Today, the BlackRock closed-end funds listed below (each a

“Fund,” and collectively the “Funds”) have announced changes to

their monthly distribution amounts per share under their managed

distribution plans (each, a “Plan”), as applicable, and declared

their December distributions early. Each Fund has adopted a Plan to

support a level monthly distribution of income, capital gains

and/or return of capital.

The Funds’ monthly distribution rates for December can be found

below:

Key Dates:

Declaration- 11/22/2024 Ex- 12/16/2024 Record- 12/16/2024

Payable- 12/23/2024

Fund *

Ticker

Distribution

Change From Prior

Distribution ($)

Change From Prior

Distribution (%)

BlackRock Enhanced Capital and

Income Fund, Inc.

CII

$0.141000

$0.041500

42%

BlackRock Enhanced Equity

Dividend Trust

BDJ

$0.061900

$0.005700

10%

BlackRock Enhanced Global

Dividend Trust

BOE

$0.082700

$0.019700

31%

BlackRock Enhanced International

Dividend Trust

BGY

$0.042600

$0.008800

26%

BlackRock Health Sciences

Trust

BME

$0.262100

$0.049100

23%

BlackRock Energy and Resources

Trust

BGR

$0.097300

$0.021900

29%

BlackRock Resources &

Commodities Strategy Trust

BCX

$0.069700

$0.017900

35%

BlackRock Utilities,

Infrastructure & Power Opportunities Trust

BUI

$0.136000

$0.015000

12%

BlackRock Science and Technology

Trust

BST

$0.250000

-

-

* In order to comply with the requirements of Section 19 of the

Investment Company Act of 1940, as amended (the “1940 Act”), each

of the Funds above posted to the DTC bulletin board and sent to its

shareholders of record as of the applicable record date a Section

19 notice with the previous distribution payment. The Section 19

notice was provided for informational purposes only and not for tax

reporting purposes. This information can be found in the

“Closed-End Funds” section of www.blackrock.com. As

applicable, the final determination of the source and tax

characteristics of all distributions in 2024 will be made after the

end of the year.

The fixed amounts distributed per share are subject to change

at the discretion of each Fund’s Board of Directors/Trustees.

Under its Plan, each Fund will distribute all available investment

income to its shareholders, consistent with its investment

objectives and as required by the Internal Revenue Code of 1986, as

amended (the “Code”). If sufficient income (inclusive of net

investment income and short-term capital gains) is not available on

a monthly basis, a Fund will distribute long-term capital gains

and/or return capital to its shareholders in order to maintain a

level distribution.

The Funds’ estimated sources of the distributions paid as of

October 31, 2024 and for their current fiscal year are as

follows:

Estimated Allocations as of

October 31, 2024

Fund

Distribution

Net Income

Net Realized Short-Term Gains

Net Realized Long-Term Gains

Return of Capital

CII

$0.099500

$0 (0%)

$0 (0%)

$0.099500 (100%)

$0 (0%)

BDJ

$0.056200

$0.017422 (31%)

$0 (0%)

$0.038778 (69%)

$0 (0%)

BOE1

$0.063000

$0.014884 (24%)

$0 (0%)

$0 (0%)

$0.048116 (76%)

BGY1

$0.033800

$0.003015 (9%)

$0 (0%)

$0.030785 (91%)

$0 (0%)

BME1

$0.213000

$0 (0%)

$0 (0%)

$0.213000 (100%)

$0 (0%)

BGR1

$0.075400

$0.015903 (21%)

$0 (0%)

$0 (0%)

$0.059497 (79%)

BCX1

$0.051800

$0.011095 (21%)

$0 (0%)

$0 (0%)

$0.040705 (79%)

BUI1

$0.121000

$0.001188 (1%)

$0 (0%)

$0.060793 (50%)

$0.059019 (49%)

BST

$0.250000

$0 (0%)

$0 (0%)

$0.250000 (100%)

$0 (0%)

Estimated Allocations for the

Fiscal Year through October 31, 2024

Fund

Distribution

Net Income

Net Realized Short-Term Gains

Net Realized Long-Term Gains

Return of Capital

CII

$0.995000

$0.059966 (6%)

$0 (0%)

$0.935034 (94%)

$0 (0%)

BDJ

$0.562000

$0.329298 (59%)

$0 (0%)

$0.232702 (41%)

$0 (0%)

BOE1

$0.630000

$0.170921 (27%)

$0 (0%)

$0 (0%)

$0.459079 (73%)

BGY1

$0.338000

$0.085258 (25%)

$0.023488 (7%)

$0.207532 (62%)

$0.021722 (6%)

BME1

$2.130000

$0.077558 (4%)

$0 (0%)

$0.890031 (42%)

$1.162411 (54%)

BGR1

$0.666700

$0.263985 (40%)

$0 (0%)

$0 (0%)

$0.402715 (60%)

BCX1

$0.518000

$0.199609 (39%)

$0 (0%)

$0 (0%)

$0.318391 (61%)

BUI1

$1.210000

$0.253187 (21%)

$0 (0%)

$0.627127 (52%)

$0.329686 (27%)

BST

$2.500000

$0 (0%)

$0 (0%)

$2.500000 (100%)

$0 (0%)

1The Fund estimates that it has distributed more than its income

and net-realized capital gains in the current fiscal year;

therefore, a portion of your distribution may be a return of

capital. A return of capital may occur, for example, when some or

all of the shareholder’s investment is paid back to the

shareholder. A return of capital distribution does not necessarily

reflect the Fund's investment performance and should not be

confused with ‘yield’ or ‘income’. When distributions exceed total

return performance, the difference will reduce the Fund’s net asset

value per share.

