UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

Under

the Securities Exchange Act of 1934

For

the Month of October 2024

001-36345

(Commission

File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact

name of Registrant as specified in its charter)

c/o

Meitar Law Offices Abba Hillel Silver Rd.,

Ramat

Gan, 5250608

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover

Form

20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

On

October 21, 2024, Galmed Pharmaceuticals Ltd. (the “Company”) held a Special

General Meeting of Shareholders (the “Meeting”). At the Meeting, the Company’s shareholders voted on the proposal described

in the proxy statement for the Meeting included as an exhibit to the Company’s report on Form 6-K furnished by the Company with

the Securities and Exchange Commission on September 20, 2024. The proposal brought before the shareholders at the Meeting was approved

by the shareholders of the Company with the requisite majority in accordance with the Israeli Companies Law, 5759-1999.

In

addition, as previously disclosed, on August 30, 2024, the Company entered into a Standby Equity Purchase Agreement (the “Purchase

Agreement”) with YA II PN, LTD., a Cayman Islands exempt limited partnership (“Yorkville”). Pursuant to the Purchase

Agreement, the Company has the right, but not the obligation, to sell to Yorkville from time to time (each such occurrence, an “Advance”)

up to $10.0 million (the “Commitment Amount”) of the Company’s ordinary

shares, par value NIS 1.80 per share (the “Ordinary Shares”), during the 36 months

following the execution of the Purchase Agreement, subject to the restrictions and satisfaction of the conditions in the Purchase Agreement.

On

October 21, 2024. the Company and Yorkville entered

into an amendment to the Purchase Agreement (the “Amendment”) to increase the Commitment Amount to $20.0 million of the Company’s

Ordinary Shares.

The

foregoing summary of the material terms of the Amendment is not complete and is qualified in its entirety by reference to the full text

thereof, a copy of which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

This

Form 6-K is incorporated by reference into the Company’s Registration Statement on Form S-8 (Registration No. 333-206292

and 333-227441) and the Company’s Registration Statement on Form F-3 (Registration No. 333-272722).

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Galmed

Pharmaceuticals Ltd. |

| |

|

|

| Date:

October 21, 2024 |

By: |

/s/

Allen Baharaff |

| |

|

Allen

Baharaff |

| |

|

President

and Chief Executive Officer |

Exhibit 10.1

AMENDMENT TO STANDBY EQUITY PURCHASE AGREEMENT

This AMENDMENT TO THE STANDBY

EQUITY PURCHASE AGREEMENT, dated as of October 21, 2024 (this “Amendment”), is entered between GALMED PHARMACEUTICALS

LTD., a company incorporated under the laws of Israel (“Company”), and YA II PN, LTD., a Cayman Islands

exempt limited company (the “Investor”).

PRELIMINARY STATEMENTS

A. Reference

is hereby made to that certain Standby Equity Purchase Agreement, dated as of August 30, 2024 (as may be amended, amended and restated,

extended, supplemented or otherwise modified in writing from time to time and in effect immediately prior to the effectiveness of this

Amendment, the “Existing Agreement”, and the Existing Agreement, as amended by this Amendment, the “Amended

Agreement”), between the Company and the Investor.

B. The

parties desire to amend certain of the terms and provisions of the Existing Agreement as specifically set forth in this Amendment.

C. The

parties are prepared to amend the Existing Agreement, subject to the conditions and in reliance on the representations set forth in this

Amendment.

Accordingly, in consideration

of the premises and the mutual covenants contained herein, and other good and valuable consideration, the receipt and adequacy of which

are hereby acknowledged, the parties hereto agree as follows:

SECTION 1. Defined

Terms. Unless otherwise defined herein, all capitalized terms used herein, including in the preamble and the preliminary statements

hereto, shall have the meanings assigned to such terms in the Existing Agreement.

SECTION 2. Amendments

to Existing Agreement. In reliance upon the representations and warranties set forth in Section 3, the Existing Agreement is

hereby amended as follows:

(a) The

first Whereas clause in the Recitals to the Existing Agreement is hereby amended and restated in its entirety as follows:

“WHEREAS, the parties desire

that, upon the terms and subject to the conditions contained herein, the Company shall have the right to issue and sell to the Investor,

from time to time as provided herein, and the Investor shall purchase from the Company, up to $20 million of the Company’s ordinary

shares, par value NIS 1.80 per share (the “Ordinary Shares”); and”

(b) The

Definition of the term “Commitment Amount” as defined in Article I of the Existing Agreement is hereby amended and restated

in its entirety as follows:

“Commitment Amount”

shall mean $20,000,000 of Ordinary Shares.

SECTION 3. Representations

and Warranties. All representations and warranties contained in the Amended Agreement shall be true and correct in all respects as

of the date hereof as though made on and as of the date hereof (or, to the extent such representations or warranties are expressly made

solely as of an earlier date, such representations and warranties shall be true and correct as of such earlier date). Each party further

represents and warrants that:

(a) Authorization;

No Contravention. The execution, delivery and performance by such party of this Amendment (i) have been duly and validly authorized

by all corporate, stockholder, partnership or limited liability company action required to be taken by such party, and (ii) do not violate

or contravene such party’s governing documents or any applicable law or any material agreement or instrument or any court order

which is binding upon such party or its property.

(b) Enforceability.

This Amendment and the Amended Agreement are a legal, valid and binding obligation of such party, enforceable against it in accordance

with their respective terms, except as enforceability may be limited by bankruptcy, insolvency or similar laws affecting the enforcement

of creditors’ rights generally and by general principles of equity.

