MidCap Financial Investment Corporation (NASDAQ: MFIC) or the

“Company,” today announced financial results for its quarter ended

March 31, 2024. The Company’s net investment income was $0.44

per share for the quarter ended March 31, 2024, compared to

$0.46 per share for the quarter ended December 31, 2023. The

Company’s net asset value (“NAV”) was $15.42 per share as of

March 31, 2024, compared to $15.41 as of December 31,

2023.

On May 7, 2024, the Board of Directors (the

“Board”) declared a dividend of $0.38 per share payable on June 27,

2024 to stockholders of record as of June 11, 2024.

Mr. Tanner Powell, the Company’s Chief Executive

Officer, commented, “Our results for the March quarter were solid

and included a slight increase in net asset value per share,

relatively stable credit performance, and continued de-risking of

the portfolio. We believe these results underscore the benefits of

our strategy of building a well-diversified portfolio of true first

lien middle market loans sourced by MidCap Financial, a leading

middle-market lender managed by Apollo, and one of the largest and

most successful middle market lenders.” Mr. Powell continued, “We

look forward to realizing the potential benefits of our previously

announced proposed mergers with Apollo Senior Floating Rate Fund

Inc. and Apollo Tactical Income Fund Inc., which will create a

larger, more scaled BDC focused on middle market direct

lending.”

___________________

(1) Commitments made for the corporate lending portfolio.(2)

During the quarter ended March 31, 2024, corporate lending revolver

fundings totaled $24 million, corporate lending revolver repayments

totaled $37 million, and the Company received a $4 million revolver

paydown from Merx Aviation Finance, LLC. (3) The Company’s net

leverage ratio is defined as debt outstanding plus payable for

investments purchased, less receivable for investments sold, less

cash and cash equivalents, less foreign currencies, divided by net

assets.(4) The dividend is payable on June 27, 2024 to stockholders

of record as of June 11, 2024.

FINANCIAL HIGHLIGHTS

| ($ in billions, except

per share data) |

March 31,2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

June 30, 2023 |

|

March 31, 2023 |

|

Total assets |

$ |

2.45 |

|

$ |

2.50 |

|

$ |

2.46 |

|

$ |

2.50 |

|

$ |

2.49 |

| Investment portfolio (fair

value) |

$ |

2.35 |

|

$ |

2.33 |

|

$ |

2.37 |

|

$ |

2.41 |

|

$ |

2.39 |

| Debt outstanding |

$ |

1.41 |

|

$ |

1.46 |

|

$ |

1.43 |

|

$ |

1.48 |

|

$ |

1.47 |

| Net assets |

$ |

1.01 |

|

$ |

1.01 |

|

$ |

0.99 |

|

$ |

0.99 |

|

$ |

0.99 |

| Net asset value per share |

$ |

15.42 |

|

$ |

15.41 |

|

$ |

15.28 |

|

$ |

15.20 |

|

$ |

15.18 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt-to-equity ratio |

|

1.40 x |

|

|

1.45 x |

|

|

1.44 x |

|

|

1.49 x |

|

|

1.48 x |

| Net leverage ratio (1) |

|

1.35 x |

|

|

1.34 x |

|

|

1.40 x |

|

|

1.45 x |

|

|

1.41 x |

____________________

(1) The Company’s net leverage ratio is defined

as debt outstanding plus payable for investments purchased, less

receivable for investments sold, less cash and cash equivalents,

less foreign currencies, divided by net assets.

PORTFOLIO AND INVESTMENT

ACTIVITY

| |

Three Months Ended March 31, |

|

| (in

millions)* |

2024 |

|

|

2023 |

|

|

Investments made in portfolio companies |

$ |

152.8 |

|

|

$ |

151.1 |

|

|

Investments sold |

|

— |

|

|

|

— |

|

| Net

activity before repaid investments |

|

152.8 |

|

|

|

151.1 |

|

|

Investments repaid |

|

(136.9 |

) |

|

|

(171.5 |

) |

| Net

investment activity |

$ |

15.9 |

|

|

$ |

(20.5 |

) |

| |

|

|

|

|

|

|

|

|

Portfolio companies, at beginning of period |

|

152 |

|

|

|

135 |

|

| Number

of investments in new portfolio companies |

|

7 |

|

|

|

8 |

|

| Number

of exited companies |

|

(5 |

) |

|

|

(2 |

) |

|

Portfolio companies at end of period |

|

154 |

|

|

|

141 |

|

| |

|

|

|

|

|

|

|

| Number

of investments in existing portfolio companies |

|

49 |

|

|

|

45 |

|

____________________

* Totals may not foot due to rounding.

