false

0001434621

0001434621

2024-06-12

2024-06-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 12, 2024

LendingTree, Inc.

(Exact name of registrant as specified in charter)

| Delaware |

|

001-34063 |

|

26-2414818 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.)

|

| 1415 Vantage Park Dr., Suite 700, Charlotte, NC |

28203 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone

number, including area code: (704) 541-5351

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

|

TREE |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 12, 2024, Trent

Ziegler informed LendingTree, Inc. (the “Company”) of his intent to resign as Chief Financial Officer of the Company effective

as of August 9, 2024. Mr. Ziegler’s resignation was not the result of any disagreement with the Company, any matter related to the

Company’s operations, policies or practices, the Company’s management or the board.

On June 17, 2024, the

board of directors of the Company appointed Jason Bengel, LendingTree, LLC’s Senior Vice President, Financial Planning and Analysis

as Chief Financial Officer of the Company effective as of August 9, 2024.

Jason Bengel, 47, a Chartered

Financial Analyst, has served as Senior Vice President, Financial Planning and Analysis of LendingTree, LLC since July 2021. From February

2018 until July 2021, he served as Vice President, Financial Planning and Analysis of LendingTree, LLC. Prior to joining LendingTree,

LLC, Mr. Bengel served in various capacities including Vice President, Financial Planning and Analysis of Outbrain, a web recommendation

platform; Vice President, Treasury and Corporate Development, Director, Corporate Development, and Manager, Financial Planning and Analysis

of Revlon, a beauty company; Associate of Goldman Sachs, an investment banking, securities and investment management firm; and Senior

Financial Analyst of Air Products, a company selling gases and chemicals for industrial use. Mr. Bengel also previously worked as a structural

engineer. In addition, since August 2021, Mr. Bengel has served as a board member of Urban League of Central Carolinas, a nonprofit agency

whose mission is to advocate for and equip underserved communities with the tools needed to achieve social and economic equality.

In connection with the

additional duties that Mr. Bengel will be responsible for during the transition period, effective as of June 17, 2024, Mr. Bengel will

receive a base salary of $350,000 per year and may be entitled to an annual bonus with a target amount equal to 50% of his base salary.

In addition, Mr. Bengel may be entitled to receive an annual equity award at the Company’s sole discretion.

There are no family relationships

between Mr. Bengel and any of our directors or executive officers. Except as set forth herein, there is no arrangement or understanding

between Mr. Bengel and any other persons pursuant to which Mr. Bengel was appointed an executive officer of the Company. There are no

related party transactions involving Mr. Bengel that are reportable under Item 404(a) of Regulation S-K.

Item 8.01 Other Events.

On June 18, 2024, the

Company issued a press release with respect to the resignation of Trent Ziegler as Chief Financial Officer of the Company and appointment

of Jason Bengel as Chief Financial Officer of the Company to be effective as of August 9, 2024. A

copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 18, 2024 |

|

| |

LENDINGTREE, INC. |

| |

|

| |

By: |

/s/ Heather Novitsky |

| |

|

Heather Novitsky |

| |

|

Corporate Secretary |

Exhibit 99.1

LendingTree

Announces Chief Financial Officer Transition, Additional Leadership Promotions

Company to exceed Q2 revenue guidance and maintains Adjusted EBITDA outlook

CHARLOTTE,

N.C., June 18, 2024 /PRNewswire/ -- LendingTree, Inc. (NASDAQ: TREE), is the parent of LendingTree,

LLC and several companies owned by LendingTree, LLC (collectively, "LendingTree" or the "Company") and the operator

of LendingTree.com, the nation's leading online financial services marketplace, announces the promotion of Jason Bengel to Chief Financial

Officer following the departure of Trent Ziegler on August 9, 2024. Along with this change, LendingTree is also announcing several leadership

changes to further propel the Company's strategic initiatives and growth trajectory.

After 12 years of exceptional

service, Trent Ziegler will be stepping down from his position to pursue a new opportunity outside the Company. Ziegler leaves behind

a legacy of strong shareholder relationships, optimized cost structure and the successful execution of complex financing initiatives.

