Acri Capital Acquisition Corporation (NASDAQ: ACAC) (“Acri” or

“ACAC”), a Delaware incorporated special purpose acquisition

company listed on the Nasdaq Global Market, and Foxx Development

Inc. (“Foxx”), a Texas based consumer electronics and integrated

Internet-of-Things (IoT) solution company, today announced that

they have entered into a definitive business combination agreement

(the “Business Combination Agreement”) pursuant to which a newly

established subsidiary of Acri will become a publicly listed

company combining Acri and Foxx (the “Combined Company”) upon the

closing of the transaction contemplated therein (the “Proposed

Transaction”). Upon closing, the Combined Company expects to list

its common stock on Nasdaq.

Foxx, established in 2017 as a Texas incorporated company, is a

consumer electronics and integrated Internet-of-Things (IoT)

solution company catering to both retail and institutional clients.

With robust research and development capabilities and a strategic

commitment to cultivating long-term partnerships with mobile

network operators, distributors and suppliers around the world,

FOXX currently sells a diverse range of products including mobile

phones, tablets and other consumer electronics devices throughout

the United States, and is in the process of developing and

distributing end-to-end communication terminals and IoT

solutions.

“Acri's inception revolved around the goal of identifying and

partnering with companies led by visionary, mission-oriented

leadership teams who harness the technology and innovation to

disrupt thriving and expanding markets. In this context, Foxx is an

ideal fit, aligning with our criteria.” said “Joy” Yi Hua, CEO and

Chairwoman of Acri. “We are glad to forge a partnership with Foxx,

strengthening their financial foundation and enabling them to

pursue a diverse range of growth initiatives, including product

development, customer expansion, geographical reach, and industry

innovation."

Haitao Cui, CEO of Foxx, expressed his excitement regarding the

transaction, declaring, "Today's announcement marks an incredible

milestone for Foxx, and I am genuinely delighted with this

strategic partnership. Combining forces with Acri will

significantly accelerate our capacity to deliver products,

services, and solutions at scale, transforming the consumer

electronics and IoT solutions landscape. Foxx's vision revolves

around creating a world where technology seamlessly enriches

people's lives and revolutionizes the way we connect and interact

with our environment. We are poised to tap into an immense total

addressable market, where we have the potential to generate

substantial value for both our valued customers and investors.”

Key Transaction

Terms

As provided in the Business Combination

Agreement, the merger consideration is $50,000,000, payable by

newly-issued common stock of the Combined Company valued at $10.00

per share, among which 500,000 shares will be deposited into an

escrow account (i) to be released to the shareholders of Foxx

immediately prior to the closing (the “Foxx Stockholders”) if,

within one year of the Business Combination Agreement, the

Affordable Connectivity Program managed by the U.S. Federal

Communication Commission is reauthorized by the U.S. Congress with

funding of no less than $4 billion in total for the reauthorized

period, or (ii) otherwise to be cancelled without

consideration. Additional up to 4,200,000 shares of common

stock may be issued to Foxx Stockholders upon achievement of

certain financial performance milestones of the Combined Company

for the fiscal years ending June 30, 2024 and June 30,

2025.

Following the closing, assuming no redemption by

existing public stockholders of Acri, the Acri stockholders will

have approximately 51.98% equity interest in the Combined Company

and the Foxx Stockholders will have approximately 48.02% equity

interest in the Combined Company assuming there is no transaction

financing in connection with the Proposed Transaction. If, however,

there is a maximum redemption of existing public shareholders of

Acri (without consideration of the $5 million net tangible asset

requirements), the Acri shareholders will have approximately 30.13%

equity interest in the Combined Company and the Foxx Stockholders

will have approximately 69.87% equity interest in the Combined

Company.

The boards of directors of both Acri and Foxx

have unanimously approved the Proposed Transaction, which is

expected to be completed in the second quarter of 2024, subject to,

among other things, approval by the Acri stockholders and the Foxx

stockholders respectively, and satisfaction (or waiver, as

applicable) of the conditions provided in the Business Combination

Agreement, including regulatory approvals and other customary

closing conditions, including a registration statement in

connection with the Proposed Transaction being declared effective

by the U.S. Securities and Exchange Commission (the “SEC”) and the

listing application being approved by the Nasdaq Capital Markets

LLC.

Additional information about the Proposed

Transaction, including a copy of the Business Combination

Agreement, will be provided in a Current Report on Form 8-K to be

filed by Acri with the SEC and available at www.sec.gov. Additional

information about the Proposed Transaction will be described in the

Registration Statement, which Acri and/or its subsidiary will file

with the SEC.

Advisors

EF Hutton LLC is serving as capital markets

advisor to Acri, and Robinson & Cole LLP is serving as legal

counsel to Acri. VCL Law LLP is serving as legal counsel to

Foxx.

About Acri Capital Acquisition

Corporation

Acri Capital Acquisition Corporation is a blank

check company, also commonly referred to as a special purpose

acquisition company, or SPAC, formed for the purpose of

effecting a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with

one or more businesses with one or more businesses or entities,

provided that it will not undertake its initial business

combination with any entity being based in or having the majority

of its operations in China (including Hong Kong and Macau).

About Foxx Development

Inc.

Founded in 2017 as a Texas-incorporated entity, Foxx stands as a

distinguished player in the realm of consumer electronics and

integrated Internet-of-Things (IoT) solutions, catering to both

retail and institutional clients. Leveraging its robust research

and development capabilities, the company's strategic vision

focuses on forging enduring alliances with global mobile network

operators, distributors, and suppliers. This approach has

translated into a robust presence within the United States, where

the portfolio encompasses a diverse range of mobile phones,

tablets, and consumer electronics. Concurrently, Foxx is diligently

engaged in the development and distribution of end-to-end

communication terminals and an innovative suite of IoT solutions,

with the aim of positioning itself at the forefront of

technological advancement to shape the future of global

connectivity.