OPERATING RESULTS

| |

Three Months Ended March 31, |

|

| (in

millions)* |

2024 |

|

|

2023 |

|

|

Net investment income |

$ |

28.5 |

|

|

$ |

29.5 |

|

| Net realized and change in

unrealized gains (losses) |

|

(3.1 |

) |

|

|

0.6 |

|

| Net increase in net assets

resulting from operations |

$ |

25.5 |

|

|

$ |

30.1 |

|

| |

|

|

|

|

|

|

|

| (per share)*

(1) |

|

|

|

|

|

|

|

| Net investment income on per

average share basis |

$ |

0.44 |

|

|

$ |

0.45 |

|

| Net realized and change in

unrealized gain (loss) per share |

|

(0.05 |

) |

|

|

0.01 |

|

| Earnings per share —

basic |

$ |

0.39 |

|

|

$ |

0.46 |

|

____________________

* Totals may not foot due to rounding.(1) Based

on the weighted average number of shares outstanding for the period

presented.

SHARE REPURCHASE PROGRAM *

During the three months ended March 31,

2024, the Company did not repurchase any shares.

Since the inception of the share repurchase

program and through May 7, 2024, the Company repurchased 15,593,120

shares at a weighted average price per share of $15.91, inclusive

of commissions, for a total cost of $248.1 million, leaving a

maximum of $26.9 million available for future purchases under the

current Board authorization of $275 million.

* Share figures have been adjusted for the

1-for-3 reverse stock split which was completed after market close

on November 30, 2018.

LIQUIDITY

As of March 31, 2024, the Company’s

outstanding debt obligations, excluding deferred financing cost and

debt discount of $7.0 million, totaled $1.412 billion which was

comprised of $350 million of Senior Unsecured Notes (the “2025

Notes”) which will mature on March 3, 2025, $125 million of

Unsecured Notes (the “2026 Notes”) which will mature on July 16,

2026, $80 million of Unsecured Notes (the “2028 Notes”) which will

mature on December 15, 2028, $232 million outstanding Class A-1

Notes under the CLO and $625.1 million outstanding under the

multi-currency revolving credit facility (the “Facility”). As of

March 31, 2024, $17.3 million in standby letters of credit

were issued through the Facility. The available remaining capacity

under the Facility was $1.063 billion as of March 31, 2024,

which is subject to compliance with a borrowing base that applies

different advance rates to different types of assets in the

Company’s portfolio.

CONFERENCE CALL / WEBCAST AT 8:30 AM EDT

ON MAY 8, 2024

The Company will host a conference call on

Wednesday, May 8, 2024, at 8:30 a.m. Eastern Time. All interested

parties are welcome to participate in the conference call by

dialing (800) 274-8461 approximately 5-10 minutes prior to the

call; international callers should dial (203) 518-9848.

Participants should reference either MidCap Financial Investment

Corporation Earnings or Conference ID: MFIC0508 when prompted. A

simultaneous webcast of the conference call will be available to

the public on a listen-only basis and can be accessed through the

Events Calendar in the Shareholders section of our website

at www.midcapfinancialic.com. Following the call, you may

access a replay of the event either telephonically or via audio

webcast. The telephonic replay will be available approximately two

hours after the live call and through May 29, 2024, by dialing

(800) 938-2305; international callers should dial (402) 220-1126. A

replay of the audio webcast will also be available later that same

day. To access the audio webcast please visit the Events Calendar

in the Shareholders section of our website

at www.midcapfinancialic.com.

SUPPLEMENTAL INFORMATION

The Company provides a supplemental information

package to offer more transparency into its financial results and

make its reporting more informative and easier to follow. The

supplemental package is available in the Shareholders section of

the Company’s website under Presentations at

www.midcapfinancialic.com.

