0001227654false00012276542024-08-122024-08-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2024

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-31921 | 36-3972986 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(Address of principal executive offices)

(913) 344-9200

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On August 12, 2024, Compass Minerals International, Inc. (the “Company”) entered into an amendment no. 2 (the “Credit Agreement Amendment”) to the credit agreement dated as of April 20, 2016 (as amended and restated as of November 26, 2019, as further amended and restated as of May 5, 2023 and as further amended as of March 27, 2024, the “Credit Agreement”) among the Company, Compass Minerals Canada Corp., Compass Minerals UK Limited, the other loan parties party thereto, JPMorgan Chase Bank, N.A., as administrative agent and the lenders from time to time party thereto.

The Credit Agreement Amendment extends the deadline under Section 5.01(b) of the Credit Agreement with respect to delivery of the Company’s financial statements for the quarter ended June 30, 2024, together with the accompanying compliance certificate, to September 13, 2024, 75 days after the last day of the quarter ended June 30, 2024.

The foregoing description of the Credit Agreement Amendment is qualified in its entirety by reference to the full text of the Credit Agreement Amendment, which is filed as exhibit 10.1 hereto and incorporated herein by reference. Capitalized terms used but not defined herein have the meanings ascribed to them in the Credit Agreement Amendment.

On August 12, 2024, Compass Minerals America Inc., Compass Minerals Receivables LLC and PNC Bank National Association (collectively, the “Receivables Financing Agreement Parties”) entered into a fourth amendment (the “Receivables Facility Amendment”) to the receivables financing agreement dated as of June 30, 2020, among the Receivables Financing Agreement Parties (as previously amended, the “Receivables Financing Agreement”).

The Receivables Facility Amendment extends the deadline under Section 8.01(c)(iv) of the Receivables Financing Agreement with respect to delivery of the of the Company’s financial statements for the quarter ended June 30, 2024, together with the accompanying compliance certificate, to September 13, 2024, 75 days after the last day of the quarter ended June 30, 2024.

The foregoing description of the Financing Facility Amendment is qualified in its entirety by reference to the full text of the Financing Facility Amendment, which is filed as exhibit 10.2 hereto and incorporated herein by reference. Capitalized terms used but not defined herein have the meanings ascribed to them in the Financing Facility Amendment.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On August 15, 2024, the Company received written notice from the New York Stock Exchange (the “Exchange”) that the Company is not in compliance with the Exchange’s continued listing standards as set forth in Section 802.01E of the NYSE Listed Company Manual as a result of the Company’s failure to timely file (the “Filing Delinquency”) its Form 10-Q for the period ended June 30, 2024 (the “Report”) prior to August 14, 2024, the end of the extension period provided by Rule 12b-25 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Filing Delinquency will be cured via the filing of the Report.

The Filing Delinquency has no immediate effect on the listing of the Company’s common stock on the Exchange. The Company plans to avail itself of the process provided by the Exchange to regain compliance. The Company is working diligently to file the Report as soon as possible.

As previously disclosed in the Company’s Notification of Late Filing on Form 12b-25 filed with the Securities and Exchange Commission (the “SEC”) on August 9, 2024, the Company was unable to file the Report within the prescribed time period without unreasonable effort or expense as a result of pending restatements of its (i) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, (ii) audited financial statements included in its Annual Report on Form 10-K for the period ended Sept. 30, 2023, (iii) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended Dec. 31, 2023 and (iv) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024.

Item 7.01 Regulation FD Disclosure.

On August 16, 2024, the Company issued a press release discussing the matters disclosed in Item 3.01 above. A copy of this press release is being furnished as Exhibit 99.1 and incorporated by reference herein.

