NASDAQ: AIRT FY25 Q2 Update A PORTFOLIO OF POWERFUL COMPANIES September 30, 2024

Statements in this document, which contain more than historical information, may be considered forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995), which are subject to risks and uncertainties. Actual results may differ materially from those expressed in the forward-looking statements because of important potential risks and uncertainties, including, but not limited to, economic and industry conditions in the Company’s markets, the risk that contracts with FedEx could be terminated or adversely modified, the risk that the number of aircraft operated for FedEx will be reduced, the risk that GGS customers will defer or reduce significant orders for deicing equipment, the impact of any terrorist activities on United States soil or abroad; the Company’s ability to manage its cost structure for operating expenses, or unanticipated capital requirements, and match them to shifting customer service requirements and production volume levels the Company's ability to meet debt service covenants and to refinance existing debt obligations, the risk of injury or other damage arising from accidents involving the Company’s overnight air cargo operations, equipment or parts sold and/or services provided, market acceptance of the Company’s commercial and military equipment and services, competition from other providers of similar equipment and services, changes in government regulation and technology, changes in the value of marketable securities held as investments, mild winter weather conditions reducing the demand for deicing equipment, and market acceptance and operational success of the Company’s relatively new aircraft asset management business and related aircraft capital joint venture. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. The Company is under no obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. Potential investors should review the Company’s risk factors contained in its reports filed with the Securities and Exchange Commission, as well as the summary Risk Factors contained herein, prior to investing. 2 SAFE HARBOR

3 ■ AIR T, INC. (NASDAQ: AIRT) is an industrious American company focusing on growing intrinsic value per share at a high rate. ■ Founded in 1980, our businesses have a history of growth and cash flow generation. ■ Current management has been in place since 2013. The two largest shareholders have seats on the Board of Directors. WHO WE ARE OPERATING HIGHLIGHTS EXECUTIVE SUMMARY ■ AIR T, INC. operates 14 companies with 600+ employees. ■ For the fiscal year ended 3/31/2024, Revenues were $286.8 million, and Adjusted EBITDA was $5.6 million. ■ Since 9/30/13, shares outstanding have declined from 3.7m* to 2.8m or 23.2%. *Adjusted for 3/2 stock split

1. About AIR T, INC. 2. Performance 3. Our Growth Strategies 4. Appendix - Risk Factors 4 CONTENTS

5 ABOUT AIR T, INC.

We are an industrious American company established 40+ years and growing. 6 ■ Our businesses have a history of growth and cash flow generation. ■ We seek to identify and empower individuals and teams who will operate businesses well, increasing value over time. ■ We work to activate growth and overcome challenges, ultimately building businesses that flourish over the long term. ■ Management has purchased a significant % of AIRT common stock in the open market, demonstrating real alignment with all common shareholders. ■ AIRT’s management team has a track record of successfully allocating capital.

“Investor-Operator Partnership” is designed to drive short and long-term value creation. 7 “We want our businesses to be managed by dynamic individuals within high-performance teams. We are set up to make space for dynamos and support their enterprises. The holding company team seeks to focus resources, activate growth and deliver long-term value for everyone associated with AIR T, INC.” - Nick Swenson

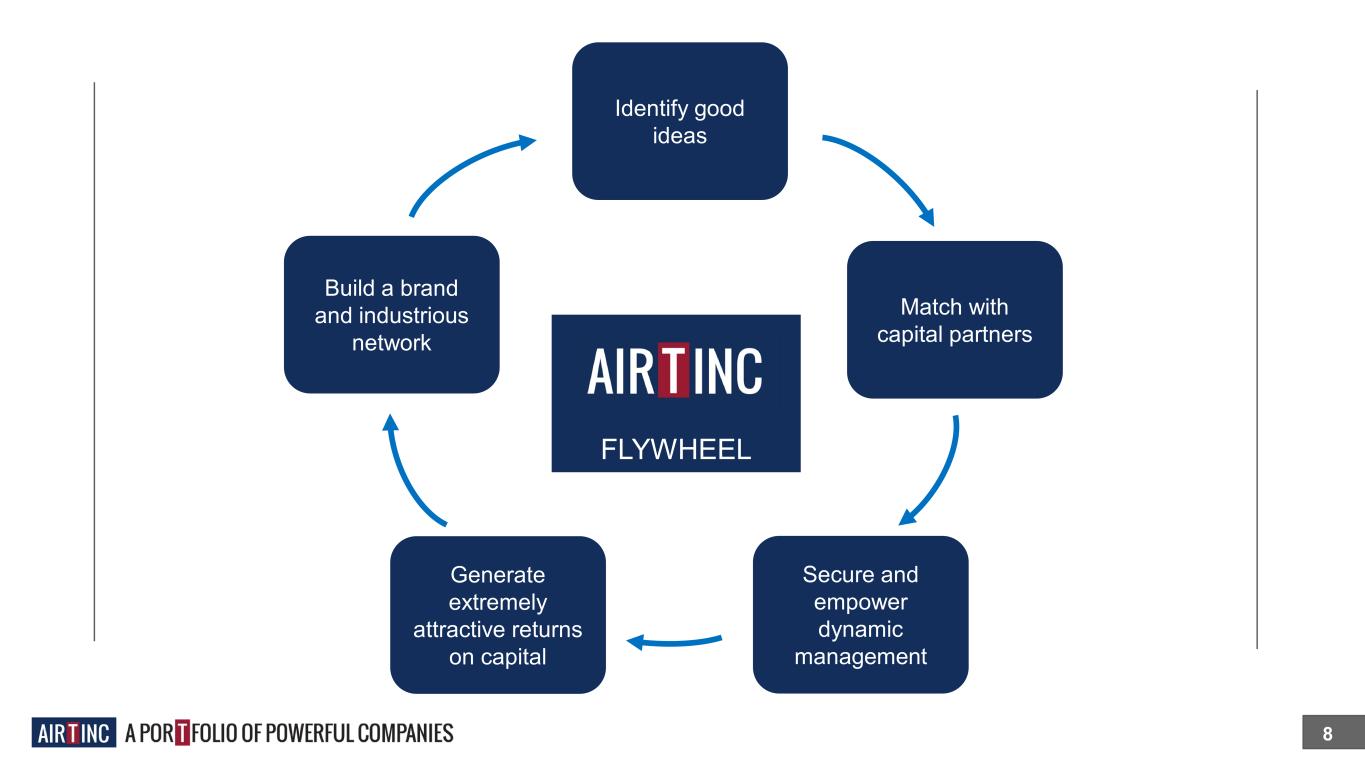

8 Build a brand and industrious network FLYWHEEL Generate extremely attractive returns on capital Secure and empower dynamic management Match with capital partners Identify good ideas 8

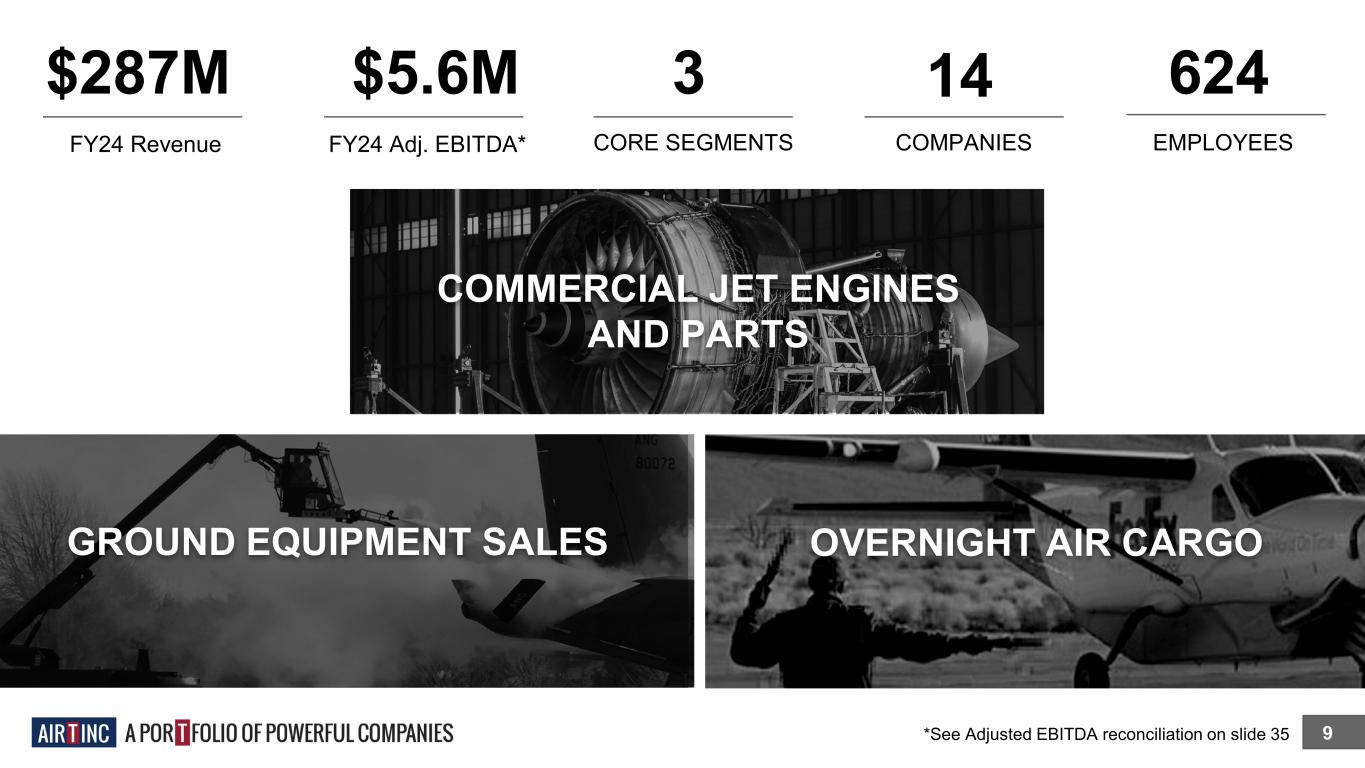

$287M 9 FY24 Revenue $5.6M FY24 Adj. EBITDA* 3 CORE SEGMENTS 14 COMPANIES 624 EMPLOYEES OVERNIGHT AIR CARGO COMMERCIAL JET ENGINES AND PARTS GROUND EQUIPMENT SALES *See Adjusted EBITDA reconciliation on slide 35

