Form 424B3 - Prospectus [Rule 424(b)(3)]

01 Agosto 2024 - 1:45PM

Edgar (US Regulatory)

H The following is a summary of the terms of the notes offered by the preliminary pricing supplement hyperlinked below. Overview The notes provide exposure to the J.P. Morgan Dynamic Blend ℠ Index (the “Index”). The Index attempts to provide a dynamic rules - based allocation to the J.P. Morgan US Large Cap Equities Futures Index (the “Equity Constituent”) and the J.P. Morgan 2Y US Treasury Futures Index (the “Bond Constituent” and, together with the Equity Constituent, the “Portfolio Constituents”) while ta rgeting a level volatility of 3.0%. The Index tracks the return of (a) a notional dynamic portfolio consisting of the Equity Constitue nt and the Bond Constituent, less (b) the daily deduction of 0.95% per annum. Each futures contract underlying a Portfolio Constituent as of a particular time is referred to as an “Underlying Futures Contract.” The Equity Constituent is an excess return index that tracks the re tur n of a notional rolling futures position in futures contracts on the S&P 500 ® Index. The Bond Constituent is an excess return index that tracks the return of a notional rolling futures position in futures contracts on 2 - Year U.S. treasury notes. Summary of Terms Issuer: JPMorgan Chase Financial Company LLC Guarantor: JPMorgan Chase & Co. Minimum Denomination: $1,000 Index: J.P. Morgan Dynamic Blend ℠ Index Index Ticker: JPUSDYBL Pricing Date: August 30, 2024 Observation Date: August 31, 2026 Maturity Date: September 3, 2026 Contingent Digital Return: At least 18.00%* Payment at Maturity: If the Final Value is greater than or equal to the Initial Value, your payment at maturity per $1,000 principal amount note will be calculated as follows: $1,000 + ($1,000 î Contingent Digital Return) If the Final Value is less than the Initial Value, you will receive the principal amount of your notes at maturity. You are entitled to repayment of principal in full at maturity, subject to the credit risks of JPMorgan Financial and JPMorgan Chase & Co. CUSIP: 48135PD32 Preliminary Pricing http :// sp.jpmorgan.com/document/cusip/48135PD32/doctype/Product_Termsheet/document.pdf Supplement: Estimated Value: The estimated value of the notes, when the terms of the notes are set, will not be less than $900.00 per $1,000 principal amount note. For information about the estimated value of the notes, which likely will be lower than th e price you paid for the notes, please see the hyperlink above. Any payment on the notes is subject to the credit risk of JPMorgan Chase Financial Company LLC, as issuer of the notes, and t he credit risk of JPMorgan Chase & Co., as guarantor of the notes. *The actual Contingent Digital Return will be provided in the pricing supplement and will not be less than 18.00%. **Reflects Contingent Digital Return equal to the minimum Contingent Digital Return set forth herein, for illustrative purpos es. The “total return” as used above is the number, expressed as a percentage, that results from comparing the payment at maturit y p er $1,000 principal amount note to $1,000. The hypothetical returns shown above apply only at maturity. These hypotheticals do not reflect fees or expenses that would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical returns shown above would likel y b e lower. Investing in the notes linked to the Index involves a number of risks. See "Selected Risks" on page 2 of this document, "Ris k Factors" in the prospectus supplement and the relevant product supplement and underlying supplement, Annex A to the prospectu s addendum and "Selected Risk Considerations" in the relevant pricing supplement. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes o r p assed upon the accuracy or the adequacy of this document or the relevant product supplement, underlying supplement, prospectus supp lem ent, prospectus and prospectus addendum. Any representation to the contrary is a criminal offense. J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_investments@jpmorgan.com Hypothetical Total Returns** Total Return on the Notes Index Return Final Value 18.00% 80.00% 180.00 18.00% 65.00% 165.00 18.00% 50.00% 150.00 18.00% 40.00% 140.00 18.00% 30.00% 130.00 18.00% 20.00% 120.00 18.00% 18.00% 118.00 18.00% 10.00% 110.00 18.00% 5.00% 105.00 18.00% 1.00% 101.00 18.00% 0.00% 100.00 0.00% - 5.00% 95.00 0.00% - 10.00% 90.00 0.00% - 20.00% 80.00 0.00% - 40.00% 60.00 0.00% - 60.00% 40.00 0.00% - 80.00% 20.00 0.00% - 100.00% 0.00 2yr J.P. Morgan Dynamic Blend ℠ Index Capped Digital Notes North America Structured Investments Terms supplement to the prospectus dated April 13, 2023, the prospectus supplement dated April 13, 2023, the product supplement no. 3 - I dated April 13, 2023, the underlying supplement no. 24 - I dated September 1, 2023 and the prospectus addendum dated June 3, 2024 Registration Statement Nos. 333 - 270004 and 333 - 270004 - 01 August 1 , 2024 Rule 424(b)(3)