Additional Information about the Transaction and Where

to Find It

The proposed transaction has been approved by

the boards of directors of the ACAC, PubCo and Foxx, and will be

submitted to stockholders of the ACAC and the stockholders of Foxx

for their approval. In connection with such approval, PNAI intends

to file with the SEC the Proxy Statement/Prospectus. After the

Registration Statement that forms a part of the Proxy

Statement/Prospectus has been declared effective, the ACAC will

mail a definitive proxy statement and other relevant documents to

its stockholders as of the record date established for voting on

the proposed transaction. The ACAC stockholders are urged to read,

once available, the preliminary Proxy Statement/Prospectus and any

amendments thereto and the definitive Proxy Statement/Prospectus in

connection with the proposed transaction, as these materials will

contain important information about the ACAC, PubCo, Foxx and the

proposed Business Combination. ACAC stockholders will also be able

to obtain a free copy of the Proxy Statement/Prospectus, as well as

other filings containing information about the ACAC, without

charge, at the SEC’s website (www.sec.gov).

Participants in the Solicitation

The ACAC, PubCo, Foxx and their respective

directors and executive officers and other persons may be deemed to

be participants in the solicitation of proxies from the ACAC’s

stockholders with respect to the proposed Business Combination.

Information regarding the ACAC’s directors and executive officers

is available in the IPO Prospectus. Additional information

regarding the persons who may, under the rules of the SEC, be

deemed to be participants in the proxy solicitation relating to the

proposed Business Combination and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the Proxy Statement/Prospectus when it becomes

available.

No Offer or Solicitation

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any securities, or a

solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act of 1933, as

amended.

Forward-Looking Statements

This press release includes forward looking

statements that involve risks and uncertainties. Forward-looking

statements are statements that are not historical facts and may be

accompanied by words that convey projected future events or

outcomes, such as “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “design,” “intend,” “expect,” “could,” “plan,”

“potential,” “predict,” “seek,” “target,” “aim,” “plan,” “project,”

“forecast,” “should,” “would,” or variations of such words or by

expressions of similar meaning. Such forward-looking statements,

including statements regarding anticipated financial and

operational results, projections of market opportunity and

expectations, the estimated post-transaction enterprise value, the

advantages and expected growth of the PubCo, the cash position of

the PubCo following closing, the ability of the ACAC, PubCo or Foxx

to consummate the proposed business combination and the timing of

such consummation, are subject to risks and uncertainties, which

could cause actual results to differ from the forward-looking

statements. These risks and uncertainties include, but are not

limited to, those factors described in the section entitled “Risk

Factors” in the final prospectus filed with the SEC on June 10,

2022 (the “IPO Prospectus”), the Registration Statement on Form S-4

to be filed by PubCo, which will include a proxy statement

containing information about the proposed transaction and the

respective businesses of Foxx and the ACAC, as well as the

prospectus relating to the offer of the PubCo securities to be

issued to Foxx Stockholders in connection with the completion of

the proposed transaction (the “Proxy Statement/Prospectus”), and in

other documents filed by the ACAC or PubCo with the SEC from time

to time. Important factors that could cause the PubCo’s actual

results or outcomes to differ materially from those discussed in

the forward-looking statements include: Foxx’s or Pubco’s limited

operating history; the ability of Foxx or PubCo to identify and

integrate acquisitions; general economic and market conditions

impacting demand for the products and services of Foxx or PubCo;

the inability to complete the proposed Business Combination; the

inability to recognize the anticipated benefits of the proposed

Business Combination, which may be affected by, among other things,

the amount of cash available following any redemptions by the ACAC

stockholders; the ability to meet Nasdaq’s listing standards

following the consummation of the proposed Business Combination;

costs related to the proposed Business Combination; and such other

risks and uncertainties as are discussed in the IPO Prospectus and

the Proxy Statement/Prospectus. Other factors include the

possibility that the proposed Business Combination does not close,

including due to the failure to receive required security holder

approvals, or the failure of other closing conditions.

The ACAC, PubCo and Foxx each expressly disclaim

any obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the expectations of ACAC, PubCo or Foxx with

respect thereto or any change in events, conditions or

circumstances on which any statement is based, except as required

by law.

Contacts

Acri Contact:

Acri Capital Acquisition CorporationMs. “Joy” Yi Hua,

ChairwomanEmail: acri.capital@gmail.com

Media and Investor Relations Contact:

International Elite CapitalAnnabelle ZhangTelephone: +1(646)

866-7989Email: acri@iecapitalusa.com

Foxx Contact:

Foxx Development Inc.Mr. Haitao Cui, CEOTelephone: +1

(855)-585-3699Email: haitao.cui@foxxusa.com

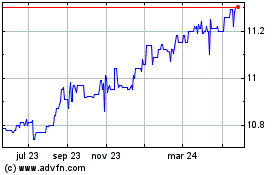

Acri Capital (NASDAQ:ACAC)

Gráfica de Acción Histórica

De Mar 2025 a Abr 2025

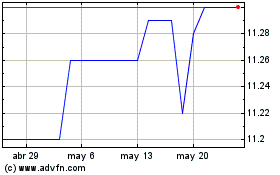

Acri Capital (NASDAQ:ACAC)

Gráfica de Acción Histórica

De Abr 2024 a Abr 2025