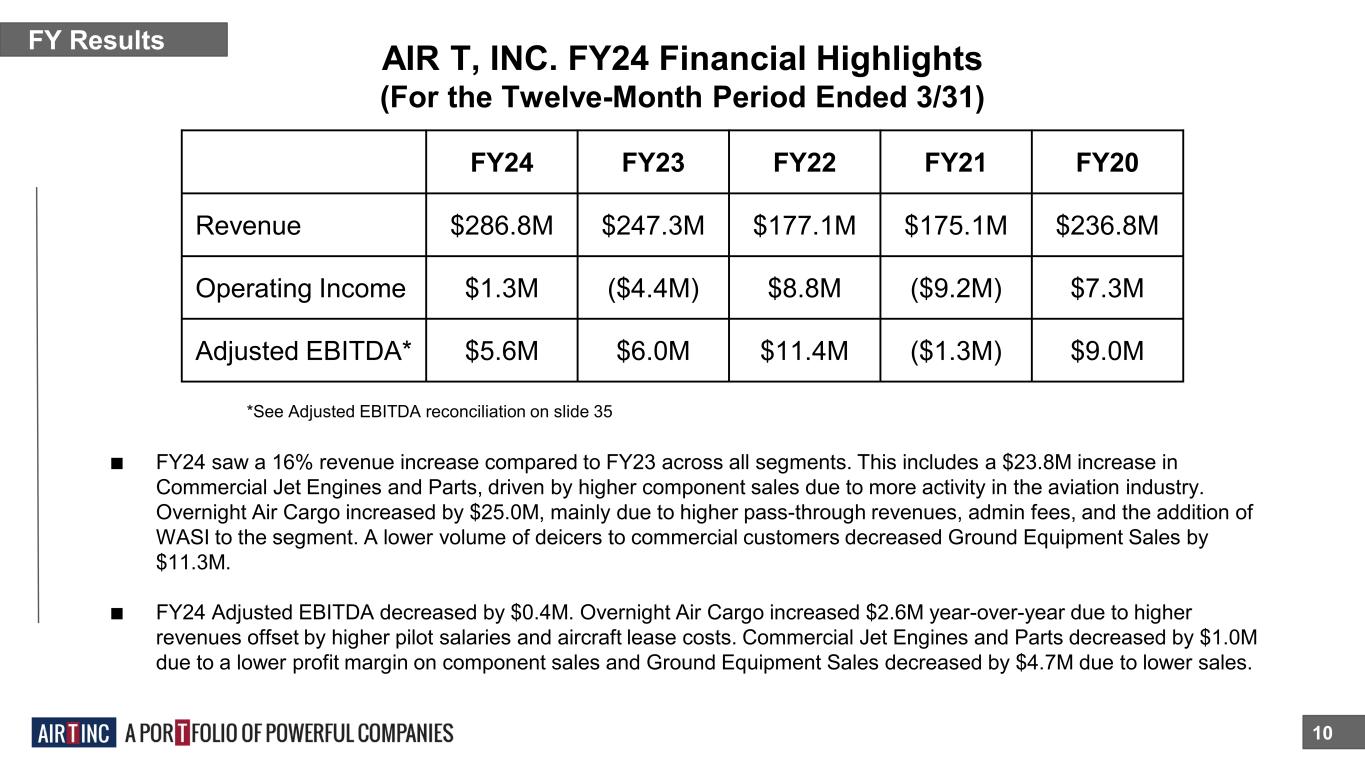

AIR T, INC. FY24 Financial Highlights (For the Twelve-Month Period Ended 3/31) 10 FY Results ■ FY24 saw a 16% revenue increase compared to FY23 across all segments. This includes a $23.8M increase in Commercial Jet Engines and Parts, driven by higher component sales due to more activity in the aviation industry. Overnight Air Cargo increased by $25.0M, mainly due to higher pass-through revenues, admin fees, and the addition of WASI to the segment. A lower volume of deicers to commercial customers decreased Ground Equipment Sales by $11.3M. ■ FY24 Adjusted EBITDA decreased by $0.4M. Overnight Air Cargo increased $2.6M year-over-year due to higher revenues offset by higher pilot salaries and aircraft lease costs. Commercial Jet Engines and Parts decreased by $1.0M due to a lower profit margin on component sales and Ground Equipment Sales decreased by $4.7M due to lower sales. FY24 FY23 FY22 FY21 FY20 Revenue $286.8M $247.3M $177.1M $175.1M $236.8M Operating Income $1.3M ($4.4M) $8.8M ($9.2M) $7.3M Adjusted EBITDA* $5.6M $6.0M $11.4M ($1.3M) $9.0M *See Adjusted EBITDA reconciliation on slide 35

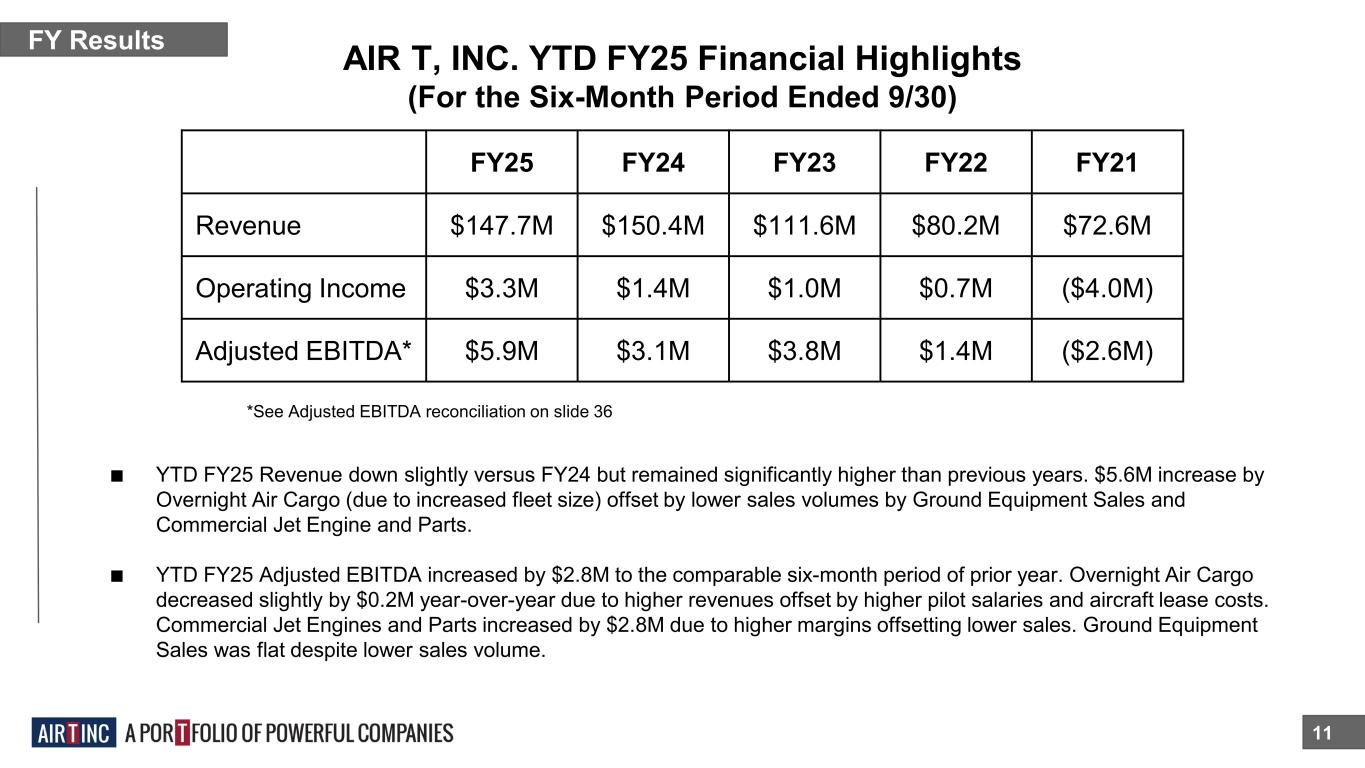

AIR T, INC. YTD FY25 Financial Highlights (For the Six-Month Period Ended 9/30) 11 FY Results ■ YTD FY25 Revenue down slightly versus FY24 but remained significantly higher than previous years. $5.6M increase by Overnight Air Cargo (due to increased fleet size) offset by lower sales volumes by Ground Equipment Sales and Commercial Jet Engine and Parts. ■ YTD FY25 Adjusted EBITDA increased by $2.8M to the comparable six-month period of prior year. Overnight Air Cargo decreased slightly by $0.2M year-over-year due to higher revenues offset by higher pilot salaries and aircraft lease costs. Commercial Jet Engines and Parts increased by $2.8M due to higher margins offsetting lower sales. Ground Equipment Sales was flat despite lower sales volume. FY25 FY24 FY23 FY22 FY21 Revenue $147.7M $150.4M $111.6M $80.2M $72.6M Operating Income $3.3M $1.4M $1.0M $0.7M ($4.0M) Adjusted EBITDA* $5.9M $3.1M $3.8M $1.4M ($2.6M) *See Adjusted EBITDA reconciliation on slide 36

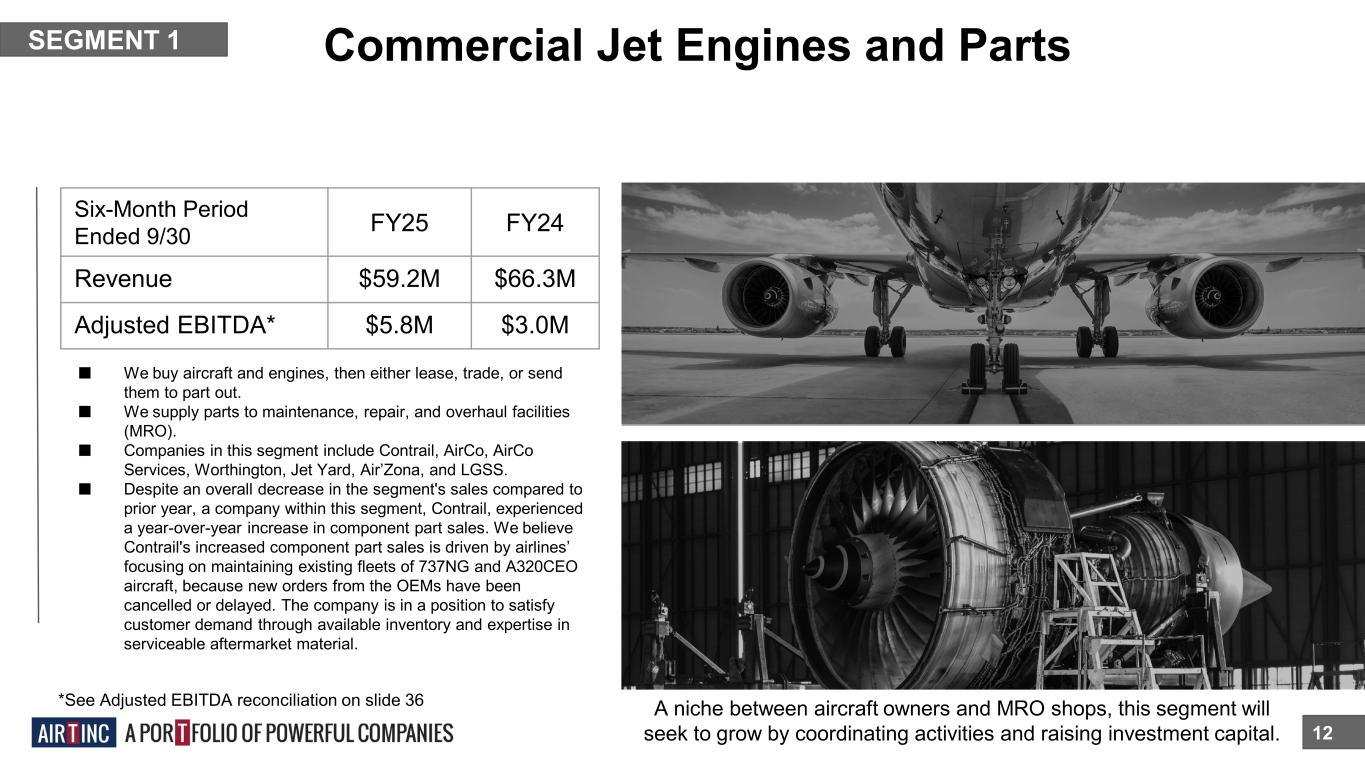

Commercial Jet Engines and Parts 12 SEGMENT 1 ■ We buy aircraft and engines, then either lease, trade, or send them to part out. ■ We supply parts to maintenance, repair, and overhaul facilities (MRO). ■ Companies in this segment include Contrail, AirCo, AirCo Services, Worthington, Jet Yard, Air’Zona, and LGSS. ■ Despite an overall decrease in the segment's sales compared to prior year, a company within this segment, Contrail, experienced a year-over-year increase in component part sales. We believe Contrail's increased component part sales is driven by airlines’ focusing on maintaining existing fleets of 737NG and A320CEO aircraft, because new orders from the OEMs have been cancelled or delayed. The company is in a position to satisfy customer demand through available inventory and expertise in serviceable aftermarket material. A niche between aircraft owners and MRO shops, this segment will seek to grow by coordinating activities and raising investment capital. Six-Month Period Ended 9/30 FY25 FY24 Revenue $59.2M $66.3M Adjusted EBITDA* $5.8M $3.0M *See Adjusted EBITDA reconciliation on slide 36

