Applied UV Announces Pricing of $6.4 Million Upsized Underwritten Public Offering

14 Noviembre 2023 - 8:32AM

via NewMediaWire -- Applied UV, Inc. (Nasdaq: AUVI; AUVIP)

(“Applied UV” or the “Company”), a global leading provider of

advanced food security and air and surface disinfection technology,

today announced the pricing of a firm commitment underwritten

public offering with gross proceeds to the Company expected to be

approximately $6.4 million, before deducting underwriting discounts

and other estimated expenses payable by the Company. The offering

was upsized from $6.0 million. The base offering consists of

42,666,666 units or pre-funded units (the “Units”), each Unit

consisting of one share of common stock (“Common Stock”) or one

pre-funded warrant (“Pre-Funded Warrant”) to purchase one share of

Common Stock, one-tenth (1/10) of a Series A warrant (“Series A

Warrant”) to purchase one a share of Common Stock and one-tenth

(1/10) of a Series B Warrant to purchase one a share of Common

Stock (“Series B Warrant” and, together with the Series A Warrant,

the “Warrants”), at an offering price of $0.15 per Unit. The

purchase price of each Unit including a Pre-Funded Warrant will be

equal to the price per Unit including one share of Common Stock,

minus $0.00001, and the remaining exercise price of each Pre-Funded

Warrant will equal $0.00001 per share. The Pre-Funded Warrants will

be immediately exercisable and may be exercised at any time until

all of the Pre-Funded Warrants are exercised in full. The Company

intends to use the net proceeds to us from this offering for the

repayment of notes, and for general corporate purposes, including

working capital.

In addition, the Company has granted Aegis Capital Corp. a

45-day option to purchase additional shares of Common Stock and/or

Pre-Funded Warrants, representing up to 15% of the number of Common

Stock and/or Pre-Funded Warrants sold in the offering, and

additional Warrants representing up to 15% of the Warrants sold in

the offering, solely to cover over-allotments, if any.

The offering is expected to close on November 16, 2023, subject

to the satisfaction of customary closing conditions.

Aegis Capital Corp. is acting as the sole book-running

manager for the Offering

The offering was made pursuant to an effective registration

statement on Form S-1 (No. 333-274879) previously filed with the

U.S. Securities and Exchange Commission (the “SEC”) and declared

effective by the SEC on November 13, 2023. A preliminary prospectus

(the “Preliminary Prospectus”) describing the terms of the proposed

offering was filed with the SEC and is available on the SEC’s

website located at www.sec.gov. Electronic copies of the

Preliminary Prospectus may be obtained by contacting Aegis Capital

Corp., Attention: Syndicate Department, 1345 Avenue of the

Americas, 27th floor, New York, NY 10105, by email at

syndicate@aegiscap.com, or by telephone at (212) 813-1010. Before

investing in this offering, interested parties should read in their

entirety the registration statement and the Preliminary Prospectus

and the other documents that the Company has filed with the SEC

that are incorporated by reference in such registration statement

and the Preliminary Prospectus, which provide more information

about the Company and the offering.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Applied UV

Applied UV, Inc. provides proprietary surface and air pathogen

elimination and disinfection technology focused on improving indoor

air quality, specialty LED lighting and luxury mirrors and

commercial furnishings, all of which serve clients globally in both

the commercial and retail segments. For information on Applied UV,

Inc., and its subsidiaries, please visit www.applieduvinc.com.

Forward-Looking Statements

The information contained herein may contain “forward‐looking

statements.” Forward‐looking statements reflect the current view

about future events. When used in this press release, the words

“anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,”

“plan,” or the negative of these terms and similar expressions, as

they relate to us or our management, identify forward‐looking

statements. Such statements include, but are not limited to,

statements contained in this press release relating to the closing

of the offering. Forward‐looking statements are based on the

Company’s current expectations and assumptions regarding its

business, the economy, and other future conditions. In this news

release, such forward-looking statements include statements

regarding the anticipated use of proceeds from the offering.

Because forward–looking statements relate to the future, they are

subject to inherent uncertainties, risks, and changes in

circumstances that are difficult to predict, many of which are

beyond the control of the Company, including those set forth in the

Risk Factors section of the Preliminary Prospectus. The Company’s

actual results may differ materially from those contemplated by the

forward‐looking statements. They are neither statements of

historical fact nor guarantees of assurance of future performance.

We caution you therefore against relying on any of these

forward‐looking statements. Factors or events that could cause the

Company’s actual results to differ may emerge from time to time,

and it is not possible for the Company to predict all of them. The

Company cannot guarantee future results, levels of activity,

performance, or achievements. Except as required by applicable law,

including the securities laws of the United States, the Company

does not intend to update any of the forward‐looking statements.

References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

For additional Company Information:

Applied UV Inc.

Max Munn

Applied UV Founder, CEO & Director

Max.munn@applieduvinc.com

Investor Relations Contact:

TraDigital IR

Kevin McGrath

+1-646-418-7002

kevin@tradigitalir.com

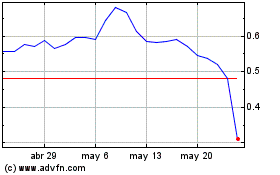

Applied UV (NASDAQ:AUVI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Applied UV (NASDAQ:AUVI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024