TIDMWHR

RNS Number : 4601T

Warehouse REIT PLC

15 November 2023

15 November 2023

Warehouse REIT plc

(the "Company" or "Warehouse REIT", together with its

subsidiaries, the "Group")

Resilient occupier market and active asset management supports

leasing momentum and valuation uplift, providing a strong platform

to drive rents and earnings

Neil Kirton, Chairman of Warehouse REIT commented:

"In June we set out a plan to drive earnings by capturing

portfolio reversion, selling non-core assets to reduce expensive

debt and progressing Radway Green. We have made good progress. Our

focus on multi-let industrials where demand is resilient and supply

is tight has supported further leasing momentum; we have delivered

asset sales significantly ahead of book value and strengthened the

balance sheet with 88% of our debt now hedged.

"A consensus is emerging that interest rates will remain 'higher

for longer' and we are managing our business accordingly. Key to

this is delivering value for shareholders at Radway Green, which is

a highly attractive development but not one we will undertake

alone. We have therefore launched a process for a sale of the

whole, or a majority, of the asset, which will enable the business

to focus on what it does well - active asset management. This is

also the most effective way to deliver sustainable earnings growth

over the long term."

Portfolio valuation increase driven by ERV growth, with

valuation yields stable

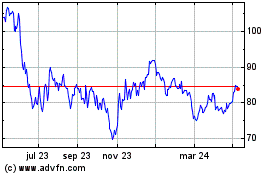

-- Like-for-like portfolio valuation increased 1.0% to GBP811.3

million (31 March 2023: GBP828.8 million)

o Yields broadly flat, with like-for-like growth in estimated

rental values of 2.8% benefitting from our leasing activity;expect

ERV growth for the year of 5-6%

-- EPRA NTA per share up 0.9% to 123.7p (31 March 2023: 122.6p)

with a total accounting return of 3.5%

Leasing activity capturing reversion, driving rents 31.8% ahead

of previous rents

-- 48 lease events over 0.5 million sq ft securing GBP3.4

million in contracted rent, including:

o GBP0.7 million from 23 new lettings, 21.5% ahead of previous

contracted rent;

o GBP0.9 million from 15 renewals, 36.7% ahead of previous

contracted rent; and

o GBP1.8 million from 10 rent reviews, 32.4% ahead of previous

contracted rent

-- 1.7% like-for-like growth in contracted rents, with 11.7%

portfolio reversion as at 30 September 2023

-- Occupancy stable at 96.0% with c.98.0% of HY24 rent already collected

-- Post period-end, a further 14 lease events over 0.7 million

sq ft, 20.5% ahead of previous contracted rent taking like-for-like

growth in contracted rents to 3.4% for the first seven months

Targeted disposal plan well progressed, capitalising on pockets

of demand with sales ahead of book

-- GBP39.6 million of non-core asset sales completed, 20.1%

ahead of March 2023 book value; generating GBP5.4 million of

profit

-- Total sales of GBP94.3 million since disposal plan announced in November 2022

-- Evaluating options to deliver value at Radway Green, Crewe to further reduce debt

-- GBP21.0 million of debt repaid during the period and GBP7.8

million allocated to value-enhancing capital expenditure

initiatives

Robust financial performance and sound financial management

-- Operating profit up 1.5% to GBP17.3 million (30 Sept 2022:

GBP17.0 million), reflecting leasing momentum and reduction in

total cost ratio of 440 basis points to 23.2%

-- Adjusted earnings of GBP9.8 million (30 Sept 2022: GBP11.1

million), primarily reflecting increased debt costs

-- Adjusted EPS of 2.3p (30 Sept 2022: 2.6p)

-- Dividend maintained at 3.2p; dividend cover expected to

improve as ongoing asset management initiatives conclude; fully

cash covered when profits on disposals included

-- GBP320.0 million of debt refinanced with more favourable

covenants and additional interest rate caps of GBP50.0 million

acquired; 87.7% of debt hedged against interest rate volatility

with no major refinancing until 2028

-- LTV at 34.0%, with significant headroom of GBP35.0 million in cash and available facilities

Progressing our sustainability strategy

-- 64.1% of the portfolio now EPC A-C rated (31 March 2023: 60.2%)

Financial highlights

Six months to 30 September 2023 2022

Gross property income GBP23.3m GBP24.1m

------------- -----------

Operating profit before change in GBP17.3m GBP17.0m

value of investment properties

------------- -----------

IFRS profit/(loss) before tax GBP22.0m (GBP46.4m)

------------- -----------

IFRS earnings per share 5.2p (10.9p)

------------- -----------

EPRA earnings per share 1.0p 2.6p

------------- -----------

Adjusted earnings per share 2.3p 2.6p

------------- -----------

Dividends per share 3.2p 3.2p

------------- -----------

Total accounting return 3.5% (9.9%)

------------- -----------

Gross to net rental income ratio 95.1% 94.1%

------------- -----------

Total cost ratio 23.2% 27.6%

------------- -----------

As at 30 September 31 March

2023 2023

------------- -----------

Portfolio valuation GBP811.3m GBP828.8m

------------- -----------

IFRS net asset value GBP536.8m GBP528.5m

------------- -----------

IFRS net asset value per share 126.4p 124.4p

------------- -----------

EPRA net tangible assets ("NTA") per

share 123.7p 122.6p

------------- -----------

Loan to value ("LTV") ratio 34.0% 33.9%

------------- -----------

Investment portfolio statistics

As at 30 September 31 March

2023 2023

Contracted rent GBP43.8m GBP45.3m

------------- ----------

ERV GBP52.0m GBP53.3m

------------- ----------

Passing rent GBP41.3m GBP41.2m

------------- ----------

WAULT to expiry 5.2 years 5.5 years

------------- ----------

WAULT to first break 4.4 years 4.5 years

------------- ----------

EPRA topped up yield 5.5% 5.5%

------------- ----------

Equivalent yield 6.3% 6.5%

------------- ----------

Occupancy 96.0% 95.8%

------------- ----------

Meeting

A meeting for professional investors and analysts will be held

at 9.00am on 15 November 2023 at the offices of FTI Consulting, 200

Aldersgate, London EC1A 4HD. Registration is required for this

event, please email FTI Consulting at

warehousereit@fticonsulting.com should you wish to attend.

The results presentation will also be available in the Investor

Centre section of the Group's website.

Enquiries

Warehouse REIT plc

via FTI Consulting

Tilstone Partners Limited

Simon Hope, Peter Greenslade, Paul Makin, Jo Waddingham

+44 (0) 1244 470 090

G10 Capital Limited (part of the IQEQ Group, AIFM)

Maria Baldwin

+44 (0) 207 397 5450

FTI Consulting (Financial PR & IR Adviser to the

Company)

Dido Laurimore, Richard Gotla

+44 (0) 7904 122207 / WarehouseReit@fticonsulting.com

Further information on Warehouse REIT is available on its

website: warehousereit.co.uk

Notes

Warehouse REIT is a UK Real Estate Investment Trust that invests

in UK warehouses, focused on multi-let assets in industrial hubs

across the UK.

We provide a range of warehouse accommodation in key locations

which meets the needs of a broad range of occupiers. Our focus on

multi-let assets means we provide occupiers with greater

flexibility so we can continue to match their requirements as their

businesses evolve, encouraging them to stay with us for longer.

We invest in our business by selectively acquiring assets with

potential and by delivering opportunities we have created. Through

pro-active asset management we unlock the value inherent in our

portfolio, helping to capture rising rents and driving an increase

in capital values to deliver strong returns for our investors over

the long term.