The information contained in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Exhibit Description |

| | Amendment No. 2, dated August 12, 2024, to the Credit Agreement dated as of April 20, 2016 as amended and restated as of November 26, 2019, as further amended and restated as of May 5, 2023 and as further amended as of March 27, 2024, among Compass Mineral International, Inc., Compass Minerals Canada Corp., Compass Minerals UK Limited, JPMorgan Chase Bank, N.A., as administrative agent and the lenders from time to time party thereto. |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| | |

Date: August 16, 2024 | By: | /s/ Jeffrey Cathey |

| | Name: Jeffrey Cathey |

| | Title: Chief Financial Officer |

| | |

AMENDMENT NO. 2 dated as of August 12, 2024 (this “Amendment”), to the CREDIT AGREEMENT dated as of April 20, 2016, as amended and restated as of November 26, 2019, as further amended and restated as of May 5, 2023 (as further amended, supplemented or otherwise modified from time to time, the “Credit Agreement”), among COMPASS MINERALS INTERNATIONAL, INC., a Delaware corporation (the “US Borrower”), COMPASS MINERALS CANADA CORP., a corporation continued and amalgamated under the laws of the province of Nova Scotia, Canada (the “Canadian Borrower”), COMPASS MINERALS UK LIMITED, a company incorporated under the laws of England and Wales (the “UK Borrower” and, together with the US Borrower and the Canadian Borrower, the “Borrowers”), the other LOAN PARTIES party hereto, the several banks and other financial institutions or entities from time to time party thereto (the “Lenders”) and JPMORGAN CHASE BANK, N.A., as administrative agent for the Lenders and as collateral agent for the Secured Parties. Capitalized terms used in this Amendment but not otherwise defined shall have the meanings assigned to such terms in the Credit Agreement.

WHEREAS pursuant to the Credit Agreement, the Lenders have agreed to extend credit to the Borrowers on the terms and subject to the conditions set forth therein;

WHEREAS the Borrowers have requested that the Lenders extend the deadline for satisfaction by the Borrowers of the requirements to deliver, no later than 45 days after the last day of the fiscal quarter of the US Borrower ended June 30, 2024 (the “Affected Fiscal Quarter”), (x) financial statements in accordance with Section 5.01(b) of the Credit Agreement and (y) a Compliance Certificate in accordance with Section 5.02(b) of the Credit Agreement (clauses (x) and (y), collectively, the “Delivery Requirements”), in each case solely in respect of the Affected Fiscal Quarter, by 30 days to the date that is 75 days after the last day of the Affected Fiscal Quarter; and

WHEREAS the Required Lenders are willing to so extend the Delivery Requirements in respect of the Affected Fiscal Quarter on the terms and subject to the conditions set forth herein.

NOW, THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the sufficiency and receipt of which are hereby acknowledged, and subject to the conditions set forth herein, the parties hereto hereby agree as follows:

SECTION 1. Amendment. Effective as of the Amendment Effective Date (as defined below), Section 5.01(b) of the Credit Agreement is hereby amended by inserting the following text immediately after the text “45 days” in such Section: “(or, solely in the case of the fiscal quarter of the US Borrower ended June 30, 2024, 75 days)”.

SECTION 2. Representations and Warranties. Each Loan Party represents and warrants to the Administrative Agent and to each of the Lenders that this Amendment has been duly authorized, executed and delivered by an authorized officer of such Loan Party and constitutes a legal, valid and binding obligation of such Loan Party, enforceable against such Loan Party in accordance with its terms, subject to applicable bankruptcy, insolvency,

reorganization, moratorium or other similar laws affecting creditors’ rights generally, regardless of whether considered in a proceeding in equity or at law.

SECTION 3. Effectiveness. This Amendment shall become effective as of the date (the “Amendment Effective Date”):

(a)the Administrative Agent shall have received counterparts of this Amendment that, when taken together, bear the signatures of each Loan Party, the Administrative Agent and the Required Lenders;

(b)as of the Amendment Effective Date, no Default or Event of Default shall have occurred and be continuing;

(c)each representation and warranty set forth in Section 2 hereof and each other representation and warranty made by any Loan Party in or pursuant to the Loan Documents is true and correct in all material respects on and as of the Amendment Effective Date, except to the extent such representation and warranty expressly relates to an earlier date (in which case such representation and warranty is true and correct in all material respects as of such earlier date); provided that any representation and warranty that is qualified as to “materiality”, “Material Adverse Effect” or similar language is true and correct (after giving effect to any qualification therein) in all respects on such respective dates; and

(d)the fees and expenses required to be paid pursuant to Section 7 hereof shall have been paid on or substantially simultaneously with (but in no event later than) the Amendment Effective Date.