The amounts and sources of distributions reported are only

estimates and are being provided to you pursuant to regulatory

requirements and are not being provided for tax reporting purposes.

The actual amounts and sources of the amounts for tax reporting

purposes will depend upon each Fund’s investment experience during

the remainder of its fiscal year and may be subject to changes

based on tax regulations. The Fund will send you a Form 1099-DIV

for the calendar year that will tell you how to report these

distributions for federal income tax purposes.

Fund Performance and

Distribution Rate Information:

Fund

Average annual total return (in

relation to NAV) for the 5-year period ending on 9/30/2024

Annualized current distribution

rate expressed as a percentage of NAV as of 9/30/2024

Cumulative total return (in

relation to NAV) for the fiscal year through 9/30/2024

Cumulative fiscal year

distributions as a percentage of NAV as of 9/30/2024

CII

12.91%

5.54%

13.90%

4.16%

BDJ

9.41%

7.14%

13.76%

5.36%

BOE

9.36%

5.93%

13.91%

4.45%

BGY

9.07%

6.21%

11.08%

4.66%

BME

10.37%

5.65%

12.22%

4.24%

BGR

10.01%

6.34%

5.69%

4.14%

BCX

11.53%

5.81%

6.53%

4.36%

BUI

9.80%

5.94%

13.80%

4.46%

BST

13.30%

7.94%

15.86%

5.96%

Shareholders should not draw any conclusions about a Fund’s

investment performance from the amount of the Fund’s current

distributions or from the terms of the Fund’s Plan.

The amount distributed per share under a Plan is subject to

change at the discretion each Fund’s Board. Each Plan will be

subject to ongoing review by the Board to determine whether the

Plan should be continued, modified or terminated. The Board may

amend the terms of a Plan or suspend or terminate a Plan at any

time without prior notice to the Fund’s shareholders if it deems

such actions to be in the best interest of the Fund or its

shareholders. The amendment or termination of a Plan could have an

adverse effect on the market price of the Fund's shares.

About BlackRock

BlackRock’s purpose is to help more and more people experience

financial well-being. As a fiduciary to investors and a leading

provider of financial technology, we help millions of people build

savings that serve them throughout their lives by making investing

easier and more affordable. For additional information on

BlackRock, please visit www.blackrock.com/corporate

Availability of Fund Updates

BlackRock will update performance and certain other data for the

Funds on a monthly basis on its website in the “Closed-end Funds”

section of www.blackrock.com as well as certain other material

information as necessary from time to time. Investors and others

are advised to check the website for updated performance

information and the release of other material information about the

Funds. This reference to BlackRock’s website is intended to allow

investors public access to information regarding the Funds and does

not, and is not intended to, incorporate BlackRock’s website in

this release.

Forward-Looking Statements

This press release, and other statements that BlackRock or a

Fund may make, may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act, with

respect to a Fund’s or BlackRock’s future financial or business

performance, strategies or expectations. Forward-looking statements

are typically identified by words or phrases such as “trend,”

“potential,” “opportunity,” “pipeline,” “believe,” “comfortable,”

“expect,” “anticipate,” “current,” “intention,” “estimate,”

“position,” “assume,” “outlook,” “continue,” “remain,” “maintain,”

“sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may”

or similar expressions.

BlackRock cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and BlackRock assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

With respect to the Funds, the following factors, among others,

could cause actual events to differ materially from forward-looking

statements or historical performance: (1) changes and volatility in

political, economic or industry conditions, the interest rate

environment, foreign exchange rates or financial and capital

markets, which could result in changes in demand for the Funds or

in a Fund’s net asset value; (2) the relative and absolute

investment performance of a Fund and its investments; (3) the

impact of increased competition; (4) the unfavorable resolution of

any legal proceedings; (5) the extent and timing of any

distributions or share repurchases; (6) the impact, extent and

timing of technological changes; (7) the impact of legislative and

regulatory actions and reforms, and regulatory, supervisory or

enforcement actions of government agencies relating to a Fund or

BlackRock, as applicable; (8) terrorist activities, international

hostilities, health epidemics and/or pandemics and natural

disasters, which may adversely affect the general economy, domestic

and local financial and capital markets, specific industries or

BlackRock; (9) BlackRock’s ability to attract and retain highly

talented professionals; (10) the impact of BlackRock electing to

provide support to its products from time to time; and (11) the

impact of problems at other financial institutions or the failure

or negative performance of products at other financial

institutions.

Annual and Semi-Annual Reports and other regulatory filings of

the Funds with the Securities and Exchange Commission (“SEC”) are

accessible on the SEC's website at www.sec.gov and on

BlackRock’s website at www.blackrock.com, and may discuss

these or other factors that affect the Funds. The information

contained on BlackRock’s website is not a part of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122587141/en/

1-800-882-0052

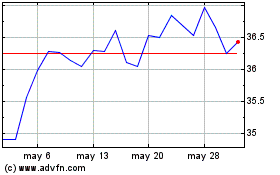

BlackRock Science and Te... (NYSE:BST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

BlackRock Science and Te... (NYSE:BST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024