0001653909false12/3100016539092024-08-302024-08-3000016539092024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2024

___________________________________

Allbirds, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-40963 | | 47-3999983 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

30 Hotaling Place

San Francisco, CA 94111

(Address of principal executive offices, including zip code)

(628) 225-4848

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value | | BIRD | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

The information contained in Item 5.03 of this Current Report on Form 8-K (this “Current Report”) is incorporated herein by reference.

Item 5.03 Amendment to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As previously disclosed, at a special meeting of stockholders held on August 13, 2024, the stockholders of Allbirds, Inc. (the “Company”) approved amendments to the Company’s Ninth Amended and Restated Certificate of Incorporation (the “Certificate”) to effect a reverse stock split of the Company’s Class A and Class B common stock at a ratio ranging from 1-for-10 to 1-for-50, to be determined by the Company’s Board of Directors in its discretion. The Board of Directors subsequently approved the amendment to the Certificate effecting the reverse stock split at a ratio of 1-for-20 (the “Reverse Stock Split” and such ratio, the “Split Ratio”).

On August 30, 2024, the Company announced that it had filed with the Secretary of State of the State of Delaware a Certificate of Amendment to the Certificate (the “Certificate of Amendment”) to effect the Reverse Stock Split of the Company’s Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) and Class B Common Stock, par value $0.0001 per share (the “Class B Common Stock” and together with the Class A Common Stock, the “Common Stock”), effective as of 5:00 p.m. Eastern Standard Time on September 4, 2024 (the “Effective Time”). Accordingly, each holder of Common Stock will own fewer shares of Common Stock as a result of the Reverse Stock Split. However, the Reverse Stock Split will affect all holders of Common Stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except to the extent that the Reverse Stock Split would result in an adjustment to a stockholder’s ownership of Common Stock due to the treatment of fractional shares in the Reverse Stock Split. Therefore, voting rights and other rights and preferences of the holders of Common Stock will not be affected by the Reverse Stock Split (other than as a result of the treatment of fractional shares). Common stock issued pursuant to the Reverse Stock Split will remain fully paid and nonassessable, without any change in the par value per share.

No fractional shares are being issued as a result of the Reverse Stock Split. Instead, each stockholder will be entitled to receive a cash payment equal to the fraction of which such stockholder would otherwise be entitled multiplied by the closing price per share of Class A Common Stock on the date of the Effective Time as reported by Nasdaq (as adjusted to give effect to the Reverse Stock Split).

The Common Stock will begin trading on a Reverse Stock Split-adjusted basis on The Nasdaq Global Select Market on September 5, 2024. The trading symbol for the Common Stock will remain “BIRD.” The new CUSIP number for the Class A Common Stock following the Reverse Stock Split will be 01675A 208.

For more information about the Reverse Stock Split, see the definitive proxy statement for the special meeting of stockholders held on August 13, 2024 filed by the Company with the Securities and Exchange Commission (the “Commission”) on June 28, 2024, the relevant portions of which are incorporated herein by reference. The information set forth herein is qualified in its entirety by reference to the complete text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 to this Current Report and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

A copy of the press release announcing the Reverse Stock Split is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information set forth in this Item 7.01, including Exhibit 99.1, shall not be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

The information contained in Item 5.03 of this Current Report is incorporated herein by reference.

The Company has registration statements on Form S-8 (File Nos. 333-260696, 333-260697, 333-263892, 333-270456, and 333-277866) on file with the Commission. Commission regulations permit the Company to incorporate by reference future filings made with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offerings covered by registration statements filed on Form S-8. The information incorporated by reference is considered to be part of the prospectus included within each of those registration statements. Information in this Item 8.01 of this Current Report is therefore intended to be automatically incorporated by reference into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act, the amount of undistributed shares of Common Stock deemed to be covered by the effective registration statements of the

Company described above are proportionately reduced as of the Effective Time at the Split Ratio to give effect to the Reverse Stock Split.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 3.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Allbirds, Inc. |

| Dated: August 30, 2024 | |

| By: | /s/ Ann Mitchell |

| | Ann Mitchell |

| | Chief Financial Officer |

CERTIFICATE OF AMENDMENT

TO THE

NINTH AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

ALLBIRDS, INC.