SECTION 4. Credit Agreement. Except as expressly set forth herein, this Amendment (a) shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders, the Administrative Agent, any Borrower or any other Loan Party under the Credit Agreement or any other Loan Document and (b) shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Nothing herein shall be deemed to entitle any Borrower or any other Loan Party to any future consent to, or waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other Loan Document in similar or different circumstances. After the date hereof, any reference in the Loan Documents to the Credit Agreement shall mean the Credit Agreement as modified hereby. This Amendment shall constitute a “Loan Document” for all purposes of the Credit Agreement and the other Loan Documents.

SECTION 5. Applicable Law; Submission to Jurisdiction and Waivers; Waiver of Jury Trial.

(a)THIS AMENDMENT AND ANY DISPUTE, CLAIM OR CONTROVERSY ARISING OUT OF OR RELATING TO THIS AMENDMENT (WHETHER ARISING IN CONTRACT, TORT OR OTHERWISE) SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO CONFLICTS OF LAW RULES THAT WOULD RESULT IN THE APPLICATION OF A DIFFERENT GOVERNING LAW.

(b)EACH PARTY HERETO HEREBY AGREES AS SET FORTH IN SECTIONS 9.13 AND 9.16 OF THE CREDIT AGREEMENT AS IF SUCH SECTIONS WERE SET FORTH IN FULL HEREIN.

SECTION 6. Counterparts; Electronic Execution; Amendment. This Amendment may be executed by one or more of the parties to this Amendment on any number of separate counterparts (including by facsimile or other electronic means), and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment that is an Electronic Signature transmitted by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page shall be effective as delivery of a manually executed counterpart of this Amendment. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment shall be deemed to include Electronic Signatures, deliveries or the keeping of records in any electronic form (including deliveries by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page), each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be; provided that (a) the Administrative Agent and each of the Lenders shall be entitled to rely on such Electronic Signature purportedly given by or on behalf of any Borrower or any other Loan Party without further verification thereof and without any obligation to review the appearance or form of any such Electronic Signature and (b) upon the request of the Administrative Agent or any Lender, any Electronic Signature shall be promptly followed by a manually executed counterpart. Without limiting the generality of the foregoing, each Loan Party party hereto hereby (i) agrees that, for all purposes, including in connection with any workout, restructuring, enforcement of remedies, bankruptcy proceedings or litigation among the Administrative Agent, the Lenders and the Loan Parties, Electronic Signatures transmitted by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page and/or any electronic images of this Amendment shall have the same legal effect, validity and enforceability as any paper original, (ii) the Administrative Agent and each of the Lenders may, at its option, create one or more copies of this Amendment in the form of an imaged electronic record in any format, which shall be deemed created in the ordinary course of such Person’s business, and destroy the original paper document (and all such electronic records shall be considered an original for all purposes and shall have the same legal effect, validity and enforceability as a paper record), (iii) waives any argument, defense or right to contest the legal effect, validity or enforceability of this Amendment based solely on the lack of paper original copies of this Amendment, including with respect to any signature pages thereto and (iv) waives any claim against the Administrative Agent, any Issuing Bank, any Lender or any Related Party of any of the foregoing Persons (collectively, the “Lender-Related Parties” and each, a “Lender-Related Party”) for any losses, claims (including intraparty claims), demands, damage or liabilities of any kind (collectively, “Liabilities”) arising solely from any Lender-Related Party’s reliance on or use of Electronic Signatures and/or transmissions by telecopy, emailed pdf. or any other electronic means that reproduces an image of an actual executed signature page, including any Liabilities arising as a result of the failure of any Loan Party to use any available security measures in connection with the execution, delivery or transmission of any Electronic Signature. As used herein, “Electronic Signatures” means any electronic sound, symbol or process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept such contract or record. This Amendment may not be amended nor may any provision hereof be waived except pursuant to a writing signed by each Borrower and each other Loan Party, the Administrative Agent and the Required Lenders.

SECTION 7. Fees and Expenses.

