UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): August 5, 2024

Thunder Bridge Capital Partners IV, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-40555 |

|

86-1826129 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

9912 Georgetown Pike

Suite D203

Great Falls, Virginia

(Address of principal

executive offices)

22066

(Zip Code)

Registrant’s telephone

number, including area code: (202) 431-0507

Not Applicable

(Former name or former

address, if changed since last report.)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock and one-fifth of one Redeemable Warrant |

|

THCPU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A Common Stock, par value $0.0001 per share |

|

THCP |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Redeemable Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

|

THCPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

As previously disclosed, Thunder

Bridge Capital Partners IV, Inc. (the “THCP”), a Delaware corporation, entered into a Business Combination Agreement, dated

March 22, 2022 and amended May 31, 2023 and May 28, 2024 (as amended from time to time, the “Business Combination Agreement”)

by and among the Company, Coincheck Group B.V., a Dutch private limited liability company (besloten vennootschap met beperkte aansprakelijkheid)

(“CCG”), M1 Co G.K., a Japanese limited liability company (godo kaisha) (“HoldCo”), Coincheck Merger Sub, Inc.,

a Delaware corporation (“Merger Sub”), and Coincheck, Inc., a Japanese joint stock company (kabushiki kaisha) (“Coincheck”).

Furnished herewith as Exhibit

99.1 and incorporated into this Item 7.01 by reference, is an investor presentation, dated August 2024, that the Company and Coincheck

have prepared for use in connection with the proposed business combination and various meetings with investors.

The foregoing (including Exhibit

99.1) is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed

to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Additional Information and Where to Find It

In connection with the proposed business combination,

the parties will file relevant materials with the SEC, including a registration statement on Form F-4 filed by CCG, which will include

a proxy statement/prospectus of THCP, and other documents regarding the proposed business combination with the SEC. CCG filed a preliminary

proxy statement prospectus on Form F-4 with the SEC on May 7, 2024, as subsequently amended. THCP’s shareholders and other interested

persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto and, when available, the definitive

proxy statement and documents incorporated by reference therein filed in connection with the proposed business combination, as these materials

contain and will contain important information about CCG, Coincheck, Inc. (“Coincheck”), THCP and the proposed business combination.

Promptly after the Form F-4 is declared effective by the SEC, THCP will mail the definitive proxy statement/prospectus and a proxy card

to each shareholder entitled to vote at the meeting relating to the approval of the proposed business combination and other proposals

set forth in the proxy statement/prospectus. Before making any voting or investment decision, investors and shareholders of THCP are urged

to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant

documents filed with the SEC, as well as any amendments or supplements to these documents, because they will contain important information

about the proposed business combination. The documents filed by THCP with the SEC may be obtained free of charge at the SEC’s website

at www.sec.gov, or by directing a request to Thunder Bridge Capital Partners IV, Inc., 9912 Georgetown Pike, Suite D203, Great Falls,

Virginia 22066, Attention: Secretary, (202) 431-0507.

Participants in the Solicitation

THCP and its directors and executive officers

may be deemed participants in the solicitation of proxies from its shareholders with respect to the proposed business combination. A list

of the names of those directors and executive officers and a description of their interests in THCP will be included in the proxy statement/prospectus

for the proposed business combination when available at www.sec.gov. Information about THCP’s directors and executive officers

and their ownership of THCP common stock is set forth in the THCP prospectus, dated June 29, 2021, as modified or supplemented by any

Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the

proxy solicitation will be included in the proxy statement/prospectus pertaining to the proposed business combination when it becomes

available. These documents can be obtained free of charge from the source indicated above.

CCG, Coincheck and their respective directors

and executive officers may also be deemed to be participants in the solicitation of proxies from the shareholders of THCP in connection

with the proposed business combination. A list of the names of such directors and executive officers and information regarding their interests

in the proposed business combination will be included in the proxy statement/prospectus for the proposed business combination.

Forward Looking Statements

This communication contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future

operations, products and services; and other statements identified by words such as “will likely result,” “are expected

to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,”

“plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include,

but are not limited to, statements regarding Coincheck’s industry and market sizes, future opportunities for CCG, Coincheck and

THCP, Coincheck’s estimated future results and the proposed business combination between THCP and Coincheck, including the implied

enterprise value, the expected transaction and ownership structure and the likelihood, timing and ability of the parties to successfully

consummate the proposed transaction. Such forward-looking statements are based upon the current beliefs and expectations of our management

and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult

to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated

in these forward-looking statements.

In addition to factors previously disclosed

in THCP’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others,

could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed

in the forward-looking statements: inability to meet the closing conditions to the business combination, including the occurrence of any

event, change or other circumstances that could give rise to the termination of the Business Combination Agreement; the inability to complete

the transactions contemplated by the Business Combination Agreement due to the failure to obtain approval of THCP’s shareholders,

the failure to achieve the minimum amount of cash available following any redemptions by THCP shareholders, redemptions exceeding a maximum

threshold or the failure to meet Nasdaq listing standards in connection with the consummation of the contemplated transactions; costs

related to the transactions contemplated by the Business Combination Agreement; a delay or failure to realize the expected benefits from

the proposed business combination; risks related to disruption of management’s time from ongoing business operations due to the

proposed business combination; changes in the cryptocurrency and digital asset markets in which Coincheck competes, including with respect

to its competitive landscape, technology evolution or regulatory changes; changes in domestic and global general economic conditions,

risk that Coincheck may not be able to execute its growth strategies, including identifying and executing acquisitions; risk that Coincheck

may not be able to develop and maintain effective internal controls; and other risks and uncertainties indicated in THCP’s final

prospectus, dated June 29, 2021, for its initial public offering, and the proxy statement/prospectus relating to the proposed business

combination, including those under “Risk Factors” therein, and in THCP’s other filings with the SEC. CCG, THCP and Coincheck

caution that the foregoing list of factors is not exclusive.

Actual results, performance or achievements

may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those

forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to

any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected

financial information and other information are based on estimates and assumptions that are inherently subject to various significant

risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date

hereof in the case of information about THCP and Coincheck or the date of such information in the case of information from persons other

than THCP or Coincheck, and we disclaim any intention or obligation to update any forward looking statements as a result of developments

occurring after the date of this communication. Forecasts and estimates regarding Coincheck’s industry and end markets are based

on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or

in part. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not

reflect actual results.

No Offer or Solicitation

This current report shall not constitute a

solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination.

This current report shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there

be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: August 5, 2024 |

|

| |

|

| |

THUNDER BRIDGE CAPITAL PARTNERS IV, INC. |

| |

|

| |

By: |

/s/ Gary A. Simanson |

| |

Name: |

Gary A. Simanson |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

1 �ç©çÜã � ɸɶɸɺ

:›ö�‚ � d›Âȼȩö � =›‚•›ØܯÕ

� (ÈØçÁ

2 �¯Ü¼‚¯Á›Ø

�••¯ã¯È‚¼ � 0¨ÈØÁ‚ã¯È � ‚•

� w›Ø› � ãÈ � (¯Â• � 0ã 0 � È›ã¯ÈÂ

� ô¯ã � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂ

� ‚©Ø››Á›Âãʍ � ‚Ü � ‚Á›Â•›•ʍ

� ‚ÁÈ© � �ȯ›¹ʍ � 0Âʒ � ʞʪ�ȯ›¹ʫʟʍ

� �ȯ›¹ � *ØÈçÕ � �ʒtʒ � ʞʪ��*ʫʟʍ

� dç•›Ø � �د•©› � �‚կゼ �

V‚Øã›ØÜ � 0tʍ � 0Âʒ � ʞʪdç•›Ø

� �د•©› � 0tʫʟ � ‚• � Èã›ØÜ � ô¯ã

� Ø›©‚Ø•Ü � ãÈ � ã›¯Ø � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ �

ã› � Õ‚Øã¯›Ü �� ‚ó› � ¨¯¼›•

� ‚ � Ø›©¯ÜãØ‚ã¯È � Üã‚ã›Á›Âã

� È � (ÈØÁ � ( ʣ ɺ � ô¯ã � ã› � hʒ]ʒ

� ]›çØ¯ã¯›Ü � ‚• � �õ‚©›

� �ÈÁÁ¯ÜܯÈ � ʞʪ]��ʫʟʍ � ô¯

� ¯Â¼ç•›Ü � ‚ � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� Ȩ � dç•›Ø � �د•©› � 0tʍ � ‚•

� Èã›Ø � •ÈçÁ›ÂãÜ � Ø›©‚Ø•¯Â©

� ã› � ÕØÈÕÈÜ›• � ãØ‚ÂÜ‚ã¯ÈÂʒ

� dç•›Ø � �د•©› � 0tʭÜ � Üãȹȼ•›ØÜ

� ‚• � Èã›Ø � ¯Âã›Ø›Ü㛕 � Õ›ØÜÈÂÜ

� ‚Ø› � ‚•ó¯Ü›• � ãÈ � Ø›‚• � ã›

� ÕØ›¼¯Á¯Â‚Øö � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� ‚• � ã› � ‚Á›Â•Á›ÂãÜ � ã›Ø›ãÈ

