NYLI MacKay DefinedTerm Muni Opportunities Fund (the “Fund”)

(NYSE: MMD) today commenced a tender offer. The Fund will conduct a

tender offer allowing shareholders to offer up to 100% of their

shares for repurchase for cash at a price per share equal to 100%

of the net asset value per share determined on the date the tender

offer expires. The tender offer will expire on November 14, 2024,

at 5:00 p.m. Eastern time, or on such later date to which the offer

is extended.

“The Fund has provided shareholders with compelling returns and

tax-exempt income since its inception,” said Bob DiMella,

portfolio manager of the Fund and co-head of MacKay Municipal

Managers™. “We believe the municipal fixed income markets are

poised for another strong decade and are confident that the

investment team will continue to successfully implement the Fund’s

investment strategy if shareholders elect to remain invested in the

Fund.”

The Fund was the #1 performing fund based upon both its price

return and its NAV return among 37 Muni National Long closed-end

funds over the trailing 10-year period ending September 30, 2024.1

The Fund has paid steady monthly distributions amounting to $12.43

per share in total since its inception in June 2012, none of which

contained return of capital.

The completion of the Fund’s tender offer is subject to certain

conditions, including that the aggregate net assets of the Fund

must equal or exceed $200 million as of the expiration date of the

tender offer, taking into account the amounts that would be paid to

shareholders who have properly tendered their shares. If the Fund’s

net assets after the tender offer would be less than $200 million,

the tender offer shall be cancelled, no common shares will be

repurchased and the Fund will dissolve on December 31, 2024. If

undertaken, this dissolution may take a significant amount of time

and result in the Fund holding large amounts of uninvested cash. As

a result, in such a case, there could be times when the Fund is not

pursuing its investment objective or is not being managed

consistent with its stated investment strategies.

Additional terms and conditions of the tender offer will be set

forth in the Fund’s tender offer documents, which will be

distributed to common shareholders.

The Fund will declare its regular monthly distribution according

to a modified schedule. The following dates will apply to the

Fund’s November and December 2024 monthly distributions:

Month

Declaration Date

Ex-Date

Record Date

Payable Date

November 2024

11/1/2024

11/21/2024

11/21/2024

11/29/2024

December 20242

12/2/2024

12/16/2024

12/16/2024

12/31/2024

Shareholders participating in the tender offer will not receive

the November or December 2024 monthly distributions on tendered

shares.

This announcement is not a recommendation, an offer to purchase

or a solicitation of an offer to sell shares of the Fund. Any

tender offer will be made only by an offer to purchase, a related

letter of transmittal and other documents that will be filed with

the Securities and Exchange Commission (“SEC”) as exhibits to a

tender offer statement on Schedule TO. Common shareholders should

read the Fund’s offer to purchase and tender offer statement on

Schedule TO and related exhibits as they contain important

information about the Fund’s tender offer. The offer to purchase

and related letter of transmittal are available free of charge at

the SEC’s website at www.sec.gov and from the Fund by calling your

financial advisor or Georgeson, LLC, the information agent for the

Fund’s tender offer, at (888) 658-5755.

The Fund’s daily New York Stock Exchange closing prices, net

asset values per share, as well as other information are available

by clicking here or by calling the Fund’s shareholder servicing

agent at (855) 456-9683.

For more insights from MacKay Municipal Managers™ and our New

York Life Investments affiliates click here.

There are risks inherent in any investment, including market

risk, interest rate risk, credit risk and the possible loss of

principal. There can be no assurance that the Fund’s investment

objectives will be achieved. Shares of closed-end funds frequently

trade at a discount from their net asset value, which may increase

investor risk.

Past performance is no guarantee of future results, which

will vary.

About New York Life Investments

With over $727 billion in assets under management as of June 30,

2024, New York Life Investments, a Pensions & Investments’ Top

30 Largest Money Manager3, is comprised of the affiliated global

asset management businesses of its parent company, New York Life

Insurance Company, and offers clients access to specialized,

independent investment teams through its family of affiliated

boutiques. New York Life Investments remains committed to clients

through a combination of the diverse perspectives of its boutiques

and a long-lasting focus on sustainable relationships.

About MacKay Municipal Managers™

MacKay Municipal Managers™ is a recognized leader in active

municipal bond investing and is entrusted with $77 billion in

assets under management, as of 6/30/24. The team manages a suite of

highly rated municipal bond solutions available in multiple

vehicles. MacKay Municipal Managers™ is a fundamental

relative-value bond manager that combines a top-down approach with

bottom-up, credit research. Our investment philosophy is centered

on the belief that strong long-term performance can be achieved

with a relative value, research driven approach in a highly

fragmented, inefficient municipal bond market.

About MacKay Shields LLC

MacKay Shields LLC (together with its subsidiaries, "MacKay")4,

a New York Life Investments Company, is a global asset management

firm with $144 billion in assets under management5 as of June 30,

2024. MacKay manages fixed income strategies for high-net worth

individuals and institutional clients through separately managed

accounts and collective investment vehicles including private

funds, UCITS, ETFs, closed end funds and mutual funds. MacKay

provides investors with specialty fixed income expertise across

global fixed income markets including municipal bonds, structured

credit, corporate credit and emerging markets debt. The MacKay

client experience provides investors direct access to senior

investment professionals. MacKay maintains offices in New York

City, Princeton, Los Angeles, London and Dublin. For more

information, please visit www.mackayshields.com or follow us on

Twitter or LinkedIn.

_________________________

1 Over the trailing one-year period ending

September 30, 2024, the Fund’s price return and NAV return rank 41

and 39, respectively, among 42 Muni National Long closed-end funds.

Over the trailing five-year period ending September 30, 2024, the

Fund’s price return and NAV return rank 27 and 7, respectively,

among 39 Muni National Long closed-end funds.

2 If necessary.

3 New York Life Investment Management

ranked 26th largest institutional investment manager in Pensions

& Investments' Largest Money Managers 2024 published June 2024,

based on worldwide institutional AUM as of 12/31/23. No direct or

indirect compensation was paid for the creation and distribution of

this ranking.

4 MacKay is a wholly owned subsidiary of

New York Life Investment Management Holdings LLC, which is wholly

owned by New York Life Insurance Company.

5 Assets under management (AUM) as of June

30, 2024 represents assets managed by MacKay LLC and its

subsidiaries but excludes certain accounts and other assets over

which MacKay continues to exercise discretionary authority to

liquidate but which are no longer actively managed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017660420/en/

Media: Sara Guenoun | New York Life | (212) 576-4757 |

Sara_j_Guenoun@newyorklife.com

Investors: 855-456-9683

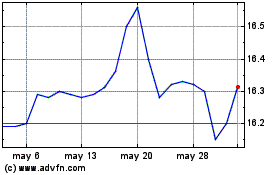

NYLI MacKay DefinedTerm ... (NYSE:MMD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

NYLI MacKay DefinedTerm ... (NYSE:MMD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024