Our portfolio composition and weighted average

yields as of March 31, 2024, December 31, 2023, September 30, 2023,

June 30, 2023, and March 31, 2023 were as follows:

| |

March 31,2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

June 30, 2023 |

|

March 31, 2023 |

|

Portfolio composition, at fair value: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First lien secured debt |

|

90% |

|

|

89% |

|

|

88% |

|

|

88% |

|

|

89% |

| Second lien secured debt |

|

1% |

|

|

1% |

|

|

3% |

|

|

3% |

|

|

3% |

| Total secured debt |

|

91% |

|

|

90% |

|

|

91% |

|

|

91% |

|

|

92% |

| Unsecured debt |

|

0% |

|

|

—% |

|

|

—% |

|

|

0% |

|

|

0% |

| Structured products and

other |

|

1% |

|

|

2% |

|

|

2% |

|

|

2% |

|

|

0% |

| Preferred equity |

|

1% |

|

|

1% |

|

|

1% |

|

|

1% |

|

|

2% |

| Common equity/interests and

warrants |

|

7% |

|

|

7% |

|

|

6% |

|

|

6% |

|

|

6% |

| Weighted average

yields, at amortized cost (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| First lien secured debt

(2) |

|

12.0% |

|

|

12.1% |

|

|

11.9% |

|

|

11.7% |

|

|

11.4% |

| Second lien secured debt

(2) |

|

14.1% |

|

|

13.7% |

|

|

14.4% |

|

|

14.2% |

|

|

13.7% |

| Total secured debt (2) |

|

12.0% |

|

|

12.1% |

|

|

12.0% |

|

|

11.8% |

|

|

11.4% |

| Unsecured debt portfolio

(2) |

|

—% |

|

|

—% |

|

|

—% |

|

|

10.0% |

|

|

10.0% |

| Total debt portfolio (2) |

|

12.0% |

|

|

12.1% |

|

|

12.0% |

|

|

11.8% |

|

|

11.4% |

| Total portfolio (3) |

|

10.0% |

|

|

10.1% |

|

|

10.1% |

|

|

10.0% |

|

|

9.7% |

| Interest rate type, at

fair value (4): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed rate amount |

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

| Floating rate amount |

$ |

2.0 billion |

|

$ |

2.0 billion |

|

$ |

2.0 billion |

|

$ |

2.1 billion |

|

$ |

2.1 billion |

| Fixed rate, as percentage of

total |

|

0% |

|

|

0% |

|

|

0% |

|

|

0% |

|

|

0% |

| Floating rate, as percentage

of total |

|

100% |

|

|

100% |

|

|

100% |

|

|

100% |

|

|

100% |

| Interest rate type, at

amortized cost (4): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed rate amount |

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

|

$ |

0.0 billion |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Floating rate amount |

$ |

2.0 billion |

|

$ |

2.0 billion |

|

$ |

2.1 billion |

|

$ |

2.1 billion |

|

$ |

2.1 billion |

| Fixed rate, as percentage of

total |

|

0% |

|

|

0% |

|

|

0% |

|

|

0% |

|

|

0% |

| Floating rate, as percentage

of total |

|

100% |

|

|

100% |

|

|

100% |

|

|

100% |

|

|

100% |

(1) An investor’s yield may be lower than the portfolio yield

due to sales loads and other expenses.(2) Exclusive of investments

on non-accrual status.(3) Inclusive of all income generating

investments, non-income generating investments and investments on

non-accrual status.(4) The interest rate type information is

calculated using the Company’s corporate debt portfolio and

excludes aviation and investments on non-accrual status.

|

MIDCAP FINANCIAL INVESTMENT CORPORATION |

|

CONSOLIDATED STATEMENTS OF ASSETS AND

LIABILITIES |

|

(In thousands, except share and per share

data) |

| |

| |

| |

March 31,2024 |

|

|

December 31,2023 |

|

| |

(Unaudited) |

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

| Investments at fair

value: |

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated investments (cost — $2,008,281 and