Sustainability is embedded throughout our business, helping us

meet the expectations of our stakeholders today and futureproofing

our business for tomorrow.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager ("AIFM"). The AIFM and the

Investment Manager is currently G10 Capital Limited (Part of the

IQEQ Group).

Forward-looking statements

Certain information contained in these half-year results may

constitute forward-looking information. This information relates to

future events or occurrences or the Company's future performance.

All information other than information of historical fact is

forward-looking information. The use of any of the words

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "should", "believe", "predict" and "potential"

and similar expressions are intended to identify forward-looking

information. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that this

information will prove to be correct, and such forward looking

information included in this announcement should not be relied

upon. Forward-looking information speaks only as of the date of

this announcement.

The forward-looking information included in this announcement is

expressly qualified by this cautionary statement and is made as of

the date of this announcement. The Company and its Group do not

undertake any obligation to publicly update or revise any

forward-looking information except as required by applicable

securities laws.

Chairman's statement

When we announced our full-year results in June, we reiterated

our focus on driving earnings through capturing the reversion in

our portfolio, reducing the variable rate element of our debt and

delivering value at our Radway Green development in Crewe. We are

pleased to be reporting good progress against these targets with

0.5 million sq ft of leasing activity, GBP39.6 million of asset

sales completed, and a GBP320 million debt refinancing, extending

the term and improving the covenants on our debt. Radway Green is

an outstanding development opportunity but in the current

environment, our focus is on extracting value from it in the near

term.

Our leasing activity over the six months has generated an

additional GBP1.2 million in rent, bringing contracted rent to

GBP43.8 million as at 30 September 2023 with a like-for-like

increase of 1.7% for the six-month period. New lettings have been

achieved on average 21.5% ahead of previous rent while renewals and

rent reviews were 36.7% and 32.4% ahead respectively. This is a

good performance and reflects both the expertise of the Tilstone

team as well as our focus on multi-let industrial space. Ours is a

scarce asset class with new development constrained by a strict

planning environment and with average capital values of GBP92.4 per

sq ft well below rebuild cost, new development is rarely economic.

At the same time, it appeals to a broad spectrum of occupier, from

light industrial, to technology, warehousing and e-commerce. This

is reflected in our occupier base which comprises businesses across

a range of industries and is a key advantage from a risk

diversification perspective.

We have been particularly pleased with the performance of

Bradwell Abbey, Milton Keynes which we acquired 15 months ago. An

undermanaged estate in an emerging economic hub, it is an excellent

case study of what we do well. Following a partial refurbishment,

we are now achieving top rents of c. GBP10 psf on the largest units

ranging up to GBP19 psf on the smaller units; this compares to

average rents of GBP7.89 per sq ft on acquisition. Our improvements

have also increased EPC A-C rated space to 71% from 38% at

acquisition.

The context for the half year has been an uncertain economic

environment with perhaps some greater clarity over peak interest

rates tempered by the growing 'higher for longer' perspective.

Against this backdrop, we have prioritised optimising the balance

sheet to enable the business to focus on its competitive advantage

in asset management and with that in mind, we are evaluating our

options with respect to Radway Green. With potential for over 1.8

million sq ft, this is an exceptionally well-located logistics

development opportunity, just 1.5 miles from Junction 16 of the M6.

We assembled the site through a series of acquisitions starting in

2017 and we achieved full planning consent during the period,

making this a highly attractive opportunity for asset owners or

developers with a low cost of capital. In the current environment,

it would not be prudent to progress this development using our own

balance sheet. In addition, the pre-let we were close to signing at

the start of the period has now fallen away as the proposed

occupier required the space sooner than originally envisaged. While

disappointing not to be progressing this development as planned, we

consider a sale of the whole or a majority of the scheme to be in

the best interests of shareholders and have therefore launched a

formal process to deliver this. We will update the market as

appropriate.

The Board is alert to all opportunities to deleverage, but not

at any price. We have completed on the sale of GBP39.6 million of

properties since 1 April 2023, all of which are non-core or where

we have successfully delivered on our asset management initiatives.

Sales were on average 20.1% ahead of book value, demonstrating that

there are pockets of demand for well-let and well-located

industrial assets. This continuing programme of disposals not only

strengthens our balance sheet, but also progresses the reshaping of

our portfolio, increasing our weighting towards multi-let assets in

leading industrial hubs.

Financial performance

We reported a 1.5% increase in operating profits before

interest, reflecting the impact of disposals, offset by our

successful leasing activity and a fall in overall operating

expenditure. However, with SONIA increasing 300 basis points since

1 October 2022, adjusted earnings per share fell 11.5% to 2.3 pence

(H1 FY22: 2.6 pence).

Yields have continued to stabilise and were broadly flat in the

period. ERV growth across the portfolio was 2.8%, demonstrating the

continuing attraction of our assets and driving an increase of 1.0%

in the like-for-like value of our portfolio to GBP811.3 million.

EPRA NTA per share increased 0.9% to 123.7 pence (31 March 2023:

122.6 pence), contributing to a total accounting return of 3.5%.

Reflecting our very strong performance in the years following IPO,

our average total accounting return is 7.8% per annum.

We took further steps to optimise our capital structure in June

2023 by refinancing our previous GBP320 million facility and

extending the tenure from January 2025 to June 2028. The new

facility comprises a GBP220 million term loan and a GBP100 million

revolving credit facility with a club of four lenders; HSBC, Bank

of Ireland, NatWest and Santander. It was agreed with more

favourable covenants, reflecting the strength of our banking

relationships as well as the quality of our portfolio.

Last year, we acquired GBP200 million of interest rate caps,

fixing SONIA at 1.5% and in November this year, we are replacing

the GBP30 million of caps expiring this month with GBP50 million of

caps, fixing SONIA at 2.0% and effectively hedging 87.7% of our

debt.

These measures significantly reduce the risk that earnings are

impacted by changes in the cost of finance, providing greater

confidence in our earnings trajectory.

As at 30 September 2023, the Group's loan to value remains

within our target range of 30% to 40%, at 34.0%, with GBP35.0

million of headroom within our new facilities.

Environmental, social and governance

ESG considerations are now firmly embedded in the way we do

business. Last year, we set out an annual commitment to reduce our

Scope 1 and 2 emissions by 4.2%, but we also recognise that we have

a key role to play in helping our occupiers to reduce their

emissions. Accurately measuring Scope 3 emissions is an important

first step and one we are focused on this year. Our close

engagement with occupiers and the steps we have taken to introduce

green leases encouraging data sharing wherever possible are already

having a positive impact in this regard. We have delivered good

progress on EPCs with 64% of the portfolio now rated EPC A - C by

sq ft, up from 60% at the start of the period.

As previously announced, Martin Meech stepped down from the

Board at the Annual General Meeting ('AGM') in September 2023. He

has made a very significant contribution to our development as a

listed company, and we wish him well for the future. Following a

comprehensive search, Dominic O'Rourke joined the Board as a

Non-Executive Director, also in September. He is currently Group

Property Director for FTSE 100 retailer Next plc, a role he has

held since 2014. His customer-facing experience in a sector that is

key for our business will be a highly positive and complementary

addition to the Board's expertise.

Outlook

Since I last wrote to you, interest rate expectations have

shifted. While peak rates may be in sight, the expectation is that

they will remain higher for longer, which inevitably has

implications for how we, and our peers, run our businesses.

