First Quarter 2024

Highlights:

- Gross premiums written of $1,514.3 million; growth of 21.6%

from the first quarter of 2023

- Combined ratio of 85.8%

- Annualized operating return on opening common equity

(“Operating ROE”) of 14.4% and operating return on average common

equity (“Operating ROAE”) of 14.0%

- Net income of $81.2 million, or $0.69 per diluted common

share and operating net income of $87.3 million, or $0.74 per

diluted common share

- Book value per diluted common share was $21.22 at March 31,

2024.

Fidelis Insurance Holdings Limited (“Fidelis” or “FIHL” or “the

Group”) (NYSE: FIHL) announced today its financial results for the

first quarter ended March 31, 2024.

Dan Burrows, Group Chief Executive Officer of Fidelis Insurance

Group, commented “2024 is off to a very strong start as we build on

our momentum from 2023 and continue capitalizing on attractive

market opportunities. In line with our expectations, we delivered

strong underwriting performance including 21.6% growth in gross

premiums written and a combined ratio of 85.8%. Additionally, we

achieved an Annualized Operating ROAE of 14.0% and grew our book

value per diluted common share to $21.22.

As we look ahead to the rest of the year, we will continue to

leverage our scale, deep relationships, and lead positioning to

further grow our business. Our fundamentals are excellent, we have

a strong pipeline of opportunities, and we are leaning in across

attractive lines where we expect to generate increased underwriting

profitability. Coupled with our proactive and disciplined approach

to investment and capital management, we believe we are well

positioned to continue delivering compelling returns through the

cycle and creating value for our shareholders.”

First Quarter Consolidated

Results

- Net income for the first quarter of 2024 was $81.2 million, or

$0.69 per diluted common share. Operating net income was $87.3

million, or $0.74 per diluted common share.

- Underwriting income for the first quarter of 2024 was $69.2

million and a combined ratio of 85.8%, compared to underwriting

income of $80.6 million and a combined ratio of 79.1% for the first

quarter of 2023.

- Net favorable prior year loss reserve development for the first

quarter of 2024 was $67.0 million compared to $2.1 million in the

prior year period.

- Net investment income for the first quarter of 2024 was $41.0

million compared to $20.4 million in the prior year period.

Purchased $428.7 million of fixed income securities at an average

yield of 4.9% compared to sales of $201.2 million at an average

yield of 0.9%.

- Operating ROE of 3.6%, or 14.4% annualized, in the quarter

compared to 5.2%, or 20.8% annualized in the prior year

period.

- Operating ROAE of 3.5%, or 14.0% annualized, in the quarter

compared to 5.1%, or 20.4% annualized in the prior year

period.

- Book value per diluted common share was $21.22 at March 31,

2024.

The following table details key financial indicators in

evaluating our performance for the three months ended March 31,

2024 and 2023:

Three Months Ended March

31,

2024

2023

($ in millions, except for per

share data)

Net income

$

81.2

$

1,732.6

Earnings per diluted common share

0.69

15.64

Operating net income(1)

87.3

93.7

Operating EPS(1)

0.74

0.85

Gross premiums written

1,514.3

1,245.3

Net premiums earned

488.0

386.0

Catastrophe and large losses

103.0

22.2

Net favorable prior-year reserve

development

67.0

2.1

Net investment income

41.0

20.4

Combined ratio

85.8

%

79.1

%

Operating ROE(1)

3.6

%

5.2

%

Operating ROAE(1)

3.5

%

5.1

%

(1) Operating net income, Operating EPS,

Operating ROE and Operating ROAE are non-GAAP financial measures.

See definition and reconciliation in “Non-GAAP Financial

Measures.”