(a)The US Borrower hereby agrees to pay to JPMorgan, for its own account, such fees that have been separately agreed to by the US Borrower and JPMorgan in connection with this Amendment. The fees payable pursuant to this Section 7(a) will be paid in immediately available funds on, and subject to the occurrence of, the Amendment Effective Date and shall not be refundable.

(b)The US Borrower hereby agrees to reimburse the Administrative Agent for its reasonable out-of-pocket expenses in connection with this Amendment to the extent required under Section 9.05 of the Credit Agreement.

SECTION 8. Headings. The Section headings used in this Amendment are for convenience of reference only and are not to affect the construction hereof or be taken into consideration in the interpretation hereof.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized officers as of the day and year first written above.

| | | | | |

| COMPASS MINERALS INTERNATIONAL, INC. |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| COMPASS MINERALS CANADA CORP. |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| COMPASS MINERALS UK LIMITED |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

NAMSCO INC. COMPASS MINERALS AMERICA, INC COMPASS MINERALS LOUISIANA INC. COMPASS MINERALS USA INC. GREAT SALT LAKE HOLDINGS, LLC GSL CORPORATION COMPASS MINERALS OGDEN INC. CLYMAN BAY RESOURCES, INC. COMPASS MINERALS WINNIPEG UNLIMITED LIABILITY COMPANY CMP CANADA INC. COMPASS MINERALS NOVA SCOTIA COMPANY COMPASS RESOURCES CANADA COMPANY COMPASS CANADA POTASH HOLDINGS INC. COMPASS MINERALS WYNARD INC. COMPASS MINERALS LITHIUM CORP OF AMERICA, INC. |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| DOVE CREEK GRAZING, LLC |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| COMPASS CANADA LIMITED PARTNERSHIP |

| By: CMP Canada Inc., its General Partner |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

COMPASS MINERALS (EUROPE) LIMITED COMPASS MINERALS UK HOLDINGS LIMITED DEEPSTORE HOLDINGS LIMITED COMPASS MINERALS STORAGE & ARCHIVES LIMITED |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| NASC NOVA SCOTIA COMPANY |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| COMPASS MINERALS INTERNATIONAL LIMITED PARTNERSHIP |

| By: NASC Nova Scotia Company, as general partner |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| CMI NOVA SCOTIA COMPANY |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

| COMPASS MINERALS DO BRASIL LTDA |

| By: |

| /s/ Jeffrey Cathey |

| Name: Jeffrey Cathey |

| Title: Chief Financial Officer |

| | | | | |

JPMORGAN CHASE BANK, N.A., in its respective capacities as Administrative Agent, a Revolving Lender and a Term Lender |

| By: |

| /s/ Maria Fahey |

| Name: Maria Fahey |

| Title: Vice President |

LENDER SIGNATURE PAGE TO AMENDMENT NO. 2 TO THE CREDIT AGREEMENT DATED AS OF APRIL 20, 2016, AS AMENDED AND RESTATED AS OF NOVEMBER 26, 2019, AS FURTHER AMENDED AND RESTATED AS OF MAY 5, 2023 (AS FURTHER AMENDED, RESTATED, SUPPLEMENTED OR OTHERWISE MODIFIED FROM TIME TO TIME), AMONG COMPASS MINERALS INTERNATIONAL, INC., COMPASS MINERALS CANADA CORP., COMPASS MINERALS UK LIMITED, THE SEVERAL BANKS AND OTHER FINANCIAL INSTITUTIONS OR ENTITIES FROM TIME TO TIME PARTY THERETO AND JPMORGAN CHASE BANK, N.A., AS ADMINISTRATIVE AGENT