Successfully restructuring our debt was the key balance sheet event

in the first half of the year and positions us well for the second

half, where our focus is on rebuilding dividend coverage. We have a

clear plan to achieve this, which includes capturing the reversion

in our portfolio, actively seeking a majority partner for or sale

of our Radway Green development and further reducing our finance

costs through asset sales and active financial management. We have

real conviction in this plan and that underpins our recommendation

to pay a second interim dividend of 1.6 pence, taking the total

dividend for the period to 3.2 pence, in line with last year.

The Board also believes that our focus on multi-let space in key

industrial hubs in the UK is one of the best places to be in real

estate. We benefit from supportive long-term trends, including

online retail and supply chain resilience but we also cater for a

broad range of other industries, reflecting our presence in

economically relevant centres in the UK. This diversity helps

protect our income and with a 'higher for longer' environment also

posing challenges for our occupiers, is a key benefit of our

business model. While we recognise there is an elevated risk around

tenant default, we are managing that appropriately, and we do

expect attractive levels of rental growth to continue across our

markets albeit at a lower, more sustainable level than in prior

years. Based on our recent trading, we would expect ERV growth for

the year to be in the region of 5-6%.

In conclusion, we firmly believe in the quality of our assets

and their potential to deliver an attractive total return over the

long-term but are also examining more immediate opportunities to

drive returns for shareholders. We set these priorities both as a

Board and significant shareholders ourselves.

Neil Kirton

Chairman

14 November 2023

Investment Advisor's report

Overview

This was a good period for the Group from an operational

perspective, with positive leasing momentum and low vacancy

contributing to a solid trading performance and uplift in

valuation. However, increased interest costs due to the 300 basis

point increase in SONIA since 1 October 2022 resulted in an 11.5%

reduction in adjusted earnings per share to 2.3p.

FY'24 priorities

At the start of the financial year, we set ourselves four

priorities. These were to:

-- continue to capture the reversionary potential of the portfolio,

-- dispose of further assets, to pay down the Group's floating

rate debt, strengthening the balance sheet and supporting

earnings;

-- progress the Radway Green development scheme; and

-- increase dividend cover by driving earnings through these actions.

We made good progress against the first two objectives in the

period which position the Group well for improving dividend cover,

our fourth objective. We are evaluating a range of options with

regards to Radway Green which will enable us to make further

progress on this in the coming period. More information can be

found in the relevant sections below.

Market overview

The long-term trends underpinning the wider industrial market,

including the dominance of e-commerce and focus on supply chain

resilience continue to play out albeit demand was more muted at the

big box end of the market, with take up back to pre-Covid averages

at 12.5 million sq ft for the six months to June (source: Savills).

Multi-let assets increasingly attract a broad range of uses

including innovation / technology, trade counters, retail,

quasi-office and business storage meaning the occupier pool is more

diverse and demand more resilient.

Void rates across the multi-let space have ticked up marginally

over the period to 8.2% for London and the South-east and 8.7% for

the rest of the UK (source: Gerald Eve) but remain well below

historic averages of 9.3% and 10.8% respectively. In London and the

South-east, where there is more reversion to capture and occupier

covenants are strong, landlords appear happy to hold out for the

right occupier rather than compromising on rents, explaining part

of the increase in vacancy. Vacancy is also notably lower in the

North-west, West and East Midlands at 6% or less.

For multi-let assets, where build cost per sq ft is typically

above capital value, new development is uneconomic in many regions.

Gerald Eve estimates that there is only 3.2 million sq ft of

multi-let space under construction with at most only 0.5 million sq

ft in any one region, having relatively limited impact on supply.

The higher cost of finance makes profitable development highly

challenging for all but those with the lowest cost of capital and

Savills report that in the big box space, there have been just 22

speculative announcements in the first half of the year compared to

39 over the comparable period last year. These dynamics are

supportive for long-term rental growth; multi-let ERVs are

estimated to be growing at an annualised rate of 7.0% in London and

the Southeast and 7.8% across the rest of the UK as at Q1 2023.

Having adjusted rapidly in the prior reporting period,

industrial yields have now effectively stabilised. This has been

driven by increased confidence in the prime end of the market and

supported by the weight of global equity which continues to target

the industrial space reflecting relatively attractive forward total

return prospects at 5.8% annualised for 2023-5, ahead of retail and

offices.

Actively managing the investment portfolio

The Group is highly focused on multi-let estates, which offer

more asset management opportunities than single-let assets,

creating more opportunities to raise the rental tone and therefore

more quickly capture the reversion created, while reducing risk by

having a more diverse range of occupiers. Multi-let assets are also

more flexible for occupiers, allowing them to scale up or down by

taking different units on the site. At 30 September 2023, multi-let

estates made up 70.4% of the portfolio by value (excluding

development land). The portfolio is spread across key economic hubs

such as the North-west, Midlands and Oxford-Cambridge Arc, in

gateway locations with access to major arterial routes and a

plentiful local labour force.

We keep the portfolio under constant review, to identify mature

or non-core assets that are candidates for disposal. This allows

the Group to pay down debt or redeploy the capital and better

focuses the portfolio on its most attractive opportunities. During

the first half, the Group disposed of five assets for GBP39.6

million, overall 20.1% ahead of book value. This brings total

disposals since our disposal plan was announced in November 2022 to

GBP94.3 million.

Disposals during in the period included Dales Manor Business

Park, Cambridge for GBP27.0 million, and smaller assets in Ipswich,

Ellesmere Port, the Isle of Wight and Cardiff. The disposals were

at a blended NIY of 5.3% and crystallised a profit of GBP5.4

million above 31 March 2023 valuations. We continue to be focused

on capital recycling and expect to make further progress in the

second half.

Following these disposals, the investment portfolio comprised

647 units across 8.0 million sq ft of space at the period end (31

March 2023: 693 units across 8.2 million sq ft). The table below

analyses the portfolio as at 30 September 2023:

Value Occupancy NIY NEY (%) Average ERV Capital

(GBPm) by ERV (%) rent (GBP value

(%) (GBP per (GBP

per sq ft) per

sq ft) sq ft)

----------------- -------- ---------- ----- -------- -------- -------- --------

Multi-let

more than

100k sq ft 367.1 94.8 5.6 6.3 5.77 6.55 89.43

Multi-let

less than

100k sq ft 150.4 96.1 6.1 6.7 6.68 7.33 97.79

Single-let

regional

distribution 129.6 100.0 5.2 5.8 5.22 5.95 93.86

Single-let

last mile 87.6 95.1 5.2 6.5 5.97 7.37 94.21

Total 734.7 96.0 5.6 6.3 5.87 6.69 92.37

Development

land 76.6

----------------- -------- ---------- ----- -------- -------- -------- --------

Total portfolio 811.3

----------------- -------- ---------- ----- -------- -------- -------- --------

At the period-end, the contracted rent roll for the investment

portfolio (excluding developments) was GBP43.8 million. The

estimated rental value (ERV) was GBP52.0 million, with the

difference reflecting GBP6.1 million of portfolio reversion and

GBP2.1 million of potential rent on vacant space. The structure of

the Group's leases supports capturing reversion, with less than 9%

of leases index linked. During the period we captured GBP0.4

million of reversion and GBP0.5 million from letting vacant space

with a further GBP0.5 million of reversion captured since 30

September 2023. More information can be found in the Leasing

Activity section below. Contracted rent from development property

was GBP0.2 million as at 30 September 2023. Total contracted rents

increased by 1.7% on a like-for-like basis during the period or

4.7% in the past 12 months.

The NIY of the Investment portfolio was 5.6% at 30 September

2023, with a reversionary yield of 6.6%. The WAULT for the

investment portfolio stood at 5.2 years (31 March 2023: 5.5

years).