$2,012,273, respectively) |

$ |

1,937,316 |

|

|

$ |

1,936,327 |

|

|

Non-controlled/affiliated investments (cost — $150,771 and

$130,648, respectively) |

|

95,309 |

|

|

|

77,528 |

|

|

Controlled investments (cost — $393,475 and $395,221,

respectively) |

|

320,210 |

|

|

|

320,344 |

|

| Cash and cash equivalents |

|

49,611 |

|

|

|

93,575 |

|

| Foreign currencies (cost — $30

and $28,563, respectively) |

|

1 |

|

|

|

28,553 |

|

| Receivable for investments

sold |

|

1,347 |

|

|

|

2,796 |

|

| Interest receivable |

|

20,977 |

|

|

|

21,441 |

|

| Dividends receivable |

|

459 |

|

|

|

1,327 |

|

| Deferred financing costs |

|

18,238 |

|

|

|

19,435 |

|

| Prepaid expenses and other

assets |

|

1,594 |

|

|

|

5 |

|

|

Total Assets |

$ |

2,445,062 |

|

|

$ |

2,501,331 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

| Debt |

$ |

1,405,121 |

|

|

$ |

1,462,267 |

|

| Payable for investments

purchased |

|

1,343 |

|

|

|

— |

|

| Management and

performance-based incentive fees payable |

|

10,424 |

|

|

|

10,729 |

|

| Interest payable |

|

13,313 |

|

|

|

14,494 |

|

| Accrued administrative

services expense |

|

1,734 |

|

|

|

1,657 |

|

| Other liabilities and accrued

expenses |

|

7,126 |

|

|

|

6,874 |

|

|

Total Liabilities |

$ |

1,439,061 |

|

|

$ |

1,496,021 |

|

|

Commitments and contingencies (Note 8) |

|

|

|

|

|

|

|

|

Net Assets |

$ |

1,006,001 |

|

|

$ |

1,005,310 |

|

| |

|

|

|

|

|

|

|

| Net

Assets |

|

|

|

|

|

|

|

| Common stock, $0.001 par value

(130,000,000 shares authorized; 65,253,275 and 65,253,275 shares

issued and outstanding, respectively) |

$ |

65 |

|

|

$ |

65 |

|

| Capital in excess of par

value |

|

2,103,718 |

|

|

|

2,103,718 |

|

| Accumulated under-distributed

(over-distributed) earnings |

|

(1,097,782 |

) |

|

|

(1,098,473 |

) |

|

Net Assets |

$ |

1,006,001 |

|

|

$ |

1,005,310 |

|

| |

|

|

|

|

|

|

|

| Net Asset Value Per

Share |

$ |

15.42 |

|

|

$ |

15.41 |

|

|

MIDCAP FINANCIAL INVESTMENT CORPORATION |

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) |

|

(In thousands, except per share data) |

| |

| |

Three Months Ended March 31, |

|

| |

2024 |

|

|

2023 |

|

|

Investment Income |

|

|

|

|

|

|

|

| Non-controlled/non-affiliated

investments: |

|

|

|

|

|

|

|

|

Interest income (excluding Payment-in-kind (“PIK”) interest

income) |

$ |

59,996 |

|

|

$ |

60,021 |

|

|

Dividend income |

|

12 |

|

|

|

22 |

|

|

PIK interest income |

|

1,995 |

|

|

|

329 |

|

|

Other income |

|

1,708 |

|

|

|

1,934 |

|

| Non-controlled/affiliated

investments: |

|

|

|

|

|

|

|

|

Interest income (excluding PIK interest income) |

|

299 |

|

|

|

278 |

|

|

Dividend income |

|

— |

|

|

|

— |

|

|

PIK interest income |

|

34 |

|

|

|

27 |

|

|

Other income |

|

— |

|

|

|

— |

|

| Controlled investments: |

|

|

|

|

|

|

|

|

Interest income (excluding PIK interest income) |

|

4,287 |

|

|

|

4,489 |

|

|

Dividend income |

|

— |

|

|

|

— |

|

|

PIK interest income |

|

— |

|

|

|

428 |

|

|

Other income |

|

— |

|

|

|

250 |

|

|

Total Investment Income |

$ |

68,331 |

|

|

$ |

67,778 |

|

| Expenses |

|

|

|

|

|

|

|

| Management fees |

$ |

4,386 |

|

|

$ |

4,264 |

|

| Performance-based incentive

fees |

|

6,038 |

|

|

|

6,196 |

|

| Interest and other debt

expenses |

|

26,179 |

|

|

|

24,766 |

|

| Administrative services

expense |

|

1,223 |

|

|

|

1,422 |

|

| Other general and

administrative expenses |

|

2,129 |

|

|

|

2,256 |

|

|

Total expenses |

|

39,955 |

|

|

|

38,904 |

|

| Management and

performance-based incentive fees waived |

|

— |

|

|

|

— |

|

| Performance-based incentive

fee offset |

|

— |

|

|

|

(274 |

) |

| Expense reimbursements |

|

(168 |

) |

|

|

(335 |

) |

|

Net Expenses |

$ |

39,787 |

|

|

$ |

38,295 |

|

|

Net Investment Income |

$ |

28,544 |

|

|

$ |

29,483 |

|

| Net Realized and

Change in Unrealized Gains (Losses) |

|

|

|

|

|

|

|

| Net realized gains

(losses): |

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated investments |

$ |

(7,470 |

) |

|