� ‚•ʍ � ô›Â � ‚󂯼‚Ž¼›ʍ � ã›

� •›¨¯Â¯ã¯ó› � ÕØÈõö � Üã‚ã›Á›Âã

� ‚• � •ÈçÁ›ÂãÜ � ¯ÂÈØÕÈ؂㛕

� Žö � Ø›¨›Ø›Â› � ã›Ø›¯Â � ¨¯¼›•

� ¯Â � È›ã¯È � ô¯ã � ã›

� ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ

� ‚Ü � ã›Ü› � Á‚ã›Ø¯‚¼Ü � ô¯¼¼

� ÈÂク � ¯ÁÕÈØã‚Âã � ¯Â¨ÈØÁ‚ã¯ÈÂ

� ‚ŽÈçã � ��*ʍ � �ȯ›¹ʍ � dç•›Ø

� �د•©› � 0t � ‚• � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ �

VØÈÁÕã¼ö � ‚¨ã›Ø � ã› � (ÈØÁ �

( ʣ ɺ � ¯Ü � •›¼‚Ø›• � ›¨¨›ã¯ó›

� Žö � ã› � ]��ʍ � dç•›Ø � �د•©›

� 0t � ô¯¼¼ � Á‚¯¼ � ã› � •›¨¯Â¯ã¯ó›

� ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� ‚• � ‚ � ÕØÈõö �� ‚Ø• � ãÈ � ›‚

� Üãȹȼ•›Ø � ›Âã¯ã¼›• � ãÈ

� óÈã› � ‚ã � ã› � Á››ã¯Â© � Ø›¼‚ã¯Â©

� ãÈ � ã› � ‚ÕÕØÈó‚¼ � Ȩ � ã›

� ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂ

� ‚• � Èã›Ø � ÕØÈÕÈÜ‚¼Ü � Ü›ã

� ¨ÈØã � ¯Â � ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜʒ

� �›¨ÈØ› � Á‚¹¯Â© � ‚Âö � óÈã¯Â©

� ÈØ � ¯Âó›ÜãÁ›Âã � •›¯Ü¯ÈÂʍ

� ¯Âó›ÜãÈØÜ � ‚• � Üãȹȼ•›ØÜ

� Ȩ � dç•›Ø � �د•©› �� 0t � ‚Ø›

� çØ©›• � ãÈ � ‚Ø›¨ç¼¼ö � Ø›‚•

� ã› � ›Âã¯Ø› � Ø›©¯ÜãØ‚ã¯ÈÂ

� Üã‚ã›Á›Âã � ‚• � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� ‚• � ‚Âö � Èã›Ø � Ø›¼›ó‚Âã

� •ÈçÁ›ÂãÜ � ¨¯¼›• � ô¯ã � ã›

� ]��ʍ � ‚Ü � ô›¼¼ � ‚Ü � ‚Âö � ‚Á›Â•Á›ÂãÜ

� ÈØ � ÜçÕÕ¼›Á›ÂãÜ � ãÈ � ã›Ü›

� •ÈçÁ›ÂãÜʍ � Ž›‚çÜ› � ã›ö

� ô¯¼¼ � ÈÂク � ¯ÁÕÈØã‚Âã

� ¯Â¨ÈØÁ‚ã¯È � ‚ŽÈçã � ã› �

ÕØÈÕÈÜ›• � ãØ‚ÂÜ‚ã¯ÈÂʒ � d›

� •ÈçÁ›ÂãÜ � ¨¯¼›• � Žö � dç•›Ø

� �د•©› � 0t � ô¯ã � ã› � ]�� � Á‚ö

� Ž› � Ȏク›• � ¨Ø›› � Ȩ � ‚Ø©›

� ‚ã � ã› � ]��ʭÜ � ô›ŽÜ¯ã› � ‚ã

� ôôôʒÜ›ʒ©Èóʍ � ÈØ � Žö � •¯Ø›ã¯Â©

� ‚ � Ø›×ç›Üã � ãÈ � dç•›Ø � �د•©›

� �‚կゼ � V‚Øã›ØÜ � 0tʍ � 0Âʒʍ

� ɿɿɷɸ � *›ÈØ©›ãÈô � V¯¹›ʍ � ]ç¯ã›

� �ɸɶɹʍ � *Ø›‚ã � (‚¼¼Üʍ � t¯Ø©¯Â¯‚

� ɸɸɶɼɼʍ � �ãã›Âã¯ÈÂʌ � ]›Ø›ã‚Øöʍ

� ʞɸɶɸʟ � ɺɹɷ ʣ ɶɻɶɽʒ V‚Ø㯯ՂÂãÜ

� ¯Â � ã› � ]ȼ¯¯ã‚ã¯È dç•›Ø

� �د•©› � 0t � ‚• � ¯ãÜ � •¯Ø›ãÈØÜ

� ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ

� Á‚ö � Ž› � •››Á›• � Õ‚Ø㯯ՂÂãÜ

� ¯Â � ã› � Üȼ¯¯ã‚ã¯È � Ȩ

� ÕØÈõ¯›Ü � ¨ØÈÁ � ¯ãÜ � Üãȹȼ•›ØÜ

� ô¯ã � Ø›ÜÕ›ã � ãÈ � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ �

� � ¼¯Üã � Ȩ � ã› � ‚Á›Ü � Ȩ �

ãÈÜ› � •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó›

� Ȩ¨¯›ØÜ � ‚• � ‚ � •›ÜدÕã¯ÈÂ

� Ȩ � ã›¯Ø � ¯Âã›Ø›ÜãÜ � ¯Â �

dç•›Ø � �د•©› � 0t � ô¯¼¼ � Ž›

� ¯Â¼ç•›• � ¯Â � ã› � ÕØÈõö �

Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ � ¨ÈØ

� ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ �

ÈÁŽ¯Â‚ã¯ÈÂʒ � 0¨ÈØÁ‚ã¯ÈÂ

� ‚ŽÈçã � dç•›Ø � �د•©› � 0tʭÜ

� •¯Ø›ãÈØÜ � ‚• � ›õ›çã¯ó›

� Ȩ¨¯›ØÜ � ‚• � ã›¯Ø � Èô›ØܯÕ

� Ȩ � dç•›Ø � �د•©› � 0t � ÈÁÁÈÂ

� Üãȹ � ¯Ü � Ü›ã � ¨ÈØã � ¯Â �

dç•›Ø � �د•©› � 0tʭÜ � ¨¯Â‚¼

� ÕØÈÜÕ›ãçÜ � ¨ÈØ � ¯ãÜ � ¯Â¯ã¯‚¼

� Õ玼¯ � Ȩ¨›Ø¯Â©ʍ � •‚㛕

� 9ç› � ɸɿʍ � ɸɶɸɷʍ � ‚Ü � ÁÈ•¯¨¯›•

� ÈØ � ÜçÕÕ¼›Á›Â㛕 � Žö � ‚Âö

� (ÈØÁ � ɹ � ÈØ � (ÈØÁ � ɺ � ¨¯¼›• � ô¯ã

� ã› � ]�� � ܯ› � ã› � •‚ã› �

Ȩ � Üç � ¨¯¼¯Â©ʒ � Iã›Ø � ¯Â¨ÈØÁ‚ã¯ÈÂ

� Ø›©‚Ø•¯Â© � ã› � ¯Âã›Ø›ÜãÜ

� Ȩ � ã› � Õ‚Ø㯯ՂÂãÜ � ¯Â

� ã› � ÕØÈõö � Üȼ¯¯ã‚ã¯ÈÂ

� ô¯¼¼ � Ž› � ¯Â¼ç•›• � ¯Â � ã›

� ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� Õ›Øク¯© � ãÈ � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯È � ô›Â

� ¯ã � Ž›ÈÁ›Ü � ‚󂯼‚Ž¼›ʒ �

d›Ü› � •ÈçÁ›ÂãÜ � ‚ � Ž› � Ȏク›•

� ¨Ø›› � Ȩ � ‚Ø©› � ¨ØÈÁ � ã›

� ÜÈçØ› � ¯Â•¯‚㛕 � ‚ŽÈó›ʒ

��*ʍ � �ȯ›¹ � ‚• � 㛯Ø

� Ø›ÜÕ›ã¯ó› � •¯Ø›ãÈØÜ � ‚•

� ›õ›çã¯ó› � Ȩ¨¯›ØÜ � Á‚ö

� ‚¼ÜÈ � Ž› � •››Á›• � ãÈ � Ž› � Õ‚Ø㯯ՂÂãÜ

� ¯Â � ã› � Üȼ¯¯ã‚ã¯È � Ȩ

� ÕØÈõ¯›Ü � ¨ØÈÁ � ã› � Üãȹȼ•›ØÜ

� Ȩ � dç•›Ø � �د•©› � 0t � ¯Â � È›ã¯ÈÂ

� ô¯ã � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯ÈÂʒ � � � ¼¯Üã � Ȩ

� ã› � ‚Á›Ü � Ȩ � Üç � •¯Ø›ãÈØÜ

� ‚• � ›õ›çã¯ó› � Ȩ¨¯›ØÜ

� ‚• � ¯Â¨ÈØÁ‚ã¯È � Ø›©‚Ø•¯Â©

� ã›¯Ø � ¯Âã›Ø›ÜãÜ � ¯Â � ã›

� ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂ

� ô¯¼¼ � Ž› � ¯Â¼ç•›• � ¯Â � ã›

� ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� ¨ÈØ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯ÈÂʒ (ÈØô‚Ø• � =Èȹ¯Â©