Segment Results

Specialty Segment

The following table is a summary of our Specialty segment’s

underwriting results:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Gross premiums written

$

1,034.0

$

834.1

$

199.9

Reinsurance premium ceded

(406.3

)

(341.1

)

(65.2

)

Net premiums written

627.7

493.0

134.7

Net premiums earned

352.2

266.2

86.0

Losses and loss adjustment expenses

(174.5

)

(140.7

)

(33.8

)

Policy acquisition expenses

(99.8

)

(66.3

)

(33.5

)

Underwriting income

$

77.9

$

59.2

$

18.7

Loss ratio

49.5

%

52.9

%

(3.4) pts

Policy acquisition expense ratio

28.3

%

24.9

%

3.4 pts

Underwriting ratio

77.8

%

77.8

%

0.0 pts

- For the three months ended March 31, 2024, our GPW increased

primarily driven by growth from new business and improved rates in

our Property D&F, Property and Marine lines of business.

- Our NPE increased as the quarter benefited from the earnings

from higher net premiums written in the prior year.

- Our policy acquisition expense ratio increased due to changes

in the mix of business written and ceded, and commissions earned

from reinsurance partners.

- Our underwriting ratio in the Specialty segment was flat

compared to the prior year period.

The following table is a summary of our Specialty segment’s

losses and loss adjustment expenses:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Attritional losses

$

111.0

$

91.8

$

19.2

Catastrophe and large losses

97.9

18.4

79.5

(Favorable)/adverse prior year

development

(34.4

)

30.5

(64.9

)

Losses and loss adjustment expenses

$

174.5

$

140.7

$

33.8

Loss ratio - attritional losses

31.5

%

34.5

%

(3.0) pts

Loss ratio - catastrophe and large

losses

27.8

%

6.9

%

20.9 pts

Loss ratio - prior accident years

(9.8

)%

11.5

%

(21.3) pts

Loss ratio

49.5

%

52.9

%

(3.4) pts

- For the three months ended March 31, 2024, our loss ratio in

the Specialty segment improved by 3.4 points.

- The attritional loss ratio in the three months ended March 31,

2024 improved by 3.0 points compared to the prior year period due

to a lower level of small losses in the current year period.

- The large losses in the three months ended March 31, 2024

included $51.2 million for the Baltimore Bridge collapse in our

Marine line of business together with other smaller losses in

various lines of business including Aviation and Aerospace, Marine

and Property D&F.

- The favorable prior year development for the three months ended

March 31, 2024 was driven primarily by better than expected loss

emergence in the Marine and Property D&F lines of

business.

Bespoke Segment

The following table is a summary of our Bespoke segment’s

underwriting results:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Gross premiums written

$

153.5

$

150.8

$

2.7

Reinsurance premium ceded

(100.7

)

(69.1

)

(31.6

)

Net premiums written

52.8

81.7

(28.9

)

Net premiums earned

89.9

91.2

(1.3

)

Losses and loss adjustment expenses

(23.4

)

(13.1

)

(10.3

)

Policy acquisition expenses

(30.3

)

(33.3

)

3.0

Underwriting income

$

36.2

$

44.8

$

(8.6

)

Loss ratio

26.0

%

14.4

%

11.6 pts

Policy acquisition expense ratio

33.7

%

36.5

%

(2.8) pts

Underwriting ratio

59.7

%

50.9

%

8.8 pts

- For the three months ended March 31, 2024, GPW and NPE remained

relatively consistent.

- Our policy acquisition expense ratio decreased due to changes

in the mix of business written and ceded, and commissions earned

from reinsurance partners.

- Our underwriting ratio in the Bespoke segment increased by 8.8

points from the prior year period, driven by an increase in our

loss ratio.

The following table is a summary of our Bespoke segment’s losses

and loss adjustment expenses:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Attritional losses

$

27.5

$

18.9

$

8.6

Large losses

4.2

3.0

1.2

Favorable prior year development

(8.3

)

(8.8

)

0.5

Losses and loss adjustment expenses

$

23.4

$

13.1

$

10.3

Loss ratio - attritional losses

30.5

%

20.7

%

9.8 pts

Loss ratio - large losses

4.7

%

3.3

%

1.4 pts

Loss ratio - prior accident years

(9.2

)%

(9.6

)%

0.4 pts

Loss ratio

26.0

%

14.4

%

11.6 pts

- For the three months ended March 31, 2024, our loss ratio in

the Bespoke segment increased driven by higher attritional losses

in the current year period.