SECTION 4. Survival

of Representations and Warranties. All representations and warranties made in this Amendment shall survive the execution and delivery

of this Amendment. Such representations and warranties have been and will be relied upon by the parties and shall continue in full force

and effect as long as any obligation under the Amended Agreement shall remain unpaid or unsatisfied.

SECTION 5. Effect

of Amendment, Other Agreements, Etc.

(a) Effect

of Amendment. After giving effect to this Amendment, the Amended Agreement shall be and remain in full force and effect in accordance

with its terms and is hereby ratified and confirmed by the parties in all respects. The execution, delivery, and performance of this Amendment

shall not operate as a waiver of any right, power, or remedy of any party under the Existing Agreement. Each party hereby acknowledges

and agrees that, after giving effect to this Amendment, all of its obligations and liabilities under the Existing Agreement to which it

is a party, as such obligations and liabilities have been amended by this Amendment, are reaffirmed and remain in full force and effect.

All references to the Existing Agreement in any document or instrument delivered in connection therewith shall be deemed to refer to the

Amended Agreement. Nothing contained herein shall be construed as a novation of the obligations outstanding under the Existing Agreement,

which shall remain in full force and effect, except as modified hereby.

(b) Limited

Effect. This Amendment relates only to the specific matters expressly covered herein, shall not be considered to be an amendment or

waiver of any rights or remedies that any party may have under the Existing Agreement or under applicable law other than as expressly

set forth herein, and shall not be considered to create a course of dealing or to otherwise obligate in any respect a party to execute

similar or other amendments or waivers or grant any amendments or waivers under the same or similar or other circumstances in the future.

(c) SEC

Filings. The Company shall, as soon as practicable following the date hereof, publicly disclose in an SEC filing all the material

terms and transactions contemplated by this Amendment. Prior to the delivery of any Advance Notices pursuant to the Amended Agreement,

the Company shall prepare and file with the SEC a Registration Statement or any amendments or supplements to a previously filed Registration

Statement and related prospectus used in connection with such Registration Statement as may be necessary to keep such Registration Statement

effective considering the amendments set forth herein, and to ensure that the Investor is able to resell the Common Shares issuable in

connection with any such Advance Notice.

(d) Commitment

Fee. The parties agree that the Commitment Fee, which was paid pursuant to the Existing Agreement, shall not be increased as a result

of this Amendment and no additional Commitment Fee shall be due from the Company.

SECTION 6. Miscellaneous.

(a) Headings.

Section headings in this Amendment are included herein for convenience and do not affect the meanings of the provisions that they precede.

(b) Severability.

If any provision of this Amendment is held invalid or unenforceable, either in its entirety or by virtue of its scope or application to

given circumstances, such provision shall thereupon be deemed modified only to the extent necessary to render same valid, or not applicable

to given circumstances, or excised from this Amendment, as the situation may require, and this Amendment shall be construed and enforced

as if such provision had been included herein as so modified in scope or application, or had not been included herein or therein, as the

case may be.

(c) Binding

Effect. This Amendment binds and is for the benefit of the successors of each party.

(d) GOVERNING

LAW. THIS AMENDMENT SHALL BE GOVERNED BY AND INTERPRETED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO THE

PRINCIPLES OF CONFLICT OF LAWS. THE PARTIES FURTHER AGREE THAT ANY ACTION BETWEEN THEM SHALL BE HEARD IN NEW YORK COUNTY, NEW YORK, AND

EXPRESSLY CONSENT TO THE JURISDICTION AND VENUE OF THE SUPREME COURT OF NEW YORK, SITTING IN NEW YORK COUNTY, NEW YORK AND THE UNITED

STATES DISTRICT COURT OF THE SOUTHERN DISTRICT OF NEW YORK, SITTING IN NEW YORK, NEW YORK, FOR THE ADJUDICATION OF ANY CIVIL ACTION ASSERTED

PURSUANT TO THIS AMENDMENT.

(e) Execution

in Counterparts. This Amendment may be executed in identical counterparts, both which shall be considered one and the same agreement

and shall become effective when counterparts have been signed by each party and delivered to the other party. Facsimile or other electronically

scanned and delivered signatures, including by e-mail attachment, shall be deemed originals for all purposes of this Amendment.

[Remainder of Page Intentionally

Left Blank; Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have

caused this Amendment to be executed and delivered as of the date first above written.

| |

GALMED PHARMACEUTICALS LTD. |

| |

|

|

| |

By: |

|

| |

Name: |

Allen Baharaff |

| |

Title: |

Chief Executive Officer |

[Signature Page to Amendment

to Standby Equity Purchase Agreement]

| |

YA II PN, LTD. |

| |

|

| |

By: |

Yorkville Advisors Global, LP |

| |

Its: |

Investment Manager |

| |

By: |

Yorkville Advisors Global II, LLC |

| |

Its: |

General Partner |

| |

By: |

|

| |

Name: |

Matthew Beckman |

| |

Title: |

Manager |

[Signature Page to Amendment

to Standby Equity Purchase Agreement]

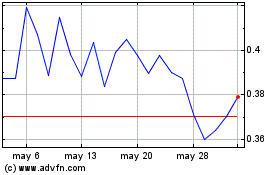

Galmed Pharmaceuticals (NASDAQ:GLMD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Galmed Pharmaceuticals (NASDAQ:GLMD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024