� ]ã‚ã›Á›ÂãÜ d¯Ü � Õ؛ܛÂã‚ã¯ÈÂ

� ÈÂクÂÜ � ʪ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â©

� Üã‚ã›Á›ÂãÜʫ � ô¯ã¯Â � ã›

� Á›‚¯© � Ȩ � ã› � Vدó‚ã› �

]›çØ¯ã¯›Ü � =¯ã¯©‚ã¯È � Y›¨ÈØÁ

� �ã � Ȩ � ɷɿɿɻʒ � ]ç � Üã‚ã›Á›ÂãÜ

� ¯Â¼ç•›ʍ � Žçã � ‚Ø› � ÂÈã � ¼¯Á¯ã›•

� ãÈʍ � Üã‚ã›Á›ÂãÜ � ‚ŽÈçã � ¨çãçØ›

� ¨¯Â‚¯‚¼ � ‚• � È՛؂ã¯Â©

� Ø›Üç¼ãÜʍ � ÈçØ � Õ¼‚ÂÜʍ � ÈŽ¸›ã¯ó›Üʍ

� ›õÕ›ã‚ã¯ÈÂÜ � ‚• � ¯Âã›Âã¯ÈÂÜ

� ô¯ã � Ø›ÜÕ›ã � ãÈ � ¨çãçØ›

� È՛؂ã¯ÈÂÜʍ � ÕØÈ•çãÜ � ‚•

� Ü›Øó¯›Üʗ � ‚• � Èã›Ø � Üã‚ã›Á›ÂãÜ

� ¯•›Â㯨¯›• � Žö � ôÈØ•Ü � Üç

� ‚Ü � ʪô¯¼¼ � ¼¯¹›¼ö � Ø›Üç¼ãʍʫ

� ʪ‚Ø› � ›õ՛㛕 � ãÈʍʫ � ʪô¯¼¼

� ÈÂã¯Âç›ʍʫ � ʪ¯Ü � ‚Â㯯Ղ㛕ʍʫ

� ʪ›Üã¯Á‚㛕ʍʫ � ʪŽ›¼¯›ó›ʍʫ

� ʪ¯Âã›Â•ʍʫ � ʪÕ¼‚Âʍʫ � ʪÕØȸ›ã¯ÈÂʍʫ

� ʪÈçã¼Èȹʫ � ÈØ � ôÈØ•Ü � Ȩ �

ܯÁ¯¼‚Ø � Á›‚¯©ʒ �� d›Ü› �

¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ

� ¯Â¼ç•›ʍ � Žçã � ‚Ø› � ÂÈã � ¼¯Á¯ã›•

� ãÈʍ � Üã‚ã›Á›ÂãÜ � Ø›©‚Ø•¯Â©

� �ȯ›¹ʭÜ � ¯Â•çÜãØö � ‚•

� Á‚ع›ã � ܯú›Üʍ � ¨çãçØ› � ÈÕÕÈØãç¯㯛Ü

� ¨ÈØ � ��*ʍ � �ȯ›¹ � ‚• �

dç•›Ø � �د•©› � 0tʍ � �ȯ›¹ʭÜ

� ›Üã¯Á‚㛕 � ¨çãçØ› � Ø›Üç¼ãÜ

� ‚• � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯È � Ž›ãô››Â � dç•›Ø

� �د•©› � 0t � ‚• � �ȯ›¹ʍ

� ¯Â¼ç•¯Â© � ã› � ¯ÁÕ¼¯›• �

›Âã›ØÕدܛ � ó‚¼ç›ʍ � ã› � ›õ՛㛕

� ãØ‚ÂÜ‚ã¯È � ‚• � Èô›ØܯÕ

� ÜãØçãçØ› � ‚• � ã› � ¼¯¹›¼¯ÈÈ•ʍ

� ã¯Á¯Â© � ‚• � ‚Ž¯¼¯ãö � Ȩ �

ã› � Õ‚Øã¯›Ü � ãÈ � Üç›Üܨ缼ö

� ÈÂÜçÁÁ‚ã› � ã› � ÕØÈÕÈÜ›•

� ãØ‚ÂÜ‚ã¯ÈÂʒ � ]ç � ¨ÈØô‚Ø•

ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ø›

� Ž‚Ü›• � çÕÈ � ã› � çØØ›Âã

� Ž›¼¯›¨Ü � ‚• � ›õÕ›ã‚ã¯ÈÂÜ

� Ȩ � ÈçØ � Á‚‚©›Á›Âã � ‚• �

‚Ø› � ¯Â›Ø›Âã¼ö � Ü玸›ã �

ãÈ � ܯ©Â¯¨¯‚Âã � Žçܯ›ÜÜʍ

� ›ÈÂÈÁ¯ � ‚• � ÈÁÕ›ã¯ã¯ó›

� ç›ØクÂã¯›Ü � ‚• � ÈÂã¯Â©›Â¯›Üʍ

� Á‚Âö � Ȩ � ô¯ � ‚Ø› � •¯¨¨¯ç¼ã

� ãÈ � ÕØ›•¯ã � ‚• � ©›Â›Ø‚¼¼ö

� Ž›öÈ• � ÈçØ � ÈÂãØȼʒ � �ã炼

� Ø›Üç¼ãÜ � ‚• � ã› � ã¯Á¯Â©

� Ȩ � ›ó›ÂãÜ �� Á‚ö � •¯¨¨›Ø �

Á‚ã›Ø¯‚¼¼ö � ¨ØÈÁ � ã› � Ø›Üç¼ãÜ

� ‚Â㯯Ղ㛕 � ¯Â � ã›Ü› � ¨ÈØô‚Ø•

ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜʒ 0 �

‚••¯ã¯È � ãÈ � ¨‚ãÈØÜ � ÕØ›ó¯Èçܼö

� •¯Ü¼ÈÜ›• � ¯Â � dç•›Ø � �د•©›

� 0tʭÜ � Ø›ÕÈØãÜ � ¨¯¼›• � ô¯ã

� ã› � ]��ʍ � ã› � ¨È¼¼Èô¯Â© �

¨‚ãÈØÜʍ � ‚ÁÈ© � Èã›ØÜʍ �

È缕 � ‚çÜ› � ‚ã炼 � Ø›Üç¼ãÜ

� ‚• � ã› � ã¯Á¯Â© � Ȩ � ›ó›ÂãÜ

� ãÈ � •¯¨¨›Ø � Á‚ã›Ø¯‚¼¼ö � ¨ØÈÁ

� ã› � ‚Â㯯Ղ㛕 � Ø›Üç¼ãÜ

� ÈØ � Èã›Ø � ›õÕ›ã‚ã¯ÈÂÜ �

›õÕØ›ÜÜ›• � ¯Â � ã› � ¨ÈØô‚Ø•

ʣ � ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜʌ � ¯Â‚Ž¯¼¯ãö

� ãÈ � Á››ã � ã› � ¼Èܯ© � È•¯ã¯ÈÂÜ

� ãÈ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯ÈÂʍ � ¯Â¼ç•¯Â©

� ã› � ÈçØ؛› � Ȩ � ‚Âö �

›ó›Âãʍ � ‚©› � ÈØ � Èã›Ø �

¯ØçÁÜã‚Â›Ü � ã‚ã � È缕

� ©¯ó› � دܛ � ãÈ � ã› � ã›ØÁ¯Â‚ã¯ÈÂ

� Ȩ � ã› � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂ

� ‚©Ø››Á›Âãʗ � ã› � ¯Â‚Ž¯¼¯ãö

� ãÈ � ÈÁÕ¼›ã› � ã› � ãØ‚ÂÜ‚ã¯ÈÂÜ

� ÈÂã›ÁÕ¼‚㛕 � Žö � ã› � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âã �

•ç› � ãÈ � ã› � ¨‚¯¼çØ› � ãÈ � ȎクÂ

� ‚ÕÕØÈó‚¼ � Ȩ � dç•›Ø � �د•©›

� 0tʭÜ � Üãȹȼ•›ØÜʍ � ã› � ¨‚¯¼çØ›

� ãÈ � ‚¯›ó› � ã› � Á¯Â¯ÁçÁ

� ‚ÁÈçÂã � Ȩ � ‚Ü � ‚󂯼‚Ž¼›

� ¨È¼¼Èô¯Â© � ‚Âö � Ø›•›ÁÕã¯ÈÂÜ

� Žö � dç•›Ø � �د•©› � 0t � Üãȹȼ•›ØÜʍ

� Ø›•›ÁÕã¯ÈÂÜ � ›õ››•¯Â© �

‚ � Á‚õ¯ÁçÁ � ãØ›Üȼ• � ÈØ �

ã› � ¨‚¯¼çØ› � ãÈ � Á››ã � C‚Ü•‚×ʭÜ

� ¯Â¯ã¯‚¼ � ¼¯Üã¯Â© � Üã‚•‚Ø•Ü

� ¯Â � È›ã¯È � ô¯ã � ã›

� ÈÂÜçÁÁ‚ã¯È � Ȩ � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʗ �

ÈÜãÜ � Ø›¼‚㛕 � ãÈ � ã› � ãØ‚ÂÜ‚ã¯ÈÂÜ

� ÈÂã›ÁÕ¼‚㛕 � Žö � ã› � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯È � ‚©Ø››Á›Âãʗ

