50%

at September 2019.

Economic forecasts vary depending on possible Brexit scenarios, but the

forthcoming general election may provide a clearer direction for businesses and

consumers.

UK Property Market

Despite this challenging economic backdrop, the All Property total return for

the six months to September 2019 was positive. The UK commercial property

market nevertheless is feeling the effects of political and economic

uncertainty surrounding Brexit.

The MSCI Monthly Index shows a total return for All Property for the six months

to September 2019 of 1.3%, with an income return of 2.6%. Capital growth for

the six months to September 2019 was negative at -1.2% compared to -1.0% for

the six months to March 2019. Rental growth was positive at 0.3% for the six

months to September 2019, higher than the 0.0% for the six months to March

2019. Initial yields have moved out from 5.0% in March 2019 to 5.1% in

September 2019.

According to Property Data, total investment for the six months to September

2019 was GBP20.9 billion, a decrease of 26% compared to GBP28.2 billion in the six

months to March 2019. Of total investment in the period, 46% was from overseas

investors.

The industrial and office sectors have enjoyed positive month-on-month total

returns during the past six months, whereas the declining returns of the retail

sector have intensified, resulting in widening variations in performance at a

sector level. The retail sector continues to undergo structural change, with

failing retailers, declining rental values and poor investor demand showing no

sign of abating.

Industrial and office sector total returns were positive for the six months to

September, at 3.5% and 2.4% respectively. Retail total returns were negative at

-2.4%.

Occupancy in the wider market was broadly stable, with MSCI recording an

occupancy rate of 92.4% in September 2019 (March 2019: 92.5%).

According to the MSCI Monthly Index, the market performance was as follows.

In the industrial sector, total returns comprised 2.3% income and 1.2% capital

growth. Rental growth was 1.8%. In terms of capital growth by segment, growth

ranged from -0.2% in Midlands & Wales to 2.6% in London. Rental growth ranged

from 0.5% in South West to 3.9% for Inner South East.

In the office sector, total returns comprised 2.3% income and 0.1% capital

growth. Rental growth was 1.1%. In terms of capital growth by segment, growth

ranged from -1.4% in Midlands & Wales to 2.9% in South West. Rental growth

ranged from -0.5% for Scotland to 2.2% for South West.

In the retail sector, total returns comprised 3.2% income and -5.4% capital

growth. Rental growth was -1.8%. In terms of capital growth by segment, growth

ranged from -11.8% for Standard Retail Yorkshire & Humberside to -1.5% for

Standard Retail Central London. Rental growth ranged from -5.6% for Standard

Retail Outer South East to 0.1% for Standard Retail Central London.

BUSINESS REVIEW

Valuation

The independent portfolio valuation, as provided by CBRE Limited, was GBP693.4

million, reflecting a net initial yield of 4.9% and a reversionary yield of

6.3%.

The portfolio valuation increased by 1.2% on a like-for-like basis over the

period to September 2019, reflecting investment into the portfolio and active

management. The industrial portfolio increased by 3.8% and the office portfolio

by 1.9%, while the retail and leisure portfolio declined by 6.1%, primarily

reflecting weakness in this sector and corresponding rental declines.

Sector Portfolio Sept 19 Like-for-like

Weightings Valuation change

Industrial 46.8% GBP324.7m 3.8%

South East 33.3% 4.0%

Rest of UK 13.5% 3.4%

Office 34.6% GBP239.6m 1.9%

London City and West 4.1% 0.0%

End

Inner and Outer 8.2% 1.0%

London

South East 11.4% 3.1%

Rest of UK 10.9% 2.1%

Retail and Leisure 18.6% GBP129.1m -6.1%

Retail warehouse 7.4% -8.0%

High Street - Rest 4.5% -8.3%

of UK

High Street - South 4.9% -2.7%

East

Leisure 1.8% -1.1%

Total 100% GBP693.4m 1.2%

For the six months to September, the portfolio returned 3.2%, outperforming the

MSCI UK Quarterly Property Index which delivered 0.8%. The income return was

2.4%, 0.1% ahead of the Index.

Our continued overweight position to the better performing sectors, combined

with portfolio activity, contributed to the outperformance.

Passing rent increased on a like-for-like basis by 0.4% to GBP37.9 million per

annum. The increase takes into account the significant activity over the

period, offsetting the decline in occupancy through lease events and surrenders

which reduced income by GBP1.1 million per annum.

We completed 14 lettings securing GBP1.5 million per annum, in line with ERV.

This includes three back-to-back surrenders and new lettings securing GBP0.7

million per annum, 7% above the previous passing rent. There were also 20 lease

renewals for GBP1.2 million per annum, increasing the previous passing rent by

11%, and 9% above ERV. 12 rent reviews were concluded securing a GBP0.5 million

per annum uplift in income, 6% above ERV.

