TIDMIME

RNS Number : 8213I

Immedia Group PLC

21 April 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT, THIS

INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

21 April 2022

Immedia Group Plc

("Immedia" or "the Company" or "the Group")

(to be renamed Immediate Acquisition Plc)

Disposal of Immedia Broadcast Limited

Change of Name and Notice of General Meeting

Introduction

Immedia announces the Disposal of its wholly owned subsidiary,

Immedia Broadcast Limited, which is subject, inter alia, to

Shareholders' approval at a General Meeting which is to be held at

10.00 a.m. on 9 May 2022 at the offices of Charles Russell

Speechlys LLP, 5 Fleet Place, London EC4M 7RD. In addition, the

Company is proposing to change its name to Immediate Acquisition

Plc with effect from Completion of the Disposal.

The Disposal will represent a fundamental change of business, as

well as a related party transaction, under the AIM Rules for

Companies following completion of which, the Company will become an

AIM Rule 15 cash shell.

The purpose of the Circular is to provide you with details of

the Proposals, to explain the background to and the reasons for the

Proposals and why the Independent Directors (in respect of the

Disposal) recommend that Shareholders vote in favour of Resolutions

1 and 2 and all Directors recommend that Shareholders vote in

favour of Resolution 3, all to be proposed at the General

Meeting.

The Circular, and notice of the General Meeting are available on

the Company's website: http://www.immediaplc.com/

Definitions

Definitions in this announcement have the same meaning as in the

Circular to Shareholders dated 21 April 2022.

For further information please contact:

Immedia Group Plc Tel: +44 (0) 1635 556200

Tim Hipperson, Non-executive Chairman

Ross Penney, Chief Executive

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Buchanan Communications Tel: +44 (0) 207 466 5000

Chris Lane

Background to and reasons for the Disposal

As announced previously, in the Directors' opinion, the Company

has experienced a challenging trading environment in the last few

years, due primarily to both Brexit and the impact of Covid-19. The

Company's core retail sector business, operated through Immedia

Broadcast Limited, has been challenged beyond expectations and,

although the Company sought to scale-up Immedia Broadcast's

operations via acquisition, prevailing circumstances made

undertaking such a transaction difficult.

For some time, the Directors have believed that Immedia

Broadcast Limited would trade more efficiently as a private

company, due in part to being able to save the significant costs of

being a quoted company, and to this end have been exploring

divestment options for the business. Whilst the Board received some

indications of interest from third parties, such indications were

not sufficiently certain or compelling and therefore the

Independent Directors have agreed to undertake the disposal to

Immedia Broadcast's management team.

Current Trading

As previously announced in the Trading Update on 21 December

2021, Immedia Broadcast Limited experienced a significantly

improved outlook for H2 2021, with September and October 2021 being

two of the best trading months in the Group's history, helped

hugely by the creative content and AV installation work done for

participants at COP26 in Glasgow.

Whilst the upturn in trade was significant and trading in Q1

2022 has been promising, the operations remain too small to readily

absorb the costs of being a PLC and generate a return for

investors. Accordingly, the Independent Directors believe that,

despite the UK's apparent recovery from the pandemic, there remains

significant uncertainties in the economy and the growth of the

Group would continue to be limited in the foreseeable future.

Details of the Disposal

The Company is proposing to dispose of its main trading

subsidiary, Immedia Broadcast Limited. Therefore, the Company has

entered into a conditional sale and purchase agreement with AVC

Immedia Limited, a company owned by Ross Penney, John Trevorrow,

Keith Robertson, Euan McMorrow and Mark Horrocks in relation to the

Disposal (the "Disposal Agreement").

Under the terms of the Disposal Agreement, AVC Immedia Limited

will acquire the entire issued capital of Immedia Broadcast Limited

for a total consideration of GBP2.0 million, of which GBP1.718

million will be paid on completion of the Disposal with the balance

of GBP282,000 payable in 12 equal monthly instalments, beginning

one month after Completion.

The Disposal will represent a fundamental change of business for

the Company, as well as a related party transaction under the AIM

Rules. This is because the proposed purchaser, AVC Immedia Limited,

is owned in part by Ross Penney, John Trevorrow and Mark Horrocks,

each of whom are Directors of the Company. Should the Disposal

complete, the Company will become an AIM Rule 15 cash shell.

The Disposal also requires approval by Shareholders under the

Companies Act 2006 as it constitutes a substantial property

transaction with a director, given Ross Penney and John Trevorrow

are Directors of both the Company and the acquiring entity, and

Mark Horrocks is a shareholder in the acquiring entity.

