R.E.A. Holdings plc: Trading update (1693553)

02 Agosto 2023 - 1:00AM

UK Regulatory

R.E.A. Holdings plc (RE.)

R.E.A. Holdings plc: Trading update

02-Aug-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

R.E.A. Holdings plc ("REA" or the "company") - Trading update

In advance of publication in September of the company's half yearly report to 30 June 2023, REA announces the following

trading update for the 6 months to 30 June 2023 (with comparative figures for 2022):

2023 2022

Fresh Fruit Bunch ("FFB") crops (tonnes):

Group harvested 346,216 321,993

Third party harvested 98,413 126,893

Total 444,629 448,886

Production (tonnes):

Total FFB processed 411,255 428,608

FFB sold 32,345 14,445

CPO 90,167 96,299

Palm kernels 20,300 20,578

CPKO 8,331 7,970

Extraction rates (percentage):

CPO 21.9 22.5

Palm kernel 4.9 4.8

CPKO* 39.6 39.5

Rainfall (mm):

Average across the estates 1,924 2,012

*Based on kernels processed

Opening the year at USD1,090 per tonne, CIF Rotterdam, CPO

prices weakened progressively through the first 6 months of the

year to a low of USD855 per tonne in early June 2023. With growth

in global production of CPO expected to remain generally slower

than in the past, dry crops in North America affecting soybean and

canola crops and the Russian / Ukrainian situation likely to

constrain sunflower seed exports, the immediate outlook for CPO

prices appears positive. Since the low point in June, the CPO price

has rallied and currently stands at USD960 per tonne.

The average selling price for the group's CPO for the six months

to the end of June 2023, including premia for certified oil, net of

export duty and levy, adjusted to FOB Samarinda, was USD746 per

tonne (2022: USD971 per tonne). The average selling price for the

group's CPKO, on the same basis, was USD875 per tonne (2022:

USD1,712 per tonne).

The combination of static production volumes in the first half

of 2023 and lower selling prices compared with 2022 will mean that

revenues for the six months to 30 June 2023 will be significantly

lower than in the comparable period of 2022.

The outlook for the second half of 2023 is more positive. The

average net selling price for the group's CPO for the second half

of 2022 was USD703 per tonne as compared with a current net local

market price of USD740 per tonne. Accordingly, if the current price

is maintained, revenue for the second half of 2023 may reasonably

be expected to exceed that of the second half of 2022. It is likely

that, as is normal, FFB crops will be weighted to the second

half.

The recent weakness of coal prices and the necessary costs

incurred to commence production of stone and sand has delayed the

expected recovery of loans made by the company to the group's stone

and coal interests. The logistical problems related to the opening

of the stone quarry have, however, been resolved and progress is

again being made towards initiating stone production and sales.

The fall in coal prices, if sustained, may make more difficult

the planned refinancing of loans to the stone and coal interests

which, when combined with the expected delay to normal recoveries

of those loans, will reduce the cash available to the group.

Accordingly, the directors will keep under review their intention

to pay in December 2023 the remaining arrears of preference

dividend (currently amounting to 7p per share) when the semi-annual

dividend arising on 31 December 2023 is paid.

In line with the timetable adopted in previous years, the

company's half yearly report for 2023 will be published in late

September 2023.

Enquiries:

R.E.A Holdings plc

Tel: 020 7436 7877

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB0002349065

Category Code: TST

TIDM: RE.

LEI Code: 213800YXL94R94RYG150

Sequence No.: 261677

EQS News ID: 1693553

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1693553&application_name=news

(END) Dow Jones Newswires

August 02, 2023 02:00 ET (06:00 GMT)

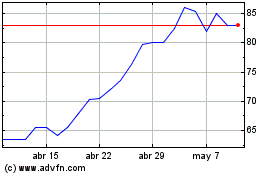

R.e.a (LSE:RE.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

R.e.a (LSE:RE.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024