- The increase in the attritional loss ratio for the three months

ended March 31, 2024 compared to the prior year period was

primarily attributable to a single loss of $5 million.

- The favorable prior year development for the three months ended

March 31, 2024 was primarily driven by better than expected loss

activity.

Reinsurance Segment

The following table is a summary of our Reinsurance segment’s

underwriting results:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Gross premiums written

$

326.8

$

260.4

$

66.4

Reinsurance premium ceded

(229.2

)

(175.4

)

(53.8

)

Net premiums written

97.6

85.0

12.6

Net premiums earned

45.9

28.6

17.3

Losses and loss adjustment expenses

15.6

(5.8

)

21.4

Policy acquisition expenses

(6.1

)

(5.4

)

(0.7

)

Underwriting income

$

55.4

$

17.4

$

38.0

Loss ratio

(34.0

)%

20.3

%

(54.3) pts

Policy acquisition expense ratio

13.3

%

18.9

%

(5.6) pts

Underwriting ratio

(20.7

)%

39.2

%

(59.9) pts

- For the three months ended March 31, 2024 GPW increased driven

by rate increases as well as new business, while NPE increased

driven by earnings from higher net premiums written in the current

year period.

- For the three months ended March 31, 2024, our policy

acquisition expense ratio decreased due to changes in the mix of

business written and ceded, and commissions earned from reinsurance

partners.

- For the three months ended March 31, 2024, our underwriting

ratio in the Reinsurance segment improved by 59.9 points from the

prior year period, primarily driven by a decrease in our loss

ratio.

The following table is a summary of our Reinsurance segment’s

losses and loss adjustment expenses:

Three Months Ended March

31,

2024

2023

Change

($ in millions)

Attritional losses

$

7.8

$

28.8

$

(21.0

)

Catastrophe and large losses

0.9

0.8

0.1

Favorable prior year development

(24.3

)

(23.8

)

(0.5

)

Losses and loss adjustment expenses

$

(15.6

)

$

5.8

$

(21.4

)

Loss ratio - attritional losses

16.9

%

100.7

%

(83.8) pts

Loss ratio - catastrophe and large

losses

2.0

%

2.8

%

(0.8) pts

Loss ratio - prior accident years

(52.9

)%

(83.2

)%

30.3 pts

Loss ratio

(34.0

)%

20.3

%

(54.3) pts

- For the three months ended March 31, 2024, our loss ratio in

the Reinsurance segment improved by 54.3 points from the prior year

period, driven by a reduction in attritional losses.

- The attritional loss ratio in the three months ended March 31,

2024 was 83.8 points lower than the prior year period. The prior

year period was impacted by southern hemisphere storm and flood

losses, whereas the current year period saw a very low level of

loss activity.

- For the three months ended March 31, 2024, favorable prior year

development was driven by benign prior year attritional

experience.

Other Underwriting Expenses

We do not allocate The Fidelis Partnership commissions or

general and administrative expenses by segment.

The Fidelis Partnership Commissions

For the three months ended March 31, 2024, The Fidelis

Partnership commissions were $76.7 million or 15.7% of the combined

ratio (2023: $24.2 million and 6.3% of the combined ratio), and

comprise ceding and profit commissions as part of the Framework

Agreement effective from January 1, 2023. The Fidelis Partnership

manages origination, underwriting, underwriting administration,

outwards reinsurance and claims handling under delegated authority

agreements with the Group.

The following table summarizes The Fidelis Partnership

commissions earned:

Three Months Ended March

31,

2024

2023

($ in millions)

Ceding commission expense

$

67.7

$

12.1

Profit commission expense

9.0

12.1

Total commissions

$

76.7

$

24.2

General and Administrative Expenses

For the three months ended March 31, 2024, general and

administrative expenses were $23.6 million, or 4.8% of the combined

ratio (2023: $16.6 million and 4.3% of the combined ratio). The

increase was driven primarily by employment costs relating to

increased head count from the build out of the team after the

Separation Transactions.