� ‚ � •›¼‚ö � ÈØ � ¨‚¯¼çØ› � ãÈ ��

Ø›‚¼¯ú› � ã› � ›õ՛㛕 � Ž›Â›¨¯ãÜ

� ¨ØÈÁ � ã› � ÕØÈÕÈÜ›• � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯ÈÂʗ � Ø¯Ü¹Ü � Ø›¼‚㛕

� ãÈ � •¯ÜØçÕã¯È � Ȩ � Á‚‚©›Á›ÂãʭÜ

� ã¯Á› � ¨ØÈÁ � È©ȯ© � Žçܯ›ÜÜ

� È՛؂ã¯ÈÂÜ � •ç› � ãÈ � ã› �

ÕØÈÕÈÜ›• � Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʗ

� ‚©›Ü � ¯Â � ã› � ØöÕãÈçØØ›Âö

� ‚• � •¯©¯ã‚¼ � ‚ÜÜ›ã � Á‚ع›ãÜ

� ¯Â � ô¯ � �ȯ›¹ � ÈÁÕ›ã›Üʍ

� ¯Â¼ç•¯Â© � ô¯ã � Ø›ÜÕ›ã

� ãÈ � ¯ãÜ � ÈÁÕ›ã¯ã¯ó› � ¼‚•܂՛ʍ

� ã›Âȼȩö � ›óȼçã¯È � ÈØ

� Ø›©ç¼‚ãÈØö � ‚©›Üʗ � ‚©›Ü

� ¯Â � •ÈÁ›Ü㯠� ‚• � ©¼ÈŽ‚¼

� ©›Â›Ø‚¼ � ›ÈÂÈÁ¯ � È•¯ã¯ÈÂÜʗ

� دܹ � ã‚ã � �ȯ›¹ � Á‚ö

� ÂÈã � Ž› � ‚Ž¼› � ãÈ � ›õ›çã›

� ¯ãÜ � ©ØÈôã � Üã؂㛩¯›Üʍ

� ¯Â¼ç•¯Â© � ¯•›Â㯨ö¯Â© �

‚• � ›õ›çã¯Â© � ‚×ç¯Ü¯ã¯ÈÂÜʗ

� دܹ � ã‚ã � �ȯ›¹ � Á‚ö

� ÂÈã � Ž› � ‚Ž¼› � ãÈ � •›ó›¼ÈÕ

� ‚• � Á‚¯Âク � ›¨¨›ã¯ó›

� ¯Âã›Ø‚¼ � ÈÂãØȼÜʗ � ‚•

� Èã›Ø � Ø¯Ü¹Ü � ‚• � ç›ØクÂ㯛Ü

� ¯Â•¯‚㛕 � ¯Â � dç•›Ø � �د•©›

� 0tʭÜ � ¨¯Â‚¼ � ÕØÈÜÕ›ãçÜ � ¨ÈØ

� ¯ãÜ � ¯Â¯ã¯‚¼ � Õ玼¯ � Ȩ¨›Ø¯Â©ʍ

� •‚㛕 � 9ç› � ɸɿʍ � ɸɶɸɷʍ � ‚•

� ã› � ÕØÈõö � Üã‚ã›Á›ÂãʘÕØÈÜÕ›ãçÜ

� Ø›¼‚ã¯Â© � ãÈ � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʍ �

¯Â¼ç•¯Â© � ãÈÜ› � ç•›Ø � ʪY¯Ü¹

� (‚ãÈØÜʫ � ã›Ø›¯Âʍ � ‚• � ¯Â

� dç•›Ø � �د•©› � 0tʭÜ � Èã›Ø

� ¨¯¼¯Â©Ü � ô¯ã � ã› � ]��ʒ � dç•›Ø

� �د•©› � 0tʍ � ��* � ‚• � �ȯ›¹

� ‚çã¯È � ã‚ã � ã› � ¨ÈØ›©È¯Â©

� ¼¯Üã � Ȩ � ¨‚ãÈØÜ � ¯Ü � ÂÈã

� ›õ¼çܯó›ʒ �ã炼 � Ø›Üç¼ãÜʍ

� ՛بÈØÁ‚› � ÈØ � ‚¯›ó›Á›ÂãÜ

� Á‚ö � •¯¨¨›Ø � Á‚ã›Ø¯‚¼¼öʍ

� ‚• � ÕÈã›Â㯂¼¼ö � ‚•ó›ØÜ›¼öʍ

� ¨ØÈÁ � ‚Âö � ÕØȸ›ã¯ÈÂÜ � ‚•

� ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ

� ‚• � ã› � ‚ÜÜçÁÕã¯ÈÂÜ � ÈÂ

� ô¯ � ãÈÜ› � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â©

� Üã‚ã›Á›ÂãÜ � ‚Ø› � Ž‚Ü›•ʒ �

d›Ø› � ‚ � Ž› � ÂÈ � ‚ÜÜç؂›

� ã‚ã � ã› � •‚ã‚ � ÈÂク›•

� ›Ø›¯Â � ¯Ü � Ø›¨¼›ã¯ó› � Ȩ

� ¨çãçØ› � ՛بÈØÁ‚› � ãÈ �

‚Âö � •›©Ø››ʒ � yÈç � ‚Ø› � ‚çã¯È›•

� ÂÈã � ãÈ � Õ¼‚› � çÂ•ç› � Ø›¼¯‚›

� È � ¨ÈØô‚Ø• ʣ ¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ

� ‚Ü � ‚ � ÕØ›•¯ãÈØ � Ȩ � ¨çãçØ›

� ՛بÈØÁ‚› � ‚Ü � ÕØȸ›ã›•

� ¨¯Â‚¯‚¼ � ¯Â¨ÈØÁ‚ã¯È �

‚• � Èã›Ø � ¯Â¨ÈØÁ‚ã¯È � ‚Ø›

� Ž‚Ü›• � È � ›Üã¯Á‚ã›Ü � ‚•

� ‚ÜÜçÁÕã¯ÈÂÜ � ã‚ã � ‚Ø› � ¯Â›Ø›Âã¼ö

� Ü玸›ã � ãÈ � ó‚دÈçÜ � ܯ©Â¯¨¯‚Âã

� دܹÜʍ � ç›ØクÂã¯›Ü � ‚•

� Èã›Ø � ¨‚ãÈØÜʍ � Á‚Âö � Ȩ

� ô¯ � ‚Ø› � Ž›öÈ• � ÈçØ � ÈÂãØȼʒ

� �¼¼ � ¯Â¨ÈØÁ‚ã¯È � Ü›ã � ¨ÈØã

� ›Ø›¯Â � ÜÕ›‚¹Ü � ȼö � ‚Ü �

Ȩ � ã› � •‚ã› � ›Ø›È¨ � ¯Â � ã›

� ‚Ü› � Ȩ � ¯Â¨ÈØÁ‚ã¯È � ‚ŽÈçã

� dç•›Ø � �د•©› � 0tʍ � ��* � ‚•

� �ȯ›¹ � ÈØ � ã› � •‚ã› �

Ȩ � Üç � ¯Â¨ÈØÁ‚ã¯È � ¯Â �

ã› � ‚Ü› � Ȩ � ¯Â¨ÈØÁ‚ã¯ÈÂ

� ¨ØÈÁ � Õ›ØÜÈÂÜ � Èã›Ø � ã‚Â

� dç•›Ø � �د•©› � 0tʍ � ��* � ‚•

� �ȯ›¹ʍ � ‚• � ô› � •¯Ü¼‚¯Á

� ‚Âö � ¯Âã›Âã¯È � ÈØ � ÈŽ¼¯©‚ã¯ÈÂ

� ãÈ � çÕ•‚ã› � ‚Âö � ¨ÈØô‚Ø• �

¼Èȹ¯Â© � Üã‚ã›Á›ÂãÜ � ‚Ü � ‚

� Ø›Üç¼ã � Ȩ � •›ó›¼ÈÕÁ›ÂãÜ

� ÈçØد© � ‚¨ã›Ø � ã› � •‚ã›

� Ȩ � ã¯Ü � Õ؛ܛÂã‚ã¯ÈÂʒ �

(ÈØ›‚ÜãÜ � ‚• � ›Üã¯Á‚ã›Ü

� Ø›©‚Ø•¯Â© � �ȯ›¹ʭÜ �

¯Â•çÜãØö � ‚• � ›Â• � Á‚ع›ãÜ

� ‚Ø› � Ž‚Ü›• � È � ÜÈçØ›Ü � ô›

� Ž›¼¯›ó› � ãÈ � Ž› � Ø›¼¯‚Ž¼›ʍ

� Èô›ó›Ø � ã›Ø› � ‚ � Ž› � ÂÈ

� ‚ÜÜç؂› � ã›Ü› � ¨ÈØ›‚ÜãÜ

� ‚• � ›Üã¯Á‚ã›Ü � ô¯¼¼ � ÕØÈó›

� ‚çØ‚ã› � ¯Â � ôȼ› � ÈØ � ¯Â