J.P. Morgan Structured Investments | 1 800 576 3529 | jpm_structured_investments@jpmorgan.com Selected Risks • The notes may not pay more than the principal amount at maturity. • Our affiliate, JPMS, the index sponsor and the index calculation agent of the Index and each Portfolio Constituent, may have interests that conflict with yours and may adjust the Index or each Portfolio Constituent in a way that affects its level. • The level of the Index will include a 0.95% per annum daily deduction. • Your maximum gain on the notes is limited to the Contingent Digital Return. • Your ability to receive the Contingent Digital Return may terminate on the Observation Date. • The Index may not be successful, may not outperform any alternative strategy, may not approximate its target volatility of 3.0% and the performance of the Index may be adversely affected by its target volatility of 3.0%. • Any payment on the notes is subject to the credit risks of JPMorgan Chase Financial Company LLC and JPMorgan Chase & Co. Therefore the value of the notes prior to maturity will be subject to changes in the market’s view of the creditworthiness of JPMorgan Chase Financial Company LLC or JPMorgan Chase & Co. • The Index may be significantly uninvested. • A significant portion of the Index’s exposure may be allocated to the Bond Constituent. • The Index may be more heavily influenced by the performance of the Equity Constituent than the performance of the Bond Constituent in general over time. • The investment strategy used to construct the Index involves daily adjustments to its notional exposure to its Portfolio Constituents. • There is no assurance that the strategy employed by the Equity Constituent will be successful. • JPMorgan Chase & Co. is currently one of the companies that make up the S&P 500 ® Index, the reference index underlying the Underlying Futures Contracts of the Equity Constituent. • The returns of the Constituents may offset each other or become correlated in decline. • A Portfolio Constituent may be replaced by a substitute constituent or futures contract if certain extraordinary events occur. • Each Portfolio Constituent is subject to significant risks associated with the Underlying Futures Contracts. • Suspension or disruptions of market trading in the Underlying Futures Contract may adversely affect the value the of your notes. • An increase in the margin requirements for the Underlying Futures Contract included in the Portfolio Constituents may adversely affect the level of that Portfolio Constituent. • The Index may in the future include Underlying Futures Contracts that are not traded on regulated futures exchange. • Negative roll returns associated with the Underlying Futures Contracts constituting the Portfolio Constituents may adversely affect the performance of the Portfolio Constituents and the value of the notes. Selected Risks (continued) • The Index, which was established on March 23, 2021, and the Portfolio Constituents, which were established on December 22, 2020, have limited operating histories and may perform in unanticipated ways. • The Index comprises notional assets and liabilities. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. • No interest payments or rights to the futures contracts underlying the Portfolio Constituents. • As a finance subsidiary, JPMorgan Chase Financial Company LLC has no independent operations and has limited assets. • The estimated value of the notes will be lower than the original issue price (price to public) of the notes. • The estimated value of the notes is determined by reference to an internal funding rate. • The estimated value of the notes does not represent future values and may differ from others’ estimates. • The value of the notes, which may be reflected in customer account statements, may be higher than the then current estimated value of the notes for a limited time period. • Lack of liquidity: J.P. Morgan Securities LLC (who we refer to as JPMS) intends to offer to purchase the notes in the secondary market but is not required to do so. The price, if any, at which JPMS will be willing to purchase notes from you in the secondary market, if at all, may result in a significant loss of your principal. • Potential conflicts: We and our affiliates play a variety of roles in connection with the issuance of notes, including acting as calculation agent and hedging our obligations under the notes, and making the assumptions used to determine the pricing of the notes and the estimated value of the notes when the terms of the notes are set. It is possible that such hedging or other trading activities of J.P. Morgan or its affiliates could result in substantial returns for J.P. Morgan and its affiliates while the value of the notes declines. • The tax consequences of the notes may be uncertain. You should consult your tax adviser regarding the U.S. federal income tax consequences of an investment in the notes. Additional Information Any information relating to performance contained in these materials is illustrative and no assurance is given that any indic ati ve returns, performance or results, whether historical or hypothetical, will be achieved. These terms are subject to change, and J.P. Morgan undertakes no duty to update this information. This document shall be amended, supers ede d and replaced in its entirety by a subsequent preliminary pricing supplement and/or pricing supplement, and the documents referred to therein. In the event any inconsistency between the information presented herein an d a ny such preliminary pricing supplement and/or pricing supplement, such preliminary pricing supplement and/or pricing supplement shall govern. Past performance, and especially hypothetical back - tested performance, is not indicative of future results. Actual performance may vary significantly from past performance or any hypothetical back - tested performance. This type of information has inherent limitations and you should carefully consider these limitations before placing reliance on s uch information. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters contained herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone unaffiliated with JPMorgan Cha se & Co. of any of the matters addressed herein or for the purpose of avoiding U.S. tax - related penalties. Investment suitability must be determined individually for each investor, and the financial instruments described herein may not be suitable for all investors. This information is not intended to provide and should not be relied upon as providing accounting, legal, regulatory or tax advice. Investors should consult with their own advisers as to these m att ers. This material is not a product of J.P. Morgan Research Departments. North America Structured Investments 2yr J.P. Morgan Dynamic Blend ℠ Index Capped Digital Notes The risks identified above are not exhaustive. Please see “Risk Factors” in the prospectus supplement and the applicable pro duc t supplement and underlying supplement, Annex A to the prospectus addendum and “Selected Risk Considerations” in the applicable preliminary pricing supplement for additional information.

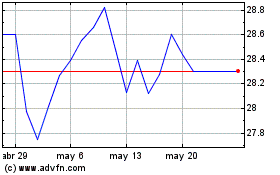

JP Morgan Alerian MLP (AMEX:AMJ)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

JP Morgan Alerian MLP (AMEX:AMJ)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024