Investments

Three Months Ended March

31,

2024

2023

($ in millions)

Net realized and unrealized investment

gains/(losses)

$

(9.0

)

$

2.8

Net investment income

41.0

20.4

Net investment return

$

32.0

$

23.2

Net Realized and Unrealized Investment Gains/(Losses)

The net realized and unrealized investment losses in the three

months ended March 31, 2024 resulted primarily from realized losses

on the sale of $201.2 million of fixed maturity securities with an

average yield of 0.9%, the proceeds of which were reinvested at

higher yields.

Net Investment Income

The increase in our net investment income in the three months

ended March 31, 2024 was due to the increase in investible assets

and a higher yield achieved on the fixed income portfolio and cash

balances. During the three months ended March 31, 2024, we

purchased $428.7 million of fixed maturity securities at an average

yield of 4.9%.

Conference Call

Fidelis will host a teleconference to discuss its financial

results on Friday, May 10, 2024 at 9:00 a.m Eastern time. The call

may be accessed by dialing 1-888-886-7786 (U.S. callers), or

1-206-962-3782 (international callers), and entering the passcode

55112324 approximately 10 minutes in advance of the call. A live,

listen-only webcast of the call will also be available via the

Investor Relations section of the Company’s website at

https://investors.fidelisinsurance.com/. A recording of the webcast

will be available in the Investor Relations section of the

Company’s website approximately two hours after the event concludes

and will be archived on the site for one year.

About Fidelis Insurance Group

Fidelis Insurance Group is a global specialty insurer,

leveraging strategic partnerships to offer innovative and tailored

insurance solutions.

We have a highly diversified portfolio focused on three

segments: Specialty, Bespoke, and Reinsurance, which we believe

allows us to take advantage of the opportunities presented by

evolving (re)insurance markets, proactively shift our business mix

across market cycles, and produce superior underwriting

returns.

Headquartered in Bermuda, with worldwide offices including

Ireland and the UK, Fidelis Insurance Group operating companies

have a financial strength rating of A from AM Best, A- from S&P

and A3 from Moody’s. For additional information about Fidelis

Insurance, our people, and our products please visit our website at

www.FidelisInsurance.com.

Non-GAAP Financial Measures

This Press Release includes, and the related conference call

will include, certain financial measures that are not calculated in

accordance with generally accepted accounting principles in the

U.S. (“U.S. GAAP”) including Operating net income, Operating EPS,

Operating ROE and Operating ROAE, and therefore are non-U.S. GAAP

financial measures. Reconciliations of such measures to the most

comparable U.S. GAAP figures are included in the attached financial

information in accordance with Regulation G.

RPI Measure

Renewal price index (RPI) is a measure that Fidelis has used to

assess an approximate index of rate increases on a particular set

of contracts, using the base of 100% for the rates for the relevant

prior year. Although management considers RPI to be an appropriate

statistical measure, it is not a financial measure that directly

relates to the Fidelis consolidated financial results. Management’s

calculation of RPI involves a degree of judgment in relation to

comparability of contracts and the relative impacts of changes in

price, exposure, retention levels, as well as any other changing

terms and conditions on the RPI calculation. Consideration is given

to potential renewals of a comparable nature so it does not reflect

every contract in Fidelis’ portfolio. The future profitability and

performance of a portfolio of contracts expressed within the RPI is

dependent upon many factors besides the trends in premium rates,

including policy terms, conditions and wording.

