UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Aimfinity

Investment Corp. I

(Name of Issuer)

Class A Ordinary Shares, $0.0001 par value per share

(Title of Class of Securities)

G0135E100

(CUSIP Number)

I-Fa Chang

Manager

Aimfiniy

Investment LLC

221 W 9th St, PMB 235

Wilmington, Delaware

Telephone Number: (425) 365-2933

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 17, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

3d-1(f) or 13d-1(g), check the following box. ☒

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. G0135E100 |

|

SCHEDULE 13D |

|

|

|

|

|

|

|

|

|

| 1 |

|

Name of reporting persons I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) Aimfinity

Investment LLC (the “Sponsor”) |

| 2 |

|

Check the appropriate box

if a member of a group* (a) ☐ (b) ☐

|

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds*

OO |

| 5 |

|

Check box if disclosure of

legal proceedings is required pursuant to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or place of

organization Cayman

Islands |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

1,692,500 (1) |

| |

8 |

|

Shared voting power

|

| |

9 |

|

Sole dispositive voting power

1,692,500 (1) |

| |

10 |

|

Shared dispositive power

|

|

|

|

|

|

|

|

| 11 |

|

Aggregate amount beneficially owned by each reporting person

1,692,500 (1) |

| 12 |

|

Check box if the aggregate

amount in row (11) excludes certain shares* ☐ |

| 13 |

|

Percent of class

represented by amount in row (11) 16.04% (2) |

| 14 |

|

Type of reporting

person* CO |

| (1) |

Including (i) 1,932,500 Class B Ordinary Shares that were acquired by the Reporting Person in a private

placement before the Issuer’s IPO; (ii) 492,000 Class A Ordinary Shares underlying units (each unit having a price of $10.00 and consisting of one Class A Ordinary Share and one redeemable warrant, with each whole warrant entitling

the holder to purchase one Class A Ordinary Share at a price of $11.50 per share) that were acquired by the Reporting Person in a private placement effected concurrently with the closing of the Issuer’s initial public offering, based on

the exercise of the underwriters’ over-allotment option in full, on April 28, 2022; (iii) the distribution of the 280,000 Class B Ordinary Shares by the Sponsor to Imperii Strategies LLC, then a member of the Sponsor, on

March 10, 2023; (iv) the distribution of the 492,000 Class A Ordinary Shares underlying the units that the Sponsor distributed to Imperii Strategies LLC on March 10, 2023; (v) the purchase of 40,000 Class B Ordinary Shares by the

Sponsor from certain directors and officer of the Issuer pursuant to certain securities transfer agreement dated March 17, 2023. |

| (2) |

On an as-converted basis. The Class B ordinary shares will

automatically convert into Class A ordinary shares concurrently with or immediately following the consummation of the Issuer’s initial business combination on a

one-for-one basis, subject to adjustment, and have no expiration date. |

|

|

|

|

|

| CUSIP No. G0135E100 |

|

SCHEDULE 13D |

|

|

|

|

|

|

|

|

|

| 1 |

|

Name of reporting persons I.R.S.

IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

I-Fa Chang |

| 2 |

|

Check the appropriate box

if a member of a group* (a) ☐ (b) ☐

|

| 3 |

|

SEC use only

|

| 4 |

|

Source of funds*

OO |

| 5 |

|

Check box if disclosure of

legal proceedings is required pursuant to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or place of

organization

Taiwan |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7 |

|

Sole voting power

1,692,500 (3)(4) |

| |

8 |

|

Shared voting power

|

| |

9 |

|

Sole dispositive voting power

1,692,500 (3)(4) |

| |

10 |

|

Shared dispositive power

|

|

|

|

|

|

|

|

| 11 |

|

Aggregate amount beneficially owned by each reporting person

1,692,500 (3)(4) |

| 12 |

|

Check box if the aggregate

amount in row (11) excludes certain shares* ☐ |

| 13 |

|

Percent of class

represented by amount in row (11) 16.04% (5) |

| 14 |

|

Type of reporting

person* IN |

| (3) |

Since March 17, 2023, I-Fa Chang is the sole manager and sole

member of the Sponsor, and as such may be deemed to have sole voting and investment discretion with respect to the Ordinary Shares held by the Sponsor. |

| (4) |

Including (i) 1,932,500 Class B Ordinary Shares that were acquired by the Reporting Person in a private

placement before the Issuer’s IPO; (ii) 492,000 Class A Ordinary Shares underlying units (each unit having a price of $10.00 and consisting of one Class A Ordinary Share and one redeemable warrant, with each whole warrant entitling

the holder to purchase one Class A Ordinary Share at a price of $11.50 per share) that were acquired by the Reporting Person in a private placement effected concurrently with the closing of the Issuer’s initial public offering, based on

the exercise of the underwriters’ over-allotment option in full, on April 28, 2022; (iii) the distribution of the 280,000 Class B Ordinary Shares by the Sponsor to Imperii Strategies LLC, then a member of the Sponsor, on

