Slope Taps Marqeta to Power Buy Now, Pay Later Card, Enabling Brands And Marketplaces To Offer Flexible Loan Options

12 Diciembre 2024 - 6:00AM

Business Wire

The Marqeta-powered Slope Card will allow

businesses of any size to get lower cost and modern access to

business capital at checkout

Marqeta (NASDAQ: MQ), the global modern card issuing platform

that enables embedded finance solutions for the world’s innovators,

today announced its customer Slope, powering the Slope Card and

enabling low interest Buy Now, Pay Later (BNPL) loan options for

its commercial customers. The Slope Card enables businesses to pay

in-store or online with 30 or 60 day loan options, allowing for

increased flexibility and choice in how they make payments and

manage their finances.

The status quo in accessing capital and streamlining expenses

creates a struggle for many businesses today. The Slope Card is an

example of how flexible payment solutions can overcome that status

quo, make capital more accessible and meet the evolving needs of

businesses of all sizes. Global retailer IKEA is already utilizing

the Slope Card, enabling its IKEA for Business small and medium

sized (SMB) business clientele to access BNPL options at checkout

in-store and online. Slope chose Marqeta to power its Slope Card

because of its single, trusted platform and proven expertise in

powering scalable card programs for some of the biggest names in

the BNPL space. By integrating with Marqeta, Slope enables its

customers to make in-store purchases when needed and spread

payments over time, enhancing cash flow and allowing for faster

access to working capital.

"At Slope, we are committed to empowering businesses to thrive

by making digital payments and financing more seamless and

accessible," said Lawrence Lin Murata, CEO and Co-Founder of Slope.

"Marqeta allows us to deliver flexible and scalable BNPL solutions

that provide businesses with timely access to low interest loans.

Together, we’re driving a transformative approach to financial

management, empowering businesses with easier access to working

capital when they need it most.”

Marqeta’s technology simplifies the process of launching card

programs, enabling companies to put their brands front and center

and provide the embedded, mobile payment experiences today’s

consumers expect. With flexible APIs, Marqeta offers control and

security, enabling real time card issuance and transaction

monitoring, and simplified financial management, allowing

businesses to focus on what’s most important–their growth.

“We couldn’t be more thrilled to power Slope’s commercial BNPL

card solution, bringing the innovative payment experience that

changed the consumer retail landscape to household names like IKEA,

and building on their ability to provide fast, secure and flexible

digital payment options to their SMB customers,” said Todd Pollak,

Chief Revenue Officer at Marqeta. “This is another example of how

Marqeta is pioneering the responsible transformation in payments to

enable brands to offer embedded finance solutions that unlock

purchasing power for businesses whenever needed.”

About Marqeta (NASDAQ: MQ)

Marqeta makes it possible for companies to build and embed

financial services into their branded experience—and unlock new

ways to grow their business and delight users. The Marqeta platform

puts businesses in control of building financial solutions,

enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital

efficiency. With compliance and security built-in, Marqeta’s

platform has been proven at scale, processing more than $200

billion in annual payments volume in 2023. Marqeta is certified to

operate in more than 40 countries worldwide and counting. Visit

www.marqeta.com to learn more.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business; Marqeta’s

products and services; and statements made by Marqeta’s senior

leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212424732/en/

James Robinson press@marqeta.com

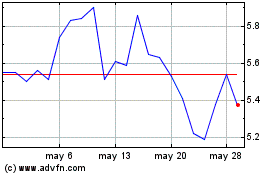

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

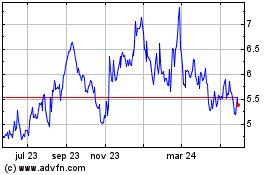

Marqeta (NASDAQ:MQ)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024