Safe Harbor Regarding Forward-Looking Statements

This press release (including the documents incorporated herein)

contains, and our officers and representatives may from time to

time make (including on our related conference call),

"forward-looking statements" which include all statements that do

not relate solely to historical or current facts and which may

concern our strategy, plans, projections or intentions and are made

pursuant to the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as: “continue,” “grow,”

“pipeline,” “opportunity,” “create,” "anticipate," "intend,"

"plan," "goal," "seek," "believe," "project," "estimate," "expect,"

"strategy," "predict," "potential," "assumption," "future,"

"likely," "may," "should," "could," "will" and the negative of

these and also similar terms and phrases. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are qualified by these cautionary

statements, because they are based only on our current beliefs,

expectations and assumptions regarding the future of our business,

future plans and strategies, projections, anticipated events and

trends, the economy and other future conditions, but are subject to

significant business, economic and competitive uncertainties, many

of which are beyond our control or are subject to change. Our

actual results and financial condition may differ materially from

those indicated in the forward-looking statements. Therefore, you

should not rely on any of these forward-looking statements.

Examples of forward-looking statements include, among others,

statements we make in relation to: discussion relating to net

income and net income per share; expected operating results, such

as revenue growth and earnings; our expectations regarding our

strategy and the performance of our business; information regarding

our estimates for catastrophes and other loss events; our liquidity

and capital resources; and expectations of the effect on our

financial condition of claims, litigation, environmental costs,

contingent liabilities and governmental and regulatory

investigations and proceedings.

Our actual results in the future could differ materially from

those anticipated in any forward-looking statements as a result of

changes in assumptions, risks, uncertainties and other factors

impacting us, many of which are outside our control, including: the

ongoing trend of premium rate hardening and factors likely to drive

continued rate hardening; expected growth across our portfolio; the

availability of outwards reinsurance and capital resources as

required; the development and pattern of earned and written

premiums impacting embedded premium value; changes in accounting

principles or the application thereof; the level of underwriting

leverage; the level and timing of catastrophe and other losses and

related reserves on the business we underwrite; the performance of

our investment portfolios; our strategic relationship with The

Fidelis Partnership; the maintenance of financial strength ratings;

the impact of global geopolitical and economic uncertainties

impacting the lines of business we write; the impact of tax reform

and insurance regulation in the jurisdictions where our businesses

are located; and those risks, uncertainties and other factors

disclosed under the section titled ‘Risk Factors’ in Fidelis

Insurance Holdings Limited’s Form 20-F filed with the SEC on March

15, 2024 (which such section is incorporated herein by reference),

as well as subsequent filings with the SEC available electronically

at www.sec.gov.

Any forward-looking statements, expectations, beliefs and

projections made by us in this release and on our related

conference call speak only as of the date on which they are made

and are expressed in good faith and our management believes that

there is reasonable basis for them, based only on information

currently available to us. However, there can be no assurance that

management’s expectations, beliefs, and projections will be

achieved and actual results may vary materially from what is

expressed or indicated by the forward-looking statements.

Furthermore, our past performance, and that of our management team

and of The Fidelis Partnership, should not be construed as a

guarantee of future performance. We undertake no obligation to

publicly update any forward-looking statement, whether written or

oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Balance

Sheets

At March 31, 2024 (Unaudited)

and December 31, 2023

(Expressed in millions of U.S.

dollars, except share and per share amounts)

March 31, 2024

December 31, 2023

Assets

Fixed maturity securities,

available-for-sale, at fair value (amortized cost: $3,254.5, 2023:

$3,271.4 (net of allowances for credit losses of $2.4, 2023:

$1.3))

$

3,227.1

$

3,244.9

Short-term investments,

available-for-sale, at fair value (amortized cost: $76.3, 2023:

$49.0 (net of allowances for credit losses of $nil, 2023:

$nil))

76.3

49.0

Other investments, at fair value

(amortized cost: $50.7, 2023: $50.8)

47.0

47.5

Total investments

3,350.4

3,341.4

Cash and cash equivalents

671.7

712.4

Restricted cash and cash equivalents

220.5

251.7

Accrued investment income

22.8

27.2

Premiums and other receivables (net of

allowances for credit losses of $18.4, 2023: $17.3)

2,836.6

2,209.3

Amounts due from The Fidelis Partnership

(net of allowances for credit losses of $nil, 2023: $nil)

