Destination XL Group, Inc. Reports Holiday Sales Results

13 Enero 2025 - 6:00AM

Destination XL Group, Inc. (NASDAQ: DXLG), the leading

integrated-commerce specialty retailer of Big + Tall men’s clothing

and shoes, today announced the following results for the 9-week

holiday sales period ended January 4, 2025 (unaudited):

- Total sales were $94.7 million compared to $102.4 million for

the 9-week holiday sales period ended December 28, 2023.

- Comparable sales for the same 9-week holiday period decreased

7.4%, with comparable sales from stores down 6.2% and the direct

business down 10.0%.

Based on the holiday sales results and expectations for the

remainder of the fourth quarter, the Company is updating its

guidance for fiscal 2024 as follows:

- Total sales for fiscal 2024 are expected to be $467.0 to $470.0

million, a slight decrease from its previous guidance of $470.0

million.

- Adjusted EBITDA margin of 4.2% to 4.5%, as compared to its

previous guidance of 4.5%. Adjusted EBITDA margin is a non-GAAP

financial measure.

“Our sales results for the 9-week holiday period were mostly in

line with our expectations given the late Thanksgiving holiday and

continued headwinds and challenges regarding consumer spending. Our

customers have been very price conscious and, when they shop, they

are gravitating toward our more moderate and entry-level price

points. We had a slow start to the quarter with November sales down

11.8%, but our customer responded positively to strategic

promotions during our Black Friday and Cyber Monday deals which

drove improvement in comparable sales to a decline of 4.4% in

December,” said Harvey Kanter, President and Chief Executive

Officer.

The Company plans to report its actual fourth-quarter and fiscal

2024 financial results on March 20, 2025, when management will also

conduct its quarterly conference call to discuss its results. The

earnings call will be hosted by Harvey Kanter, President and Chief

Executive Officer, and Peter Stratton, Executive Vice President,

Chief Financial Officer, and Treasurer.

Non-GAAP Measures

In addition to financial measures prepared in accordance with

U.S. generally accepted accounting principles (“GAAP”), this press

release contains a projection for adjusted EBITDA margin for fiscal

2024, a non-GAAP measure. The presentation of this non-GAAP

measure is not in accordance with GAAP and should not be considered

superior to, or as a substitute for, net income, or any other

measure of performance derived in accordance with GAAP. In

addition, not all companies calculate non-GAAP financial measures

in the same manner and, accordingly, the non-GAAP measure presented

in this release may not be comparable to similar measures used by

other companies. The Company believes the inclusion of this

non-GAAP measure helps investors gain a better understanding of the

Company’s performance, especially when comparing such results to

previous periods, and that it is useful as an additional means for

investors to evaluate the Company's operating results when reviewed

in conjunction with the Company's GAAP financial statements.

Adjusted EBITDA is calculated as earnings before interest,

taxes, depreciation and amortization and adjusted for asset

impairment charges (gain), if any. Adjusted EBITDA margin is

calculated as adjusted EBITDA divided by total sales. The Company

believes that providing adjusted EBITDA and adjusted EBITDA margin

is useful to investors to evaluate the Company’s performance and

are key metrics to measure profitability and economic

productivity.

About Destination XL Group, Inc.

Destination XL Group, Inc. is the leading retailer of Men’s Big

+ Tall apparel that provides the Big + Tall man the freedom to

choose his own style. Subsidiaries of Destination XL Group, Inc.

operate DXL Big + Tall retail and outlet stores and Casual Male XL

retail and outlet stores throughout the United States, and an

e-commerce website, DXL.COM, and mobile app, which offer a

multi-channel solution similar to the DXL store experience with the

most extensive selection of online products available anywhere for

Big + Tall men. The Company is headquartered in Canton,

Massachusetts, and its common stock is listed on the Nasdaq Global

Market under the symbol "DXLG." For more information, please visit

the Company's investor relations website:

https://investor.dxl.com.

