Avalanche (AVAX) Ecosystem Poised For An Explosion, Here’s Why

25 Mayo 2023 - 6:30PM

NEWSBTC

The Avalanche (AVAX) ecosystem is gaining increasing attention in

the world of blockchain and decentralized finance (DeFi). Despite

not being as well known as other chains, such as Ethereum or

Binance Smart Chain, Avalanche’s unique consensus mechanism and

interoperability with other chains make it a compelling option for

developers and users alike. With a promising Total Value

Locked (TVL) and strong engagement from users and developers, the

Avalanche ecosystem is on the cusp of significant growth and

innovation. Related Reading: XRP Bears Prevail As Asset Retreats

From Recent Highs Is AVAX The Next Big Thing? According to DeFi

researcher Wacy, the Avalanche ecosystem is on the verge of

blooming, and there are several reasons behind its recent increase

in popularity. While many are focused on the new Layer 2 solutions,

Wacy suggests that the potential of Avalanche should not be

overlooked. One important measure of a chain’s success is Total

Value Locked, and despite the token price dropping over 80%, the

TVL for $AVAX has only decreased by 50%. This indicates continued

interest in the chain and serves as a positive indicator of its

future potential. In addition to TVL, other metrics such as daily

active addresses and daily transactions show good growth,

indicating strong engagement from users. The number of contracts

and deployers is also a powerful indicator of interest in a

project, and this metric also shows strong engagement from

developers. Furthermore, Wacy notes that The Avalanche community is

also growing, with increasing followers on Twitter and a high level

of Twitter mentions over the past 7 days. These basic metrics may

be overlooked by some, but they provide valuable insights into the

potential of the Avalanche ecosystem. Avalanche Emerges As A Hidden

Gem For Developers and Users According to Wacy, as the Avalanche

ecosystem continues to gain attention in the world of blockchain

and decentralized finance, several projects are emerging as

potential main narratives that could see a significant rise during

this heyday. One such project is Trader Joe, which is currently the

number one decentralized exchange (DEX) on Avalanche. By creating

the most capital-efficient DEX in DeFi, Trader Joe is shaping the

future of decentralized finance. The JOE token allows users to earn

a share of the platform’s revenue and unlocks access to exclusive

rewards and features. With a current price of $0.35 and a market

cap of $120M, Trader Joe is listed on Binance, OKX, and Huobi, and

is poised for significant growth in the coming months. Another

project that could see significant growth during the Avalanche

ecosystem’s heyday is GMX. GMX is a decentralized exchange with low

swap fees and zero price impact trades. While it is well known for

its support of Arbitrum, GMX also supports AVAX. With a current

price of $54 and a market cap of $475 million, GMX is listed on

Binance, OKX, Huobi, and KuCoin, and staking GMX earns rewards,

with 30% of swap and leverage trading fees converting to ETH/AVAX

and distributing to GMX tokens. Staking on Arbitrum earns ETH while

staking on Avalanche earns AVAX. Related Reading: Bitcoin Bearish

Signal: NUPL Finds Rejection At Long-Term Resistance Overall, these

projects represent the unique potential of the Avalanche ecosystem.

With its unique consensus mechanism, interoperability with other

chains, and promising metrics, Avalanche is attracting significant

interest from developers and users alike. As more projects like

Trader Joe and GMX emerge, we can expect to see continued growth

and innovation in the ecosystem, with new use cases and

applications for blockchain technology. At present, AVAX is

experiencing a significant drop in value across all time frames.

Its current trading price is $14.09, with a slight increase of 0.1%

over the last 24 hours. However, over the seven, fourteen, and

thirty-day periods, AVAX has experienced a decline of 5%, 6%, and

16% respectively. Featured image from Unsplash, chart from

TradingView.com

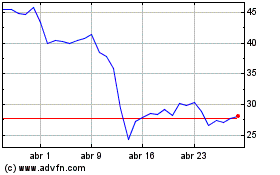

GMX (COIN:GMXUSD)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

GMX (COIN:GMXUSD)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024