Overnight Air Cargo 13 SEGMENT 2 ■ We operate two of the seven FedEx feeder airlines. ■ Business units Mountain Air Cargo and CSA Air have a 41-year history with FedEx. ■ Air T Companies since 1982, 1983 ■ Air T added Worldwide Aircraft Services (WASI) to this segment in Q4 FY23. ■ The increase in revenue was principally attributable to higher administrative fees due to increased fleet of 105 aircraft in the current year quarter compared to 85 aircraft in the prior year quarter and additional routes granted by FedEx. An asset-light, predictable business. Six-Month Period Ended 9/30 FY25 FY24 Revenue $61.6M $56.0M Adjusted EBITDA* $3.9M $4.1M *See Adjusted EBITDA reconciliation on slide 36

Ground Equipment Sales 14 SEGMENT 3 ■ We manufacture deicing equipment, scissor lift trucks, and other ground support equipment. ■ Sole-source deicer supplier to the US Air Force for 20 years. ■ Highly efficient light manufacturing facility. ■ The segment is comprised of Global Ground Support LLC. ■ Air T Company since 1998. ■ We believe that the decline in sales for this segment is directly attributable to a decreased demand for deicing trucks across the entire industry, driven by the recent milder winters. Segment’s order backlog was $9.1 million as of 9/30/24 compared to $7.0 million as of 9/30/23 Six-Month Period Ended 9/30 FY25 FY24 Revenue $21.8M $24.0M Adjusted EBITDA* $0.0M ($0.0M) *See Adjusted EBITDA reconciliation on slide 36

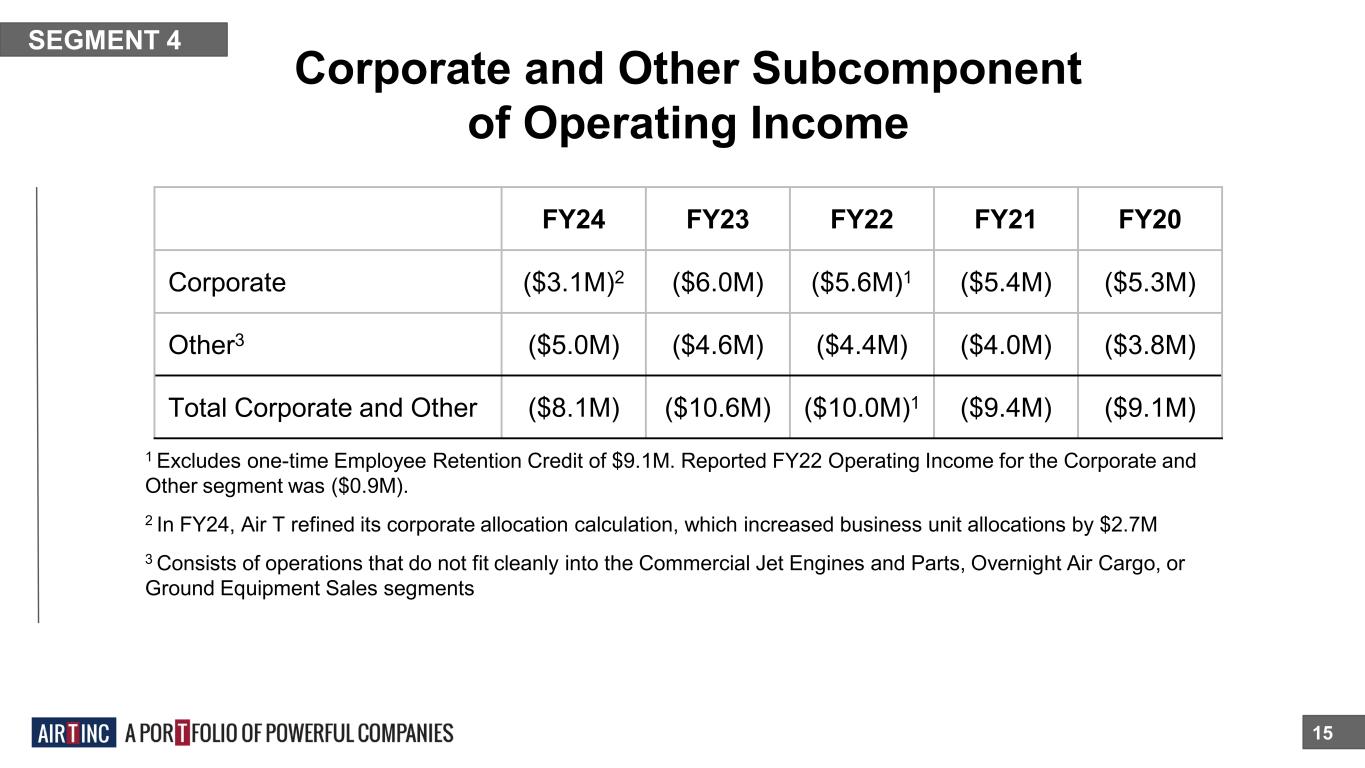

15 SEGMENT 4 FY24 FY23 FY22 FY21 FY20 Corporate ($3.1M)2 ($6.0M) ($5.6M)1 ($5.4M) ($5.3M) Other3 ($5.0M) ($4.6M) ($4.4M) ($4.0M) ($3.8M) Total Corporate and Other ($8.1M) ($10.6M) ($10.0M)1 ($9.4M) ($9.1M) Corporate and Other Subcomponent of Operating Income 1 Excludes one-time Employee Retention Credit of $9.1M. Reported FY22 Operating Income for the Corporate and Other segment was ($0.9M). 2 In FY24, Air T refined its corporate allocation calculation, which increased business unit allocations by $2.7M 3 Consists of operations that do not fit cleanly into the Commercial Jet Engines and Parts, Overnight Air Cargo, or Ground Equipment Sales segments

16 Investment manager focused on unearthing fundamentally attractive small and mid-cap opportunities. Allows us to further expand upon our idea generation capabilities to identify, analyze, develop and execute innovative investment strategies that are aimed at building better financial futures for all our stakeholders. Air T company since 2017. Digital inkjet press designer and manufacturer, delivering color presses that produce high-quality output without compromising efficiency or budgets. Air T company since 2017. Software developer and solution provider focused on the Aviation MRO and aftermarket community. Developed a suite of cloud-based and mobile applications to provide affordable, common-sense solutions. Air T company since 2018. Investing For Growth

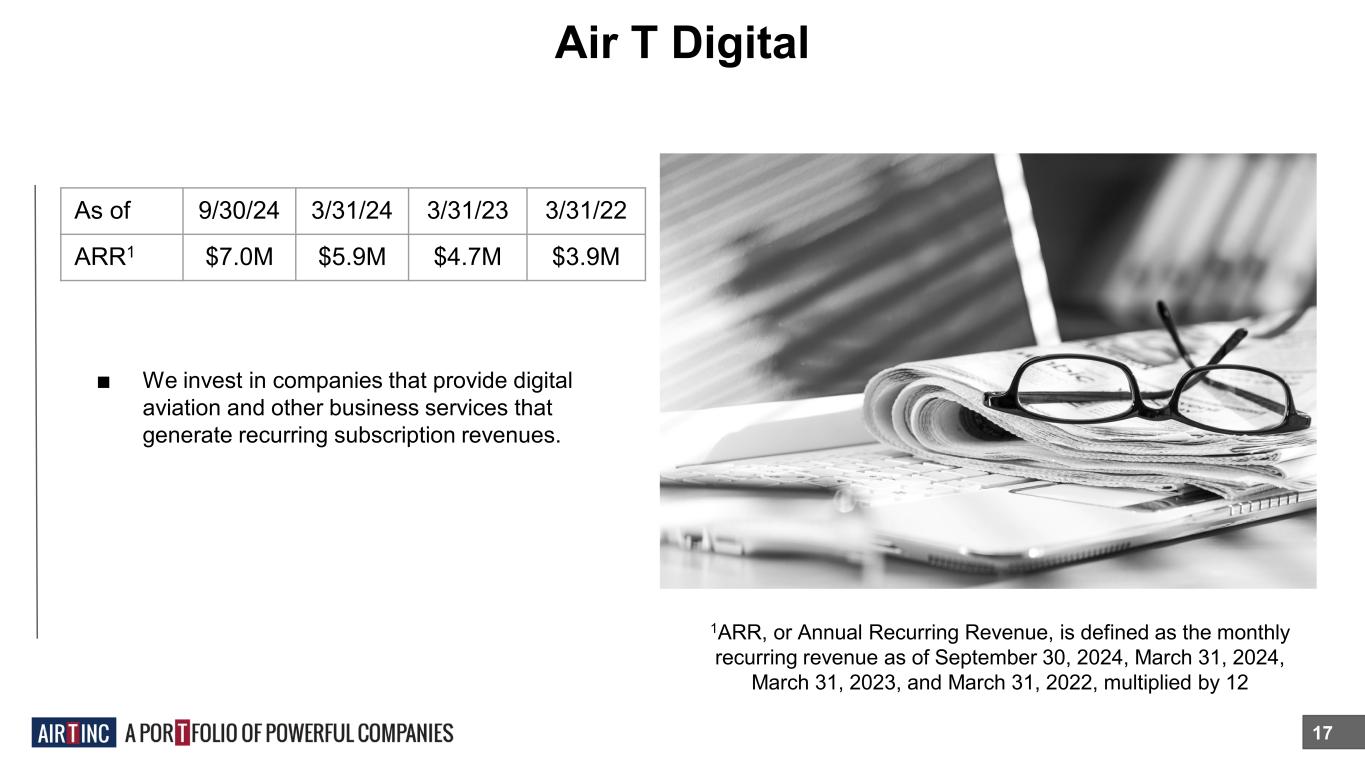

Air T Digital 17 ■ We invest in companies that provide digital aviation and other business services that generate recurring subscription revenues. As of 9/30/24 3/31/24 3/31/23 3/31/22 ARR1 $7.0M $5.9M $4.7M $3.9M 1ARR, or Annual Recurring Revenue, is defined as the monthly recurring revenue as of September 30, 2024, March 31, 2024, March 31, 2023, and March 31, 2022, multiplied by 12

