Workshop on Amundi's Fixed Income expertise: A comprehensive,

efficient and agile platform for seizing growth opportunities

Workshop on Amundi's Fixed Income

expertise: A comprehensive, efficient and agile

platform for seizing growth opportunities

€1tn+ in Fixed Income assets under management1,

+€24bn in MLT2 inflows over one year to September

Paris, 15 December 2023

Today in London, Group Chief Investment Officer

Vincent Mortier and the Heads of the relevant business lines gave a

presentation on Amundi's Fixed Income platform.

Amundi, the leading European asset manager with

nearly €2tn3 of assets under management, offers a complete range of

investment solutions to its clients, Retail and institutional, in

all asset classes, in both active and passive management. Amundi’s

Fixed Income expertise, covering bonds, money

market, private debt and structured products, accounts

for €1,045bn1 in assets

under management at end-September 2023, making it the

Number 1 European manager in this asset class, and

among the leading managers worldwide.

Amundi boasts one of the most

comprehensive and significant Fixed Income platforms in the

industry. Its experience, agility and diversified product

offering allow it to meet the needs Retail and

institutional clients, and seize opportunities for growth in this

segment, as evidenced by the inflows recorded since the return to

positive rates: +€24bn in MLT assets excl. JVs and CA &

SG insurers’ mandates2 over the

course of one year at end-September.

The majority of inflows were generated in active

bond management, particularly in Target Maturity funds, an area in

which Amundi is the Number 1 globally. The remainder is

attributable to robust growth in passive management and private

debt. In addition to MLT assets, treasury products saw inflows of

nearly +€30bn over the same period.

Amundi's Fixed Income platform is

positioned for continued growth and market share gains in 2024 and

beyond, in a rates environment that will remain higher for

longer.

Vincent Mortier, Chief Investment

Officer, said:

“Amundi is the European leader in asset

management, as well as in Fixed Income management. With over €1

trillion in assets under management and 400 experts in this asset

class, this platform benefits from its size, its teams, its tools,

that allow us to meet the needs of all different client types,

regardless of market context. It offers a wide range of solutions,

with a high level of performance and at a competitive cost thanks

to powerful and effective tools, such as ALTO*4 our portfolio

management system.

The large MLT2 inflows recorded over one year,

at +€24 billion, illustrate the relevance and potential of our

platform, as well as our position in promising segments: active

management - particularly in terms of target maturity funds,

treasury products and structured products - passive management,

where we are expanding our range of fixed income solutions, and

private debt. Furthermore, we are in a position to apply

responsible investment strategies to this asset class to meet the

expectations of investors who, for example, are mindful of meeting

the Paris Climate Agreement objectives. This move is at the heart

of our development strategy. “

The slide deck of this workshop is available at

about.amundi.com, in the « Shareholders » section.

About Amundi

Amundi, the leading European asset manager,

ranking among the top 10 global players5, offers its 100 million

clients - retail, institutional and corporate - a complete range of

savings and investment solutions in active and passive management,

in traditional or real assets. This offering is enhanced with IT

tools and services to cover the entire savings value chain. A

subsidiary of the Crédit Agricole group and listed on the stock

exchange, Amundi currently manages more than €1.95 trillion of

assets6.

With its six international investment hubs7,

financial and extra-financial research capabilities and

long-standing commitment to responsible investment, Amundi is a key

player in the asset management landscape.

Amundi clients benefit from the expertise and

advice of 5,400 employees in 35 countries.

Amundi, a trusted partner, working every

day in the interest of its clients and society.

www.amundi.com

Press contacts:

Natacha

Andermahr Tel. +33 1 76 37 86

05natacha.andermahr@amundi.com

Corentin HenryTel. +33 1 76 36 26

96corentin.henry@amundi.com

Investor contacts:Cyril Meilland,

CFATel. +33 1 76 32 62

67cyril.meilland@amundi.com

Thomas LapeyreTel. +33 1 76 33 70

54thomas.lapeyre@amundi.com

DISCLAIMER:

This document may contain forward-looking

information concerning Amundi's financial situation and results.

The figures provided do not constitute a “forecast” as defined in

Commission Delegated Regulation (EU) 2019/980.

This forward-looking information includes

projections, and financial estimates are based on scenarios that

employ a number of economic assumptions in a given competitive and

regulatory context, evaluations relating to plans, objectives and

expectations in line with future events, transactions, products and

services and assumptions in terms of future performances and

synergies. As such, the forward-looking aspects indicated may not

necessarily come to pass due to unforeseeable circumstances. As a

result, no guarantees can be made with regard to whether or not

these projections or estimates will come to fruition, and Amundi's

financial situation and results may differ significantly from those

projected or implied in the forward-looking information contained

in this document. Amundi is not required, under any circumstances,

to publish amendments or updates to such forward-looking

information provided on the date of this document. More detailed

information on risks that may affect Amundi's financial situation

and results can be reviewed in the “Risk factors” chapter of our

Universal Registration Document filed with the French Autorité des

Marchés Financiers. The reader should take all of these

uncertainties and risks into consideration before forming their own

opinion.

The figures presented were prepared in

accordance with IFRS guidelines as adopted by the European Union

and applicable on this date, and with the securities regulations in

force on this date. This financial information does not constitute

an interim financial statement as defined by standard IAS 34

“Interim financial reporting” and has not been audited.

Unless otherwise mentioned, the sources for

rankings and market positions are internal. The information

contained in this document, to the extent that it relates to

parties other than Amundi or comes from external sources, has not

been verified by a supervisory authority or, more generally, been

subject to independent verification, and no representation or

warranty has been expressed as to, nor should any reliance be

placed on, the fairness, accuracy, correctness or completeness of

the information or opinions contained herein. Neither Amundi nor

its representatives can be held liable for any decision made,

negligence or loss that may result from the use of this document or

its contents, or anything related to them, or any document or

information to which the document may refer.

The sum of the values appearing in the tables

and analyses may differ slightly from the total reported as a

result of rounding.

1

Assets under active

and passive management (ETFs, Index) invested as bonds and money

market assets, including structured products and private debt2

Excluding JVs and

CA&SG insurers; MLT: Medium to Long term, thus excluding

treasury products, 3

Assets under

management: €1,973bn at 30 September, including assets under

advisory, marketed assets and funds of funds, and taking into

account 100% of the assets under management and inflows of Asian

JVs; for Wafa in Morocco, assets under management are included in

their share.4 ALTO:

Amundi Leading Technologies & Operations5

Source: IPE “Top

500 Asset Managers” published in June 2023, based on assets under

management as at 31/12/20226

Amundi data as at

30/09/20237 Boston,

Dublin, London, Milan, Paris and Tokyo

- Amundi PR Fixed income workshop_EN 2023-12-15

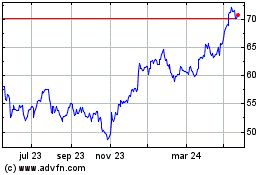

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

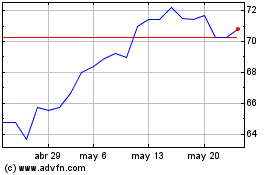

Amundi (EU:AMUN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024