TIDMKNB

RNS Number : 6714Y

Kanabo Group PLC

09 May 2023

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF

SOUTH AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE

THE IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT OR ANY PART OF IT IS FOR INFORMATION PURPOSES

ONLY AND DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER TO ISSUE OR

SELL, OR THE SOLICITATION OF AN OFFER TO ACQUIRE, PURCHASE OR

SUBSCRIBE FOR, ANY SECURITIES IN THE UNITED STATES (INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE

DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE SAME WOULD

BE UNLAWFUL. NO PUBLIC OFFERING OF SECURITIES KANABO GROUP PLC IS

BEING MADE IN ANY SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION (EU) 596/2014 AS IT FORMS PART OF DOMESTIC LAW IN THE

UNITED KINGDOM BY VIRTUE OF THE EU (WITHDRAWAL) ACT 2018 ("MAR").

IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN

RESPECT OF THE FUNDRAISE WITH THE RESULT THAT CERTAIN PERSONS

BECAME AWARE OF INSIDE INFORMATION (AS DEFINED IN MAR), AS

PERMITTED BY MAR. THIS INSIDE INFORMATION IS SET OUT IN THIS

ANNOUNCEMENT. THEREFORE, THOSE PERSONS THAT RECEIVED INSIDE

INFORMATION IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF

SUCH INSIDE INFORMATION RELATING TO THE COMPANY AND ITS

SECURITIES.

9 May 2023

Kanabo Group plc

("Kanabo", the "Group" or the "Company")

Fundraise of GBP2.54 million and Broker Option

Kanabo Group plc (LSE: KNB), the patient focused healthcare

technology and cannabis company, is pleased to announce the

completion of a fundraise (the "Fundraise") to raise approximately

GBP2.54 million via the issue of 88,194,44 3 new Ordinary Shares

("Fundraise Shares"). Additionally, the Company has also agreed to

issue investors warrants to purchase up to 44,097,220 new Ordinary

Shares. Participants in the fundraising include a new institutional

investor as well as the Group's recently appointed Non-Executive

Chairman, Ian Mattioli, Chief Executive Officer, Avihu Tamir and

other Directors and Officers of the Company. The issue of the

shares to the Directors and Officers of the Company in the

Fundraise, is conditional upon the approval by the Company's

shareholders of certain resolutions to be proposed at the annual

general meeting of the Group (the "AGM").

Avihu Tamir, Chief Executive Officer of Kanabo, commented:

"We are delighted to be announcing this fresh capital injection,

which further endorses the strength and quality of our business and

highlights the confidence we have in our growth strategy. This

raise will not only accelerate the roll-out of our online platform

but will also enable our team to pursue a number of exciting

commercial opportunities.

"As we continue to further develop our commercial footprint, I

look forward to updating shareholders on our progress over the

course of the year."

Key Highlights and Rationale

The Fundraise proceeds will be allocated towards the following

strategic initiatives for Kanabo:

1. Expansion of digital health services division:

Kanabo intends to drive growth by extending the reach of its

digital health services, addressing the growing need for accessible

and personalised healthcare.

2. Investment in technology and network growth:

To meet the increasing demand for consultation services, Kanabo

will further invest in technology and expand its pharmacy network,

ensuring efficient delivery of medications.

3. Product development focused on pain management:

Kanabo plans to invest in developing pain management solutions

using medicinal cannabis products and other treatments that are not

available through traditional channels.

4. General working capital:

The remaining proceeds will be used for general working capital

purposes, supporting the company's daily operations and strategic

plans.

By focusing on these initiatives, Kanabo aims to strengthen its

position in the digital healthcare sector and capitalise on the

rising demand for medicinal cannabis products and digital health

services.

Details of the Subscription

Kanabo Group plc has raised approximately GBP2.54 million via

the issue of 88,194,443 new ordinary shares of 2.5p each ("Ordinary

Shares") at a price of 2.88p per share ("Fundraise Price") . The

Fundraise Price was calculated based on a 30-day VWAP from the day

that commercial terms were agreed with investors.

