U.S. Dollar Advances As Powell Signals Modest Rate Cuts

30 Septiembre 2024 - 11:06AM

RTTF2

The U.S. dollar rose against its major counterparts in the New

York session on Monday, as Federal Reserve Chair Jerome Powell

suggested that the central bank will continue to lower interest

rates, but the pace of reduction is unclear.

Speaking at the National Association for Business Economics,

Powell said the decision to slash rates by half a percentage point

earlier this month reflects the Fed's growing confidence that an

appropriate recalibration of monetary policy will maintain strength

in the labor market and keep inflation moving sustainably down to

the 2 percent target.

"Looking forward, if the economy evolves broadly as expected,

policy will move over time toward a more neutral stance," Powell

said.

"But we are not on any preset course," he continued. "The risks

are two-sided, and we will continue to make our decisions meeting

by meeting."

Powell said Fed officials have "greater confidence" that

inflation is on a sustainable path to 2 percent and predicted there

would not need to be further cooling in labor market conditions to

achieve their objective.

"As we consider additional policy adjustments, we will carefully

assess incoming data, the evolving outlook, and the balance of

risks," Powell said. "Overall, the economy is in solid shape; we

intend to use our tools to keep it there."

The greenback recovered to 0.6898 against the aussie and 0.6337

against the kiwi, from an early 1-1/2-year low of 0.6942 and more

than a 1-year low of 0.6379, respectively. The currency is seen

finding resistance around 0.64 against the aussie and 0.60 against

the kiwi.

The greenback climbed to 6-day highs of 1.3538 against the

loonie and 1.1113 against the euro, from an early low of 1.3489 and

a 5-day low of 1.1208, respectively. The currency is likely to

locate resistance around 1.38 against the loonie and 1.09 against

the euro.

The greenback advanced to 0.8473 against the franc and 143.90

against the yen, from an early low of 0.8403 and near a 2-week low

of 141.64, respectively. The currency is poised to challenge

resistance around 0.90 against the franc and 147.00 against the

yen.

The greenback touched 1.3346 against the pound, setting a 4-day

high. Immediate resistance for the currency is seen around the 1.31

level.

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Oct 2024 a Nov 2024

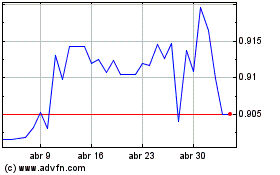

US Dollar vs CHF (FX:USDCHF)

Gráfica de Divisa

De Nov 2023 a Nov 2024