0001086745

false

0001086745

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

AYRO,

Inc.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

001-34643 |

|

98-0204758 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

No.) |

|

(IRS

Employer

Identification

No.) |

AYRO,

Inc.

900

E. Old Settlers Boulevard, Suite 100

Round

Rock, Texas 78664

(Address

of principal executive offices and zip code)

Registrant’s

telephone number, including area code: 512-994-4917

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock,

par value $0.0001 per share |

|

AYRO |

|

The Nasdaq

Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2023, AYRO, Inc. issued a press release announcing its financial results for the second fiscal quarter ended June 30,

2022. A copy of this press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

In

accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, that

is furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AYRO,

INC. |

| |

|

|

| Date: August

14, 2023 |

By:

|

/s/

Thomas M. Wittenschlaeger |

| |

|

Thomas M.

Wittenschlaeger |

| |

|

Chief Executive

Officer |

Exhibit

99.1

AYRO

Announces Second Quarter 2023 Financial Results and Provides Corporate Update

ROUND

ROCK, TX (August 14, 2023) – AYRO, Inc. (NASDAQ: AYRO) (“AYRO” or the “Company”), a designer and manufacturer

of electric, purpose-built delivery vehicles and solutions for micro distribution, micro-mobility, and last-mile delivery, announces

financial results for the second quarter ended June 30, 2023.

Recent

Financial Highlights:

| |

● |

Net

loss of $6.0 million in the second quarter of 2023 compared to net loss of $6.0 million in the prior year period |

| |

● |

Approximately

$52.0 million in cash to date, including

the proceeds of a $22 million financing consummated in early August 2023 |

“We

made significant progress during the second quarter that we believe brings us ever closer to the commercial launch of the AYRO Vanish,

our new low-speed electric vehicle, or LSEV,” commented AYRO CEO Tom Wittenschlaeger. “We recently completed all of our homologation

safety and testing requirements and expect to receive certifications shortly. With these certifications in hand and given the thorough

track testing and tuning of nearly every component of the Vanish, we are targeting the start of low-rate initial production, or LRIP,

this fall. We have confidence in the Vanish’s performance, safety, and quality and have taken great measures to ensure the Vanish

is designed and manufactured to incredibly high engineering standards that are befitting a vehicle that has won prominent awards from

Red Dot and Frost & Sullivan prior to even beginning commercial production.

“In

addition to the 12 prototype units we have already produced, some of which were used in homologation testing and dealer presales, units

produced in the forthcoming LRIP phase will be placed with vehicle upfitters, distributors, strategic partners, and key end-customers

that we believe will offer the most sales leverage entering 2024. Following LRIP, we anticipate moving to full-scale production with

a target of producing 2,000 vehicles per year from a single shift operation.

“Revenue

in the second quarter was minimal, as expected, given the sunsetting of our first generation LSEV, the Club Car Current. Predictably,

nearly all our internal efforts have been advancing the development of the Vanish to the production phase.

“Concurrently,

we have begun increasing our inventory of components from our supply chain in preparation for LRIP and, eventually, full-scale production.

To further support the manufacturing efforts, inventory build, and initial launch efforts, we recently completed a $22 million financing

that strengthens our balance sheet substantially. We believe having this additional capital, along with our $33 million in cash and marketable

securities on hand at June 30, will allow us to meet anticipated demand for the Vanish and proceed with the development of our Valet

and Vapor models.

“As

always, we thank our stockholders for their continued support and our employees for their commitment and dedication,” concluded

Mr. Wittenschlaeger.

Second

Quarter 2023 Earnings Conference Call

AYRO

management will host a conference call at 8:30 a.m. ET on Tuesday, August 15, 2023 to review financial results and provide an update

on corporate developments. Following management’s formal remarks, there will be a question-and-answer session.

To

listen to the conference call, interested parties within the U.S. should dial 1-833-953-2436 (domestic) or 1-412-317-5765 (international).

All callers should dial in approximately 10 minutes prior to the scheduled start time and ask to be joined into the AYRO, Inc. conference

call.

The

conference call will also be available through a live webcast that can be accessed at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=VRoZ5XQC

or via the Company’s website at https://ir.ayro.com/news-events/ir-calendar.

The

webcast replay will be available until November 15, 2023 and can be accessed through the above links. A telephonic replay will be available

until August 29, 2023 by calling 1-877-344-7529 (domestic) or 1-412-317-0088 (international) and using access code 1804289.

About

AYRO

AYRO

designs and produces zero emission vehicles and systems that redefine the very nature of sustainability. Our goal is to craft solutions

in a way that leaves minimal impact on not only carbon emissions, but the space itself. From tire tread, fuel cells, sound, and even

discordant visuals, we apply engineering and artistry to every element of our product mix. The AYRO Vanish is the first in this new product

roadmap. For more information, visit www.ayro.com.

