Ferroglobe PLC (NASDAQ: GSM) (“Ferroglobe”, the “Company”, or the

“Parent”), a leading producer globally of silicon metal,

silicon-based and manganese-based specialty alloys, today announced

financial results for the first quarter 2023.

FINANCIAL HIGHLIGHTS

- Q1 2023 revenue of $400.9 million,

down 11% over the prior quarter

- Q1 2023 adjusted EBITDA of $44.8

million, down 66% over the prior quarter

- Q1 2023 adjusted EBITDA margins

were down at 11.2% versus 29.1% in the prior quarter and 33.7%% in

Q1 2022

- Q1 2023 Adjusted EPS was $.05

versus $.39 in Q4 and $.88 in Q1-22

- Gross debt declined to $400

million, down from $450 million in Q4 and $518 in Q1-22

- Net debt declined to $55 million,

down from $127 million in Q4 and $342 in

Q1-22

- $100 million available from our ABL

facility completely undrawn in Q1

- Total cash increased to $344

million, up from $323 million in Q4-22 and $176 million in

Q1-22

BUSINESS

HIGHLIGHTS

- Finalizing two multi-year power

contracts in Spain to provide competitive source of renewable

energy to ramp up Spanish footprint

- Investing in expansion of quartz

mine in Spain to secure additional source of high quality

quartz

- Signed letter of intent to acquire

additional quartz mine

- Ready to start the third furnace in

Polokwane resulting in total plant capacity of 55,000 tons

- Continue to focus on battery and

solar opportunities

Dr. Marco Levi, Ferroglobe’s Chief Executive

Officer, commented, “We ended the first quarter with the lowest net

debt level in the Company’s history and are on target to achieve a

positive net cash position in the next couple of quarters. This

achievement was a result of well planned execution and our

continued focus on optimizing our working capital. Ferroglobe is at

its strongest financial position since its inception.

“While the current macroeconomic environment is

challenging, we are successfully managing through it and focused on

positioning the Company for long-term success. Vertical integration

is an important part of our overall strategy, positioning

Ferroglobe with a competitive advantage, enhancing our ability to

control our supply chain and ensure access to quality materials. In

line with this strategy, we are currently in the process of

expanding our capacity of high quality quartz reserves. We are

expanding our quartz mine in Spain and we have also signed a letter

of intent to acquire a new high quality quartz mine. High quality

quartz is the most important raw material used in the production of

high purity silicon metal.

“We are finalizing two multi-year energy

contracts that will provide us with access to 100% renewable energy

at competitive rates. These contracts affirm our commitment to

clean energy as well as enabling us to ramp up production in

Spain.

“As we discussed on our fourth quarter earnings

call, the market has weakened in the first quarter and we believe

it is currently at trough levels. Global economic conditions remain

challenging with weak overall pricing and soft demand. We expect

some improvement in the second quarter, continuing into the second

half, in line with our 2023 estimations. Accordingly, we are

reiterating our guidance for the full year of adjusted EBITDA of

$270 to $300 million,” concluded Dr. Levi.

First Quarter 2023 Financial Highlights

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

% |

|

% |

|

Twelve Months Ended |

| $,000

(unaudited) |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

Q/Q |

|

Y/Y |

|

December 31, 2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

$ |

400,868 |

|

|

$ |

448,625 |

|

|

$ |

715,265 |

|

|

(11%) |

|

(44%) |

|

$ |

2,597,916 |

|

| Raw materials and energy

consumption for production |

$ |

(255,036) |

|

|

$ |

(289,572) |

|

|

$ |

(340,555) |

|

|

(20%) |

|

(25%) |

|

$ |

(1,285,086) |

|

| Energy consumption for

production (PPA impact) |

|

23,193 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Operating profit (loss) |

