Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

18 Mayo 2022 - 4:20PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-260150

CITIZENS FINANCIAL GROUP, INC.

$400,000,000 5.641% FIXED-RESET SUBORDINATED NOTES DUE 2037

PRICING TERM SHEET DATED MAY 18, 2022

The following information relates to Citizens Financial Group, Inc.’s offering of its 5.641% Fixed-Reset Subordinated Notes due 2037

and should be read together with the preliminary prospectus supplement dated May 18, 2022 and the accompanying prospectus dated October 8, 2021 (collectively, the “Preliminary Prospectus”), including the documents incorporated by

reference therein. This information supersedes the information in the Preliminary Prospectus to the extent it is inconsistent with the information in the Preliminary Prospectus.

|

|

|

| Issuer: |

|

Citizens Financial Group, Inc. |

|

|

| Expected Ratings / Outlook*: |

|

NR / BBB (Stable) / BBB (Positive) (Moody’s / S&P / Fitch) |

|

|

| Ranking: |

|

Subordinated |

|

|

| Securities: |

|

5.641% Fixed-Reset Subordinated Notes due May 21, 2037 (the “Notes”) |

|

|

| Format: |

|

SEC Registered |

|

|

| Aggregate Principal Amount: |

|

$400,000,000 |

|

|

| Issue Price: |

|

100% |

|

|

| Underwriters’ Commission: |

|

0.450% |

|

|

| All-in Price to Issuer: |

|

99.550% |

|

|

| Net Proceeds to Issuer (after commissions, before expenses): |

|

$398,200,000 |

|

|

| Authorized Denominations: |

|

$2,000 x $1,000 |

|

|

| Trade Date: |

|

May 18, 2022 |

|

|

| Settlement Date**: |

|

May 23, 2022 (T+3) |

|

|

| Maturity Date: |

|

May 21, 2037 |

|

|

| Benchmark: |

|

2.875% Treasury due May 15, 2032 |

|

|

| Benchmark Price & Yield: |

|

99-27; 2.891% |

|

|

| Spread: |

|

+ 275 bps |

|

|

|

| Re-Offer Yield: |

|

5.641% |

|

|

| Coupon: |

|

From the original issue date to, but excluding, May 21, 2032 (the “Reset Date”), 5.641%, and from, and including, the Reset Date to, but excluding, the Maturity Date, at a rate equal to the Five- year U.S. Treasury

Rate (as defined in the Preliminary Prospectus) as of the Reset Determination Date (as defined in the Preliminary Prospectus) plus 2.75%. |

|

|

| Interest Payment Dates: |

|

Semi-annually on May 21 and November 21, beginning on November 21, 2022. |

|

|

| Optional Redemption: |

|

Prior to May 21, 2032, the Notes may not be redeemed.

The Notes may be redeemed, (a) in whole, but not in part, on the Reset Date, (b) in whole or in part, at any time or from time to time, on or after

November 22, 2036 (the date that is 180 days prior to the scheduled Maturity Date of the Notes) or (c) in whole, but not in part, at any time within 90 days following a Regulatory Capital Treatment Event (as defined in the Preliminary

Prospectus), in each case at a redemption price equal to 100% of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest thereon to, but excluding, the redemption date. |

|

|

| Concurrent Unregistered Offering: |

|

In a concurrent unregistered offering, our subsidiary Citizens Bank, N.A. is offering $650,000,000 aggregate principal amount of its 4.119% Fixed/Floating Rate Senior Notes due 2025 (the “Bank Notes”). The Bank Notes are

being offered pursuant to Section 16.6 of the regulations of the Office of the Comptroller of the Currency and an exemption provided in Section 3(a)(2) of the Securities Act of 1933, as amended, and are not being offered hereby. |

|

|

| Day Count Convention: |

|

30/360 |

|

|

| CUSIP: |

|

174610 BE4 |

|

|

| ISIN: |

|

US174610BE40 |

|

|

| Listing: |

|

None |

|

|

| Book-Running Managers: |

|

BofA Securities, Inc. |

|

|

Goldman Sachs & Co. LLC |

|

|

J.P. Morgan Securities LLC |

|

|

Morgan Stanley & Co. LLC |

|

|

Citizens Capital Markets, Inc. |

|

|

| Co-Managers: |

|

Barclays Capital Inc. |

|

|

Credit Suisse Securities (USA) LLC |

|

|

Wells Fargo Securities, LLC |

| * |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or

withdrawal at any time. |

| ** |

It is expected that delivery of the Notes will be made against payment therefor on or about May 23, 2022,

which will be the third business day following the date hereof (this settlement cycle being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary

market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes on any day prior to two business days before delivery will be required to

specify alternative settlement arrangements at the time of any such trade to prevent a failed settlement and should consult their own advisors |

The Issuer has filed a registration statement (including the Preliminary Prospectus) with the SEC for the

offering to which this communication relates. Before you invest, you should read the Preliminary Prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and the

offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the Preliminary Prospectus if you

request it by contacting BofA Securities, Inc. at 1-800-294-1322, Goldman Sachs & Co. LLC at 1-866-471-2526, J.P. Morgan Securities LLC collect at 1-212-834-4533, Morgan Stanley & Co. LLC toll-free at 1-866-718-1649 and

Citizens Capital Markets, Inc. at 1-203-900-6763.

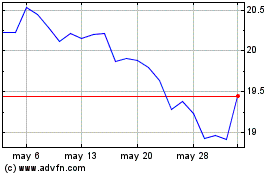

Citizens Financial (NYSE:CFG-E)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Citizens Financial (NYSE:CFG-E)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024