Fourth Quarter Results

(All comparisons refer to the fourth quarter of 2021, except as

noted)

- Earned record quarterly net income and diluted earnings per

share.

- Increase in diluted earnings per share of 21.8%, to $.67 from

$.55.

- Increase in net income of 20.6%, to $9.3 million from $7.7

million.

- Increase in return on average equity to 18.96% from

12.70%.

- Increase in financial fees of $1.7 million, or 18.1%.

- Increase in average loans of $154.5 million, or 17.3%.

- Increase in net interest margin to 3.15% from 2.30%.

- Maintained exceptional credit quality.

2022 Results

- Earned record annual net income and diluted earnings per

share.

- Increase in diluted earnings per share of 26.5%, to $2.53 from

$2.00.

- Increase in net income of 22.0%, to $34.9 million from $28.6

million.

- Increase in return on average equity to 16.53% from

11.29%.

- Increase in financial fees of $11.0 million, or 33.7%.

- Increase in ending loans of $122.3 million, or 12.7%.

- Increase in net interest margin to 2.74% from 2.31%.

- Made significant technology improvements.

Cass Information Systems, Inc. (Nasdaq:

CASS), (the Company or Cass) reported fourth quarter

2022 earnings of $.67 per diluted share, an increase of 21.8% from

the $.55 per diluted share it earned in the fourth quarter of 2021.

Net income for the period was $9.3 million, an increase of 20.6%

from the $7.7 million earned in the same period in 2021. Diluted

earnings per share and net income also increased 4.7% and 5.5%,

respectively as compared to the third quarter of 2022.

Eric Brunngraber, the Company’s chairman and chief executive

officer, noted, “Our success in 2022 is a testament to the strong

franchise we have built over our 116 year history. With the

assistance of rising interest rates, we not only achieved record

earnings but were able to begin significant technological

investments which should allow us to better serve our clients and

make us more efficient over the long-term. I look forward to 2023

where we will continue to focus on profitable growth, positioning

the company for long-term success through technological investment

in our core businesses, and creating shareholder value.”

Fourth Quarter 2022 Highlights

Processing Fees – Processing fees increased $579,000, or

3.1%, over the same period in the prior year and $322,000, or 1.7%,

as compared to the third quarter of 2022. The increase in

processing fee income as compared to the same period in the prior

year was largely driven by the increase in facility transaction

volumes of 1.6%. Transportation invoice volumes decreased 0.3% over

the same period. The increase as compared to the third quarter of

2022 was driven by ancillary processing services as transportation

and facility volumes declined 2.2% and 3.6%, respectively.

Financial Fees – Financial fees, earned on a

transactional level basis for invoice payment services when making

customer payments, increased $1.7 million, or 18.1%, over the same

period in the prior year. The increase in financial fee income was

largely driven by increases in transportation and facility dollar

volumes of 4.7% and 12.6%, respectively, in addition to rising

market interest rates. Financial fees increased 0.9% over the third

quarter of 2022 as rising interest rates offset a decline in dollar

volumes.

Net Interest Income – Net interest income increased $5.6

million, or 47.6%. The Company’s net interest margin increased to

3.15% as compared to 2.30% in the same period last year and 2.90%

for the third quarter of 2022. The increase in net interest income

and margin was largely driven by the rise in market interest rates

which are favorable for the Company over the long-term. The Company

was also assisted by the 6.4% increase in average interest-earning

assets, specifically an increase in average loans, excluding PPP

loans, of 18.9%.

Provision for Credit Losses - The provision for credit

losses was $500,000 during the fourth quarter of 2022 as compared

to $740,000 in the fourth quarter of 2021. The provision for the

fourth quarter of 2022 was primarily driven by the increase in

total loans of $45.8 million, or 4.4%, as compared to September 30,

2022.

Operating Expenses - Consolidated operating expenses rose

$6.5 million, or 20.7%. Personnel expense increased $5.3 million,

or 22.4%. Base salaries increased as a result of merit increases,

wage pressures, an increase in average full-time equivalent

employees of 11.4% due to the Touchpoint acquisition and strategic

investment in various technology initiatives, including improved

rating engine capabilities and investment in optical character

recognition, artificial intelligence, machine learning and other

processes to consume images and produce data. Also driving the

increase in personnel expense was an increase in stock compensation

due to improved Company earnings and the impact on performance

based restricted stock. Stock compensation was $2.3 million during

the fourth quarter of 2022 as compared to $1.3 million in the third

quarter of 2022 and $273,000 during the fourth quarter of 2021.

Certain other expense categories are also elevated as the Company

invests in, and transitions to, improved technology. The Company

anticipates this elevated spending will result in improved

operating leverage beginning in late 2023.

Loans - Average loans increased $154.5 million, or 17.3%.

The Company has been successful in achieving organic growth in its

franchise, faith-based and other commercial and industrial loans.

When compared to December 31, 2021, ending loans increased $122.3

million, or 12.7%, during 2022.

