Form 8-A12B/A - Registration of securities [Section 12(b)]: [Amend]

19 Agosto 2024 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-A/A

Amendment No. 1

___________________________________

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

___________________________________

Better Home & Finance Holding Company

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | | 93-3029990 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

3 World Trade Center 175 Greenwich Street, 57th Floor New York, NY | | 10007 |

| (Address of principal executive offices) | | (Zip Code) |

Securities to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class to be so registered | | Name of each exchange on which each class is to be registered |

| Class A common stock, par value $0.0001 per share | | The Nasdaq Stock Market LLC |

| Warrants exercisable for one share of Class A common stock at an exercise price of $575 | | The Nasdaq Stock Market LLC |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), please check the following box: ☒

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), please check the following box: ☐

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box: ☐

Securities Act registration statement or Regulation A offering statement file number to which this form relates: 333-253106.

Securities to be registered pursuant to Section 12(g) of the Act: N/A.

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment”) to Form 8-A amends the information set forth in Item 1 of the Registration Statement on Form 8-A, filed by Aurora Acquisition Corp., the predecessor of Better Home & Finance Holding Company (the “Registrant”), with the Securities and Exchange Commission (the “Commission”) on March 1, 2021.

No new securities are being registered pursuant to this Amendment, which is being filed solely to update the description of the Registrant’s Class A common stock, par value $0.0001 per share (“Class A Common Stock”), and warrants to purchase Class A Common Stock (“Warrants”) to reflect a reverse stock split at a ratio of one-for-50 shares of Class A Common Stock, Class B common stock, par value $0.0001 per share (“Class B Common Stock”), and Class C common stock, par value $0.0001 per share (“Class C Common Stock” and together with Class A Common Stock and Class B Common Stock, the “Common Stock”).

INFORMATION REQUIRED IN REGISTRATION STATEMENT

| | | | | |

| Item 1. | Description of Registrant’s Securities to be Registered |

A reverse stock split (the “Reverse Stock Split”) of the Common Stock became effective at 6:00 p.m., New York Time, on August 16, 2024 (the “Effective Date”). Pursuant to the Reverse Stock Split, every fifty shares of the issued and outstanding Class A Common Stock, Class B Common Stock and Class C Common Stock were combined into one issued and outstanding share of Class A Common Stock, Class B Common Stock and Class C Common Stock, respectively, without any change to (i) the par value of $0.0001 per share or (ii) any stockholder’s percentage interest in the Company’s equity, subject to the effects of fractional shares. Immediately following the Effective Date, the 1,800,000,000 authorized shares of Class A Common Stock was reduced to 36,000,000 authorized shares of Class A Common Stock, the 700,000,000 authorized shares of Class B Common Stock was reduced to 14,000,000 authorized shares of Class B Common Stock and the 800,000,000 authorized shares of Class C Common Stock was reduced to 16,000,000 authorized shares of Class C Common Stock. The Class A Common Stock, Class B Common Stock and Class C Common Stock have the same voting rights and are identical in all other respects to the Class A Common Stock, Class B Common Stock and Class C Common Stock, respectively, prior to the Effective Date. Each share of Class B Common Stock and Class C Common Stock may be converted to a share of Class A Common Stock at any time by the holder thereof and upon certain other transfers that are not permitted transfers provided by the Company’s Amended and Restated Certificate of Incorporation. The number of authorized shares and par value of preferred stock remained unchanged. Proportionate adjustments were made to the number of shares of Class A Common Stock underlying the Company’s outstanding Warrants and the exercise price of such Warrants.

The foregoing summary of the Reverse Stock Split does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment to the Company’s Amended and Restated Certificate of Incorporation (“Certificate of Amendment”), which was filed with the Delaware Secretary of State on August 16, 2024 and is attached hereto as Exhibit 3.2. The Common Stock and the Warrants are described in the Certificate of Amendment and Exhibit 4.1 to the Registrant’s current report on Form 8-K, filed with the Commission on August 19, 2024, each of which are incorporated by reference herein.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| BETTER HOME & FINANCE HOLDING COMPANY |

| | |

Date: August 19, 2024 | By: | /s/ Kevin Ryan |

| Name: | Kevin Ryan |

| Title: | Chief Financial Officer |

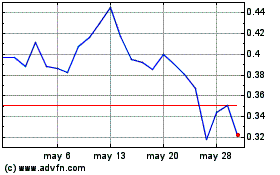

Better Home and Finance (NASDAQ:BETR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

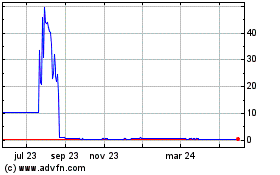

Better Home and Finance (NASDAQ:BETR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024