Jason Bengel, an integral

member of LendingTree’s management team and a Chartered Financial Analyst, will step into the CFO role effective as of August 9,

2024. Bengel's expertise in financial planning and analysis, coupled with his dedication to operational efficiency and deep understanding

of LendingTree’s business lines, position him well to drive LendingTree's financial strategies forward.

“Jason’s leadership

and insights have been instrumental in enhancing the Company’s reporting standards and bringing discipline to the organization's

operations, both of which will be crucial as we continue to efficiently scale the business,” said Doug Lebda, LendingTree Chairman

and CEO. "We are grateful for Trent's exceptional contributions to LendingTree and wish him ample success in his new role. While

Trent will be missed among our team, I am incredibly confident in Jason’s skilled expertise and in his ability to lead our finance

team to drive operational excellence.”

Additionally,

effective immediately, Sarah Guidry will expand her role into SVP of Analytics and Corporate Strategy. Guidry has been leading LendingTree's

Analytics function since 2021, and as part of this move, her responsibilities expand into LendingTree's strategy work, including the

new AI lab, underscoring the Company’s commitment to data-driven decision making. Lebda adds “I’ve

seen first-hand how Sarah can take ambiguous processes and improve them for greater clarity and accountability.

This move more closely aligns analytics and strategy, enabling us to make smarter prioritization

decisions. I’m incredibly excited to see what she can accomplish in this new role.”

Finally, also effective immediately,

Andrew Wessel will be taking on a larger role as SVP of Investor Relations and Corporate Development. Wessel will continue

to strengthen LendingTree’s relationships with shareholders, banks, and other capital market participants. “Andrew’s

experience as an equity research analyst and hedge fund investor provides a unique and essential skillset to LendingTree, and he has a

proven track record at the Company of driving shareholder value,” continued Lebda.

As LendingTree embarks on

this new chapter, the Company believes it remains poised for continued success and strategic innovation.

Second-quarter 2024 Outlook

In the second quarter we anticipate

revenue will be above the previously forecasted range of $175 - $190 million, and we reiterate our published second quarter variable marketing

margin and adjusted EBITDA outlook of $70 - $76 million and $22 – $26 million, respectively.

About LendingTree, Inc.

LendingTree is one of the nation's largest, most experienced

online financial platforms, created to give consumers the power to win financially. LendingTree provides customers with access to the

best offers on loans, credit cards, insurance and more through its network of over 400 financial partners. Since its founding, LendingTree

has helped millions of customers obtain financing, save money, and improve their financial and credit health in their personal journeys.

With a portfolio of innovative products and tools and personalized financial recommendations, LendingTree helps customers achieve everyday

financial wins.

LendingTree, Inc. is headquartered in

Charlotte, NC. For more information, please visit www.lendingtree.com.

Cautionary

Language Concerning Forward-Looking Statements

The

matters contained in this press release may be considered to be "forward-looking statements" within the meaning of the Securities

Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are made on the basis of the current beliefs, expectations

and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking

statements should, therefore, be considered in light of various important factors, including those set forth in Company’s reports

that it files from time to time with the Securities and Exchange Commission (“SEC”) and which you should review, including

those statements under “Item 1A – Risk Factors” in the Company’s Annual Report on Form 10-K, as may be amended

from time to time by other reports the Company files with the SEC. These forward-looking statements should not be relied upon as predictions

of future events and the Company cannot assure you that the events or circumstances discussed or reflected in these statements will be

achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard

these statements as a representation or warranty by the Company or any other person that we will achieve our objectives and plans in any

specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as

of the date of this press release. The Company disclaims any obligation to publicly update or release any revisions to these forward-looking

statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the

occurrence of unanticipated events, except as required by law.

v3.24.1.1.u2

Cover

|

Jun. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 12, 2024

|

| Entity File Number |

001-34063

|

| Entity Registrant Name |

LendingTree, Inc.

|

| Entity Central Index Key |

0001434621

|

| Entity Tax Identification Number |

26-2414818

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1415 Vantage Park Dr.

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28203

|

| City Area Code |

(704)

|

| Local Phone Number |

541-5351

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

TREE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

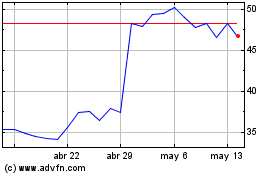

LendingTree (NASDAQ:TREE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

LendingTree (NASDAQ:TREE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024