From Margin To Perpetuals: How Decentralized Exchanges Are Redefining DeFi Trading

19 Abril 2023 - 2:00PM

NEWSBTC

The decentralized finance (DeFi) space has been gaining tremendous

traction over the last months, especially in the area of perpetual

trading. The on-chain perpetual exchange sector has seen

significant growth recently, with a total trading volume of $164.2

billion in Q1 2023. According to the DeFi researcher and analyst,

Thor Hartvigsen, the on-chain perpetual exchange sector is poised

for significant growth in the coming years, with projections of

10-20x growth. This growth is driven by the emergence of new

protocols and the increasing number of traders moving on-chain,

especially after the collapse of the crypto exchange FTX.

Decentralized Perpetual Exchanges, The Future Of DeFi Trading?

Hartvigsen’s analysis shows that, as the space matures, it is

expected that the cumulative on-chain perpetual trading volume will

increase to trillions per quarter. Related Reading: These Top 5

Cryptos Are Thriving Despite A Slippery Market Several

decentralized exchanges such as DYDX, GMX, KWENTA, and GNS have

emerged in the on-chain perpetual exchange space, offering unique

features such as low fees, increased privacy, and the ability to

trade various assets without the need for intermediaries. For

example, dYdX was one of the first on-chain perpetual exchanges to

launch in the DeFi space, and it has since gained significant

traction. Despite a decrease in trading activity since 2021, dYdX

still does more in daily trading volume than all of the other perp

protocols combined, with a total trading volume of $913 billion.

The analysis shows that when it comes to on-chain perpetual trading

protocols, dYdX operates differently from its counterparts like

GMX, gTrade, and Level. dYdX has a low trading-fee structure that

is more similar to a centralized exchange (CEX). Furthermore,

dYdX does not charge fees on the first $100,000 traded and allows

users to avoid Ethereum gas on all deposits above $500. This low

fee structure works to dYdX’s advantage as it attracts more traders

to the platform, similar to how CEXs attract traders with their low

fees. On the other hand, GMX is another of the leading on-chain

perpetual exchange protocols, with a total trading volume of $100.5

billion and total fees of $148.2 million. Additionally, GMX is

getting close to launching V2, which will introduce a new liquidity

structure to the protocol, a large number of trading pairs, new

asset classes, and much lower fees. Hartvigsen suggests that the

success of GMX last year sparked the on-chain perpetual exchange

narrative, with its novel liquidity model (GLP) and real yield

distribution of fees to liquidity providers and $GMX stakers

playing a significant role. The Road Ahead For DEXs Hartvigsen also

highlights in his analysis that while the on-chain perpetual

exchange sector is expected to grow significantly, it is unlikely

that it will overtake centralized exchanges in perpetual trading

volume due to CEXs’ larger marketing budgets and ability to onboard

retail more easily. Related Reading: ADA 10% Rally Coincides

With Cardano Foundation’s Annual Report Additionally, regulatory

uncertainty remains a significant headwind for the sector, with

tokens paid as a yield resembling securities to a significant

extent. This could make larger entities from traditional finance

more reluctant to invest in these tokens. Despite these challenges,

Hartvigsen believes that the on-chain perpetual exchange sector has

significant growth potential. The protocols mentioned above are the

ones to watch, but new entrants could also emerge in the future,

attracting significant liquidity. Featured image from

Unsplash, chart from TradingView.com

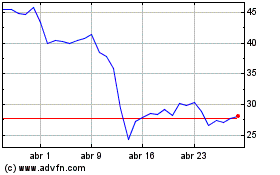

GMX (COIN:GMXUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

GMX (COIN:GMXUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024