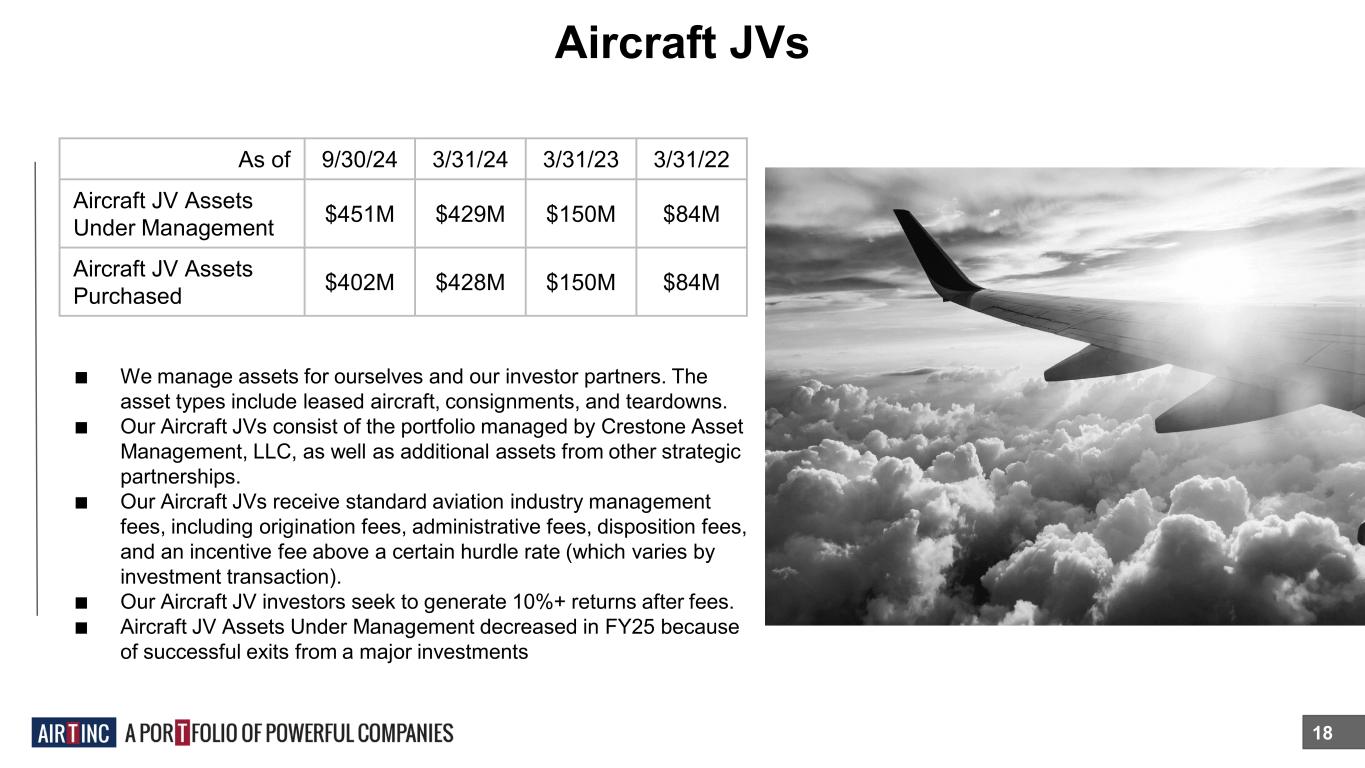

Aircraft JVs 18 ■ We manage assets for ourselves and our investor partners. The asset types include leased aircraft, consignments, and teardowns. ■ Our Aircraft JVs consist of the portfolio managed by Crestone Asset Management, LLC, as well as additional assets from other strategic partnerships. ■ Our Aircraft JVs receive standard aviation industry management fees, including origination fees, administrative fees, disposition fees, and an incentive fee above a certain hurdle rate (which varies by investment transaction). ■ Our Aircraft JV investors seek to generate 10%+ returns after fees. ■ Aircraft JV Assets Under Management decreased in FY25 because of successful exits from a major investments As of 9/30/24 3/31/24 3/31/23 3/31/22 Aircraft JV Assets Under Management $451M $429M $150M $84M Aircraft JV Assets Purchased $402M $428M $150M $84M

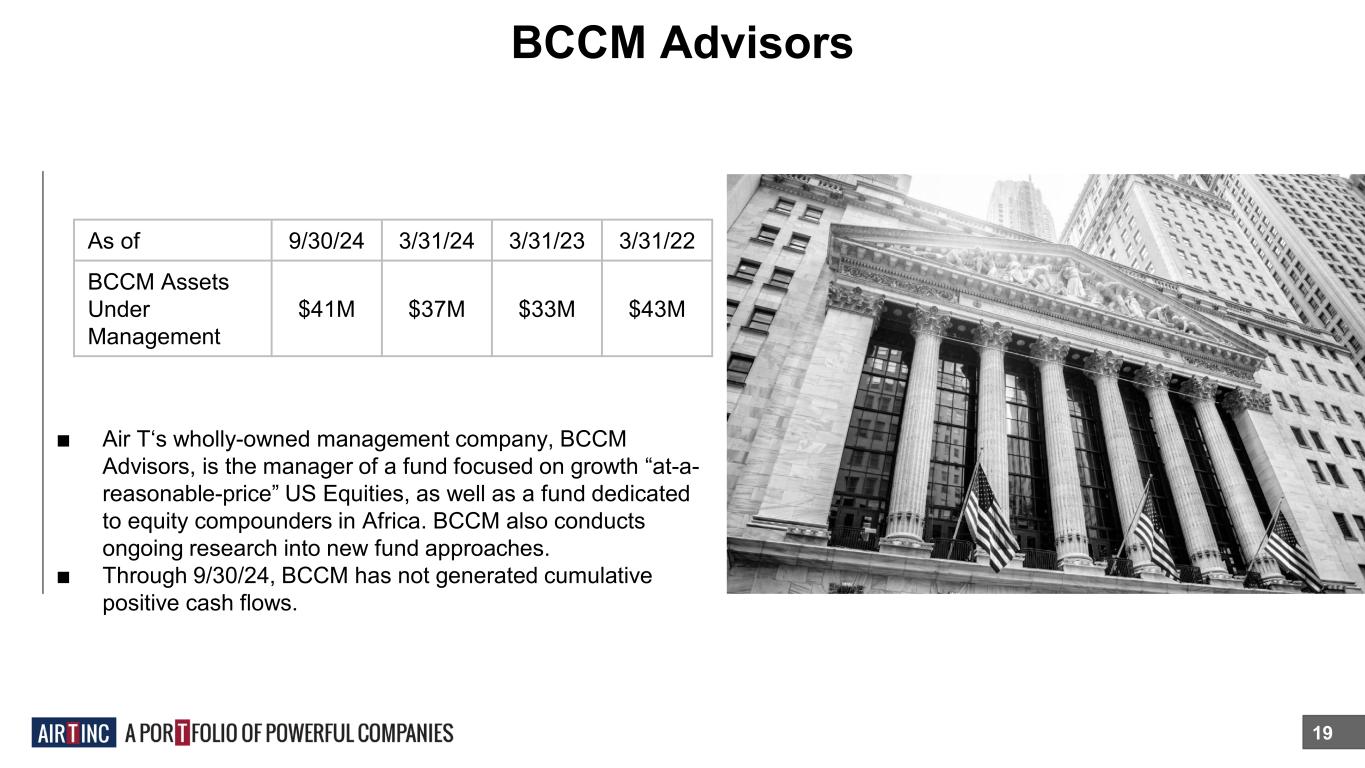

BCCM Advisors 19 ■ Air T‘s wholly-owned management company, BCCM Advisors, is the manager of a fund focused on growth “at-a- reasonable-price” US Equities, as well as a fund dedicated to equity compounders in Africa. BCCM also conducts ongoing research into new fund approaches. ■ Through 9/30/24, BCCM has not generated cumulative positive cash flows. As of 9/30/24 3/31/24 3/31/23 3/31/22 BCCM Assets Under Management $41M $37M $33M $43M

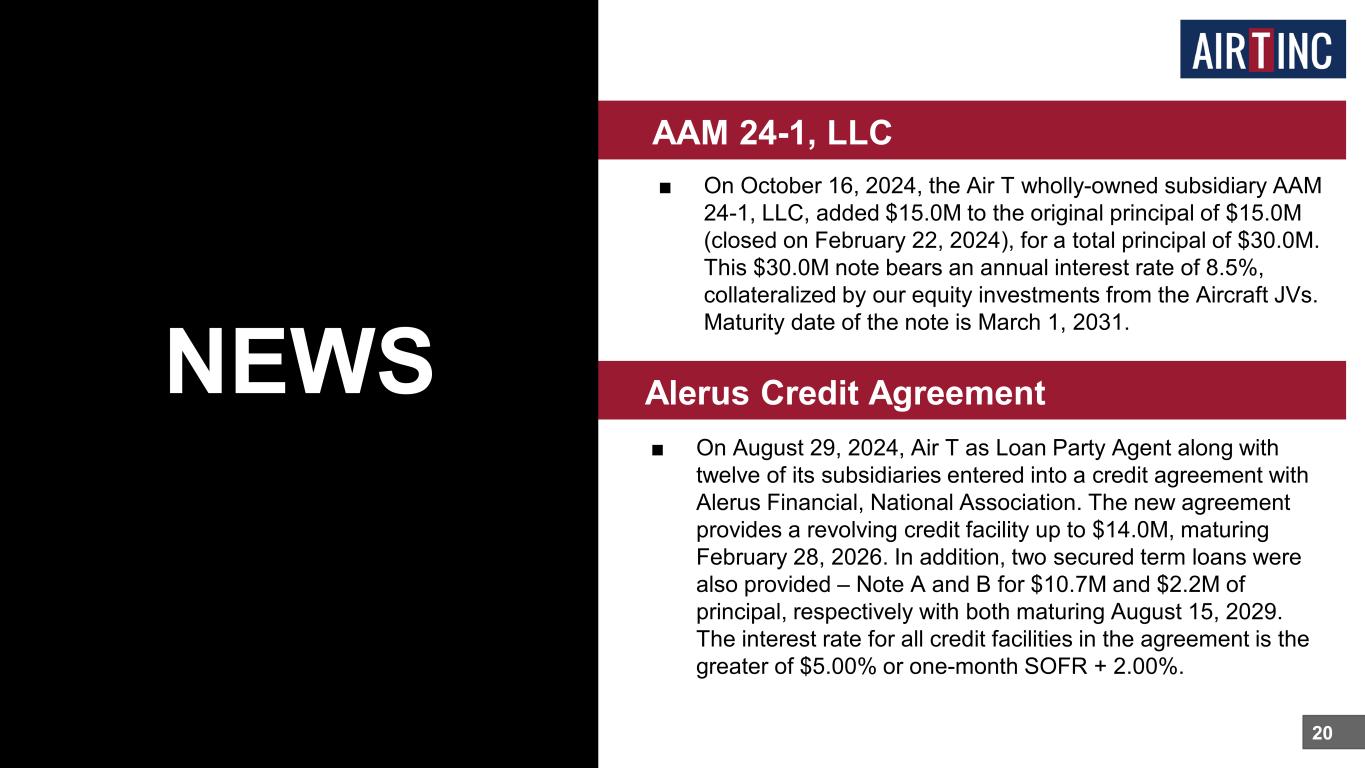

■ On October 16, 2024, the Air T wholly-owned subsidiary AAM 24-1, LLC, added $15.0M to the original principal of $15.0M (closed on February 22, 2024), for a total principal of $30.0M. This $30.0M note bears an annual interest rate of 8.5%, collateralized by our equity investments from the Aircraft JVs. Maturity date of the note is March 1, 2031. 20 AAM 24-1, LLC NEWS Alerus Credit Agreement ■ On August 29, 2024, Air T as Loan Party Agent along with twelve of its subsidiaries entered into a credit agreement with Alerus Financial, National Association. The new agreement provides a revolving credit facility up to $14.0M, maturing February 28, 2026. In addition, two secured term loans were also provided – Note A and B for $10.7M and $2.2M of principal, respectively with both maturing August 15, 2029. The interest rate for all credit facilities in the agreement is the greater of $5.00% or one-month SOFR + 2.00%.