$ |

44,454 |

|

|

$ |

29,696 |

|

|

$ |

211,130 |

|

|

50% |

|

(79%) |

|

$ |

660,547 |

|

| Operating margin |

|

11.1% |

|

|

|

6.6% |

|

|

|

29.5% |

|

|

|

|

|

|

|

25.4% |

|

| Adjusted net

incomeattributable to the parent |

$ |

7,807 |

|

|

$ |

75,896 |

|

|

$ |

165,303 |

|

|

(90%) |

|

(95%) |

|

$ |

572,630 |

|

| Adjusted diluted EPS |

$ |

0.05 |

|

|

$ |

0.39 |

|

|

$ |

0.88 |

|

|

|

|

|

|

$ |

3.04 |

|

| Adjusted EBITDA |

$ |

44,767 |

|

|

$ |

130,442 |

|

|

$ |

241,119 |

|

|

(66%) |

|

(81%) |

|

$ |

860,006 |

|

| Adjusted EBITDA margin |

|

11.2% |

|

|

|

29.1% |

|

|

|

33.7% |

|

|

|

|

|

|

|

33.1% |

|

| Operating cash flow |

$ |

134,532 |

|

|

$ |

118,059 |

|

|

$ |

65,908 |

|

|

14% |

|

104% |

|

$ |

405,018 |

|

| Free cash flow1 |

$ |

117,240 |

|

|

$ |

103,507 |

|

|

$ |

56,783 |

|

|

13% |

|

106% |

|

$ |

353,244 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Working Capital |

$ |

582,344 |

|

|

$ |

705,888 |

|

|

$ |

613,187 |

|

|

(18%) |

|

(5%) |

|

$ |

705,888 |

|

| Cash and Restricted Cash |

$ |

344,197 |

|

|

$ |

322,943 |

|

|

$ |

176,022 |

|

|

7% |

|

96% |

|

$ |

322,943 |

|

| Adjusted Gross Debt2 |

$ |

399,723 |

|

|

$ |

449,711 |

|

|

$ |

518,093 |

|

|

(11%) |

|

(23%) |

|

$ |

459,620 |

|

| Equity |

$ |

658,490 |

|

|

$ |

756,813 |

|

|

$ |

475,477 |

|

|

(13%) |

|

38% |

|

$ |

756,813 |

|

(1) Free cash flow is

calculated as operating cash flow plus investing cash

flow(2) Adjusted gross debt excludes bank borrowings on

factoring program and impact of leasing standard IFRS16 at December

31, 2022 March 31, 2023 & March 31, 2022

Sales

In the first quarter of 2023, Ferroglobe

reported net sales of $400.8 million, a decrease of 11% over the

prior quarter and a decrease of 44% over the year-ago period. The

decrease in our first quarter results is primarily attributable to

lower volumes across our product portfolio, and lower pricing in

our main products. The $48 million decrease in sales over the prior

quarter was primarily driven by silicon metal, which accounted for

$23 million of the decrease, and manganese-based alloys, which

accounted for $29 million, partially offset by an increase in

silicon-based alloys, which accounted for $9 million.

Raw materials and energy consumption for

production

Raw materials and energy consumption for

production was $231.8 million in the first quarter of 2023 versus

$289.6 million in the prior quarter, a decrease of 20%. As a

percentage of sales, raw materials and energy consumption for

production was 58% in the first quarter of 2023 versus 65% in the

prior quarter. This variance was mainly due to the change in the

fair value of a short-term power purchase agreement (PPA) that

finalized on April 30, 2023 to hedge energy prices in Spain.

Net Income (Loss) Attributable to the

Parent

In the first quarter of 2023, net profit

attributable to the parent was $21.0 million, or $0.11 per diluted

share, compared to a net profit attributable to the parent of $6.2

million, or $0.03 per diluted share in the fourth quarter.

Adjusted EBITDA

In the first quarter of 2023, adjusted EBITDA

was $44,8 million, or 11% of sales, a decrease of 66% compared to

adjusted EBITDA of $130.4 million, or 29% of sales in the fourth

quarter of 2022. The decrease in the first quarter of 2023 adjusted

EBITDA as a percentage of sales decrease is primarily attributable

to a decrease in sales volumes, prices, and the indirect CO2 and

energy compensation in France in December 2022.

Total Cash

The total cash balance was $344.2 million as of

March 31, 2023, up $21.3 million from $322.9 million as of December

31, 2022.

During the first quarter of 2023, we generated

positive operating cash flow of $134.8 million, had negative cash

flow from investing activities of $17.3 million, and $96.2 million

in negative cash flow from financing activities.

Total Working Capital

Total working capital was $582.3 million at

March 31, 2023, decreasing from $705.9 million at December 31,

2022. The $123.5 million decrease in working capital during the

quarter was due to a decrease in trade and other receivables by

$113.0 million and inventories by $83.0 million, partially offset

by an increase in trade and other payables by $72.5 million.

Beatriz García-Cos, Ferroglobe’s Chief Financial

Officer, commented, “During the first quarter, we followed through

on our commitment to optimize working capital, with a total release

of $131 million, driven by inventories and trade receivables. We

continued to strengthen our balance sheet in the first quarter,

achieving the lowest leverage in the company’s history with net

debt of just $55 million. We expect continued improvement to our

balance sheet and project to get to net debt positive in the next

couple of quarters. With a strong balance sheet and improved cash

flows, we are actively reviewing actions to optimize our capital

structure and begin returning value to shareholders,” concluded

Mrs. García-Cos.