$ |

(876 |

) |

|

Non-controlled/affiliated investments |

|

— |

|

|

|

— |

|

|

Controlled investments |

|

— |

|

|

|

1 |

|

|

Foreign currency transactions |

|

(618 |

) |

|

|

41 |

|

|

Net realized gains (losses) |

|

(8,088 |

) |

|

|

(834 |

) |

| Net change in unrealized gains

(losses): |

|

|

|

|

|

|

|

|

Non-controlled/non-affiliated investments |

|

4,983 |

|

|

|

(45 |

) |

|

Non-controlled/affiliated investments |

|

(2,341 |

) |

|

|

1,233 |

|

|

Controlled investments |

|

1,613 |

|

|

|

1,315 |

|

|

Foreign currency translations |

|

778 |

|

|

|

(1,020 |

) |

|

Net change in unrealized gains (losses) |

|

5,033 |

|

|

|

1,483 |

|

|

Net Realized and Change in Unrealized Gains

(Losses) |

$ |

(3,055 |

) |

|

$ |

649 |

|

|

Net Increase (Decrease) in Net Assets Resulting from

Operations |

$ |

25,489 |

|

|

$ |

30,132 |

|

| Earnings (Loss) Per Share —

Basic |

$ |

0.39 |

|

|

$ |

0.46 |

|

Important Information

Investors are advised to carefully

consider the investment objective, risks, charges and expenses of

the Company before investing. The prospectus dated April 12, 2023,

which has been filed with the Securities and Exchange Commission

(“SEC”), contains this and other information about the Company and

should be read carefully before investing. An effective

shelf registration statement relating to certain securities of the

Company is on file with the SEC. Any offering may be made only by

means of a prospectus and any accompanying prospectus supplement.

Before you invest, you should read the base prospectus in that

registration statement, the prospectus and any documents

incorporated by reference therein, which the issuer has filed with

the SEC, for more complete information about the Company and an

offering. You may obtain these documents for free by visiting EDGAR

on the SEC website at www.sec.gov.

The information in the prospectus and in this

announcement is not complete and may be changed. This communication

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such state or other jurisdiction.

Past performance is not indicative of,

or a guarantee of, future performance. The performance and

certain other portfolio information quoted herein represents

information as of dates noted herein. Nothing herein shall be

relied upon as a representation as to the future performance or

portfolio holdings of the Company. Investment return and principal

value of an investment will fluctuate, and shares, when sold, may

be worth more or less than their original cost. The Company’s

performance is subject to change since the end of the period noted

in this report and may be lower or higher than the performance data

shown herein.

About MidCap Financial Investment

Corporation

MidCap Financial Investment Corporation (NASDAQ:

MFIC) is a closed-end, externally managed, diversified management

investment company that has elected to be treated as a business

development company (“BDC”) under the Investment Company Act of

1940 (the “1940 Act”). For tax purposes, the Company has elected to

be treated as a regulated investment company (“RIC”) under

Subchapter M of the Internal Revenue Code of 1986, as amended (the

“Code”). The Company is externally managed by Apollo Investment

Management, L.P. (the “MFIC Adviser”), an affiliate of Apollo

Global Management, Inc. and its consolidated subsidiaries

(“Apollo”), a high-growth global alternative asset manager. The

Company’s investment objective is to generate current income and,

to a lesser extent, long-term capital appreciation. The Company

primarily invests in directly originated and privately negotiated

first lien senior secured loans to privately held U.S.

middle-market companies, which the Company generally defines as

companies with less than $75 million in EBITDA, as may be adjusted

for market disruptions, mergers and acquisitions-related charges

and synergies, and other items. To a lesser extent, the Company may

invest in other types of securities including, first lien

unitranche, second lien senior secured, unsecured, subordinated,

and mezzanine loans, and equities in both private and public middle

market companies. For more information, please visit

www.midcapfinancialic.com.

About Apollo Senior Floating Rate Fund

Inc.