Encouragingly, the portfolio's like-for-like ERV increased by 0.9% to GBP47.3

million per annum due to rental growth in the industrial and office portfolios,

albeit this is offset by declines in the retail portfolio where the market has

considerable oversupply, depressing values generally.

Investment Activity

There has been a slowdown in investment activity in the market generally and

this has also impacted availability of suitable opportunities. With a

disciplined acquisition approach and a current desire to maintain a prudent

gearing level, no acquisitions were made during the period. As recently

announced, an asset was sold following the period end and the proceeds will be

deployed into capital expenditure initiatives across the portfolio.

Our focus has been on the portfolio, with GBP2.8 million invested over the period

to refurbish and reposition buildings, which will attract and retain occupiers.

Projects have been completed in Marlow and Manchester, where space is either

under offer or we have good interest, and we are currently carrying out works

on a further 11 buildings which will also improve the capital and income

position.

Occupancy

As anticipated, there was a further reduction in occupancy over the period from

90% to 88%. The decrease was primarily due to two voids in Chatham and Rugby

(currently under refurbishment) with a combined ERV of GBP0.9 million per annum,

but also where we surrendered leases and received a further GBP0.8 million of

additional income.

We have a total void ERV of GBP5.8 million of which nearly 80% is currently under

refurbishment.

Portfolio and Asset Management

Industrial Portfolio

The industrial portfolio has performed well over the half-year. Tight supply,

limited development and continued demand, especially in the South East and

multi-let sector, have resulted in further rental growth, which we are

capturing through asset management activity. On a like-for-like basis capital

values increased by 3.8% or GBP11.9 million, the passing rent increased by 1.2%

or GBP0.2 million per annum and the ERV grew by 2.7% or GBP0.5 million.

The UK wide distribution warehouse assets total 1.3 million sq ft in six units,

five of which are fully income producing and our 100,000 sq ft unit in Rugby,

with an ERV of GBP0.6 million, is currently being refurbished prior to

re-letting. At 3220, Magna Park, Lutterworth we moved the break option out by

three years in return for a nominal rent-free period and at the same time

settled a forthcoming rent review, securing an 11% uplift to GBP1.0 million per

annum.

The multi-let estates, of which 96% by value are in the South East, total 1.4

million sq ft and are 97% let. Six units are vacant out of 126, five of which

are currently under offer with a combined ERV of GBP0.3 million per annum.

Occupational demand remains robust and four multi-let units were let in

Belfast, Epsom and Radlett during the period, securing

GBP0.2 million per annum, 5% ahead of ERV. We are actively pursuing surrenders

where we can secure a premium and re-let at higher rents.

We have secured GBP0.4 million of additional income from eight rent reviews

settled over the period, 6% ahead of ERV. Four occupiers have been retained at

renewal increasing the passing rent by 32% to GBP0.3 million per annum, 6% above

ERV and occupier break options have been varied in three leases.

The industrial portfolio currently has GBP3.0 million of reversionary income

potential, with GBP0.9 million relating to the void units. We can look to capture

this reversion principally through the letting of Rugby, active management and

lease events. Looking to the end of 2020, we have 25 lease events with an ERV

of GBP3.8 million per annum, GBP0.2 million above the current passing rent.

Office Portfolio

The office portfolio performed positively over the half-year. The regional

markets outperformed London, with occupiers seeking buildings that provide

Grade A space with amenities for their staff. On a like-for-like basis, capital

values increased by 1.9% or GBP4.5 million. Also, on a like-for-like basis the

passing rent decreased by 2.2% or GBP0.3 million per annum primarily due to a

unit coming back in Chatham, which is currently being refurbished, with an ERV

of GBP0.3 million. The office portfolio ERV increased by 2.3% over the period or

GBP0.4 million with the regional assets growing by 2.7%, with London at 0.8%.

The office portfolio is 85% let, with lettings completing in Colchester,

Croydon, Glasgow and St. Albans during the period. The most notable transaction

was at Citylink, Croydon where, in a back-to-back transaction, a lease over the

entire west block that was due to expire in November 2019 was surrendered, for

a premium of GBP0.4 million. The building was simultaneously let to the sub

tenant (without requiring refurbishment) on a four-year lease, subject to a

mutual break, at a rent of GBP0.6 million per annum, 10% ahead of the previous

passing rent. This transaction also had a positive valuation impact over the

period and the property was subsequently sold after the period end at a 7%

premium to the March 2019 valuation.

13 occupiers have been retained at renewal increasing the passing rent by 16%

to GBP0.7 million per annum, 14% above ERV and we have secured GBP0.1 million of

additional income from one rent review settled over the period.