Summary of the Disposal Agreement

On 20 April 2022, the Company entered into the Disposal

Agreement, pursuant to which it has conditionally agreed to dispose

of the entire issued share capital of Immedia Broadcast Limited to

AVC Immedia Limited for an aggregate total consideration of

GBP2,000,000 to be satisfied as follows:

1. by the payment of GBP1,718,000, in cash, immediately

following completion of the Disposal ("Completion"); and

2. by the payment of deferred consideration of, in aggregate,

GBP282,000, which shall be payable in 12 equal monthly instalments

of GBP23,500 with the first such instalment to be paid on the date

falling one month after Completion and each of the remaining 11

instalments to be paid on the same date in each of the 11

subsequent months.

In addition, the Disposal Agreement includes a provision that,

in the event that AVC Immedia Limited disposes of some or all of

the shares or assets of Immedia Broadcast Limited or any of its or

its holding company's shares are admitted to trading on a

recognised investment exchange (each, a "Trigger Event") within 18

months of Completion, additional consideration (calculated by

reference to, as applicable, the consideration received, or value

of, the relevant Trigger Event) will become due and payable to the

Company.

The Disposal Agreement is conditional on the passing of the

Resolutions at the General Meeting and Completion occurring on or

before the date falling three months after the date of the Disposal

Agreement.

Due to the nature of the Disposal and the fact that Immedia

Broadcast Limited's existing management team control AVC Immedia

Limited, the Company has given only limited fundamental warranties

and a short form and limited tax covenant in the Disposal

Agreement, which are appropriate for a transaction of this

nature.

Residual Assets and Future Intentions

On Completion, the Company intends to adopt a capital growth

strategy through the monetisation of its remaining assets, in an

orderly manner, and the pursuit of an acquisition of a company in

the technology or fintech sectors.

Upon receipt of the initial Disposal proceeds the Company will

have a total cash balance of c. GBP1.718m less costs associated

with the Disposal. In addition to this amount the Company's assets

include the Sprift Loan of GBP1.05m and 84,200 Ordinary Shares in

Audioboom plc, which has a total value of c. GBP1.82m, as at close

of business on 20 April 2022, being the latest practicable date

prior to publication of the circular.

The Sprift Loan remains outstanding as at the date of the

circular and the intention is to dispose of this loan note, at face

value, for cash. In the meantime, the loan interest continues to be

received on a monthly basis.

Over and above the existing cash and investments the Company

also intends to utilise the shareholder support inherent in the

outstanding shareholder warrants. There are 12,000,000 warrants

outstanding with an exercise price of 35p with a warrant expiry

date of 30 June 2022. If exercised in full this could result in an

additional GBP4.2m of funding to finance any potential

acquisition.

Upon Completion, the Company will become an AIM Rule 15 cash

shell (see below) and will therefore be dependent upon the ability

of the Board to identify suitable acquisition targets. The

Directors have continued to investigate a number of potential

acquisitions in the technology and fintech sector; none of which

they have yet committed to pursue at this time. There is therefore

no guarantee that the Company will be able to acquire an identified

opportunity at an appropriate price, or at all. As a consequence,

the cash resources and management time may be expended on

investigative work and due diligence.

AIM Rule 15

In accordance with AIM Rule 15, the Disposal constitutes a

fundamental change of business of the Company. On Completion, the

Company will cease to own, control or conduct all or substantially

all, of its existing trading business, activities or assets, save

as set out in the paragraph headed "Residual Assets and Future

Intentions" above.

The Company will therefore become an AIM Rule 15 cash shell and,

as such, will be required to make an acquisition or acquisitions

which constitute(s) a reverse takeover under AIM Rule 14 (including

seeking re-admission as an investing company (as defined under the

AIM Rules)) on or before the date falling six months from

Completion or be re-admitted to trading on AIM as an investing

company under the AIM Rules (which requires the raising of at least

GBP6 million), failing which the Company's Ordinary Shares would

then be suspended from trading on AIM pursuant to AIM Rule 40.

Admission to trading on AIM would be cancelled six months from the

date of suspension should the reason for the suspension not be

rectified during that period.

Any failure in completing an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14, including

seeking re-admission as an investing company (as defined under the

AIM Rules), will result in the cancellation of the Company's

Ordinary Shares from trading on AIM.

Market conditions may also have a negative impact on the

Company's ability to make an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14. There is

therefore no guarantee that the Company will be successful meeting

the AIM Rule 15 deadline as described above.

