969 BroadwaySuite 200OaklandCaliforniaThe Nasdaq Stock Market LLCFALSE000148477800014847782025-01-142025-01-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 14, 2025

ThredUp Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-40249 | 26-4009181 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

969 Broadway, Suite 200 Oakland, California | 94607 |

| (Address of principal executive offices) | (Zip Code) |

(415) 402-5202

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | TDUP | | The Nasdaq Stock Market LLC Long-Term Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 14, 2025, ThredUp Inc. (the “Company”) issued a press release announcing its preliminary financial results for the quarter ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1. The press release is incorporated herein by reference.

The information in this Current Report on Form 8-K and the exhibits attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THREDUP INC. |

| | |

| By: | /s/ SEAN SOBERS |

| | Sean Sobers |

| | Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

Date: January 14, 2025

ThredUp Provides Preliminary Fourth Quarter 2024 Results, Exceeding Guidance

OAKLAND, CA (January 14, 2025) – ThredUp Inc. (Nasdaq: TDUP, LTSE: TDUP), one of the largest online resale platforms for apparel, shoes, and accessories, today provided preliminary unaudited financial results for the fourth quarter ended December 31, 2024.

“I am encouraged by our preliminary fourth quarter results that exceeded all elements of our guidance, and the return to solid growth in our core business,” said ThredUp Co-Founder and CEO James Reinhart. “The exclusive focus on our U.S. business, along with the growing impact of the AI-driven enhancements to our product experience, helped to accelerate momentum throughout the quarter. At the same time, leverage on our many years of infrastructure and marketplace investments drove meaningfully higher margins. We look forward to sustaining this momentum as we turn the page to 2025.”

Preliminary results for Total revenue, Gross margin, Net loss as a percent of Total revenue and Adjusted EBITDA margin for the fourth quarter are shown in the table below. These preliminary results reflect the Company's ongoing U.S.-only operations. Total revenue, gross margin and Adjusted EBITDA margin are above our previously issued guidance for the United States.

| | | | | | | | | | | | | | |

| | Preliminary Results | | Previous U.S. Outlook |

| | (in millions, except percentages) |

Total revenue | | $66.7 to $67.2 | | $58.0 to $60.0 |

| Annual growth % | | 9% | | (6)% to (2)% |

| | | | |

Gross margin | | 80.2% to 80.4% | | 78.5% to 79.5% |

| | | | |

Net loss as a % of Total revenue | | (12.6)% to (12.0)% | | N/A |

| | | | |

Adjusted EBITDA margin | | 6.4% to 6.9% | | 0.0% to 2.0% |

The preliminary combined results in the table below include the Company’s European business Remix Global EAD (“Remix”) until the November 30, 2024 divestiture (the “Remix Divestiture”). These results are compared to our previously issued consolidated guidance, which included Remix through December 31, 2024 and did not give effect to the Remix Divestiture.

| | | | | | | | | | | | | | |

| | Preliminary Combined Results | | Previous Combined Outlook |

| | (in millions, except percentages) |

Combined revenue | | $74.5 to $75.0 | | $67.2 to $69.2 |

| Annual growth % | | (8)% | | (17)% to (15)% |

| | | | |

Combined gross margin | | 75.9% to 76.1% | | 72.3% to 73.3% |

| | | | |

Net loss as a % of Combined revenue | | (25.4)% to (24.7)% | | N/A |

| | | | |

Combined Adjusted EBITDA margin | | 3.2% to 3.7% | | (4.7)% to (2.7)% |

Following the Remix Divestiture, ThredUp no longer operates in Europe and will no longer report combined results or provide a combined outlook going forward. ThredUp expects to report Remix’s results as a discontinued operation when it files its Annual Report on Form 10-K.

Adjusted EBITDA margin, Combined revenue, Combined gross margin and Combined Adjusted EBITDA margin are non-GAAP financial measures. At the conclusion of this press release, we have included more information regarding these non-GAAP financial measures, including reconciliations to the most directly comparable financial measures reported in accordance with GAAP.

The Company has not yet completed its reporting process for the quarterly period and year ended December 31, 2024 and the preliminary financial data set forth above have not been audited or otherwise reviewed by the Company’s independent registered public auditing firm. The preliminary results presented herein are based on its reasonable estimates and the information available to it at this time and, because of their preliminary nature, the Company has provided ranges, rather than specific amounts. As such, the Company's actual results may materially vary from these preliminary results and will not be finalized until the Company reports its final results for the quarterly period and full year after the completion of its customary accounting procedures. In addition, any statements regarding the Company's estimated financial results for the quarterly period ended December 31, 2024 do not present all information necessary for an understanding of the Company's financial condition and results of operations for the quarterly period and year ended December 31, 2024. In addition, the Company’s independent registered public accounting firm, Deloitte & Touche LLP, has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data set forth above. Accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto. It is possible that we or Deloitte & Touche LLP may identify items that require us to make adjustments to the preliminary financial data set forth above and any changes could be material. Accordingly, undue reliance should not be placed on this preliminary financial data.

ThredUp Inc.