| | | | | |

| The Bank of Nova Scotia |

| Lender Name |

| By: |

| /s/ Dhirendra Udharamaney |

| Name: Dhirendra Udharamaney |

| Title: Director |

| | | | | |

| Commerce Bank |

| Lender Name |

| By: |

| /s/ Mike Bruening |

| Name: Mike Bruening |

| Title: Sr. Vice President |

| | | | | |

| COÖPERATIEVE RABOBANK U.A., NEW YORK BRANCH |

| Lender Name |

| By: |

| /s/ Pacella Lehane |

| Name: Pacella Lehane |

| Title: Managing Director |

| |

| /s/ Reggie Crichlow |

| Name: Reggie Crichlow |

| Title: Vice President |

| | | | | |

| ING Capital LLC |

| Lender Name |

| By: |

| /s/ Brian Gorski |

| Name: Brian Gorski |

| Title: Director |

| |

| /s/ Remco Meeuwis |

| Name: Remco Meeuwis |

| Title: Director |

| | | | | |

| Morgan Stanley Bank, N.A. |

| Lender Name |

| By: |

| /s/ Aaron McLean |

| Name: Aaron McLean |

| Title: Authorized Signatory |

| | | | | |

| PNC Bank, National Association |

| Lender Name |

| By: |

| /s/ Caleb A. Shapkoff |

| Name: Caleb A. Shapkoff |

| Title: Vice President |

| | | | | |

| Wells Fargo Bank, N.A. |

| Lender Name |

| By: |

| /s/ Megan Pridmore |

| Name: Megan Pridmore |

| Title: Director |

FOURTH AMENDMENT TO THE

RECEIVABLES FINANCING AGREEMENT

This FOURTH AMENDMENT TO THE RECEIVABLES FINANCING AGREEMENT (this “Amendment”), dated as of August 12, 2024, is entered into by and among the following parties:

(i)COMPASS MINERALS RECEIVABLES LLC, as Borrower;

(ii)PNC BANK, NATIONAL ASSOCIATION (“PNC”), as Administrative Agent and Lender; and

(iii)COMPASS MINERALS AMERICA INC., as initial Servicer.

Capitalized terms used but not otherwise defined herein (including such terms used above) have the respective meanings assigned thereto in the Receivables Financing Agreement described below.

BACKGROUND

A.The parties hereto are parties to the Receivables Financing Agreement, dated as of June 30, 2020 (as amended, restated, supplemented or otherwise modified through the date hereof, the “Receivables Financing Agreement”).

B.Concurrently herewith, the parties hereto are entering into a fee letter (the “Fee Letter”).

C.The parties hereto desire to amend the Receivables Financing Agreement as set forth herein.

NOW, THEREFORE, with the intention of being legally bound hereby, and in consideration of the mutual undertakings expressed herein, each party to this Amendment hereby agrees as follows:

SECTION 1.Amendment to the Receivables Financing Agreement. Subject to Section 3, Section 8.01(c)(iv) of the Receivables Financing Agreement is hereby amended by inserting the following text immediately after the text “45 days” in such Section: “(or, solely in the case of the fiscal quarter of the US Borrower ended June 30, 2024, 75 days)”.

SECTION 2.Representations and Warranties of the Borrower and the Servicers. The Borrower and the Servicers hereby represent and warrant to each of the parties hereto as of the date hereof as follows:

(a)Representations and Warranties. The representations and warranties made by it in the Receivables Financing Agreement and each of the other Transaction Documents to which it is a party are true and correct as of the date hereof and immediately after giving effect to this Amendment.

(b)Enforceability. The execution and delivery by it of this Amendment, and the performance of its obligations under this Amendment, the Receivables Financing Agreement (as amended hereby) and the other Transaction Documents to which it is a party are within its

organizational powers and have been duly authorized by all necessary action on its part, and this Amendment, the Receivables Financing Agreement (as amended hereby) and the other Transaction Documents to which it is a party are (assuming due authorization and execution by the other parties thereto) its valid and legally binding obligations, enforceable in accordance with its terms, except (x) the enforceability thereof may be limited by bankruptcy, insolvency, reorganization, moratorium or other similar laws from time to time in effect relating to creditors’ rights, and (y) the remedy of specific performance and injunctive and other forms of equitable relief may be subject to equitable defenses and to the discretion of the court before which any proceeding therefor may be brought.

(c)No Event of Default. No Event of Default or Unmatured Event of Default has occurred and is continuing immediately after giving effect to this Amendment, or would occur as a result of this Amendment or the transactions contemplated hereby.