The office portfolio currently has GBP4.7 million of reversionary income

potential, with GBP2.9 million relating to the void units. Our three largest

voids, accounting for 48% of the total office void, are in Bristol, London

(Angel Gate) and Manchester. We will look to capture this reversion through

these key lettings, active management and lease events such as those noted

above. Looking to the end of 2020, we have 37 lease events with an ERV of GBP3.2

million per annum, GBP0.4 million above the current passing rent.

Retail and Leisure Portfolio

The retail property market has continued to weaken, and our portfolio has not

been immune from the decline in investment and occupational demand. On a

like-for-like basis capital values reduced by 6.1% or GBP8.4 million, principally

driven by the retail warehouse sector. The retail portfolio passing rent on a

like-for-like basis increased by 3.9% or GBP0.3 million per annum and the ERV

declined by 4.7% or GBP0.5 million over the period with declines being seen

across the board.

Against this difficult occupational backdrop, we have had success, seeing an

increase of 3.9% in respect of the retail passing rent and have identified

opportunities to increase occupancy and rental income. Four units were let in

Bury, Carlisle and Swansea securing GBP0.5 million per annum, 2% below ERV. The

most notable transaction was the renewal of Argos's lease at Angouleme Retail

Park in Bury for a further ten years at a rent of GBP0.2 million per annum, 16%

ahead of ERV. On the same park we let a vacant unit for five years, subject to

break, at a rent of GBP0.1 million per annum, in line with ERV. Both transactions

follow ongoing refurbishment works to improve the external appearance of the

units and common areas which are due to complete in November.

We have secured a 42% uplift from a hotel rent review in Carlisle to GBP0.2

million per annum, 8% ahead of ERV. In Bristol one occupier break option has

been removed, maintaining GBP0.1 million per annum of income until 2025.

Our largest void, accounting for 79% of the total retail void, is in Covent

Garden, and comprises a prime Grade II listed building on Long Acre. By ERV 47%

of the building is retail, with 53% being office and residential. We are

proposing a substantial refurbishment and works have now been instructed with a

view to completing them in early 2020. We have already identified a retailer

for the lower floors, subject to contract, and we will start marketing the

offices closer to completion.

The void ERV is GBP2.0 million, with the Covent Garden building accounting for GBP

1.6 million of this. The overall reversionary income is GBP1.7 million, with an

element of over-renting in the portfolio. We can look to capture this

principally through the lettings, active management and lease events as

demonstrated above. Looking to the end of 2020, we have six lease events with

an ERV of GBP0.4 million per annum, GBP0.1 million above the current passing rent.

Looking Ahead

Our focus going forward is capturing the reversionary income potential embedded

within the portfolio, alongside value creation through further refurbishment

and active management.

In summary there is GBP9.4 million per annum of upside from the current passing

rent. This includes GBP2.9 million per annum which follows expiries of rent-free

periods and further stepped rent increases. There is a further GBP5.8 million per

annum from leasing currently vacant space. Finally, there is a further GBP0.7

million where ERVs are higher than the contracted rent.

Recognising the strength of the portfolio in terms of its location, sector and

asset quality, we are confident in our ability to unlock further upside.

Top Ten Assets

The largest assets in the portfolio as at 30 September 2019, ranked by capital

value, represent 50% of the total portfolio valuation and are detailed below:

Sector Tenure Approximate Appraised

Area (sq ft) Value

Parkbury Industrial Estate, Radlett, Industrial Freehold 336,700 >GBP40m

Herts.

River Way Industrial Estate, Harlow, Industrial Freehold 454,800 >GBP40m

Essex

Angel Gate, City Road, London EC1 Office Freehold 64,500 GBP30m-GBP40m

Stanford House, Long Acre, London Retail Freehold 19,700 GBP30m-GBP40m

WC2

50 Farringdon Road, London EC1 Office Leasehold 31,000 GBP20m-GBP30m

Tower Wharf, Cheese Lane, Bristol Office Freehold 70,800 GBP20m-GBP30m

Belkin Unit, Shipton Way, Rushden, Industrial Leasehold 312,900 GBP20m-GBP30m

Northants.

Lyon Business Park, Barking, Essex Industrial Freehold 99,400 GBP20m-GBP30m

30 & 50 Pembroke Court, Chatham, Office Leasehold 86,300 GBP20m-GBP30m

Kent

Colchester Business Park, Office Leasehold 150,700 GBP20m-GBP30m

Colchester, Essex

A full portfolio listing is available on the Company's website:

www.picton.co.uk

Top Ten Occupiers

The top ten occupiers, based as a percentage of annualised contracted rental

income, after lease incentives, as at 30 September 2019, are summarised below:

Occupier %

1 Belkin Limited 4.2

2 DHL Supply Chain Limited 3.9

3 Public Sector 3.2

4 B&Q PLC 3.1

5 The Random House Group Limited 2.9

6 Snorkel Europe Limited 2.8

7 Portal Chatham LLP 2.2

8 TK Maxx 1.8

9 Canterbury Christ Church University 1.7

10 XMA Limited 1.7

27.5

Financial Overview

Income Statement

For the six months to 30 September our total profit was GBP14.5 million,

representing earnings per share of 2.7 pence. This is lower than we reported at

our previous half year results, largely due to the lower capital growth

environment we are operating in. The revaluation gains on the portfolio were GBP

4.3 million for the half year, a like-for-like increase in the portfolio

valuation of 1.2%. Although lower than in 2018 it is well ahead of the MSCI

Monthly Index capital return of -1.2%.

