Eurozone Manufacturing Shrinks Further

01 Marzo 2024 - 12:26AM

RTTF2

The euro area manufacturing activity continued to shrink in

February but the pace of contraction was moderate, final data from

the purchasing managers' survey by S&P Global showed

Friday.

The HCOB manufacturing Purchasing Managers' Index, or PMI, fell

slightly to 46.5 from January's 10-month high of 46.6. The score

was above the flash 46.1.

The reading suggested the second-slowest deterioration in

manufacturing conditions since March 2023.

Factory orders declined at the slowest pace since March last

year. Production decreased midway through the first quarter,

although the rate of contraction held steady.

Companies reduced their inventories and operating expenses

continued to fall. Input price inflation was the weakest since

March 2023. Prices charged for Eurozone goods were discounted

further.

Further, prospects regarding future output remained cautiously

optimistic.

The decline in the manufacturing sector was largely driven by

the largest economy of the single currency union, Germany.

Spain returned to growth for the first time in nearly a year,

while softer contractions were seen in Italy and France.

Germany's HCOB manufacturing PMI dropped for the first time in

seven months in February. The index slid to 42.5 from an 11-month

high of 45.5 in January.

Meanwhile, France's HCOB factory PMI rose to 47.1 from 43.1 in

the prior month. The measure hit the highest since March 2023. The

initial score for February was 46.8.

Italy's manufacturing PMI posted 48.7 in February, up from 48.5

in January. The score was well above economists' forecast of

49.1.

Spain returned to growth in February with both output and new

orders staging marginal improvements. The corresponding index

registered 51.5, up from 49.2 a month ago.

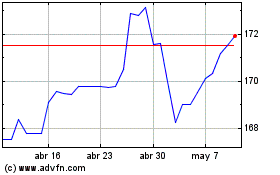

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024