Occupancy across the investment portfolio remained high at 96.0%

at the period-end (31 March 2023: 95.8%). Effective occupancy,

which excludes units under offer or undergoing refurbishment was

98.0% (31 March 2023: 98.4%), with 1.0% of the investment portfolio

under offer and a further 1.0% undergoing refurbishment at that

date.

Working with occupiers

The Group has a diverse occupier base of over 440 businesses,

with the top 15 accounting for 36.2% of the contracted rent roll

from the investment portfolio, and the top 100 generating 77.7%.

The spread of the Group's occupiers across industries and business

sizes means it is not reliant on any one occupier or industry. This

increases the Group's resilience and helps to mitigate financial

and leasing risks.

We monitor the strength of the occupier" covenants using credit

software such as Dun & Bradstreet, keeping us informed of what

impact evolving macro-economic conditions are having on their

business. During the period, we also ran a formal occupier survey,

with responses from around 50% of major occupiers. This showed that

trading conditions were the same, or better, for most respondents,

although they identified rising costs as an issue. Informal

discussions with occupiers also suggest that the very smallest

businesses may be finding it harder to adapt to higher costs, due

to lower pricing power in their markets.

Overall, the Group's occupiers appear well placed in the current

environment, and we have not yet seen a rise in corporate failures

or issues with rent collection escalate. As at 14 November 2023, we

had collected c.98.0% of the rent due in respect of the period and

we expect this to increase as we work with occupiers to collect the

outstanding amounts.

Leasing activity

The robust occupier demand described above has helped us to

continue to capture reversion in the portfolio through lease

renewals and new lettings. New leases were in line with ERVs, while

lease renewals and rent reviews are achieving strong average

uplifts against previous rental levels.

New leases

The Group completed 23 new leases on 0.1 million sq ft of space

during the period, which will generate annual rent of GBP0.7

million, 21.5% ahead of the previous contracted rent and in-line

with 31 March 2023 ERV. The level of incentives remained steady

over the period compared to the prior period.

Highlights included new leases for:

-- 20,700 sq ft at Delta Court Industrial Estate, Doncaster, to

a building and DIY supplier, on a five-year lease, at a rent of

GBP138,700 per annum, 15.7% ahead of previous contracted rent and

12.0% ahead of 31 March 2023 ERV. The letting is also the third

expansion by the occupier on the estate; and

-- 6,800 sq ft at Granby Industrial Estate, Milton Keynes, to an

event management company, on a ten-year term at a rent of

GBP57,400, 42.2% ahead of previous contracted rent and 6.3% above

the 31 March 2023 ERV.

Lease renewals

The Group continues to retain the majority of its occupiers,

with 79.0% remaining in occupation at lease expiry and 94.1% with a

break arising in the period.

There were 15 lease renewals on 0.1 million sq ft of space

during the period, generating an additional GBP0.2 million per

annum, 36.7% above the previous passing rent, and 7.8% above the

ERV.

Highlights included:

-- 21,100 sq ft at South Fort Street Edinburgh, across three

units, securing GBP200,200 of contracted rent at an average of

30.1% ahead of previous contracted rent and 5.5% ahead of 31 March

2023 ERV; and

-- 12,400 sq ft at Bradwell Abbey, Milton Keynes, across four

units, securing GBP120,000 of contracted rent at an average of

35.6% ahead of previous contracted rent and in-line with 31 March

2023 ERV.

Rent reviews

During the period, ten rent reviews were completed, generating

an additional GBP0.4 million per annum, 32.4% ahead of previous

rent and 12.1% ahead of the March 2023 ERV.

Highlights included:

-- two leases at Chittening Industrial Estate, Bristol, which

were settled at GBP390,000, 51.0% ahead of the previous contracted

rent, and 3.2% ahead of 31 March 2023 ERV; and

-- one lease at Howley Park Industrial Estate, Morley, settled

at GBP304,500, 31.5% ahead of the previous contracted rent and

15.0% ahead of the 31 March 2022 ERV.

Development activity

Radway Green is the Group's key logistics development

opportunity, in a premier location just 1.5 miles from Junction 16

of the M6 near Crewe. Targeting BREEAM Excellent, it will provide

state-of-the-art, sustainable warehouse space suitable for a

diverse range of occupiers.

The development has the potential to deliver 1.8 million sq ft

of space, across two phases. During the period, we discharged the

pre-commencement planning conditions on the 0.8 million sq ft Phase

1, allowing the contractor to start enabling and site clearance

works, to create a levelled and serviced plot. The Group also

achieved full planning permission on the remaining 1.0 million sq

ft Phase 2 having executed the s106 requirements during the first

half.

In June 2023, the Group announced that it was in discussions for

a pre-let on part of Phase 1; the proposed occupier is trading very

well and since that time has seen an acceleration in its timetable

which cannot be accommodated at Radway Green. As a result, the

pre-let has fallen away. The Group is currently evaluating a number

of options to deliver value for shareholders from this scheme which

include a sale of the whole, or a majority, of the asset but in any

event will not progress the development alone.

Capital expenditure

On average, the Group aims to invest around 0.75% of its gross

asset value ("GAV") in capital expenditure each year. This excludes

development projects and is therefore based on GAV excluding

developments. Total capital expenditure in the period was GBP2.2

million, equivalent to 0.3% of GAV excluding developments. At the

period-end, approximately 1.0% of the portfolio's ERV was under

refurbishment (31 March 2023: 1.3%). The Group's priorities when

investing in the portfolio are to drive rental growth, improve EPC

ratings and deliver other ESG improvements; approximately 20.0% of

capex spend is typically directed towards EPC-related improvements

and satisfies a minimum return of 10.0% from new capital

deployed.

Sustainability

The Group's sustainability strategy focuses on creating a

resilient portfolio, reducing the Group's carbon footprint,

supporting the Group's occupiers, and ensuring we have responsible

business foundations. We made good progress against each part of

the strategy during the first half of the financial year.

Creating a resilient portfolio

For FY24, the Group's targets include a 25% reduction in

properties with Energy Performance Certificate ("EPC") ratings of D

or E. During the first half, we reduced the number of D and E

ratings across the portfolio by c.10% both by number of units and

by square footage (on a like-for-like basis). By the period-end,

the proportion of units with A to C ratings had risen from 60.2% to

64.1%. Examples of progress include nine units at Bradwell Abbey

improving to B or C ratings. In total, we completed EPC assessments

on 85 units in the portfolio.

Reducing our footprint

In the prior year, we introduced Environmental Refurbishment and

Development Standards as part of our pathway to net zero. In the

first half of this year, we implemented a system to track

compliance with these standards.

We aim for all new utility contracts to be renewables-based and

the Group's property managers have continued to implement this

requirement.

Supporting our occupiers

We continue to engage with occupiers on sustainability matters,

to understand their issues and identify how we can work together to

address them. We ran an in-depth occupier survey at Bradwell Abbey,

Milton Keynes, which highlighted reducing energy use, LED lighting,

recycling and employee wellbeing as among their key issues. In

response to this, we are prioritising energy efficient initiatives

as part of the Group's refurbishment programme as set out above,

and we have plans for a café on the site, expected to open by

Christmas. We are rolling out similar surveys at the Group's

largest assets in the second half.

Ensuring responsible business foundations

Activities during the period included a data protection audit,

which confirmed that the Group is low risk as it does not hold or

process any sensitive data, as well as identifying some areas for

improvement.

