As

filed with the Securities and Exchange Commission on December 31, 2024

Registration

No. 333-283927

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1

TO

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ORAGENICS,

INC.

(Exact

name of registrant as specified in its charter)

| Florida |

|

59-3410522 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

1990

Main Street, Suite 750

Sarasota,

Florida 34236

(813)

286-7900

(Address,

including zip code, and telephone number, including area code, of principal executive offices)

Janet

Huffman, Chief Financial Officer

Oragenics,

Inc.

1990

Main Street, Suite 750

Sarasota,

Florida 34236

(813)

286-7900

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

With

copies to:

Mark

A. Catchur, Esq.

Julio

C. Esquivel, Esq.

Shumaker,

Loop & Kendrick, LLP

101

East Kennedy Boulevard

Suite

2800

Tampa,

Florida 33602

Telephone:

(813) 229-7600

Facsimile:

(813) 229-1660 |

|

Ralph

V. DeMartino, Esq.

Marc

Rivera, Esq.

ArentFox

Schiff LLP

1717

K Street NW

Washington,

DC 20006

Telephone:

(202) 350-3643

Facsimile:

(202) 857-6395 |

Approximate

date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

|

|

|

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

|

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that the Registration Statement shall thereafter become effective

in accordance with Section 8(A) of the Securities Act of 1933, or until this registration statement shall become effective on such date

as the Commission, acting pursuant to section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting

an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED,

DECEMBER 31, 2024 |

Up

to 15,151,515 Units, consisting of One Share of Common Stock

or

One Pre-Funded Warrant and

One

Common Warrant to Purchase One Share of Common

Stock

Up

to 15,151,515 Shares of Common Stock underlying such Common Warrants

Up

to 15,151,515 Shares of Common Stock underlying such Pre-Funded Warrants

Placement

Agent Warrants to Purchase an Aggregate of up to 757,576 Shares of Common Stock

Up

to 757,576 Shares of Common Stock Underlying the Placement Agent Warrants

This

is a reasonable best efforts public offering of up to 15,151,515 units consisting of one share of common stock, par value $0.001 per

share (“Common Stock”) (or one Pre-Funded Warrant to purchase one share of our Common Stock in lieu thereof), and one common

warrant to purchase one share of our Common Stock (the “Common Warrants” and together with the shares of Common Stock, the

“Units”) at an assumed public offering price of $0.33 per Unit, the last reported sale price of our common stock as reported

on NYSE American, or the “NYSE American,” on December 13, 2024. The actual public offering price per Unit will be determined

between us and the Placement Agent at the time of pricing and may be at a discount to this assumed offering price. Therefore, the assumed

public offering price used throughout this prospectus may not be indicative of the final offering price.

The

Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. Each Common Warrant offered hereby

is exercisable upon issuance at an initial exercise price of $0.33 (assuming an offering price of $0.33 per Unit) per share of common

stock, and will expire five (5) years from the date of issuance.

We

are also offering to each purchaser of Units whose purchase of shares of our Common Stock in this offering would otherwise result in

the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of

the holder, 9.99%) of our outstanding shares of Common Stock immediately following consummation of this offering, the opportunity to

purchase, if the purchaser so chooses, Units consisting of one Pre-Funded Warrant to purchase one share of Common Stock (“Pre-Funded

Warrants”), and one Common Warrant. Each Pre-Funded Warrant will be exercisable immediately upon issuance, will expire when exercised

in full, and will be exercisable for one share of our Common Stock. The purchase price of each Unit including a Pre-Funded Warrant will

equal the price per Unit of the Units including one share of Common Stock being sold to the public in this offering, minus $0.001, and

the exercise price of each Pre-Funded Warrant will be $0.001 per share. For each Unit including a Pre-Funded Warrant that we sell, the

number of Units including one share of our Common Stock that we are offering will be decreased on a one-for-one basis.

The

Common Stock and Prefunded Warrants can each be purchased in this offering only with the accompanying Common Warrants that are part of

a Unit, but the components of the Units will be immediately separable and will be issued separately in this offering. See “Description

of Securities” in this prospectus for more information.

This

offering also relates to the shares of Common Stock issuable upon exercise of the Common Warrants (the “Common Warrant Shares”),

the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants (the “Pre-Funded Warrant Shares”), and the shares

of Common Stock issuable upon exercise of Placement Agent Warrants (defined below).

There

is no established public trading market for the Units, the Common Warrants or the Pre-Funded Warrants, and we do not expect a

market to develop. We do not intend to apply for listing of the Units, the Common Warrants or the Pre-Funded Warrants on any securities

exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Units, the Common Warrants

and the Pre-Funded Warrants will be limited.

Our

Common Stock is listed on NYSE American under the symbol “OGEN.” On December 13, 2024, the closing sale price of our common

stock was $0.33 per share.

Investing

in our securities involves a high degree of risk. You should review carefully the disclosures described under the heading “Risk

Factors” beginning on page 14 of this prospectus and in documents that are incorporated by reference into this prospectus

for a discussion of the risks and uncertainties that should be considered in connection with an investment in our securities.

We

have engaged Dawson James Securities, Inc. to act as our placement agent (the “Placement Agent”) in connection with the securities

offered by this prospectus. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities

offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering, and the Placement

Agent is not required to arrange the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay to

the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities offered by

this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum number

of shares of securities or minimum aggregate amount of proceeds that is a condition for this offering to close. We may sell fewer than

all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering

will not receive a refund if we do not sell all of the securities offered hereby. Because there is no escrow account and no minimum number

of securities or amount of proceeds, investors could be in a position where they have invested in us, but we have not raised sufficient

proceeds in this offering to adequately fund the intended uses of the proceeds as described in this prospectus. We will bear all costs

associated with the offering. See “Plan of Distribution” on page 29 of this prospectus for more information regarding

these arrangements. This offering will terminate no later than January 31, 2025, unless we decide to terminate the offering (which we

may do at any time in our discretion) prior to that date.