SECTION 3.Effect of Amendment; Ratification. All provisions of the Receivables Financing Agreement and the other Transaction Documents, as expressly amended and modified by this Amendment, shall remain in full force and effect. After this Amendment becomes effective, all references in the Receivables Financing Agreement (or in any other Transaction Document) to “this Receivables Financing Agreement”, “this Agreement”, “hereof”, “herein” or words of similar effect referring to the Receivables Financing Agreement shall be deemed to be references to the Receivables Financing Agreement as amended by this Amendment. This Amendment shall not be deemed, either expressly or impliedly, to waive, amend or supplement any provision of the Receivables Financing Agreement other than as set forth herein. The Receivables Financing Agreement, as amended by this Amendment, is hereby ratified and confirmed in all respects.

SECTION 4.Effectiveness. This Amendment shall become effective as of the date hereof upon the Administrative Agent’s receipt of:

(a)counterparts to this Amendment executed by each of the parties hereto;

(b)counterparts to the Fee Letter executed by each of the parties thereto; and

(c)confirmation that all fees owing under the Fee Letter and the other Transaction Documents have been paid in full.

SECTION 5.Severability. Any provisions of this Amendment which are prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

SECTION 6.Transaction Document. This Amendment shall be a Transaction Document for purposes of the Receivables Financing Agreement.

SECTION 7.Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which when so executed

shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page to this Amendment by facsimile or e-mail transmission shall be effective as delivery of a manually executed counterpart hereof.

SECTION 8.GOVERNING LAW AND JURISDICTION.

(a)THIS AMENDMENT, INCLUDING THE RIGHTS AND DUTIES OF THE PARTIES HERETO, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK (INCLUDING SECTIONS 5-1401 AND 5-1402 OF THE GENERAL OBLIGATIONS LAW OF THE STATE OF NEW YORK, BUT WITHOUT REGARD TO ANY OTHER CONFLICTS OF LAW PROVISIONS THEREOF, EXCEPT TO THE EXTENT THAT THE PERFECTION, THE EFFECT OF PERFECTION OR PRIORITY OF THE INTERESTS OF ADMINISTRATIVE AGENT OR ANY LENDER IN THE COLLATERAL IS GOVERNED BY THE LAWS OF A JURISDICTION OTHER THAN THE STATE OF NEW YORK).

(b)EACH PARTY HERETO HEREBY IRREVOCABLY SUBMITS TO (I) WITH RESPECT TO THE BORROWER AND THE SERVICERS, THE EXCLUSIVE JURISDICTION, AND (II) WITH RESPECT TO EACH OF THE OTHER PARTIES HERETO, THE NON-EXCLUSIVE JURISDICTION, IN EACH CASE, OF ANY NEW YORK STATE OR FEDERAL COURT SITTING IN NEW YORK CITY, NEW YORK IN ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AMENDMENT OR ANY OTHER TRANSACTION DOCUMENT, AND EACH PARTY HERETO HEREBY IRREVOCABLY AGREES THAT ALL CLAIMS IN RESPECT OF SUCH ACTION OR PROCEEDING (I) IF BROUGHT BY THE BORROWER, THE SERVICERS OR ANY AFFILIATE THEREOF, SHALL BE HEARD AND DETERMINED, AND (II) IF BROUGHT BY ANY OTHER PARTY TO THIS AMENDMENT OR ANY OTHER TRANSACTION DOCUMENT, MAY BE HEARD AND DETERMINED, IN EACH CASE, IN SUCH NEW YORK STATE COURT OR, TO THE EXTENT PERMITTED BY LAW, IN SUCH FEDERAL COURT. NOTHING IN THIS SECTION 9 SHALL AFFECT THE RIGHT OF THE ADMINISTRATIVE AGENT OR ANY OTHER CREDIT PARTY TO BRING ANY ACTION OR PROCEEDING AGAINST THE BORROWER OR THE SERVICERS OR ANY OF THEIR RESPECTIVE PROPERTY IN THE COURTS OF OTHER JURISDICTIONS. EACH OF THE BORROWER AND THE SERVICERS HEREBY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT IT MAY EFFECTIVELY DO SO, THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING. THE PARTIES HERETO AGREE THAT A FINAL JUDGMENT IN ANY SUCH ACTION OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON THE JUDGMENT OR IN ANY OTHER MANNER PROVIDED BY LAW.