Forward-Looking

Statements

This

press release may contain forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties

and other factors which may cause actual results, performance or achievements to be materially different from any expected future results,

performance, or achievements. Words such as “anticipate,” “believe,” “could,” “estimate,”

“intend,” “expect,” “may,” “plan,” “will,” “would” and their

opposites and similar expressions are intended to identify forward-looking statements and include the development and launch of the AYRO

Vanish. Such forward-looking statements are based on the beliefs of management as well as assumptions made by and information currently

available to management. Important factors that could cause actual results to differ materially from those indicated by such forward-looking

statements include, without limitation: AYRO’s success depends on its ability to complete the development of and successfully introduce

new products; AYRO may experience delays in the development and introduction of new products; the ability of AYRO’s suppliers to

deliver parts and assemble vehicles; the ability of the purchaser to terminate or reduce purchase orders; AYRO has a history of losses

and has never been profitable, and AYRO expects to incur additional losses in the future and may never be profitable; AYRO’s failure

to meet the continued listing requirements of The Nasdaq Capital Market could result in a delisting of its common stock; AYRO may be

unable to replace lost manufacturing capacity on a timely and cost-effective basis, which could adversely impact its operations and ability

to meet delivery timelines; the impact of public health epidemics, including the COVID-19 pandemic; the market for AYRO’s products

is developing and may not develop as expected and AYRO, accordingly, may never meet its targeted production and sales goals; AYRO’s

limited operating history makes evaluating its business and future prospects difficult and may increase the risk of any investment in

its securities; AYRO may experience lower-than-anticipated market acceptance of its vehicles; developments in alternative technologies

or improvements in the internal combustion engine may have a materially adverse effect on the demand for AYRO’s electric vehicles;

the markets in which AYRO operates are highly competitive, and AYRO may not be successful in competing in these industries; AYRO may

become subject to product liability claims, which could harm AYRO’s financial condition and liquidity if AYRO is not able to successfully

defend or insure against such claims; increases in costs, disruption of supply or shortage of raw materials, in particular lithium-ion

cells, chipsets and displays, could harm AYRO’s business; AYRO may be required to raise additional capital to fund its operations,

and such capital raising may be costly or difficult to obtain and could dilute AYRO stockholders’ ownership interests, and AYRO’s

long term capital requirements are subject to numerous risks; AYRO may fail to comply with evolving environmental and safety laws and

regulations; and AYRO is subject to governmental export and import controls that could impair AYRO’s ability to compete in international

market due to licensing requirements and subject AYRO to liability if AYRO is not in compliance with applicable laws. A discussion of

these and other factors with respect to AYRO is set forth in our most recent Annual Report on Form 10-K and subsequent reports on Form

10-Q. Forward-looking statements speak only as of the date they are made and AYRO disclaims any intention or obligation to revise any

forward-looking statements, whether as a result of new information, future events or otherwise.

For

investor inquiries:

CORE

IR

investors@ayro.com

516-222-2560

Non-GAAP

Financial Measures

We

present Adjusted EBITDA because we consider it to be an important supplemental measure of our operating performance, and we believe it

may be used by certain investors as a measure of our operating performance. Adjusted EBITDA is defined as income (loss) from operations

before interest income and expense, income taxes, depreciation, amortization of intangible assets, amortization of discount on debt,

impairment of long-lived assets, stock-based compensation expense and certain non-recurring expenses.

Adjusted

EBITDA is not a measurement of financial performance under generally accepted accounting principles in the United States, or GAAP. Because

of varying available valuation methodologies, subjective assumptions and the variety of equity instruments that can impact our non-cash

operating expenses, we believe that providing a non-GAAP financial measure that excludes non-cash and non-recurring expenses allows for

meaningful comparisons between our core business operating results and those of other companies, as well as providing us with an important

tool for financial and operational decision making and for evaluating our own core business operating results over different periods

of time.

Adjusted

EBITDA may not provide information that is directly comparable to that provided by other companies in our industry, as other companies

in our industry may calculate non-GAAP financial results differently, particularly related to non-recurring, unusual items. Adjusted

EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to operating income or

as an indication of operating performance or any other measure of performance derived in accordance with GAAP. We do not consider Adjusted

EBITDA to be a substitute for, or superior to, the information provided by GAAP financial results.