Product Category Highlights

Silicon Metal

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

|

|

Quarter Ended |

|

|

|

Twelve MonthsEnded |

| |

March 31, 2023 |

|

December 31, 2022 |

|

% Q/Q |

|

March 31, 2022 |

|

% Y/Y |

|

December 31, 2022 |

|

Shipments in metric tons: |

36,942 |

|

|

39,459 |

|

|

(6.4 |

)% |

|

56,349 |

|

|

(34.4 |

)% |

|

209,342 |

|

|

Average selling price ($/MT): |

4,351 |

|

|

4,655 |

|

|

(6.5 |

)% |

|

5,552 |

|

|

(21.6 |

)% |

|

5,332 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Silicon Metal Revenue

($,000) |

160,735 |

|

|

183,682 |

|

|

(12.5 |

)% |

|

312,850 |

|

|

(48.6 |

)% |

|

1,116,212 |

|

| Silicon Metal

Adj.EBITDA ($,000) |

31,120 |

|

|

89,064 |

|

|

(65.1 |

)% |

|

151,661 |

|

|

(79.5 |

)% |

|

529,355 |

|

| Silicon Metal

Adj.EBITDA Mgns |

19.4% |

|

|

48.5% |

|

|

|

|

48.5% |

|

|

|

|

47.4% |

|

Silicon metal revenue in the first quarter was

$160.7 million, a decrease of 12.5% over the prior quarter. The

average realized selling price decreased by 6.5%, primarily due to

a pricing market decline of 6.5% in the US and 8% in Europe. Total

shipments decreased due to self-constraint of our European assets

in response to the general demand slowdown. Adjusted EBITDA for

silicon metal decreased to $31.1 million during the first quarter,

a decrease of 65.1% compared with $89.1 million for the prior

quarter. EBITDA margin in the quarter decreased mainly driven by

the energy compensation in France in the fourth quarter of

2022.

Silicon-Based Alloys

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

|

|

Quarter Ended |

|

|

|

Twelve Months Ended |

| |

March 31, 2023 |

|

December 31, 2022 |

|

% Q/Q |

|

March 31, 2022 |

|

% Y/Y |

|

December 31, 2022 |

|

Shipments in metric tons: |

49,100 |

|

|

39,847 |

|

|

23.2 |

% |

|

57,594 |

|

|

(14.7 |

)% |

|

204,076 |

|

|

Average selling price ($/MT): |

2,756 |

|

|

3,182 |

|

|

(13.4 |

)% |

|

3,680 |

|

|

(25.1 |

)% |

|

3,694 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Silicon-based Alloys

Revenue ($,000) |

135,320 |

|

|

126,793 |

|

|

6.7 |

% |

|

211,946 |

|

|

(36.2 |

)% |

|

753,857 |

|

| Silicon-based Alloys

Adj.EBITDA ($,000) |

21,924 |

|

|

37,102 |

|

|

(40.9 |

)% |

|

78,411 |

|

|

(72.0 |

)% |

|

257,144 |

|

| Silicon-based Alloys

Adj.EBITDA Mgns |

16.2% |

|

|

29.3% |

|

|

|

|

37.0% |

|

|

|

|

34.1% |

|

Silicon-based alloy revenue in the first quarter

was $135.3 million, an increase of 6.7% over the prior quarter. The

shipments increase by 23.2%, triggered by the restart of blast

furnaces taking advantage of low energy prices. Adjusted EBITDA for

the silicon-based alloys portfolio decreased to $21.9 million in

the first quarter of 2023, a decrease of 40.9% compared with $37.1

million for the prior quarter. EBITDA margin decreased in the

quarter mainly due to the decrease in sale prices.

Manganese-Based Alloys

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

|

|

Quarter Ended |

|

|

|

Twelve Months Ended |

| |

March 31, 2023 |

|

December 31, 2022 |

|

% Q/Q |

|

March 31, 2022 |

|

% Y/Y |

|

December 31, 2022 |

|

Shipments in metric tons: |

46,867 |

|

|

61,917 |

|

|

(24.3 |

)% |

|

75,082 |

|

|

(37.6 |

)% |

|

295,589 |

|

|

Average selling price ($/MT): |

1,316 |

|

|

1,466 |

|

|

(10.2 |

)% |

|

1,925 |

|

|

(31.6 |

)% |

|

1,778 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Manganese-based Alloys

Revenue ($,000) |

61,677 |

|

|

90,770 |

|

|

(32.1 |

)% |

|

144,533 |

|

|

(57.3 |

)% |

|

525,557 |

|

| Manganese-based Alloys

Adj.EBITDA ($,000) |

2,043 |

|

|

19,696 |

|

|

(89.6 |

)% |

|

20,371 |

|

|

(90.0 |

)% |

|

69,966 |

|

| Manganese-based Alloys

Adj.EBITDA Mgns |

3.3% |

|

|

21.7% |

|

|

|

|

14.1% |

|

|

|

|

13.3% |

|

Manganese-based alloy revenue in the first

quarter was $61.7 million, a decrease of 32.1% over the prior

quarter. The average realized selling price decreased by 10.2% and

total shipments decreased 24.3%. Adjusted EBITDA for the

manganese-based alloys portfolio decreased to $2.0 million in the

first quarter of 2023, a decrease of 89.6% compared with $19.9

million for the prior quarter. EBITDA margin in the quarter

decreased mainly driven by the energy compensation in France in the

fourth quarter of 2022.

