Atos opens a new chapter with the successful closing of its

financial restructuring

Press release

Atos opens a

new chapter with the successful closing of its financial

restructuring

- All transactions of Atos’

accelerated safeguard plan have now been implemented, resulting in:

- A more sustainable capital

structure with €2.1 billion gross debt reduction

- Additional liquidity thanks to €1.6

billion new money debt and c. €145 million resulting from the

rights issue and the additional reserved capital increase

- With no debt maturities before the

end of 2029, Atos now has the resources and flexibility to execute

its mid term strategy

- Atos corporate credit rating

upgraded to B- (stable) by S&P and rated B- (stable) by

Fitch

- Atos’ share capital comprised of

179,035,979,643 shares and 179,035,979,643 theoretical voting

rights1 as a result of the share capital increases

Paris, France

– December 19, 2024 – Following its December 16, 2024

press release, Atos SE (“Atos” or

the “Company”) today announces the successful

closing of its financial restructuring, thanks to the completion of

the final steps of the accelerated safeguard plan (the

“Plan”) approved by the specialized Commercial

Court of Nanterre on October 24, 2024.

The completion of the

Plan results in particular in:

-

a €2.1 billion gross debt reduction through the equitization of

€2.9 billion (principal amount) of existing financial debts and the

repayment of €800 million interim financings with the new money

debt provided to the Company; and

-

€1.6 billion of new money debt and c. €145 million of new money

equity from the rights issue and the additional reserved capital

increase.

With no debt maturing

before the end of 2029, Atos has the resources and flexibility to

implement its mid-term strategy.

Atos Corporate credit

rating has been upgraded to B- (stable) by S&P and rated B-

(stable) by Fitch.

Philippe

Salle, Chairman of the Board of Directors of Atos, said:

“The successful completion of our financial restructuring plan

ensures the continuity of Atos' activities in the best interests of

our stakeholders, including our employees and customers, and opens

an exciting new chapter for the Group. I would like to thank the

entire management team for the remarkable work they have

accomplished over the past few months.”

Jean Pierre

Mustier, Chief Executive Officer of Atos, said: “With

the closing of our financial restructuring, Atos has the financial

resources to successfully deliver a new period of industrial

development under the leadership of Philippe Salle. All our teams

are focused on providing the best possible support to our customers

through innovation and quality of service. »

Reminder on the Accelerated Safeguard

Plan

As a reminder, the operations of Atos’ financial

restructuring provided for under the Plan led in particular to:

- the €233 million

rights issue (the “Rights Issue”) which was

settled and delivered on December 10, 2024 and which resulted in a

cash contribution of c. €143 million (including the €75 million

contributed as part of the first-rank subscription guarantee for

the Rights Issue) and the equitization of claims amounting to c.

€90 million,

- the equitization

of €2.9 billion (principal amount) of existing financial debts (via

three capital increases reserved to creditors which were settled

and delivered on December 18, 2024 (the “Reserved Capital

Increases”) and including the claims converted into equity

under the second-rank subscription guarantee as part of the Rights

Issue),

- the

reinstallation in the form of reinstated debts maturing after 6

years or more of €1.95 billion of existing financial debts,

- a total of €1.75

billion of new money obtained:

- €1.6 billion of

New Preferred Financings (new money debt – including c. €60 million

of bank guarantee and €440 million RCF, of which €190 million

dedicated to meeting the needs for bank guarantees) and

- c. €145 million

of new money equity resulting from the Rights Issue (which resulted

in a cash contribution of c. €143 million mentioned above), as well

as additional voluntary cash subscriptions by the participating

creditors under the additional reserved capital increase which was

settled and delivered on December 18, 2024 (which resulted in c. €2

million of cash contributions), as provided in the Plan,

- the issue of

22,398,648,580 share subscription warrants (bons de

souscription d’actions or BSA) (the

“Warrants”).

These transactions are detailed in the Plan

available on the Company’s website (“Financial Restructuring” tab),

in the prospectus related to the Reserved Capital Increases

approved by the AMF under number 24-515 on December 11, 2024 and in

the prospectus related to the Rights Issue approved by the AMF

under number 24-474 on November 7, 2024 and the supplement to this

prospectus approved by the AMF under number 24-501 on November 25,

2024.