Apollo Senior Floating Rate Fund Inc. (NYSE:

AFT) is registered under the 1940 Act as a diversified closed-end

management investment company. AFT’s investment objective is to

seek current income and preservation of capital by investing

primarily in senior, secured loans made to companies whose debt is

rated below investment grade and investments with similar economic

characteristics. Senior loans typically hold a first lien priority

and pay floating rates of interest, generally quoted as a spread

over a reference floating rate benchmark. Under normal market

conditions, AFT invests at least 80% of its managed assets (which

includes leverage) in floating rate senior loans and investments

with similar economic characteristics. Apollo Credit Management,

LLC, an affiliate of Apollo, serves as AFT’s investment adviser.

For tax purposes, AFT has elected to be treated as a RIC under the

Code. For more information, please visit

www.apollofunds.com/apollo-senior-floating-rate-fund.

About Apollo Tactical Income Fund

Inc.

Apollo Tactical Income Fund Inc. (NYSE: AIF) is

registered under the 1940 Act as a diversified closed-end

management investment company. AIF’s primary investment objective

is to seek current income with a secondary objective of

preservation of capital by investing in a portfolio of senior

loans, corporate bonds and other credit instruments of varying

maturities. AIF seeks to generate current income and preservation

of capital primarily by allocating assets among different types of

credit instruments based on absolute and relative value

considerations. Under normal market conditions, AIF invests at

least 80% of its managed assets (which includes leverage) in credit

instruments and investments with similar economic characteristics.

Apollo Credit Management, LLC, an affiliate of Apollo, serves as

AIF’s investment adviser. For tax purposes, AIF has elected to be

treated as a RIC under the Code. For more information, please visit

www.apollofunds.com/apollo-tactical-income-fund.

Forward-Looking Statements

Some of the statements in this press release

constitute forward-looking statements because they relate to future

events, future performance or financial condition. The

forward-looking statements may include statements as to: future

operating results of MFIC, AFT and AIF, and distribution

projections; business prospects of MFIC, AFT and AIF, and the

prospects of their portfolio companies, if applicable; and the

impact of the investments that MFIC, AFT and AIF expect to make. In

addition, words such as “anticipate,” “believe,” “expect,” “seek,”

“plan,” “should,” “estimate,” “project” and “intend” indicate

forward-looking statements, although not all forward-looking

statements include these words. The forward-looking statements

contained in this press release involve risks and uncertainties.

Certain factors could cause actual results and conditions to differ

materially from those projected, including the uncertainties

associated with (i) the ability of the parties to consummate one or

both of the Mergers contemplated by the Agreement and Plan of

Merger among MFIC, AFT and certain other parties thereto and the

Agreement and Plan of Merger among MFIC, AIF and certain other

parties thereto on the expected timeline, or at all; (ii) the

expected synergies and savings associated with the Mergers; (iii)

the ability to realize the anticipated benefits of the Mergers,

including the expected elimination of certain expenses and costs

due to the Mergers; (iv) the percentage of the stockholders of

MFIC, AFT and AIF voting in favor of the applicable Proposals (as

defined below); (v) the possibility that competing offers or

acquisition proposals will be made; (vi) the possibility that any

or all of the various conditions to the consummation of the Mergers

may not be satisfied or waived; (vii) risks related to diverting

management’s attention from ongoing business operations; (viii) the

combined company’s plans, expectations, objectives and intentions,

as a result of the Mergers; (ix) any potential termination of one

or both merger agreements; (x) the future operating results and net

investment income projections of MFIC, AFT and AIF or, following

the closing of one or both of the Mergers, the combined company;

(xi) the ability of MFIC Adviser to implement MFIC Adviser’s future

plans with respect to the combined company; (xii) the ability of

MFIC Adviser and its affiliates to attract and retain highly

talented professionals; (xiii) the business prospects of MFIC, AFT

and AIF or, following the closing of one or both of the Mergers,

the combined company and the prospects of their portfolio

companies; (xiv) the impact of the investments that MFIC, AFT and

AIF or, following the closing of one or both of the Mergers, the

combined company expect to make; (xv) the ability of the portfolio

companies of MFIC, AFT and AIF or, following the closing of one or

both of the Mergers, the combined company to achieve their

objectives; (xvi) the expected financings and investments and

additional leverage that MFIC, AFT and AIF or, following the

closing of one or both of the Mergers, the combined company may

seek to incur in the future; (xvii) the adequacy of the cash

resources and working capital of MFIC, AFT and AIF or, following

the closing of one or both of the Mergers, the combined company;