Russia – Ukraine War

The ongoing war between Russia and Ukraine has

disrupted supply chains and caused instability in the global

economy, while the United States, United Kingdom and European

Union, among other countries, announced sanctions against Russia.

The ongoing conflict could result in the imposition of further

economic sanctions against Russia. Sanctions imposed on coal and

assimilated products such as anthracite and metallurgical coke have

obliged Ferroglobe to redirect its sourcing of such products to

other. New sourcing of carbon electrodes was put in place in 2022

allowing Ferroglobe to ensure supply continuity to its operations

worldwide while maintaining compliance with applicable

sanctions.

Conference Call

Ferroglobe invites all interested persons to

participate on its conference call at 8:30 AM, Eastern Time on May

10, 2023. Please dial-in at least five minutes prior to the call to

register. The call may also be accessed via an audio webcast.

To join via

phone: Conference

call participants should pre-register using this

link: https://register.vevent.com/register/BI80b8c060e88c4ab7abcef347366e2149Once

registered, you will receive the dial-in numbers and a personal

PIN, which are required to access the conference call.

To join via

webcast: A

simultaneous audio webcast, and replay will be accessible

here: https://edge.media-server.com/mmc/p/xkwnauwt

About Ferroglobe

Ferroglobe PLC is a leading global producer of

silicon metal, silicon- and manganese- based specialty alloys and

ferroalloys, serving a customer base across the globe in dynamic

and fast-growing end markets, such as solar, electronics,

automotive, consumer products, construction, and energy. The

Company is based in London. For more information, visit

http://investor.ferroglobe.com.

Forward-Looking Statements

This release contains “forward-looking

statements” within the meaning of U.S. securities laws.

Forward-looking statements are not historical facts but are based

on certain assumptions of management and describe the Company’s

future plans, strategies and expectations. Forward-looking

statements often use forward-looking terminology, including words

such as “anticipate”, “believe”, “could”, “estimate”, “expect”,

“forecast”, “guidance”, “intends”, “likely”, “may”, “plan”,

“potential”, “predicts”, “seek”, “target”, “will” and words of

similar meaning or the negative thereof.

Forward-looking statements contained in this

press release are based on information currently available to the

Company and assumptions that management believe to be reasonable,

but are inherently uncertain. As a result, Ferroglobe’s actual

results, performance or achievements may differ materially from

those expressed or implied by these forward-looking statements,

which are not guarantees of future performance and involve known

and unknown risks, uncertainties and other factors that are, in

some cases, beyond the Company’s control.

Forward-looking financial information and other

metrics presented herein represent the Company’s goals and are not

intended as guidance or projections for the periods referenced

herein or any future periods.

All information in this press release is as of

the date of its release. Ferroglobe does not undertake any

obligation to update publicly any of the forward-looking statements

contained herein to reflect new information, events or

circumstances arising after the date of this press release. You

should not place undue reliance on any forward-looking statements,

which are made only as of the date of this press release.

Non-IFRS Measures

This document may contain summarized,

non-audited or non-GAAP financial information. The information

contained herein should therefore be considered as a whole and in

conjunction with all the public information regarding the Company

available, including any other documents released by the Company

that may contain more detailed information. Adjusted EBITDA,

adjusted EBITDA as a percentage of sales, working capital as a

percentage of sales, adjusted EBITDA margin, adjusted net profit,

adjusted profit per share, working capital, adjusted gross debt and

net debt, are non-IFRS financial metrics that management uses in

its decision making. Ferroglobe has included these financial

metrics to provide supplemental measures of its performance. The

Company believes these metrics are important and useful to

investors because they eliminate items that have less bearing on

the Company’s current and future operating performance and

highlight trends in its core business that may not otherwise be

apparent when relying solely on IFRS financial measures.

INVESTOR CONTACT:

Anis BarodawallaExecutive Vice President – Investor

Relations Email: investor.relations@ferroglobe.com

MEDIA CONTACT:

Cristina Feliu RoigExecutive Director – Communications &

Public

AffairsEmail: corporate.comms@ferroglobe.com

| |

|

Ferroglobe PLC and Subsidiaries |

|

Unaudited Condensed Consolidated Income

Statement |

|

(in thousands of U.S. dollars, except per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Twelve Months Ended |