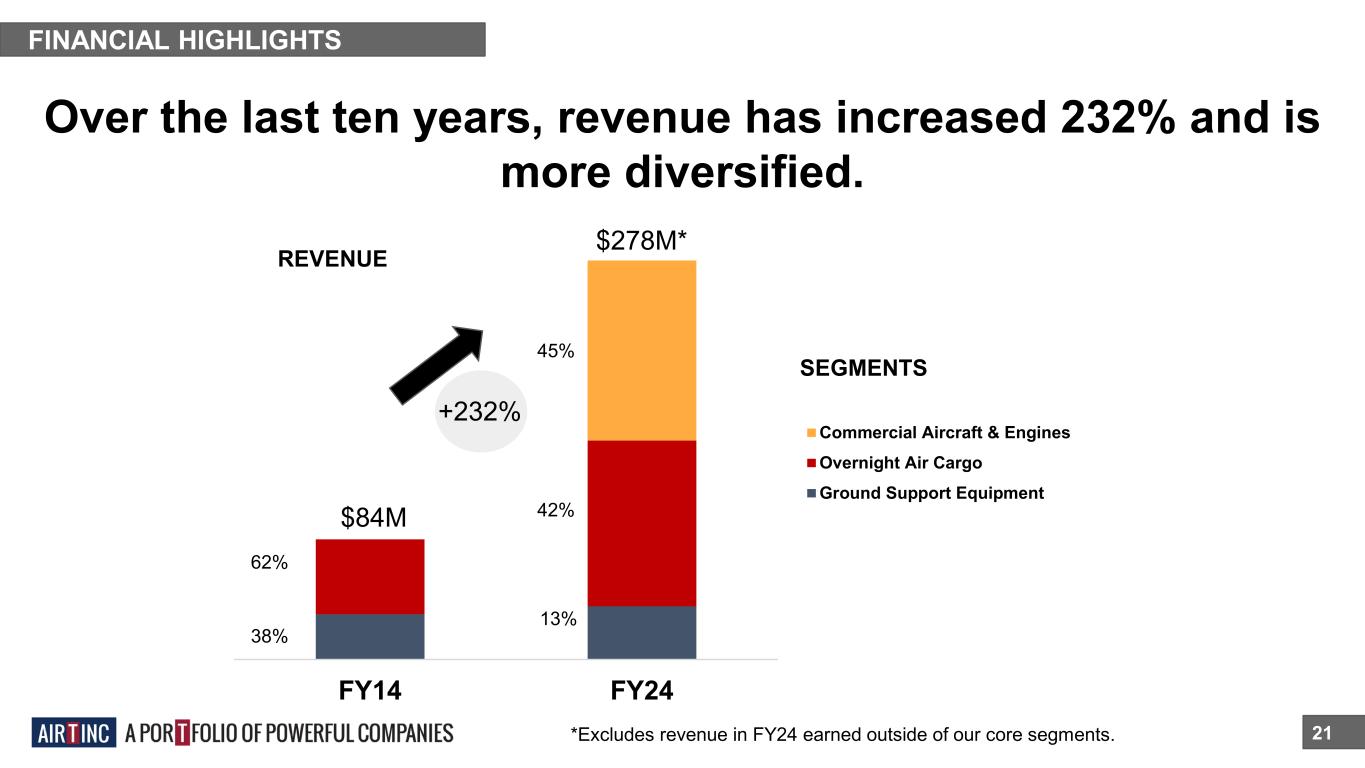

FY14 FY24 Commercial Aircraft & Engines Overnight Air Cargo Ground Support Equipment FINANCIAL HIGHLIGHTS Over the last ten years, revenue has increased 232% and is more diversified. 21 +232% $278M* $84M SEGMENTS REVENUE 62% 38% 42% 13% 45% *Excludes revenue in FY24 earned outside of our core segments.

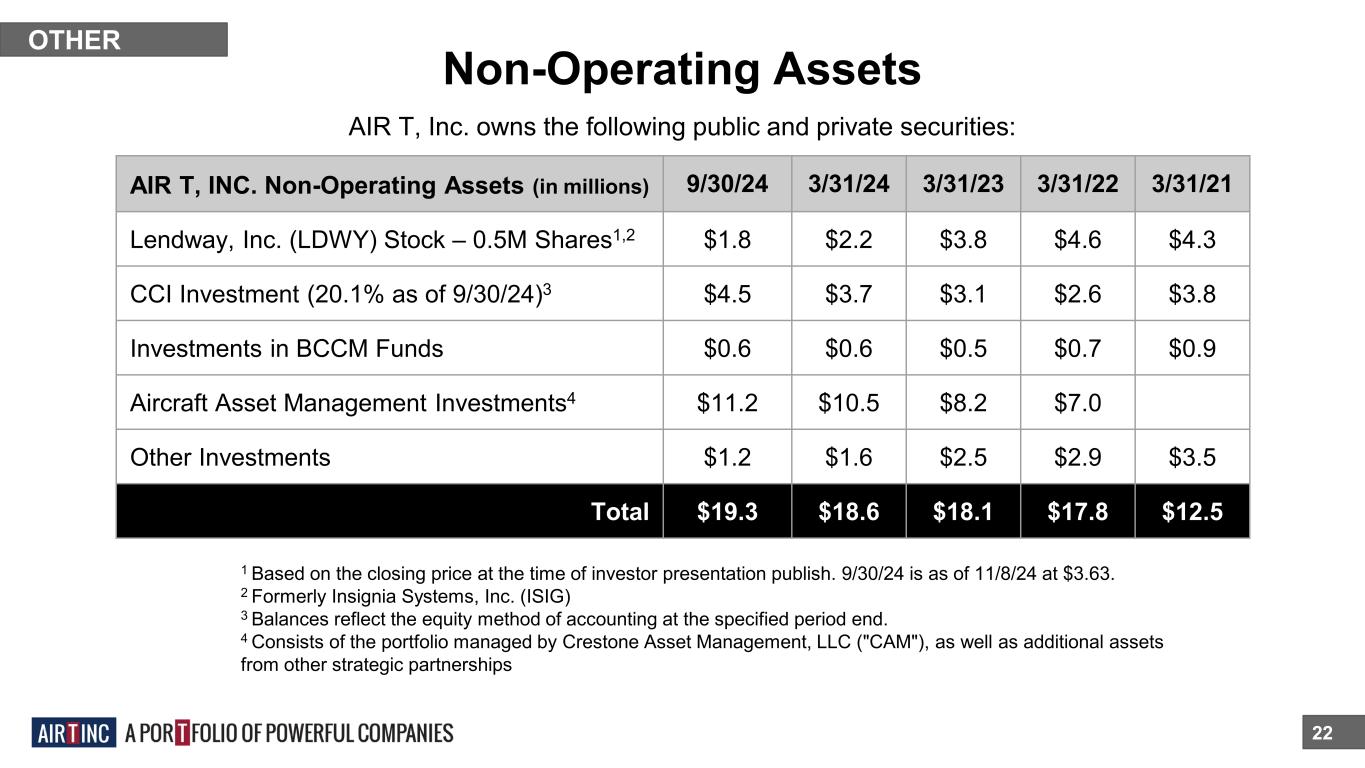

Non-Operating Assets 22 AIR T, Inc. owns the following public and private securities: OTHER AIR T, INC. Non-Operating Assets (in millions) 9/30/24 3/31/24 3/31/23 3/31/22 3/31/21 Lendway, Inc. (LDWY) Stock – 0.5M Shares1,2 $1.8 $2.2 $3.8 $4.6 $4.3 CCI Investment (20.1% as of 9/30/24)3 $4.5 $3.7 $3.1 $2.6 $3.8 Investments in BCCM Funds $0.6 $0.6 $0.5 $0.7 $0.9 Aircraft Asset Management Investments4 $11.2 $10.5 $8.2 $7.0 Other Investments $1.2 $1.6 $2.5 $2.9 $3.5 Total $19.3 $18.6 $18.1 $17.8 $12.5 1 Based on the closing price at the time of investor presentation publish. 9/30/24 is as of 11/8/24 at $3.63. 2 Formerly Insignia Systems, Inc. (ISIG) 3 Balances reflect the equity method of accounting at the specified period end. 4 Consists of the portfolio managed by Crestone Asset Management, LLC ("CAM"), as well as additional assets from other strategic partnerships

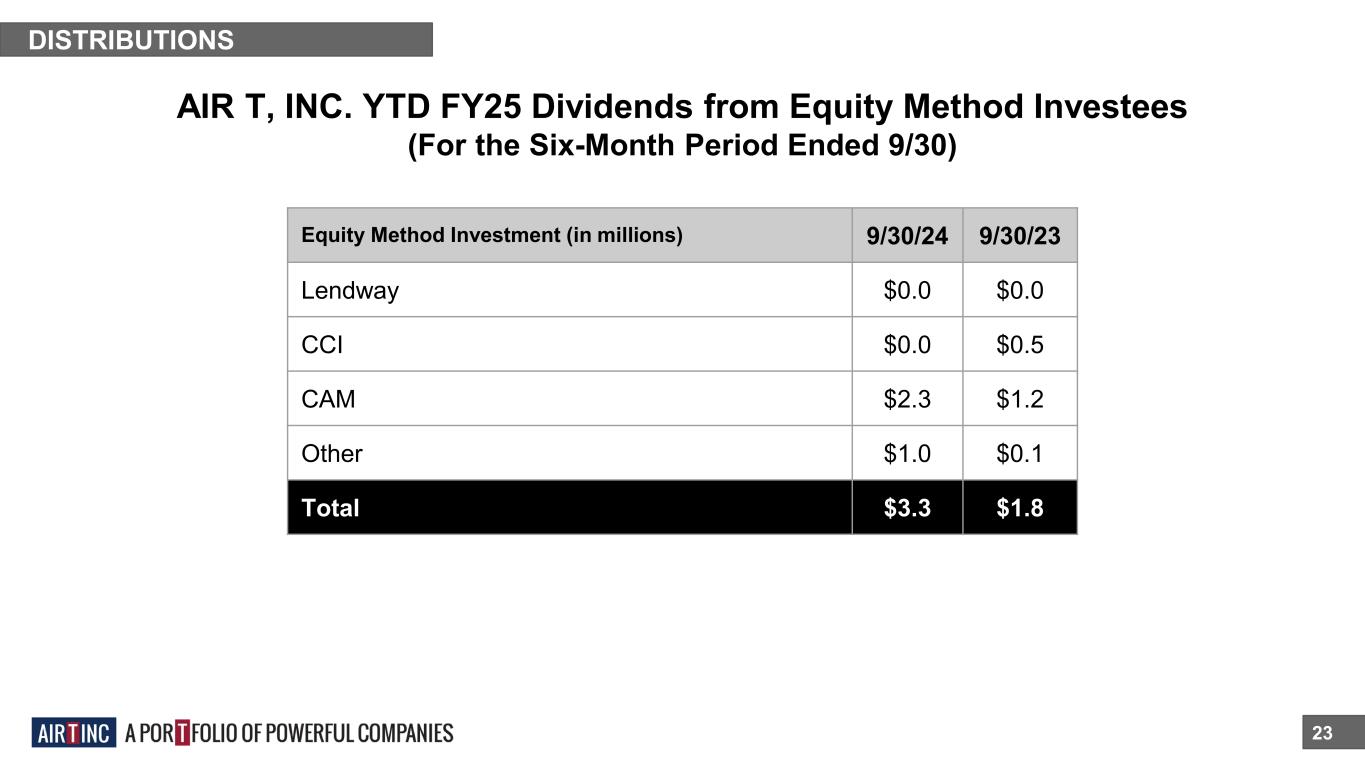

23 DISTRIBUTIONS Equity Method Investment (in millions) 9/30/24 9/30/23 Lendway $0.0 $0.0 CCI $0.0 $0.5 CAM $2.3 $1.2 Other $1.0 $0.1 Total $3.3 $1.8 AIR T, INC. YTD FY25 Dividends from Equity Method Investees (For the Six-Month Period Ended 9/30)