March 10, 2023; (iv) the distribution of the 492,000 Class A Ordinary Shares underlying the units that the Sponsor distributed to Imperii Strategies LLC on March 10, 2023; (v) the purchase of 40,000 Class B Ordinary Shares by the

Sponsor from certain directors and officer of the Issuer pursuant to certain securities transfer agreement dated March 17, 2023. |

| (5) |

On an as-converted basis. The Class B ordinary shares will

automatically convert into Class A ordinary shares concurrently with or immediately following the consummation of the Issuer’s initial business combination on a

one-for-one basis, subject to adjustment, and have no expiration date. |

SCHEDULE 13D

CUSIP No. G0135E100

This statement relates (the

“Schedule 13D”) to the Class A Ordinary Share, par value $0.0001 (the “Class A Ordinary Share”), issued by Feutune Light Acquisition Corporation (the “Issuer”). All

capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D. Except as otherwise provided herein, each Item of the Schedule 13D remains unchanged.

Item 1. Security and Issuer.

Securities acquired:

Class A Ordinary Share, $0.0001 par value.

Issuer: Aimfinity Investment Corp. I

221 W 9th St, PMB 235

Wilmington, Delaware

Item 2. Identity and Background.

(a) This statement

is filed by Aimfinity Investment LLC, a Cayman Islands limited liability company (the “Sponsor”) and I-Fa Chang (“Mr. Chang”, with Sponsor, the

“Reporting Persons”). The Sponsor is the holder of record of approximately 16.04% of the Issuer’s outstanding Ordinary Shares based on the number of Ordinary Shares outstanding as of March 27, 2023 (including Class A

Ordinary Share and Class B Ordinary Share on as converted basis) and Mr. Chang is the sole manager and sole member of the Sponsor and deemed to have sole voting and investment discretion with respect to the Ordinary Shares held by the

Sponsor.

(b) The principal business address of each of the Reporting Persons is 221 W 9th St, PMB 235, Wilmington, Delaware.

(c) Sponsor is a sponsor of the Issuer and primarily involved in investment. Ms Mr. Chang is the sole manager and sole memberof Sponsor.

(d) During the past five years, none of the Reporting Persons or to the knowledge of the Reporting Persons, the persons identified in this Item 2, has been

convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the past five years, none of the Reporting Persons

or to the knowledge of the Reporting Persons, the persons identified in this Item 2, has been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was the subject to a

judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal and state securities laws of findings any violation with respect to such laws.

(f) The Sponsor is a limited liability company incorporated in the Cyman Islands. The Citizenship of Mr. Chang is Taiwan.

Item 3. Source and Amount of Funds or Other Consideration.

The information set forth in Items 4 and 5 of this Schedule 13D are hereby incorporated by reference into this Item 3.

SCHEDULE 13D

CUSIP No. G0135E100

Item 4. Purpose of

Transaction.

On December 4, 2021 the Sponsor acquired 2,875,000 Class B ordinary shares (“founder shares”) for an aggregate

purchase price of $25,000. On March 18, 2022, the sponsor surrendered to the Issuer for cancellation 862,500 Class B ordinary shares for no consideration, resulting in the Issuer’s initial shareholders holding an aggregate of

2,012,500 Class B ordinary shares, or approximately $0.012 per share. The Sponsor later transferred 20,000 founder shares to Nicholas Torres III, the Chief Financial Officer of the Issuer, and 60,000 founder shares to Xin Wang, Joshua Gordon,

and James J. Long, then members of the Issuer’s board of directors, on March 29, 2022.

