ICG : Q3 Trading Statement for nine months ended 31 December 2023

25 Enero 2024 - 1:00AM

UK Regulatory

ICG : Q3 Trading Statement for nine months ended 31 December 2023

| |

|

|

| |

Fee-earning AUM up 6.5% in the quarter |

|

| |

Highlights

- Total AUM of

$86.3bn; fee-earning AUM of $68.4bn; AUM not yet earning fees of

$15.2bn

- Fee-earning AUM

+6.5% in the quarter on a reported basis, +3.4% on a constant

currency basis; 20.6%1 annualised growth over the last

five years

- Fundraising of

$3.6bn2 during the quarter, driven by two flagship

strategies: Senior Debt Partners ($1.8bn) and Strategic Equity

($0.8bn). Scaling strategies raised a total of $0.9bn. Momentum

continuing into final quarter of financial year

- Achieved

fundraising ambition ahead of target; $41bn raised since 1 April

2021

- Deployment of

$2.9bn during the quarter, particularly strong activity within

Senior Debt Partners ($1.9bn). Actionability of pipeline is

increasing across a number of strategies

- Well capitalised

and valuable balance sheet: investment portfolio of £3.1bn; total

available liquidity of £1.1bn; net financial debt of £954m. ICG's

credit rating upgraded to positive outlook by S&P during the

period

- ICG joined the

FTSE 100 index effective 18th December 2023

- Shareholder

seminar on 21 February at 2pm GMT: "Deep dive on scaling-out".

Register here

Unless otherwise stated the financial results discussed herein are

on the basis of alternative performance measures (APM) basis unless

otherwise stated; see full year results

1 Constant currency basis; 2 Includes $0.2bn of leverage

attributable to equity that was raised in previous periods |

|

PERFORMANCE REVIEW

| |

AUM |

|

|

|

|

| |

|

|

Growth1 |

| |

|

31 December 2023 |

Last three months |

Year-on-year |

Last five years (CAGR) |

| |

Total AUM |

$86.3bn |

3.4% |

13.0% |

20.6% |

| |

Fee-earning AUM |

$68.4bn |

3.4% |

10.0% |

20.6% |

| |

|

|

|

|

|

| |

1 On a constant currency basis |

|

|

|

|

| |

Business

activity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

$bn

|

Fundraising1 |

|

Deployment2 |

|

Realisations2,3 |

| |

Q3 FY24 |

LTM |

|

Q3 FY24 |

LTM |

|

Q3 FY24 |

LTM |

| |

Structured and Private Equity |

1.1 |

4.0 |

|

0.5 |

1.2 |

|

0.3 |

1.6 |

| |

Private Debt |

1.9 |

4.1 |

|

1.9 |

4.4 |

|

0.3 |

1.3 |

| |

Real Assets |

0.4 |

1.0 |

|

0.5 |

2.0 |

|

0.1 |

0.7 |

| |

Credit |

0.2 |

1.2 |

|

— |

— |

|

— |

— |

| |

Total |

3.6 |

10.3 |

|

2.9 |

7.6 |

|

0.7 |

3.6 |

| |

|

|

|

|

|

|

|

|

|

| |

1 Includes $0.2bn of leverage attributable to equity that was

raised in previous periods; 2 Direct investment funds; 3

Realisations of third-party fee-earning AUM |

PERIOD IN REVIEW

AUM

- Total AUM:

$86.3bn, of which the balance investment portfolio accounted for

3.9%

- Dry powder:

$24.5bn

- AUM not yet

earning fees: $15.2bn

- Current

fundraising: at 31 December 2023, funds that were actively

fundraising included SDP V and SDP SMAs; Strategic Equity V; North

America Credit Partners III; Europe Mid-Market II; Infrastructure

II; LP Secondaries I; Life Sciences I; and various Real Estate and

Credit strategies

|

Third-party AUM ($m) |

Structured and Private Equity |

Private Debt |

Real Assets |

Credit |

Total |

|

At 30 September 2023 |

28,796 |

24,230 |

7,973 |

16,768 |

77,767 |

|

Additions |

1,330 |

2,153 |

371 |

175 |

4,029 |

| Realisations |

(339) |

(121) |

(111) |

(743) |

(1,314) |

| Net additions /

(realisations) |

991 |

2,032 |

260 |

(568) |

2,715 |

| FX and

other |

896 |

751 |

298 |

460 |

2,405 |

|

At 31 December 2023 |

30,683 |

27,013 |

8,531 |

16,660 |

82,887 |

|

Change $m |

1,887 |

2,783 |

558 |

(108) |

5,120 |

| Change % |

6.6% |

11.5% |

7.0% |

(0.6%) |

6.6% |

| Change

% (constant exchange rate) |

3.7% |

8.0% |

2.6% |

(3.1%) |

3.5% |

|

Fee-earning AUM ($m) |

Structured and Private Equity |

Private Debt |

Real Assets |

Credit |

Total |

|

At 30 September 2023 |

25,331 |

14,651 |

7,163 |

17,059 |

64,204 |

|

Funds raised: fees on committed capital |

1,076 |

— |

176 |

— |

1,252 |

|

Deployment of funds: fees on invested capital |

447 |

1,878 |

196 |

185 |

2,706 |

| Total additions |

1,523 |

1,878 |

372 |

185 |

3,958 |

| Realisations |

(339) |

(298) |

(73) |

(832) |

(1,542) |

| Net additions /

(realisations) |

1,184 |

1,580 |

299 |

(647) |

2,416 |

| FX and

other |

684 |

431 |

170 |

470 |

1,755 |

|

At 31 December 2023 |

27,199 |

16,662 |

7,632 |

16,882 |

68,375 |

|

Change $m |

1,868 |

2,011 |

469 |

(177) |

4,171 |

| Change % |

7.4% |

13.7% |

6.5% |

(1.0%) |

6.5% |

| Change

% (constant exchange rate) |

4.4% |

10.2% |

2.2% |

(3.5%) |

3.4% |

Balance sheet

- At 31 December 2023

the balance sheet investment portfolio was valued at £3,079m. The

increase was driven by a combination of net deployment within seed

investments and positive net investment returns during the quarter,

partially offset by the strengthening of GBP against USD

|

£m |

30 September 2023 |

31 December 2023 |

|

Structured and Private Equity |

1,766 |

1,802 |

|

Private Debt |

170 |

168 |

|

Real Assets |

333 |

381 |

|

Credit |

377 |

312 |

|

Seed investments |

375 |

416 |

|

Balance sheet investment portfolio |

3,021 |

3,079 |

- At 31 December 2023 the Group had total

available liquidity of £1,053m (FY23: £1,100m), comprised of £503m

cash (FY23: £550m) and a £550 committed liquidity facility

Other

- Debt ratings:

ICG's corporate debt was upgraded to positive outlook by S&P

(from stable) during the period. At 31 December 2023 ICG was rated

BBB (positive) by S&P and BBB (stable) by Fitch

- ESG ratings: ICG retained its Industry

Leader ‘AAA’ ESG rating by MSCI and its membership of the Dow Jones

Sustainability Europe Index

FOREIGN EXCHANGE RATES

| |

Average rate |

Period end |

|

|

Q3 FY23 |

Q3 FY24 |

30 September 2023 |

31 December 2023 |

|

GBP:EUR |

1.1496 |

1.1539 |

1.1541 |

1.1536 |

| GBP:USD |

1.1870 |

1.2503 |

1.2200 |

1.2731 |

|

EUR:USD |

1.0329 |

1.0835 |

1.0571 |

1.1036 |

COMPANY TIMETABLE

| Shareholder seminar: "Deep

dive on scaling-out" |

21 February 2024, 2pm GMT |

| Full year results

announcement |

28 May 2024 |

ENQUIRIES

| Shareholders and debtholders /

analysts: |

|

| Chris Hunt, Head of Corporate

Development and Shareholder Relations, ICG |

+44(0)20 3545 2020 |

| Media: |

|

| Fiona Laffan, Global Head of

Corporate Affairs, ICG |

+44(0)20 3545 1510 |

This results statement may contain forward

looking statements. These statements have been made by the

Directors in good faith based on the information available to them

up to the time of their approval of this report and should be

treated with caution due to the inherent uncertainties, including

both economic and business risk factors, underlying such forward

looking information.

ABOUT ICG

ICG provides flexible capital solutions to help

companies develop and grow. We are a global alternative asset

manager with over 30 years' history, operating across four asset

classes: Structured and Private Equity, Private Debt, Real Assets,

and Credit.

We develop long-term relationships with our

business partners to deliver value for shareholders, clients and

employees. We are committed to being a net zero asset manager

across our operations and relevant investments by 2040.

ICG is listed on the London Stock Exchange

(ticker symbol: ICP). Further details are available at

www.icgam.com.

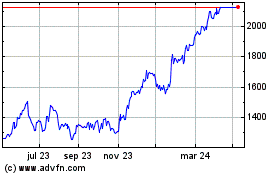

Intermediate Capital (LSE:ICP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Intermediate Capital (LSE:ICP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024