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

December 31, 2022 |

|

Sales |

$ |

400,868 |

|

|

$ |

448,625 |

|

|

$ |

715,265 |

|

|

$ |

2,597,916 |

|

| Raw materials and energy

consumption for production |

|

(255,036 |

) |

|

|

(289,572 |

) |

|

|

(340,555 |

) |

|

|

(1,285,086 |

) |

| Energy consumption for

production (PPA impact) |

|

23,193 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Other operating income |

|

14,814 |

|

|

|

78,414 |

|

|

|

23,008 |

|

|

|

147,356 |

|

| Staff costs |

|

(67,543 |

) |

|

|

(76,431 |

) |

|

|

(81,986 |

) |

|

|

(314,810 |

) |

| Other operating expense |

|

(54,145 |

) |

|

|

(54,129 |

) |

|

|

(83,176 |

) |

|

|

(346,252 |

) |

| Depreciation and amortization

charges, operating allowances and write-downs |

|

(17,990 |

) |

|

|

(20,547 |

) |

|

|

(21,109 |

) |

|

|

(81,559 |

) |

| Impairment (losses) gain |

|

246 |

|

|

|

(56,999 |

) |

|

|

— |

|

|

|

(56,999 |

) |

| Other gain (loss) |

|

47 |

|

|

|

335 |

|

|

|

(317 |

) |

|

|

(19 |

) |

| Operating

profit |

|

44,454 |

|

|

|

29,696 |

|

|

|

211,130 |

|

|

|

660,547 |

|

| Net finance expense |

|

(10,980 |

) |

|

|

(16,830 |

) |

|

|

(12,455 |

) |

|

|

(58,741 |

) |

| Exchange differences |

|

1,455 |

|

|

|

4,051 |

|

|

|

(4,393 |

) |

|

|

(9,995 |

) |

| Profit before

tax |

|

34,929 |

|

|

|

16,917 |

|

|

|

194,282 |

|

|

|

591,811 |

|

| Income tax (loss) |

|

(9,461 |

) |

|

|

(7,775 |

) |

|

|

(43,495 |

) |

|

|

(147,983 |

) |

| Profit for the

period |

|

25,468 |

|

|

|

9,142 |

|

|

|

150,787 |

|

|

|

443,828 |

|

| Profit (loss) attributable to

non-controlling interest |

|

(4,477 |

) |

|

|

(2,943 |

) |

|

|

376 |

|

|

|

(3,514 |

) |

| Profit attributable to the

parent |

$ |

20,991 |

|

|

$ |

6,199 |

|

|

$ |

151,163 |

|

|

$ |

440,314 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

$ |

62,444 |

|

|

$ |

50,243 |

|

|

$ |

232,239 |

|

|

$ |

742,106 |

|

| Adjusted EBITDA |

$ |

44,767 |

|

|

$ |

130,442 |

|

|

$ |

241,119 |

|

|

$ |

860,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

187,873 |

|

|

|

187,523 |

|

|

|

187,408 |

|

|

|

187,816 |

|

|

Diluted |

|

189,629 |

|

|

|

188,949 |

|

|

|

188,583 |

|

|

|

189,625 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss) per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.81 |