On March 16, 2023, the Sponsor initiated a

distribution of 280,000 founder shares and 492,000 private placement units of the Company held by the sponsor to its then existing members. On the same date, it repurchased 10,000 founder shares from each of Xin Wang, Joshua Gordon, James J. Long

and Nicholas Torres III, as a result of which, the Sponsor will directly hold 1,692,500 founder shares.

Depending on prevailing market, economic and

other conditions, the Reporting Persons may from time to time acquire additional Class A Ordinary Shares or engage in discussions with the Issuer concerning future acquisitions of shares of its capital stock. Such acquisitions may be made

by means of open-market purchases, privately negotiated transactions, direct acquisitions from the Issuer or otherwise.

Except as set forth in this Item

4, none of the Reporting Persons has any plans or proposals that relate to or would result in: (a) the acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary

corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries; (d) any change in the

present Board or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Board; (e) any material change in the present capitalization or dividend policy of

the Issuer; (f) any other material change in the Issuer’s business or corporate structure, including but not limited to, if the issuer is a registered closed-end investment company; (g) changes

in the Issuer’s charter, by-laws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of

the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association; (i) a class of equity securities of the Issuer becoming

eligible for termination of registration pursuant to Section 12(g)(4) of the Exchange Act; or (j) any action similar to any of those enumerated above.

The Reporting Persons may, at any time and from time to time, formulate other purposes, plans or proposals regarding the Issuer, or any other actions that

could involve one or more of the types of transactions or have one or more of the results described in clauses (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

(a)

The responses to Items 7 - 13 of the cover pages of this Schedule 13D are incorporated herein by reference. The aggregate number and percentage of Ordinary Shares beneficially or directly owned by the Reporting Persons is based upon a total of

10,554,500 Ordinary Shares outstanding as of March 27, 2023 (including Class A Ordinary Shares and Class B Ordinary Shares on as converted basis). The Reporting Persons collectively beneficially own 1,692,500 Ordinary Shares,

representing approximately 16.04% issued and outstanding Ordinary Shares (including Class A Ordinary Shares and Class B Ordinary Shares on as converted basis).

(b) The responses to Items 7 - 13 of the cover pages of this Schedule 13D are incorporated herein by reference. The beneficial ownership of the Sponsor is

1,692,500 Ordinary Shares, representing approximately 16.04% issued and outstanding Ordinary Shares. In addtiona, Mr. Chang, the sole manager of the Sponsor, is deemed to have sole voting and investment discretion with respect to the Ordinary

Shares held by the Sponsor.

(c) Other than the disposition of the shares as reported in this Schedule 13D, no actions in the Ordinary

Shares were effected during the past sixty (60) days by the Reporting Persons.

(d) N/A

(e) N/A

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

The information set forth in Items 4 of this Schedule 13D are hereby

incorporated by reference into this Item 6.

SCHEDULE 13D

CUSIP No. G0135E100

Item 7. Materials to be

Filed as Exhibits.

Item 7 of the Schedule 13D is hereby amended by adding the following to the end of the section:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 7.1 |

|

Joint Filing Agreement, dated March 27, 2023. |

|

|

| 10.1 |

|

Securities Subscription Agreement between the registrant and the Sponsor dated December 4, 2021. |

|

|

| 10.3 |

|

Form of Securities Assignment Agreement between the Sponsor and certain directors and officers of the registeant, dated March 29, 2022. |

|

|

| 10.4 |

|

Founder Shares Repurchase Agreement dated March 17, 2023 between the Sponsor and certain directors and officers of the Issuer. |

SCHEDULE 13D

CUSIP No. G0135E100

SIGNATURES

After reasonable inquiry and to the best of our knowledge and belief, we certify that the information set forth in this statement is true, complete

and correct.

Date: March 27, 2023

|

|

|

|

|

|

|

| Aimfinity Investment LLC |

|

|

|

|

|

|

|

|

| By: |

|

/s/ I-Fa Chang |

|

|

|

/s/ I-Fa Chang |

| Name: |

|

I-Fa Chang |

|

|

|

I-Fa Chang |

| Title: |

|

Sole Manager |

|

|

|

|

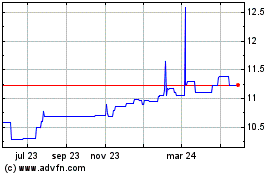

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

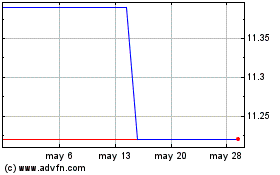

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024