222.1

173.3

Deferred reinsurance premiums

1,469.2

1,061.4

Reinsurance balances recoverable on paid

losses (net of allowances for credit losses of $nil, 2023:

$nil)

193.0

182.7

Reinsurance balances recoverable on

reserves for losses and loss adjustment expenses (net of allowances

for credit losses of $1.3, 2023: $1.3)

1,135.2

1,108.6

Deferred policy acquisition costs

(includes Fidelis Partnership deferred commissions $196.2, 2023:

$164.1)

959.9

786.6

Other assets

185.3

173.5

Total assets

$

11,266.7

$

10,028.1

Liabilities and shareholders'

equity

Liabilities

Reserves for losses and loss adjustment

expenses

$

2,541.1

$

2,448.9

Unearned premiums

3,846.2

3,149.5

Reinsurance balances payable

1,414.4

1,071.5

Amounts due to The Fidelis Partnership

334.6

334.5

Long term debt

448.4

448.2

Preference securities ($0.01 par,

redemption price and liquidation preference $10,000)

58.4

58.4

Other liabilities

106.5

67.3

Total liabilities

8,749.6

7,578.3

Commitments and contingencies

Shareholders' equity

Common shares ($0.01 par, issued and

outstanding: 117,557,152, 2023: 117,914,754)

1.2

1.2

Additional paid-in capital

2,042.1

2,039.0

Accumulated other comprehensive loss

(27.2

)

(27.0

)

Retained earnings

506.0

436.6

Common shares held in treasury, at cost

(shares held: 357,602, 2023: nil)

(5.0

)

—

Total shareholders' equity

2,517.1

2,449.8

Total liabilities and shareholders'

equity

$

11,266.7

$

10,028.1

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Statements of

Income and Comprehensive Income (Unaudited)

For the three months ended

March 31, 2024 and 2023

(Expressed in millions of U.S.

dollars except for share and per share amounts)

Three Months Ended

March 31, 2024

March 31, 2023

Revenues

Gross premiums written

$

1,514.3

$

1,245.3

Reinsurance premiums ceded

(736.2

)

(585.6

)

Net premiums written

778.1

659.7

Change in net unearned premiums

(290.1

)

(273.7

)

Net premiums earned

488.0

386.0

Net realized and unrealized investment

gains/(losses)

(9.0

)

2.8

Net investment income

41.0

20.4

Other income

—

3.5

Total revenues before net gain on

distribution of The Fidelis Partnership

520.0

412.7

Net gain on distribution of The Fidelis

Partnership

—

1,639.1

Total revenues

520.0

2,051.8

Expenses

Losses and loss adjustment expenses

182.3

159.6

Policy acquisition expenses (includes The

Fidelis Partnership commissions of $76.7 (2023: $24.2))

212.9

129.2

General and administrative expenses

23.6

16.6

Corporate and other expenses

—

1.5

Net foreign exchange (gains)/losses

(2.5

)

1.5

Financing costs

8.6

8.6

Total expenses

424.9

317.0

Income before income taxes

95.1

1,734.8

Income tax expense

(13.9

)

(2.2

)

Net income

81.2

1,732.6

Other comprehensive

income/(loss)

Unrealized gains/(losses) on

available-for-sale investments

$

(8.2

)

$

24.9

Reclassification of net realized losses

recognized in net income

7.4

—

Income tax (expense)/benefit, all of which

relates to unrealized gains/(losses) on available-for-sale

investments

0.6

(2.0

)

Total other comprehensive

income/(loss)

(0.2

)

22.9

Comprehensive income

$

81.0

$

1,755.5

Per share data

Earnings per common share

Earnings per common share

$

0.69

$

15.64

Earnings per diluted common share

$

0.69

$

15.64

Weighted average common shares

outstanding

117,658,016

110,771,897

Weighted average diluted common shares

outstanding

118,348,384

110,771,897

FIDELIS INSURANCE HOLDINGS

LIMITED

Consolidated Segment Data

(Unaudited)