Forward-Looking Statements Certain statements

and information contained in this press release constitute

forward-looking statements under the federal securities laws,

including statements regarding our guidance for fiscal 2024,

including expected sales and adjusted EBITDA margin, and the

expected timing of the release of its financial results for the

fourth quarter and fiscal year 2024. The discussion of

forward-looking information requires management of the Company to

make certain estimates and assumptions regarding the Company's

strategic direction and the effect of such plans on the Company's

financial results. The Company's actual results and the

implementation of its plans and operations may differ materially

from forward-looking statements made by the Company. The Company

encourages readers of forward-looking information concerning the

Company to refer to its filings with the Securities and Exchange

Commission, including without limitation, its Annual Report on Form

10-K filed on March 21, 2024, its Quarterly Reports on Form 10-Q

and other filings with the Securities and Exchange Commission that

set forth certain risks and uncertainties that may have an impact

on future results and the direction of the Company, including risks

relating to: changes in consumer spending in response to economic

factors; the impact of inflation with rising costs and high

interest rates; the impact of ongoing worldwide conflicts on the

global economy; potential labor shortages; and the Company’s

ability to execute on its marketing, digital, store and

collaboration strategies, ability to grow its market share, predict

customer tastes and fashion trends, forecast sales growth trends

and compete successfully in the United States men’s big and tall

apparel market.

Forward-looking statements contained in this press release speak

only as of the date of this release. Subsequent events or

circumstances occurring after such date may render these statements

incomplete or out of date. The Company undertakes no obligation and

expressly disclaims any duty to update such statements occurring

after such date may render these statements incomplete or out of

date. The Company undertakes no obligation and expressly disclaims

any duty to update such statements.

| |

| CERTAIN COLUMNS IN

THE FOLLOWING TABLE MAY NOT FOOT DUE TO ROUNDING |

| |

| FISCAL 2024

FORECAST |

| GAAP TO

NON-GAAP ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

RECONCILIATION |

|

(unaudited) |

| |

| |

|

Projected |

|

|

|

| |

|

Fiscal 2024 |

|

|

|

| (in millions, except per share

data and percentages) |

|

|

|

|

per diluted share |

| Sales |

|

$467.0 - $470.0 |

|

|

|

| Net income (GAAP basis)(1) |

|

4.4 - 5.5 |

|

|

$0.07-$0.09 |

| Add back: |

|

|

|

|

|

| Provision for income taxes |

|

2.9 - 3.4 |

|

|

|

| Interest

income, net |

|

|

(2.2 |

) |

|

|

| Depreciation and amortization |

|

|

14.5 |

|

|

|

| Adjusted EBITDA (non-GAAP basis) |

|

$19.6 - $21.2 |

|

|

|

| Adjusted EBITDA margin as a percentage of sales (non-GAAP

basis) |

|

4.2% - 4.5% |

|

|

|

| |

|

|

|

|

|

| Weighted average common shares outstanding - diluted(2) |

|

|

60.0 |

|

|

|

| |

|

|

|

|

|

| (1) Forecasted net income used in this table for

purposes of reconciling adjusted EBITDA (a non-GAAP measure) does

not include the impact of future events that are outside of our

control for which we cannot reasonably predict, such as potential

asset impairments. |

| (2) Forecasted weighted average common shares

outstanding does not reflect future share repurchase activity |

| |

Investor Contact:investor.relations@dxlg.com(603) 933-0541

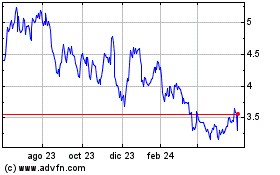

Destination XL (NASDAQ:DXLG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

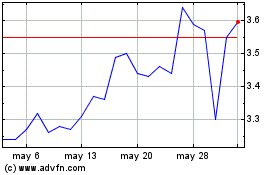

Destination XL (NASDAQ:DXLG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025