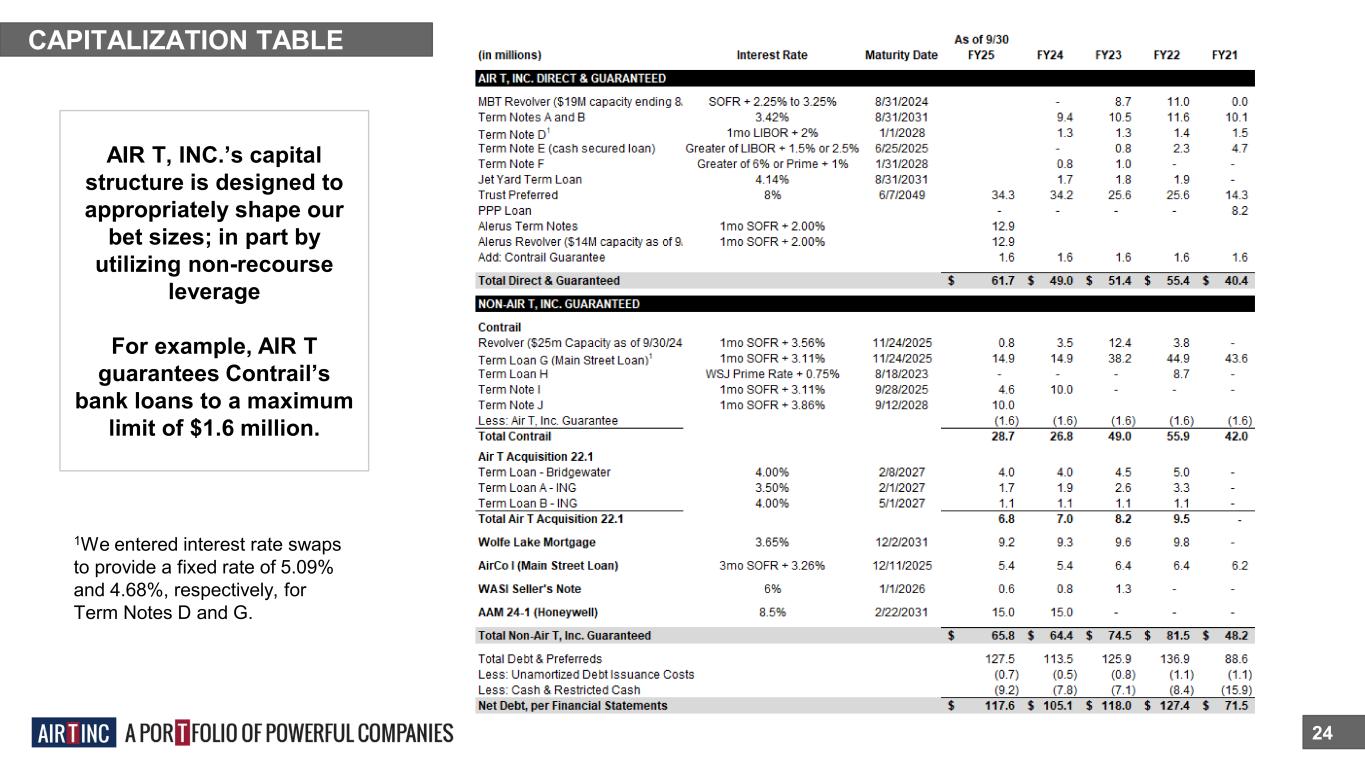

24 CAPITALIZATION TABLE AIR T, INC.’s capital structure is designed to appropriately shape our bet sizes; in part by utilizing non-recourse leverage For example, AIR T guarantees Contrail’s bank loans to a maximum limit of $1.6 million. 1We entered interest rate swaps to provide a fixed rate of 5.09% and 4.68%, respectively, for Term Notes D and G.

Calibrated Bets & Capitalization Structure 25 Risk Management: Downside Protection • Anti-fragile company • Islands of segregated assets and businesses • Market-driven and savvy risk management program that oversees all of the company STRUCTURE Tailored, Limited, Convex Exposures • Convexity-promoting organizational design • Kelly-calibrated bets: sized to edge & bankroll • Limit downside: tailored exposures

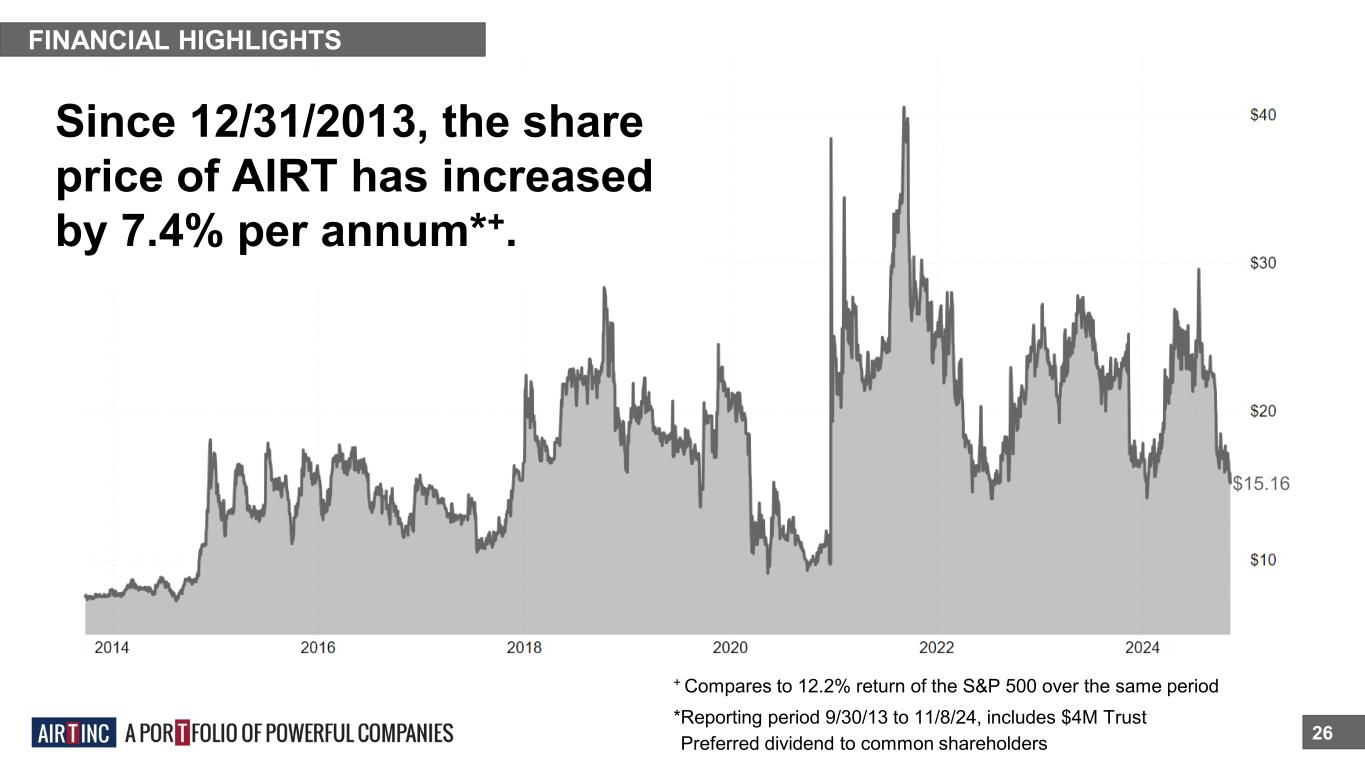

FINANCIAL HIGHLIGHTS 26 Since 12/31/2013, the share price of AIRT has increased by 7.4% per annum*+. *Reporting period 9/30/13 to 11/8/24, includes $4M Trust *Preferred dividend to common shareholders + Compares to 12.2% return of the S&P 500 over the same period $15.16

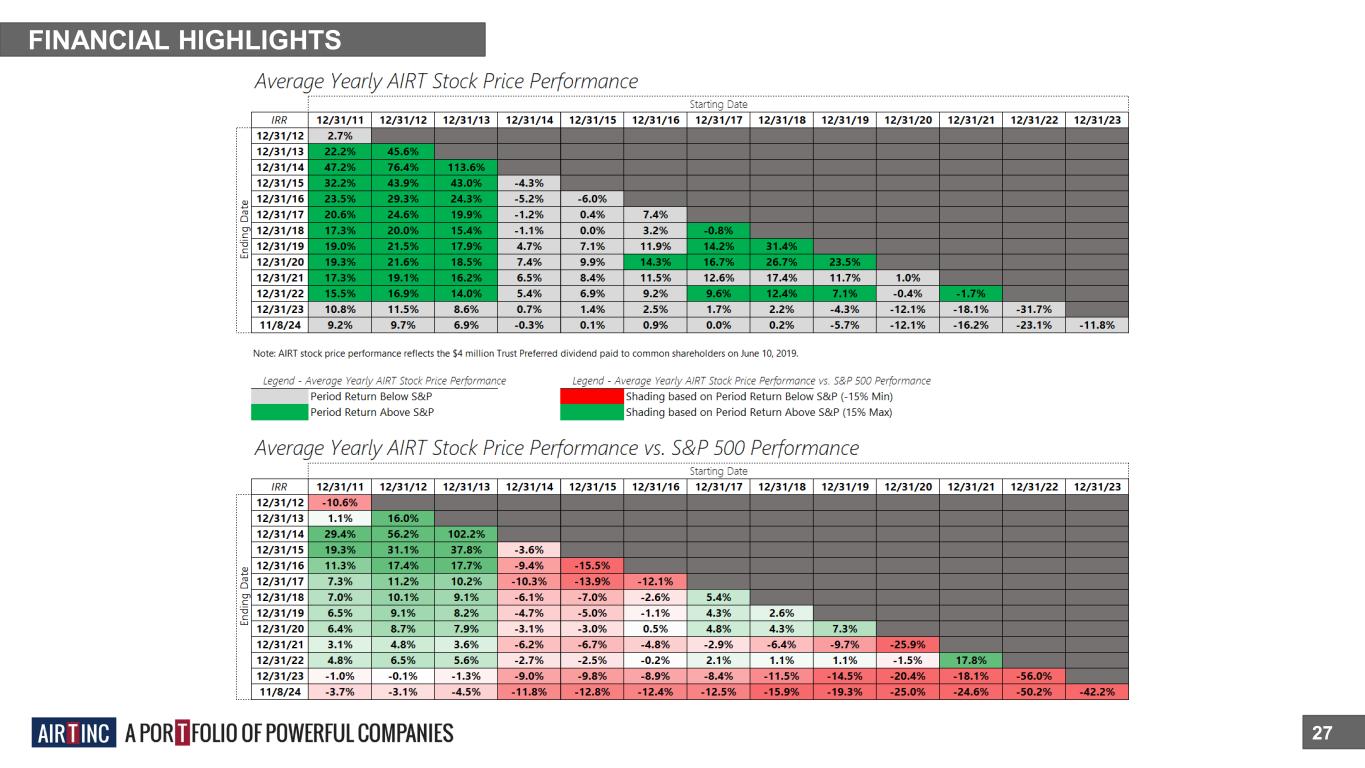

FINANCIAL HIGHLIGHTS 27

28 GROWTH STRATEGIES

GROWTH STRATEGIES Our four growth strategies are... 29 ■ Invest to build our current high-performing businesses. ■ Seek to acquire new cash-flow generating businesses. ■ Identify great marketable securities or alternative assets. ■ Create unique investment products and fund alongside third- party capital partnerships.