We have also updated the Group's Modern Slavery statement and

created a supplier appointment checklist, which we are integrating

into the business. The checklist helps us to understand suppliers'

ESG credentials and ensure they are taking appropriate measures in

areas such as Modern Slavery.

We were also delighted to achieve an EPRA sBPR gold award for

the third year running, confirming our continuing dedication to

best practice sustainability reporting.

Financial review

Performance

Rental income for the period was GBP22.2 million (six months

ended 30 September 2022: GBP22.9 million), reflecting asset

disposals in the period and in the prior year, partially offset by

EPRA like-for-like rental growth of 1.3% and a full period of

ownership of Bradwell Abbey, which the Group acquired halfway

through the comparator period.

The Group's operating costs include its running costs (primarily

the management, audit, company secretarial, other professional, and

Directors' fees), and property-related costs (including legal

expenses, void costs and repairs). Total operating costs for the

six months were GBP8.7 million (six months ended 30 September 2022:

GBP10.0 million), with the cost base benefiting from a reduction in

the Investment Advisor's fee of GBP1.0 million and lower vacancy

costs. The net increase in the expected credit loss allowance was

low at GBP0.2 million (six months ended 30 September 2022: GBP0.1

million).

The total cost ratio, which is the adjusted cost ratio including

direct vacancy costs, was 23.2% (six months ended 30 September

2022: 27.6%). The ongoing charges ratio, representing the costs of

running the REIT as a percentage of NAV, was 1.4% (six months ended

30 September 2022: 1.3%).

The Group disposed of five assets in the period, resulting in a

net profit on disposal of GBP5.4 million.

At 30 September 2023, the Group recognised a gain of GBP6.8

million on the revaluation of its investment properties (six months

ended 30 September 2022: loss of GBP73.4 million), reflecting the

stabilisation of yields in the period and an increase in the

portfolio ERV of 2.8%.

Financing income in the period was GBP5.5 million (six months

ended 30 September 2022: GBP16.0 million), including GBP3.7 million

(six months ended 30 September 2022: GBP0.1 million) of interest

receipts from interest rate derivatives and a GBP1.6 million change

in the fair value of interest rate derivatives (six months ended 30

September 2022: GBP16.0 million).

Financing costs include the interest and fees on the Group's

revolving credit facility ("RCF") and term loan (see debt financing

and hedging). Total finance expenses were GBP13.0 million (six

months ended 30 September 2022: GBP5.9 million). The increase

primarily reflects the higher weighted average cost of debt, with

the SONIA reference rate having increased by 300 basis points

between the two periods. While the impact has been partly mitigated

by the interest rate caps taken out in the previous financial year

(see below), the all-in cost of debt for the period was 4.7% (six

months ended 30 September 2022: 2.8%). We aim to continue to reduce

the Group's variable-rate debt through further asset disposals.

Finance expenses in the period also included GBP1.7 million

relating to the accelerated amortisation of loan issue costs as a

result of the debt refinancing in the period (see below).

The statutory profit before tax was GBP22.0 million (six months

ended 30 September 2022: GBP46.4 million loss).

The Group has continued to comply with its obligations as a REIT

and the profits and capital gains from its property investment

business are, therefore, exempt from corporation tax. The

corporation tax charge for the period was therefore GBPnil (six

months ended 30 September 2022: GBPnil).

Earnings per share ("EPS") under IFRS was 5.2 pence (six months

ended 30 September 2022: 10.9 pence loss per share). EPRA EPS was

1.0 pence (six months ended 30 September 2022: 2.6 pence). Adjusted

earnings per share was 2.3 pence (six months ended 30 September

2022 (restated): 2.6 pence).

Dividends

The Company has declared the following interim dividends in

respect of the period:

Quarter to Declared Paid/to be Amount (pence)

paid

-------------- ---------------- ---------------- ---------------

30 June 2023 31 August 2023 6 October 2023 1.6

30 September 15 November 29 December

2023 2023 2023 1.6

Total 3.2

-------------------------------------------------- ---------------

The total dividend of 3.2 pence per share for the interim period

is in line with the Group's target for the year of 6.4 pence and

was 71.9% covered by adjusted EPS. Both interim dividends were

property income distributions. The cash cost of the total dividend

for the period will be GBP13.6 million (six months ended 30

September 2022: GBP14.0 million).

Valuation and net asset value

The portfolio was independently valued by CBRE as at 30

September 2023, in accordance with the internationally accepted

RICS Valuation - Global Standards 2020 (incorporating the

International Valuation Standards) (the "Red Book"), and the RICS

Valuation - Global Standards 2021 - UK national supplement.

The portfolio valuation was GBP811.3 million (31 March 2023:

GBP828.8 million), representing a 1.0% like-for-like valuation

increase or 1.3% valuation increase on the investment portfolio,

after taking account of capital expenditure of GBP7.8 million. The

EPRA NIY was 5.2% (31 March 2023: 5.0%) and the EPRA topped up NIY

was 5.5% (31 March 2023: 5.5%).

The valuation uplift contributed to an increase of 0.9% in the

EPRA NTA to 123.7 pence per share at the period-end (31 March 2023:

122.6 pence per share).

Debt financing and hedging

During the period, the Group refinanced its debt facilities,

extending the term and improving the covenants. The new GBP320.0

million facility comprises a GBP220.0 million term loan and a

GBP100.0 million RCF. It replaces the Company's previous GBP320.0

million debt facility and extends the tenure from January 2025 to

June 2028. The facility is provided by a club of four lenders:

HSBC, Bank of Ireland, NatWest and Santander. The minimum interest

cover is 1.5 times, compared to 2.0 times under the previous

facility, and the maximum LTV has been extended from 55% to 60%.

Both the term loan and the RCF attract a margin of 2.2% plus SONIA

for an LTV below 40% or 2.5% if the LTV is above 40%.

At 30 September 2023, GBP65.0 million was drawn against the RCF

and GBP220.0 million against the term loan. This gave total debt of

GBP285.0 million (31 March 2023: GBP306.0 million), with the Group

also holding cash balances of GBP9.5 million (31 March 2023:

GBP25.1 million). The LTV ratio at 30 September 2023 was therefore

34.0% (31 March 2023: 33.9%). Interest cover for the period was 3.1

times, meaning the Group was substantially within the covenants in

the debt facility.

At the period end, the Group had GBP230.0 million of interest

rate caps in place, of which GBP200.0 million fixed SONIA at 1.5%

and GBP30.0 million fixed SONIA at 1.75%. The GBP30.0 million

interest rate cap is due to expire in November 2023 and has been

replaced since the period end by a further cap of GBP50.0 million,

which fixes SONIA at 2.0% until November 2026.

We continue to explore opportunities to diversify the Group's

sources of debt funding, extend the average maturity of its debt

and further reduce the average cost of debt.

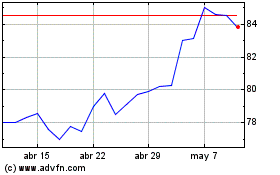

Post period-end activity

The Group completed a further 14 lease events over 0.7 million

sq ft, securing GBP4.1 million, 20.5% ahead of previous contracted

rent. Driven by a lease renewal of 71,000 sq ft at Kingsland

Grange, 42.3% ahead of prior rent, and a 500,000 sq ft rent review,

settled at GBP2.8m, 12.0% ahead of prior rent.

Principal risks and uncertainties

The principal risks facing the Group are documented on pages 60

to 64 of the Annual Report for the year ended 31 March 2023. Since

then, the Board has continued its regular review of risks and

emerging risks, including detailed consideration of those risks

that are most material to the Group and are recorded as its

principal risks.