Each Fundraise Share issued pursuant to the Fundraise has half a

warrant (the "Warrants") attached, granting the holder the right to

subscribe for an additional half a new ordinary share at an

exercise price of 5.76 pence for a period of 24 months following

Admission. As such , the Company has agreed to issue investors

Warrants to purchase up to 44,097,220 new Ordinary Shares. The

Warrants cannot be exercised in the first 90 days of admission of

the Fundraise Shares and are subject to a prospectus being

published and the receival of approval at a General Meeting of the

Company.

The GBP2.54 million subscription is composed of a GBP2.0 million

invested by the alternative asset management fund Seamróg Em

Multi-Strat Sub-Fund ("Seamróg Em"), which is regulated by the

Central Bank of Ireland, and a GBP0.54 million investment by

officers and directors of the Company of which further details can

be found below. Application will be made for admission of the new

Ordinary Shares issued as part of the Fundraise to the Standard

List of the London Stock Exchange ("Admission").

Seamróg Em will be issued with 69,444,444 new Ordinary Shares at

the Fundraise Price, which will represent 13.6 % of the issued

share capital of the Company following completion on the Fundraise.

Additionally, the Company has issued Seamróg Em with 34,722,222

Warrants.

Directors' participation in the Fundraise

Board members Mr Ian Mattioli (Non-Executive Chair), Mr David

Tsur (Deputy Chair), Mr Avihu Tamir (Chief Executive Officer) and

Executive team member Mr Suleman Sacranie (Chief Technology Officer

and Founder of the GP Service) (together "Directors and Officers")

have all participated in the subscription.

The Company does not have sufficient headroom to issue the new

Ordinary Shares to be allocated to the Directors and Officers as

part of the Fundraise. As a result, the Directors and Officers have

agreed that the new Ordinary Shares to be issued to them will be

conditional upon the approval by the Company's shareholders of

certain resolutions to be proposed at the AGM. Notice of the AGM

will be set out in a circular to be issued shortly. Settlement of

the Directors' and Officers' participation is expected to occur on

or around 15 May, with the new Ordinary Shares to be issued subject

to the AGM. The Company will issue further announcements in this

regard.

The number of shares subscribed for by each of these Directors

and the conversion of the Fee Shares, are set out below:

Director/Officer Number of Number of Number of Number Percentage

Existing New Ordinary Ordinary of new of enlarged

Ordinary Shares subscribed Shares held Warrants share capital

Shares for on Admission issued on Admission

Mr Ian Mattioli 500,000 17,361,111 17,861,111 8,680,555 3.5%

----------- ------------------- -------------- ---------- ---------------

Mr David Tsur 9,061,102 173,611 9,234,713 86,805 1.8%

----------- ------------------- -------------- ---------- ---------------

Mr Avihu Tamir 97,263,870 520,833 97,784,703 260,416 19.1%

----------- ------------------- -------------- ---------- ---------------

Mr Suleman

Sacranie 10,651,230 694,444 11,345,674 347,222 2.2%

----------- ------------------- -------------- ---------- ---------------

Broker Option

In order to provide qualified Kanabo shareholders ("Existing

Shareholders") and other qualified investors with an opportunity to

participate on the same basis as the investors in the Fundraise,

the Company has granted Peterhouse a Broker Option over 6,944,444

new Ordinary Shares (or such other number of new Ordinary Shares as

agreed between the Company and Peterhouse) ("Broker Option

Shares"). Full take up of this number of new Ordinary Shares under

the Broker Option would raise a further GBP200,000 for the Company,

before expenses.

Existing Shareholders who hold shares in the Company and are on

the register of members as at the close of business on 5 May 2023,

will be given a priority right to participate in the Broker Option

and all orders from such Existing Shareholders will be accepted and

processed by Peterhouse, subject to scale-back in the event of

over-subscription under the Broker Option. The Broker Option has

not been underwritten. Peterhouse is entitled to participate in the

Broker Option as principal.