SECTION 9.Section Headings. The various headings of this Amendment are included for convenience only and shall not affect the meaning or interpretation of this Amendment, the Receivables Financing Agreement or any provision hereof or thereof.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties have executed this Amendment as of the date first written above.

| | | | | |

| COMPASS MINERALS RECEIVABLES LLC |

| By: | /s/ Jeffrey Cathey |

| Name: | Jeffrey Cathey |

| Title: | Chief Financial Officer |

| | | | | |

COMPASS MINERALS AMERICA INC., as initial Servicer |

| By: | /s/ Jeffrey Cathey |

| Name: | Jeffrey Cathey |

| Title: | Chief Financial Officer |

| | | | | |

PNC BANK, NATIONAL ASSOCIATION, as Administrative Agent and Lender |

| By: | /s/ Henry Chan |

| Name: | Henry Chan |

| Title: | Senior Vice President |

| | | | | |

PNC BANK, NATIONAL ASSOCIATION, as a Lender |

| By: | /s/ Henry Chan |

| Name: | Henry Chan |

| Title: | Senior Vice President |

FOR IMMEDIATE RELEASE

Compass Minerals Receives Notice of Filing Delinquency from

the New York Stock Exchange

OVERLAND PARK, Kan. (Aug. 16, 2024) – Compass Minerals (NYSE: CMP), a leading global provider of essential minerals, received written notice on August 15, 2024 from the New York Stock Exchange (NYSE) that, because the company has not yet filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (the Report) with the Securities and Exchange Commission (SEC), the company is not in compliance with the continued listing requirements under Section 802.01E of the NYSE Listed Company Manual (Section 802.01E), which requires NYSE-listed companies to timely file all periodic reports with the SEC.

The company’s noncompliance with Section 802.01E has no immediate effect on the listing of the company’s securities on the NYSE. Compass Minerals plans to avail itself of the process provided by the NYSE to regain compliance. The company is working diligently to file the Report as soon as possible.

As previously reported by Compass Minerals in its Notification of Late Filing on Form 12b-25, filed with the SEC on Aug. 9, 2024, the company was unable to file the Report within the prescribed time period without unreasonable effort or expense as a result of pending restatements of its (i) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, (ii) audited financial statements included in its Annual Report on Form 10-K for the period ended Sept. 30, 2023, (iii) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended Dec. 31, 2023 and (iv) unaudited financial statements included in its Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024.

About Compass Minerals

Compass Minerals (NYSE: CMP) is a leading global provider of essential minerals focused on safely delivering where and when it matters to help solve nature’s challenges for customers and communities. The company’s salt products help keep roadways safe during winter weather and are used in numerous other consumer, industrial, chemical and agricultural applications. Its plant nutrition products help improve the quality and yield of crops, while supporting sustainable agriculture. Additionally, it is working to develop a long-term fire-retardant business. Compass Minerals operates 12 production and packaging facilities with nearly 2,000 employees throughout the U.S., Canada and the U.K. Visit compassminerals.com for more information about the company and its products.

| | | | | |

| Media Contact | Investor Contact |

| Rick Axthelm | Brent Collins |

| Chief Public Affairs and Sustainability Officer | Vice President, Investor Relations |

| +1.913.344.9198 | +1.913.344.9111 |

| MediaRelations@compassminerals.com | InvestorRelations@compassminerals.com |

Cover Page

|

Aug. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 12, 2024

|

| Entity Registrant Name |

Compass Minerals International, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31921

|

| Entity Tax Identification Number |

36-3972986

|

| Entity Address, Address Line One |

9900 West 109th Street

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Overland Park

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66210

|

| City Area Code |

913

|

| Local Phone Number |

344-9200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

CMP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001227654

|

| Amendment Flag |

false

|

| Document Information [Line Items] |

|

| Document Period End Date |

Aug. 12, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

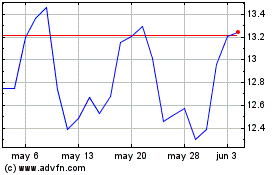

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Compass Minerals (NYSE:CMP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024