Third Quarter Results

(All comparisons refer to the third quarter of 2022, except as

noted)

- Net income of $7.4 million, or $0.54 per diluted common

share.

- Increase in total revenues of $2.0 million, or 4.3%.

- Return on average equity of 13.80%.

- Increase in net interest margin to 3.24% from 2.90%.

- Maintained exceptional credit quality, with no non-performing

loans or charge-offs.

- Continued to make progress on technology initiatives to

increase operational efficiency.

- Signed several new large facility clients.

- Repurchased 73,272 shares of Company stock.

- Increased quarterly dividend to $0.30 per share.

- Authorized the repurchase of up to 500,000 shares of common

stock.

Cass Information Systems, Inc. (Nasdaq:

CASS), (the Company or Cass) reported third quarter 2023

earnings of $0.54 per diluted share, as compared to $0.64 in the

third quarter of 2022 and $0.52 in the second quarter of 2023. Net

income for the period was $7.4 million, a decrease of 16.0% from

$8.8 million in the same period in 2022 and an increase of

$256,000, or 3.6%, as compared to the second quarter of 2023.

The Company’s financial results have been impacted by a decrease

in payment float generated from its transportation clients as a

result of a decline in freight rates and a decrease in deposit

balances generated from its Cass Commercial Bank clients. The lower

level of funding provided by these sources has impacted the

Company’s ability to earn interest income on short-term

investments. The Company also continues to invest in updating and

upgrading its technology platforms in its payment business. The

Company anticipates an improvement in profitability levels as

compared to the third quarter of 2023 in future quarters as

efficiencies are gained around ingesting and processing invoices,

new facility clients are onboarded and net interest income improves

as a result of net interest margin expansion via repricing of

maturing fixed rate loans and investment securities to current

market interest rates.

Martin Resch, the Company’s President and Chief Executive

Officer, noted, “We continue to update and upgrade the various

technology platforms supporting our payments businesses. These

technology enhancements, while temporarily increasing expense

levels beyond what is necessary to run our business, are creating

capacity to meet ongoing business demand, presenting significant

revenue opportunities. We have recently signed several new large

clients which are expected to increase our facility transaction and

dollar volumes by 30-40% over third quarter of 2023 levels and

marginally impact freight transaction and dollar volumes. The

facilities clients are expected to be fully onboarded by the end of

the first quarter of 2024.”

Third Quarter 2023 Highlights

Transportation Dollar Volumes – Transportation dollar

volumes were $9.3 billion during the third quarter of 2023, a

decrease of 19.8% as compared to the third quarter of 2022 and a

decrease of 4.6% as compared to the second quarter of 2023. The

decrease in dollar volumes was due to a decrease in the average

dollars per transaction to $1,038 during the third quarter of 2023

as compared to $1,231 in the third quarter of 2022 and $1,056 in

the second quarter of 2023 as a result of lower fuel costs and

overall freight rates. Transportation dollar volumes are key to the

Company’s revenue as higher volumes generally lead to an increase

in payment float, which generates interest income, as well as an

increase in payments in advance of funding, which generates

financial fees.

Facility Expense Dollar Volumes – Facility dollar volumes

totaled $5.1 billion during the third quarter of 2023, a decrease

of 7.1% as compared to the third quarter of 2022 and an increase of

11.3% as compared to the second quarter of 2023. The change in

dollar volumes period to period are largely reflective of

seasonality and energy prices.

Processing Fees – Processing fees increased $975,000, or

5.1%, over the same period in the prior year. The increase in

processing fee income was largely driven by an increase in

ancillary fees and an increase in facility transaction volumes of

3.1%. The Company has experienced recent success in winning

facility clients with high transaction volumes which is expected to

contribute to more meaningful growth in processing fees beginning

in the first quarter of 2024 as these new clients are onboarded.

Transportation invoice volumes decreased 4.9% over the same period.

The decline in transportation volumes is due to the on-going

freight recession.