� Õ‚Øãʒ � �ÂÂ炼¯ú›•ʍ � ÕØÈ �

¨ÈØÁ‚ʍ � ÕØȸ›ã›• � ‚• � ›Üã¯Á‚㛕

� ÂçÁŽ›ØÜ � ‚Ø› �� çÜ›• � ¨ÈØ �

¯¼¼çÜãØ‚ã¯ó› � ÕçØÕÈÜ› � ȼöʍ

� ‚Ø› � ÂÈã � ¨ÈØ›‚ÜãÜ � ‚• �

Á‚ö � ÂÈã � Ø›¨¼›ã � ‚ã炼 �

Ø›Üç¼ãÜ CÈ � I¨¨›Ø � ÈØ � ]ȼ¯¯ã‚ã¯ÈÂ

d¯Ü � Õ؛ܛÂã‚ã¯È � Ü‚¼¼

� ÂÈã � ÈÂÜã¯ãçã› � ‚ � Üȼ¯¯ã‚ã¯ÈÂ

� Ȩ � ‚ � ÕØÈõöʍ � ÈÂÜ›Âãʍ � ÈØ

� ‚çãÈدú‚ã¯È � ô¯ã � Ø›ÜÕ›ã

� ãÈ � ‚Âö � Ü›çØ¯ã¯›Ü � ÈØ � ¯Â

� Ø›ÜÕ›ã � Ȩ � ã› � ÕØÈÕÈÜ›•

� Žçܯ›ÜÜ � ÈÁŽ¯Â‚ã¯ÈÂʒ �

d¯Ü � Õ؛ܛÂã‚ã¯È � Ü‚¼¼

� ‚¼ÜÈ � ÂÈã � ÈÂÜã¯ãçã› � ‚Â

� Ȩ¨›Ø � ãÈ � Ü›¼¼ � ÈØ � ã› � Üȼ¯¯ã‚ã¯ÈÂ

� Ȩ � ‚ � Ȩ¨›Ø � ãÈ � Žçö � ‚Âö

� Ü›çد㯛Üʍ � ÂÈØ � Ü‚¼¼ �

ã›Ø› � Ž› � ‚Âö � Ü‚¼› � Ȩ � Ü›çد㯛Ü

� ¯Â � ‚Âö � Üã‚ã›Ü � ÈØ � ¸çدܕ¯ã¯ÈÂÜ

� ¯Â � ô¯ � Üç � Ȩ¨›Øʍ � Üȼ¯¯ã‚ã¯ÈÂʍ

� ÈØ � Ü‚¼› � ôÈ缕 � Ž› � 缂ô¨ç¼

� ÕدÈØ � ãÈ � Ø›©¯ÜãØ‚ã¯È �

ÈØ � ×炼¯¨¯‚ã¯È � ç•›Ø �

ã› � Ü›çØ¯ã¯›Ü � ¼‚ôÜ � Ȩ �

‚Âö � Üç � ¸çدܕ¯ã¯ÈÂʒ �

CÈ � Ȩ¨›Ø¯Â© � Ȩ � Ü›çد㯛Ü

� Ü‚¼¼ � Ž› � Á‚•› � ›õ›Õã � Žö

� Á›‚ÂÜ � Ȩ � ‚ � ÕØÈÜÕ›ãçÜ �

Á››ã¯Â© � ã› � Ø›×ç¯Ø›Á›ÂãÜ

� Ȩ � ]›ã¯È � ɷɶ � Ȩ � ã› � ]›çد㯛Ü

� �ã � Ȩ � ɷɿɹɹʍ � ‚Ü � ‚Á›Â•›•ʍ

� ÈØ � ‚ � ›õ›ÁÕã¯È � ã›Ø›¨ØÈÁʒ

CÈ ʣ 0(Y] � (¯Â‚¯‚¼ � B›‚ÜçØ›Ü d¯Ü

� Õ؛ܛÂã‚ã¯È � ¯Â¼ç•›Ü �

›Øク � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Ü

� ÂÈã � Õ؛Ղ؛• � ¯Â � ‚ÈØ•‚›

� ô¯ã � 0(Y]ʍ � ô¯ � ÈÂÜã¯ãçã›

� ʪÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›Üʫ

� ‚Ü � •›¨¯Â›• � Žö � ã› � Øç¼›Ü

� Ȩ � ã› � ]��ʒ � d› � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼

� Á›‚ÜçØ› � ¯Ü � ��0d��ʒ � d¯Ü � ÂÈÂ

ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ› � ‚Ü

� Ž››Â � ¯Â¼ç•›• �� Ž›‚çÜ›

� �ȯ›¹ � Ž›¼¯›ó›Ü � ¯ã �

ÕØÈó¯•›Ü � ‚ � ‚••¯ã¯È‚¼ �

ãÈȼ � ¨ÈØ � ¯Âó›ÜãÈØÜ � ãÈ � çÜ›

� ¯Â � ›ó‚¼ç‚ã¯Â© � ¯ãʭÜ � ¨¯Â‚¯‚¼

� ՛بÈØÁ‚› � ‚• � ÕØÈÜÕ›ãÜʒ

� ��0d�� � ÜÈ缕 � ÂÈã � Ž› � ÈÂܯ•›Ø›•

� ¯Â � ¯Üȼ‚ã¯È � ¨ØÈÁʍ � ÈØ �

‚Ü � ‚ � ‚¼ã›Ø‚ã¯ó› � ãÈʍ � ¨¯Â‚¯‚¼

� Á›‚ÜçØ›Ü � •›ã›ØÁ¯Â›• � ¯Â

� ‚ÈØ•‚› � ô¯ã � 0(Y]ʒ � 0 � ‚••¯ã¯ÈÂʍ

� ã¯Ü � ÂÈ ʣ 0(Y] � ¨¯Â‚¯‚¼ � Á›‚ÜçØ›

� Á‚ö � •¯¨¨›Ø � ¨ØÈÁ � ÂÈ ʣ 0(Y] �

¨¯Â‚¯‚¼ � Á›‚ÜçØ›Ü � ô¯ã

� ÈÁÕ‚Ø‚Ž¼› � ‚Á›Ü � çÜ›• �

Žö � Èã›Ø � ÈÁՂ¯›Üʒ

3 �ȯ›¹ʍ

� 0Âʒ � Ió›Øó¯›ô Mission : to increase the accessibility of new forms of investing

and commerce for our highly - engaged customer base • =›‚•¯Â© � 9‚Ղ›ܛ

� ØöÕãÈ � ›õ‚©› � ÈÁÕ‚Âö

• I՛؂ã›Ü � È› � Ȩ � ã› � ¼‚Ø©›Üã

� •ÈÁ›Ü㯠� Áç¼ã¯ ʣ � ØöÕãÈçØØ›Âö

� Á‚ع›ãÕ¼‚›Ü � ‚• � ØöÕãÈ

� ‚ÜÜ›ã� ›õ‚©›Ü � ¯Â � 9‚Õ‚Â

• ]›Øó¯›Ü � ÜçÕÕÈØã¯Â© � ɸɿ

� ØöÕãÈçØØ›Âö � ãȹ›ÂÜ�

‚ØÈÜÜ � ÈçØ � B‚ع›ãÕ¼‚› � ‚•

� �õ‚©› � Õ¼‚ã¨ÈØÁÜ� ¨ÈØ

� ãØ‚•¯Â© � ‚• � çÜãÈ•öʍ � ‚Ü

� ô›¼¼ � ‚Ü � Èã›Ø � ØöÕãÈ� ‚ã¯ó¯ã¯›Ü

� ¯Â¼ç•¯Â© � 0¯㯂¼ � �õ‚©›

� I¨¨›Ø¯Â©Ü � ʞ0�IÜʟ� ‚• � C(dÜ • Y›©¯Üã›Ø›•

� ØöÕãÈ � ‚ÜÜ›ã � ›õ‚©› �

Ü›Øó¯› � ÕØÈó¯•›Ø ô¯ã � ã›

� (¯Â‚¯‚¼ � ]›Øó¯›Ü � �©›Âö

� Ȩ � 9‚Õ‚Â � ʞ9(]�ʟ • ]çŽÜ¯•¯‚Øö

� Ȩ � BÈ›õ � *ØÈçÕʍ � ‚ � •¯ó›Øܯ¨¯›•

� ¨¯Â‚¯‚¼�Ü›Øó¯›Ü � ÈÁÕ‚Âö

� Õ玼¯¼ö � ¼¯Ü㛕 � È � ã›

� dȹöÈ�]ãȹ � �õ‚©› =›‚•¯Â©

� 9‚Ղ›ܛ � ØöÕãÈ � Žçܯ›ÜÜ

� ¯Â � ÕØÈ›ÜÜ � Ȩ � ¼¯Üã¯Â© �

Õ玼¯¼ö � ¯Â � ã› � hʒ]ʒ Who is Coincheck Process

Update Coincheck is undergoing a business combination with Thunder Bridge Capital Partners IV (“Thunder Bridge”) to become