Effective completion of the Reserved

Capital Increases for creditors under the Plan

The settlement and

delivery and the admission to trading on the regulated market of

Euronext Paris (“Euronext Paris”) of the

115,860,932,658 new shares (the “New Shares”)

issued under the three Reserved Capital Increases provided for

under the Plan, described in the press releases published by Atos

on 12 and 16 December 2024, have been completed on December 18,

2024.

As a reminder, the

Reserved Capital Increases have notably resulted in the

equitization of approximately 2.9 billion euros (principal amount)

of Atos’ existing financial debt (and including the debt converted

into equity under the second-rank subscription guarantee as part of

the Rights Issue).

The Reserved Capital

Increases are the last capital increases planned in the Plan

following the €233 million Rights Issue completed on December 10,

2024.

The New Shares are of the same class as the

Company’s existing ordinary shares and are subject to all the

provisions of the Company’s articles of association. They carry all

rights attached and are entitled, as from their issue date, to all

distributions decided by the Company as from that date. They are

immediately assimilated with the existing shares of the Company

already traded on Euronext Paris and are tradable, as from that

date, on the same trading line under the same ISIN code

FR0000051732.

The completion of the Reserved Capital Increases

has been followed by the issue of 22,398,648,580 Warrants,

exercisable for a period of 36 months, giving the right to

subscribe for one new ordinary share per Warrant, allocated free of

charge to certain Participating Creditors (as defined below) in

accordance with the Plan, in consideration for subscription and

guarantee commitments in respect of the new preferred financings

made prior to the judgment opening the accelerated safeguard

proceedings of Atos. No application has been made for the Warrants

to be admitted to trading on a regulated market.

The Restructuring Effective Date (as this term

is defined in the Plan) has therefore occurred on December 18,

2024.

Impact of the Reserved Capital Increases

and the potential exercise of all the Warrants on the Atos’

shareholding structure

As a result of the completion of the Reserved

Capital Increases, the Company’s share capital amounts to

€17,903,597.9643 and is comprised of 179,035,979,643 shares with a

par value of €0.0001 each.

Based on public information available to date,

the allocation of the share capital of the Company following the

Reserved Capital Increases is set out as below:

|

Shareholders |

% of share capital |

% of voting rights |

|

Participating Creditors2 |

74.4% |

74.4% |

|

Non-Participating Creditors |

15.2% |

15.2% |

|

Employees3 |

0.0% |

0.0% |

|

Board of Directors4 |

1.4% |

1.4% |

|

Treasury shares |

0.0% |

0.0% |

|

Free Float |

9.0% |

9.0% |

|

TOTAL |

100% |

100% |

By way of illustration, following the completion

of the Reserved Capital Increases and assuming that all the

Warrants are exercised (it being specified that the Warrants may be

exercised until the end of a period of 36 months following their

settlement-delivery date), the Company’s share capital would amount

to 20,143,462.8223 and would be comprised of 201,434,628,223 shares

with a par value of €0.0001 each.

Based on public information available to date,

the allocation of the share capital of the Company following the

Reserved Capital Increases and assuming the exercise of all the

Warrants would be as follows:

|

Shareholders |

% of share capital |

% of voting rights |

|

Participating Creditors5 |

77.3% |

77.3% |

|

Non-Participating Creditors |

13.5% |

13.5% |

|

Employees3 |

0.0% |

0.0% |

|

Board of Directors4 |

1.2% |

1.2% |

|

Treasury shares |

0.0% |

0.0% |

|

Free Float |

8.0% |

8.0% |

|

TOTAL |

100% |

100% |

Any thresholds crossings (upwards or downwards)

by shareholders of the Company, following the settlement-delivery

of the Reserved Capital Increases and the exercise of the Warrants,

shall, as the case may be, be subject to applicable notifications

(pursuant to regulations or the articles of association) and will

be communicated to the market pursuant to applicable

regulations.

