Coca-Cola Posts Higher Quarterly Sales --Update

30 Enero 2020 - 7:42AM

Noticias Dow Jones

By Dave Sebastian

Coca-Cola Co. reported higher sales in the latest quarter as

demand for its namesake drinks grew, beating analysts'

estimates.

Fourth-quarter sales rose 16% to $9.07 billion from a year

earlier, ahead of the $8.88 billion analysts polled by FactSet had

expected.

The beverage giant on Thursday said organic revenue, which

excludes currency swings, acquisitions and divestitures, grew 7%.

Global unit case volume increased 3% for the quarter, led by growth

in emerging markets.

Sales of its sparkling soft drinks, which include its namesake

soda drink, Diet Coke, Fanta and Sprite, grew 3% for the quarter,

led by growth in China, Brazil and Southeast Asia.

Sales of water, enhanced water and sports drinks were up 2%, and

tea and coffee volume grew 4%.

Coke has pushed to roll out new flavors and diversify its

offerings in recent years. The company late last year launched a

new flavored seltzer brand, Aha, with caffeinated options. It was a

late entrant to the category that includes market-leading bubbly

water LaCroix, which has lost market share as new drinks crowd

store shelves. PepsiCo Inc. in 2018 launched a competitor called

Bubly.

Unit case volume, or the number of 24 8-ounce servings of

finished beverage sold, in North America was flat for the quarter,

though the metric for its water, enhanced water and sports drinks

grew 3%. The Coca-Cola Zero Sugar beverage grew by a double-digit

percentage, the company said.

In Europe, the Middle East and Africa, unit case volume grew 4%,

driven by growth in Nigeria, North Africa, Turkey and central and

Eastern Europe. But quarterly operating income in the region fell

14%, or 5% on an adjusted basis, due to reduced bottler-inventory

levels related to Brexit, Coke said.

In Asia Pacific, unit case volume grew 2%, though sales in China

softened as growth in sparkling-soft-drink sales was offset by the

downsizing of certain water and juice products.

The Atlanta-based company recorded earnings of $2.04 billion, or

47 cents a share, compared with $870 million, or 20 cents a share,

in the same period a year before.

Adjusted earnings were 44 cents a share, meeting analysts'

expectations.

For 2020, the company expects organic sales to grow about 5%. It

sees adjusted earnings of about $2.25 a share for the year.

Shares rose 1.4% in premarket trading.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

January 30, 2020 08:27 ET (13:27 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

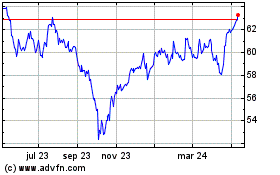

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

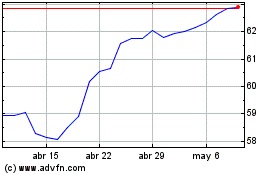

Coca Cola (NYSE:KO)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024