|

|

$ |

2.34 |

|

|

Diluted |

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.80 |

|

|

$ |

2.32 |

|

| |

|

Ferroglobe PLC and Subsidiaries |

|

Unaudited Condensed Consolidated Statement of Financial

Position |

|

(in thousands of U.S. dollars) |

|

|

|

|

|

|

|

|

|

|

|

| |

March 31, |

|

December 31, |

|

March 31, |

| |

2023 |

|

2022 |

|

2022 |

|

ASSETS |

| Non-current

assets |

|

|

|

|

|

|

|

|

|

|

Goodwill |

$ |

|

29,702 |

|

$ |

29,702 |

|

$ |

29,702 |

|

Other intangible assets |

|

|

223,447 |

|

|

111,797 |

|

|

188,407 |

|

Property, plant and equipment |

|

|

497,557 |

|

|

486,247 |

|

|

548,862 |

|

Other non-current financial assets |

|

|

14,702 |

|

|

14,186 |

|

|

3,977 |

|

Deferred tax assets |

|

|

7,123 |

|

|

7,136 |

|

|

246 |

|

Non-current receivables from related parties |

|

|

2,915 |

|

|

1,600 |

|

|

1,665 |

|

Other non-current assets |

|

|

19,297 |

|

|

18,218 |

|

|

18,819 |

|

Non-current restricted cash and cash equivalents |

|

|

2,175 |

|

|

2,133 |

|

|

2,220 |

| Total non-current

assets |

|

|

796,918 |

|

|

671,019 |

|

|

793,898 |

| Current

assets |

|

|

|

|

|

|

|

|

|

|

Inventories |

|

|

417,042 |

|

|

500,080 |

|

|

362,298 |

|

Trade and other receivables |

|

|

312,452 |

|

|

425,474 |

|

|

499,953 |

|

Current receivables from related parties |

|

|

2,728 |

|

|

2,675 |

|

|

2,784 |

|

Current income tax assets |

|

|

7,652 |

|

|

6,104 |

|

|

408 |

|

Other current financial assets |

|

|

2 |

|

|

3 |

|

|

203 |

|

Other current assets |

|

|

26,914 |

|

|

30,608 |

|

|

11,838 |

|

Assets and disposal groups classified as held for sale |

|

|

1,088 |

|

|

1,067 |

|

|

— |

|

Current restricted cash and cash equivalents |

|

|

2,411 |

|

|

2,875 |

|

|

— |

|

Cash and cash equivalents |

|

|

339,611 |

|

|

317,935 |

|

|

173,802 |

| Total current

assets |

|

|

1,109,900 |

|

|

1,286,821 |

|

|

1,051,286 |

| Total

assets |

$ |

|

1,906,818 |

|

$ |

1,957,840 |

|

$ |

1,845,184 |

| |

|

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

| Equity |

$ |

|

658,490 |

|

$ |

756,813 |

|

$ |

475,477 |

| Non-current

liabilities |

|

|

|

|

|

|

|

|

|

|

Deferred income |

|

|

128,125 |

|

|

3,842 |

|

|

70,699 |

|

Provisions |

|

|

50,937 |

|

|

47,670 |

|

|

57,858 |

|

Bank borrowings |

|

|

15,590 |

|

|

15,774 |

|

|

3,360 |

|

Lease liabilities |

|

|

11,744 |

|

|

12,942 |

|

|

10,636 |

|

Debt instruments |

|

|

304,621 |

|

|

330,655 |

|

|

404,954 |

|

Other financial liabilities |

|

|

39,276 |

|

|

38,279 |

|

|

38,674 |

|

Other Obligations |

|

|

36,310 |

|

|

37,502 |

|

|

37,241 |

|

Other non-current liabilities |

|

|

22 |

|

|

12 |

|

|

— |

|

Deferred tax liabilities |

|

|

35,272 |

|

|

35,854 |

|

|

35,423 |

| Total non-current

liabilities |

|

|

621,897 |

|

|

522,530 |

|

|

658,845 |

| Current

liabilities |

|

|

|

|

|

|

|

|

|

|

Provisions |

|

|

146,501 |

|

|

145,507 |

|

|

159,386 |

|

Bank borrowings |

|

|

31,462 |

|

|

62,059 |

|

|

95,359 |

|

Lease liabilities |

|

|

7,492 |

|

|

8,929 |

|

|

7,869 |

|

Debt instruments |

|

|

4,688 |

|

|

12,787 |

|

|

6,382 |

|

Other financial liabilities |

|

|

43,950 |

|

|

60,382 |

|

|

62,141 |

|

Financial Instruments |

|

|

79,331 |

|

|

— |

|

|

— |

|

Payables to related parties |

|

|

2,377 |

|

|

1,790 |

|

|

8,685 |

|

Trade and other payables |

|

|

147,150 |

|

|

219,666 |

|

|

249,064 |

|

Current income tax liabilities |

|

|

48,326 |

|

|

53,234 |

|

|

21,208 |

|

Other Obligations |

|

|

18,790 |

|

|

9,580 |

|

|

18,369 |

|

Other current liabilities |

|

|

96,364 |

|

|

104,563 |

|

|

82,399 |

| Total current

liabilities |

|

|

626,431 |

|

|

678,497 |

|

|

710,862 |

| Total equity and

liabilities |

$ |

|

1,906,818 |

|

$ |

1,957,840 |

|

$ |

1,845,184 |

|

|

|

Ferroglobe PLC and Subsidiaries |

|

Unaudited Condensed Consolidated Statement of Cash

Flows |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Twelve Months Ended |

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

December 31, 2022 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period |

$ |

25,468 |

|

|

$ |

9,142 |

|

|

$ |

150,787 |

|

|

$ |

443,828 |

|

| Adjustments to

reconcile net (loss) profit to net cash used by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

