TIDMCEY

RNS Number : 6549B

Centamin Egypt Limited

30 October 2009

Rule 5.3

Appendix 5B

Mining exploration entity quarterly report

Introduced 1/7/96. Origin : Appendix 8. Amended 1/7/98, 30/9/2001.

Name of Entity

+----------------------------------------------------------------------------------+

| Centamin Egypt Limited |

+----------------------------------------------------------------------------------+

ABN Quarter ended ("current quarter")

+--------------------------------+-----------------+--------------------------------+

| 86 007 700 352 | | 30 September 2009 |

+--------------------------------+-----------------+--------------------------------+

Consolidated statement of cash flows

Centamin Egypt Limited

Pharaoh Gold Mines NL (100%)

Viking Resources Ltd (100%)

North African Resources (100%)

Centamin Limited (100%)

+----------------------------------------------------+---------------+---------------+

| Cash flows related to operating activities | Current | Year to date |

| | Quarter | (3 months) |

| | $US'000 | $US'000 |

+----------------------------------------------------+---------------+---------------+

| 1.1 Receipts from product sales and related | - | - |

| debtors | | |

+----------------------------------------------------+---------------+---------------+

| 1.2 Payments for (a) exploration and evaluation | (2,894) | (2,894) |

+----------------------------------------------------+---------------+---------------+

| (b) development | (38,665) | (38,665) |

+----------------------------------------------------+---------------+---------------+

| (c) production | - | - |

+----------------------------------------------------+---------------+---------------+

| (d) administration | (1,094) | (1,094) |

+----------------------------------------------------+---------------+---------------+

| 1.3 Dividends received | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.4 Interest and other items of a similar nature | 302 | 302 |

| received | | |

+----------------------------------------------------+---------------+---------------+

| 1.5 Interest and other costs of finance paid | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.6 Income taxes paid | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.7 Other (provide details if material) | - | - |

+----------------------------------------------------+---------------+---------------+

| Net Operating Cash Flows | (42,351) | (42,351) |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| Cash flows related to investing activities | | |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 1.8 Payment for purchases of (a) prospects | - | - |

+----------------------------------------------------+---------------+---------------+

| (b) equity investments | - | - |

+----------------------------------------------------+---------------+---------------+

| (c) other fixed assets | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.9 Proceeds from sale of (a) prospects | - | - |

+----------------------------------------------------+---------------+---------------+

| (b) equity investments | - | - |

+----------------------------------------------------+---------------+---------------+

| (c) other fixed assets | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.10 Loans to other entities | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.11 Loans repaid by other entities | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.12 Other (provide details if material) | - | - |

+----------------------------------------------------+---------------+---------------+

| Net investing cash flows | - | - |

+----------------------------------------------------+---------------+---------------+

| 1.13 Total operating and investing cash flows | (42,351) | (42,351) |

| (carried forward) | | |

+----------------------------------------------------+---------------+---------------+

+----------------------------------------------------+---------------+---------------+

| 1.13 Total operating and investment cash flows | (42,351) | (42,351) |

| (brought forward) | | |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| Cash flows related to financing activities | | |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 1.14 Proceeds from issues of shares, options, etc. | 30,897 | 30,897 |

+----------------------------------------------------+---------------+---------------+

| 1.15 Proceeds from sale of forfeited shares | | |

+----------------------------------------------------+---------------+---------------+

| 1.16 Proceeds from borrowings | | |

+----------------------------------------------------+---------------+---------------+

| 1.17 Repayment of borrowings | | |

+----------------------------------------------------+---------------+---------------+

| 1.18 Dividends paid | | |

+----------------------------------------------------+---------------+---------------+

| 1.19 Other (bank and realised foreign exchange | (1,228) | (1,228) |

| charges) | | |

+----------------------------------------------------+---------------+---------------+

| Net financing cash flows | 29,669 | 29,669 |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| Net increase (decrease) in cash held | (12,682) | (12,682) |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 1.20 Cash at beginning of quarter/year to date | 68,609 | 68,609 |

+----------------------------------------------------+---------------+---------------+

| 1.21 Exchange rate adjustments to item 1.20 | 3,114 | 3,114 |

+----------------------------------------------------+---------------+---------------+

| 1.22 Cash at end of quarter | 59,041 | 59,041 |

+----------------------------------------------------+---------------+---------------+

+--------------------------------------------------------------------+---------------+

| Payments to directors of the entity and associates of the | Current |

| directors | quarter |

| Payments to related entities of the entity and associates of the | $US'000 |

| related entities | |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 1.23 Aggregate amount of payments to the parties included in item | 289 |

| 1.2 | |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 1.24 Aggregate amount of loans to the parties included in item | - |

| 1.10 | |

+--------------------------------------------------------------------+---------------+