Our EPRA earnings, so the recurring income and costs in running the business,

were GBP10.2 million for the period, or 1.9 pence per share. We have had lower

occupancy across the portfolio this period, which has been discussed in more

detail in the Business Review section. As well as impacting our revenue for the

period, it has also led to greater property holding costs.

Administrative expenses for the period were GBP2.9 million, some 6% lower than

the previous period.

Finance costs are reduced, as a result of the early loan repayment that we made

in July 2018. Our average interest rate across all of our borrowings is 4.1%.

Following conversion to a UK REIT there is no tax liability on our property

business. A small refund relating to a prior year has been received.

During the period we paid out two interim dividends as Property Income

Distributions, each of 0.875 pence per share, or GBP9.5 million in total.

Dividend cover for the six months was 107%.

Balance Sheet

Following the issue of new equity in June, and the valuation gains, the net

assets of the Group rose by GBP11.3 million over the period, to GBP510.7 million,

an increase of 2.3%.

The appraised value of the property portfolio stood at GBP693.4 million at 30

September. No acquisitions or disposals were made, but we have invested GBP2.8

million in capital projects undertaken across the portfolio.

Borrowings have reduced to GBP187.1 million, representing a loan to value ratio

of 24.5%. Initially the proceeds from the equity raise were used to reduce

borrowings, thereby avoiding cash drag ahead of being utilised for future

capital expenditure projects.

DIRECTORS' RESPONSIBILITIES

STATEMENT OF PRINCIPAL RISKS AND UNCERTAINTIES

The Company's assets comprise direct investments in UK commercial property. Its

principal risks are therefore related to the commercial property market in

general and its investment properties. Other risks faced by the Company include

economic, investment and strategic, regulatory, management and control,

operational and financial risks.

These risks, and the way in which they are managed, are described in more

detail under the heading 'Managing Risk' within the Strategic Report in the

Company's Annual Report for the year ended 31 March 2019. The Company's

principal risks and uncertainties have not changed materially since the date of

that report.

STATEMENT OF GOING CONCERN

The directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable future.

Therefore, they continue to adopt the going concern basis in preparing the

financial statements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN RESPECT OF THE INTERIM REPORT

We confirm that to the best of our knowledge:

a. the condensed set of consolidated financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

b. the Chairman's Statement and Business Review (together constituting the

Interim Management Report) together with the Statement of Principal Risks and

Uncertainties above include a fair review of the information required by the

Disclosure Guidance and Transparency Rules ('DTR') 4.2.7R, being an indication

of important events that have occurred during the first six months of the

financial year, a description of principal risks and uncertainties for the

remaining six months of the year, and their impact on the condensed set of

consolidated financial statements; and

c. the Chairman's Statement together with the condensed set of consolidated

financial statements include a fair review of the information required by DTR

4.2.8R, being related party transactions that have taken place in the first six

months of the current financial year and that have materially affected the

financial position or performance of the Company during that period, and any

changes in the related party transactions described in the last Annual Report

that could do so.

The directors are responsible for the maintenance and integrity of the

corporate and financial information included on the Company's website, and for

the preparation and dissemination of financial statements. Legislation in

Guernsey governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

By Order of the Board

Andrew Dewhirst

Director

11 November 2019

INDEPENT REVIEW REPORT TO PICTON PROPERTY INCOME LIMITED

CONCLUSION

We have been engaged by Picton Property Income Limited (the "Company") to

review the condensed set of financial statements in the Half Year Report for

the six months ended 30 September 2019 of the Company and its subsidiaries

(together the "Group") which comprises the Condensed Consolidated Statement of

Comprehensive Income, Condensed Consolidated Statement of Changes in Equity,

Condensed Consolidated Balance Sheet, Condensed Consolidated Statement of Cash

Flows and the related explanatory notes.

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the Half Year Report

for the six months ended 30 September 2019 is not prepared, in all material

respects, in accordance with IAS 34 Interim Financial Reporting and the

Disclosure Guidance and Transparency Rules ("the DTR") of the UK's Financial

Conduct Authority ("the UK FCA").

SCOPE OF REVIEW

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the Auditing

Practices Board for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review procedures.

