TIDMSOS

RNS Number : 3435P

Sosandar PLC

08 February 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF

SOUTH AFRICA, THE REPUBLIC OF IRELAND, SINGAPORE, HONG KONG OR

JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

PLEASE SEE THE IMPORTANT NOTICES AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE EU REGULATION 2014/596/EU ("MAR") AND ARTICLE 7

OF MAR AS INCORPORATED INTO UK DOMESTIC LAW PURSUANT TO THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

8 February 2023

Sosandar plc

("Sosandar" or the "Company")

Result of Placing

Further to the announcement earlier today, Sosandar plc (AIM:

SOS), one of the fastest growing fashion brands in the UK, creating

quality, trend-led products for women of all ages, is pleased to

announce that, as a result of increased demand, it has

conditionally raised gross proceeds of approximately GBP5.4 million

pursuant to the Placing from existing and new investors. A total of

24,545,454 Placing Shares have been placed at 22 pence per share by

Singer.

Ali Hall and Julie Lavington, Co-CEOs, commented:

"We are delighted to have successfully completed our placing,

with both existing and new investors showing support for our

business and future growth plans. We welcome the strength of

support shown by our existing shareholders and would like to

welcome new investors to the Company.

The progress and momentum that we have experienced over the last

two years has been substantial. The strength of our brand and

distinctive product range continues to resonate incredibly well

with our large but underserved demographic and with this strong

momentum, the Board believes the opportunity for Sosandar is larger

than ever. This opportunity has been demonstrated by us delivering

a record performance in the third quarter of FY23 with a record

number of visits to Sosandar.com and a record quarter for our third

party partners.

We see a number of opportunities for further growth both on our

own site and through our third party partners in the coming months

and beyond. Proceeds of the placing will provide the balance sheet

flexibility to enable us to execute our omni-channel strategy,

starting with increasing stock from Autumn Winter 2023 for the

in-store launch with Sainsbury's, fast-tracking other growth

initiatives and accelerating our proven customer acquisition

model.

Our decision to become an omni-channel business will allow us to

enhance our brand equity, accelerate market share growth both in

the UK and internationally while also increasing both brand

awareness and scalable growth potential.

We are as confident as ever that the winning formula of our

distinctive product range and effective marketing strategy will

enable us to capitalise on the sizable opportunity available and

continue to move forward on our journey to becoming one of the

largest womenswear brands globally."

The Placing is conditional upon, inter alia, Placing Admission

becoming effective. The Placing is also conditional on the Placing

Agreement not being terminated in accordance with its terms.

Singer Capital Markets Securities Limited ("Singer") is acting

as agent for and on behalf of the Company in respect of the

Placing. The Placing was conducted by way of an accelerated book

build process.

Related Party Transaction

Further to the announcement released by the Company at 7.00 a.m.

on 8 February 2023, Octopus Investments Limited has confirmed its

participation in the Placing in the amount of 909,090 Ordinary

Shares. As at the date of this announcement, (excluding its

participation in the Placing) Octopus Investments Limited holds

27,621,693 Ordinary Shares, representing approximately 12.5 per

cent. of the Company's existing issued share capital. As a

Substantial Shareholder (as defined in the AIM Rules for

Companies), the participation of Octopus Investments Limited in the

Placing constitutes a related party transaction pursuant to Rule 13

of the AIM Rules.

The Directors (all of whom are regarded as being independent of

Octopus Investments Limited ), having consulted with Singer Capital

Markets Advisory LLP, the Company's nominated adviser, consider

that the participation by Octopus Investments Limited in the

Placing is fair and reasonable in so far as shareholders are

concerned.

Admission, Settlement and Dealings

Application has been m ade to the London Stock Exchange for the

admission of 24,545,454 Placing Shares to trading on AIM. Placing

Admission is expected to take place and dealings in the Placing

Shares are expected to commence at 8.00 a.m. on or around 13

February 2023.