Financial Fees – Financial fees, earned on a

transactional level basis for invoice payment services when making

customer payments, increased $345,000, or 3.1%. The increase in

financial fee income was primarily due to the increase in

short-term interest rates, partially offset by a decline in

transportation dollar volumes of 19.8%.

Net Interest Income – Net interest income increased

$577,000, or 3.6%. The Company’s net interest margin improved to

3.24% as compared to 2.90% in the same period last year. The

increase in net interest income and margin was largely driven by

the rise in market interest rates as compared to the same period

last year, which is favorable for these financial metrics over the

long-term. The positive impact of the increase in the net interest

margin was partially offset by a decline in average

interest-earning assets of $183.4 million, or 8.2%.

Net interest income increased $534,000, or 3.3%, as compared to

the second quarter of 2023. The increase was driven by an increase

in average interest-earning assets of $49.0 million, or 2.4%. The

Company’s net interest margin declined 1 basis point to 3.24% from

3.25% primarily driven by the migration of certain non-interest

bearing deposits to interest-bearing. The Company anticipates its

net interest margin will expand in future quarters as a result of

72.4% of the Company’s average funding sources, consisting of

deposits and accounts and drafts payable being non

interest-bearing. The Company has $109.8 million in U.S. Treasury

securities with a weighted average yield of 2.43% maturing at

various dates from April through July of 2024. In addition, the

recent success of winning new facility clients is expected to

generate a significant average volume of non-interest bearing

payment float which can be invested at current market interest

rates.

Provision for Credit Losses - The Company recorded a

provision for credit losses of $125,000 during the third quarter of

2023 as compared to $550,000 in the third quarter of 2022. The

provision for credit losses for the third quarter of 2023 was

driven by certain changes to assumptions in the Company’s CECL

model, partially offset by a decrease in total loans of $16.2

million, or 1.5%, as compared to June 30, 2023.

Personnel Expenses - Personnel expenses increased $2.6

million, or 9.8%. Salaries and commissions increased $1.4 million,

or 6.6%, as a result of merit increases and an increase in average

full-time equivalent employees of 8.1% due to strategic investment

in various technology initiatives. Pension expense increased

$745,000. Despite the Company’s defined benefit pension plan being

frozen in the first quarter of 2021 resulting in no service cost in

subsequent periods, expense increased as a result of the accounting

impact of the decline in plan assets during 2022 and corresponding

decline in expected return on plan assets for 2023. Other benefits,

such as 401(k) match, health insurance and payroll taxes, increased

$776,000, or 17.6%, primarily due to the 8.1% increase in average

FTEs as well as a significant increase in employer health insurance

costs over prior year levels.

Non-Personnel Expenses - Non-personnel expenses rose $1.1

million, or 11.9%. Certain expense categories such as equipment,

outside service fees and data processing are elevated as the

Company invests in, and transitions to, improved technology.

Multiple technology platforms are being maintained prior to

switching over to what the Company believes will be more efficient

technology platforms for data entry processing by the end of

2023.

Loans - When compared to December 31, 2022, ending loans

decreased $43.3 million, or 4.0%. The Company has opted to be more

selective in booking new loans as a result of the decline in

deposits during the first half of 2023, focusing on building new

client relationships rather than transactional opportunities like

investment grade leases. The Company expects to experience a more

normal level of loan growth in future quarters.

Payments in Advance of Funding – Average payments in

advance of funding decreased $43.0 million, or 15.5%, primarily due

to a 19.8% decrease in transportation dollar volumes, which led to

fewer dollars advanced to freight carriers.