(A PUBLIC BENEFIT CORPORATION)

Allbirds, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), hereby certifies that:

1.This Certificate of Amendment to the Ninth Amended and Restated Certificate of Incorporation (this “Certificate of Amendment”) amends the provisions of the Certificate of Incorporation of the Corporation (the “Certificate of Incorporation”).

2.This Certificate of Amendment has been approved and duly adopted by the Corporation’s Board of Directors and stockholders in accordance with the provisions of Section 242 of the DGCL.

3.Upon this Certificate of Amendment becoming effective, Article IV(A) of the Corporation’s Certificate of Incorporation is hereby amended by adding the following at the end thereof:

Effective as of 5:00 p.m. Eastern Time on September 4, 2024 (the “Reverse Split Effective Time”), (i) each twenty (20) shares of Class A Common Stock issued and outstanding immediately prior to the Reverse Split Effective Time shall be combined into one (1) validly issued, fully paid and non-assessable share of Class A Common Stock automatically and without any action by the holder thereof, and (ii) each twenty (20) shares of Class B Common Stock issued and outstanding immediately prior to the Reverse Split Effective Time shall be combined into one (1) validly issued, fully paid and non-assessable share of Class B Common Stock automatically and without any action by the holder thereof (such combination of shares, the “Reverse Stock Split”). The par value of the Class A Common Stock and Class B Common Stock following the Reverse Stock Split shall remain at $0.0001 per share. The number of authorized shares of Class A Common Stock, Class B Common Stock, and Preferred Stock shall remain unchanged following the Reverse Split Effective Time. No fractional shares of Class A Common Stock or Class B Common Stock shall be issued as a result of the Reverse Stock Split. In lieu thereof, any holder who would otherwise be entitled to a fractional share of Class A Common Stock or Class B Common Stock as a result of the Reverse Stock Split, following the Reverse Split Effective Time, shall be entitled to receive a cash payment equal to the fraction of which such holder would otherwise be entitled multiplied by the closing price per share of Class A

Common Stock as reported by the Nasdaq Stock Market (as adjusted to give effect to the Reverse Stock Split) on the date of the Reverse Split Effective Time; provided that all shares of Class A Common Stock or Class B Common Stock (including fractions thereof) issuable as a result of the Reverse Stock Split to a given holder shall be aggregated for purposes of determining whether the Reverse Stock Split would result in the issuance of a fractional share of Class A Common Stock or Class B Common Stock, as applicable. The Reverse Stock Split shall occur automatically without any further action by the holders of Common Stock, and whether or not the certificates representing such shares have been surrendered to the Corporation; provided that the Corporation shall not be obligated to issue certificates evidencing the shares of Common Stock issuable as a result of the Reverse Stock Split unless the existing certificates evidencing the applicable shares of stock prior to the Reverse Stock Split are either surrendered to the Corporation, or the holder notifies the Corporation that such certificates have been lost, stolen or destroyed and executes a lost certificate affidavit and agreement reasonably acceptable to the Corporation (which may include a requirement to post a bond) to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft or destruction of such certificates.

4.This Certificate of Amendment shall become effective at 5:00 p.m. Eastern Time, on September 4, 2024.

***

This Certificate of Amendment to the Ninth Amended and Restated Certificate of Incorporation has been signed by a duly authorized officer of the Company on August 29, 2024.

ALLBIRDS, INC.

By: /s/ Joseph Vernachio

Name: Joseph Vernachio

Title: Chief Executive Officer

ALLBIRDS ANNOUNCES 1-FOR-20 REVERSE STOCK SPLIT

SAN FRANCISCO, Calif., August 30, 2024 (GLOBE NEWSWIRE) – Allbirds, Inc. (NASDAQ: BIRD), a global lifestyle brand that innovates with sustainable materials to make better products in a better way, today announced that it will proceed with a 1-for-20 reverse stock split (“Reverse Stock Split”) of its outstanding shares of Class A Common Stock and Class B Common Stock (collectively, the “Common Stock”) following approval by its Board of Directors. The 1-for-20 ratio is within the range approved by stockholders at a special meeting of BIRD stockholders held on August 13, 2024.