Payments in Advance of Funding – Average payments in

advance of funding increased $5.3 million, or 2.1%, primarily due

to a 4.7% increase in transportation dollar volumes, which led to

higher dollars advanced to freight carriers.

Deposits – Average deposits increased $67.2 million, or

6.0%, when compared to the fourth quarter of 2021. Average deposits

were flat with the third quarter of 2022.

Accounts and Drafts Payable - Average accounts and drafts

payable increased $71.2 million, or 6.5%. The increase in these

balances, which are non-interest bearing, are primarily reflective

of the increase in transportation and facility expense dollar

volumes of 7.0%. As compared to the third quarter of 2022, average

accounts and drafts payable declined 2.1% due to a decrease in

total dollar volumes of 7.6%.

Transportation Dollar Volumes – Transportation dollar

volumes were $10.9 billion during the fourth quarter of 2022. The

4.7% increase in dollar volumes was largely due to inflationary

pressures and fuel surcharges, among other factors. Dollar volumes

declined 5.4% as compared to the third quarter of 2022 due to

seasonality and a decrease in the average invoice paid of 3.2%

reflective of declining freight rates.

Facility Expense Dollar Volumes – Facility dollar volumes

totaled $4.8 billion during the fourth quarter of 2022. The 12.6%

increase in dollar volumes was largely due to an increase in energy

prices. Dollar volumes declined 12.2% as compared to the third

quarter of 2022 due to seasonality and lower energy prices.

Capital - The Company’s common equity tier 1, total

risk-based capital and leverage ratios were 12.80%, 13.52% and

9.52% at December 31, 2022, respectively. Total shareholders’

equity has declined $39.5 million since December 31, 2021 primarily

as a result of an increase in accumulated other comprehensive loss

due to the rise in market interest rates and resulting negative

impact on the fair value of available-for-sale investment

securities.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of

integrated information and payment management solutions. Cass

enables enterprises to achieve visibility, control and efficiency

in their supply chains, communications networks, facilities and

other operations. Disbursing over $90 billion annually on behalf of

clients, and with total assets of nearly $2.6 billion, Cass is

uniquely supported by Cass Commercial Bank. Founded in 1906 and a

wholly owned subsidiary, Cass Commercial Bank provides

sophisticated financial exchange services to the parent

organization and its clients. Cass is part of the Russell 2000®.

More information is available at www.cassinfo.com.

Note to Investors

Certain matters set forth in this news release may contain

forward-looking statements that are provided to assist in the

understanding of anticipated future financial performance. However,

such performance involves risks and uncertainties that may cause

actual results to differ materially from those in such statements.

These risks and uncertainties include the impact of the COVID-19

pandemic as well as economic and market conditions, inflationary

pressures, risks of credit deterioration, interest rate changes,

governmental actions, market volatility, security breaches and

technology interruptions, energy prices and competitive factors,

among others, as set forth in the Company’s most recent Annual

Report on Form 10-K and subsequent reports filed with the

Securities and Exchange Commission. The Company has used, and

intends to continue using, the Investors portion of its website to

disclose material non-public information and to comply with its

disclosure obligations under Regulation FD. Accordingly, investors

are encouraged to monitor Cass’s website in addition to following

press releases, SEC filings, and public conference calls and

webcasts.

Consolidated Statements of

Income (unaudited)

($ and numbers in thousands, except per

share data)

Quarter Ended

December 31, 2022

Quarter Ended

September 30, 2022

Quarter Ended

December 31, 2021

Year Ended

December 31, 2022

Year Ended

December 31, 2021

Processing fees

$

19,286

$

18,964

$

18,707

$

76,470

$

74,589

Financial fees

11,350

11,252

9,611

43,757

32,733

Net interest income

17,329

15,971

11,738

58,844

44,326

(Provision for) release of credit

losses

(500)

(550)

(740)

(1,350)

130

Other

1,481

1,568

634

4,755

2,369

Total revenues

$

48,946

$

47,205

$

39,950

$

182,476

$

154,147

Personnel

$

28,724

$

26,999

$

23,466

$

106,474

$

92,155

Occupancy

875

970

965

3,676

3,824

Equipment

1,664

1,633

1,717

6,668

6,745

Other

6,526

6,719

5,160

22,758

17,602

Total operating expenses

$

37,789

$

36,321

$

31,308

$

139,576

$

120,326

Income from operations before income

taxes

$

11,157

$

10,884

$

8,642

$

42,900

$

33,821

Income tax expense

1,872

2,085

940

7,996

5,217

Net income

$

9,285

$

8,799

$

7,702

$

34,904

$

28,604

Basic earnings per share

$

.69

$

.65

$

.56

$

2.58

$

2.03

Diluted earnings per share

$

.67

$

.64

$

.55

$

2.53

$

2.00

Share data:

Weighted-average common shares

outstanding

13,548

13,542

13,761

13,553

14,092

Weighted-average common shares

outstanding assuming dilution

13,812

13,804

13,996

13,808

14,330

Consolidated Balance

Sheets

($ in thousands)