During the period the Board has agreed an additional principal

risk, relating to the potential impact of a general economic

downturn on the warehouse market. This was already recognised as

one of the Group's business risks, but the Board considers that

changing economic conditions make it appropriate to now consider

this as one of the Group's principal risks.

Financial risks

-- Changes in interest rates could directly impact our cost of

capital, and indirectly may impact market stability.

-- It may become more difficult to raise funding through equity,

debt, or asset disposals, which may impact the Group's ability to

finance its activities and deliver growth.

Business risks

-- Returns may not be in line with our plans and forecasts, for

example because of an inappropriate investment strategy, poor

delivery of the strategy, or reduced capital valuations or rental

income.

-- The Group depends on the performance of its third-party

service providers, in particular the Investment Advisor, and poor

delivery by these providers could impact on the REIT's

performance.

-- Climate change may have an increasing impact across the

business, including adverse weather events, increasing utility

costs, and the potential for property values to be impacted.

-- A general economic downturn may have an impact on the

warehouse market, as current occupiers may struggle to cover costs

if business contracts; and potential occupiers may be less likely

to seek additional space or higher quality buildings.

Operational risks

-- A substantial increase in bad debts, arrears or slow payment

could have a direct impact on cash flow and profitability. It could

also negatively impact average lease lengths, void levels and

costs, resulting in reducing portfolio returns.

-- Inappropriate acquisitions could also increase risk in

relation to portfolio returns, as properties may be harder to let,

may not generate appropriate revenues, or may require additional

costs to support.

Compliance risks

-- Loss of REIT status, through failing to meet regulatory

requirements or the Listing Rules, would have a significant impact

on the Group's reputation and the financial returns for

investors.

-- Breaching the conditions of the Group's loan funding could

result in restrictions to funding and activities going forward. In

addition, the Board has approved and communicated the Group's

borrowing policy and breaching it may risk financial and reputation

damage.

Going concern

In preparing the financial statements, we, and the Company's

Board are required to assess whether the Group remains a going

concern. During the period, the Group generated gross property

income of GBP23.3 million and operating profits of GBP17.3 million,

showing that rents would have to fall by approximately 34.7% before

the business became loss-making. This is considered highly unlikely

given the high occupational demand for warehouse assets, the

Group's strong relationships with the broad range of occupiers

across the portfolio, the level of rent collection, and the fact

that the portfolio ERV exceeds the period-end contracted rent roll

by 15.7%.

At the same time, the Group has a strong balance sheet, with

substantial cash and headroom within its facilities at the

period-end of GBP35.0 million. The Group has refinanced its debt

facilities, extending the term by more than three years to June

2028, and at the date of this report has interest rate caps on

GBP250.0 million of debt.

We and the Company's Board have also carefully reviewed the risk

landscape and do not believe that the risks facing the Group have

materially increased. As a result, we are confident that the Group

remains a going concern.

Investment Manager

The Company is an alternative investment fund for the purposes

of the Alternative Investment Fund Managers Directive ("AIFMD")

and, as such, is required to have an Investment Manager who is duly

authorised to undertake that role. G10 Capital Limited ("G10") is

the Company's AIFM and Investment Manager and is authorised and

regulated by the Financial Conduct Authority.

Investment Advisor

Tilstone Partners Limited is Investment Advisor to the Company

and the Investment Manager.

Tilstone Partners Limited

14 November 2023

Directors' responsibilities statement

The Directors confirm to the best of our knowledge:

-- the condensed set of financial statements have been prepared

in accordance with IAS 34 'Interim Financial Reporting', and give a

true and fair view of the assets, liabilities, financial position

and profit of the Group, as required by DTR 4.2.4R;

-- the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the financial year);

and

-- the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

The directors of Warehouse REIT plc are listed on the company

website warehousereit.co.uk

By order of the Board.

Neil Kirton

Director

14 November 2023

Results for the six months ended 30 September 2023

Condensed consolidated statement of comprehensive income

(unaudited)

For the six months ended 30 September 2023

Six months Six months

ended ended

30 September 30 September

Notes 2023 2022

Continuing operations GBP'000 GBP'000

--------------------------------------------------------------- ----- ------------- -------------

Gross property income 3 23,291 24,140

Service charge income 3 2,669 2,901

Service charge expense 4 (2,785) (3,123)

--------------------------------------------------------------- ----- ------------- -------------

Net property income 23,175 23,918

Property operating expenses 4 (2,031) (2,341)

--------------------------------------------------------------- ----- ------------- -------------

Gross profit 21,144 21,577

Administration expenses 4 (3,857) (4,550)

--------------------------------------------------------------- ----- ------------- -------------

Operating profit before gains on investment properties 17,287 17,027

Profit/(loss) on disposal of investment properties 11 5,419 (84)

Fair value gain/(loss) on revaluation of investment properties 11 6,778 (73,362)

--------------------------------------------------------------- ----- ------------- -------------

Operating profit/(loss) 29,484 (56,419)

Finance income 5 5,471 16,038

Finance expenses 6 (12,986) (5,974)

--------------------------------------------------------------- ----- ------------- -------------

Profit/(loss) before tax 21,969 (46,355)

Taxation 7 - -

--------------------------------------------------------------- ----- ------------- -------------

Total comprehensive income/(loss) for the period 21,969 (46,355)

--------------------------------------------------------------- ----- ------------- -------------

EPS (basic and diluted) (pence) 10 5.2 (10.9)

--------------------------------------------------------------- ----- ------------- -------------

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated statement of financial position

(unaudited)

As at 30 September 2023

30 September 31 March

2023 2023

Notes GBP'000 GBP'000

------------------------------------------ ----- ------------ ---------

Assets

Non-current assets

Investment property 11 822,410 842,269

Interest rate derivatives 15 11,064 7,387

------------------------------------------ ----- ------------ ---------

833,474 849,656

------------------------------------------ ----- ------------ ---------

Current assets

Investment property held for sale 12 2,750 625

Cash and cash equivalents 13 9,542 25,053

Trade and other receivables 14 15,135 9,258

Interest rate derivatives 15 150 -

------------------------------------------ ----- ------------ ---------

27,577 34,936

------------------------------------------ ----- ------------ ---------

Total assets 861,051 884,592

------------------------------------------ ----- ------------ ---------

Liabilities

Non-current liabilities

Interest-bearing loans and borrowings 16 (281,015) (304,093)

Head lease liability 17 (13,871) (14,320)

Other payables and accrued expenses 18 - (11,300)

------------------------------------------ ----- ------------ ---------

(294,886) (329,713)

------------------------------------------ ----- ------------ ---------

Current liabilities

Other payables and accrued expenses 18 (20,781) (18,584)

Deferred income 18 (7,546) (7,115)

Head lease liability 17 (990) (705)

------------------------------------------ ----- ------------ ---------

(29,317) (26,404)

------------------------------------------ ----- ------------ ---------

Total liabilities (324,203) (356,117)

------------------------------------------ ----- ------------ ---------

Net assets 536,848 528,475

------------------------------------------ ----- ------------ ---------

Equity

Share capital 19 4,249 4,249

Share premium 275,648 275,648

Retained earnings 256,951 248,578

------------------------------------------ ----- ------------ ---------

Total equity 536,848 528,475

------------------------------------------ ----- ------------ ---------

Number of shares in issue (thousands) 424,862 424,862

------------------------------------------ ----- ------------ ---------

NAV per share (basic and diluted) (pence) 20 126.4 124.4

------------------------------------------ ----- ------------ ---------

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated statement of changes in equity

(unaudited)

For the six months ended 30 September 2023

Share Share Retained

capital premium earnings Total

Notes GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ----- ------- ------- -------- --------

Balance at 1 April 2022 4,249 275,648 459,057 738,954

----------------------------- ----- ------- ------- -------- --------

Total comprehensive loss - - (46,355) (46,355)

Dividends paid 9 - - (14,021) (14,021)

----------------------------- ----- ------- ------- -------- --------

Balance at 30 September 2022 4,249 275,648 398,681 678,578

----------------------------- ----- ------- ------- -------- --------

Balance at 1 April 2023 4,249 275,648 248,578 528,475

----------------------------- ----- ------- ------- -------- --------

Total comprehensive income - - 21,969 21,969

Dividends paid 9 - - (13,596) (13,596)

----------------------------- ----- ------- ------- -------- --------

Balance at 30 September 2023 4,249 275,648 256,951 536,848

----------------------------- ----- ------- ------- -------- --------

The accompanying notes form an integral part of these financial

statements.

