Diamondback Energy Announces Pricing of Upsized Secondary Common Stock Offering

19 Septiembre 2024 - 10:35PM

Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback”) announced

today the upsize and pricing of an underwritten public offering

of 12,770,000 shares of its common stock (the “Secondary

Offering”) by certain Legacy Endeavor Stockholders (the “Selling

Stockholders”). The gross proceeds from the sale of the shares by

the Selling Stockholders will be approximately $2.2 billion.

Diamondback will not receive any proceeds from the sale of the

shares by the Selling Stockholders. The Secondary Offering is

expected to close on September 23, 2024, subject to customary

closing conditions.

The Selling Stockholders have also granted the underwriters a

30-day option to purchase up to an additional 1,615,500 shares of

common stock.

In addition, Diamondback has agreed to purchase from the

underwriters 2,000,000 shares of common stock that are the subject

of the Secondary Offering at a price per share equal to the price

per share to be paid by the underwriters to the Selling

Stockholders (the “Share Repurchase”) under Diamondback’s existing

share repurchase program. Diamondback plans to fund the Share

Repurchase from existing cash on hand. The underwriters will not

receive any compensation for the shares being repurchased by

Diamondback in the Share Repurchase.

Evercore ISI, Citigroup and J.P. Morgan are acting as joint

book-running managers for the Secondary Offering.

Copies of the written base prospectus and prospectus supplement

for the Secondary Offering, when available, may be obtained from

Evercore Group L.L.C., Attention: Equity Capital Markets, 55 East

52nd Street, 35th Floor, New York, New York 10055, by telephone at

(888) 474-0200, or by email at ecm.prospectus@evercore.com;

Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island

Avenue, Edgewood, NY 11717 (Tel: 800-831-9146); and J.P. Morgan

Securities LLC, c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, New York 11717, via email at

prospectus-eq_fi@jpmchase.com.

The common stock will be sold pursuant to an effective automatic

shelf registration statement on Form S-3 previously filed with the

Securities and Exchange Commission.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. The Secondary Offering may only be made by

means of a prospectus supplement and related base prospectus.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural gas company

headquartered in Midland, Texas focused on the acquisition,

development, exploration and exploitation of unconventional,

onshore oil and natural gas reserves in the Permian Basin in West

Texas.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which involve risks, uncertainties, and assumptions. All

statements, other than statements of historical fact, including

statements regarding the completion of the Secondary Offering,

Diamondback’s future performance; business strategy; future

operations (including drilling plans and capital plans); estimates

and projections of revenues, losses, costs, expenses, returns, cash

flow, and financial position; reserve estimates and its ability to

replace or increase reserves; anticipated benefits of strategic

transactions (including acquisitions and divestitures); and plans

and objectives of management (including plans for future cash flow

from operations and for executing environmental strategies) are

forward-looking statements. When used in this news release or

otherwise by Diamondback, the words “aim,” “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “future,”

“guidance,” “intend,” “may,” “model,” “outlook,” “plan,”

“positioned,” “potential,” “predict,” “project,” “seek,” “should,”

“target,” “will,” “would,” and similar expressions (including the

negative of such terms) as they relate to Diamondback are intended

to identify forward-looking statements, although not all

forward-looking statements contain such identifying words. Although

Diamondback believes that the expectations and assumptions

reflected in its forward-looking statements are reasonable as and

when made, they involve risks and uncertainties that are difficult

to predict and, in many cases, beyond Diamondback’s control.

Accordingly, forward-looking statements are not guarantees of

future performance and Diamondback’s actual outcomes could differ

materially from what Diamondback has expressed in its

forward-looking statements. Information concerning these risks and

uncertainties and other factors can be found in Diamondback’s

filings with the U.S. Securities and Exchange Commission ("SEC"),

including the registration statement, prospectus and prospectus

supplement relating to the Secondary Offering and its reports on

Forms 10-K, 10-Q and 8-K, each of which can be obtained free of

charge on the SEC’s web site at http://www.sec.gov. Diamondback

undertakes no obligation to update or revise any forward-looking

statement unless required by applicable law.

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

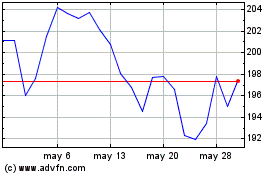

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024