(unaudited) December 31,

2022

(unaudited) September 30,

2022

December 31, 2021

Assets:

Cash and cash equivalents

$

200,942

$

346,994

$

514,928

Investment securities

754,468

763,789

673,453

Loans, excluding PPP loans

1,082,906

1,037,101

954,268

PPP loans

--

--

6,299

Allowance for credit losses

(13,539)

(13,049)

(12,041)

Payments in advance of funding

293,775

269,221

291,427

Premises and equipment, net

19,958

19,375

18,113

Investments in bank-owned life

insurance

47,998

47,714

43,176

Goodwill and other intangible assets

21,435

21,630

16,826

Other assets

165,080

118,040

48,452

Total assets

$

2,573,023

$

2,610,815

$

2,554,901

Liabilities and shareholders’ equity:

Deposits

Non-interest bearing

$

642,757

$

581,731

$

582,642

Interest bearing

614,460

647,990

638,861

Total deposits

1,257,217

1,229,721

1,221,503

Accounts and drafts payable

1,067,600

1,146,334

1,050,396

Other liabilities

41,882

43,025

37,204

Total liabilities

$

2,366,699

$

2,419,080

$

2,309,103

Shareholders’ equity:

Common stock

$

7,753

$

7,753

$

7,753

Additional paid-in capital

207,422

205,624

204,276

Retained earnings

131,682

126,361

112,220

Common shares in treasury, at cost

(81,211)

(81,624)

(78,904)

Accumulated other comprehensive (loss)

income

(59,322)

(66,379)

453

Total shareholders’ equity

$

206,324

$

191,735

$

245,798

Total liabilities and shareholders’

equity

$

2,573,023

$

2,610,815

$

2,554,901

Average Balances

(unaudited)

($ in thousands)

Quarter Ended

December 31, 2022

Quarter Ended

September 30, 2022

Quarter Ended

December 31, 2021

Year Ended

December 31, 2022

Year Ended

December 31, 2021

Average interest-earning assets

$

2,232,764

$

2,243,219

$

2,099,414

$

2,205,793

$

1,999,609

Average loans, excluding PPP loans

1,049,294

983,953

882,748

990,964

821,758

Average PPP loans

--

152

12,003

1,040

65,904

Average investment securities

760,424

776,162

636,020

745,637

513,390

Average short-term investments

346,198

431,516

578,749

425,004

614,390

Average payments in advance of funding

262,620

277,683

257,261

278,185

211,809

Average assets

2,581,086

2,617,814

2,495,901

2,586,078

2,333,992

Average deposits

1,184,186

1,184,330

1,116,992

1,191,373

1,039,940

Average accounts and drafts payable

1,158,112

1,182,373

1,086,944

1,141,329

986,572

Average shareholders’ equity

$

194,269

$

207,247

$

240,597

$

211,142

$

253,436

Consolidated Financial

Highlights (unaudited)

($ and numbers in thousands, except

ratios)

Quarter Ended

December 31, 2022

Quarter Ended

September 30, 2022

Quarter Ended

December 31, 2021

Year Ended

December 31, 2022

Year Ended

December 31, 2021

Return on average equity

18.96%

16.84%

12.70%

16.53%

11.29%

Net interest margin (1)

3.15%

2.90%

2.30%

2.74%

2.31%

Average interest-earning assets yield

(1)

3.53%

3.04%

2.35%

2.90%

2.37%

Average loan yield

4.37%

4.03%

3.95%

3.98%

3.96%

Average investment securities yield

(1)

2.50%

2.35%

2.11%

2.30%

2.30%

Average short-term investment yield

3.44%

2.07%

0.14%

1.51%

0.12%

Average cost of total deposits

0.72%

0.26%

0.09%

0.31%

0.11%

Allowance for credit losses to loans

1.25%

1.26%

1.25%

1.25%

1.25%

Non-performing loans to total loans

0.11%

--%

--%

0.11%

--%

Net loan charge-offs (recoveries) to

loans

--%

--%

--%

--%

--%

Transportation invoice volume

9,174

9,385

9,202

36,807

36,783

Transportation dollar volume

$

10,930,786

$

11,549,980

$

10,443,905

$

44,749,359

$

36,829,841

Facility expense transaction volume

(2)

3,196

3,315

3,147

12,990

12,499

Facility expense dollar volume

$

4,814,145

$

5,485,783

$

4,277,119

$

19,514,048

$

15,867,556

(1) Yields are presented on

tax-equivalent basis assuming a tax rate of 21%.

(2) Facility expense transaction

volumes have been restated for the current and prior periods to

reflect total invoices processed. In prior periods, we utilized

billing account numbers in our Telecom division as a proxy for

transactions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230119005833/en/

Cass Investor Relations ir@cassinfo.com

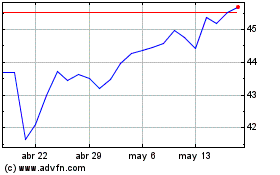

Cass Information Systems (NASDAQ:CASS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cass Information Systems (NASDAQ:CASS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025