New preferred financings and debt

reinstallation

As provided for under

the Plan, the Company has obtained a total amount of €1.6 billion

of new preferred financings (the “New Preferred

Financings”) from banks and bondholders that had committed

to fund and/or backstop these financings (respectively the

“Participating Banks” and the

“Participating Bondholders”, together the

“Participating Creditors”) consisting of:

- €0.80 billion of new bonds provided

by Participating Bondholders and rated B+ by S&P and BB- by

Fitch; and

- €0.80 billion provided by

Participating Banks including:

- €0.30 billion of new term

loan;

- €0.44 billion of a new revolving

credit facility (RCF) (including €0.19 billion dedicated to meeting

the needs for bank guarantees); and

- €0.06 billion of new bank

guarantees.

In accordance with the

Plan, the New Preferred Financings have been partially allocated to

the repayment of the €800 million interim financings that had been

provided to the Company before the approval of the Plan in order to

provide the necessary liquidity to fund the business until close of

the financial restructuring (the “Interim

Financings”), as previously described by the Company.

The maturity of the

New Preferred Financings is set on December 2029.

In addition, as part

of the implementation of the Plan, €1.95 billion of existing

financial debts have been reinstalled in the form of new secured

debts maturing after 6 years or more, in the following debt

instruments:

- €1.59 billion euros of 1.5L

reinstated debt (subordinated to the New Preferred Financings but

senior to the 2L reinstated debt) allocated to Participating

Creditors and creditors who participated to the Interim Financings,

divided between:

- a 1.5L reinstated term loan

(€0.75bn), and

- 1.5L reinstated notes (€0.84bn,

rated CCC by S&P and CCC+ by Fitch);

And

- €0.36 billion euros of 2L

reinstated debt allocated to non-Participating Creditors, divided

between

- a 2L reinstated term loan

(€0.22bn), and

- 2L reinstated notes (€0.14bn, rated

CCC by S&P and CCC by Fitch).

Implementation of the financial

restructuring plan results in a massive issue of new shares and a

substantial dilution of Atos existing shareholders, that could have

a very unfavorable impact on the market price of the

share

As stated by Atos in its previous communications

and in light of the recent volatility on the Atos stock, it is

reminded that a massive number of new shares has been issued under

the Reserved Capital Increases resulting in a substantial dilution

of the existing shareholders as a result of the equitization of c.

€3 billion of old debt and the potential exercise of the Warrants,

resulting in a c. 90.8% ownership by creditors.

For indicative purposes only, a shareholder

holding 1% of the Company’s share capital6 would see its

stake fall (on a diluted basis), post completion of the Reserved

Capital Increases, to 0.35% of the Company's share capital and to

0.31% post exercise of all the Warrants7.

As some creditors of the Company, who have not

supported or voted in favor of the Plan, have become holders of new

shares, a significant number of shares could be traded after the

completion of the financial restructuring capital increases, or

such trades could be anticipated by the market, which could have an

unfavorable impact on the market price of the share.

Forthcoming events

Atos’ Annual General Meeting of its shareholders

convened to approve the statutory and consolidated financial

statements for the year ending December 31, 2023 will take place on

January 31, 2025.

Atos will issue its full year 2024 results on

March 5, 2025.

*

Atos SE confirms that information that could be

qualified as inside information within the meaning of Regulation

No. 596/2014 of 16 April 2014 on market abuse and that may have

been given on a confidential basis to its financial creditors has

been published to the market, either in the past or in the context

of this press release, with the aim of reestablishing equal access

to information relating to the Atos Group between the

investors.

*

***

Disclaimer

This document contains

forward-looking statements that involve risks and uncertainties,

including references, concerning the Group’s expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Atos’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Atos’s plans, objectives, strategies, goals, future events, future

revenues or synergies, or performance, and other information that

is not historical information. Actual events or results may differ

from those described in this document due to a number of risks and

uncertainties that are described within the 2023 Universal

Registration Document filed with the Autorité des Marchés

Financiers (AMF) on May 24, 2024 under the registration number

D.24-0429, as updated by chapter 2 “Risk factors” of the first

amendment to Atos' 2023 universal registration document and by

chapter 2 “Risk factors” of the second amendment to Atos' 2023

universal registration document, and the half-year report filed

with the Autorité des Marchés Financiers (AMF) on August 6, 2024.