The Placing Shares, when issued, will be fully paid and will

rank pari passu in all respects with the Existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Total Voting Rights

Following admission of the Placing Shares, the Company's issued

and fully paid share capital will consist of 245,953,786 Ordinary

Shares, all of which carry one voting right per share. The Company

does not hold any Ordinary Shares in treasury. Therefore, the total

number of ordinary shares and voting rights in the Company will be

245,953,786. This figure may be used by Shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

A further announcement will be made in relation to total voting

rights in the Company's share capital following the issue of the

Retail Offer Shares.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

Enquiries

Sosandar plc www.sosandar.com

Julie Lavington / Ali Hall, Joint CEOs c/o Alma PR

Steve Dilks, CFO

Singer Capital Markets

Peter Steel / Alaina Wong / Alex Emslie /

Tom Salvesen +44 (0) 20 7496 3000

Alma PR Limited (Financial PR) +44 (0) 20 3405 0205

Sam Modlin / Matthew Young sosandar@almapr.co.uk

About Sosandar plc

Sosandar is one of the fastest growing women's fashion brands in

the UK targeting style conscious women who have graduated from

price-led alternatives. The Company offers this underserved

audience fashion-forward, affordable, quality clothing to make them

feel sexy, feminine, and chic. The business sells predominantly

own-label exclusive product designed in-house.

Sosandar's product range is diverse, providing its customers

with an array of choice for all occasions across all women's

fashion categories. The company sells through Sosandar.com and has

brand partnerships in place with Next, John Lewis, Marks &

Spencer, The Very Group, JD Williams and J Sainsbury.

Sosandar's strategy is to continue growing brand awareness and

expand its customer database, whilst also further driving its high

levels of customer retention. This is achieved through its

exceptional products, seamless customer experience and impactful,

lifestyle marketing activities all of which is underpinned by

combining innovation with data analysis.

Sosandar was founded in 2016 and listed on AIM in 2017. More

information is available at www.sosandar-ir.com

Definitions

Save as otherwise defined, capitalised terms used in this

announcement have the meanings given to them in the announcement

released by the Company at 7.00a.m.on 08 February 2023 to announce

the launch of the Fundraise.

Important Notice

Singer Capital Markets Securities Limited ("Singer"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting solely for the Company and no-one else in connection with

the Fundraise and the transactions and arrangements described in

this Announcement and will not regard any other person (whether or

not a recipient of this Announcement) as a client in relation to

the Fundraise or the transactions and arrangements described in

this Announcement. Singer is not responsible to anyone other than

the Company for providing the protections afforded to clients of

Singer or for providing advice in connection with the contents of

this Announcement, the Fundraise or the transactions and

arrangements described in this Announcement.

Singer Capital Markets Advisory LLP ("SCM Advisory"), which is

authorised and regulated in the United Kingdom by the FCA, is

acting as nominated adviser to the Company for the purposes of the

AIM Rules and no-one else in connection with the Fundraise and the

transactions and arrangements described in this Announcement and

will not be responsible to any other person (whether or not a

recipient of this Announcement) as a client in relation to the

Fundraise or the transactions and arrangements described in this

Announcement. SCM Advisory is not responsible to anyone other than

the Company for providing the protections afforded to clients of

SCM Advisory or for providing advice in connection with the

contents of this Announcement, the Fundraise or the transactions

and arrangements described in this Announcement. SCM Advisory's

responsibilities as the Company's nominated adviser under the AIM

Rules for Nominated Advisers are owed solely to the London Stock

Exchange and are not owed to the Company or to any Director or to

any other person

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Singer, SCM Advisory or by any of its