The Broker Option is exercisable by Peterhouse on more than one

occasion, at any time from the time of this announcement to 4.45

p.m. UK time on 9 May 2023, at its absolute discretion, following

consultation with the Company. There is no obligation on Peterhouse

to exercise the Broker Option or to seek to procure subscribers for

the Broker Option. Peterhouse may also, subject to prior consent of

the Company, allocate new shares after the time of any initial

allocation to any person submitting a bid after that time.

The Broker Option Shares are not being made available to the

public and none of the Broker Option Shares are being offered or

sold in any jurisdiction where it would be unlawful to do so. No

Prospectus will be issued in connection with the Broker Option.

To subscribe for Broker Option Shares, Existing Shareholders and

other qualified investors should communicate their bid to

Peterhouse via their stockbroker as Peterhouse cannot take direct

orders from individual private investors. Existing Shareholders or

other interested parties who wish to register their interest in

participating in the Broker Option Shares should instruct their

stockbroker to call Peterhouse on STX: 76086 or 020 7469 0938 or

020 7469 0936 or 020 7220 9797. Each bid should state the number of

Broker Option Shares the Existing Shareholder wishes to subscribe

for at the Issue Price.

Admission

Application will be made to the Financial Conduct Authority for

Admission of the 69,444,444 new Ordinary Shares issued to Seamróg

Em to the London Stock Exchange (the "LSE"). It is expected that

Admission will take place at 8.00 a.m. on or around 12 May 2023 and

that dealings in the 69,444,444 new Ordinary Shares on the LSE will

commence at the same time. The remaining new Ordinary Shares to be

issued as part of the Fundraise, including the Ordinary Shares to

be issued to Directors and Officers and the Broker Option shares

will be applied for Admission in due course.

When issued, the Fundraise Shares will be credited as fully paid

and will rank pari passu in all respects with the existing Ordinary

Shares in the share capital of the Company, including the right to

receive all dividends and other distributions declared, made, or

paid on or in respect of such shares after the date of issue of the

Fundraise Shares.

Total voting rights

Following Admission of the Fundraise Shares, the Company will

have 511,110,499 Ordinary Shares in issue, each share carrying the

right to one vote. This figure includes the Ordinary Shares to be

issued to Directors and Officers but excludes any Ordinary Shares

to be issued as part of the Broker Option.

Kanabo is a company incorporated in England and Wales with

company number 10485105 . The Ordinary Shares are registered with

ISIN GB00BYQCS703, SEDOL code BYQCS70 and TIDM KNB.

Enquiries:

Kanabo Group plc via Vigo Consulting

Avihu Tamir, Chief Executive Officer +44 (0)20 7390 0230

Assaf Vardimon, Chief Financial Officer

Ian Mattioli, Non-Executive Chair of the

Board

Peterhouse Capital Ltd (Financial Adviser

and Broker)

Eran Zucker/ Lucy Williams / Charles Goodfellow +44 (0)20 7469 0930

Vigo Consulting (Financial Public Relations/Investor

Relations)

Jeremy Garcia / Fiona Hetherington / Verity

Snow +44 (0)20 7390

kanabo@vigoconsulting.com 0230

About Kanabo Group Plc

Kanabo Group Plc (LSE:KNB) is a healthtech company committed to

revolutionising patient care through its innovative technology

platform and disruptive product offerings. Since its inception in

2017, Kanabo has been focused on researching, developing, and

commercialising regulated medicinal cannabis-derived formulations

and therapeutic inhalation devices.

Kanabo's NHS-approved online telehealth platform, The GP

Service, provides patients with video consultations, online

prescriptions, and primary care services. The Company is a leader

in its field, focusing on improving patient outcomes and providing

more accessible healthcare experiences.

In March 2023, Kanabo successfully launched its Pain Clinic,

Treat It, under the expert guidance of its technological and

product expertise. Treat It initially focuses on chronic pain

management using plant-based medicine and treatments that are

currently unavailable through traditional channels.

At Kanabo Group Plc, we are dedicated to providing patients with

the highest quality medical treatments and more accessible

healthcare experiences.