Condensed consolidated statement of cash flows (unaudited)

For the six months ended 30 September 2023

Six months Six months

ended ended

30 30 September

September (Restated)

2023 2022

Notes GBP'000 GBP'000

------------------------------------------------------------------------- ----- ---------- -------------

Cash flows from operating activities

Operating profit/(loss) 29,484 (56,419)

Adjustments to reconcile profit/(loss) for the period to net cash flows:

(Profit)/loss from change in fair value of investment properties (6,778) 73,362

Realised (profit)/loss on disposal of investment properties (5,419) 84

Head lease asset depreciation 217 91

------------------------------------------------------------------------- ----- ---------- -------------

Operating cash flows before movements in working capital 17,504 17,118

Increase in other receivables and prepayments (6,155) (4,980)

(Decrease)/increase in other payables and accrued expenses (2,596) 2,086

Net cash flows generated from operating activities 8,753 14,224

------------------------------------------------------------------------- ----- ---------- -------------

Cash flows from investing activities

Acquisition of investment properties (5,560) (66,375)

Capital expenditure (3,710) (1,582)

Development expenditure (5,012) (2,847)

Purchase of interest rate caps (2,181) -

Interest received 3,188 1

Disposal of investment properties 38,458 4,603

------------------------------------------------------------------------- ----- ---------- -------------

Net cash generated from/(used in) investing activities 25,183 (66,200)

------------------------------------------------------------------------- ----- ---------- -------------

Cash flows from financing activities

Bank loans drawn down 306,000 65,000

Bank loans repaid (327,000) -

Loan interest and other finance expenses paid (10,000) (3,968)

Other finance expenses paid (99) -

Loan issuance fees (4,223) -

Head lease payments (529) (526)

Dividends paid in the period (13,596) (14,020)

Net cash flows (used in)/generated from financing activities (49,447) 46,486

------------------------------------------------------------------------- ----- ---------- -------------

Net decrease in cash and cash equivalents (15,511) (5,490)

Cash and cash equivalents at the start of the period 25,053 16,706

------------------------------------------------------------------------- ----- ---------- -------------

Cash and cash equivalents at the end of the period 13 9,542 11,216

------------------------------------------------------------------------- ----- ---------- -------------

The accompanying notes form an integral part of these financial

statements.

Notes to the condensed consolidated financial statements

(unaudited)

For the six months ended 30 September 2023

1. General information

Warehouse REIT plc (the "Company") is a closed-ended Real Estate

Investment Trust ("REIT") incorporated in England and Wales on 24

July 2017. The Company began trading on 20 September 2017. The

registered office of the Company is 65 Gresham Street, London EC2V

7NQ. The Company is admitted to trading on the Premium Listing

Segment of the Main Market, a market operated by the London Stock

Exchange.

2. Basis of preparation

These interim condensed consolidated unaudited financial

statements have been prepared in accordance with IAS 34 Interim

Financial Reporting and International Financial Reporting Standards

("IFRS") and interpretations issued by the International Accounting

Standards Board ("IASB") as adopted by the United Kingdom.

These interim condensed consolidated unaudited financial

statements should be read in conjunction with the Company's last

financial statements for the year ended 31 March 2023. These

interim condensed consolidated unaudited financial statements do

not include all of the information required for a complete set of

annual financial statements prepared in accordance with IFRS as

adopted by the UK; however, they have been prepared using the

accounting policies adopted in the audited financial statements for

the year ended 31 March 2023 and selected explanatory notes have

been included to explain events and transactions that are

significant in understanding changes in the Company's financial

position and performance since the last financial statements.

The financial statements have been prepared under the historical

cost convention, except for investment property and interest rate

derivatives, which have been measured at fair value. The interim

financial statements are presented in Pound Sterling and all values

are rounded to the nearest thousand pounds (GBP'000), except when

otherwise indicated.

The financial information contained within these interim results

does not constitute full statutory accounts as defined in section

434 of the Companies Act 2006. The financial statements for the six

months ended 30 September 2023 have not been either audited or

reviewed by the Company's Auditor. The information for the year

ended 31 March 2023 has been extracted from the latest published

Annual Report and Financial Statements, which has been filed with

the Registrar of Companies. The Auditor reported on those accounts;

its report was unqualified and did not contain a statement under

sections 498(2) or (3) of the Companies Act 2006.

The Directors have made an assessment of the Group's ability to

continue as a going concern and are satisfied that the Group has

the resources to continue in business for the foreseeable future,

for a period of not less than 12 months from the date of this

report. Furthermore, the Directors are not aware of any material

uncertainties that may cast significant doubt upon the Group's

ability to continue as a going concern.

2.1 Changes to accounting standards and interpretations

There were several new standards and amendments to existing

standards, which are required for the Group's accounting period

beginning on 1 April 2023, which have been considered and applied

as follows:

-- amendments to IAS 1 Presentation of Financial Statements; and

-- amendments to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors.

There was no material effect from the adoption of the

above-mentioned amendments to IFRS effective in the period. They

have no significant impact to the Group as they are either not

relevant to the Group's activities or require accounting, which is

already consistent with the Group's current accounting

policies.

2.2 Significant accounting judgements and estimates

The preparation of these financial statements in accordance with

IAS 34 requires the Directors of the Company to make judgements,

estimates and assumptions that affect the reported amounts

recognised in the financial statements. However, uncertainty about

these assumptions and estimates could result in outcomes that

require a material adjustment to the carrying amount of an asset or

liability in the future.

Judgements

In the course of preparing the financial statements, no

judgements have been made in the process of applying the Group's

accounting policies, other than those involving estimations, that

have had a significant effect on the amounts recognised in the

financial statements.

Estimates

In the process of applying the Group's accounting policies,

management has made the following estimate, which has the most

significant risk of material change to the carrying value of assets

recognised in the consolidated financial statements:

Valuation of property

The valuations of the Group's investment property are at fair

value as determined by the external valuer on the basis of market

value in accordance with the internationally accepted RICS

Valuation - Professional Standards 2020 (incorporating the

International Valuation Standards), in accordance with IFRS 13. The

key estimates made by the valuer are the ERV and equivalent yields

of each investment property and the land values per acre for

development properties. The valuers have considered the impact of

climate change and that this has not had a material impact on the

valuation at the current time. See notes 11 and 21 for further

details.

2.3 Restatement of financial statements

Following a review of the gross service charge income recognised

for the six months ended 30 September, it was noted that there was

an inconsistency in the methodology prescribed in the previous

year's annual financial statements. The comparative service charge

income and expenditure have been updated to reflect this, with no

change to net property income previously recognised.