We read the other information contained in the Half Year Report and consider

whether it contains any apparent misstatements or material inconsistencies with

the information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does not enable

us to obtain assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not express an audit

opinion.

DIRECTORS' RESPONSIBILITIES

The Half Year Report is the responsibility of, and has been approved by, the

directors. The directors are responsible for preparing the Half Year Report in

accordance with the DTR of the UK FCA.

As disclosed in note 2, the annual financial statements of the Group are

prepared in accordance with International Financial Reporting Standards. The

directors are responsible for preparing the condensed set of financial

statements included in the Half Year Report in accordance with IAS 34.

OUR RESPONSIBILITY

Our responsibility is to express to the Company a conclusion on the condensed

set of financial statements in the Half Year Report based on our review.

THE PURPOSE OF OUR REVIEW WORK AND TO WHOM WE OWE OUR RESPONSIBILITIES

This report is made solely to the Company in accordance with the terms of our

engagement letter to assist the Company in meeting the requirements of the DTR

of the UK FCA. Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Company for our review work, for

this report, or for the conclusions we have reached.

Deborah Smith

For and on behalf of KPMG Channel Islands Limited

Chartered Accountants, Guernsey

11 November 2019

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF YEARED 30 SEPTEMBER 2019

Note 6 months 6 months Year

ended ended ended

30 Sept 30 Sept 31 March

2019 2018 2019

unaudited unaudited audited

Total Total Total

GBP000 GBP000 GBP000

Income

Revenue from properties 3 23,399 24,537 47,733

Property expenses 4 (6,190) (4,297) (9,433)

Net property income 17,209 20,240 38,300

Expenses

Administrative expenses (2,879) (3,068) (5,842)

Total operating expenses (2,879) (3,068) (5,842)

Operating profit before movement 14,330 17,172 32,458

on investments

Investments

Profit on disposal of investment 9 - 379 379

properties

Investment property valuation 9 4,341 9,961 10,909

movements

Total profit on investments 4,341 10,340 11,288

Operating profit 18,671 27,512 43,746

Financing

Interest income 3 16 38

Interest expense (4,235) (4,936) (9,126)

Debt prepayment fees - (3,245) (3,245)

Total finance costs (4,232) (8,165) (12,333)

Profit before tax 14,439 19,347 31,413

Tax 68 (445) (458)

Profit after tax and total 14,507 18,902 30,955

comprehensive income for the

period

Earnings per share

Basic and diluted 7 2.7p 3.5p 5.7p

All income is attributable to the equity holders of the Company. There are no

minority interests. Notes 1 to 15 form part of these condensed consolidated

financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE HALF YEARED 30 SEPTEMBER 2019

Note Share Other Retained Total

Capital Reserves Earnings GBP000

GBP000 GBP000 GBP000

Balance as at 31 March 2018 157,449 (251) 330,157 487,355

Profit for the period - - 18,902 18,902

Share based awards - 319 - 319

Dividends paid 6 - - (9,432) (9,432)

Balance as at 30 September 2018 157,449 68 339,627 497,144

Profit for the period - - 12,053 12,053

Dividends paid 6 - - (9,428) (9,428)

Share based awards - 44 - 44

Purchase of shares held in trust - (398) - (398)

Balance as at 31 March 2019 157,449 (286) 342,252 499,415

Profit for the period - - 14,507 14,507

Dividends paid 6 - - (9,493) (9,493)

Issue of ordinary shares 11 7,137 - - 7,137

Issue costs of shares (186) - - (186)

Vesting of shares held in trust - 54 (54) -

Share based awards - 146 - 146

Purchase of shares held in trust - (844) - (844)

Balance as at 30 September 2019 164,400 (930) 347,212 510,682

Notes 1 to 15 form part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 30 SEPTEMBER 2019

Note 30 30 31 March

September September 2019

2019 2018 audited

unaudited unaudited GBP000

GBP000 GBP000

Non-current assets

Investment properties 9 683,208 673,870 676,102

Tangible assets 23 25 25

Total non-current assets 683,231 673,895 676,127

Current assets

Accounts receivable 17,765 16,420 14,309

Cash and cash equivalents 17,125 20,130 25,168

Total current assets 34,890 36,550 39,477

Total assets 718,121 710,445 715,604

Current liabilities

Accounts payable and accruals (21,062) (20,113) (22,400)

Loans and borrowings 10 (860) (808) (833)

Obligations under finance leases (108) (109) (109)

Total current liabilities (22,030) (21,030) (23,342)

Non-current liabilities

Loans and borrowings 10 (183,699) (190,559) (191,136)

Obligations under finance leases (1,710) (1,712) (1,711)

Total non-current liabilities (185,409) (192,271) (192,847)

Total liabilities (207,439) (213,301) (216,189)