Deposits – Average deposits decreased $112.3 million, or

9.5%, when compared to the third quarter of 2022 but increased

$10.0 million, or 0.9% from the second quarter of 2023. Total

deposits at September 30, 2023 decreased $79.9 million, or 6.4% as

compared to December 31, 2022. The Company experienced deposit

attrition during the first six months of 2023 as larger commercial

depository clients moved their funds to higher interest rate

alternatives outside of Cass Commercial Bank. The Company has

experienced a recent increase in its deposit balances as a result

of an increase in its deposit rates and increased depositor

confidence across the banking industry. During the third quarter of

2023, as compared to the second quarter of 2023, the Company

experienced an increase in average interest-bearing deposits of

$82.2 million and a decrease in non-interest bearing deposits of

$72.2 million as a couple large depository clients transferred

funds to interest-bearing accounts.

Accounts and Drafts Payable - Average accounts and drafts

payable decreased $112.3 million, or 9.5%. The decrease in these

balances, which are non-interest bearing, are primarily reflective

of the decrease in transportation dollar volumes of 19.8%. Accounts

and drafts payable are a stable source of funding generated by

payment float from transportation and facility clients.

Liquidity - The Company maintained strong liquidity

during the third quarter of 2023 with average short-term

investments, primarily consisting of cash in a reserve account at

the Federal Reserve Bank, of $310.8 million. In addition, all of

the Company’s investment securities are classified as

available-for-sale, and there were no outstanding borrowings at

September 30, 2023.

Capital - The Company’s common equity tier 1, total

risk-based capital and leverage ratios were 14.53%, 15.30% and

10.61% at September 30, 2023, respectively. Total shareholders’

equity has decreased $89,000 since December 31, 2022 as a result of

an increase in accumulated other comprehensive loss of $7.6 million

due to the increase in market interest rates and resulting negative

impact on the fair value of available-for-sale investment

securities, dividends of $11.9 million and the repurchase of

Company stock of $5.2 million, partially offset by year-to-date

2023 earnings of $21.6 million. On October 17, 2023, the Company’s

Board of Directors approved an increase in the quarterly dividend

to $0.30 per share effective with the dividend payable on December

15, 2023 to shareholders of record on December 5, 2023. The

Company’s Board of Directors also authorized the repurchase of up

to 500,000 shares of common stock in future periods.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of

integrated information and payment management solutions. Cass

enables enterprises to achieve visibility, control and efficiency

in their supply chains, communications networks, facilities and

other operations. Disbursing over $90 billion annually on behalf of

clients, and with total assets of $2.5 billion, Cass is uniquely

supported by Cass Commercial Bank. Founded in 1906 and a wholly

owned subsidiary, Cass Commercial Bank provides sophisticated

financial exchange services to the parent organization and its

clients. Cass is part of the Russell

2000®. More information is

available at www.cassinfo.com.

Forward Looking Information

This information contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include future financial and operating results,

expectations, intentions, and other statements that are not

historical facts. Such statements are based on current beliefs and

expectations of the Company’s management and are subject to

significant risks and uncertainties. These risks and uncertainties

include the impact of economic and market conditions, inflationary

pressures, risks of credit deterioration, interest rate changes,

governmental actions, market volatility, security breaches and

technology interruptions, energy prices and competitive factors,

among others, as set forth in the Company’s most recent Annual

Report on Form 10-K and subsequent reports filed with the

Securities and Exchange Commission. Actual results may differ

materially from those set forth in the forward-looking

statements.

Note to Investors

The Company has used, and intends to continue using, the

Investors portion of its website to disclose material non-public

information and to comply with its disclosure obligations under

Regulation FD. Accordingly, investors are encouraged to monitor

Cass’s website in addition to following press releases, SEC

filings, and public conference calls and webcasts.

