TIDMTRI

RNS Number : 5711K

Trifast PLC

23 April 2020

Trifast plc

(Trifast, Group or TR)

"Holding the world together"

International specialist in the design, engineering,

manufacture, and distribution

of high quality industrial and Category 'C' fastenings

principally to major global assembly industries

Trading Update

"TR is proud to be supporting essential industries around the

world"

London, Thursday, 23 April 2020 : Trifast (Main market LSE

Symbol: TRI) issues the following unaudited Trading Update covering

the Group's financial year ended 31 March 2020 ahead of the

announcement of its preliminary financial results.

Highlights

* Despite a challenging finish to the year:

o Revenue levels held up well against the prior year

o Underlying profit before tax remained broadly in line with

market expectations

* Good cash conversion, a strong balance sheet with

leverage well within our banking covenants and

significant facility headroom provide ongoing

resilience in uncertain times

* Global Covid-19 Task force in place and action plans

progressing

* Project Atlas ends the year on track and on budget

* Pipeline of opportunities and new business wins

provide optimism for the longer term

Trading

In our Q3 trading update we reported that ongoing weakness

across several of our sectors had continued to constrain revenue

growth in the second half of the year. Whilst the impact of

Covid-19 at this time was restricted to the extended closure of our

Chinese sites.

Over the course of the last six weeks of FY2020, the effect of

the Covid-19 pandemic significantly widened. Leading to government

mandated temporary site closures in Malaysia, Italy and Spain and

customer production line shutdowns predominantly in the automotive

sector. This in conjunction with a general reduction in

manufacturing volumes across almost all end markets, has reduced

year end trading levels across the Group.

The impact of this weakness has led to a corresponding reduction

in gross and operating margins against a semi-fixed cost base.

However, despite these challenges underlying profit remains broadly

in line with market expectations.

Covid-19 - Trifast's response

A cross-functional global Covid-19 Task Force has been set up to

develop and implement our action plan, manage internal

communications, and drive our responses and activities across the

world

Our people

Our first priority was to ensure a safe working environment for

all of our employees around the world. This included making sure we

were shielding our vulnerable employees, facilitating working from

home (helped by our Project Atlas investments), providing

appropriate levels of PPE and enhanced cleaning, implementing

staggered shift patterns, and increased spacing between workers at

our sites.

Scenario planning, cost control and cash management

initiatives

Daily stress-testing and scenario planning has been in place

since the beginning of March to ensure that we are able to look

ahead and make the right decisions at the right times. This will

not only allow us to protect and sustain the business but will also

ensure that the actions we are taking are measured and appropriate

in anticipation of trading conditions improving. Our balance sheet

is in a strong position, with leverage well inside our banking

covenants. Significant undrawn revolving credit facilities,

together with our existing cash resources, provide substantial

liquidity headroom with which to navigate an extended period of

uncertainty.

To protect our existing workforce and their ongoing employment

as far as possible, we are making full use of available government

backed job retention and wage subsidy schemes. From the 8 April

2020, initially up until the 30 June 2020, the Trifast plc Board

has agreed to take a 20% reduction in salaries and fees. Other cost

control measures include the implementation of a recruitment

freeze, a pay-rise deferral, reductions in temporary and contractor

headcount and a ban on all non-essential travel.

We are working closely with all our businesses so we can

continue to manage working capital effectively, whilst protecting

our underlying trading relationships. Capital investment, outside

of Project Atlas, is also being minimised in the short-term.

In order to allow us to appropriately manage our financial

position and flexibility in such an uncertain time, we do not

currently intend to propose a final dividend for FY2020 at our

forthcoming AGM. We plan to revisit this decision, including the

possibility of a special dividend later in the year, depending on

how the wider macroeconomic environment develops.

Operations - new opportunities in a changing marketplace

Despite ongoing lockdowns in a number of our key geographies, as

of today, all of our manufacturing and distribution sites around

the world are open for business. We have successfully applied for

essential business lockdown exemptions in Italy, Malaysia, and

Singapore, which has allowed us to continue to manufacture and

service our customer base.

Considerable work has been undertaken with customers and the

supplier base to minimise supply chain risks. We are pleased to

report that we have been able to keep supply routes open for all

our customers, despite the unprecedented logistical challenges

around the world.

As a business TR is incredibly proud to be supporting several

global OEMs and subcontractors in the medical sector, a market we

have operated in for a significant period of time and where we

continue to see ongoing opportunities for us as a business. Current

good examples are our fasteners going into ventilators and medical

grade masks across the world, as well as hospital beds here in the

UK's Nightingale Hospitals.

