TIDMDPP

RNS Number : 7042G

DP Poland PLC

21 July 2023

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

DP Poland PLC

("DP Poland", the "Company" or the "Group")

Q2 & H1 2023 Trading Update

DP Poland, the operator of pizza stores and restaurants across

Poland and Croatia, announces a trading update for first half of

2023.

DP Poland's Chief Executive Officer, Nils Gornall, said:

"I'm delighted to announce record sales in the first half of

2023. Like-for-like sales in Poland increased 18% compared with the

prior year, supported by order count growth of 11.3%.

We have continued to execute on our strategy of building a High

Volume Mentality business, delivering a compelling value

proposition for our customers based on fantastic quality pizza

delivered quickly. These efforts have resulted in an improvement in

customer satisfaction ratings and increased consumer loyalty which

place the business in a strong position to capitalise on the strong

potential we see in both Poland and Croatia.

At the same time we improved our footprint by the opening of one

store and full refurbishment of four stores in Poland as well as

opening our fourth store in Croatia. We expect to open another two

stores in Poland and one in Croatia by the end of this year.

High inflation in energy and food have eventually started to

abate in May, and whilst labour rates are still under inflationary

pressures we are constantly focusing on further optimization

projects. We expect performance to continue improving and remain

optimistic about the outlook for the Group."

Highlights

-- LFL System Sales(1) in Poland increased by 16.8% in Q2 2023

compared to Q2 2022, driven by a strong increase in order

counts

-- Inflationary pressures in food and energy have begun to

recede, though remain in labour markets

-- Two store openings (in each of Poland and Croatia) in H1 2023 and three planned for H2

-- Four store refurbishments completed in H1 2023

-- Investment in an updated scooter fleet and IT system enhancements

-- Cash at bank of GBP2.5 million as at 30(th) June 2023 (31(st) December 2022: GBP4.1 million)

Trading Update H1 2023

Poland

Q1 2023 Q2 2023 H1 2023

--------------- ----------------

PLNm % YoY PLNm % YoY PLNm % YoY

change change change

----------------------- ----- -------- ----- -------- ------ --------

Total System sales(1) 53.1 15.4% 55.0 14.4% 108.1 14.9%

LFL System sales(2) 52.2 19.4% 53.7 16.8% 105.8 18.0%

non-delivery 16.9 47.7% 18.8 6.3% 35.7 22.6%

delivery 35.3 9.3% 34.8 23.3% 70.1 15.8%

----------------------- ----- -------- ----- -------- ------ --------

H1 2023

Million % YoY

Units change

------------------------ -------- --------

Total System orders(1) 1.85 7.7%

LFL System orders(2) 1.81 11.3%

------------------------ -------- --------

(1) System Sales and System orders - total retail sales or

orders including sales or orders from corporate and sub-franchised

stores, unaudited

(2) Like-for-like System Sales growth in Polish Z oty, matching

trading periods for the same stores

Current trading remains strong, with double digit sales growth

underpinned by higher order counts. System Sales increased by 14.9%

in H1 2023 vs. H1 2022, with the growth split between sales

channels. LFL Sales in H1 2023 were up by 18.0% vs 2022.

Inflationary costs have begun to diminish in food and energy,

however, labour inflationary pressures have remained.

In the first half of 2023, one new store was opened in the

Polish market and a contract signed for an additional store opening

to take place in Q3. A third store opening is planned for Q4 2023.

At the same time, four ex-Dominium stores have been fully upgraded

to Domino's standards and two stores were closed as part of the

store network optimisation plan with a future relocation

planned.

Croatia

Q1 2023 Q2 2023 H1 2023

--------------- ---------------

EURm % YoY EURm % YoY EURm % YoY

change change change

-------------------- ----- -------- ----- -------- ----- --------

Total System sales 0.49 52.9% 0.55 37.7% 1.04 44.5%

LFL System sales 0.37 15.7% 0.40 5.5% 0.78 10.2%

-------------------- ----- -------- ----- -------- ----- --------

(1) System Sales - total retail sales including sales from

corporate and sub-franchised stores. unaudited

(2) Like-for-like System Sales growth in Euro, matching trading

periods for the same stores between 1 January and 30 June 2022 and

1 January and 30 June 2023

(3) Difference between Total System Sales growth and LFL system

sales growth driven by 3(rd) store opening in June 2022

The transition of the Croatian currency from the Kuna to the

Euro at the beginning of 2023 contributed to weaker sales in

January, whilst also being impacted by inflation. However, since

February, Croatia has seen strong double digit LFL Sales growth,

excluding a temporary drop in June resulting from two long public

holiday weekends.

H1 2023 System Sales increased by 44.5% vs. H1 2022, benefitting

from the third store opening in June 2022. LFL Sales also increased

strongly, up 10.2% against the prior period.

At the start of 2023, the Croatian business began utilising the

benefits of group purchasing, which should meaningfully reduce

direct costs.

A fourth store opened in Croatia at the end of June and has

reported strong sales since launch. A fifth store is planned to be

opened at the end of Q3.

The person responsible for arranging the release of this

announcement on behalf of the Company is Nils Gornall, CEO.

Enquiries:

DP Poland plc

Nils Gornall , CEO

Tel: +44 (0) 20 3393 6954

Email: ir@dppoland.com

Singer Capital Markets (Nominated Adviser and Broker)

Shaun Dobson / Jen Boorer

Tel: +44 (0) 20 7496 3000

Notes for editors

About DP Poland plc

DP Poland has the exclusive right to develop, operate and

sub-franchise Domino's Pizza stores in Poland and Croatia. The

group operates 117 stores and restaurants throughout cities and

towns in Poland and Croatia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZGZNDGGGFZM

(END) Dow Jones Newswires

July 21, 2023 02:00 ET (06:00 GMT)

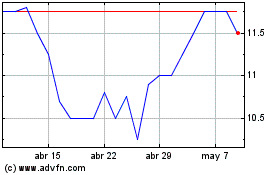

Dp Poland (LSE:DPP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Dp Poland (LSE:DPP)

Gráfica de Acción Histórica

De May 2023 a May 2024