Consolidated Statements of

Income (unaudited)

($ and numbers in thousands, except per

share data)

Quarter Ended

September 30, 2023

Quarter Ended

June 30, 2023

Quarter Ended

September 30, 2022

Nine-Months Ended September

30, 2023

Nine-Months Ended September

30, 2022

Processing fees

$

19,939

$

19,386

$

18,964

$

58,838

$

57,184

Financial fees

11,597

11,662

11,252

34,518

32,406

Total fee revenue

$

31,536

$

31,048

$

30,216

$

93,356

$

89,590

Interest and fees on loans

12,863

12,931

10,006

38,029

27,890

Interest and dividends on securities

4,392

4,677

4,498

13,863

11,546

Interest on federal funds sold and

other short-term investments

3,934

2,100

2,249

9,147

3,423

Total interest income

$

21,189

$

19,708

$

16,753

$

61,039

$

42,859

Interest expense

4,641

3,694

782

11,579

1,344

Net interest income

$

16,548

$

16,014

$

15,971

$

49,460

$

41,515

(Provision for) release of credit

losses

(125

)

120

(550

)

335

(850

)

(Loss) gain on sale of investment

securities

--

(199

)

13

(160

)

15

Other

1,264

1,224

1,555

3,784

3,260

Total revenues

$

49,223

$

48,207

$

47,205

$

146,775

$

133,530

Salaries and commissions

23,391

23,617

21,953

69,613

62,516

Share-based compensation

938

909

1,260

3,796

4,431

Net periodic pension cost (benefit)

129

138

(616

)

402

(1,847

)

Other benefits

5,178

4,768

4,402

15,283

12,650

Total personnel expenses

$

29,636

$

29,432

$

26,999

$

89,094

$

77,750

Occupancy

908

907

970

2,670

2,801

Equipment

1,789

1,749

1,633

5,188

5,004

Other

7,730

7,251

6,719

22,822

16,233

Total operating expenses

$

40,063

$

39,339

$

36,321

$

119,774

$

101,788

Income from operations before

income taxes

$

9,160

$

8,868

$

10,884

$

27,001

$

31,742

Income tax expense

1,766

1,730

2,085

5,352

6,123

Net income

$

7,394

$

7,138

$

8,799

$

21,649

$

25,619

Basic earnings per share

$

.55

$

.53

$

.65

$

1.60

$

1.89

Diluted earnings per share

$

.54

$

.52

$

.64

$

1.56

$

1.86

Share data:

Weighted-average common

shares outstanding

13,501

13,553

13,542

13,551

13,554

Weighted-average common

shares outstanding assuming

dilution

13,793

13,854

13,804

13,836

13,807

Consolidated Balance

Sheets

($ in thousands)

(unaudited ) September 30,

2023

(unaudited ) June 30,

2023

December 31, 2022

Assets:

Cash and cash equivalents

$

408,435

$

270,473

$

200,942

Securities available-for-sale, at fair

value

615,855

637,513

754,468

Loans

1,039,619

1,055,848

1,082,906

Less: Allowance for credit losses

(13,318

)

(13,194

)

(13,539

)

Loans, net

$

1,026,301

$

1,042,654

$

1,069,367

Payments in advance of funding

258,587

269,180

293,775

Premises and equipment, net

26,257

24,320

19,958

Investments in bank-owned life

insurance

48,857

48,564

47,998

Goodwill and other intangible assets

20,849

21,044

21,435

Accounts and drafts receivable from

customers

28,710

83,627

95,779

Other assets

71,027

73,421

69,301

Total assets

$

2,504,878

$

2,470,796

$

2,573,023

Liabilities and shareholders’ equity:

Deposits

Non-interest bearing

$

511,292

$

679,107

$

642,757

Interest-bearing

666,050

512,327

614,460

Total deposits

$

1,177,342

$

1,191,434

$

1,257,217

Accounts and drafts payable

1,082,224

1,021,524

1,067,600

Other liabilities

39,076

42,692

41,881

Total liabilities

$

2,298,642

$

2,255,650

$

2,366,698

Shareholders’ equity:

Common stock

$

7,753

$

7,753

$

7,753

Additional paid-in capital

207,663

206,734

207,422

Retained earnings

141,444

137,996

131,682

Common shares in treasury, at cost

(83,704

)

(80,943

)

(81,211

)

Accumulated other comprehensive loss

(66,920

)