Net assets 510,682 497,144 499,415

Equity

Share capital 11 164,400 157,449 157,449

Retained earnings 347,212 339,627 342,252

Other reserves (930) 68 (286)

Total equity 510,682 497,144 499,415

Net asset value per share 13 94p 92p 93p

These condensed consolidated financial statements were approved by the Board of

Directors on 11 November 2019 and signed on its behalf by:

Andrew Dewhirst

Director

Notes 1 to 15 form part of these condensed consolidated financial statements.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 SEPTEMBER 2019

Note 6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 audited

unaudited unaudited GBP000

GBP000 GBP000

Operating activities

Operating profit 18,671 27,512 43,746

Adjustments for non-cash items 12 (4,191) (10,018) (10,918)

Interest received 3 16 38

Interest paid (4,073) (4,603) (8,668)

Tax received/ (paid) 11 (80) (845)

(Increase)/ decrease in accounts receivables (3,456) (1,715) 396

(Decrease)/ increase in payable and accruals (1,260) (1,566) 1,532

Cash inflows from operating activities 5,705 9,546 25,281

Investing activities

Capital expenditure on investment properties 9 (2,765) (275) (1,559)

Disposal of investment properties - 11,837 11,837

Purchase of tangible assets (2) (23) (27)

Cash (outflows)/ inflows from investing activities (2,767) 11,539 10,251

Financing activities

Borrowings repaid (7,595) (34,288) (34,871)

Borrowings drawn - 14,500 15,500

Debt prepayment fees - (3,245) (3,245)

Issue of ordinary shares 11 7,137 - -

Issue costs of ordinary shares (186) - -

Purchase of shares held in trust (844) - (398)

Dividends paid 6 (9,493) (9,432) (18,860)

Cash outflows from financing activities (10,981) (32,465) (41,874)

Net decrease in cash and cash equivalents (8,043) (11,380) (6,342)

Cash and cash equivalents at beginning of period/ 25,168 31,510 31,510

year

Cash and cash equivalents at end of period/year 17,125 20,130 25,168

Notes 1 to 15 form part of these condensed consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE HALF YEARED 30 SEPTEMBER 2019

1. GENERAL INFORMATION

Picton Property Income Limited (the "Company" and together with its

subsidiaries the "Group") was established in Guernsey on 15 September 2005 and

entered the UK REIT regime on 1 October 2018.

The financial statements are prepared for the period from 1 April to 30

September 2019, with unaudited comparatives for the period from 1 April to 30

September 2018. Comparatives are also provided from the audited financial

statements for the year ended 31 March 2019.

2. SIGNIFICANT ACCOUNTING POLICIES

These financial statements have been prepared in accordance with IAS 34

'Interim Financial Reporting'. They do not include all of the information

required for full annual financial statements and should be read in conjunction

with the financial statements of the Group as at and for the year ended 31

March 2019.

The accounting policies applied by the Group in these financial statements are

the same as those applied by the Group in its financial statements as at and

for the year ended 31 March 2019.

The annual financial statements of the Group are prepared in accordance with

International Financial Reporting Standards ('IFRS') as adopted by the IASB.

The Group's annual financial statements for the year ended 31 March 2019 refer

to new Standards and Interpretations none of which has a material impact on

these financial statements. There have been no significant changes to

management judgements and estimates as disclosed in the last annual report and

financial statements for the year ended 31 March 2019.

3. REVENUE FROM PROPERTIES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Rents receivable (adjusted for lease incentives) 19,369 20,825 40,942

Surrender premiums 363 342 682

Dilapidation receipts 413 230 269

Other income 82 79 122

Service charge income 3,172 3,061 5,718

23,399 24,537 47,733

Rents receivable includes lease incentives recognised of GBP0.8 million (30

September 2018: GBP0.5 million, 31 March 2019: GBP0.8 million).

4. PROPERTY EXPENSES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Property operating costs 1,342 848 2,342

Property void costs 1,676 388 1,373

Recoverable service charge costs 3,172 3,061 5,718

6,190 4,297 9,433

5. OPERATING SEGMENTS

The Board is charged with setting the Group's business model and strategy. The

key measure of performance used by the Board to assess the Group's performance

is the total return on the Group's net asset value. As the total return on the

Group's net asset value is calculated based on the net asset value per share

calculated under IFRS as shown at the foot of the Balance Sheet, assuming

dividends are reinvested, the key performance measure is that prepared under

IFRS. Therefore, no reconciliation is required between the measure of profit or

loss used by the Board and that contained in the financial statements.

The Board has considered the requirements of IFRS 8 'Operating Segments'. The

Board is of the opinion that the Group, through its subsidiary undertakings,

operates in one reportable industry segment, namely real estate investment, and

across one primary geographical area, namely the United Kingdom, and therefore

no segmental reporting is required. The portfolio consists of 49 commercial

properties, which are in the industrial, office, retail, retail warehouse and

leisure sectors.