9,461 |

|

|

|

7,775 |

|

|

|

43,495 |

|

|

|

147,983 |

|

|

Depreciation and amortization charges, operating allowances and

write-downs |

|

17,990 |

|

|

|

20,547 |

|

|

|

21,109 |

|

|

|

81,559 |

|

|

Net finance expense |

|

10,980 |

|

|

|

16,830 |

|

|

|

12,455 |

|

|

|

58,741 |

|

|

Exchange differences |

|

(1,455 |

) |

|

|

(4,051 |

) |

|

|

4,393 |

|

|

|

9,995 |

|

|

Impairment losses |

|

(246 |

) |

|

|

56,999 |

|

|

|

— |

|

|

|

56,999 |

|

|

Net loss (gain) due to changes in the value of asset |

|

(25 |

) |

|

|

(209 |

) |

|

|

(6 |

) |

|

|

(349 |

) |

|

Gain on disposal of non-current assets |

|

(22 |

) |

|

|

(120 |

) |

|

|

302 |

|

|

|

459 |

|

|

Share-based compensation |

|

1,905 |

|

|

|

1,941 |

|

|

|

1,807 |

|

|

|

5,836 |

|

|

Other adjustments |

|

— |

|

|

|

(6 |

) |

|

|

21 |

|

|

|

(91 |

) |

| Changes in operating

assets and liabilities |

|

|

|

|

|

|

|

|

|

|

— |

|

|

(Increase) decrease in inventories |

|

86,275 |

|

|

|

41,566 |

|

|

|

(73,611 |

) |

|

|

(220,823 |

) |

|

(Increase) decrease in trade receivables |

|

118,714 |

|

|

|

14,518 |

|

|

|

(121,767 |

) |

|

|

(72,558 |

) |

|

Increase (decrease) in trade payables |

|

(73,864 |

) |

|

|

(130 |

) |

|

|

40,073 |

|

|

|

30,640 |

|

|

Other |

|

(44,100 |

) |

|

|

(10,288 |

) |

|

|

(12,463 |

) |

|

|

(56,677 |

) |

| Income taxes paid |

|

(16,298 |

) |

|

|

(36,455 |

) |

|

|

(687 |

) |

|

|

(80,524 |

) |

| Net cash provided

(used) by operating activities |

|

134,783 |

|

|

|

118,059 |

|

|

|

65,908 |

|

|

|

405,018 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Interest and finance income

received |

|

668 |

|

|

|

257 |

|

|

|

68 |

|

|

|

1,520 |

|

| Payments due to

investments: |

|

|

|

|

|

|

|

|

|

|

|

|

Other intangible assets |

|

— |

|

|

|

(918 |

) |

|

|

— |

|

|

|

(1,147 |

) |

|

Property, plant and equipment |

|

(17,960 |

) |

|

|

(13,891 |

) |

|

|

(9,193 |

) |

|

|

(52,153 |

) |

|

Other |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6 |

|

| Net cash (used)

provided by investing activities |

|

(17,292 |

) |

|

|

(14,552 |

) |

|

|

(9,125 |

) |

|

|

(51,774 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

| Payment for debt and equity

issuance costs |

|

— |

|

|

|

(60 |

) |

|

|

— |

|

|

|

(853 |

) |

| Repayment of debt

instruments |

|

(26,283 |

) |

|

|

— |

|

|

|

(4,943 |

) |

|

|

(111,106 |

) |

| Increase/(decrease) in

bank borrowings: |

|

|

|

|

|

|

|

|

|

|

— |

|

|

Borrowings |

|

109,762 |

|

|

|

158,607 |

|

|

|

244,164 |

|

|

|

898,586 |

|

|

Payments |

|

(141,900 |

) |

|

|

(168,230 |

) |

|

|

(237,627 |

) |

|

|

(919,932 |

) |

| Amounts paid due to

leases |

|

(2,247 |

) |

|

|

(4,383 |

) |

|

|

(2,518 |

) |

|

|

(11,590 |

) |

| Proceeds from other financing

liabilities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

38,298 |

|

| Other amounts received/(paid)

due to financing activities |

|

(17,377 |

) |

|

|

— |

|

|

|

38,298 |

|

|

|

678 |

|

| Interest paid |

|

(18,192 |

) |

|

|

(3,569 |

) |

|

|

(34,799 |

) |

|

|

(60,822 |

) |

| Net cash (used)

provided by financing activities |

|

(96,237 |

) |

|

|

(17,635 |

) |

|

|

2,575 |

|

|

|

(166,741 |

) |

| Total net cash flows

for the period |

|

21,254 |

|

|

|

85,872 |

|

|

|

59,358 |

|

|

|

186,503 |

|

|

Beginning balance of cash and cash equivalents |

|

322,943 |

|

|

|

236,789 |

|

|

|

116,663 |

|

|

|

116,663 |

|

|

Exchange differences on cash and cash equivalents in foreign

currencies |

|

— |

|

|

|

282 |

|

|

|

1 |

|

|

|

(6,506 |

) |

| Ending balance of cash

and cash equivalents |

$ |

344,197 |

|

|

$ |

322,943 |

|

|

$ |

176,022 |

|

|

$ |

296,660 |

|

| Cash from continuing

operations |

|

339,611 |

|

|

|

317,935 |

|

|

|

173,802 |

|

|

|

317,935 |

|

| Current/Non-current restricted

cash and cash equivalents |

|

4,586 |

|

|

|

5,008 |

|

|

|

2,220 |

|

|

|

5,008 |

|

| Cash and restricted

cash in the statement of financial position |

$ |

344,197 |

|

|

$ |

322,943 |

|

|

$ |

176,022 |

|

|

$ |

322,943 |

|

Adjusted EBITDA ($,000):