(56,394

)

(59,321

)

Total shareholders’ equity

$

206,236

$

215,146

$

206,325

Total liabilities and shareholders’

equity

$

2,504,878

$

2,470,796

$

2,573,023

Average Balances

(unaudited)

($ in thousands)

Quarter Ended

September 30, 2023

Quarter Ended

June 30, 2023

Quarter Ended

September 30, 2022

Nine-Months Ended September

30, 2023

Nine-Months Ended September

30, 2022

Average interest-earning assets

$

2,059,801

$

2,010,771

$

2,243,219

$

2,077,392

$

2,196,704

Average loans

1,045,967

1,075,891

984,105

1,065,915

972,698

Average securities available-for-sale

634,835

686,777

776,162

681,820

740,654

Average short-term investments

310,770

185,230

431,516

263,774

451,562

Average payments in advance of funding

234,684

254,869

277,683

243,458

283,431

Average assets

2,395,264

2,370,359

2,617,814

2,421,274

2,587,760

Average non-interest bearing deposits

480,472

552,718

586,872

528,677

594,994

Average interest-bearing deposits

591,556

509,319

597,458

563,994

598,801

Average borrowings

11

3,199

11

2,993

11

Average interest-bearing liabilities

591,567

512,518

597,469

566,987

598,812

Average accounts and drafts payable

1,070,057

1,049,281

1,182,373

1,071,414

1,135,673

Average shareholders’ equity

$

212,591

$

214,066

$

207,247

$

212,159

$

216,827

Consolidated Financial

Highlights (unaudited)

($ and numbers in thousands, except

ratios)

Quarter Ended

September 30, 2023

Quarter Ended

June 30, 2023

Quarter Ended

September 30, 2022

Nine-Months Ended September

30, 2023

Nine-Months Ended September

30, 2022

Return on average equity

13.80 %

13.37 %

16.84 %

13.64 %

15.80 %

Net interest margin (1)

3.24 %

3.25 %

2.90 %

3.24 %

2.61 %

Average interest-earning assets yield

(1)

4.13 %

3.98 %

3.04 %

3.98 %

2.69 %

Average loan yield

4.88 %

4.82 %

4.03 %

4.77 %

3.83 %

Average investment securities yield

(1)

2.62 %

2.64 %

2.35 %

2.63 %

2.22 %

Average short-term investment yield

5.02 %

4.55 %

2.07 %

4.64 %

1.01 %

Average cost of total deposits

1.72 %

1.38 %

0.26 %

1.42 %

0.15 %

Average cost of interest-bearing

deposits

3.11 %

2.88 %

0.52 %

2.72 %

0.30 %

Average cost of interest-bearing

liabilities

3.11 %

2.89 %

0.52 %

2.73 %

0.30 %

Allowance for credit losses to loans

1.28 %

1.25 %

1.26 %

1.28 %

1.26 %

Non-performing loans to total loans

-- %

-- %

-- %

-- %

-- %

Net loan charge-offs (recoveries) to

loans

-- %

-- %

-- %

-- %

-- %

Transportation invoice volume

8,925

9,193

9,385

27,216

27,633

Transportation dollar volume

$

9,263,453

$

9,711,801

$

11,549,980

$

29,243,706

$

33,818,573

Facility expense transaction volume

3,417

3,467

3,315

10,352

9,794

Facility expense dollar volume

$

5,096,882

$

4,578,490

$

5,485,783

$

14,988,757

$

14,699,903

(1) Yields are presented on

tax-equivalent basis assuming a tax rate of 21%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019213339/en/

Cass Investor Relations ir@cassinfo.com

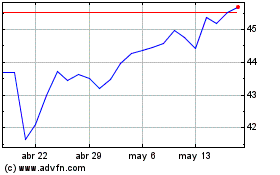

Cass Information Systems (NASDAQ:CASS)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cass Information Systems (NASDAQ:CASS)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025