publicly listed in the United States • �ÂÂÈ盕 � Žçܯ›ÜÜ

� ÈÁŽ¯Â‚ã¯È � ô¯ã � ÜÕ›¯‚¼�

ÕçØÕÈÜ› � ‚×ç¯Ü¯ã¯È � ÈÁÕ‚Âö

� ʞ]V��ʟ � dç•›Ø� �د•©› � ¯Â �

B‚Ø � ɸɶɸɸ � ãÈ � ¼¯Üã � Õ玼¯¼ö

� È � ã› � C‚Ü•‚× • 0Âã›Â• � ãÈ

� çÜ› � Õ玼¯ � ¼¯Üã¯Â© � ãÈ �

‚›ÜÜ � ©¼ÈŽ‚¼� ¯Âó›ÜãÈØ �

Ž‚Ü› � ‚• � çÜ› � Õ玼¯ � Üãȹ

� ‚Ü � ‚×ç¯Ü¯ã¯ÈÂ� çØØ›Âö

• I©ȯ© � •¯‚¼È©ç› � ‚• � Áç¼ã¯Õ¼›

� Ø›©ç¼‚ãÈØö� ÜçŽÁ¯ÜܯÈÂÜ

� ãÈ � ã› � hʒ]ʒ � ]��ʍ � ÁÈÜã � Ø››Âã¼ö

� ÈÂ� �ç©çÜã � ɸ • ʍ � ɸɶɸɺ • �õã›Â•›•

� Èçãܯ•› � •‚ã› � ¨ÈØ � ã›ØÁ¯Â‚ã¯ÈÂ

� •‚ã› � Ȩ� �çܯ›ÜÜ � �ÈÁŽ¯Â‚ã¯ÈÂ

� �©Ø››Á›Âã � ô¯ã � dç•›Ø��د•©›

� ãÈ � 9‚Âç‚Øö � ɸ • � ɸɶɸɻ

4 I› � Ȩ � 㛠�

=‚Ø©›Üã � �ØöÕãÈ � V¼‚ã¨ÈØÁÜ

� ¯Â � 9‚Õ‚Â d› � �ȯ›¹ � IÕÕÈØãç¯ãö

Providing Japanese Customers & Institutions with Direct Access to the Global Crypto Economy Source: Company filings Note: Figures

in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; 1 As of Mar - 2024; Coincheck FY ended 3/31; Does not include

NFTs; 2 Coincheck is also known as the Crypto Asset segment in Monex filings; 3 Represents J - GAAP accounting of customer assets which

is calculated as the sum of crypto currencies deposited by customers and fiat currency deposited by customers Broad Product Set x �›•¯‚㛕

� ØöÕãÈ � ›õ‚©› � ¨ÈØ� ؛ク¼

� çÜãÈÁ›ØÜ x dØ‚•¯Â© � Õ¼‚ã¨ÈØÁ

� ¨ÈØ� ÕØȨ›ÜܯÈ‚¼ � ãØ‚•›ØÜ

x C(d � Á‚ع›ãÕ¼‚› x YÈŽçÜã � ÜÕØ›‚•

ʣ Ž‚Ü›• � Žçܯ›ÜÜ� ÁÈ•›¼ � ô¯ã

� ÕÈã›Â㯂¼ � ¨ÈØ � ¯©� ¯ÂØ›Á›Âゼ

� ÕØȨ¯ã‚Ž¯¼¯ãö x dÈØÈç© �

ö›ã � Ü›‚Á¼›ÜÜ � :y�� ‚• � �B= � ÕØÈ›•çØ›Ü

� ‚•� ÈÂŽÈ‚Ø•¯Â© Strong track record of growth and “first

crypto account” status ~2.0M accounts 1 29 supported crypto assets $4.7B customer assets 1, 3 $1.5B FY24 Marketplace trading value

1 27% FY24 YoY revenue growth 1, 2 $23mm FY24 EBITDA 1

5 w›¼¼ ʣ VÈܯã¯È›•

� ¯Â � ‚ � =‚Ø©› � ‚• � Y‚Õ¯•¼ö � *ØÈô¯Â©

� B‚ع›ã �Üã‚Ž¼¯Ü›• � =›‚•›Ø

� I՛؂ã¯Â© � ‚ã � ]‚¼› � ¯Â � 9‚Õ‚ÂʭÜ

� .¯©¼ö � Y›©ç¼‚㛕 � B‚ع›ã .¯©¼ö

ʣ �©‚©›• � �çÜãÈÁ›Ø � �‚Ü› dØ‚¹

� Y›ÈØ• � Ȩ � �ÈÂã¯Â盕 � 0ÂÂÈó‚ã¯ÈÂ

� ˬ � =›‚•›ØÜ¯Õ ]¯©Â¯¨¯‚Âã

� *ØÈôã � VÈã›Â㯂¼ � ãØÈç©

� VØÈ•çã � ˬ � 0Âã›Ø‚ã¯È‚¼

� �õÕ‚ÂܯÈ ]ãØÈ© � B‚‚©›Á›Âã

� d›‚Á � ãÈ � ]çÕÕÈØã � Y›©¯È‚¼

� ˬ � *¼ÈŽ‚¼ � *ØÈôã� YÈŽçÜã � (¯Â‚¯‚¼

� BÈ•›¼ � ô¯ã � VÈã›Â㯂¼ � ¨ÈØ

� .¯© � 0ÂØ›Á›Âゼ � VØȨ¯ã‚Ž¯¼¯ãö�

�ÈÂãØȼ¼›• � �õÕ›ÂÜ›Ü � �‚Â

� �•¸çÜã � �‚Ü›• � È � B‚ع›ã �

�È•¯ã¯ÈÂÜ �ȯ›¹ � ¯Ü �

‚ � �ÈÁÕ›¼¼¯Â© � �¯©¯ã‚¼ � �ÜÜ›ã

� V¼‚ã¨ÈØÁ

6 =‚Ø©› � ‚• � �ããØ‚ã¯ó›

� B‚ع›ã � ¯Â � �‚ؼö � ]ã‚©›Ü � Ȩ

� �•ÈÕã¯È x 9‚Õ‚Â � ¯Ü � ã› � 4 th largest

global economy ʞ˚ɺʒɸã � *�Vʟ ɻ ʍ � ô¯ã � ‚ �

©ØÈô¯Â© � ‚•�¯ÂØ›‚ܯ©¼ö

� ÜÈÕ¯Ü㯂㛕 � ç¯ó›ØÜ›

� Ȩ� ¯Âó›ÜãÈØÜ � Ü››¹¯Â© � ô›‚¼ã

� ©›Â›Ø‚ã¯ÈÂ�ÈÕÕÈØãç¯㯛Ü

x I¼ö � ɽʒɽ˩ ɸ � Ȩ � 9‚Ղ›ܛ � ÕÈÕ缂ã¯ÈÂ

� ÈôÂÜ� ØöÕãÈ � ʞóÜʒ � ɷɽ˩ ɼ �

Ȩ � h] � ÕÈÕ缂ã¯ÈÂʟʍ � Ø›¨¼›ã¯Â©�

ã› � nascency Ȩ � ã› � 9‚Ղ›ܛ � Á‚ع›ã

x w›¼¼ � ÕÈܯã¯È›• � ãÈ � Ü›Øó¯›

� ‚ � ¼‚Ø©›¼ö� ç•›ØÜ›Øó›• �

¼È‚¼ � institutional investor base x 9‚Õ‚ÂʭÜ � thoughtful crypto regulation

ÁÈ•›¼� ¯Ü � •›Ü¯©Â›• � ‚ØÈç•

� ÕØÈã›ã¯Â© � ã›� ÈÂÜçÁ›Ø

Crypto Penetration in Japan Massive Untapped Market Opportunity Note : 1 As of Mar - 2024 ; 2 As of March 2024 , according to data from

the JVCEA ; 3 As of Jun - 2024 ; 4 Index of crypto adoption determined by rating 146 countries’ peer - to - peer exchange trade

volume and on - chain cryptocurrency and retail value received at centralized exchanges and from DeFi protocols from 0 (lowest rank) to

1 (highest rank) by Chainalysis in September 2022 ; 5 Per Associated Press February 2024 article titled “Japan slips into a recession

and loses its spot as the world’s third - largest economy” as of end of 2023 ; 6 As of January 2024 , according to Morning

Consult Japan Germany United Kingdom China United States Source: Statistics Bureau of Japan; Japan Virtual and Crypto assets Exchange

Association; The 2022 Geography of Cryptocurrency Report: Analysis of Geographic Trends in Cryptocurrency Adoption and Usage by Chainalysis,

September 2022; Morning Consult; Associated Press 9.9M 2 124M 1 Japan Population Japan Crypto Community ~2.0M 3 Coincheck User Base Crypto

Adoption by Market Snapshot 4 Today, Japan’s digital asset adoption is relatively low, representing an opportunity to ‘catch