GROWTH STRATEGY 1 We plan to reinvest in projects at our high-performing businesses by... 30 ■ Purchasing commercial aircraft for trading, leasing and part-out. ■ Purchasing engine parts inventory. ■ Funding deicer builds for Global Ground Support.

GROWTH STRATEGY 2 We seek to acquire new cash-flow generating businesses by... 31 ■ Identifying and acquiring high- performing businesses with edge in the marketplace, which either complement our current portfolio or diversify into industries beyond aviation.

GROWTH STRATEGY 3 We plan to identify great marketable securities or alternative assets by... 32 ■ Searching for another committed activist opportunity. ■ Investing in distressed and high yield securities. ■ Investing in small cap securities. ■ Further investing in our current securities portfolio.

GROWTH STRATEGY 4 We plan to create unique investment products with outside capital partners by... 33 ■ Offering thoughtful and sustainable products with attractive return profiles ■ Attracting and retaining sophisticated investment professionals and creating space for talented asset managers.

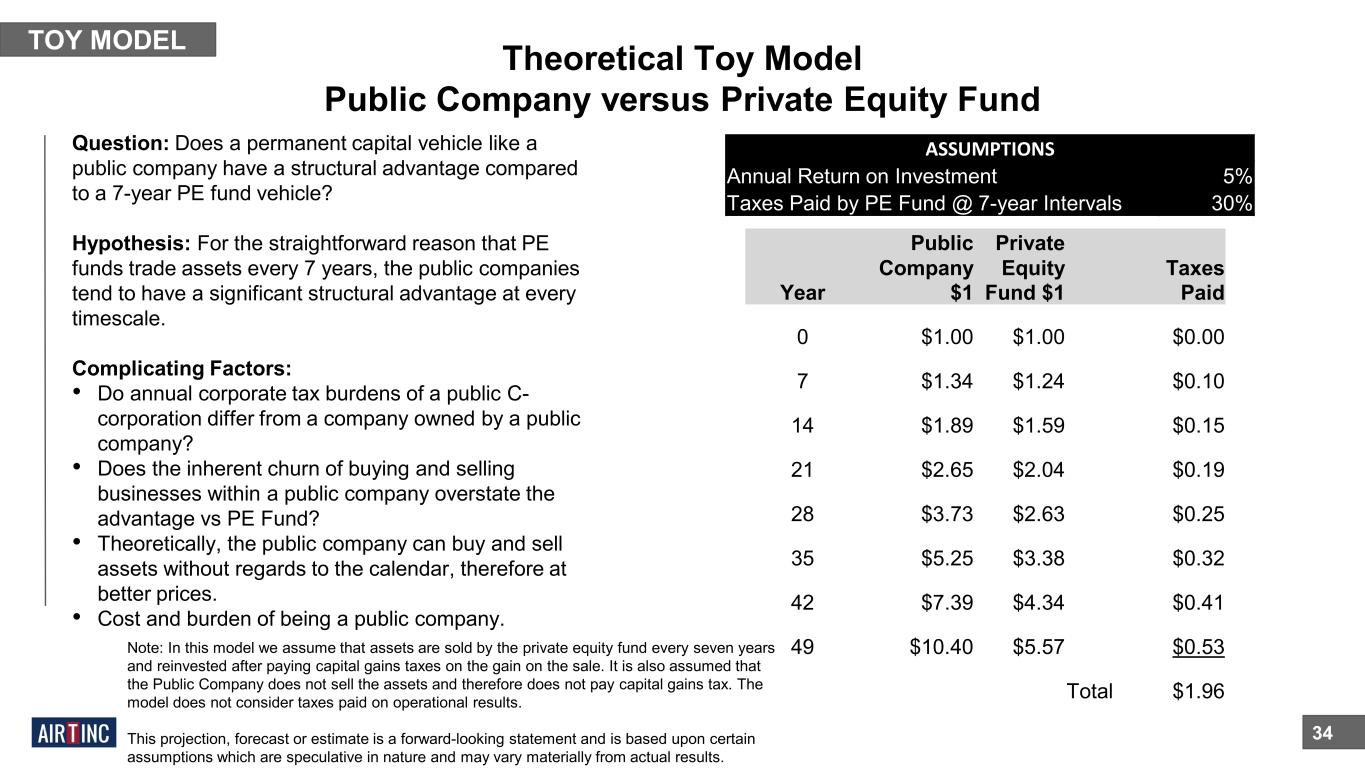

Theoretical Toy Model Public Company versus Private Equity Fund 34 TOY MODEL ASSUMPTIONS Annual Return on Investment 5% Taxes Paid by PE Fund @ 7-year Intervals 30% Year Public Company $1 Private Equity Fund $1 Taxes Paid 0 $1.00 $1.00 $0.00 7 $1.34 $1.24 $0.10 14 $1.89 $1.59 $0.15 21 $2.65 $2.04 $0.19 28 $3.73 $2.63 $0.25 35 $5.25 $3.38 $0.32 42 $7.39 $4.34 $0.41 49 $10.40 $5.57 $0.53 Total $1.96 Question: Does a permanent capital vehicle like a public company have a structural advantage compared to a 7-year PE fund vehicle? Hypothesis: For the straightforward reason that PE funds trade assets every 7 years, the public companies tend to have a significant structural advantage at every timescale. Complicating Factors: • Do annual corporate tax burdens of a public C- corporation differ from a company owned by a public company? • Does the inherent churn of buying and selling businesses within a public company overstate the advantage vs PE Fund? • Theoretically, the public company can buy and sell assets without regards to the calendar, therefore at better prices. • Cost and burden of being a public company. Note: In this model we assume that assets are sold by the private equity fund every seven years and reinvested after paying capital gains taxes on the gain on the sale. It is also assumed that the Public Company does not sell the assets and therefore does not pay capital gains tax. The model does not consider taxes paid on operational results. This projection, forecast or estimate is a forward-looking statement and is based upon certain assumptions which are speculative in nature and may vary materially from actual results.

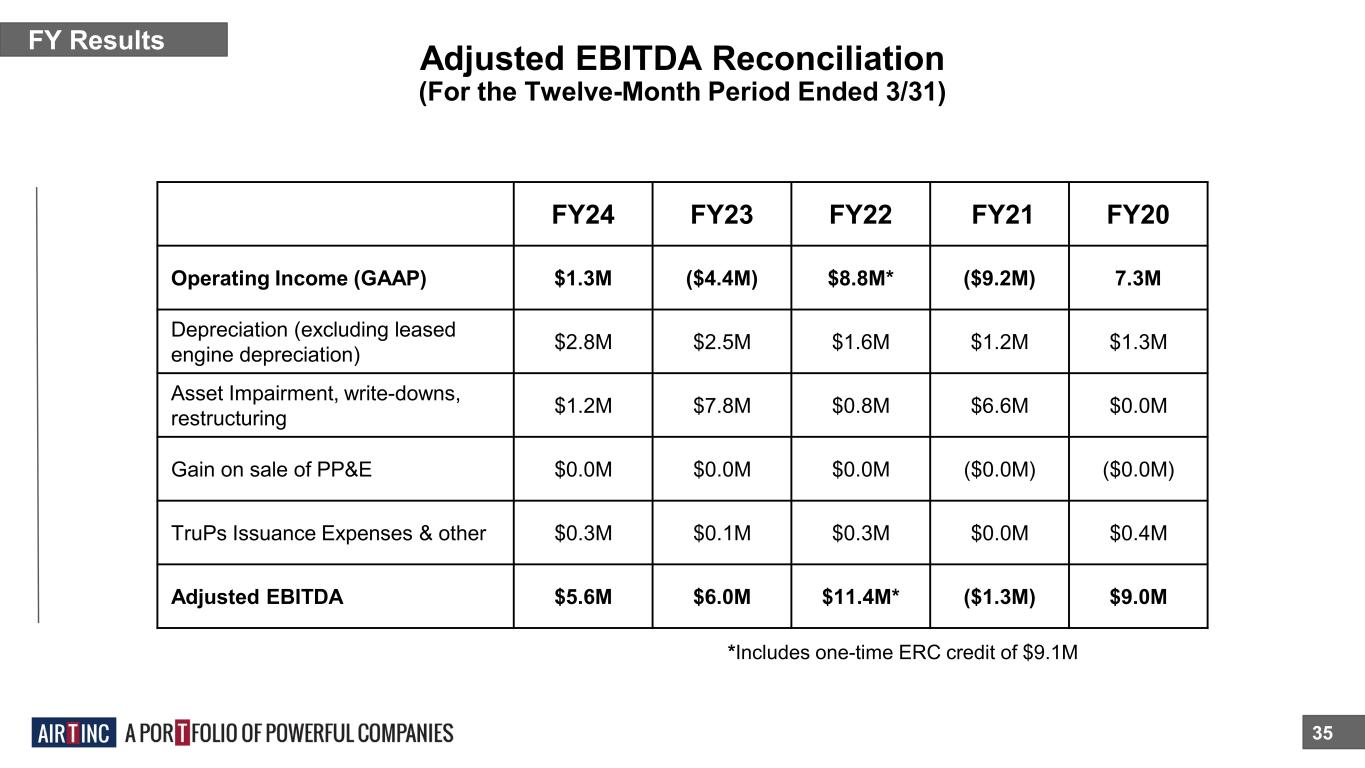

Adjusted EBITDA Reconciliation 35 FY Results *Includes one-time ERC credit of $9.1M (For the Twelve-Month Period Ended 3/31) FY24 FY23 FY22 FY21 FY20 Operating Income (GAAP) $1.3M ($4.4M) $8.8M* ($9.2M) 7.3M Depreciation (excluding leased engine depreciation) $2.8M $2.5M $1.6M $1.2M $1.3M Asset Impairment, write-downs, restructuring $1.2M $7.8M $0.8M $6.6M $0.0M Gain on sale of PP&E $0.0M $0.0M $0.0M ($0.0M) ($0.0M) TruPs Issuance Expenses & other $0.3M $0.1M $0.3M $0.0M $0.4M Adjusted EBITDA $5.6M $6.0M $11.4M* ($1.3M) $9.0M

