Kilroy Realty Corporation (NYSE: KRC) (the “Company”), today

announced that its operating partnership, Kilroy Realty, L.P. (the

“Borrower”), has closed on an amended and restated senior unsecured

revolving credit facility that permits borrowings of up to $1.1

billion (the “Revolving Credit Facility”). The term of the

Revolving Credit Facility was extended three years and goes through

July 31, 2028 before extension options.

“We are extremely pleased to announce the recast of our

revolving credit facility, which has allowed us to extend the

maturity of the facility by three years, while maintaining total

available borrowing capacity,” stated Angela Aman, Chief Executive

Officer of the Company. “Our strong banking partnerships continue

to provide Kilroy with robust liquidity and financial flexibility

as we look to capture outsized growth opportunities and create

value for all stakeholders.”

The Revolving Credit Facility also features a

sustainability-linked pricing component whereby the pricing can

improve by 1 basis point per annum if the Borrower meets certain

sustainability performance targets as verified by an independent

third-party. Additionally, the Borrower may elect to borrow,

subject to additional lender commitments and the satisfaction of

certain conditions, up to an additional $500 million under the

Revolving Credit Facility pursuant to an accordion feature. The

Borrower expects to use the Revolving Credit Facility for general

corporate purposes, including funding acquisition, development and

redevelopment projects, and repaying debt.

Revolving Credit Facility Key Terms

Overview

Amended and Restated

Revolving Credit

Facility

Old Revolving

Credit Facility

Amount

$1.1B

$1.1B

SOFR Borrowing Spread (1)

90 bps

90 bps

SOFR Credit Spread Adjustment

10 bps

10 bps

Annual Facility Fee (1)

20 bps

20 bps

Maturity Date before Extension Options

July 31, 2028

July 31, 2025

Extension Options

Two 6-Month

Two 6-Month

(1)

The borrowing spread and facility fee are

variable and subject to a ratings-based pricing grid based on the

Borrower’s credit rating.

The Revolving Credit Facility was syndicated to a group of

twelve U.S. and international banks led by JPMorgan Chase Bank,

N.A., BofA Securities, Inc., Wells Fargo Securities, LLC, PNC

Capital Markets LLC, and U.S. Bank National Association, which

acted as joint lead arrangers and joint bookrunners. JPMorgan Chase

Bank, N.A. is the administrative agent for the Revolving Credit

Facility and Bank of America, N.A. is the syndication agent. BMO

Capital Markets Corp., The Bank of Nova Scotia, and Sumitomo Mitsui

Banking Corporation acted as joint lead arrangers. Wells Fargo

Bank, N.A., PNC Bank, National Association, U.S. Bank National

Association, Barclays Bank PLC, BMO Bank, N.A., Sumitomo Mitsui

Banking Corporation, and The Bank of Nova Scotia acted as

co-documentation agents. Other participants in the Revolving Credit

Facility include KeyBank National Association, The Bank of New York

Mellon, and Associated Bank, National Association. J.P. Morgan

Securities LLC and BofA Securities, Inc. acted as sustainability

structuring agents.

In addition, the Company paid down its existing $520 million

senior unsecured term loan facility (the “Existing Term Loan

Facility”) by $200 million and extended the final maturity on an

aggregate principal amount of $200 million of the remaining $320

million by 12 months to October 3, 2027, inclusive of exercising

its two one-year extension options (the “New Term Loan Facility”).

The borrowing rate under the New Term Loan Facility is variable and

subject to a ratings-based pricing grid, currently calculated as

one-month Adjusted Secured Overnight Financing Rate (“SOFR”) plus

95-basis points, unchanged from the prior rate. The New Term Loan

Facility was syndicated to a group of twelve U.S. and international

banks led by JPMorgan Chase Bank, N.A., BofA Securities, Inc.,

Wells Fargo Securities, LLC, PNC Capital Markets LLC, U.S. Bank

National Association, and The Bank of Nova Scotia, which acted as

joint lead arrangers and joint bookrunners.

About Kilroy Realty Corporation

Kilroy Realty Corporation (NYSE: KRC, the “Company”, “Kilroy”)

is a leading U.S. landlord and developer, with operations in San

Diego, Greater Los Angeles, the San Francisco Bay Area, Greater

Seattle and Austin. The Company has earned global recognition for

sustainability, building operations, innovation and design. As a

pioneer and innovator in the creation of a more sustainable real

estate industry, the Company’s approach to modern business

environments helps drive creativity and productivity for some of

the world’s leading technology, entertainment, life science and

business services companies.

The Company is a publicly traded real estate investment trust

(“REIT”) and member of the S&P MidCap 400 Index with more than

seven decades of experience developing, acquiring and managing

office, life science and mixed-use projects. As of December 31,

2023, Kilroy’s stabilized portfolio totaled approximately 17.0

million square feet of primarily office and life science space that

was 85.0% occupied and 86.4% leased. The Company also had

approximately 1,000 residential units in Hollywood and San Diego,

which had a quarterly average occupancy of 92.5%. In addition, the

Company had two in-process life science redevelopment projects

totaling approximately 100,000 square feet with total estimated

redevelopment costs of $80.0 million and one approximately 875,000

square foot in-process development project with a total estimated

investment of $1.0 billion.