(xviii) the timing of cash flows, if any, from the operations of

the portfolio companies of MFIC, AFT and AIF or, following the

closing of one or both of the Mergers, the combined company; (xix)

future changes in laws or regulations (including the interpretation

of these laws and regulations by regulatory authorities); and (xx)

the risk that stockholder litigation in connection with one or both

of the Mergers may result in significant costs of defense and

liability. MFIC, AFT and AIF have based the forward-looking

statements included in this press release on information available

to them on the date hereof, and they assume no obligation to update

any such forward-looking statements. Although MFIC, AFT and AIF

undertake no obligation to revise or update any forward-looking

statements, whether as a result of new information, future events

or otherwise, you are advised to consult any additional disclosures

that they may make directly to you or through reports that MFIC,

AFT, and/or AIF in the future may file with the SEC, including the

Joint Proxy Statement and the Registration Statement (in each case,

as defined below), annual reports on Form 10-K, annual reports on

Form N-CSR, quarterly reports on Form 10-Q, semi-annual reports on

Form N-CSRS and current reports on Form 8-K.

No Offer or Solicitation

This press release is not, and under no

circumstances is it to be construed as, a prospectus or an

advertisement and the communication of this press release is not,

and under no circumstances is it to be construed as, an offer to

sell or a solicitation of an offer to purchase any securities in

MFIC, AFT and AIF or in any fund or other investment vehicle

managed by Apollo or any of its affiliates.

Additional Information and Where to Find

It

This press release relates to the proposed

Mergers and certain related matters (the “Proposals”). In

connection with the Proposals, MFIC, AFT, and AIF filed with the

SEC and mailed to their respective stockholders a joint proxy

statement on Schedule 14A (the “Joint Proxy Statement”), and MFIC

filed with the SEC a registration statement that includes the Joint

Proxy Statement and a prospectus of MFIC (the “Registration

Statement”). The Joint Proxy Statement and the Registration

Statement each contains important information about MFIC, AFT and

AIF and the Proposals. This communication does not constitute an

offer to sell or the solicitation of an offer to buy any securities

or a solicitation of any vote or approval. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

STOCKHOLDERS OF MFIC, AFT, AND AIF ARE URGED TO READ THE

JOINT PROXY STATEMENT AND REGISTRATION STATEMENT, AND OTHER

DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS

ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT MFIC, AFT, AND AIF AND THE

PROPOSALS. Investors and security holders will be able to

obtain the documents filed with the SEC free of charge at the SEC’s

website, http://www.sec.gov or, for documents filed by MFIC, from

MFIC’s website at https://www.midcapfinancialic.com, and, for

documents filed by AFT, from AFT’s website at

https://www.apollofunds.com/apollo-senior-floating-rate-fund, and,

for documents filed by AIF, from AIF’s website at

https://www.apollofunds.com/apollo-tactical-income-fund.

Participants in the

Solicitation

MFIC, its directors, certain of its executive

officers and certain employees and officers of MFIC Adviser and its

affiliates may be deemed to be participants in the solicitation of

proxies in connection with the Proposals. Information about the

directors and executive officers of MFIC is set forth in its proxy

statement for its 2024 Annual Meeting of Stockholders, which was

filed with the SEC on April 29, 2024. AFT, AIF, their directors,

certain of their executive officers and certain employees and

officers of Apollo Credit Management, LLC and its affiliates may be

deemed to be participants in the solicitation of proxies in

connection with the Proposals. Information about the directors and

executive officers of AFT and AIF is set forth in the proxy

statement for their 2024 Annual Meeting of Stockholders, which will

be filed with the SEC on May 8, 2024. Information regarding the

persons who may, under the rules of the SEC, be considered

participants in the solicitation of the MFIC, AFT, and AIF

stockholders in connection with the Proposals is contained in the

Joint Proxy Statement. These documents may be obtained free of

charge from the sources indicated above.

Contact

Elizabeth BesenInvestor Relations ManagerMidCap

Financial Investment Corporation212.822.0625ebesen@apollo.com

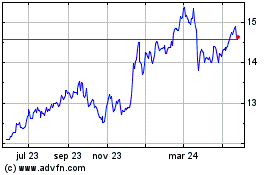

Apollo Tactical Income (NYSE:AIF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

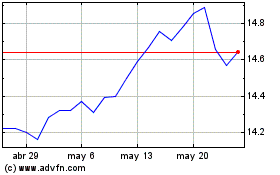

Apollo Tactical Income (NYSE:AIF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025