Atos does not undertake, and specifically disclaims, any obligation

or responsibility to update or amend any of the information above

except as otherwise required by law.

This document does not contain or constitute an offer of Atos’s

shares for sale or an invitation or inducement to invest in Atos’s

shares in France, the United States of America or any other

jurisdiction. This document includes information on specific

transactions that shall be considered as projects only. In

particular, any decision relating to the information or projects

mentioned in this document and their terms and conditions will only

be made after the ongoing in-depth analysis considering tax, legal,

operational, finance, HR and all other relevant aspects have been

completed and will be subject to general market conditions and

other customary conditions, including governance bodies and

shareholders’ approval as well as appropriate processes with the

relevant employee representative bodies in accordance with

applicable laws .

About

Atos

Atos is a global

leader in digital transformation with circa 82,000 employees and

annual revenue of circa €10 billion. European number one in

cybersecurity, cloud and high-performance computing, the Group

provides tailored end-to-end solutions for all industries in 69

countries. A pioneer in decarbonization services and products, Atos

is committed to a secure and decarbonized digital for its clients.

Atos is a SE (Societas Europaea) and listed on Euronext

Paris.

The purpose of

Atos is to help design the future of the information space.

Its expertise and services support the development of knowledge,

education and research in a multicultural approach and contribute

to the development of scientific and technological excellence.

Across the world, the Group enables its customers and employees,

and members of societies at large to live, work and develop

sustainably, in a safe and secure information space.

Contacts

Investor

relations:

David Pierre-Kahn | investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33 6 29 34 85 67

Individual

shareholders: 0805 65 00 75

Press contact: globalprteam@atos.net

1 Representing 179,035,902,331

exercisable voting rights (it being specified that number of

exercisable voting rights = number of theoretical voting rights (or

total number of voting rights attached to shares) – shares without

voting rights, such as treasury shares).

2 For indicative purposes only and pending publication of the

declarations of legal thresholds’ crossings, it is anticipated that

on the settlement-delivery date of the Reserved Capital Increases,

(i) the funds managed by D.E. Shaw hold 8.56% of the Company's

share capital and voting rights, (ii) the funds managed by Tresidor

hold 6.24% of the Company's share capital and voting rights and

(iii) the funds managed by ING Bank N.V. (through its French

subsidiary) hold 5.34% of the Company's share capital and voting

rights.

3 Information on employee share ownership is given as at

30 November 2024.

4 Information concerning the

shareholding of the members of the Board of Directors is given on

the basis of the information known to the Company as at 18 December

2024. As a reminder, Mr Philippe Salle, Chairman of the Board of

Directors, participated in Atos’ Rights Issue by subscribing to

2,432,432,432 new shares for a total amount of €9 million, in

accordance with his subscription commitment.

5 For indicative purposes only and pending

publication of the declarations of legal thresholds’ crossings, it

is anticipated that on the settlement-delivery date of the Reserved

Capital Increases and assuming exercise of all the Warrants, (i)

the funds managed by D.E. Shaw hold 9.08% of the Company's share

capital and voting rights, (ii) the funds managed by Tresidor hold

6.35% of the Company's share capital and voting right, (iii) the

funds managed by Deutsche Bank AG holds 5.00% of the Company’s

share capital and voting rights and (iv) the funds managed by ING

Bank N.V. (through its French subsidiary) hold 5.09% of the

Company's share capital and voting rights.

6 i.e. 631,750,469 shares, based on the number of shares

comprising the Company's share capital at December 11, 2024.

7 Calculated on the basis of the number of shares

comprising the Company's share capital on December 11, 2024.

- PR - Atos - Successful closing of the financial restructuring -

19 December 2024

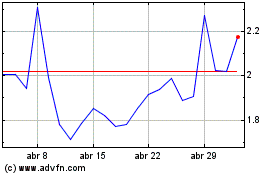

Atos (EU:ATO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Atos (EU:ATO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024