Below

is a reconciliation of Adjusted EBITDA to net loss for the three months ended March 31, 2023 and 2022 and for the six months ended June

30, 2023 and 2022, respectively:

AYRO,

INC. AND SUBSIDIARIES

EBITDA

RECONCILIATION TABLE

(UNAUDITED)

| | |

Three Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Net Loss | |

$ | (6,003,233 | ) | |

$ | (5,974,448 | ) |

| Depreciation and Amortization | |

| 258,546 | | |

| 136,366 | |

| Stock-based compensation expense | |

| 242,128 | | |

| 303,553 | |

| NCM Write-Down | |

| - | | |

| 1,938,386 | |

| Adjusted EBITDA | |

$ | (5,502,559 | ) | |

$ | (3,596,143 | ) |

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| Net Loss | |

$ | (11,479,002 | ) | |

$ | (10,553,108 | ) |

| Depreciation and Amortization | |

| 452,848 | | |

| 257,791 | |

| Stock-based compensation expense | |

| 508,869 | | |

| 591,663 | |

| NCM Write-Down | |

| - | | |

| 1,938,386 | |

| Adjusted EBITDA | |

$ | (10,517,285 | ) | |

$ | (7,765,268 | ) |

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 13,569,265 | | |

$ | 39,096,562 | |

| Marketable securities | |

| 19,464,015 | | |

| 9,848,804 | |

| Accounts receivable, net | |

| 104,155 | | |

| 510,071 | |

| Inventory | |

| 3,049,972 | | |

| 970,381 | |

| Prepaid expenses and other current assets | |

| 3,269,831 | | |

| 1,478,845 | |

| Total current assets | |

| 39,457,238 | | |

| 51,904,663 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 3,201,260 | | |

| 2,192,337 | |

| Operating lease – right-of-use asset | |

| 750,877 | | |

| 819,401 | |

| Deposits and other assets | |

| 84,595 | | |

| 73,683 | |

| Total assets | |

$ | 43,493,970 | | |

$ | 54,990,084 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 716,236 | | |

| 1,107,215 | |

| Accrued expenses | |

| 910,114 | | |

| 964,937 | |

| Current portion lease obligation – operating lease | |

| 178,013 | | |

| 165,767 | |

| Total current liabilities | |

| 1,804,363 | | |

| 2,237,919 | |

| Lease obligation – operating lease, net of current portion | |

| 601,349 | | |

| 693,776 | |

| Total liabilities | |

| 2,405,712 | | |

| 2,931,695 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred Stock, (authorized – 20,000,000 shares) | |

| - | | |

| - | |

| Convertible Preferred Stock Series H, ($0.0001 par value; authorized – 8,500 shares; issued and outstanding – 8 shares as of June 30, 2023 and December 31, 2022, respectively) | |

| - | | |

| - | |

| Convertible Preferred Stock Series H-3, ($0.0001 par value; authorized – 8,461 shares; issued and outstanding – 1,234 as of June 30, 2023 and December 31, 2022, respectively) | |

| - | | |

| - | |

| Convertible Preferred Stock Series H-6, ($0.0001 par value; authorized – 50,000 shares; issued and outstanding – 50 as of June 30, 2023 and December 31, 2022, respectively) | |

| - | | |

| - | |

| Common Stock, ($0.0001 par value; authorized – 100,000,000 shares; issued and outstanding – 37,536,101 and 37,241,642 as of June 30, 2023 and December 31, 2022, respectively) | |

| 3,753 | | |

| 3,724 | |

| Additional paid-in capital | |

| 133,733,091 | | |

| 133,224,249 | |

| Accumulated deficit | |

| (92,648,586 | ) | |

| (81,169,584 | ) |

| Total stockholders’ equity | |

| 41,088,258 | | |

| 52,058,389 | |

| Total liabilities and stockholders’ equity | |

$ | 43,493,970 | | |

$ | 54,990,084 | |

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenue | |

$ | 139,544 | | |

$ | 981,560 | | |

$ | 252,628 | | |

$ | 2,008,405 | |

| Cost of goods sold | |

| 332,027 | | |

| 2,827,512 | | |

| 551,820 | | |

| 4,004,657 | |

| Gross loss | |

| (192,483 | ) | |

| (1,845,952 | ) | |

| (299,192 | ) | |

| (1,996,252 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 2,405,398 | | |

| 1,046,797 | | |

| 4,535,388 | | |

| 1,912,204 | |

| Sales and marketing | |

| 420,861 | | |

| 337,226 | | |

| 1,138,953 | | |

| 1,182,042 | |

| General and administrative | |

| 3,247,731 | | |

| 2,741,700 | | |

| 6,091,047 | | |

| 5,446,627 | |

| Total operating expenses | |

| 6,073,990 | | |

| 4,125,723 | | |

| 11,765,388 | | |

| 8,540,873 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (6,266,473 | ) | |