1.25 Explanation necessary for an understanding of the transactions

+------------------------------------------------------------------------------+

| * |

| Salaries, superannuation contributions, consulting and Directors fees paid |

| to Directors during the three months ended 30 September 2009 amounted to |

| A$294,249 (30 September 2008: A$340,256). |

| * |

| Mr S El-Raghy and Mr J El-Raghy are Directors and shareholders of El-Raghy |

| Kriewaldt Pty Ltd ("ELK"), which provides office premises to the Company in |

| Australia. All dealings with ELK are in the ordinary course of business and |

| on normal terms and conditions. Rent paid to ELK during the three months |

| ended 30 September 2009 amounted to A$16,377 (30 September 2008: A$15,601). |

| * |

| Mr S El-Raghy provides office premises to the Company in Alexandria, Egypt. |

| All dealings are in the ordinary course of business and on normal terms and |

| conditions. Rent paid during the three months ended 30 September 2009 |

| amounted to GBP 1,950 (30 September 2008: GBP 1,950). |

| - Mr C Cowden, a non-executive director, is also a director and |

| shareholder of Cowden Limited, which |

| provides insurance broking services to the Company. All dealings with |

| Cowden Limited are on normal |

| terms and conditions. Cowden Limited was paid A$11,640 during the three |

| months ended 30 September 2009 (30 September 2008: A$8,706). In addition, |

| amounts of A$76,462 |

| (30 September 2008: A$61,103) were paid to Cowden Limited to be passed on |

| to underwriters for premiums during the three months ended 30 September |

| 2009. |

| |

+------------------------------------------------------------------------------+

Non-cash financing and investing activities

2.1 Details of financing and investing transactions which have had a material

effect on consolidated assets and liabilities but did not involve cash flows

+------------------------------------------------------------------------------+

| - |

| |

+------------------------------------------------------------------------------+

2.2 Details of outlays made by other entities to establish or increase their

share in projects in which the reporting entity has an interest

+------------------------------------------------------------------------------+

| - |

| |

+------------------------------------------------------------------------------+

Financing facilities available

Add notes as necessary fro an understanding of the position.

+----------------------------------------------------+---------------+---------------+

| | Amount | Amount used |

| | available | $US'000 |

| | $US'000 | |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 3.1 Loan facilities | - | - |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 3.2 Credit standby arrangements | - | - |

+----------------------------------------------------+---------------+---------------+

Estimated cash outflows for next quarter

+--------------------------------------------------------------------+---------------+

| | $US'000 |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 4.1 Exploration and evaluation | 2,500 |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 4.2 Development | 30,000 |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 4.3 Production | 10,000 |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| 4.4 Administration | 1,500 |

+--------------------------------------------------------------------+---------------+

| | |

+--------------------------------------------------------------------+---------------+

| Total | 44,000 |

+--------------------------------------------------------------------+---------------+

Reconciliation of Cash

+----------------------------------------------------+---------------+---------------+

| Reconciliation of cash at the end of the quarter | Current | Previous |

| (as shown in the consolidated statement of cash | quarter | quarter |

| flows) to the related items in the accounts is as | $US'000 | $US'000 |

| follows. | | |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 5.1 Cash on hand and at bank | 815 | 976 |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 5.2 Deposits at call | - | - |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 5.3 Bank overdraft | - | - |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| 5.4 Term deposits | 58,226 | 67,633 |

+----------------------------------------------------+---------------+---------------+

| | | |

+----------------------------------------------------+---------------+---------------+

| Total: cash at end of quarter (item 1.22) | 59,041 | 68,609 |

+----------------------------------------------------+---------------+---------------+

Changes in interests in mining tenements

+----------------------------+--------------+--------------+--------------+--------------+

| | Tenement | Nature of | Interest at | Interest at |

| | reference | interest |beginning of | end of |

| | | (note (2)) | quarter | quarter |

+----------------------------+--------------+--------------+--------------+--------------+

| 6.1 Interest in mining | | | | |

| tenements relinquished, | | | | |

| reduced or lapsed | | | | |

+----------------------------+--------------+--------------+--------------+--------------+

| 6.2 Interests in mining | | | | |

| tenements acquired or | | | | |

| increased | | | | |

+----------------------------+--------------+--------------+--------------+--------------+

Issued and quoted securities at end of current quarter

Description includes rate of interest and any redemption or conversion rights

together with prices and dates.