Related Party Transaction

The Disposal constitutes a related party transaction under Rule

13 of the AIM Rules for Companies. Tim Hipperson and Simon

Leathers, the Independent Directors in respect of the Disposal,

consider, having consulted with SPARK, the Company's Nominated

Adviser, that the terms of the Disposal are fair and reasonable

insofar as the Company's Shareholders are concerned. The

Independent Directors in respect of the Disposal have taken into

account the following:

1. Immedia Broadcast Limited has experienced a challenging

trading environment in the last few years due primarily to Brexit

and Covid-19 and was forced to scale back the operations, whilst

the business has restored its financial stability there is no

immediate prospect of developing the scale of the operations to a

level that can adequately support the costs associated with being

admitted to trading on AIM; and

2. the Disposal, as it is a fundamental change of business, will

be subject to Shareholders' approval at the General Meeting.

The Independent Directors have also taken into account the

principal relevant considerations that they have identified in

relation to the Disposal, which are set out further in the

Circular.

Board Changes & New Company Secretary

Upon Completion, the Executive Directors, Ross Penney and John

Trevorrow, will step down from the Board and leave the three

Non-Executive Directors, Tim Hipperson, Simon Leathers, and Mark

Horrocks.

A new Company Secretary, AMBA Secretaries Limited, will also be

appointed at this time.

Change of Name and Registered Office

The Board has agreed with Immedia Broadcast Limited that the

Company's name will be changed to Immediate Acquisition Plc,

conditional on the passing of the Resolutions. Immedia Broadcast

Limited will continue to trade under that name following

Completion.

Under the Companies Act 2006, a change of name requires the

passing of a special resolution of Shareholders at a general

meeting. Shareholders' approval is therefore being sought for this

change of name pursuant to Resolution 3.

If Resolution 3 is approved, the change of name will be

effective once Companies House has issued a new certificate on the

change of name. The Company will announce once this has

occurred.

The Company will change its registered office to c/o Charles

Russell Speechlys LLP, 5 Fleet Place, London, EC4M 7RD with effect

from Completion.

The Company's TIDM, IME.L, will remain unchanged.

Shareholders' Approval

Set out at the end of the Circular is a notice convening the

General Meeting to be held on 9 May 2022 at 10.00 a.m. at the

offices of Charles Russell Speechlys LLP, 5 Fleet Place, London

EC4M 7RDat which the following Resolutions will be proposed:

1. That the sale by the Company of Immedia Broadcast Limited to

AVC Immedia Limited be approved for the purposes of Rule 15 of the

AIM Rules.

2. That the Disposal be approved for the purposes of section 190 of the Companies Act.

3. That the Change of Name be approved.

Resolutions 1 and 2 will be proposed as ordinary resolutions and

Resolution 3 will be proposed as a special resolution.

Action to be taken by Shareholders

Shareholders will find enclosed with the Circular a Form of

Proxy for use at the General Meeting. Shareholders are requested to

complete and return the Form of Proxy to Share Registrars, 3 The

Millennium Centre, Crosby Way, Farnham, Surrey, GU9 7XX in

accordance with the instructions printed thereon as soon as

possible but, in any event, to be received no later than 10.00 a.m.

on 5 May 2022 being 48 hours (excluding days that are not business

days) before the time of the General Meeting.

Recommendations

The Independent Directors believe that Resolutions 1 and 2 are

in the best interests of Shareholders and the Company as a whole

and accordingly recommend that the Shareholders vote in favour of

Resolutions 1 and 2.

The Independent Directors do not own any Ordinary Shares in the

Company and are therefore unable to vote on the Resolutions to be

proposed at the General Meeting.

Due to their position as owners of the proposed purchaser of

Immedia Broadcast Limited, Ross Penney, John Trevorrow and Mark

Horrocks as Directors of the Company are not considered to be

Independent Directors and are not able to consider Resolutions 1

and 2.

The Independent Directors have considered the alternatives to

the Disposal and have concluded that, out of the alternatives, the

Company carrying out the Disposal and becoming a cash shell is most

likely to represent the best value to the Shareholders in the long

term.

Conditional upon Resolutions 1 and 2 being passed, all of the

Directors unanimously recommend Shareholders to vote in favour of

Resolution 3 as they intend to do in respect of their own

beneficial shareholdings, which amount, in aggregate, to 9,313,026

Ordinary Shares, representing approximately 24.78% of the Company's

Ordinary Share capital.

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBBLLLLZLBBBZ

(END) Dow Jones Newswires

April 21, 2022 02:01 ET (06:01 GMT)

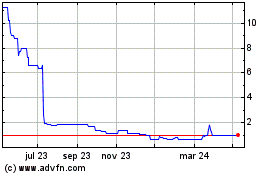

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

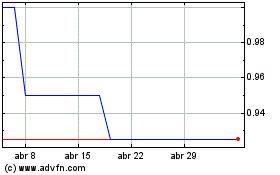

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024