In addition, during the six months ended 31 March 2023, the

licence fee previously levied over the land at Radway Green, Crewe

was renegotiated to commence upon construction of the site. The

comparative adjusted earnings have been updated to reflect the

change in negotiations.

2.4 Summary of significant accounting policies

The principal accounting policies applied in the preparation of

these financial statements are consistent with those applied within

the Company's Annual Report and Financial Statements for the year

ended 31 March 2023.

Basis of consolidation

The Company does not meet the definition of an investment entity

and, therefore, does not qualify for the consolidation exemption

under IFRS 10. The consolidated financial statements comprise the

financial statements of the Group and its subsidiaries as at 30

September 2023. Subsidiaries are consolidated from the date of

acquisition, being the date on which the Group obtained control,

and will continue to be consolidated until the date that such

control ceases. An investor controls an investee when the investor

is exposed, or has rights, to variable returns from its involvement

with the investee and has the ability to affect those returns

through its power over the investee. In preparing these financial

statements, intra--group balances, transactions and unrealised

gains or losses have been eliminated in full. All subsidiaries have

the same year-end as the Company. Uniform accounting policies are

adopted in the financial statements for like transactions and

events in similar circumstances.

Functional and presentation currency

The objective of the Group is to generate returns in Pound

Sterling and the Group's performance is evaluated in Pound

Sterling. Therefore, the Directors consider Pound Sterling as the

currency that most faithfully represents the economic effects of

the underlying transactions, events and conditions and have,

therefore, adopted it as the functional and presentation

currency.

Segmental reporting

The Directors are of the opinion that the Group is engaged in a

single segment of business, being the investment in and provision

of UK urban warehouses.

Derivative financial instruments

Derivative financial instruments, comprising interest rate

derivatives for mitigating interest rate risks, are initially

recognised at fair value, and are subsequently measured at fair

value, being the estimated amount that the Group would receive or

pay to terminate the agreement at the period-end date, taking into

account current interest rate expectations and the current credit

rating of the Group and its counterparties. Premiums payable under

such arrangements are initially capitalised into the statement of

financial position.

The Group uses valuation techniques that are appropriate in the

circumstances and for which sufficient data is available to measure

fair value, maximising the use of relevant observable inputs and

minimising the use of unobservable inputs significant to the fair

value measurement as a whole. Changes in fair value of interest

rate derivatives are recognised within finance expenses in profit

or loss in the period in which they occur.

3. Property income

Six months Six months

ended ended

30 September 30 September

2022

2023 (Restated)

GBP'000 GBP'000

---------------------- ------------ ------------

Rental income 22,245 22,941

Insurance recharged 854 827

Dilapidation income 192 372

---------------------- ------------ ------------

Gross property income 23,291 24,140

---------------------- ------------ ------------

Service charge income 2,669 2,901

---------------------- ------------ ------------

Total property income 25,960 27,041

---------------------- ------------ ------------

4. Property operating and administration expenses

Six months Six months

ended ended

30 September 30 September

2022

2023 (Restated)

GBP'000 GBP'000

---------------------------------------------------------- ------------ ------------

Service charge expenses 2,785 3,123

Premises expenses 922 953

Insurance 829 926

Rates 70 228

Utilities 35 103

Loss allowance on trade receivables 175 131

---------------------------------------------------------- ------------ ------------

Property operating expenses 2,031 2,341

---------------------------------------------------------- ------------ ------------

Investment Advisor's fees 2,820 3,804

Head lease asset depreciation 120 91

Directors' remuneration (including social security costs) 86 87

Other administration expenses 831 568

---------------------------------------------------------- ------------ ------------

Administration expenses 3,857 4,550

---------------------------------------------------------- ------------ ------------

Total 8,673 10,014

---------------------------------------------------------- ------------ ------------

5. Finance income

Six months Six months

ended ended

30 September 30

September

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ------------ ----------

Interest receivable on derivatives 3,697 74

Change in fair value of interest rate derivatives 1,646 15,963

Income from cash and short-term deposits 128 1

Total 5,471 16,038

-------------------------------------------------- ------------ ----------

6. Finance expenses

Six months Six months

ended ended

30 September 30

September

2023 2022

GBP'000 GBP'000

----------------------------------------------------------- ------------ ----------

Loan interest 10,857 4,850

Accelerated loan arrangement fees 1,688 -

Head lease interest 473 515

Loan arrangement fees amortised 457 527

Other finance costs 99 80

Bank charges 3 2

----------------------------------------------------------- ------------ ----------

13,577 5,974

Less: amounts capitalised on the development of properties (591) -

Total 12,986 5,974

----------------------------------------------------------- ------------ ----------

The interest capitalisation rate for the six months ended 30

September 2023 was 4.7%.

7. Taxation

Corporation tax has arisen as follows:

Six months Six months

ended ended

30 September 30

September

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ------------ ----------

Corporation tax on residual income for current period - -

----------------------------------------------------- ------------ ----------

Total - -

----------------------------------------------------- ------------ ----------

Reconciliation of tax charge to profit before tax:

Six months Six months

ended ended

30 September 30

September

2023 2022

GBP'000 GBP'000

----------------------------------------------------------------------------- ------------ ----------

Profit/(loss) before tax 21,969 (46,355)

----------------------------------------------------------------------------- ------------ ----------

Corporation tax at 25.0% (2022: 19.0%) 5,492 (8,807)

Change in value of investment properties (including gain/(loss) on disposal) (3,049) 13,939

Change in value of interest rate derivatives (412) (3,033)

Tax-exempt property rental business (2,031) (2,099)

----------------------------------------------------------------------------- ------------ ----------

Total - -

----------------------------------------------------------------------------- ------------ ----------

8. Operating leases

Operating lease commitments - as lessor

The Group has entered into commercial property leases on its

investment property portfolio. These non-cancellable leases have a

remaining term of up to 4.4 years.

Future minimum rentals receivable under non-cancellable

operating leases as at 30 September 2023 are as follows:

30 September 31

March

2023 2023

GBP'000 GBP'000

----------------------------- ------------ -------

Within one year 40,218 42,033

Between one and two years 33,818 33,340

Between two and three years 27,222 26,998

Between three and four years 22,362 22,360

Between four and five years 18,907 18,457

Between five and ten years 29,164 34,394

More than ten years 21,979 19,607

----------------------------- ------------ -------

Total 193,670 197,189

----------------------------- ------------ -------

9. Dividends

Pence

per

Six months ended 30 September 2023 share GBP'000

------------------------------------------------------------------------- ----- -------

Third interim dividend for year ended 31 March 2023 paid on 3 April 2023 1.60 6,798

Fourth interim dividend for year ended 31 March 2023 paid on 7 July 2023 1.60 6,798

Total dividends paid during the period 3.20 13,596

------------------------------------------------------------------------- ----- -------

Paid as:

Property income distributions 3.20 13,596

Ordinary dividends - -

------------------------------------------------------------------------- ----- -------

Total 3.20 13,596

------------------------------------------------------------------------- ----- -------

Pence per

Six months ended 30 September 2022 share GBP'000

-------------------------------------------------------------------------- --------- -------

Third interim dividend for year ended 31 March 2022 paid on 1 April 2022 1.55 6,585

Fourth interim dividend for year ended 31 March 2022 paid on 30 June 2022 1.75 7,436

Total dividends paid during the period 3.30 14,021

-------------------------------------------------------------------------- --------- -------

Paid as:

Property income distributions 3.30 14,021

Ordinary dividends - -

-------------------------------------------------------------------------- --------- -------

Total 3.30 14,021