+----------------------------+---------------+---------------+--------------+--------------+

| | Total number | Number | Issue price | Amount paid |

| | | quoted |per security | up per |

| | | |(see note 3) | security |

| | | | |(see note 3) |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.1 Preference | | | | |

| +securities | | | | |

| (description) | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.2 Changes during quarter | | | | |

| (a) increases through | | | | |

| issues | | | | |

| (b) decreases through | | | | |

| returns | | | | |

| of capital, buy-backs, | | | | |

| redemptions | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.3 +Ordinary securities |1,015,239,903 |1,015,239,903 | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.4 Changes during quarter | 19,000,000 | 19,000,000 | (see 7.9 | (see 7.9 |

| (a) increases through | 1,970,000 | 1,970,000 | below) | below) |

| issues/ | 2,329,280 | 2,329,280 | (see 7.9 | (see 7.9 |

| Options exercise/ | | | below) | below) |

| Broker warrants exercise | | | | |

| (b) decreases through | | | | |

| returns | | | | |

| of capital, buy-backs | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.5 +Convertible debt | | | | |

| securities | | | | |

| (description) | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.6 Changes during quarter | | | | |

| (a) increases through | | | | |

| issues | | | | |

| (b) decreases through | | | | |

| securities matured, | | | | |

| converted | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.7 Options | Employee | Nil | Exercise | Expiry Date |

| (description and | Option Plan | Nil | Price | 31 Jan 10 |

| conversion | 2006 | Nil | A$0.7106 | 24 May 10 |

| factor) | 90,000 | Nil | A$1.0500 | 15 Oct 10 |

| | 890,000 | Nil | A$1.4034 | 16 Apr 11 |

| | 250,000 | Nil | A$1.7022 | 25 Aug 11 |

| | 3,500,000 | Nil | A$1.1999 | 28 Oct 11 |

| | 250,000 | Nil | A$0.7033 | 19 Dec 11 |

| | 750,000 | Nil | A$1.0000 | 31 Oct 10 |

| | 1,000,000 | Nil | A$0.3500 | 31 Dec 12 |

| | Other | Nil | A$1.2000 | 23 Nov 09 |

| | Unquoted | Nil | C$1.2000 | 10 Feb 11 |

| | Options | Nil | C$0.6500 | 16 Jul 11 |

| | 850,000 | | C$1.5600 | 26 Aug 11 |

| | 1,630,150 | | C$1.5200 | |

| | Broker | | | |

| | Warrants | | | |

| | 2,441,440 | | | |

| | 4,636,990 | | | |

| | 788,437 | | | |

| | 161,563 | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.8 Issued during quarter | Unquoted | Nil | Exercise | Expiry Date |

| | Options | Nil | Price | 06 Aug 12 |

| | 350,000 | Nil | A$18658 | 16 Jul 11 |

| | Broker | | C$1.5600 | 26 Aug 11 |

| | Warrants | | C$1.5200 | |

| | 788,437 | | | |

| | 161,563 | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.9 Exercised during | Employee | 600,000 | Exercise | Expiry Date |

| quarter | Option Plan | 1,170,000 | Price | 31 Jan 10 |

| | 2006 | 200,000 | A$0.7106 | 24 May 10 |

| | 600,000 | 2,329,280 | A$1.0500 | 31 Oct 10 |

| | 1,170,000 | | A$0.3500 | 23 Nov 09 |

| | 200,000 | | C$1.20 | |

| | Broker | | | |

| | Warrants | | | |

| | 2,329,280 | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.10 Expired/lapsed during | Employee | Nil | A$0.6750 | 28 Nov 11 |

| quarter | Option Plan | | | |

| | 2006 | | | |

| | 125,000 | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.11 Debentures (totals | | | | |

| only) | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

| 7.12 Unsecured | | | | |

| notes(totals only) | | | | |

+----------------------------+---------------+---------------+--------------+--------------+

Compliance statement

1. This statement has been prepared under accounting policies which comply

with accounting standards as defined in the Corporations Act or other standards

acceptable to ASX (see note 4).

2. This statement does give a true and fair view of the matters disclosed.

Sign here:

Print name:Heidi Brown, Company Secretary Date: 30 October 2009

Notes

1. The quarterly report provides a basis for informing the market how the

entity's activities have been financed for the past quarter and the effect on

its cash position. An entity wanting to disclose additional information is

encouraged to do so, in a note or notes attached to this report.

2. The "Nature of interest" (items 6.1 and 6.2) includes options in respect

of interests in mining tenements acquired, exercised or lapsed during the

reporting period. If the entity is involved in a joint venture agreement and

there are conditions precedent which will change its percentage interest in a

mining tenement, it should disclose the change of percentage interest and

conditions precedent in the list required for items 6.1 and 6.2.

3.Issued and quoted securities: The issue price and amount paid up is not

required in items 7.1 and 7.3 for fully paid securities.

4. The definitions in, and provisions of, AASB 1022: Accounting for

Extractive Industries and AASB 1026: Statement of Cash Flows apply to this

report.

5.Accounting Standards ASX will accept, for example, the use of International

Accounting Standards for foreign entities. If the standards used do not address

a topic, the Australian standard on that topic (if any) must be complied with.

== == == == ==

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAPEEDSKNFEE

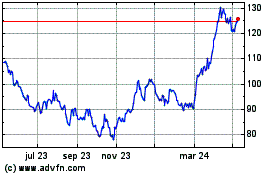

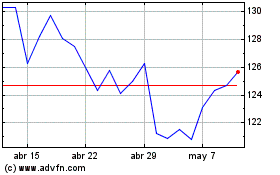

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024