- up’ to countries of similar economic size 0.339 0.387 0.473 0.535 0.653

Stablecoins (used for payments) Travel rule Licensing / Registration

Regulatory framework Jurisdiction 7 0•¯‚ 0ゼö =‚ãó¯‚ =çõ›ÁŽÈçØ©

B‚¼ã‚ B‚çدã¯çÜ CÈØô‚ö Vȼ‚•

VÈØãç©‚¼ X‚ã‚Ø ]¯Â©‚ÕÈØ› ]¼È󂹯‚

]Èçã � �¨Ø¯‚ ]ô¯ãú›Ø¼‚• d‚¯ô‚Â

dçع›ö h¯㛕 � �Ø‚Ž � �Á¯Ø‚ã›Ü

Stablecoins (used for payments) Travel rule Licensing / Registration Regulatory framework Jurisdiction Japan h¯㛕

� ]ã‚ã›Ü h¯㛕 � :¯Â©•ÈÁ �çÜãØ‚¼¯‚

�çÜãد‚ �‚‚Á‚Ü �‚Ø‚¯Â �‚‚•‚

�‚öÁ‚ � 0ܼ‚奆 �›ÂÁ‚ع �Üãȯ‚

(؂› *›ØÁ‚Âö *¯ŽØ‚¼ã‚Ø .È©

� :È© .ç©‚Øö 9‚Õ‚Â � ]ã‚奆 � Içã

� ‚Ü � ‚ � B‚ع›ã � ¨ÈØ � �ØöÕãÈ �

�ã¯ó¯ãö =›©¯Ü¼‚ã¯È � ʘ � Y›©ç¼‚ã¯ÈÂ

� ¯Â � Õ¼‚› �ã¯ó› � Ø›©ç¼‚ãÈØö

� ›Â©‚©›Á›Âã Y›©ç¼‚ãÈØö � ÕØÈ›ÜÜ

� ÂÈã � ¯Â¯ã¯‚㛕 Source: PwC Global Crypto Regulation Report 2024 Note:

Regulatory assessment is based on the analysis undertaken by individual PwC member firms �ØöÕãÈ � Ø›©ç¼‚ã¯ÈÂ

� ‚ã � ‚ � ©¼‚›

8 =›‚•›Ø � ¯Â � 9‚Õ‚ÂʭÜ

� .¯©¼ö � Y›©ç¼‚㛕 � B‚ع›ã �ȯ›¹

� ¯Ü � ‚ � Ü‚Ø› � ‚ÜÜ›ãʍ � È՛؂ã¯Â©

� ‚ã � Ü‚¼› =›‚•¯Â© � 9‚Ղ›ܛ

� ØöÕãÈ � ‚ÕÕ ]‚Ø› � Ȩ � 9‚Õ‚Â

� Á‚ع›ã � ʞŽö � ‚ÈçÂãÜʟ ɷ Strong

market share driven by trusted and recognized brand, robust relative product offering, and strong customer experience Source: AppTweak;

Japan Virtual and Crypto assets Exchange Association Note: Figures are approximate based on rounding; 1 As of Mar - 2024; 2 Based on downloads

among Japanese crypto asset exchange apps between 2019 - 2023; 3 As of June. 30, 2024 ■ �ȯ›¹

˛ Iã›Ø � 9‚Ղ›ܛ � ›õ‚©›Ü

20% 80% 9.9M No.1 domestic market share for 5 consecutive years 2 6.51 million downloads 3

9 19% 34% 27% 14% 6% .¯©¼ö ʣ �©‚©›•

� �çÜãÈÁ›Ø � �‚Ü› Coincheck’s platform strongly aligns with its

user base, offering products and services that cater towards a young demographic Note: Figures are approximate based on rounding; 1 As

of Mar - 2024 ˛ ɸɶÜ � ˬ � ç•›Ø � ˛ ɹɶÜ � ˛ ɺɶÜ

� ˛ ɻɶÜ � ˛ ɼɶÜ � ˬ � Èó›Ø Users by Age 1 Customer - Centric

Product Strategy �ȯ›¹ʭÜ � ÕØÈ•çã �

‚• � Žçܯ›ÜÜ � Üã؂㛩ö � ¯Ü�

¯Â¨ÈØÁ›• � Žö � ¯ãÜ � çÜãÈÁ›Ø

� •›ÁÈ©Ø‚Õ¯Üʍ � ô¯ã� ŽØÈ‚•

� ãȹ›Â � Èó›Ø‚©›ʍ � C(d � ÜçÕÕÈØãʍ

� ‚• � w›Žɹ � ‚¼¼� ‚ÕÕ›‚¼¯Â© �

ãÈ � Á¯¼¼›Â¯‚¼ � ‚• � ¼‚ã›Ø

� ©›Â›Ø‚ã¯ÈÂÜ x �›•¯‚㛕 � C(d

� Á‚ع›ãÕ¼‚› x �õÕÈÜçØ› � ãÈ

� Ø›©ç¼‚㛕 � •¯©¯ã‚¼ � ‚ÜÜ›ãÜ

x BÈŽ¯¼› ʣ ‚ã¯ó› � çÜ›Ø � ¯Âã›Ø¨‚›

� ʞ‚ÕÕʟ x ]›‚Á¼›ÜÜ � :y� � ÈÂŽÈ‚Ø•¯Â©

� ó¯‚ � ÁÈŽ¯¼› � ‚ÕÕ 50%+ of users are in their 30s and younger 1

10 IçØ � Y›ó›Âç› �

BÈ•›¼ Source: Company filings Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024

Transaction Revenue 92.5% of Total Revenue Transaction Volume (Marketplace) Spread 3.42% Average Spread $1.5B Total FY24 Volume X Total

Revenue Non - Transaction Revenue NFTs Initial Exchange Offering Wholesale services Cryptocurrency subscriptions Deposit and Withdrawal

Fees (Crypto + Fiat) 7.5% of Total Revenue

11 ˚ɿɺʒɿ ʣ ˚ɸʒɺ

FY23 FY24 ˚ɸɹʒɹ FY21 FY22 FY23 FY24 FY22 ˚ɸʒɿ ˚ɹʒɾ ˚ɷʒɶ

˚ɷʒɻ FY21 FY22 FY23 ��0d�� � ʞ˚Bʟ ɹ FY24 ˚ɹʍɺɼɻʒɷ

˚ɷʍɷɼɿʒɶ ˚ɷʍɺɾɶʒɺ YÈŽçÜã �

(¯Â‚¯‚¼ � BÈ•›¼ � ô¯ã � .¯©

� 0ÂØ›Á›Âゼ � VØȨ¯ã‚Ž¯¼¯ãö

dØ‚¹ � Ø›ÈØ• � Ȩ � ÜãØÈ© � ‚ÈçÂã

� ©ØÈôã � ‚• � ‚Ž¯¼¯ãö � ãÈ �

Á‚‚©› � ›õÕ›ÂÜ›Ü � ãÈ � •Ø¯ó›

� ÕØȨ¯ã‚Ž¯¼¯ãö CçÁŽ›Ø � Ȩ

� ‚ÈçÂãÜ � ʞBʟ � ‚• � yÈy � ˩ � ©ØÈôã

ɷ B‚ع›ãÕ¼‚› � dØ‚•¯Â© � tȼçÁ›

� ʞ˚�ʟ Source : Company filings ; Company information Note : Figures in JPY converted to USD based on exchange rate

of 0 . 006607 as of 3 / 31 / 2024 ; Revenue growth rates reflect YoY % growth in JPY ; Coincheck FY ended 3 / 31 ; 1 As of end of Coincheck

FY ended 3 / 31 ; 2 Coincheck is also known as the Crypto Asset segment in Monex filings ; 3 EBITDA is a non - IFRS metrics . Please refer

to slide 16 for a reconciliation to its most comparable IFRS metric . +27% ɷʒɸ ɷʒɼ ɷʒɾ +10%

ɸʒɶ FY22 FY23 Y›ó›Âç› � ʞ˚Bʟ � ‚• � yÈy �

˩ � ©ØÈôã ɸ +32% (74% ) ˚ɺʍɻɼɻʒɻ FY21 FY24 +34% +11%

12 1 0 0 0 0 1 11 10 13 4 1 1 1 1 1 1 7 5 6 9 8 17 20 8 8 45

7 7 7 7 3 3 2 3 2 4 6 2 1 21 18 24 23 20 31 31 64 63 23 110 127 81 46 57 55 39 35 27 25 21 ɶ ɸɶ ɺɶ ɼɶ

ɾɶ ɷɶɶ ɷɸɶ ˚ ɷɺɶ ɶ ɻ ɷɶ ɷɻ ɸɶ ɸɻ

ɹɶ ɹɻ ɺɶ ɺɻ ˚ÁÁ ɻɶ �ÕØʒ ʣ 9çÂʒ

� 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ

B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ

ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ

� 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ

B‚Øʒ � �ÕØʒ ʣ 9çÂʒ � 9ç¼ʒ ʣ ]›Õʒ � Iãʒ

ʣ �›ʒ � 9‚Âʒ ʣ B‚Øʒ � �ÕØʒ ʣ 9çÂʒ

� 9ç¼ʒ ʣ ]›Õʒ � Iãʒ ʣ �›ʒ � 9‚Âʒ ʣ

B‚Øʒ ɸɶɷɿ ɸɶɸɶ ɸɶɸɷ ɸɶɸɸ ɸɶɸɹ

ɸɶɸɺ Marketing costs for customer acquisition (bar chart, left axis) Revenue generated from the users who completed