Reconciliation of GAAP to Non-GAAP Preliminary Financial Measures

(unaudited)

| | | | | | | | |

| | Preliminary Results |

| | (in millions, except percentages) |

| Net loss | | $(18.9) to $(18.5) |

| Loss from discontinued operations, net of tax | | (10.5) | |

| Loss from continuing operations | | $(8.4) to $(8.0) |

| Depreciation and amortization | | 6.4 | |

| Stock-based compensation expense | | 6.1 | |

Other | | 0.2 | |

| | |

| | |

Provision (benefit) for income taxes | | — | |

Adjusted EBITDA | | $4.3 to $4.6 |

Adjusted EBITDA margin | | 6.4% to 6.9% |

| | | | | | | | |

| | Preliminary Combined Results |

| | (in millions, except percentages) |

Total revenue | | $66.7 to $67.2 |

Revenue attributable to Remix | | 7.7 | |

Combined revenue | | $74.5 to $75.0 |

| | |

Gross profit | | $53.5 to $54.0 |

Gross profit attributable to Remix | | 3.0 | |

Combined gross profit | | $56.5 to $57.1 |

Combined gross margin | | 75.9% to 76.1% |

| | |

| Net loss | | $(18.9) to $(18.5) |

| Depreciation and amortization | | 7.0 | |

| Stock-based compensation expense | | 5.9 | |

Other | | 0.2 | |

| | |

| | |

Provision (benefit) for income taxes | | — | |

Loss on Remix divestiture | | 8.2 | |

Combined Adjusted EBITDA | | $2.4 to $2.8 |

Combined Adjusted EBITDA margin | | 3.2% to 3.7% |

Adjusted EBITDA margin is Adjusted EBITDA expressed as a percentage of Total revenue.

Revenue attributable to Remix and Gross profit attributable to Remix through and including the Remix Divestiture are included within Loss from discontinued operations, net of tax. Combined gross margin is Combined gross profit expressed as a percentage of Combined revenue. Combined Adjusted EBITDA margin is Combined Adjusted EBITDA expressed as a percentage of Combined revenue. Other includes interest expense and severance and other reorganization costs.

Adjusted EBITDA margin, Combined revenue, Combined gross margin and Combined Adjusted EBITDA margin are non-GAAP financial measures. We have included these non-GAAP financial

measures because we believe they may be helpful to investors to understand our business in light of the recently completed divestiture of the Remix business. In addition to our results determined in accordance with GAAP, we believe that these non-GAAP measures and other operating and business metrics, are useful in evaluating our operating performance and enhancing an overall understanding of our financial position. We use these measures and metrics to evaluate and assess our operating performance, and for internal planning and forecasting purposes. We believe that these non-GAAP measures, when taken collectively with our GAAP results, may be helpful to investors because they provide consistency and comparability with past financial performance and assist in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. Our non-GAAP measures and other operating and business metrics are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly-titled non-GAAP measures and other operating and business metrics used by other companies.

About ThredUp

ThredUp is transforming resale with technology and a mission to inspire the world to think secondhand first. By making it easy to buy and sell secondhand, ThredUp has become one of the world's largest online resale platforms for apparel, shoes and accessories. Sellers love ThredUp because we make it easy to clean out their closets and unlock value for themselves or for the charity of their choice while doing good for the planet. Buyers love shopping value, premium and luxury brands all in one place, at up to 90% off estimated retail price. Our proprietary operating platform is the foundation for our managed marketplace and consists of distributed processing infrastructure, proprietary software and systems and data science expertise. With ThredUp’s Resale-as-a-Service, some of the world's leading brands and retailers are leveraging our platform to deliver customizable, scalable resale experiences to their customers. ThredUp has processed over 200 million unique secondhand items from 60,000 brands across 100 categories. By extending the life cycle of clothing, ThredUp is changing the way consumers shop and ushering in a more sustainable future for the fashion industry.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the federal securities laws, which are statements that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential”, “looking ahead”, “seeking” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements in this release include, but are not limited to, statements about the Company's expected reporting of its Q4 and full year 2024 operating results, the Company's future operating results and sustaining its momentum in 2025, other developments in our business and the focus of the Company’s resources and attention in the United States.

Forward-looking statements are neither historical facts nor assurances of future performance. Forward-looking statements involve substantial risks and uncertainties that may cause actual

results to differ materially from those that we expect. These risks and uncertainties include, but are not limited to: our ability to attract new users and convert users into buyers and Active Buyers; our ability to achieve our profitability, positive adjusted EBITDA and free cash flow goals; the sufficiency of our cash, cash equivalents and capital resources to meet our liquidity needs; our ability to effectively manage or sustain our growth and to effectively expand our operations; risks from an intensely competitive market; our ability to effectively deploy new and evolving technologies, such as artificial intelligence and machine learning, in our offerings; risks arising from economic and industry trends, including the effects of foreign currency exchange rate fluctuations, inflationary pressures, increased interest rates, changing consumer habits, climate change and general global economic uncertainty; our ability to comply with applicable laws and regulations; and our ability to successfully integrate and realize the benefits of our past or future strategic acquisitions or investments. More information on these risks and other potential factors that could affect the Company’s business, reputation, results of operations, financial condition, and stock price is included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The forward-looking statements in this release are based on information available to us as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing ThredUp’s views as of any date subsequent to the date of this press release.

Additional information regarding these and other factors that could affect ThredUp's results is included in ThredUp’s SEC filings, which may be obtained by visiting our Investor Relations website at ir.thredup.com or the SEC's website at www.sec.gov.

Channels for Disclosure of Information

ThredUp intends to announce material information to the public through the ThredUp Investor Relations website ir.thredup.com, SEC filings, press releases, public conference calls, and public webcasts. ThredUp uses these channels, as well as social media, to communicate with its investors, customers, and the public about the company, its offerings, and other issues. It is possible that the information ThredUp posts on social media could be deemed to be material information. As such, ThredUp encourages investors, the media, and others to follow the channels listed above, including the social media channels listed on ThredUp’s investor relations website, and to review the information disclosed through such channels.

Contact:

Lauren Frasch

IR@thredup.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

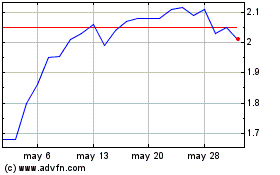

ThredUp (NASDAQ:TDUP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

ThredUp (NASDAQ:TDUP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025