For the three months ended

March 31, 2024 and 2023

(Expressed in millions of U.S.

dollars)

Three Months Ended March 31,

2024

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

1,034.0

$

153.5

$

326.8

$

—

$

1,514.3

Net premiums written

627.7

52.8

97.6

—

778.1

Net premiums earned

352.2

89.9

45.9

—

488.0

Losses and loss adjustment expenses

(174.5

)

(23.4

)

15.6

—

(182.3

)

Policy acquisition expenses

(99.8

)

(30.3

)

(6.1

)

(76.7

)

(212.9

)

General and administrative expenses

—

—

—

(23.6

)

(23.6

)

Underwriting income

77.9

36.2

55.4

(100.3

)

69.2

Net realized and unrealized investment

losses

(9.0

)

Net investment income

41.0

Net foreign exchange gains

2.5

Financing costs

(8.6

)

Income before income taxes

95.1

Income tax expense

(13.9

)

Net income

$

81.2

Losses and loss adjustment expenses

incurred - current year

(208.9

)

(31.7

)

(8.7

)

$

(249.3

)

Losses and loss adjustment expenses

incurred - prior accident years

34.4

8.3

24.3

67.0

Losses and loss adjustment expenses

incurred - total

$

(174.5

)

$

(23.4

)

$

15.6

$

(182.3

)

Underwriting Ratios(1)

Loss ratio - current year

59.3

%

35.2

%

18.9

%

51.1

%

Loss ratio - prior accident years

(9.8

%)

(9.2

%)

(52.9

%)

(13.7

%)

Loss ratio - total

49.5

%

26.0

%

(34.0

%)

37.4

%

Policy acquisition expense ratio

28.3

%

33.7

%

13.3

%

27.9

%

Underwriting ratio

77.8

%

59.7

%

(20.7

%)

65.3

%

The Fidelis Partnership commissions

ratio

15.7

%

General and administrative expense

ratio

4.8

%

Combined ratio

85.8

%

________________

(1) Underwriting ratios are calculated by dividing the related

expense by net premiums earned.

Three Months Ended March 31,

2023

Specialty

Bespoke

Reinsurance

Other

Total

Gross premiums written

$

834.1

$

150.8

$

260.4

$

—

$

1,245.3

Net premiums written

493.0

81.7

85.0

—

659.7

Net premiums earned

266.2

91.2

28.6

—

386.0

Losses and loss adjustment expenses

(140.7

)

(13.1

)

(5.8

)

—

(159.6

)

Policy acquisition expenses

(66.3

)

(33.3

)

(5.4

)

(24.2

)

(129.2

)

General and administrative expenses

—

—

—

(16.6

)

(16.6

)

Underwriting income

59.2

44.8

17.4

(40.8

)

80.6

Net realized and unrealized investment

gains

2.8

Net investment income

20.4

Other income

3.5

Net gain on distribution of The Fidelis

Partnership

1,639.1

Corporate and other expenses

(1.5

)

Net foreign exchange losses

(1.5

)

Financing costs

(8.6

)

Income before income taxes

1,734.8

Income tax expense

(2.2

)

Net income

$

1,732.6

Losses and loss adjustment expenses

incurred - current year

(110.2

)

(21.9

)

(29.6

)

$

(161.7

)

Losses and loss adjustment expenses

incurred - prior accident years

(30.5

)

8.8

23.8

2.1

Losses and loss adjustment expenses

incurred - total

$

(140.7

)

$

(13.1

)

$

(5.8

)

$

(159.6

)

Underwriting Ratios(1)

Loss ratio - current year

41.4

%

24.0

%

103.5

%

41.8

%

Loss ratio - prior accident years

11.5

%

(9.6

%)

(83.2

%)

(0.5

%)

Loss ratio - total

52.9

%

14.4

%

20.3

%

41.3

%

Policy acquisition expense ratio

24.9

%

36.5

%

18.9

%

27.2

%

Underwriting ratio

77.8

%

50.9

%

39.2

%

68.5

%

The Fidelis Partnership commissions

ratio

6.3

%

General and administrative expense

ratio

4.3

%

Combined ratio

79.1

%

________________

(1) Underwriting ratios are calculated by dividing the related

expense by net premiums earned.