KYC process during each quarter (bar chart, left axis) Cost per acquisition (line chart, right axis) �ÈÂãØȼ¼›•

� �õÕ›ÂÜ›Ü � �‚ � �•¸çÜã � �‚Ü›•

� È � B‚ع›ã � �È•¯ã¯ÈÂÜ Source: Company

information; Messari Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; Coincheck FY ended 3/31;

1 Marketing costs for customer acquisition represents total advertising and promotion expenses; 2 Cost per acquisition calculated by dividing

the marketing costs for customer acquisition by number of new verified users during the quarter Y›ó›Âç›

� �• � dÈゼ � B‚ع›ã¯Â© � �ÈÜãÜ

� (ÈØ � �çÜãÈÁ›Ø � �×ç¯Ü¯ã¯ÈÂ

� ʞB‚ع›ãÕ¼‚› � V¼‚ã¨ÈØÁʟ �ȯ›¹

� ‚•¸çÜãÜ � Á‚ع›ã¯Â© � ›õÕ›ÂÜ›

� Ž‚Ü›• � È � ã› � Á‚ع›ã � ›Âó¯ØÈÂÁ›Âãʍ

� ô¯¼› � Á‚¯Âク¯© � ‚Ž¯¼¯ãö

� ãÈ � ‚ããØ‚ã � ¯© � ×炼¯ãö

� çÜãÈÁ›ØÜ

13 IçØ � *ØÈôã � ]ã؂㛩ö

Solidify position as leading Japanese crypto exchange and deepen market penetration Advance the growth of the crypto ecosystem in both

Japan and globally with growth in non - transaction - based offerings (e.g., IEOs, subscriptions) Introduce new digital asset - based

products and capabilities, such as asset management Capitalize on longer - term Japanese institution opportunity in crypto by leveraging

trusted brand Pursue strategically accretive investments and acquisitions in domestic exchange market and emerging crypto / blockchain

technologies

14 �çܯ›ÜÜ � hÕ•‚ã›

�ȯ›¹ � Üã‚Ø㛕 � ‚¯Ø¯Â©

� dt� ÈÁÁ›Ø¯‚¼Ü � È � B‚ö � ɿʍ

� ɸɶɸɺ � ãÈ� ‚×ç¯Ø› � ›ô � çÜãÈÁ›ØÜ

� ‚• � ¨ÈÜã›Ø� ¯ãÜ � ŽØ‚• � ‚ô‚؛›ÜÜʒ

~2.0M accounts (+82K QoQ) =›‚•¯Â© � Á‚ع›ã � Ü‚Ø›

� ô¯ã � ɸɶ˩ ɷ � Ü‚Ø› � Ȩ � ó›Ø¯¨¯›•

� ‚ÈçÂãÜ CçÁŽ›Ø � Ȩ � ãȹ›ÂÜ

� ÜçÕÕÈØ㛕 � ‚ØÈÜÜ � ÈçØ � B‚ع›ãÕ¼‚›

� ‚• � �õ‚©› Õ¼‚ã¨ÈØÁÜ �

¨ÈØ � ãØ‚•¯Â© � ‚• � çÜãÈ•ö

29 coins �ȯ›¹ � ÈÂã¯Âç›Ü � ãÈ

� ‚ããØ‚ã � çÜãÈÁ›ØÜ � ‚Ü � ‚

� ØöÕãÈ � ‚ÜÜ›ãÜ � ãØ‚•¯Â© �

Õ¼‚ã¨ÈØÁ � ¯Â� 9‚Õ‚Â dt � ÈÁÁ›Ø¯‚¼Ü

�ȯ›¹ � ÁÈŽ¯¼› � ‚ÕÕ �ȯ›¹

� ¨ÈØ � �çܯ›ÜÜ �ȯ›¹ �

‚Ü � ‚ � ©ØÈô¯Â© � Üç¯ã› � Ȩ�

¯ÂÜã¯ãçã¯È‚¼ � Ȩ¨›Ø¯Â©Üʍ

� ÂÈã‚Ž¼ö � 0¯㯂¼� �õ‚©›

� I¨¨›Ø¯Â©Ü � ʞ0�IÜʟʌ x 0 � ÈÁÕ¼¯‚›

� ô¯ã � ©ç¯•›¼¯Â›Ü � •›ó›¼ÈÕ›•

� Žö � ã› � 9t���ʍ � ô› � È•ç㛕

� ã› � ¨¯ØÜã � ‚ÕÕØÈó›• � 0�I � ¯Â

� 9‚Õ‚Âʍ � ô¯ � ɼɹʍɾɻɹ � çÜ›ØÜ�‚ÕÕ¼¯›•

� ãÈ � ‚• � ô‚Ü � Èó›ØÜçŽÜدŽ›•

� Žö � ɸɺ � ã¯Á›Üʒ x Iã›Ø � ›õ‚ÁÕ¼›Ü

� Ȩ � 0�IÜ � ô› � ‚ó› � ¨‚¯¼¯ã‚㛕

� ¯Â¼ç•› � �د¼¼¯‚Âã�ØöÕãÈʍ

� ‚ � *‚Á›(¯ � Žçܯ›ÜÜ � ã‚ã

� ç㯼¯ú›Ü � Ž¼È¹‚¯Â � ã›Âȼȩöʍ

� ‚• � (‚ÂÕ¼‚ʍ � ‚ � ¨‚Â�¼çŽ�

Üȯ‚¼ � Õ¼‚ã¨ÈØÁʒ Source: JVCEA Note: ¹ As of Mar

- 2024; QoQ increase reflects change from number of verified accounts as of Dec - 23 to Mar - 24

15 �Õ՛•¯õ

16 ��0d�� � Y›È¯¼¯‚ã¯ÈÂ

FY24 FY23 FY22 ($M) $13.0 ($3.7) $64.7 C›ã � VØȨ¯ã � ʞ=ÈÜÜʟ 5.8 (1.9)

27.2 ʞ˟ʟ � 0ÂÈÁ› � d‚õ � �õÕ›ÂÜ›Ü �

ʞ�›Â›¨¯ãÜʟ 18.8 (5.6) 92.0 VØȨ¯ã � ʞ=ÈÜÜʟ

� Ž›¨ÈØ› � 0ÂÈÁ› � d‚õ›Ü 0.0 0.0 0.0 ʞ˟ʟ

� 0Âã›Ø›Üã � �õÕ›ÂÜ› 4.5 3.2 3.0 ʞ˟ʟ � �›ÕØ›¯‚ã¯ÈÂ

� ˬ � �ÁÈØã¯ú‚ã¯È $23.3 ($2.4) $94.9 ��0d�� Source:

Company filings; Company information Note: Figures in JPY converted to USD based on exchange rate of 0.006607 as of 3/31/2024; Coincheck

FY ended 3/31

Yo Nakagawa Director Senior Executive Director of Monex Group,

Inc. and Expert Director of Coincheck, Inc. Takashi Oyagi Director Founding member of Monex, Executive Officer and Chief Financial Officer

of Monex Group, Inc. Jason Sandberg Incoming Chief Financial Officer Managing Director at Thunder Bridge Capital, LLC Gary Simanson Director

with the title Chief Executive Officer Founder of Thunder Bridge Capital, LLC and has served as its Chief Executive Officer since 2017

Oki Matsumoto Director with the title Executive Chairman Founder of Monex, and the Representative Executive Officer of Monex Group, Inc

.. Jessica Sinyin Tan Non - Executive Director Serves on the strategy and consumer protection committee of PingAn Bank and former Co -

CEO of PingAn Group Yuri Suzuki Non - Executive Director Senior partner at the Tokyo office of the Japanese law firm, Atsumi & Sakai.

Toshihiko Katsuya Non - Executive Director Previously served as President & CEO at Aruhi Corporation David Burg Non - Executive Director

Global Group Head, Cyber and Digital Trust at Kroll, LLC Allerd Derk Stikker Non - Executive Director Advisor of BXR Group and is a director

of a number of portfolio companies of BXR Group Source: Company filings Note: The Directors noted above reflect nominees who will be appointed

to the PubCo Board effective as of the closing date 17 �È‚Ø• � Ȩ � �¯Ø›ãÈØÜ

� ‚• � 0ÂÈÁ¯Â© � :›ö � B‚‚©›Á›Âã

� d›‚Á

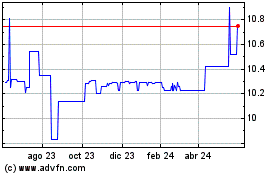

Thunder Bridge Captial P... (NASDAQ:THCPU)

Gráfica de Acción Histórica

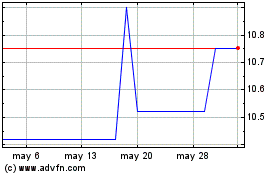

De Jul 2024 a Ago 2024

Thunder Bridge Captial P... (NASDAQ:THCPU)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024