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Twelve Months Ended |

|

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

December 31, 2022 |

|

|

Profit attributable to the parent |

$ |

20,991 |

|

|

$ |

6,199 |

|

|

$ |

151,163 |

|

|

$ |

440,314 |

|

| Profit (loss) attributable to

non-controlling interest |

|

4,477 |

|

|

|

2,943 |

|

|

|

(376 |

) |

|

|

3,514 |

|

| Income tax expense |

|

9,461 |

|

|

|

7,775 |

|

|

|

43,495 |

|

|

|

147,983 |

|

| Net finance expense |

|

10,980 |

|

|

|

16,830 |

|

|

|

12,455 |

|

|

|

58,741 |

|

| Exchange differences |

|

(1,455 |

) |

|

|

(4,051 |

) |

|

|

4,393 |

|

|

|

9,995 |

|

| Depreciation and amortization

charges, operating allowances and write-downs |

|

17,990 |

|

|

|

20,547 |

|

|

|

21,109 |

|

|

|

81,559 |

|

| EBITDA |

|

62,444 |

|

|

|

50,243 |

|

|

|

232,239 |

|

|

|

742,106 |

|

| Impairment |

|

(246 |

) |

|

|

56,999 |

|

|

|

— |

|

|

|

56,999 |

|

| Restructuring and termination

costs |

|

— |

|

|

|

— |

|

|

|

5,909 |

|

|

|

9,315 |

|

| New strategy

implementation |

|

2,049 |

|

|

|

4,442 |

|

|

|

2,971 |

|

|

|

29,032 |

|

| Pension Plan buyout |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Subactivity |

|

3,713 |

|

|

|

5,653 |

|

|

|

— |

|

|

|

9,449 |

|

| PPA Energy |

|

(23,193 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Prior periods (loss) |

|

— |

|

|

|

13,105 |

|

|

|

— |

|

|

|

13,105 |

|

| Adjusted

EBITDA |

$ |

44,767 |

|

|

$ |

130,442 |

|

|

$ |

241,119 |

|

|

$ |

860,006 |

|

Adjusted profit attributable to

Ferroglobe ($,000):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

|

Twelve Months Ended |

|

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

|

December 31, 2022 |

|

|

Profit attributable to the parent |

$ |

20,991 |

|

|

$ |

6,199 |

|

|

$ |

151,163 |

|

|

$ |

440,314 |

|

|

Tax rate adjustment |

|

(599 |

) |

|

|

4,591 |

|

|

|

6,931 |

|

|

|

36,604 |

|

|

Impairment |

|

(175 |

) |

|

|

46,272 |

|

|

|

— |

|

|

|

46,272 |

|

|

Restructuring and termination costs |

|

— |

|

|

|

— |

|

|

|

4,797 |

|

|

|

7,562 |

|

|

New strategy implementation |

|

1,459 |

|

|

|

3,606 |

|

|

|

2,412 |

|

|

|

23,568 |

|

|

Pension Plan buyout |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Subactivity |

|

2,644 |

|

|

|

4,589 |

|

|

|

— |

|

|

|

7,671 |

|

|

PPA Energy |

|

(16,513 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Prior periods (loss) |

|

— |

|

|

|

10,639 |

|

|

|

— |

|

|

|

10,639 |

|

| Adjusted profit

attributable to the parent |

$ |

7,807 |

|

|

$ |

75,896 |

|

|

$ |

165,303 |

|

|

$ |

572,630 |

|

Adjusted diluted profit per

share:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

|

Twelve Months Ended |

|

| |

March 31, 2023 |

|

December 31, 2022 |

|

March 31, 2022 |

|

December 31, 2022 |

|

|

Diluted profit per ordinary share |

$ |

0.11 |

|

|

$ |

0.03 |

|

|

$ |

0.80 |

|

|

$ |

2.32 |

|

|

Tax rate adjustment |

|

(0.00 |

) |

|

|

0.02 |

|

|

|

0.04 |

|

|

|

0.19 |

|

|

Impairment |

|

(0.00 |

) |

|

|

0.24 |

|

|

|

— |

|

|

|

0.26 |

|

|

Restructuring and termination costs |

|

— |

|

|

|

— |

|

|

|

0.03 |

|

|

|

0.04 |

|

|

New strategy implementation |

|

0.01 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.13 |

|

|

Subactivity |

|

0.01 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

0.04 |

|

|

PPA Energy |

|

(0.09 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Prior periods (loss) |

|

— |

|

|

|

0.06 |

|

|

|

— |

|

|

|

0.06 |

|

| Adjusted diluted

profit per ordinary share |

$ |

0.05 |

|

|

$ |

0.39 |

|

|

$ |

0.88 |

|

|

$ |

3.04 |

|

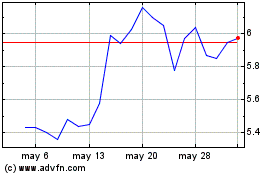

Ferroglobe (NASDAQ:GSM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ferroglobe (NASDAQ:GSM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024