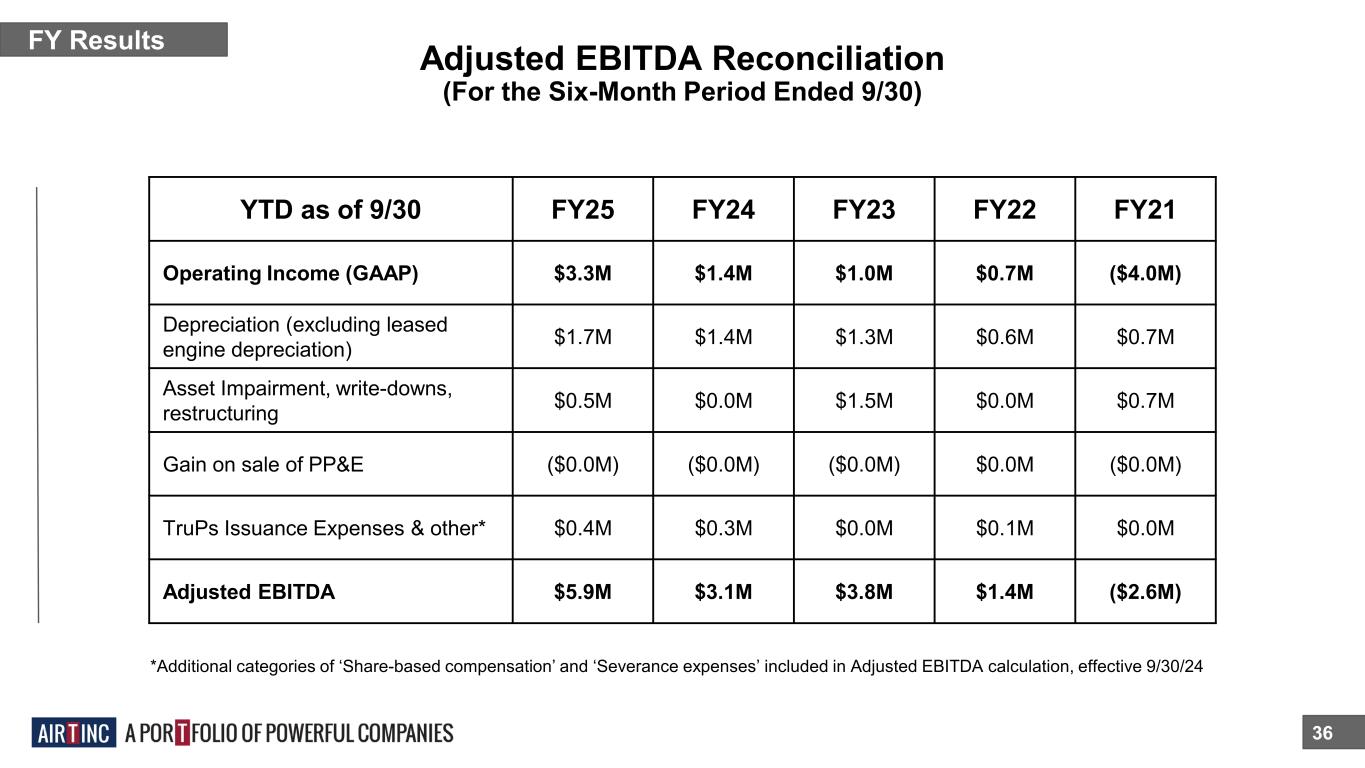

Adjusted EBITDA Reconciliation 36 FY Results YTD as of 9/30 FY25 FY24 FY23 FY22 FY21 Operating Income (GAAP) $3.3M $1.4M $1.0M $0.7M ($4.0M) Depreciation (excluding leased engine depreciation) $1.7M $1.4M $1.3M $0.6M $0.7M Asset Impairment, write-downs, restructuring $0.5M $0.0M $1.5M $0.0M $0.7M Gain on sale of PP&E ($0.0M) ($0.0M) ($0.0M) $0.0M ($0.0M) TruPs Issuance Expenses & other* $0.4M $0.3M $0.0M $0.1M $0.0M Adjusted EBITDA $5.9M $3.1M $3.8M $1.4M ($2.6M) (For the Six-Month Period Ended 9/30) *Additional categories of ‘Share-based compensation’ and ‘Severance expenses’ included in Adjusted EBITDA calculation, effective 9/30/24

37 Q&A WITH MANAGEMENT

Our interactive Q&A capability, through Slido.com, allows shareholders to ask questions of our management. Recently submitted questions have been answered below. To submit your own question, go to (https://app.sli.do/event/j8drfixw).1 38 How does the company go about sourcing information from each such supplier about the origin of conflict minerals in your products? Please refer to Air T's Form SD filed with the SEC, available in this link: https://www.sec.gov/Archives/edgar/data/353184/000035318424000055/a2024formsd-airt53124.htm Notes: 1. We plan to present and answer all questions received in the quarter through a section in the quarterly Investor Presentation. 2. Submitted questions may be edited for spelling and/or clarity.

APPENDIX Risk Factors 39

SUMMARY RISK FACTORS 40 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. The purchase of securities of Air T, Inc., the “Company,” is highly speculative and involves a very high degree of risk. An investment in the Company is suitable only for persons who can afford the loss of their entire investment. Accordingly, in making an investment decision with respect to the Company’s securities, investors should carefully consider all material risk factors, including the risks, uncertainties and additional information set forth below as well as set forth in (i) our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Currents Reports on Form 8-K, and our definitive proxy statements, all which are filed with the SEC, and (ii) our prospectus, filed as a part of our Registration Statement on Form S-3, which is filed with the SEC, and any supplement to the prospectus, including information in any documents subsequently incorporated by reference into the prospectus. Additional risks not presently known or are currently deemed immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. General Business Risks ● Market fluctuations may affect the Company’s operations. ● Rising inflation may result in increased costs of operations and negatively impact the credit and securities markets generally, which could have a material adverse effect on our results of operations and the market price of our Securities. ● We could experience significant increases in operating costs and reduced profitability due to competition for skilled management and staff employees in our operating businesses. ● Legacy technology systems require a unique technical skillset which is becoming scarcer. ● Security threats and other sophisticated computer intrusions could harm our information systems, which in turn could harm our business and financial results. ● We may not be able to insure certain risks adequately or economically. ● Legal liability may harm our business. ● Our business might suffer if we were to lose the services of certain key employees.

Risks Related to Our Segment Operations ● The operating results of our four segments may fluctuate, particularly our commercial jet engine and parts segment. ● Our Air Cargo Segment is dependent on a significant customer. ● Our dry-lease agreements with FedEx subject us to operating risks. ● Because of our dependence on FedEx, we are subject to the risks that may affect FedEx’s operations. ● A material reduction in the aircraft we fly for FedEx could materially adversely affect our business and results of operations. ● Sales of deicing equipment can be affected by weather conditions. ● We are affected by the risks faced by commercial aircraft operators and MRO companies because they are our customers. ● Our engine values and lease rates, which are dependent on the status of the types of aircraft on which engines are installed, and other factors, could decline. ● Upon termination of a lease, we may be unable to enter into new leases or sell the airframe, engine or its parts on acceptable terms. ● Failures by lessees to meet their maintenance and recordkeeping obligations under our leases could adversely affect the value of our leased engines and aircraft which could affect our ability to re-lease the engines and aircraft in a timely manner following termination of the leases. ● We may experience losses and delays in connection with repossession of engines or aircraft when a lessee defaults. ● Our commercial jet engine and parts segment and its customers operate in a highly regulated industry and changes in laws or regulations may adversely affect our ability to lease or sell our engines or aircraft. ● Our aircraft, engines and parts could cause damage resulting in liability claims. ● We have risks in managing our portfolio of aircraft and engines to meet customer needs. ● Liens on our engines or aircraft could exceed the value of such assets, which could negatively affect our ability to repossess, lease or sell a particular engine or aircraft. ● In certain countries, an engine affixed to an aircraft may become an addition to the aircraft and we may not be able to exercise our ownership rights over the engine. ● Higher or volatile fuel prices could affect the profitability of the aviation industry and our lessees’ ability to meet their lease payment obligations to us. ● Interruptions in the capital markets could impair our lessees’ ability to finance their operations, which could prevent the lessees from complying with payment obligations to us. For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS 41

Risks Related to Our Segment Operations (continued) ● Our lessees may fail to adequately insure our aircraft or engines which could subject us to additional costs. ● If our lessees fail to cooperate in returning our aircraft or engines following lease terminations, we may encounter obstacles and are likely to incur significant costs and expenses conducting repossessions. ● If our lessees fail to discharge aircraft liens for which they are responsible, we may be obligated to pay to discharge the liens. ● If our lessees encounter financial difficulties and we restructure or terminate our leases, we are likely to obtain less favorable lease terms. ● Withdrawal, suspension or revocation of governmental authorizations or approvals could negatively affect our business. Risks Related to Our Structure and Financing/Liquidity Risks ● The Company could experience liquidity issues if the Company’s revolving line of credit with MBT is not extended or replaced. ● Our holding company structure may increase risks related to our operations. ● A small number of stockholders has the ability to control the Company. ● Although we do not expect to rely on the “controlled company” exemption, we may soon become a “controlled company” within the meaning of the Nasdaq listing standards, and we would qualify for exemptions from certain corporate governance requirements. ● An increase in interest rates or in our borrowing margin would increase the cost of servicing our debt and could reduce our cash flow and negatively affect the results of our business operations. ● Our inability to maintain sufficient liquidity could limit our operational flexibility and also impact our ability to make payments on our obligations as they come due. ● Future cash flows from operations or through financings may not be sufficient to enable the Company to meet its obligations. ● A large proportion of our capital is invested in physical assets and securities that can be hard to sell, especially if market conditions are poor. ● To service our debt and meet our other cash needs, we will require a significant amount of cash, which may not be available. ● If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to seek alternatives. ● Despite our substantial indebtedness, we may incur significantly more debt, and cash may not be available to meet our financial obligations when due or enable us to capitalize on investment opportunities when they arise. ● Our current financing arrangements require compliance with financial and other covenants and a failure to comply with such covenants could adversely affect our ability to operate. 42 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS

Risks Related to Our Structure and Financing/Liquidity Risks (continued) ● Future acquisitions and dispositions of businesses and investments are possible, changing the components of our assets and liabilities, and if unsuccessful or unfavorable, could reduce the value of the Company and its securities. ● We face numerous risks and uncertainties as we expand our business. ● Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect the Company’s ability to operate profitably. ● Strategic ventures may increase risks applicable to our operations. ● Rapid business expansions or new business initiatives may increase risk. ● Our policies and procedures may not be effective in ensuring compliance with applicable law. ● Compliance with the regulatory requirements imposed on us as a public company results in significant costs that may have an adverse effect on our results. ● Deficiencies in our public company financial reporting and disclosures could adversely impact our reputation. Risks Related to Air T Funding ● The ranking of the Company’s obligations under the Junior Subordinated Debentures and the Guarantee creates a risk that Air T Funding may not be able to pay amounts due to holders of the Capital Securities. ● The Company has the option to extend the Capital Securities interest payment period. ● Tax event or investment company act redemption of the Capital Securities. ● The Company may cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities. ● There are limitations on direct actions against the Company and on rights under the guarantee. ● The covenants in the Indenture are limited. ● Holders of the Capital Securities have limited voting rights. 43 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS