Warehouse REIT PLC Rent Collection & Business Update (2745V)

06 Agosto 2020 - 1:00AM

UK Regulatory

TIDMWHR

RNS Number : 2745V

Warehouse REIT PLC

06 August 2020

6 August 2020

Warehouse REIT plc

(the 'Company' or 'Warehouse REIT')

Rent Collection & Business Update

Warehouse REIT, the AIM-listed company that invests in and

manages e-commerce urban and last-mile industrial warehouse assets

in strategic locations in the UK, today provides a business update

including Q3 rent collection and progress on its investment

pipeline following its successful GBP153 million equity raise in

July. The Company also reaffirms its first quarter dividend payment

of 1.55 pence, payable on 2 October 2020, reflecting an attractive

annual equivalent dividend payment of 6.2 pence per share.

Rent collection

As at 30 July 2020, 94% of contracted rent due on the June 2020

quarter date had been received or is being collected monthly, with

ongoing discussions continuing for the balance. The Company is

taking a proactive approach towards collecting rent and has agreed

to monthly in advance payments amounting to 27% of the contracted

rent, of which, 60% has already been received.

Financial position

The Company continues to exercise a cautious approach in its use

of debt, ensuring it has a well-capitalised balance sheet. As at 30

July 2020, the company had GBP111 million of available cash and

GBP63 million of undrawn bank facilities, providing significant

operational flexibility.

Disposals

On 21 July 2020, the Company exchanged contracts to dispose of

seven smaller, non-core assets for an aggregate of GBP9.9 million,

reflecting a blended net initial yield of 6.1%, as part of its

strategy to recycle capital into higher returning opportunities.

The disposals are line with the 31 March 2020 book value and

improve both the quality and duration of income of the core

portfolio.

Pipeline

Tilstone Partners Limited, the Company's investment advisor,

continues to make good progress delivering on the pipeline of

acquisition opportunities identified at the time of July's capital

raise, which amounts to approximately GBP346 million. The amount in

exclusive/final negotiations or with solicitors instructed has

increased from the GBP123.3 million previously reported and the

Company anticipates updating the market before the end of the half

year.

Planning application

At Radway Green, the Company's 25-acre multi let industrial

estate located at Junction 16 of the M6 motorway in Cheshire, a

planning application has been submitted, in collaboration with the

adjoining owner, for a combined 803,000 sq ft of new high-bay

warehouse units, ranging from 60,000 sq ft to 340,000 sq ft. The

application retains an amount of existing space which is currently

income producing whilst utilising the undeveloped areas of the

current estate. The overall scheme is expected to be implemented in

a number of phases in order to both maximise retained income and to

meet occupier demand. The Company expects the application to be

determined in Q4 2020.

Andrew Bird, Managing Director of the Investment Manager,

Tilstone Partners Limited, commented: "The UK warehouse

occupational market remains robust, underpinned by those structural

trends including e-commerce that are being accelerated as a result

of Covid-19. Alongside a number of ongoing asset management

successes, we are focused on assisting the Company in deploying its

available capital into the significant pipeline of accretive

opportunities the team has identified, and which will further

improve the portfolio's income and diversification

characteristics."

-ENDS-

Enquiries: via FTI Consulting

Warehouse REIT plc

Tilstone Partners Limited +44 (0) 1244 470

Andrew Bird, Paul Makin 090

FTI Consulting (Financial PR & IR Adviser

to the Company) +44 (0) 20 3727

Dido Laurimore, Ellie Sweeney, Richard Gotla 1000

G10 Capital Limited (part of the IQEQ Group),

AIFM

Maria Glew +44 (0) 20 3696

1302

Peel Hunt (Financial Adviser, Nominated Adviser

and Broker)

Capel Irwin, Carl Gough, Harry Nicholas +44 (0)20 7418 8900

Further information on Warehouse REIT is available on its

website:

http://www.warehousereit.co.uk

Notes to editors:

Warehouse REIT is an AIM listed UK Real Estate Investment Trust

that invests in and manages E-commerce urban and 'last-mile'

industrial warehouse assets in strategic locations in the UK.

Occupier demand for urban warehouse space is increasing as the

structural growth in e-commerce has driven the rise in internet

shopping and investment by retailers in the "last mile" delivery

sector, yet supply remains constrained giving rise to rental

growth.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager. The Investment Manager is

currently G10 Capital Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUVUVRRAUWRAR

(END) Dow Jones Newswires

August 06, 2020 02:00 ET (06:00 GMT)

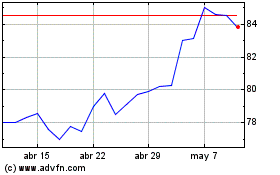

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

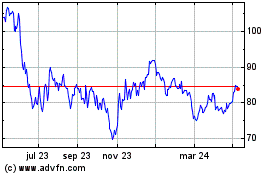

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024