Enel Launches Dual-Tranche EUR1.75 Billion Sustainability-Linked Bond

17 Enero 2024 - 1:24AM

Noticias Dow Jones

By Mauro Orru

Enel launched a dual-tranche sustainability-linked bond for

institutional investors in the Eurobond market for 1.75 billion

euros ($1.90 billion).

The Rome-based energy company said late Tuesday that the

issue--conducted through Enel Finance International--was more than

three times oversubscribed, collecting orders of roughly EUR5.8

billion.

Enel Finance International plans to use the proceeds to

refinance the group's ordinary financing needs relating to debt

maturities.

Write to Mauro Orru at mauro.orru@wsj.com

(END) Dow Jones Newswires

January 17, 2024 02:09 ET (07:09 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

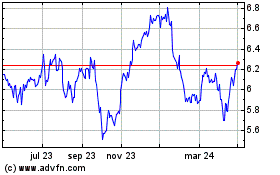

Enel (BIT:ENEL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

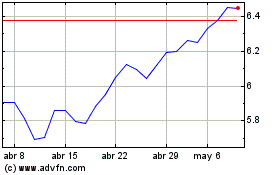

Enel (BIT:ENEL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024