Outside of medical, our pipeline of opportunities and new

business remains strong across our main sectors. All of which gives

us good reason to be optimistic for the longer term despite the

current difficult trading conditions. As a critical part of OEM

supply chains, we also recognise how important it is for us to

retain the capacity and capability to respond quickly as our

customers and markets recover.

Project Atlas

As at the end of FY2020, we are pleased to report that Project

Atlas remained on track and on budget. Ready to allow our first

pilot in 2020 and full completion of the project by the end of

FY2022.

However, given the current extensive travel restrictions and the

importance of providing adequate training to allow us to fully

realise expected benefits, we have inevitably been forced to

re-align the project timetable, deferring roll-out until the second

half of FY2021. Our revised plan has been specifically designed to

make best use of this deferral period, by focusing on upfront site

by site preparations and additional development and training

activities to increase our internal expertise and

self-sufficiency.

As a result of the above, we are optimistic that we will be able

to recover at least some of the deferral time back, although we

will continue to monitor this as the ongoing impacts of Covid-19

become clearer.

Acquisitions

M&A continues to be a key strategic driver for growth and

our activities in this area are continuing so that we remain in a

position to take advantage of opportunities as conditions in our

markets stabilise.

Looking ahead

In the short-term we will continue to closely monitor, plan, and

take appropriate action to protect and sustain our business. Given

the current level of uncertainty, we still consider it remains

prudent to remove earnings guidance for the year ending 31 March

2021 until such a time as we have a clearer view on the impact of

Covid-19.

Looking ahead it is likely that there will be some long-term

changes in the way that our customers, our suppliers, and the

macroeconomic environment operates. We consider that the real

fundamentals of our business model and strategy remain unchanged,

but we are constantly reviewing what this 'new normal' will look

like and how we can best address the challenges and opportunities

it will bring.

Summary

Despite the rapidly changing developments regarding Covid-19,

our business remains solid. Our operational cash conversion remains

good and we have a strong balance sheet and significant facility

headroom. This, coupled with a continued pipeline of new wins and

opportunities, means the Board remains optimistic about the medium

to long term future of the Group.

We will provide a further update in our Full Year results

announcement.

Enquiries please contact:

------------------------------------------

Trifast plc

Jonathan Shearman, Non-Executive Chairman

Mark Belton, Chief Executive Officer

Clare Foster, Chief Financial Officer

Office: 44 (0) 1825 747630

Email: corporate.enquiries@trifast.com

Peel Hunt LLP

Stockbroker & financial adviser

Mike Bell

Tel: 44 (0)20 7418 8900

TooleyStreet Communications

IR & media relations

Fiona Tooley

Tel: 44 (0)7785 703523

Email: fiona@tooleystreet.com

Editors' note:

------------------------------------------------------------------------------

LSE Premium Listing: Ticker: TRI

LEI number: 213800WFIVE6RUK3CR22

Group website: www.trifast.com

About us:

Trifast plc (TR) is an international specialist in the design, engineering,

manufacture and distribution of high quality industrial and Category

'C' fastenings principally to major global assembly industries.

TR employs c.1300 people across 32 business locations within the

UK, Asia, Europe and the USA including eight high volume, high-quality

and cost-effective manufacturing sites across the world. TR supplies

over 5,000 customers in c. 75 countries worldwide.

As a full-service provider to multinational OEMs and Tier 1 companies

spanning several sectors, TR delivers comprehensive support to its

customers across every requirement, from concept design through to

technical engineering consultancy, manufacturing, supply management

and global logistics.

For more information, visit

Investor website : www.trifast.com

Commercial website: www.trfastenings.com

LinkedIn : www.linkedin.com/company/tr-fastenings

Twitter: www.twitter.com/trfastenings

Facebook : www.facebook.com/trfastenings

The information contained within this announcement

is deemed by the Company to constitute inside information

stipulated under the Market Abuse Regulation (EU) No. 596/2014.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBLLLLBZLZBBQ

(END) Dow Jones Newswires

April 23, 2020 02:00 ET (06:00 GMT)

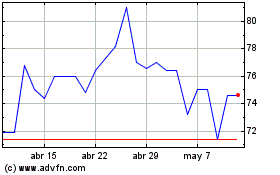

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Trifast (LSE:TRI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024