A Leader in Sustainability and Commitment to Corporate Social

Responsibility

Kilroy has a longstanding commitment to sustainability and

continues to be a recognized leader in our sector. For over a

decade, the Company and its sustainability initiatives have been

recognized with numerous honors, including being listed on the Dow

Jones Sustainability World Index, earning the GRESB five star

rating and being named a sector and regional leader in the

Americas. Other honors have included the Nareit Leader in the Light

Award, being named ENERGY STAR Partner of the Year and receiving

the ENERGY STAR highest honor of Sustained Excellence.

Kilroy is proud to have achieved carbon neutral operations

across our portfolio since 2020. The Company also has a

longstanding commitment to maintain high levels of LEED, Fitwel and

ENERGY STAR certifications across the portfolio.

A significant part of the Company’s foundation is its commitment

to enhancing employee growth, satisfaction and wellness while

maintaining a diverse and thriving culture. For the fifth year in a

row, the Company has been named to Bloomberg’s Gender Equality

Index, which recognizes companies committed to supporting gender

equality through policy development, representation, and

transparency.

More information is available at

http://www.kilroyrealty.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements are based on our current

expectations, beliefs and assumptions, and are not guarantees of

future performance. Forward-looking statements are inherently

subject to uncertainties, risks, changes in circumstances, trends

and factors that are difficult to predict, many of which are

outside of our control. Accordingly, actual performance, results

and events may vary materially from those indicated or implied in

the forward-looking statements, and you should not rely on the

forward-looking statements as predictions of future performance,

results or events. Numerous factors could cause actual future

performance, results and events to differ materially from those

indicated in the forward-looking statements, including, among

others: global market and general economic conditions, including

periods of heightened inflation, and their effect on our liquidity

and financial conditions and those of our tenants; adverse economic

or real estate conditions generally, and specifically, in the

States of California, Texas and Washington; risks associated with

our investment in real estate assets, which are illiquid, and with

trends in the real estate industry; defaults on or non-renewal of

leases by tenants; any significant downturn in tenants’ businesses,

including bankruptcy, lack of liquidity or lack of funding and the

impact labor disruptions or strikes, such as episodic strikes in

the entertainment industry, may have on our tenants’ businesses;

our ability to re-lease property at or above current market rates;

reduced demand for office space, including as a result of remote

working and flexible working arrangements that allow work from

remote locations other than the employer's office premises; costs

to comply with government regulations, including environmental

remediation; the availability of cash for distribution and debt

service and exposure to risk of default under debt obligations;

increases in interest rates and our ability to manage interest rate

exposure; changes in interest rates and the availability of

financing on attractive terms or at all, which may adversely impact

our future interest expense and our ability to pursue development,

redevelopment and acquisition opportunities and refinance existing

debt; a decline in real estate asset valuations, which may limit

our ability to dispose of assets at attractive prices or obtain or

maintain debt financing, and which may result in write-offs or

impairment charges; significant competition, which may decrease the

occupancy and rental rates of properties; potential losses that may

not be covered by insurance; the ability to successfully complete

acquisitions and dispositions on announced terms; the ability to

successfully operate acquired, developed and redeveloped

properties; the ability to successfully complete development and

redevelopment projects on schedule and within budgeted amounts;

delays or refusals in obtaining all necessary zoning, land use and

other required entitlements, governmental permits and

authorizations for our development and redevelopment properties;

increases in anticipated capital expenditures, tenant improvement

and/or leasing costs; defaults on leases for land on which some of

our properties are located; adverse changes to, or enactment or

implementations of, tax laws or other applicable laws, regulations

or legislation, as well as business and consumer reactions to such

changes; risks associated with joint venture investments, including

our lack of sole decision-making authority, our reliance on

co-venturers’ financial condition and disputes between us and our

co-venturers; environmental uncertainties and risks related to

natural disasters; and our ability to maintain our status as a

REIT. These factors are not exhaustive and additional factors could

adversely affect our business and financial performance. For a

discussion of additional factors that could materially adversely

affect our business and financial performance, see the factors

included under the caption “Risk Factors” in our annual report on

Form 10-K for the year ended December 31, 2023 and our other

filings with the Securities and Exchange Commission. All

forward-looking statements are based on currently available

information and speak only as of the dates on which they are made.

We assume no obligation to update any forward-looking statement

made in this press release that becomes untrue because of

subsequent events, new information or otherwise, except to the

extent we are required to do so in connection with our ongoing

requirements under federal securities laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306120082/en/

Eliott Trencher Executive Vice President, Chief Financial

Officer and Chief Investment Officer (310) 481-8587 or Taylor

Friend Senior Vice President, Treasurer (310) 481-8574

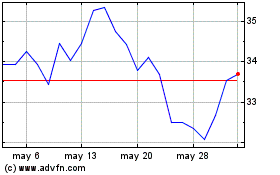

Kilroy Realty (NYSE:KRC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Kilroy Realty (NYSE:KRC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025