6. DIVIDS

Declared and paid: 6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Interim dividend for the period ended 31 March 2018: 0.875 - 4,716 4,716

pence

Interim dividend for the period ended 30 June 2018: 0.875 - 4,716 4,716

pence

Interim dividend for the period ended 30 September 2018: - - 4,716

0.875 pence

Interim dividend for the period ended 31 December 2018: 0.875 - - 4,712

pence

Interim dividend for the period ended 31 March 2019: 0.875 4,712 - -

pence

Interim dividend for the period ended 30 June 2019: 0.875 4,781 - -

pence

9,493 9,432 18,860

The interim dividend of 0.875 pence per ordinary share in respect of the period

ended 30 September 2019 has not been recognised as a liability as it was

declared after the period end. A dividend of GBP4,773,000 will be paid on 29

November 2019.

7. EARNINGS PER SHARE

Basic and diluted earnings per share is calculated by dividing the net profit

for the period attributable to ordinary shareholders of the Company by the

weighted average number of ordinary shares in issue during the period,

excluding the average number of shares held by the Employee Benefit Trust. The

diluted number of shares also reflects the contingent shares to be issued under

the Long-term Incentive Plan.

The following reflects the profit and share data used in the basic and diluted

profit per share calculation:

6 months 6 months Year ended

ended ended 31 March

30 30 2019

September September

2019 2018

Net profit attributable to ordinary shareholders of the 14,507 18,902 30,955

Company from continuing operations (GBP000)

Weighted average number of ordinary shares for basic profit/ 542,883,818 538,983,660 538,815,550

(loss) per share

Weighted average number of ordinary shares for diluted profit 545,054,006 541,093,417 541,035,348

/(loss) per share

8. FAIR VALUE MEASUREMENTS

The fair value measurement for the financial assets and financial liabilities

are categorised into different levels in the fair value hierarchy based on the

inputs to valuation techniques used. The different levels have been defined as

follows:

Level 1: quoted prices (unadjusted) in active markets for identical assets or

liabilities that the Group can access at the measurement date.

Level 2: inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly or indirectly. The fair

value of the Group's secured loan facilities, as disclosed in note 10, are

included in Level 2.

Level 3: unobservable inputs for the asset or liability. The fair value of the

Group's investment properties is included in Level 3.

The Group recognises transfers between levels of the fair value hierarchy as of

the end of the reporting period during which the transfer has occurred. There

were no transfers between levels for the period ended 30 September 2019.

The fair value of all other financial assets and liabilities is not materially

different from their carrying value in the financial statements.

The Group's financial risk management objectives and policies are consistent

with those disclosed in the consolidated financial statements for the year

ended 31 March 2019.

9. INVESTMENT PROPERTIES

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Fair value at start of period/year 676,102 674,524 674,524

Capital expenditure on investment properties 2,765 275 1,559

Disposals - (11,269) (11,269)

Realised gains on disposal - 379 379

Unrealised gains on investment properties 4,341 9,961 10,909

Fair value at the end of the period/year 683,208 673,870 676,102

Historic cost at the end of the period/year 650,809 646,759 648,044

The fair value of investment properties reconciles to the appraised value as

follows:

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Appraised value 693,355 682,950 685,335

Valuation of assets held under finance leases 1,519 1,623 1,565

Lease incentives held as debtors (11,666) (10,703) (10,798)

Fair value at the end of the period/year 683,208 673,870 676,102

As at 30 September 2019, all of the Group's properties are Level 3 in the fair

value hierarchy as it involves the use of significant inputs and there were no

transfers between levels during the period. Level 3 inputs used in valuing the

properties are those which are unobservable, as opposed to Level 1 (inputs from

quoted prices) and Level 2 (observable inputs either directly, i.e. as prices,

or indirectly, i.e. derived from prices).

The investment properties were valued by CBRE Limited, Chartered Surveyors, as

at 30 September 2019 on the basis of fair value in accordance with the RICS

Valuation - Global Standards 2017 which incorporate the International Valuation

Standards and the UK national supplement 2018. There were no significant

changes to the inputs into the valuation process (ERV, net initial yield,

reversionary yield and true equivalent yield), or assumptions and techniques

used during the period, further details on which were included in note 13 of

the consolidated financial statements of the Group for the year ended 31 March

2019.

The Group's borrowings (note 10) are secured by a first ranking fixed charge

over the majority of investment properties held.