The Reverse Stock Split is intended to bring the Company into compliance with the minimum bid price requirement for continued listing on the Nasdaq Global Select Market. The Reverse Stock Split is expected to become effective at 5 p.m. Eastern Daylight Time on September 4, 2024 and the Company’s Class A Common Stock is expected to begin trading on a post-split basis at the market open on September 5, 2024 under the same symbol (BIRD) with the new CUSIP number 01675A208.

When the Reverse Stock Split is effective, every 20 shares of Allbirds Common Stock issued and outstanding will be combined automatically into 1 share of Common Stock. The Reverse Stock Split will apply equally to all outstanding shares of Common Stock, and each stockholder will hold the same percentage of Common Stock outstanding immediately following the Reverse Stock Split, except for adjustments that may result from the treatment of fractional shares. No fractional shares will be issued in connection with the Reverse Stock Split. Instead, holders of Common Stock will receive a cash payment (without interest) in lieu of any fractional shares. Additionally, all equity awards outstanding immediately prior to the Reverse Stock Split will be proportionately adjusted.

Computershare Inc. is acting as the exchange agent and transfer agent for the Reverse Stock Split. Stockholders holding their shares electronically in book-entry form are not required to take any action to receive post-split shares. The Company does not have any outstanding certificated shares. Stockholders owning shares through a bank, broker or other nominee will have their positions adjusted to reflect the Reverse Stock Split and will receive payment for any fractional shares in accordance with their respective bank’s, broker’s, or nominee’s particular processes.

Additional information about the Reverse Stock Split can be found in Allbirds’ definitive proxy statement (Form DEF 14A) filed with the U.S. Securities and Exchange Commission (the “SEC”) on June 28, 2024.

About Allbirds, Inc.

Based in San Francisco, with its roots in New Zealand, Allbirds launched in 2016 with a single shoe: the now iconic Wool Runner. In the years since, Allbirds has sold millions of pairs of shoes, and has maintained its commitment to incredible comfort, versatile style and unmatched quality. This is made possible with materials like Allbirds’s sugarcane-based midsole technology, SweetFoam™, and textiles made with eucalyptus fibers and Merino wool – so consumers don't have to compromise between the best products and their impact on the earth. www.allbirds.com

Contacts:

Investor Relations:

ir@allbirds.com

Media Contact:

press@allbirds.com

v3.24.2.u1

Cover

|

|

12 Months Ended |

Aug. 30, 2024 |

Dec. 31, 2024 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Aug. 30, 2024

|

|

| Entity Registrant Name |

Allbirds, Inc.

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-40963

|

|

| Entity Tax Identification Number |

47-3999983

|

|

| Entity Address, Address Line One |

30 Hotaling Place

|

|

| Entity Address, City or Town |

San Francisco

|

|

| Entity Address, State or Province |

CA

|

|

| Entity Address, Postal Zip Code |

94111

|

|

| City Area Code |

628

|

|

| Local Phone Number |

225-4848

|

|

| Written Communications |

false

|

|

| Soliciting Material |

false

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value

|

|

| Trading Symbol |

BIRD

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

true

|

|

| Entity Ex Transition Period |

false

|

|

| Entity Central Index Key |

0001653909

|

|

| Amendment Flag |

false

|

|

| Current Fiscal Year End Date |

|

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

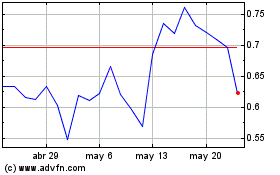

Allbirds (NASDAQ:BIRD)

Gráfica de Acción Histórica

De Dic 2024 a Dic 2024

Allbirds (NASDAQ:BIRD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024