| (5,971,675 | ) | |

| (12,064,580 | ) | |

| (10,537,125 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Other income (expense), net | |

| (9,166 | ) | |

| 10,706 | | |

| 52,532 | | |

| 19,597 | |

| Interest income | |

| 117,278 | | |

| - | | |

| 261,638 | | |

| - | |

| Unrealized gain (loss) on marketable securities | |

| 146,935 | | |

| (13,479 | ) | |

| 198,215 | | |

| (35,580 | ) |

| Realized gain on marketable securities | |

| 8,193 | | |

| | | |

| 73,193 | | |

| | |

| Other income (expense), net | |

| 263,240 | | |

| (2,773 | ) | |

| 585,578 | | |

| (15,983 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (6,003,233 | ) | |

$ | (5,974,448 | ) | |

$ | (11,479,002 | ) | |

$ | (10,553,108 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.16 | ) | |

$ | (0.16 | ) | |

$ | (0.31 | ) | |

$ | (0.29 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted weighted average Common Stock outstanding | |

| 37,476,845 | | |

| 36,982,436 | | |

| 37,398,555 | | |

| 36,945,240 | |

AYRO,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (11,479,002 | ) | |

$ | (10,553,108 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 452,848 | | |

| 257,791 | |

| Loss on disposal of fixed asset | |

| 11,666 | | |

| - | |

| Stock-based compensation | |

| 508,869 | | |

| 591,663 | |

| Amortization of right-of-use asset | |

| 81,524 | | |

| 118,092 | |

| Bad debt expense | |

| 292,010 | | |

| 2,069 | |

| Unrealized (gain) loss on marketable securities | |

| (198,215 | ) | |

| 35,580 | |

| Realized (gain) on marketable securities | |

| (73,193 | ) | |

| - | |

| Impairment of inventory and prepaid | |

| - | | |

| 1,938,386 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 113,906 | | |

| (955,609 | ) |

| Inventory | |

| (2,079,590 | ) | |

| 325,282 | |

| Prepaid expenses and other current assets | |

| (1,790,987 | ) | |

| (785,762 | ) |

| Accounts payable | |

| (405,979 | ) | |

| 164,809 | |

| Accrued expenses | |

| (234,155 | ) | |

| (838,304 | ) |

| Lease obligations - operating leases | |

| (93,181 | ) | |

| (132,403 | ) |

| Net cash used in operating activities | |

| (14,893,479 | ) | |

| (9,831,514 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property and equipment | |

| (1,271,311 | ) | |

| (414,197 | ) |

| Purchase of marketable securities, net | |

| (9,343,804 | ) | |

| (18,006,486 | ) |

| Purchase of intangible assets | |

| (18,703 | ) | |

| (17,500 | ) |

| Net cash used in investing activities | |

| (10,633,818 | ) | |

| (18,438,183 | ) |

| | |

| | | |

| | |

| Net change in cash | |

| (25,527,297 | ) | |

| (28,269,697 | ) |

| | |

| | | |

| | |

| Cash, beginning of period | |

| 39,096,562 | | |

| 69,160,466 | |

| | |

| | | |

| | |

| Cash, end of period | |

$ | 13,569,265 | | |

$ | 40,890,769 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash and non-cash transactions: | |

| | | |

| | |

| Accrued Fixed Assets | |

$ | 194,335 | | |

$ | - | |

| Restricted Stock issued, previously accrued | |

$ | - | | |

$ | 329,381 | |

| Supplemental cash amounts arising from obtaining right of use assets | |

$ | 548,158 | | |

$ | - | |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-34643

|

| Entity Registrant Name |

AYRO,

Inc.

|

| Entity Central Index Key |

0001086745

|

| Entity Tax Identification Number |

98-0204758

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

AYRO,

Inc.

|

| Entity Address, Address Line Two |

900

E. Old Settlers Boulevard

|

| Entity Address, Address Line Three |

Suite 100

|

| Entity Address, City or Town |

Round

Rock

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78664

|

| City Area Code |

512

|

| Local Phone Number |

994-4917

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock,

par value $0.0001 per share

|

| Trading Symbol |

AYRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

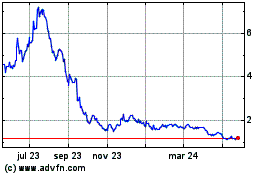

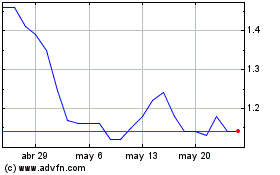

AYRO (NASDAQ:AYRO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

AYRO (NASDAQ:AYRO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024