We

have agreed to pay the Placement Agent a fee based on the aggregate proceeds raised in this offering as set forth in the table below:

| | |

Per Unit | | |

Total (3) | |

| Public offering price (1) | |

$ | 0.33 | | |

$ | 5,000,000 | |

| Placement Agent fees (2) | |

$ | .0231 | | |

$ | 350,000 | |

| Proceeds, before expenses, to us (4) | |

$ | 0.3069 | | |

$ | 4,650,000 | |

| (1) |

Assumes

the sale of Units including one share of Common Stock. The public offering price of Units

including one Pre-Funded Warrant will be $0.339.

|

| (2) |

We

will pay the Placement Agent a cash fee equal to seven percent (7%) of the aggregate gross proceeds raised in this offering. In addition,

we have agreed to reimburse the Placement Agent for certain offering-related expenses and have agreed to issue to the Placement Agent

warrants to purchase up to five percent 5% of the shares of our Common Stock (including the shares of Common Stock underlying any

Pre-Funded Warrants) sold in the offering with an exercise price equal to 125% of the per share offering price (the “Placement

Agent Warrants”). We refer you to “Plan of Distribution” beginning on page 29 for additional information

regarding compensation to be received by the Placement Agent. |

| |

|

| (3) |

Assuming

the maximum offering amount is sold in this offering. |

| |

|

| (4) |

Because

there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public

offering amount, placement agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than

the total maximum offering amounts set forth above. We estimate the total expenses of this offering payable by us, excluding the

placement agent fee, will be approximately $350,000. |

The

delivery of the shares of Common Stock, Pre-Funded Warrants and Common Warrants to purchasers is expected to be made no later than January

__, 2025.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Dawson

James Securities, Inc.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to

invest in our securities.

You

should rely only on the information contained in this prospectus. We have not, and the Placement Agent has not, authorized anyone to

provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses

prepared by or on behalf of us or to which we have referred you, and we take no responsibility for any other information others may give

you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give

you.

This

prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful

to do so. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information

contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery

or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

The

information incorporated by reference or provided in this prospectus contains statistical data and estimates, including those relating

to market size and competitive position of the markets in which we participate, that we obtained from our own internal estimates and

research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Industry publications,

studies and surveys generally state that they have been obtained from sources believed to be reliable. While we believe our internal

company research is reliable and the definitions of our market and industry are appropriate, neither this research nor these definitions

have been verified by any independent source.

For

investors outside the United States: We have not, and the Placement Agent has not, done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus outside the United States.

This

prospectus and the information incorporated by reference into this prospectus contain references to our trademarks and to trademarks

belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus and the information incorporated

by reference into this prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but

such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights

or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’

trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated

by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

As

used in this prospectus, unless the context indicates or otherwise requires, “the Company,” “our Company,” “we,”

“us,” and “our” refer to Oragenics, Inc., a Florida corporation, and its consolidated subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements. These are based on our management’s

current beliefs, expectations and assumptions about future events, conditions and results and on information currently available to us.

Discussions containing these forward-looking statements may be found, among other places, in the sections entitled “Business,”

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

contained in the documents incorporated by reference herein.

Any

statements in this prospectus, or incorporated herein, about our expectations, beliefs, plans, objectives, assumptions or future events

or performance are not historical facts and are forward-looking statements. Within the meaning of Section 27A of the Securities Act and

Section 21E of the Exchange Act, these forward-looking statements include statements regarding:

| |

● |

Our

need to raise additional capital to continue to implement our business strategy; |

| |

|

|

| |

● |

Our

financial capacity and performance, including our ability to obtain funding, non-dilutive or otherwise, necessary to do the research,

development, manufacture, and commercialization of any one or all of our product candidates; |

| |

|

|

| |

● |

Our

ability to maintain our listing on the NYSE American and the trading market of our common stock; |

| |

|

|

| |

● |

The

timing, progress and results of clinical trials of our product candidates; |

| |

|

|

| |

● |

Uncertainties

regarding submission, approval and scope of filings for regulatory approval of our product candidates and our ability to obtain and

maintain regulatory approvals for our product candidates for any indication; |

| |

|

|

| |

● |

Uncertainties

regarding the potential benefits, activity, effectiveness and safety of our product candidates including as to administration, distribution

and storage; |

| |

|

|

| |

● |

Uncertainties

regarding the size of the patient populations, market acceptance and opportunity for and clinical utility of our product candidates,

if approved for commercial use; |

| |

|

|

| |

● |

Our

manufacturing capabilities and strategy, including the scalability and commercial viability of our manufacturing methods and processes,

and those of our contractual partners; |

| |

|

|

| |

● |

Our

ability to successfully commercialize our product candidates; |

| |

|

|

| |

● |

The

potential benefits of, and our ability to maintain, our relationships and collaborations with the NIAID, the NIH, the NRC and other

potential collaboration or strategic relationships; |

| |

|

|

| |

● |

Uncertainties

regarding our expenses, ongoing losses, future revenue, capital requirements; |

| |

|

|

| |

● |

Our

ability to identify, recruit and retain key personnel and consultants; |

| |

|

|

| |

● |

Our

ability to obtain, retain, protect, and enforce our intellectual property position for our product candidates, and the scope of such

protection; |

| |

|

|

| |

● |

Our

ability to advance the development of our new and existing product candidate under the timelines and in accord with the milestones

projected; |

| |

|

|

| |

● |

Our

need to comply with extensive and costly regulation by worldwide health authorities, who must approve our product candidates prior

to substantial research and development and could restrict or delay the future commercialization of certain of our product candidates; |

| |

● |

Our

ability to successfully complete pre-clinical and clinical development of, and obtain regulatory approval of our product candidates

and commercialize any approved products on our expected timeframes or at all; |

| |

|

|

| |

● |

The

safety, efficacy, and benefits of our product candidates; |

| |

|

|

| |

● |

The

effects of government regulation and regulatory developments, and our ability and the ability of the third parties with whom we engage

to comply with applicable regulatory requirements; |

| |

|

|

| |

● |

The

capacities and performance of our suppliers and manufacturers and other third parties over whom we have limited control; and |

| |

|

|

| |

● |

Our

competitive position and the development of and projections relating to our competitors or our industry. |

In

some cases, you can identify forward-looking statements by the words “may,” “might,” “can,” “will,”

“to be,” “could,” “would,” “should,” “expect,” “intend,” “plan,”

“objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,”

“potential,” “likely,” “continue” and “ongoing,” or the negative of these terms, or other

comparable terminology intended to identify statements about the future, although not all forward-looking statements contain these words.

These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

You

should refer to the “Risk Factors” section contained in this prospectus and any related free writing prospectus, and under

similar headings in the other documents that are incorporated by reference into this prospectus, for a discussion of important factors

that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. Given these

risks, uncertainties and other factors, many of which are beyond our control, we cannot assure you that the forward-looking statements

in this prospectus will prove to be accurate, and you should not place undue reliance on these forward-looking statements. Furthermore,

if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in

these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that

we will achieve our objectives and plans in any specified time frame, or at all.

Except

as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements

to reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

PROSPECTUS

SUMMARY

This

summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all

of the information that you should consider before investing in our common stock and it is qualified in its entirety by, and should be

read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common

stock, you should read the entire prospectus carefully, including “Risk Factors” beginning on page 14 and the financial statements

and related notes incorporated by reference to this prospectus.

Our

Company

We

are a development-stage company dedicated to the research and development of nasal delivery pharmaceutical medications in neurology.

Our lead product, the ONP-002 drug, is a fully synthetic, non-naturally occurring neurosteroid, is lipophilic, and it has been shown

in animal models that it can cross the blood-brain barrier rapidly to reduce swelling, oxidative stress and inflammation while restoring

proper blood flow through gene amplification.

On

December 28, 2023, we successfully consummated our previously announced Asset Purchase Agreement with Odyssey Health, Inc. (“Odyssey”),

pursuant to which we purchased all of Odyssey’s assets related to the segment of Odyssey’s business focused on developing

medical products that treat brain related illnesses and diseases (the “Neurology Assets”). The Neurology Assets include drug

candidates for treating mild traumatic brain injury (mTBI), also known as concussion, and for treating Niemann Pick Disease Type C (NPC),

as well as Odyssey’s novel proprietary nasal formulation and its novel breath-powered intranasal delivery device.

As

a result of the acquisition of the Neurology Assets, we expect that, in the near- and mid-terms, we will focus our resources and efforts

on the continued development of the Neurology Assets and primarily ONP-002, which, as discussed further below, has successfully completed

Phase 1 clinical trials. The acquisition is expected to build on our expertise in intranasal platforms and expand our portfolio into

more areas of unmet medical needs. Nasal delivery offers many advantages over standard systemic delivery systems, such as its non-invasive

character, a fast onset of action and in many cases reduced side effects due to a more targeted delivery.

Accordingly,

given our limited resources, we anticipate, for the time being, placing the development of our nasal COVID-19 product candidate and our

lantibiotics program on hold.

In

conjunction with the Neurology Asset acquisition, we paid Odyssey a total of $1,000,000 in cash, $500,000 of which was paid in October,

2023 and $500,000 of which was paid on December 11, 2023. In addition, at the closing, we issued Odyssey 8,000,000 shares of our newly

created Series F Non-Voting Convertible Preferred Stock, which are convertible into our common stock on a one-to-one basis (subject to

certain adjustments). Odyssey converted 511,308 of those shares into our common stock on December 28, 2023. Pursuant to the Certificate

of Designation creating the Series F Preferred Stock, the remainder of the shares are not convertible until the occurrence of all of

the following: (i) Oragenics’ shall have applied for and been approved for initial listing on the NYSE American or another national

securities exchange or shall have been delisted from the NYSE American, which Oragenics’ does not anticipate undertaking until

it meets the NYSE American’s initial listing standards, and (ii) if required by the rules of the NYSE American, Oragenics’

shareholders shall have approved any change of control that could be deemed to occur upon the conversion of the Series F Preferred Stock

into common stock, based on the fact and circumstances existing at such time.

About

Mild Traumatic Brain Injury (mTBI)

Concussions

are a serious unmet medical need that affects millions worldwide. Repetitive concussions are thought to increase the risk of developing

Chronic Traumatic Encephalopathy (“CTE”) and other neuropsychiatric disorders. It is estimated that 5 million concussions

occur in the U.S. annually and that as many as 50% go unreported. The worldwide incidence of concussion is estimated at 69 million. The

global market for concussion treatment was valued at $6.9 billion in 2020 and is forecast to reach $8.9 billion by 2027, according to

Grandview Research. Common settings for concussion include contact sports, military training and operations, motor vehicle accidents,

children at play and elderly falls.

Our

ONP-002 Neurology Asset for Brain Related Illness and Injury

Our

lead product and focus is on the development and commercialization of ONP-002 for the treatment of mild traumatic brain injury (“mTBI”

or “concussion”). ONP-002 to date has been shown to be stable up to 104 degrees for 18-months. The ONP-002 drug candidate

is used in conjunction with Oragenic’s novel breath-powered intranasal device. In use, breath power drives the ONP-002 drug candidate

from the novel intranasal device through the nasal passage and directly into the brain for mTBI or concussion treatment. The novel intranasal

device is lightweight and uniquely designed for easy and simple use in the field.

We

believe the proprietary nasal formulation and intranasal administration allows for rapid and direct accessibility to the brain. The novel

intranasal device is breath propelled and is designed to drive and concentrate the ONP-002 drug into the brain, which then easily crosses

the blood brain barrier. In operation, when patients blow into the intranasal device, the soft palate closes in the back of the nasopharynx.

This mechanism prevents the flow of the ONP-002 drug into the lungs or esophagus, minimizes systemic ONP-002 drug exposure and side effects,

and concentrates the ONP-002 drug flow into the brain. In other words, this mechanism traps the ONP-002 drug in the nasal cavity allowing

for more abundant and faster drug availability in the traumatized brain.

Expected

ONP-002 Product Development Timeline:

| Pre-clinical

Animal Studies |

|

Phase

1 |

|

Phase

2a |

|

Phase

2b |

|

Phase

3 |

| Complete |

|

Complete |

|

Estimated

Q1 2025 start |

|

Estimated

Q3 2025 start |

|

Estimated

Q4 2026 start |

This

product development plan is an estimate and is subject to change based on funding, technical risks and regulatory approvals.

Validation

and Stability of ONP-002

A

Certificate of Analysis (“COA”) was issued by the manufacturer of the drug, indicating that testing methods were standard

and include appearance, identification by 1H NMR, identification by Mass Spectroscopy (MS), optical purity by HPLC, residual solvent

analysis, elemental impurities, percent water, and residue on ignition. The manufacturer has shown both the specifications and the results,

indicating that the material supplied passes all criteria. The ONP-002 drug is supplied in essentially pure form. As such, no excipients

are believed to be present. Stability studies were performed by storing the ONP-002 drug samples under carefully controlled conditions

with respect to temperature and humidity. The stability testing protocol included storage at about 25 °C± 2 °C at about

60% relative humidity ± 5% relative humidity for about 24 months and at about 40 °C± 2 °C at about 75% relative

humidity ± 5% for about 18 months. The ONP-002 drug samples were pulled at essentially the scheduled time and analyzed for appearance,

purity, assay, optical purity, and water content. No changes in ONP-002 were observed.

Intellectual

Property

Domestic

and foreign patents applications on the ONP-002 compound have been filed and to date, several have been issued. Domestic and foreign

patent applications have also been filed on the novel breath-powered intranasal delivery device as follows:

| |

● |

New

chemical entity IP filings – USPTO pending, granted in Europe and Canada |

| |

○ |

C-20

steroid compounds, compositions and uses thereof to treat traumatic brain injury (TBI), including concussion. |

| |

○ |

The

invention relates to ONP-002 drug compound, compositions and methods of use thereof to treat, minimize and/or prevent traumatic brain

injury (TBI), including severe TBI, moderate TBI, and mild TBI, including concussions. |

| |

|

|

| |

○ |

Patent

expiration with max patent term extension – 9/17/2040 |

| |

|

|

| |

○ |

Patent

expiration with no patent term extension – 9/17/2035 |

| |

● |

Method

of intranasal delivery and device components – Domestic and Foreign patent applications pending |

| |

|

|

| |

● |

Breath-powered

intranasal device and use thereof – Domestic and Foreign patent applications pending |

ONP-002

Pre-Clinical Trials

The

ONP-002 drug has completed toxicology studies in rats and dogs. Those studies show that the ONP-002 drug has a large safety margin of

its predicted efficacious dose. In preclinical animal studies, the ONP-002 drug demonstrated rapid and broad biodistribution throughout

the brain while simultaneously reducing swelling, inflammation, and oxidative stress, along with an excellent safety profile.

Results

from the preclinical studies suggest that the ONP-002 drug has an equivalent, and potentially superior, neuroprotective effect compared

to related neurosteroids. The animals treated with the ONP-002 drug post-concussion showed positive behavioral outcomes using various

testing platforms including improved memory and sensory-motor performance, and reduced depression/anxiety like behavior.

ONP-002

Drug Induction of PXR

The

induction of the human CYP450 enzymes, CYP2B6, and CYP3A4 by ONP-002, as measured by mRNA expression, was tested in human hepatocytes

from 3 donors at 3 concentrations: about 1 μM, about 10 μM and about 100 μM. Results reflected that the ONP-002 drug through

the known PXR-mechanism produced a modest induction of CYP3A4, up to about 17% of the positive control, and a greater induction of CYP2B6,

of up to about 59% of the positive control, both at a concentration of about 100 μM. Past data reflected that the ONP-001 drug candidate

(ent-Progesterone) and Progesterone induce the PXR receptor. Receptor binding studies have been performed showing neither the

ONP-001 drug candidate or the ONP-002 drug activate the classical Progesterone Receptor.

ONP-002

Drug Animal Studies

All

surgical animals (male Sprague-Dawley rats approx. 250 grams) were anesthetized with an initial isoflurane induction for about 4 min-the

minimum time necessary to sedate the animal. The scalp was shaved and cleaned with isopropanol and betadine. During the stereotaxic surgery,

anesthesia was maintained with isoflurane. A medial incision was made, and the scalp was pulled back over the medial frontal cortex.

An approximate 6-mm diameter craniotomy was performed exposing the brain tissue. An electrically controlled injury device using a 5 mm

metal impactor was positioned over the exposed brain. An impact speed of about 1.6 m/s at about a 90-degree angle from vertical was used

to produce an open head injury at a depth of 1mm to create a milder TBI. All treatments were given intranasal (IN) as a liquid solution

with a micro atomizer. Vehicle for all administrations was about 22.5% Hydroxy-Propyl-β-cyclodextrin (HPβCD).

Molecular

Studies - Brain tissue was taken from the penumbral region of injury.

Cerebral

Edema

In

Figure 2, we show that the ONP-002 drug reduces swelling in rats compared to vehicle-treated at 24-hrs after brain injury by measure

of brain water content through speed-vacuum dehydration and tissue weight comparisons. The ONP-002 drug-treated (about 4mg/kg) and vehicle-treated

were compared to sham which was set at zero. Local edema can occur after mTBI. Severe cerebral edema is associated with poor outcomes

including increased mortality after mTBI with Second Impact Syndrome (2). *Denotes significance at p<0.05, n=6

Inflammation

mTBI

causes vascular and neuronal stress. Microglia and reactive astrocytes infiltrate the areas of injury and release inflammatory mediators,

like TNF-alpha. We show that the ONP-002 drug (about 4mg/kg) reduces TNF-alpha-mediated neuroinflammation in brain tissue of rats compared

to vehicle at approximately 24-hrs after mTBI (ELISA).

Pharmacokinetics

and Safety of IN ONP-002 Drug in Dog

This

pivotal GLP 14-day study used repeat dosing of the ONP-002 drug, 3X a day, approximately about 4 hours apart, for approximately 14 consecutive

days at concentrations of about 0, 3, 10 or 23 mg/mL at a volume of about 1 mL/nostril to beagle dogs (both nostrils had drug administered).

The intranasal treatment was given as a liquid solution using a micro atomizer using about 22.5% HPβCD as the vehicle. Intranasal

ONP-002 drug dosing revealed that the ONP-002 drug was well tolerated up to the highest dose of about 23 mg/ml or about 46mg in total

per dosing. Clinical observations were limited to increased salivation in dogs which occurred in a dose-dependent manner. There were

no effects on body weight, food consumption, ophthalmic parameters, clinical chemistry, haematology, or organ weights at any of the doses

tested. Microscopic analysis revealed purulent exudates in the nasal turbinate and evidence of inflammatory infiltrates and fibrin deposition

in the lungs. All of these events were classified as mild, reversed during the recovery period, and did not appear to show any dose dependency.

Similar findings were evident in vehicle control treated dogs indicating the findings were vehicle related. The highest dose of about

23 mg/ml was thus determined to be the NOAEL which is equivalent to a ONP-002 dose of about 1.5mg/kg and about 2.3mg/kg in male and female

dogs, respectively. Testing shows the dose-dependent increase in plasma exposure of the ONP-002 drug in male and female dogs following

IN administration. Plasma exposure levels were similar in males and females and there did not appear to be any evidence of drug accumulation

following multiple doses.

Cardiopulmonary

Safety Pharmacology

The

effect of the ONP-002 drug on the human ether-a-go-go related gene (hERG) tail currents was assessed in a non-Good Laboratory Practice

(GLP) study using manual whole-cell patch clamp. The ONP-002 drug tested at a single concentration of about 10 μM inhibited hERG tail

currents by about 42.6% (n=3). In order to achieve a safety factor of about 30-fold between in vitro hERG IC50 and free plasma levels

of the ONP-002 drug in clinical studies, the Cmax (maximum concentration) should not exceed a free drug concentration of about 0.33 μM

(about 99 ng/ml). The ONP-002 drug is about 97.2% human plasma protein bound and is estimated to reach a plasma Cmax of about 12.5 nM,

the highest dose of about 0.533 mg/kg to be administered in the planned first in human (FIH) study, which provides a safety factor of

about 800-fold. A GLP study has been conducted at Charles River, Inc. and will be incorporated into the IND submission.

ONP-002

Drug Clinical Trials

The

ONP-002 drug has completed a Phase 1 clinical trial in healthy human subjects showing it is safe and well tolerated.

Safety

studies have established a dosing regimen of 2X/day for fourteen days. The Phase 1 clinical trial was performed in Melbourne, Australia

with a Contract Research Organization (CRO), Avance Clinical Pty Ltd and Nucleus Network Pty Ltd. The country of Australia provides a

currency exchange advantage and a tax rebate at the end of our fiscal year from the Australian government on all Research and Development

performed in Australia.

The

Phase 1 study was double-blinded, randomized and placebo controlled (3:1, drug:placebo). Phase 1 used a Single Ascending/Multiple Ascending

(SAD/MAD) drug administration design. The SAD component was a 1X treatment (low, medium, or high dose) and the MAD component was a 1X/day

treatment for five consecutive days (low and medium dose). Blood and urine samples were collected at multiple time points for safety

pharmacokinetics. Standard safety monitoring was provided for each body system.

Forty

human subjects (31 males, 9 females) were successfully enrolled in Phase 1. The Safety Review Board, made up of medical doctors, has

reviewed the trial data and has determined the drug is safe and well tolerated at all dosing levels.

We

anticipate preparing for Phase 2 clinical trials to further evaluate the ONP-002 drug’s safety and efficacy. Based on the Phase

1 data, we plan to apply for an Investigational New Drug application with the FDA and conduct a Phase 2 trial in the United States.

We

anticipate a Phase 2 clinical trial will be performed administering the ONP-002 drug intranasally in concussed patients 2x a day for

up to fourteen days. The Phase 2a feasibility study is expected to be performed in Australia with a target initiation date in the third

quarter of 2024 to be followed closely by a Phase 2b proof of concept study in the US.

We

have entered an agreement with one of the leading Contract Research Organization (CRO) in Australia, to conduct a Phase 2 clinical trial

in Australia. This trial aims to evaluate the ONP-002 drug for TBI. This Australian CRO, renowned for its clinical trial management capabilities

and quality of service in Australia, New Zealand, and North America, brings over two decades of expertise in navigating the Therapeutic

Goods Administration, Food and Drug Administration, and European Medicines Agency regulatory landscapes. Other key third party well-respected

vendors also have been engaged to advance and monitor our progress.

On

July 10, 2024, we announced that we had developed a new proprietary formulation for the novel ONP-002 neurosteroid. We believe the nasal

cavity provides access for our novel neurosteroid formulation to enter the brain in minutes. Given the difficulty of getting neurosteroids

into solution, unique formulations must be developed to achieve therapeutic levels. We believe that our recent work has increased the

final dose levels significantly while also providing for improved intranasal drug delivery and adhesion and, thus, longer absorption

times. We further believe we have successfully completed an improved proprietary formulation of the ONP-002 drug that should significantly

increase the bioavailability of the intranasal drug formulation. The enhanced drug percentages in this novel proprietary formulation

have been developed as part of our platform for acute-field delivery of the drug. Our newly developed proprietary intranasal drug formulation

is intended to reduce the duration of initial concussion symptoms and prevent long-lasting symptoms that can be debilitating after a

concussion.

On

August 8, 2024, we announced our candidate for treating concussion successfully completed a study that indicates the ONP-002 drug does

not cause cardiotoxicity. Prior to conducting a clinical trial, the U.S. Food and Drug Administration (FDA) requires pharmaceuticals

to be tested on cardiac receptors to ensure that they do not show any causes of electrical malformations. Further, on August 30, 2024,

we announced we successfully completed a study that indicates the ONP-002 drug does not cause DNA damage and genotoxicity in an animal

model. Prior to conducting a clinical trial, the U.S. Food and Drug Administration (FDA) requires that pharmaceuticals be tested on cells

and animals to ensure they do not cause damage affecting cell division.

Our

Medical Advisors

Dr.

James “Jim” Kelly, Neurologist, serves as our Chief Medical Officer, and oversees our upcoming Phase 2 clinical trial for

treating concussion. In the recent past, Dr. Kelly served as the Executive Director of the Marcus Institute for Brain Health (MIBH) and

Professor of Neurology at the University of Colorado Anschutz Medical Campus in Aurora, Colorado. The MIBH specialized treatment program

is funded by the Marcus Foundation to care for US military veterans with persistent symptoms of TBI. Dr. Kelly was also National Director

of the Avalon Action Alliance TBI Programs for which the MIBH serves as the clinical coordinating center. Prior to these recent positions,

Dr. Kelly was the Director of the National Intrepid Center of Excellence (NICoE) at Walter Reed National Military Medical Center in Bethesda,

MD. As its founding Director, he led the creation of an innovative interdisciplinary team of healthcare professionals who blended high-tech

diagnosis and treatment with complementary and alternative medical interventions in a holistic, integrative approach to the care of US

military personnel with the complex combination of TBI and psychological conditions, such as post-traumatic stress, depression, and anxiety.

In this role, Dr. Kelly was frequently called upon by leaders of the Military Health System at the Pentagon, the US Congress, the Department

of Veterans Affairs, and numerous military facilities in the continental US and abroad. Dr. Kelly has interacted with the FDA and clinical

trials for brain injury throughout his esteemed career. He is a strong advocate for treatments in the acute phase of brain injury and

understands the value of protecting the brain early on from inflammation, swelling and oxidative stress to gain better clinical outcomes.

Dr.

William “Frank” Peacock serves as our Chief Clinical Officer, and will conduct our anticipated Phase 2 clinical trial for

treating concussion in emergency departments. Dr. Peacock is currently the Vice Chair for Emergency Medicine Research at Baylor College

of Medicine and a past Professor at the Cleveland Clinic Lerner College of Medicine. He is also the Principal Investigator of a trial

for a company developing blood biomarkers for the identification of concussion in the emergency department, which is analyzing acute

blood markers that are elevated after concussion to not only ensure concussion is identified but also as a predictor of potential severity

and longer-term complications. Dr. Peacock is a world-renowned speaker and researcher. He has been instrumental in the approval and use

of high sensitivity blood troponins for acute coronary syndrome failure in emergency settings, which can be seen in the JAMA Cardiology

publication, Efficacy of High-Sensitivity Troponin T in Identifying Very-Low-Risk Patients with Possible Acute Coronary Syndrome,

and he is the editor of the first book of “Biomarkers of Traumatic Brain Injury”.

Our

SARS-CoV-2 Vaccine Product Candidate – NT-CoV2-1

Prior

to the purchase of the Neurology Assets, starting in May 2020 with the acquisition of one hundred percent (100%) of the total issued

and outstanding common stock of Noachis Terra, Inc. (“Noachis Terra”) and through December 31, 2023, we were focused on the

development and commercialization of a vaccine produce candidate to provide long-lasting immunity from SARS-CoV-2, which causes COVID-19.

During that time, we conducted testing in animal models, including SARS-CoV-2 challenge studies in hamsters, using specific formulations

for intramuscular administration and intranasal administration, both based on the NIAID pre-fusion stabilized spike protein antigens.

In

June of 2021, we initiated an immunogenicity study in mice and on August 30, 2021, we announced the successful completion of the mouse

studies that supported further development using either intramuscular or intranasal routes of administration. In September of 2021, we

initiated a hamster challenge to assess inhibition of viral replication using adjuvants specific for intramuscular and intranasal administration.

In December of 2021, we announced that both formulations generated robust immune responses and reduced the SARS-CoV-2 viral loads to

undetectable levels in the nasal passages and lungs five days following a viral challenge. On June 14, 2022, we announced that the results

of these studies were published in Nature Scientific Reports.

In

March of 2022, following a positive assessment of a rabbit-based pilot study, we initiated a Good Laboratory Practice toxicology study

to evaluate the safety profile and immunogenicity of NT-CoV2-1 in rabbits. This preclinical study was designed to provide data required

to advance our intranasal vaccine candidate into human clinical studies.

Following

the successful results of the animal studies previously referenced and a Type B Pre-IND Meeting with the FDA we determined to focus our

development efforts and financial resources on the intranasal delivery vaccine produce candidate, NT-CoV2-1. As part of this intranasal

development focus, during 2023 we entered into strategic license agreements and announced an award of a grant from CQDM.

However,

due to lack of financial resources our research and development activities for our NT-CoV2-1 vaccine product were suspended as of December

31, 2023, and are not currently active. We will continue to evaluate opportunities and funding resources for our SARS-CoV-2 and NT-CoV2-1

candidate products in the future of which there can be no assurances. These opportunities and funding resources could include, without

limitation, sublicensing agreements, joint ventures or partnerships, sales or licensing of technology, government grants and public or

private financings, through the sale of debt or equity securities or by securing a line of credit or other loan. There can be no assurances

that we will be able to secure any such opportunity or funding.

In

March of 2022, following a positive assessment of a rabbit-based pilot study, we initiated a Good Laboratory Practice toxicology study

to evaluate the safety profile and immunogenicity of NT-CoV2-1 in rabbits. This preclinical study was designed to provide data required

to advance our intranasal vaccine candidate into human clinical studies.

Following

the successful results of the animal studies previously referenced and a Type B Pre-IND Meeting with the FDA we determined to focus our

development efforts and financial resources on the intranasal delivery vaccine produce candidate, NT-CoV2-1. As part of this intranasal

development focus, during 2023 we entered into strategic license agreements and announced an award of a grant from CQDM.

However,

due to lack of financial resources our research and development activities for our NT-CoV2-1 vaccine product were suspended as of December

31, 2023, and are not currently active. We will continue to evaluate opportunities and funding resources for our SARS-CoV-2 and NT-CoV2-1

candidate products in the future of which there can be no assurances. These opportunities and funding resources could include, without

limitation, sublicensing agreements, joint ventures or partnerships, sales or licensing of technology, government grants and public or

private financings, through the sale of debt or equity securities or by securing a line of credit or other loan. There can be no assurances

that we will be able to secure any such opportunity or funding.

Our

Lantibiotic Product Candidate

Members

of our scientific team discovered that a certain bacterial strain of Streptococcus mutans, produces Mutacin 1140 (MU1140), a molecule

belonging to the novel class of antibiotics known as lantibiotics. Lantibiotics, such as MU1140, are highly modified peptide antibiotics

made by a small group of Gram-positive bacterial species. Over 60 lantibiotics have been discovered, to date. We believe lantibiotics

are generally recognized by the scientific community to be potent antibiotic agents. In nonclinical testing, MU1140 has shown activity

against all Gram-positive bacteria against which it has been tested, including those responsible for a number of healthcare associated

infections, or HAIs. A high percentage of hospital-acquired infections are caused by highly antibiotic-resistant bacteria such as methicillin-resistant

Staphylococcus aureus (MRSA) or multidrug-resistant Gram-negative bacteria. We believe the need for novel antibiotics is increasing because

of the growing resistance of target pathogens to existing FDA approved antibiotics on the market.

While

lantibiotics are promising, in 2023 we concluded we needed to make several changes to reduce the cash used in operations. In September

of 2023, we terminated our lease for the building where some of the research and development activities for the lantibiotic program were

undertaken. The closing of the laboratory was part of the continued focus on preserving cash resources while seeking additional funding

through various mechanisms. As of December 31, 2023, research and development activities related to the lantibiotic program are inactive.

We will evaluate opportunities for the lantibiotic program; however, moving forward our focus is to strengthen our focus and expertise

on developing our intranasal drug delivery platform and drug candidates that treat brain related illnesses and diseases.

Our

Business Development Strategy

Success

in the biopharmaceutical and product development industry relies on the continuous development of novel product candidates. Most product

candidates do not make it past the clinical development stage, which forces companies to look externally for innovation. Accordingly,

we expect, from time to time, to seek strategic opportunities through various forms of business development, which can include strategic

alliances, licensing deals, joint ventures, collaborations, equity or debt-based investments, dispositions, mergers, and acquisitions.

We view these business development activities as a necessary component of our strategies, and we seek to enhance shareholder value by

evaluating business development opportunities both within and complementary to our current business, as well as opportunities that may

be new and separate from the development of our existing product candidates.

As

discuss elsewhere, our current focus is on advancing our ONP-002 product candidate to treat concussion. Work on our other project candidates

currently is not active. As part of the focus on ONP-002, and to conserve resources, we have made several changes to reduce cash used

in operations until additional capital can be obtained. As previously announced, we exercised our option under our lease with Hawley-Wiggins,

LLC (the “Landlord”), for the building located in Progress Park and known as 13700 Progress Boulevard, Alachua, Florida 32615

(the “Lease”) to terminate the Lease by paying nine (9) months of advance rent, plus prorated rent for the month of September,

2023, plus applicable sales tax. In addition to the termination of the Lease, the Company eliminated two staff positions and Dr. Martin

Handfield transitioned from an employee of the Company to a consultant. Dr. Handfield continues to be available to provide support services

on an hourly basis through a consulting agreement. Dr. Handfield’s employment agreement was terminated in accordance with its terms.

The Alachua lease contained the laboratory where some of the research and development for the lantibiotic program was undertaken.

Corporate

and Other Information

We

were incorporated in November 1996 and commenced operations in 1999. We consummated our initial public offering in June 2003. Our executive

office is located at, 1990 Main Street, Suite 750, Sarasota, Florida 34236. Our telephone number is (813) 286-7900 and our website is

http://www.oragenics.com. We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q,

current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file or furnish

such materials to the Securities and Exchange Commission (the “SEC”). The reports are also available at www.sec.gov.

Implications

of Being a Smaller Reporting Company

We

are a “smaller reporting company” as defined in Rule 10(f)(1) of Regulation S-K. We will remain a smaller reporting company

until the last day of the fiscal year in which (1) the market value of our shares of Common Stock held by non-affiliates exceeds $250

million or (2) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our shares of Common

Stock held by non-affiliates exceeds $700 million, each as determined on an annual basis. A smaller reporting company may take advantage

of relief from some of the reporting requirements and other burdens that are otherwise applicable generally to public companies. These

provisions include:

| |

● |

being

permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements in the assessment of our internal control over financial reporting;

and |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements. |

SUMMARY

OF RISK FACTORS

Our

business is subject to a number of risks of which you should be aware of before making an investment decision. These risks are discussed

more fully in the “Risk Factors” section of this prospectus immediately following this prospectus summary. Some of

these risks include the following:

| ● |

We

have incurred significant losses since our inception, have limited financial resources, do not generate any revenues and will need

to raise additional capital in the future. |

| |

|

| ● |

We

may not be able to secure additional funding. |

| |

|

| ● |

Our

auditor has expressed substantial doubt about our ability to continue as a going concern. |

| |

|

| ● |

We

may not be able to satisfy the continued listing standards of the NYSE American and may be delisted from the NYSE American. |

| |

|

| ● |

We

have limited neurology-specific research, development, manufacturing, testing, regulatory, commercialization, sales, distribution,

and marketing experience, and we may need to invest significant financial and management resources to establish these capabilities. |

| |

|

| ● |

None

of our product candidates have been approved for sale and if we are unable to successfully develop our product candidates, we may

not be able to continue as a going concern. |

| |

|

| ● |

Our

product candidates, if approved, will face significant competition; many of our competitors have significantly greater resources

and experience. |

| |

|

| ● |

Our

ONP-002 concussion candidate may face competition from biosimilars approved through an abbreviated regulatory pathway. |

| |

|

| ● |

The

market opportunities for our neurology product candidates may be smaller than we believe them to be and we cannot assure you that

the market and consumers will accept our products or product candidates. |

| |

|

| ● |

If

our manufacturers and suppliers fail to meet our requirements and the requirements of regulatory authorities, our research and development

may be materially adversely affected. |

| |

|

| ● |

We

rely on the significant experience and specialized expertise of our senior management and scientific team and the loss of any of

our key personnel or our inability to successfully hire their successors could harm our business. |

| |

|

| ● |

If

any of our product candidates are shown to be ineffective or harmful in humans, we will be unable to generate revenues from these

product candidates. |

| |

|

| ● |

We

might not be successful at acquiring, investing in or integrating businesses, entering into joint ventures or divesting businesses. |

| |

|

| ● |

Our

concussion and neurology related research and development efforts are to a large extent dependent upon our intellectual property

and biologicals materials licenses. |

| |

|

| ● |

We

may not be able to protect our intellectual property and if we are unable to protect our trademarks or other intellectual property

from infringement, our business prospects may be harmed. |

| |

|

| ● |

We

may be subject to claims challenging the inventorship of our patents and other intellectual property rights. |

| |

|

| ● |

If

we are sued for infringing intellectual property rights of third parties, it will be costly and time-consuming and an unfavorable

outcome in that litigation could have a material adverse effect on our business. |

| |

|

| ● |

Our

success will depend on our ability to partner or sub-license our product candidates. |

| ● |

Security

breaches and other disruptions to our information technology systems or those of the vendors on whom we rely on could compromise

our information and expose us to liability, reputational damage, or other costs. |

| |

|

| ● |

Our

product candidates are subject to substantial government regulation and will be subject to ongoing and continued regulatory review

and we may also be subject to healthcare laws, regulation and enforcement. |

| |

|

| ● |

We

may be unable to obtain regulatory approval for our product candidates under applicable regulatory requirements. |

| |

|

| ● |

Delays

or difficulties in the enrollment of patients in clinical trials may result in additional costs and delays. |

| |

|

| ● |

Our

product candidates may cause serious or undesirable side effects. |

| |

|

| ● |

Our

employees, independent contractors, principal investigators, consultants, vendors and CROs may engage in misconduct or other improper

activities, including noncompliance with regulatory standards and requirements. |

| |

|

| ● |

Even

if our current product candidates or any future product candidates obtain regulatory approval, they may fail to achieve the broad

degree of health care payers, physician and patient adoption and use necessary for commercial success. |

| |

|

| ● |

The

issuance of additional equity securities by us in the future will result in dilution and the conversion of our outstanding preferred

stock will result in significant dilution. |

| |

|

| ● |

Our

Series B preferred stock, if not converted into common stock, has a distribution and liquidation preference senior to our common

stock in liquidation which could negatively affect the value of our common stock and impair our ability to raise additional capital. |

| |

|

| ● |

Certain

provisions of our articles of incorporation, bylaws, executive employment agreements and stock option plan may prevent a change of

control of our company that a shareholder may consider favorable. |

| |

|

| ● |

The

price and volume of our common stock has been volatile and fluctuates substantially. |

| |

|

| ● |

The

requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract

and retain qualified members for our Board of Directors. |

| |

|

| ● |

If

we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent

fraud. |

THE

OFFERING

| Issuer: |

|

Oragenics,

Inc. |

| |

|

|

| Units

Offered: |

|

We

are offering 15,151,515 Units. Each Unit consists of one share of Common Stock (or one Pre-Funded

Warrant to purchase one share of our Common Stock in lieu thereof) and a Common Warrant to

purchase one share of our Common Stock (together with the shares of Common Stock underlying

such warrants). The Units have no stand-alone rights and will not be certificated or issued

as stand-alone securities.

The

Common Stock and Prefunded Warrants can each be purchased in this offering only with the accompanying Common Warrants that are part

of a Unit, but the components of the Units will be immediately separable and will be issued separately in this offering. See “Description

of Securities” in this prospectus for more information. |

| |

|

|

| Pre-Funded

Warrants: |

|

We

are also offering to each purchaser of Units whose purchase of shares of our Common Stock

in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 4.99% (or, at the election of the

holder, 9.99%) of our outstanding shares of Common Stock immediately following consummation

of this offering, the opportunity to purchase, if the purchaser so chooses, Units consisting

of one Pre-Funded Warrant to purchase one share of Common Stock (“Pre-Funded Warrants”),

and one Common Warrant. Each Pre-Funded Warrant will be exercisable immediately upon issuance,

will expire when exercised in full, and will be exercisable for one share of our Common Stock.

For each Unit including a Pre-Funded Warrant that we sell, the number of Units including

one share of our Common Stock that we are offering will be decreased on a one-for-one basis.

This

offering also relates to the shares of Common Stock issuable upon exercise of the Common Warrants (the “Common Warrant Shares”),

the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants (the “Pre-Funded Warrant Shares”), and the

shares of Common Stock issuable upon exercise of Placement Agent Warrants (defined below). |

| |

|

|

| Description

of warrants: |

|

The

Common Warrants will be exercisable beginning on the closing date and expire on the fifth anniversary of the closing date and have

an initial exercise price per share equal to $0.33 per share, subject to appropriate adjustment in the event of recapitalization

events, stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our Common

Stock. |

| |

|

|

| Common

stock outstanding prior to this offering: |

|

12,570,100

shares of Common Stock, as of December 13, 2024 |

| |

|

|

| Common

Stock to be outstanding after this offering: |

|

27,386,723

shares assuming we sell only Units and no Pre-Funded Warrants and assuming no exercise of the Common Warrants being offered in this

offering. To the extent Pre-Funded Warrants are sold, it will reduce the number of shares of Common Stock that we are offering on

a one-for-one basis. |

| Offering

Price: |

|

The

assumed offering price is $0.33 per Unit including one share of Common Stock, the last reported sale price of our Common Stock as

reported on NYSE American on December 13, 2024. The purchase price of each Unit including a Pre-Funded Warrant will equal the price

per Unit of the Units including one share of Common Stock being sold to the public in this offering, minus $0.001, and the exercise

price of each Pre-Funded Warrant will be $0.001 per share. |

| |

|

|

| Use

of Proceeds: |

|

We

estimate that we will receive net proceeds of approximately $4.3 million from our sale of Common Stock in this offering. We intend

to use the net proceeds from this offering, along with our existing cash and cash equivalents, to fund our ongoing ONP-2 concussion

clinical trials, along with other related research and development activities, as well as for working capital and other general corporate

purposes. See “Use of Proceeds” in this prospectus for a more complete description of the intended use of proceeds

from this offering. |

| |

|

|

| Trading

market and symbol: |

|

Our

Common Stock is listed on NYSE American, or the “NYSE American,” under the symbol “OGEN.” |

| |

|

|

| Risk

Factors: |

|

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 14 and the other information

in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our common |

| |

|

|

| Lock-Up: |

|

Our

directors and officers have agreed, subject to certain exceptions, not to offer, pledge, sell, contract to sell, grant, lend, or

otherwise transfer or dispose of, directly or indirectly, or enter into any swap or other arrangement that transfers to another,

in whole or in part, any of the economic consequences of ownership of any shares of our capital stock or any securities convertible

into or exercisable or exchangeable for shares of our Common Stock, for a period of three (3) months from the date of this Offering. |

The

number of shares of our Common Stock to be outstanding after this offering is based on shares of our Common Stock outstanding as of December

13, 2024, and excludes the following:

●

917,353 shares of our Common Stock issuable upon the exercise of outstanding options under our equity incentive plans at a weighted

average exercise price of $4.97 per share;

●

736,574 shares of Common Stock reserved for issuance under outstanding warrants with a weighted average exercise price of $20.57 per

share;

●

2,004,164 additional shares of Common Stock reserved for future issuance under our 2021 equity incentive plan;

●

1,139,705 shares of common stock reserved for issuance under outstanding pre-funded warrants as of December 13, 2024 with a weighted

average exercise price of $0.001 per share; and

●

approximately 7,488,692 shares of Common Stock reserved for issuance under conversion of 7,488,692 outstanding shares of Series F Non-Voting,

Convertible Preferred Stock.

Unless

we indicate otherwise or unless the context otherwise requires, all information in this prospectus assumes the following:

| |

● |

no

exercise of outstanding options or warrants; |

| |

● |

assumes

no exercise of the Pre-Funded Warrants issued in this offering; and |

| |

● |

no

exercise of the Placement Agent’s warrants to be issued upon consummation of this offering. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to purchase our securities, including the shares

of Common Stock offered by this prospectus, you should carefully consider the risks and uncertainties described under “Risk Factors”

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, any subsequent Quarterly Report on Form 10-Q and our other

filings with the SEC, all of which are incorporated by reference herein. If any of these risks actually occur, our business, financial

condition and results of operations could be materially and adversely affected and we may not be able to achieve our goals, the value

of our securities could decline and you could lose some or all of your investment. Additional risks not presently known to us or that

we currently believe are immaterial may also significantly impair our business operations. If any of these risks occur, our business,

results of operations or financial condition and prospects could be harmed. In that event, the market price of our Common Stock and the

value of the warrants could decline, and you could lose all or part of your investment.

Risks

Relating to this Offering

The

market price of our Common Stock has been, and may continue to be volatile and fluctuate significantly, which could result in substantial

losses for investors.

The

trading price for our Common Stock has been, and we expect it to continue to be, volatile. The price at which our Common Stock trades

depends upon a number of factors, including our historical and anticipated operating results, our financial situation, announcements

by us or our competitors, our ability or inability to raise the additional capital we may need and the terms on which we raise it, and

general market and economic conditions. Some of these factors are beyond our control. Broad market fluctuations may lower the market

price of our Common Stock and affect the volume of trading in our stock, regardless of our financial condition, results of operations,

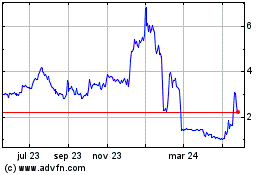

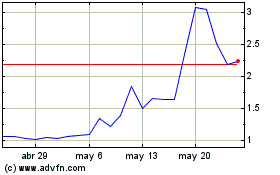

business or prospects. The closing price of our Common Stock as reported on the NYSE American had a high price of $9.00 and a low price

of $2.62 in the 52-week period ended December 31, 2023 and a high price of $6.84 and a low price of $0.27 from January 1, 2024 through

December 13, 2024. Among the factors that may cause the market price of our Common Stock to fluctuate are the risks described in this

“Risk Factors” section and other factors, including:

| |

● |

results

of preclinical and clinical studies of our product candidates or those of our competitors; |

| |

|

|

| |

● |

regulatory

or legal developments in the U.S. and other countries, especially changes in laws and regulations applicable to our product candidates; |

| |

|

|

| |

● |

actions

taken by regulatory agencies with respect to our product candidates, clinical studies, manufacturing process or sales and marketing

terms; |

| |

|

|

| |

● |

introductions

and announcements of new products by us or our competitors, and the timing of these introductions or announcements; |

| |

|

|

| |

● |

announcements

by us or our competitors of significant acquisitions or other strategic transactions or capital commitments; |

| |

|

|

| |

● |