affiliates or agents as to, or in relation to, the accuracy or

completeness of this announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

Forward-looking statements

This announcement includes statements, estimates, opinions and

projections with respect to anticipated future performance of the

Company ("forward-looking statements") which reflect various

assumptions concerning anticipated results taken from the Company's

current business plan or from public sources which may or may not

prove to be correct. These forward looking statements can be

identified by the use of forward looking terminology, including the

terms "anticipates", "target", "believes", "estimates", "expects",

"intends", "may", "plans", "projects", "should" or "will", or, in

each case, their negative or other variations or comparable

terminology or by discussions of strategy, plans, objectives,

goals, future events or intentions. Such forward-looking statements

reflect current expectations based on the current business plan and

various other assumptions and involve significant risks and

uncertainties and should not be read as guarantees of future

performance or results and will not necessarily be accurate

indications of whether or not such results will be achieved. As a

result, prospective investors should not rely on such

forward-looking statements due to the inherent uncertainty therein.

No representation or warranty is given as to the completeness or

accuracy of the forward-looking statements contained in this

announcement. Forward-looking statements speak only as of the date

of such statements and, except as required by the FCA, the London

Stock Exchange or applicable law, the Company undertakes no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

No statement in this announcement is intended to be a profit

forecast or estimate, and no statement in this announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult an

independent financial adviser.

Further information

Neither this announcement nor any copy of it may be made or

transmitted into the United States, or distributed, directly or

indirectly, in the United States. Neither this announcement nor any

copy of it may be taken or transmitted directly or indirectly into

the United States, Canada, Australia, New Zealand, the Republic of

South Africa, the Republic of Ireland, Singapore, Hong Kong or

Japan or to any persons in any of those jurisdictions, except in

compliance with applicable securities laws. Any failure to comply

with this restriction may constitute a violation of United States,

Canadian, Australian, New Zealand, South African, Irish,

Singaporean, Hong Kong or Japanese securities laws or the

securities laws of any other jurisdiction (other than the United

Kingdom). The distribution of this announcement in other

jurisdictions may be restricted by law and persons into whose

possession this announcement comes should inform themselves about,

and observe any such restrictions. This announcement does not

constitute or form part of any o er or invitation to sell or issue,

or any solicitation of any o er to purchase or subscribe for

securities in the United States, Canada, Australia, New Zealand,

the Republic of South Africa, the Republic of Ireland, Singapore,

Hong Kong or Japan or in any jurisdiction to whom or in which such

o er or solicitation is unlawful.

The securities to which this announcement relates have not been,

and will not be, registered under the US Securities Act of 1933, as

amended (the "Securities Act") or with any regulatory authority or

under any applicable securities laws of any state or other

jurisdiction of the United States, and may not be o ered or sold

within the United States unless registered under the Securities Act

or pursuant to an exemption from, or in a transaction not subject

to, the registration requirements of the Securities Act and in

compliance with applicable state laws. There will be no public o er

of the securities in the United States.

The securities referred to herein have not been registered under

the applicable securities laws of Canada, Australia, New Zealand,

The Republic of South Africa, The Republic of Ireland, Singapore,

Hong Kong or Japan and, subject to certain exceptions, may not be o

ered or sold within the United States, Canada, Australia, New

Zealand, the Republic of South Africa, the Republic of Ireland,

Singapore, Hong Kong or Japan or to any national, resident or

citizen of the United States, Canada, Australia, New Zealand, the

Republic of South Africa, the Republic of Ireland, Singapore, Hong

Kong or Japan.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than on the AIM

market of the London Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this announcement.

Basis on which information is presented

In this document, references to "GBP", "pence" and "p" are to

the lawful currency of the United Kingdom. All times referred to in

this document are, unless otherwise stated, references to London

time.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIEADAPEAPDEFA

(END) Dow Jones Newswires

February 08, 2023 08:30 ET (13:30 GMT)

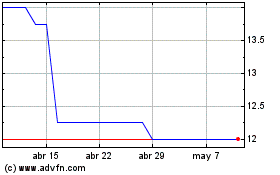

Sosandar (LSE:SOS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Sosandar (LSE:SOS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025