FIDELIS INSURANCE HOLDINGS LIMITED

NON-GAAP FINANCIAL MEASURES RECONCILIATION

(UNAUDITED)

Operating net income: is a non-GAAP financial measure of

our performance which does not consider the impact of certain

non-recurring and other items that may not properly reflect the

ordinary activities of our business, its performance or its future

outlook. This measure is calculated as net income excluding net

gain on distribution of The Fidelis Partnership, net realized and

unrealized investment gains/(losses), net foreign exchange

gains/(losses), and corporate and other expenses which include

warrant costs, reorganization expenses, any non-recurring income

and expenses, and the income tax effect on these items.

Return on average common equity (“ROAE”): represents net

income divided by average common shareholders’ equity.

Operating return on average common equity (“Operating

ROAE”): is a non-GAAP financial measure that represents a

meaningful comparison between periods of our financial performance

expressed as a percentage and is calculated as operating net income

divided by adjusted average common shareholders’ equity.

Operating net income per diluted share (“Operating EPS”):

is a non-GAAP financial measure that represents a valuable measure

of profitability and enables investors, analysts, rating agencies

and other users of its financial information to more easily analyze

the Group’s results in a manner similar to how management analyzes

the Group’s underlying business performance. Operating EPS is

calculated by dividing operating net income by the diluted weighted

average common shares outstanding.

Operating return on opening common equity (“Operating

ROE”): is a non-U.S. GAAP measure that represents a meaningful

comparison between periods of our financial performance expressed

as a percentage and is calculated as operating net income divided

by adjusted opening common shareholders’ equity.

The table below sets out the calculation of the adjusted common

shareholders’ equity, operating net income, ROAE, Operating ROE,

Operating ROAE and Operating EPS, for the three months ended March

31, 2024 and 2023.

Three Months Ended March

31,

2024

2023

($ in millions)

Average common shareholders'

equity

$

2,483.5

$

1,940.7

Opening common shareholders' equity

2,449.8

1,976.8

Adjustments related to the Separation

Transactions

—

(178.4

)

Adjusted opening common shareholders’

equity

2,449.8

1,798.4

Closing common shareholders' equity

2,517.1

1,904.5

Adjusted average common shareholders'

equity

2,483.5

1,851.5

Net income

81.2

1,732.6

Adjustment for net gain on distribution of

The Fidelis Partnership

—

(1,639.1

)

Adjustment for net realized and unrealized

investment (gains)/losses

9.0

(2.8

)

Adjustment for net foreign exchange

(gains)/losses

(2.5

)

1.5

Adjustment for corporate and other

expenses

—

1.5

Income tax effect of the above items

(0.4

)

—

Operating net income

$

87.3

$

93.7

ROAE

3.3

%

89.3

%

Operating ROE

3.6

%

5.2

%

Operating ROAE

3.5

%

5.1

%

Operating EPS

$

0.74

$

0.85

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509912411/en/

Fidelis Insurance Group Investor Contact:

Fidelis Insurance Group Miranda Hunter (441) 279 2561

miranda.hunter@fidelisinsurance.com

Fidelis Insurance Group Media Contacts:

Kekst CNC Fidelis@kekstcnc.com

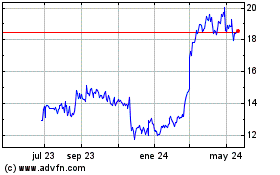

Fidelis Insurance (NYSE:FIHL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

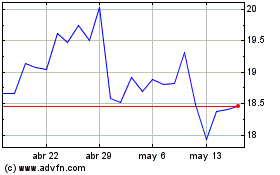

Fidelis Insurance (NYSE:FIHL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024