Visit www.kanabogroup.com for more information.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Ian Mattioli

----------------------- ------------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Director

----------------------- ------------------------------------------

b) Initial notification Initial notification

/Amendment

----------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Kanabo Group plc

----------------------- ------------------------------------------

b) LEI 213800XPJFSNWJIYKN52

----------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Ordinary Shares of 2.5 pence each

of the financial

instrument, ISIN: GB00BYQCS703

type of instrument

Identification

code

----------------------- ------------------------------------------

b) Nature of the Subscription for 17,361,111 new Ordinary

transaction Shares

----------------------- ------------------------------------------

c) Price(s) and Price No. of

volume(s) shares

2.88 pence 17,361,111

-----------

----------------------- ------------------------------------------

d) Aggregated

information

- Aggregated

volume

- Price 17,361,111

2.88 pence

----------------------- ------------------------------------------

e) Date of the 9 May 2023

transaction

----------------------- ------------------------------------------

f) Place of the Outside a trading venue

transaction

----------------------- ------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name David Tsur

------------------------ -----------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Director

------------------------ -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------ -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Kanabo Group plc

------------------------ -----------------------------------------

b) LEI 213800XPJFSNWJIYKN52

------------------------ -----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Ordinary Shares of 2.5 pence each

of the financial

instrument, ISIN : GB00BYQCS703

type of instrument

Identification

code

------------------------ -----------------------------------------

b) Nature of the Subscription for 173,611 new Ordinary

transaction Shares

------------------------ -----------------------------------------

c) Price(s) and Price No. of

volume(s) shares

2.88 pence 173,611

--------

------------------------ -----------------------------------------

d) Aggregated

information

- Aggregated

volume

- Price 173,611

2.88 pence

------------------------ -----------------------------------------

e) Date of the 9 May 2023

transaction

------------------------ -----------------------------------------

f) Place of the Outside a trading venue

transaction

------------------------ -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Avihu Tamir

------------------------ -----------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Director

------------------------ -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------ -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Kanabo Group plc

------------------------ -----------------------------------------

b) LEI 213800XPJFSNWJIYKN52

------------------------ -----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Ordinary Shares of 2.5 pence each

of the financial

instrument, ISIN: GB00BYQCS703

type of instrument

Identification

code

------------------------ -----------------------------------------

b) Nature of the Subscription for 520,833 new Ordinary

transaction Shares

------------------------ -----------------------------------------

c) Price(s) and Price No. of

volume(s) shares

2.88 pence 520,833

--------

------------------------ -----------------------------------------

d) Aggregated

information

- Aggregated

volume

- Price 520,833

2.88 pence

------------------------ -----------------------------------------

e) Date of the 9 May 2023

transaction

------------------------ -----------------------------------------

f) Place of the Outside a trading venue

transaction

------------------------ -----------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Suleman Sacranie

------------------------ -----------------------------------------

2 Reason for the notification

-------------------------------------------------------------------

a) Position/status Officer

------------------------ -----------------------------------------

b) Initial notification Initial notification

/Amendment

------------------------ -----------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Kanabo Group plc

------------------------ -----------------------------------------

b) LEI 213800XPJFSNWJIYKN52

------------------------ -----------------------------------------

4 Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description Ordinary Shares of 2.5 pence each

of the financial

instrument, ISIN: GB00BYQCS703

type of instrument

Identification

code

------------------------ -----------------------------------------

b) Nature of the Subscription for 694,444 new Ordinary

transaction Shares

------------------------ -----------------------------------------

c) Price(s) and Price No. of

volume(s) shares

2.88 pence 694,444

--------

------------------------ -----------------------------------------

d) Aggregated

information

- Aggregated

volume

- Price 694,444

2.88 pence

------------------------ -----------------------------------------

e) Date of the 9 May 2023

transaction

------------------------ -----------------------------------------

f) Place of the Outside a trading venue

transaction

------------------------ -----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUWAWROSUVRAR

(END) Dow Jones Newswires

May 09, 2023 02:00 ET (06:00 GMT)

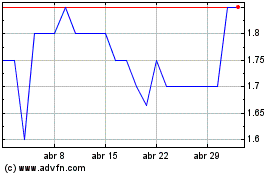

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024