10. LOANS AND BORROWINGS

Maturity 30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Current

Aviva facility - 1,231 1,178 1,204

Capitalised finance costs - (371) (370) (371)

860 808 833

Non-current

Santander revolving credit facility 18 June 2021 4,500 10,500 11,500

Santander revolving credit facility 20 June 2021 14,500 14,500 14,500

Canada Life facility 24 July 2027 80,000 80,000 80,000

Aviva facility 24 July 2032 86,843 88,074 87,465

Capitalised finance costs - (2,144) (2,515) (2,329)

183,699 190,559 191,136

Total loans and borrowings 184,559 191,367 191,969

The Group has a loan with Canada Life Limited for GBP80 million which matures in

July 2027. Interest is fixed at 4.08% over the life of the loan.

Additionally, the Group has a loan facility agreement with Aviva Commercial

Finance Limited for GBP95.3 million, which was fully drawn on 24 July 2012. The

loan matures in 2032, with approximately one-third repayable over the life of

the loan in accordance with a scheduled amortisation profile. Interest on the

loan is fixed at 4.38% over the life of the loan.

The fair value of the secured loan facilities at 30 September 2019, estimated

as the present value of future cash flows discounted at the market rate of

interest at that date, was GBP225.2 million (30 September 2018: GBP210.9 million,

31 March 2019: GBP219.5 million). The fair value of the secured loan facilities

is classified as Level 2 under the hierarchy of fair value measurements.

The Group has two revolving credit facilities ("RCF") with Santander Corporate

& Commercial Banking which expire in June 2021. In total the Group has GBP49.0

million available under both facilities, of which GBP19.0 million has been drawn.

Interest is payable on the drawn balance at LIBOR plus margins of 175 or 190

basis points.

The weighted average interest rate on the Group's borrowings as at 30 September

2019 was 4.1% (30 September 2018: 4.0%, 31 March 2019: 4.0%).

11. SHARE CAPITAL AND OTHER RESERVES

On 21 June 2019 the Company raised GBP7.1 million through the issue of 7,551,936

new ordinary shares of no par value at 94.5 pence per share. The Company now

has 547,605,596 ordinary shares in issue of no par value (30 September 2018:

540,053,660, 31 March 2019: 540,053,660).

The balance on the Company's share premium account as at 30 September 2019 was

GBP164,400,000 (30 September 2018: GBP157,449,000, 31 March 2019: GBP157,449,000).

30 30 31 March

September September 2019

2019 2018

Ordinary share capital 547,605,596 540,053,660 540,053,660

Number of shares held in Employee Benefit Trust (2,103,683) (1,070,000) (1,542,000)

Number of ordinary shares 545,501,913 538,983,660 538,511,660

The fair value of awards made under the Long-term Incentive Plan is recognised

in other reserves.

Subject to the solvency test contained in the Companies (Guernsey) Law, 2008

being satisfied, ordinary shareholders are entitled to all dividends declared

by the Company and to all of the Company's assets after repayment of its

borrowings and ordinary creditors. The Trustee of the Company's Employee

Benefit Trust has waived its right to receive dividends on the 2,103,683 shares

it holds but continues to hold the right to vote. Ordinary shareholders have

the right to vote at meetings of the Company. All ordinary shares carry equal

voting rights.

12. ADJUSTMENT FOR NON-CASH MOVEMENTS IN THE CASH FLOW STATEMENT

6 months 6 months Year

ended ended ended

30 30 31 March

September September 2019

2019 2018 GBP000

GBP000 GBP000

Profit on disposal of investment properties - (379) (379)

Investment property valuation movements (4,341) (9,961) (10,909)

Share based provisions 146 319 363

Depreciation of tangible assets 4 3 7

(4,191) (10,018) (10,918)

13. NET ASSET VALUE

The net asset value per share calculation uses the number of shares in issue at

the period end and excludes the actual number of shares held by the Employee

Benefit Trust at the period end; see note 11.

At 30 September 2019, the Company had a net asset value per ordinary share of GBP

0.94 (30 September 2018: GBP0.92, 31 March 2019: GBP0.93).

14. RELATED PARTY TRANSACTIONS

There have been no changes in the related party transactions described in the

last annual report that could have a material effect on the financial position

or performance of the Group in the first six months of the current financial

year.

The Company has no controlling parties.

15. EVENTS AFTER THE BALANCE SHEET DATE

A dividend of GBP4,773,000 (0.875 pence per share) was approved by the Board on

23 October 2019 and is payable on 29 November 2019.

On 4 November 2019 the Group completed on the sale of Citylink, Croydon for

proceeds of GBP18,200,000.

END

END

(END) Dow Jones Newswires

November 12, 2019 02:00 ET (07:00 GMT)

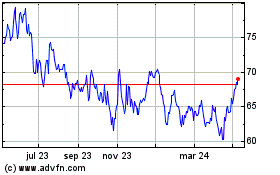

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

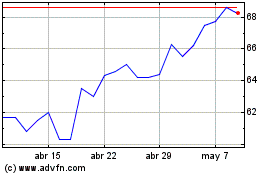

Picton Property Income Ld (LSE:PCTN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024